- The price has been forming candles above the EMA line, showing an upward trend.

- A new candle pulls back toward the EMA and briefly touches it, but does not break below.

- The next candle begins to form in the upward direction, bouncing off the EMA.

Pocket Option 5 Sec Strategy: A Professional Approach to Quick Trading

The Pocket Option 5 second trading strategy is one of the fastest and most precise methods available in modern trading. Try now with a simple example!

Article navigation

Understanding 5-Second Quick Trading

Pocket Option 5 sec strategy focuses on ultra-short-term forecasting, where traders aim to predict price movement within just five seconds. This approach is not based on traditional options — instead, traders use Quick Trading on the platform to forecast whether the price will go up or down. If the forecast is correct, the potential profit reaches up to 92%.

✔️ Try our demo for risk free practice, bot and popular strategies to trade 100+ assets!

Mastering this method requires more than just speed — it demands sharp market analysis, disciplined execution, and a deep understanding of price behavior in micro timeframes. In this article, we’ll break down the full process, including tools, setups, risks, and a real-world trade example.

✔️ Quick Trading with 5-second positions is built for identifying and exploiting short-lived price movements. Instead of relying on long-term market trends, traders look for micro-signals that appear and vanish within seconds.

Example of a 5-Second Trade on Pocket Option

Let’s take a look at how a typical 5-second trade works on the Pocket Option platform using a simple trend-following setup.

