- 53 Forex pairs

What is OTC in Pocket Option Trading System

Understanding what is OTC in Pocket Option is essential for traders who want to expand their trading opportunities beyond traditional market hours. Trade 24/7 with Pocket Option!

Article navigation

What is OTC in Pocket Option?

In the trading world, every investor seeks maximum flexibility and the ability to trade at any convenient time. However, traditional financial markets operate on a fixed schedule, creating certain limitations. This is where OTC trading (Over-The-Counter), available on the Pocket Option platform, comes into play.

OTC in Pocket Option: How Does It Work?

OTC refers to a decentralized market where trading occurs directly between participants without a centralized exchange. In the case of Pocket Option, this means the ability to trade 24/7, including weekends and holidays.

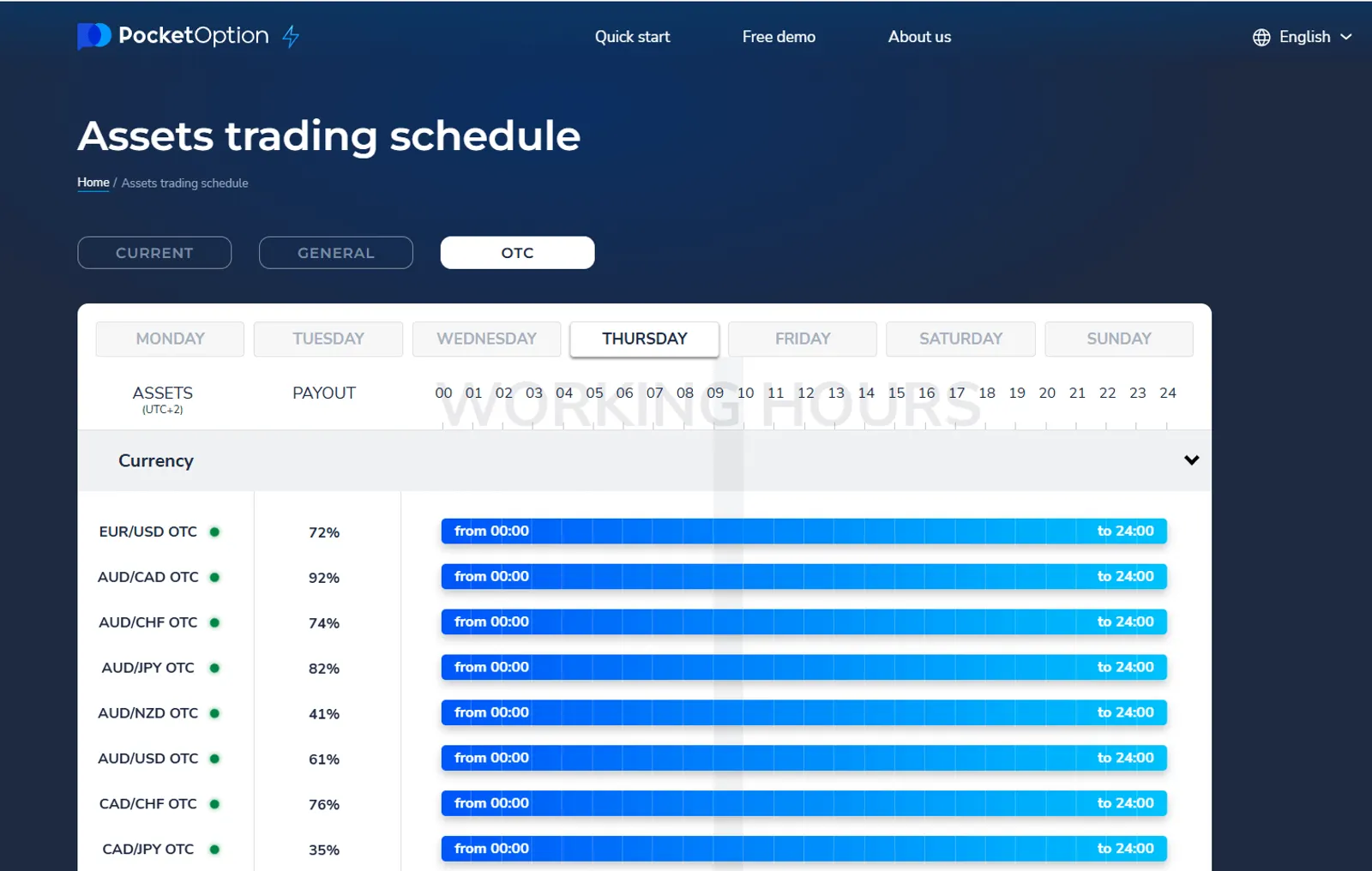

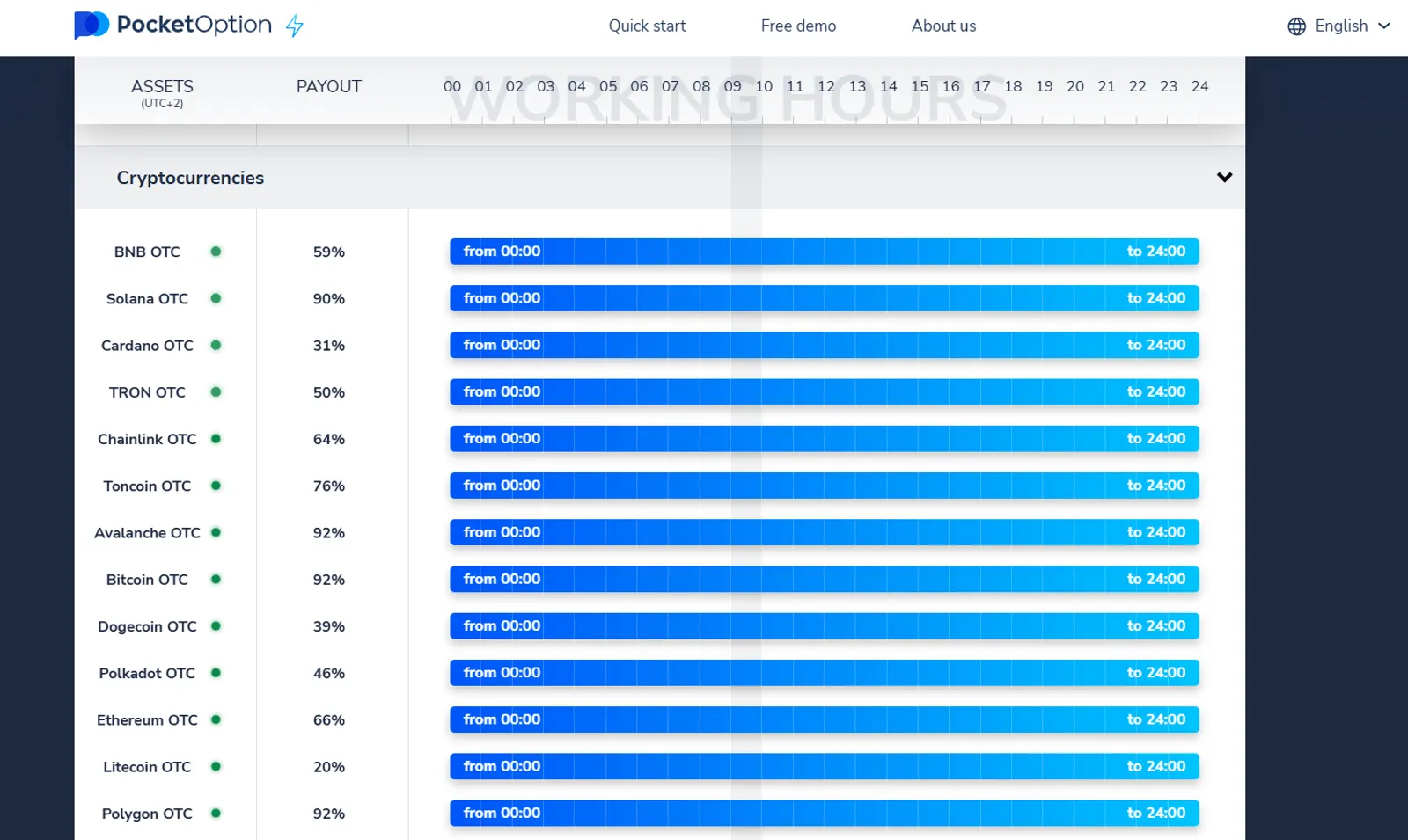

