- Quarterly earnings reports — These show Apple’s revenue, profit, and performance in different product areas. A strong report can boost the stock price.

- Product launches and announcements — New iPhones, updates to macOS, or rumors of innovation (like VR headsets) can create big price shifts.

- News and global events — Regulatory changes, lawsuits, or supply chain disruptions may affect investor confidence.

- Overall market trends — If the tech sector is rising, Apple stock often moves along with it.

Apple Stock: what you should know before trading

Apple is one of the most recognizable companies in the world — and its stock is among the most followed on the market. But what does it really mean to trade Apple stocks on a platform like Pocket Option? In this article, we’ll explain how the stock works, what affects its price, and how beginners can get started step by step — even without investing real money right away.

What is Apple Stock

When we talk about Apple stock, we’re referring to stocks of Apple Inc., a major tech company based in the United States. Apple designs and sells consumer electronics, software, and services — including the iPhone, Mac, Apple Watch, and iCloud.

Apple’s stocks are traded on the NASDAQ stock exchange under the ticker symbol AAPL.

✔️Buying or selling Apple stock on a Pocket Option trading platform doesn’t mean you’re becoming a long-term investor. Instead, you’re making a short-term forecast on where the price of the stock will go — up or down — within a specific time frame.

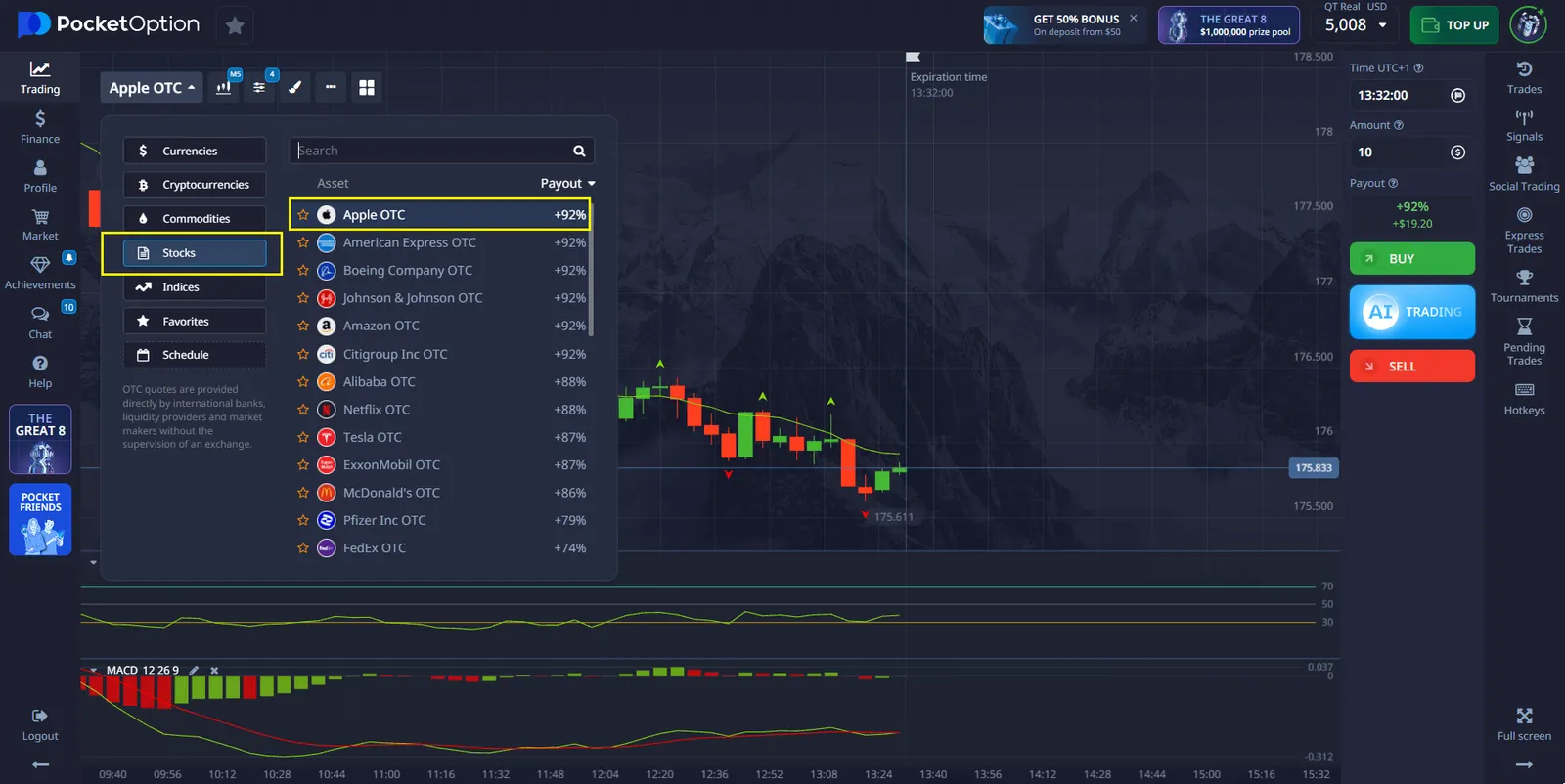

Apple is available in two formats on our trading platform: standard and OTC.

The standard version reflects real market liquidity and pricing from major financial institutions. The OTC version, although based on the same price movements, is executed internally with adjustable conditions such as spread and volume. This allows flexible trading even in periods of low liquidity with conditions tailored to the platform.

What influences Apple’s stock price

There are several key factors that cause the price of Apple stocks to move:

Example: In 2023, news about Apple’s shift to in-house chip production caused excitement among investors. As a result, the stock saw a noticeable jump over a few days.

How to interpret Apple stock movements

Let’s say Apple stock rises from $170.00 to $175.00.

This means:

- The stock gained $5 in value

- Buyers were more active, possibly after positive news

- If someone had correctly forecasted this move on the platform, their trade would’ve ended in profit

Now imagine the opposite: the stock drops from $172.00 to $166.50. That may signal a weaker earnings report, negative media, or simply market correction after a previous rise.

But remember: a rising price doesn’t always mean long-term growth, and a drop doesn’t always mean trouble. Traders focus on short-term opportunities — and those can go either way.

