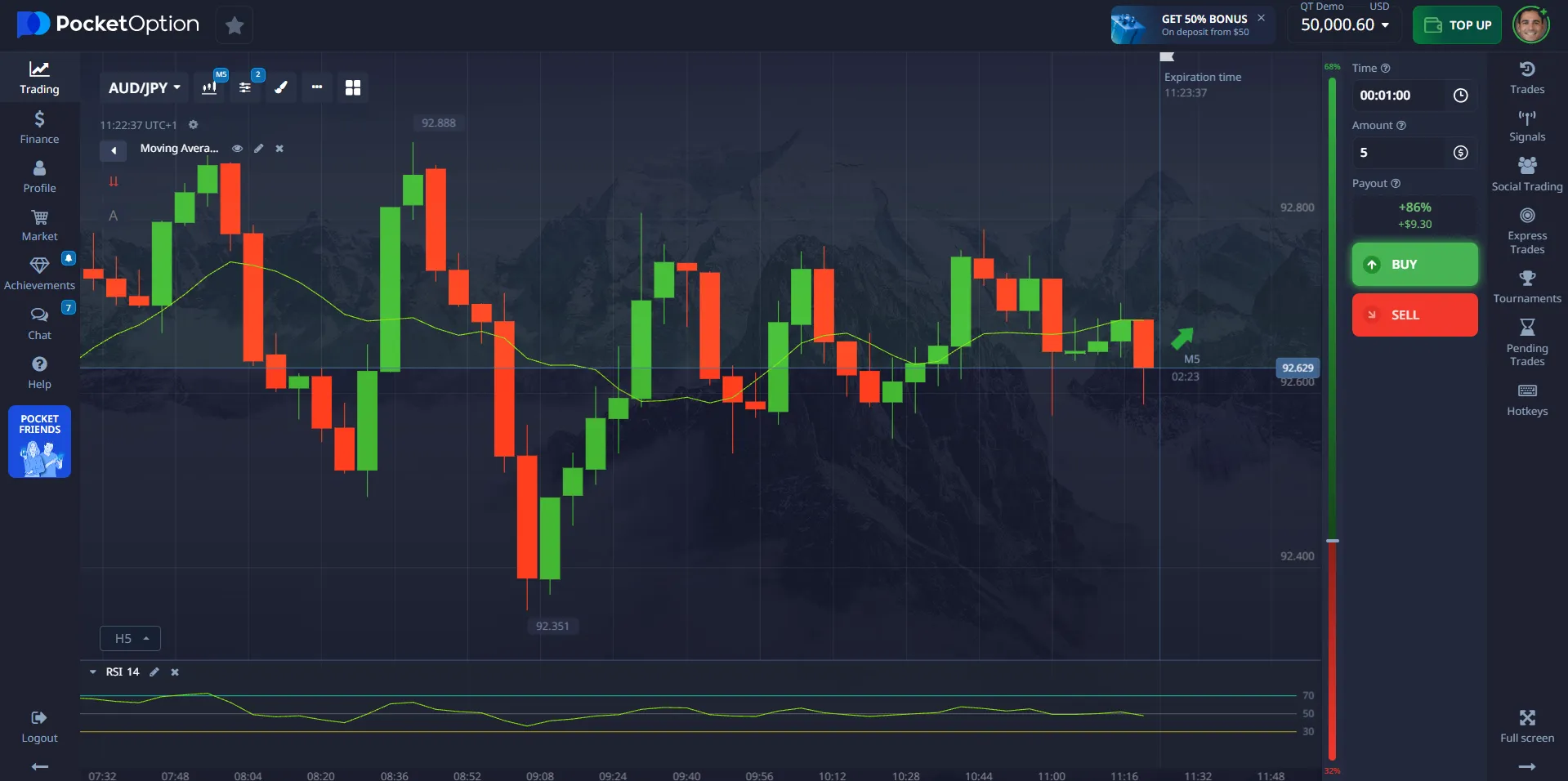

- Technical Indicators: Use tools such as RSI, MACD, and Bollinger Bands to identify momentum and volatility.