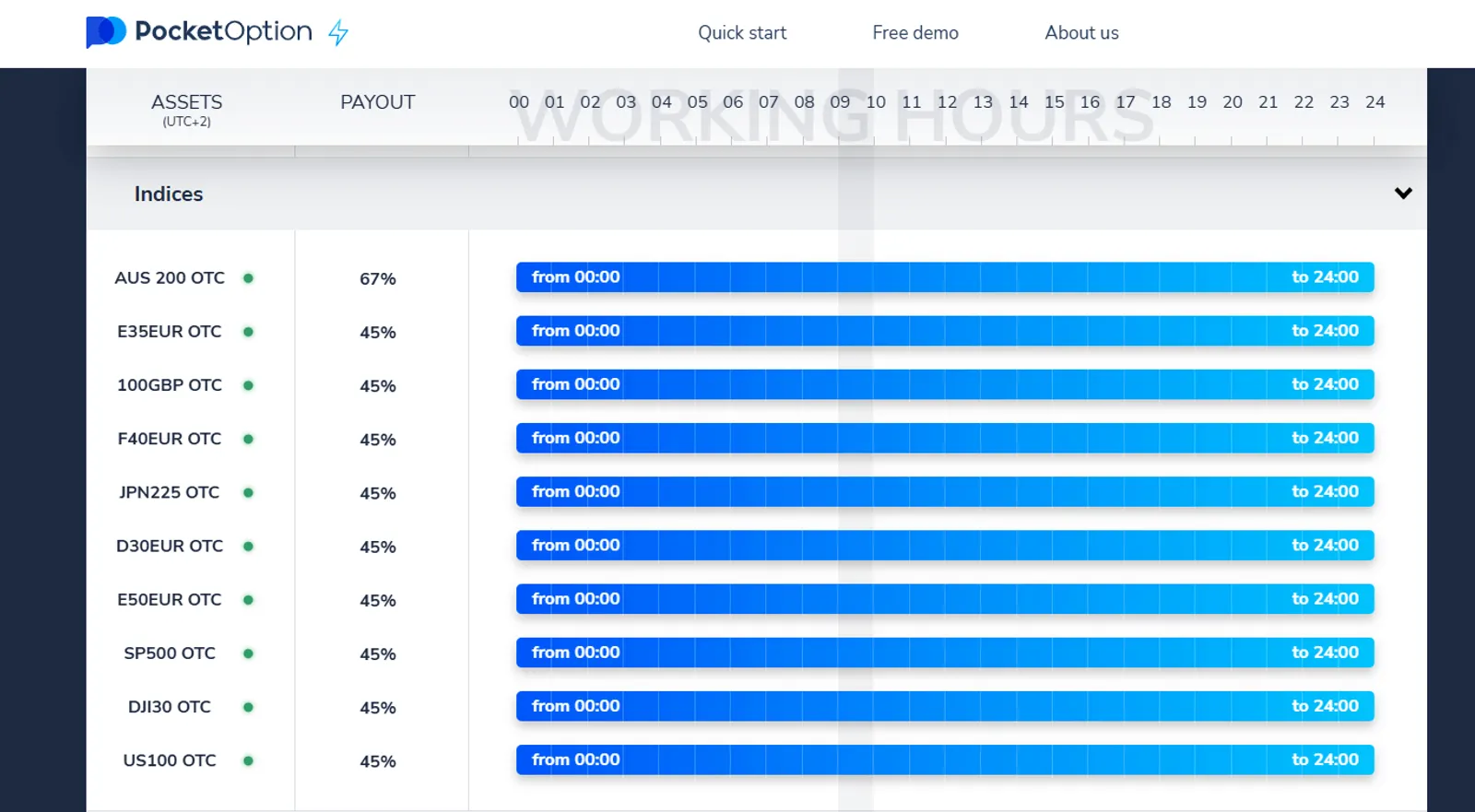

The platform offers a wide range of assets for OTC trading. As you can see, it has the high payout percentage:

- 7 commodities

- 19 stocks

- 14 cryptocurrencies

- 10 indices

This allows users to continue trading even when traditional financial markets are closed. This is why Pocket Option OTC is a popular choice among traders looking for uninterrupted market access.

How to Start Trading OTC on Pocket Option?