Example trade on Apple stocks

Here’s how a basic trade on Apple Inc. stock might look:

- Open the platform and find Apple Inc. or Apple Inc. OTC (if outside regular market hours).

- Check the chart. You can use indicators like RSI, MACD or others, and look at recent price trends.

- Choose your trade amount — starting from just $1.

- Set the trading time. From 5 seconds (for OTC assets) to several hours.

- Make your forecast:

- If you think the price will go up — click BUY

- If you think it will go down — click SELL

✅ If your forecast is correct, you can earn up to 92% on the trade. The exact return is visible before you confirm the deal.

Latest News and Analysis on Apple

In early April 2025, Apple introduced an updated iPad lineup featuring improved processors and support for a new stylus. This led to a short-term increase in interest from traders, driven by expectations of higher sales.

Additionally, investors are closely watching the upcoming financial report for Apple’s second quarter, scheduled for release in mid-April. The results may influence the stock’s movement in the near future.

✔️To better understand how such events impact price behavior, Pocket Option users can take advantage of built-in tools like the news feed, analysis section, and economic calendar. These features help track key developments and support more informed forecasting.

Practice risk-free with a $50,000 demo account

Not sure where to begin? After registering on the platform, you’ll get access to a free demo account with $50,000 in virtual funds.

With this account, you can:

- Explore how stock trading works

- Try different strategies and forecasts

- Learn from your mistakes — without real losses

- Understand how Apple stock behaves in different situations

It’s a stress-free way to build experience and confidence.

What you unlock after a $5 deposit

Once you’re ready to move from demo to real trading, a deposit starting from just $5 (may vary depending on payment methods)

Unlock powerful features:

- Copy-trading — follow and learn from experienced traders

- Cashback — receive a portion of your losses back

- Tournaments — compete with others for prizes

- Full access to trading tools and real payouts

FAQ

What affects the price of Apple stock the most?

Key events like product launches and earnings reports usually drive big moves.

How can I trade Apple stock without risking real money?

Use the free demo account with $50,000 virtual funds to practice safely.

What tools help me analyze Apple stock on the platform?

You can use indicators like RSI, MACD, and news feeds built into the interface.

Can I trade Apple stock anytime?

Yes — Apple Inc. OTC is available outside regular market hours for flexible trading.

What’s the minimum to start real trading on Apple stock?

A $5 deposit gives you full access to real trades, copy-trading, and bonuses (deposit may vary depending on payment methods).