- Sentiment Analysis: Monitor trader sentiment on Pocket Option’s interface to gauge market direction.

- Economic Calendar: Stay informed about macroeconomic events that can cause price fluctuations.

Pocket Option Live Trading: How to use it to its maximum benefit

Pocket Option Live Trading provides an opportunity for traders to engage in real-time market analysis and execute trades effectively. This platform is designed to cater to both beginners and experienced traders, offering a wide range of features that enhance the trading experience. In this article, we will explore the fundamentals of Pocket Option and how to master live trading techniques.

Article navigation

- Understanding Pocket Option Live Trading

- What is Pocket Option?

- Benefits of Online Trading with Pocket Option

- Getting Started: Creating Your Pocket Option Account

- Mastering Real-Time Market Analysis

- Tools for Market Analysis on Pocket Option

- Strategies for Analyzing Financial Markets

- Is Pocket Option Trading Profitable?

- Can I Trade Full-Time with Pocket Option?

- What Time Is the Best Time to Trade on Pocket Option?

- Example: How to Open a Trade on Pocket Option

- Demo Trading vs. Live Trading

- Regulation and Licensing

- Trader Reviews

- Learning Resources and Trading Education

- Final Thoughts

Understanding Pocket Option Live Trading

Pocket Option is an online trading platform that offers a seamless experience for traders around the globe. With its user-friendly interface and customizable features, the Pocket Option platform allows traders to execute live trades with speed and efficiency. Instead of binary or digital options, Pocket Option utilizes a method known as Quick Trading. This method mimics the binary setup, where users predict the price direction of an asset within a set timeframe by clicking “Buy” or “Sell” — but it is structurally and legally different.

What is Pocket Option?