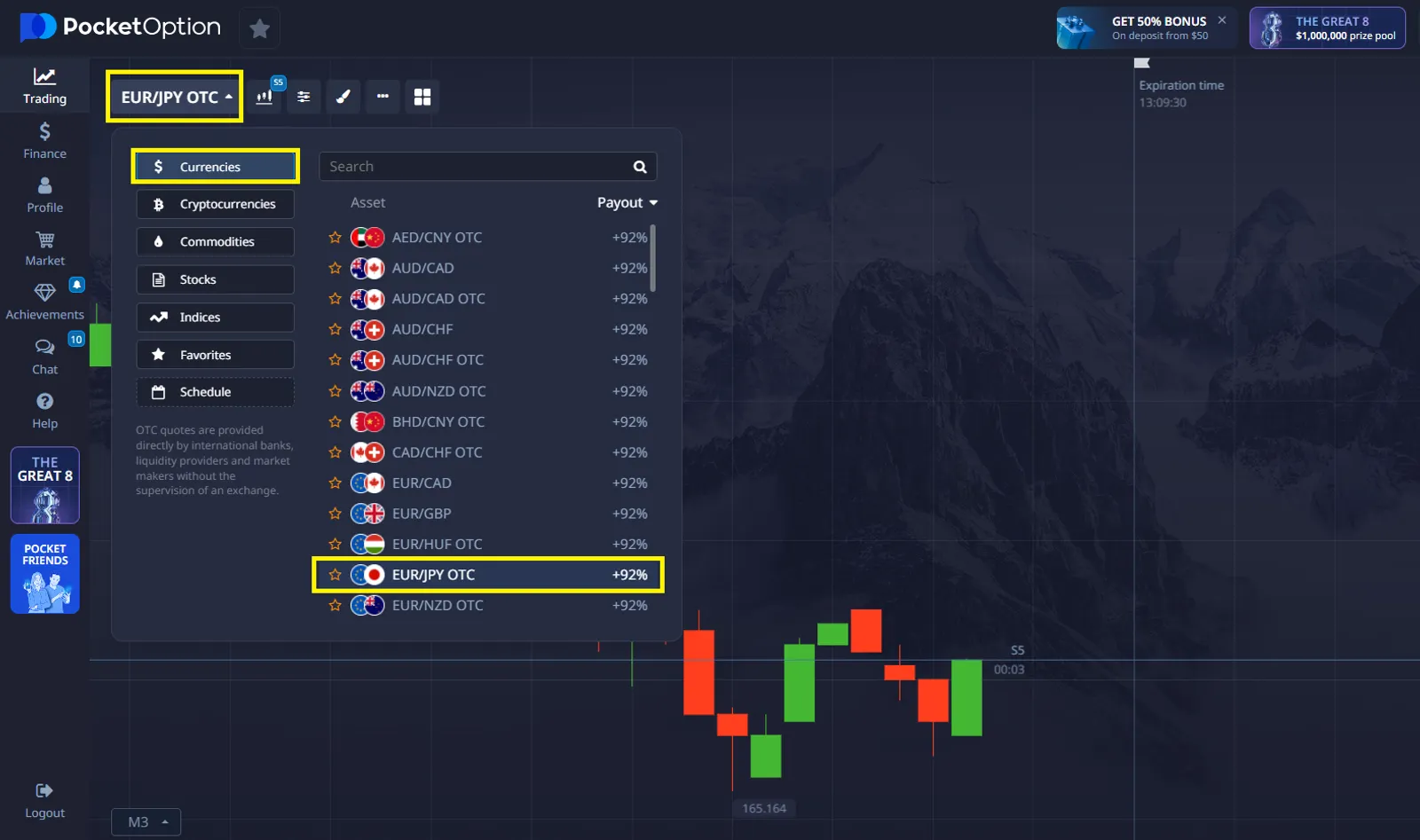

Choose an Asset: You select EUR/JPY during the London trading session. This period is known for increased volatility, which is helpful for short-term trading.

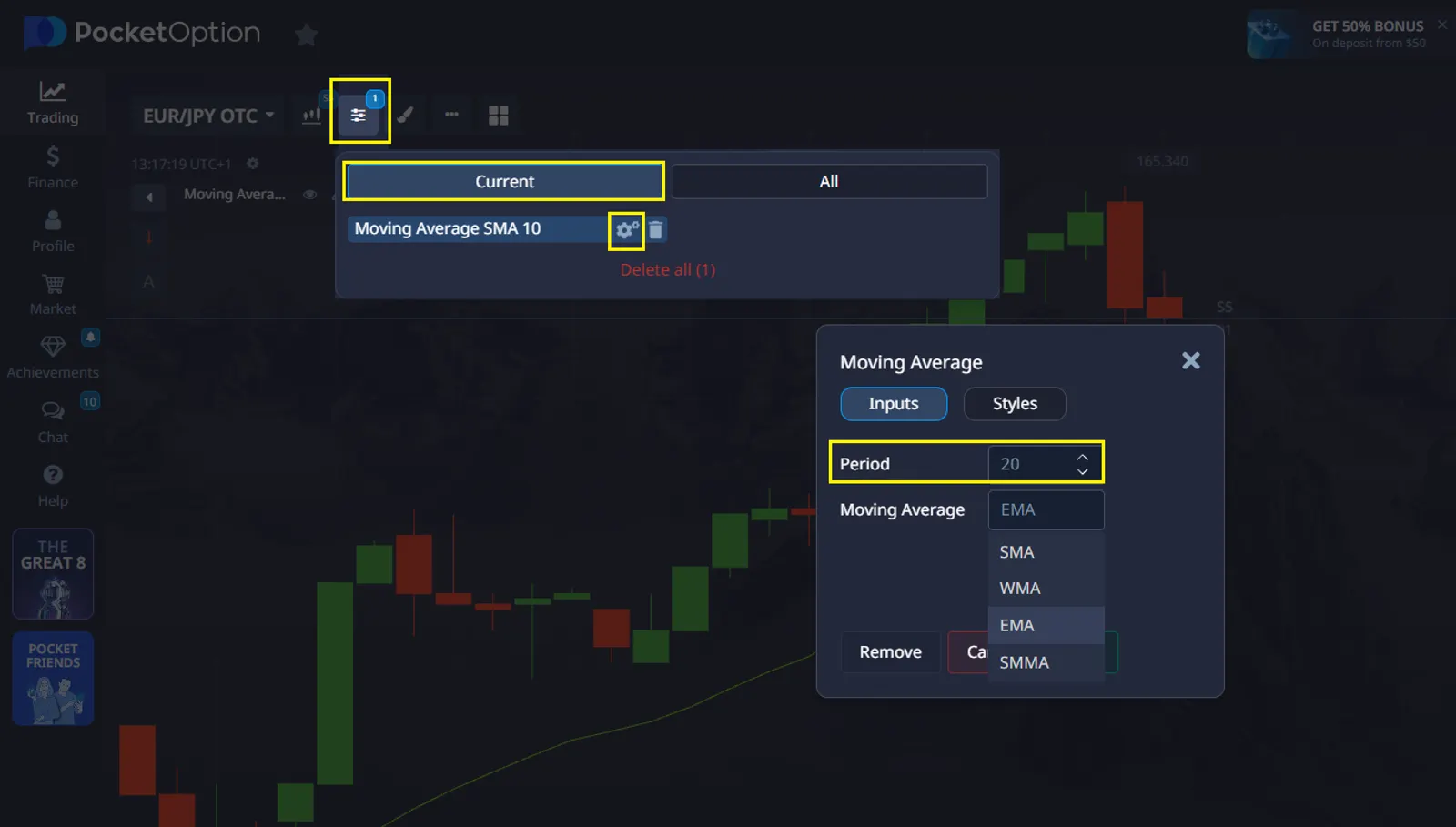

Analyze the Market: You apply the EMA (Exponential Moving Average) with a 20-period setting to the chart.