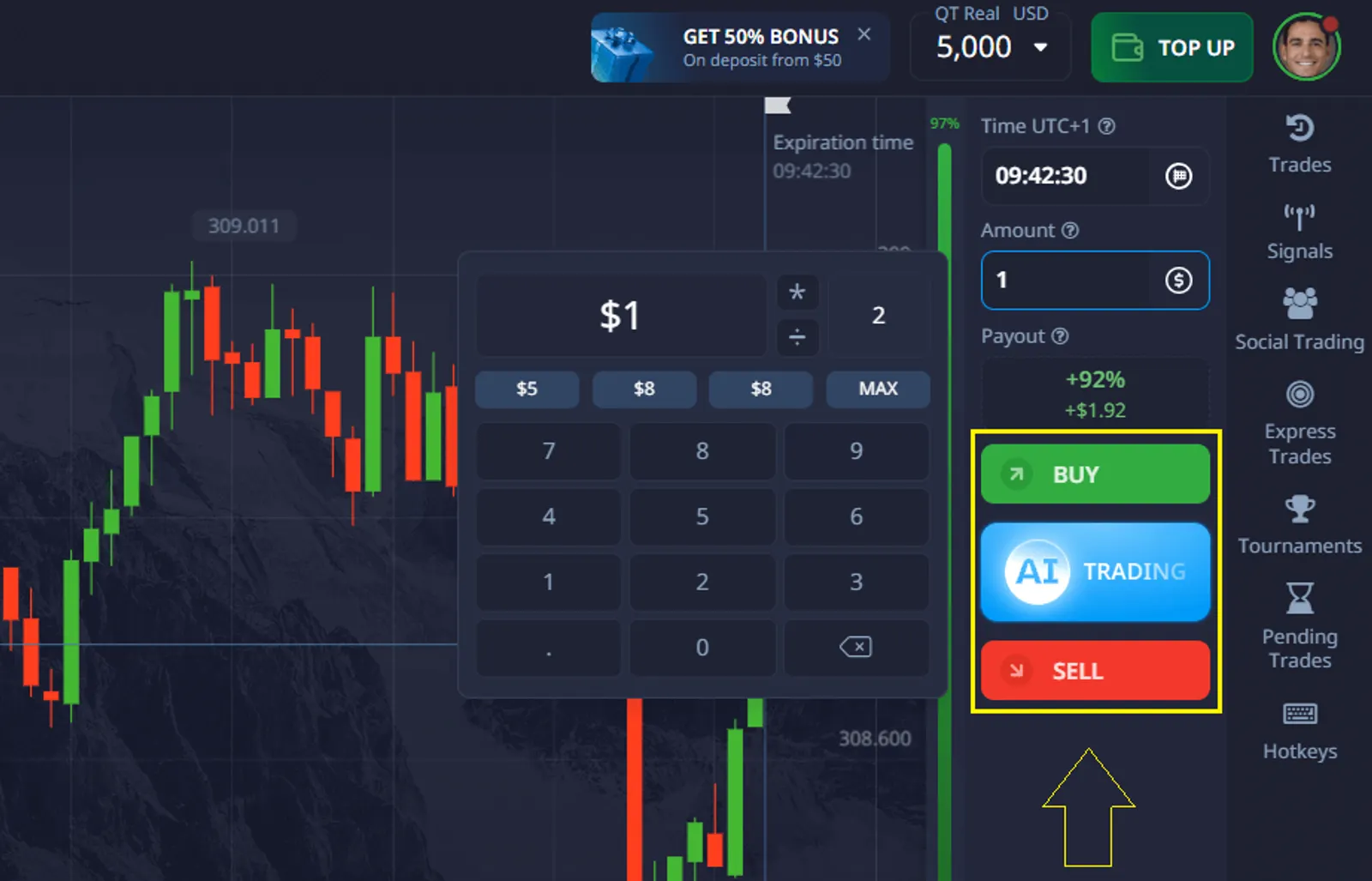

1. Select the asset you want to trade.

2. Enter the trade amount (starting from $1).

3. To select the time of a trade, click on the ‘Time’ menu on the trading panel.

4. Choose the price movement direction: Buy(up) or Sell(down)

5. Confirm the trade and monitor the chart.

Now you are ready to trade with OTC trading anytime! ✔️

Who Should Trade OTC?

OTC trading is ideal for those who cannot trade during regular market hours or want to continue earning on weekends and holidays. Professional traders benefit from non-stop opportunities, while beginners can use this time to test strategies in a demo account.

The concept of why is Pocket Option otc important becomes clear when we examine the advantages it offers to traders. This system enables continuous trading operations regardless of main market schedules.

- Extended trading hours

- Additional market opportunities

- Flexible trading conditions

- Diverse asset selection

How to Trade OTC Successfully?

Despite myths about the unpredictability of OTC markets, a strategic approach can lead to profits even with high volatility. Here are some key tips:

✔️ Study historical data – Analyze charts, identify strong trends and support/resistance levels.

✔️ Use technical analysis – Classic indicators like Moving Averages, MACD, and RSI work well in OTC trading.

✔️ Apply risk management – Never risk too much capital on a single trade.

✔️ Practice on a demo account – Test your strategy before switching to real money trading.

Conclusion

OTC in Pocket Option offers 24/7 trading opportunities, regardless of time or day. While there are certain risks, proper analysis, capital management, and discipline allow traders to succeed in the OTC market. Don’t believe in myths—try it yourself and discover the potential of OTC trading!

FAQ

What is the main difference between regular and OTC trading in Pocket Option?

Regular trading follows exchange hours, while OTC trading allows 24/7 market access with custom quotes.

Can I use the same strategies for OTC and regular market trading?

While basic strategies remain applicable, OTC trading requires adjustments for different market conditions and liquidity levels.

How reliable are OTC market prices?

OTC prices in Pocket Option are derived from multiple liquidity providers, ensuring fair market representation.

Is OTC trading suitable for beginners?

OTC trading requires understanding of market mechanics, but Pocket Option provides educational resources for all skill levels.

What assets are available for OTC trading?

OTC trading includes various assets like currencies, commodities, and indices, with availability depending on market hours.