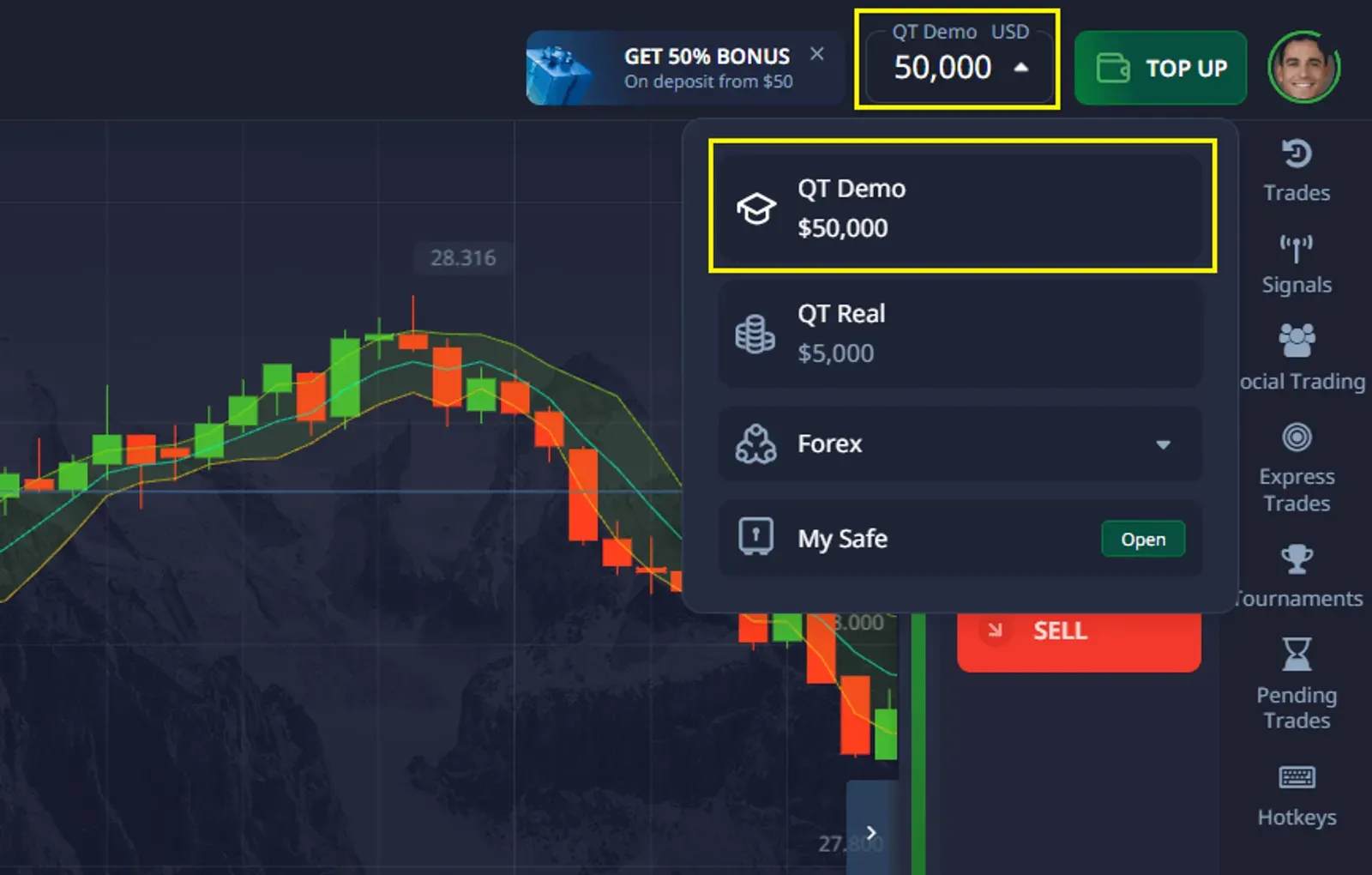

Pocket Option is a prominent trading platform in the financial markets, providing a platform for users to engage in Quick Trading. It offers a variety of trading instruments and tools that empower traders to make informed decisions. Through Pocket Option, traders can access a demo account to practice their strategies before committing real money. This approach is particularly beneficial for beginners looking to build their trading skills and confidence.