You notice that:

This movement suggests a possible continuation of the uptrend for a few more seconds.

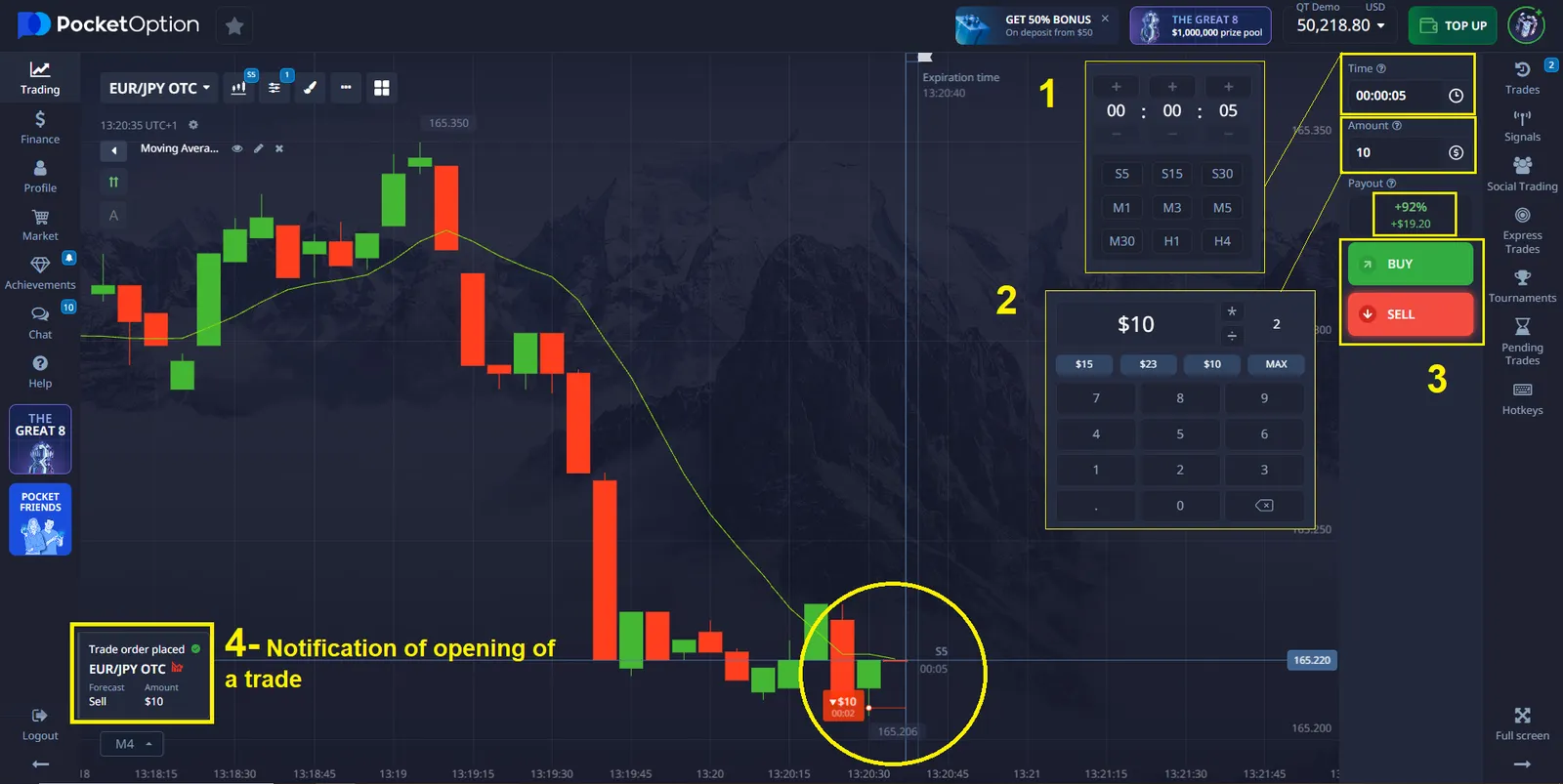

Make a Forecast and Place a Trade: Select 5 seconds as your trade duration. Then choose your trade amount — your potential profit will be calculated as a percentage of this amount.

Next, choose the price direction:

- If you believe the price will go down, click Sell.