Benefits of Online Trading with Pocket Option

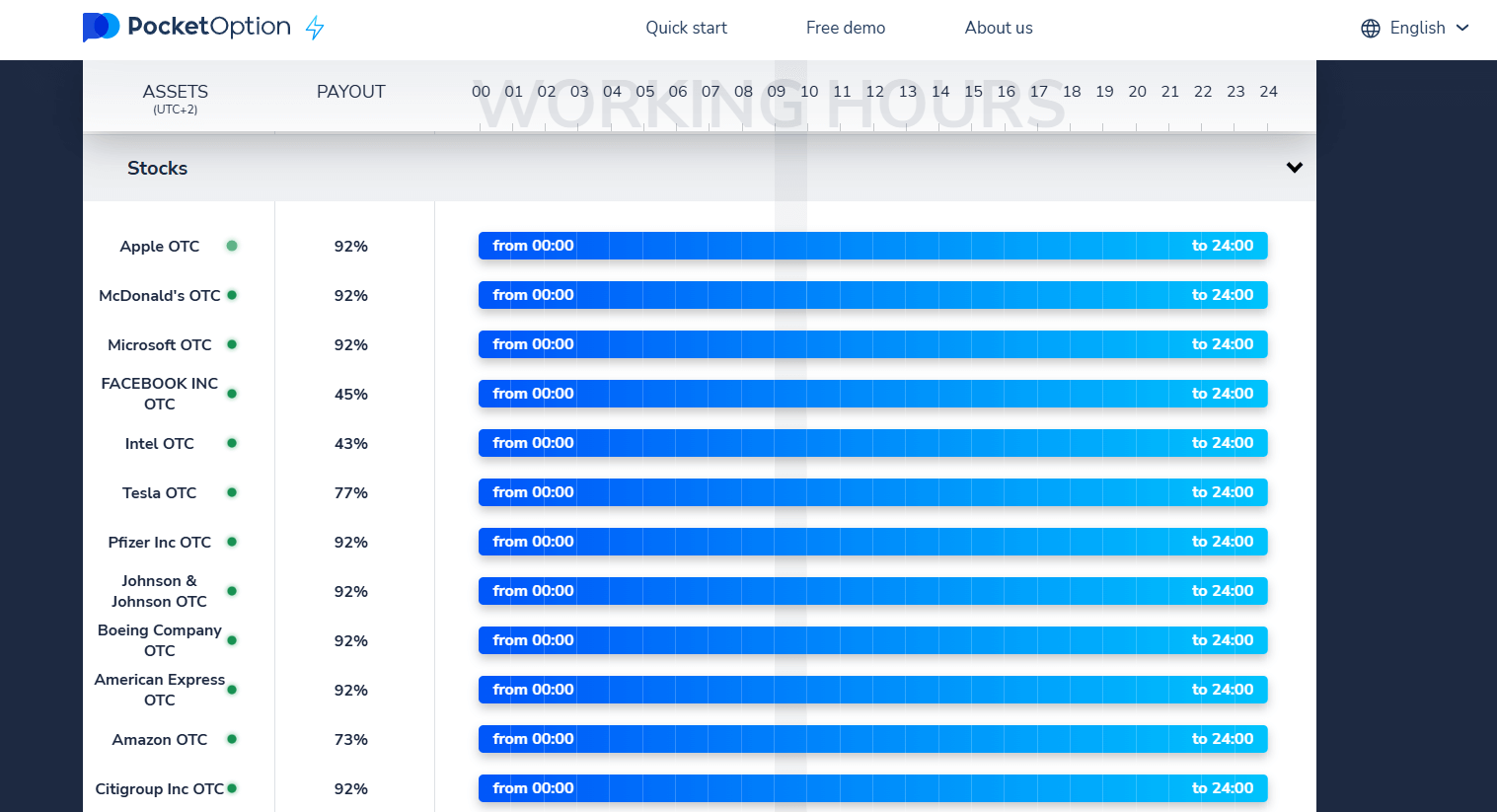

Online trading with Pocket Option comes with several advantages that appeal to traders of all levels. The platform enables fast execution of trades, ensuring that traders can capitalize on real-time market movements. In addition to a wide array of market-based assets such as stocks, currencies, and commodities, Pocket Option also offers OTC (Over-the-Counter) assets, which are available for trading 24/7 — even outside of regular market hours. This ensures that users can maintain consistent trading activity regardless of global market schedules.

OTC assets replicate real-market conditions and allow for continuous practice and strategy implementation, especially useful for traders in different time zones or with limited availability during market hours.

Benefits Table:

| Feature | Pocket Option | Other Platforms |

|---|---|---|

| Real-Time Analysis | ✅ Available | ⚠️ May lag |

| Copy Trading | ✅ Built-in | ❌ External tool |

| Low Entry | ✅ $5 minimum | ⚠️ Varies |

| Quick Payouts | ✅ Within hours | ⚠️ Days |

Getting Started: Creating Your Pocket Option Account

Creating an account on Pocket Option is a straightforward process that enables you to start trading quickly. After registering, you can choose between a demo account and a live account, depending on your trading experience. The demo account is ideal for practicing trading techniques and refining your strategies without the risk of losing real money. Once comfortable, you can transition to the live trading environment, where you can apply your market analysis skills in real-time.

Mastering Real-Time Market Analysis

Real-time market data is crucial for traders seeking to enhance their trading performance on platforms like Pocket Option. Accessing up-to-the-minute information about price movements and market trends allows traders to make informed decisions. With accurate real-time market analysis, traders can identify profitable trading opportunities and adjust their strategies promptly.