- If you think it will go up, click Buy.

In our example, the candles are forming below the moving average, so we select a Sell (Red) position.

✔️ After 5 seconds, our prediction turns out to be correct. We invested $10 and received $10 back, plus $9.20 profit (which is 92% of the trade amount).

This trade is provided as an educational example and does not constitute financial advice or a trading recommendation. You can test any strategy using a demo account before starting Pocket Option 5 second trading with real funds.

If you’re using the 5-second trading strategy, it’s important to select a short chart timeframe to clearly observe how price movements develop during each trade.

✅ Recommended chart timeframe:

- 5-second timeframe (5s) – This is the best option available for visualizing short-term trends on the platform. Each candle represents the full duration of your trade, helping you spot quick reversals, momentum bursts, or continuation signals with clarity.

- 15 seconds and above – These are not recommended for 5-second trades, as each candle covers a much longer period and may hide critical short-term price movements.

Core Components of the Strategy

| Key Element | Role in 5-Second Strategy | Application Tip |

|---|---|---|

| Pattern Recognition | Detect candle wicks, breakouts, and reversals | Practice with chart replay on 5s timeframe |

| Timing | Execute trade at the right second | Use one-click trading with fixed investment amounts |

| Volatility Monitoring | Avoid flat markets and trade during active sessions | Focus on London and New York market hours |

| Emotional Discipline | Avoid overtrading and revenge trades | Stick to trade limits and cooldown rules |

Recommended Indicators and Settings

Standard indicator settings don’t work on ultra-short intervals. For the 5-second strategy, everything needs to be faster. Here are a few optimized tools:

| Indicator | Custom Settings | Signal to Act |

|---|---|---|

| RSI | 2 periods | Cross below 20 or above 80 = reversal entry |

| Stochastic | 3, 1, 1 | Overbought/Oversold + crossover = entry |

| Bollinger Bands | 5 periods, 2.5 SD | Touch band edge + rejection wick = reversal forecast |

Experienced traders may also focus on pure price action — analyzing tick volumes, micro-reversals, or breakout candles — instead of relying solely on indicators.

High-Probability Setups

The success of the 5-second strategy depends on precise conditions. Based on trader data, these setups show higher accuracy:

| Market Condition | Entry Trigger | Why It Works |

|---|---|---|

| News Reaction | First reversal after price spike | Captures correction after volatility surge |

| Support/Resistance Bounce | Price touches key level and rejects with volume | Combines technical and volume confirmation |

| Tight Range Breakout | Sudden expansion after compression phase | High chance of directional push |

| RSI Divergence | Price extreme without indicator confirmation | Early warning of a turn |

Realistic Risk Management for Micro-Trading

Due to the frequency and speed of trades, losses can add up quickly. Here’s how to stay protected:

- Never risk more than 1% of your balance on a single trade

- Stop after three consecutive losses — do not chase recovery

- Take a 10-minute break every 20 trades to reset focus

- Only trade when volatility (measured by ATR) is above average

Pocket Option helps enforce discipline with built-in trade limits and session controls that can be pre-configured.

✔️Try Strategy tutorials on platform

Common Mistakes to Avoid

- Trading during sideways markets without clear momentum

- Using too many indicators that cause signal conflict

- Ignoring latency and platform execution speed

- Doubling trade size after a win out of excitement

Psychology and Mental Control

Short-term trading is mentally demanding. To succeed, you need to master not only setups but also your own reactions.

| Mental Skill | How to Develop It |

|---|---|

| Impulse Control | Pause 5 seconds before entering any new trade |

| Focus Discipline | Limit trading sessions to 60 minutes |

| Decisive Execution | Pre-define setups and don’t hesitate at entry moment |

| Emotional Stability | Don’t evaluate outcome — focus on setup quality |

Conclusion

The Pocket Option 5 second strategy is not about gambling — it’s about structure, speed, and discipline. While the method is aggressive, traders who invest time in backtesting, setup recognition, and risk control can find opportunities that longer timeframes often overlook.