Tools for Market Analysis on Pocket Option

The Pocket Option platform provides an array of tools designed for effective market analysis. Traders can utilize various indicators and charting tools to analyze price patterns and forecast market movements. By leveraging these tools, users can develop robust trading strategies that align with their risk management principles.

Strategies for Analyzing Financial Markets

To successfully navigate financial markets, traders must develop effective strategies for analysis. Utilizing technical analysis, fundamental analysis, or a combination of both can provide valuable insights. By understanding market sentiment and leveraging Pocket Option’s customizable features, traders can refine their trading techniques.

Core Components of Real-Time Analysis:

Tips from Experts:

“The key to profitable short-term trading is to combine real-time indicators with discipline and timing,” — Michael Brandt, Market Strategist at TradeCore.

Real-Time Strategy Checklist:

- Confirm trend direction with two or more indicators.

- Use 1-minute to 5-minute charts for short trades.

- Enter positions only during high liquidity windows.

Pocket Option enhances this process by providing instant chart updates, customizable dashboards, and integrated analysis tools.

Is Pocket Option Trading Profitable?

Trading on Pocket Option can be profitable for individuals who adopt disciplined strategies and continuously improve their market analysis. Profits depend on your ability to assess market trends and act decisively. Many users benefit from features like copy trading and real-time analysis tools.

Key Profit Strategies:

- Use technical indicators to define entry and exit points.

- Practice with demo trading before switching to a live account.

- Employ risk management principles consistently.

Can I Trade Full-Time with Pocket Option?

Trading full-time on Pocket Option is feasible for individuals who possess strong analytical skills and a structured trading plan. Pocket Option does not offer traditional options such as binary or digital options; instead, it provides Quick Trading, which allows users to speculate on short-term price movements of various assets by predicting whether the price will go up or down within a selected timeframe.

Success Factors:

- Adequate capital and financial buffer.

- A daily routine that includes analysis, journaling, and risk reviews.

- Use of Pocket Option live trading and Pocket Option day trading live features for traders who possess strong analytical skills and a structured trading plan. This path demands consistency, psychological resilience, and continuous learning.

What Time Is the Best Time to Trade on Pocket Option?

Optimal Trading Times:

- New York & London overlap (13:00–17:00 UTC) – High liquidity and volatility, ideal for major currency pairs and short-term strategies.

- Tokyo session (00:00–06:00 UTC) – Preferable for trading JPY and Asian market-related assets.

While traditional trading sessions offer specific windows of opportunity, Pocket Option expands these limits by offering OTC (Over-the-Counter) assets, which are available 24/7. This allows traders to continue refining their strategies and trading even when global markets are closed.

Adjust your approach based on asset availability and market conditions. Pocket Option’s built-in trading schedule and sentiment indicators help identify the most active and potentially profitable times.

Example: How to Open a Trade on Pocket Option

- Choose an asset, such as Apple.

- Analyze the chart using trader sentiment or technical indicators.

- Set trade amount, starting from $1.

- Set trade duration, as short as 5 seconds (for OTC).

- Make a forecast: Press “Buy” if expecting a price rise, “Sell” if expecting a fall.

- If correct, earn up to 92% return. The rate is shown in advance for each asset.

- On a live account (minimum $5 deposit), you can access copy trading, cashback, and more.

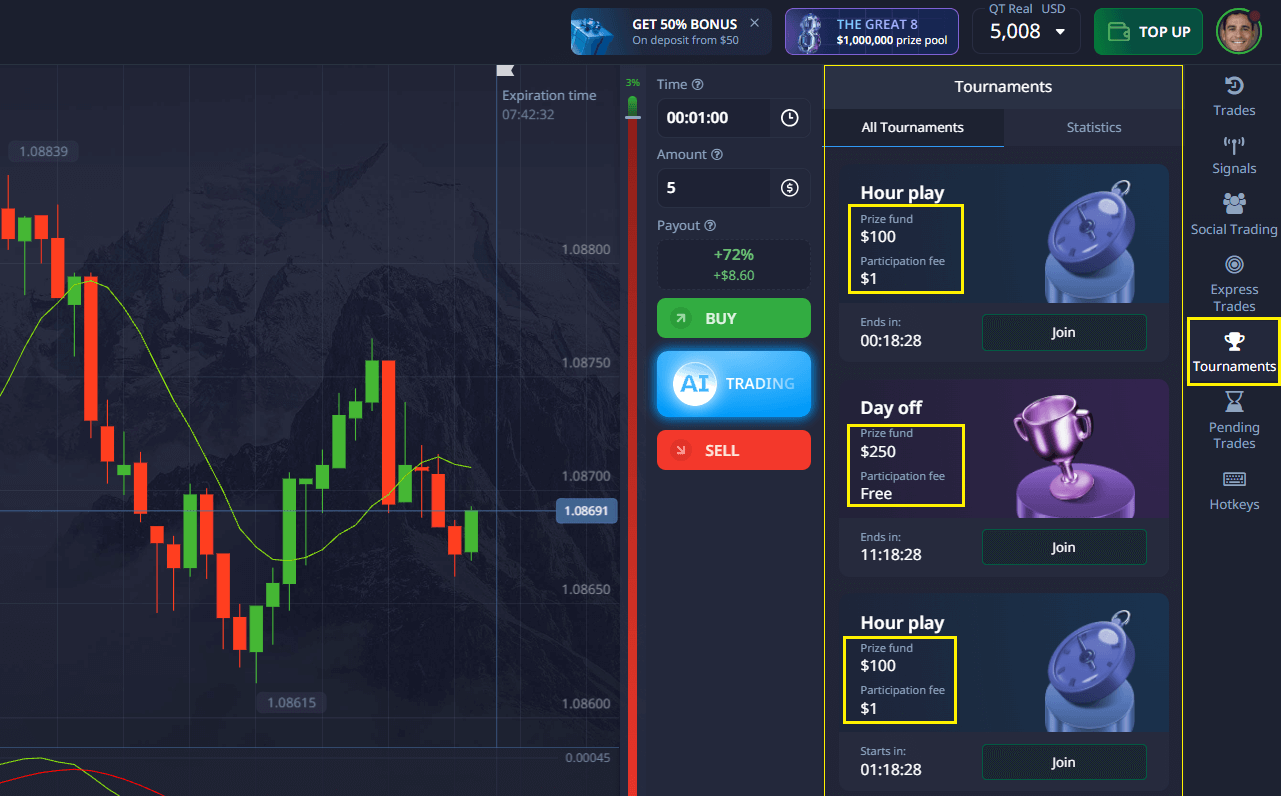

Demo Trading vs. Live Trading

| Feature | Live Account | Demo Account |

|---|---|---|

| Profit Potential | ✅ Real profits | ❌ Virtual only |

| Bonuses & Offers | ✅ Eligible | ❌ Not included |

| Real Tournaments | ✅ Access | ❌ No access |

| Cashback | ✅ Based on trades | ❌ Not applicable |

| Copy Trading | ✅ Enabled | ❌ Disabled |

| Gems & Rewards | ✅ Trade & earn | ❌ Not supported |

| Withdrawals | ✅ Available | ❌ Not applicable |

| Risk-Free Testing | ❌ Real money at risk | ✅ Safe practice |

| Strategy Testing | ❌ Costs real funds | ✅ No risk |

Regulation and Licensing

Is Pocket Option legit? Yes, the platform is officially registered and operates in accordance with legal requirements. This is confirmed by its license, which imposes strict operational standards.

Infinite Trade LLC is registered at Republic Of Costa Rica, San Jose- San Jose Mata Redonda, Neighborhood Las Vegas, Blue Building Diagonal To La Salle High School under registration number 4062001303240.

Pocket Option holds an International IBC Regulation Act 2014 Brokerage License and operates under the Autonomous Island of Mwali (Mohéli), Comoros Union jurisdiction.