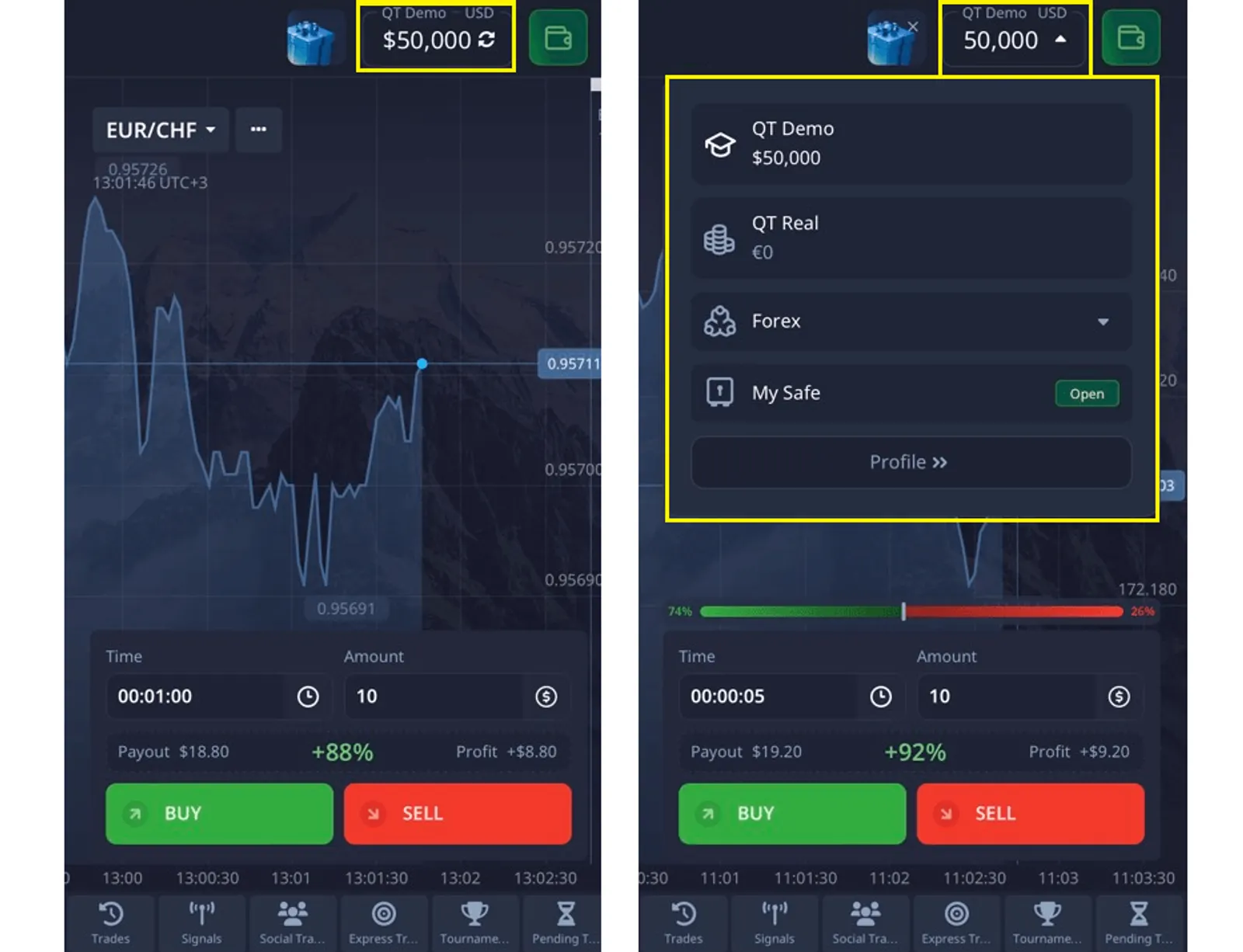

To get started safely, try Quick Trading with a free demo account, configure fast indicators, and only move to real trades after consistent demo performance.

FAQ

What exactly is the Pocket Option 5 sec strategy?

The Pocket Option 5 sec strategy is an ultra-short-term trading approach that focuses on executing trades with a 5-second expiration time. It relies on specialized technical analysis and rapid pattern recognition to capitalize on momentary price movements in highly liquid markets.

Is the Pocket Option 5 second trading strategy suitable for beginners?

This strategy requires significant trading experience and emotional discipline due to its fast-paced nature. Beginners should first master longer timeframe trading before attempting 5-second strategies to develop fundamental trading skills and risk management capabilities.

What technical indicators work best with the Pocket Option 5 sec strategy?

Fast-responding momentum indicators with modified settings work best, including RSI with 2-3 period settings, MACD with 3,6,2 parameters, and Stochastic Oscillator with 3,1,1 settings. These modifications make the indicators more responsive to the compressed timeframe requirements.

How much capital should I allocate to 5-second trading on Pocket Option?

Traders should initially allocate only a small percentage (5-10%) of their overall trading capital to 5-second strategies. This conservative approach allows for proper risk management while developing proficiency in this specialized trading method without endangering your overall investment portfolio.