Trader Reviews

“Pocket Option’s Quick Trading feature fits my schedule perfectly — especially the 24/7 OTC availability. I’ve never had more flexibility in managing my trades.” — James L., independent trader

“The sentiment indicator is a great guide for short-term entries. It’s helped me improve my real-time decisions.” — Anita D., forex strategist

“Copy trading on Pocket Option has allowed me to diversify my portfolio passively while learning from top performers.” — Carlos M., part-time investor

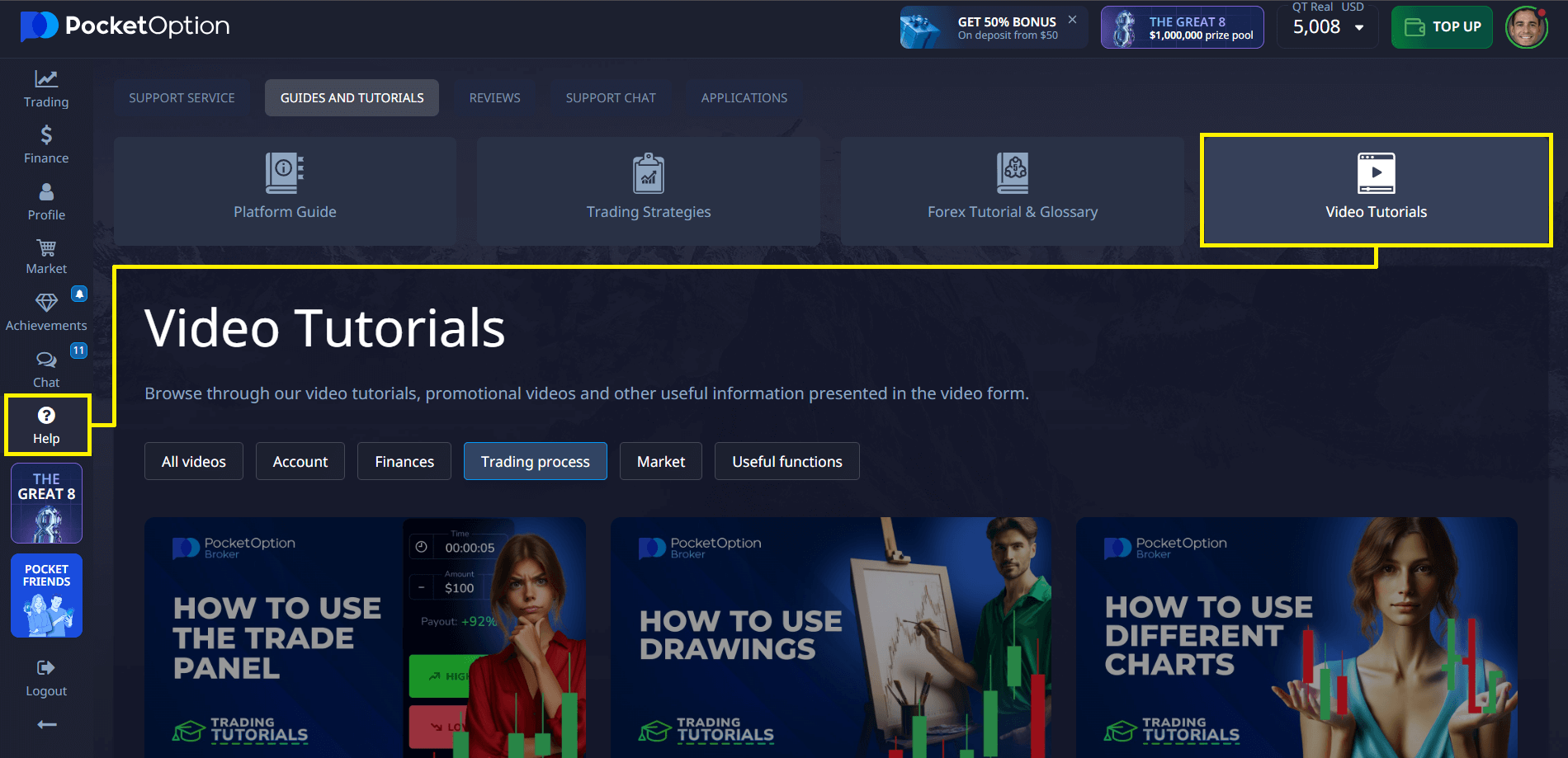

Learning Resources and Trading Education

Pocket Option provides extensive educational support to help traders at all levels improve their performance. The Help Center includes detailed guides, platform tutorials, and walkthroughs of popular trading strategies. Users can access step-by-step explanations and apply these strategies directly on a demo account before transitioning to real trading.

In addition, Pocket Option offers a library of over 30 educational videos covering a wide range of topics — from platform navigation to advanced trading strategies. These materials are designed to make both beginners and experienced users feel confident and prepared in the trading environment.

Final Thoughts

Pocket Option offers a flexible and robust platform for live traders. Whether you’re exploring Pocket Option live trading or engaging in Pocket Option day trading live, the tools and resources are designed to support your growth. Use expert insights, analyze results critically, and maintain discipline.

💬 Join the conversation: Discuss this and other topics in our community!

FAQ

What equipment setup is essential for effective Pocket Option live trading?

For optimal Pocket Option live trading, you need: 1) Computer with 8GB+ RAM and stable internet (30+ Mbps), 2) Dual monitors for simultaneous chart and execution views, 3) Backup internet connection for reliability, 4) Digital trading journal for performance tracking, and 5) Distraction-free workspace. While mobile trading works for monitoring, serious traders use desktop setups for faster analysis and execution, reducing decision lag by an average of 2.7 seconds per trade.

How do I successfully transition from demo to Pocket Option live trading?

Follow this proven transition process: 1) Achieve consistent profitability in demo for 8+ weeks, 2) Start with 25-30% of your normal position sizes in live markets, 3) Implement strict 1% risk per trade maximum, 4) Trade only your three highest-probability setups initially, and 5) Compare demo and live performance metrics weekly to identify execution differences. Expect an initial 15-20% performance decline as you adapt to the psychological reality of actual capital at risk.

What are the most common psychological challenges in Pocket Option live trading?

The primary psychological challenges are: 1) Entry hesitation despite clear signals, 2) Premature profit-taking (average profits 32% lower than demo), 3) Delayed loss-taking (average losses 27% larger than demo), 4) Revenge trading after losses, and 5) Position sizing inconsistency based on recent results. These issues stem from emotional activation when real money is involved. Counter them with pre-defined entry/exit rules, automated targets, and a 24-hour "cooling off" period after reaching daily loss limits.

How should I modify technical analysis for real-time Pocket Option trading?

Optimize your analysis with: 1) Focus on 2-3 core indicators instead of complex combinations, 2) Use leading indicators (price action, volume) rather than lagging ones, 3) Create binary "yes/no" setup qualification criteria (eliminate "maybe" situations), 4) Implement a two-timeframe system (execution timeframe plus one higher confirmation timeframe), and 5) Develop setup quality rating (A/B/C) that determines position sizing. These modifications reduce decision time by 62% while maintaining analytical accuracy.

What specific risk management protocols work best for Pocket Option live trading?

Implement these proven risk controls: 1) Fixed position sizing formula (1% risk per trade for A-setups, 0.5% for B-setups), 2) Technical-based stop placement with 15-pip buffer for market noise, 3) Three-tier profit targets (exit 1/3 at 1:1, 1/3 at 2:1, 1/3 at 3:1 risk/reward), 4) 5% maximum daily drawdown rule with mandatory 24-hour trading pause, and 5) Maximum two correlated positions simultaneously. These protocols prevent the catastrophic losses that eliminate 68% of unsuccessful traders within their first three months.