- Thời gian giao dịch bắt đầu từ 5 giây

- Thực hiện lệnh tức thì

- Dữ liệu thị trường thời gian thực

- Giao diện sạch sẽ, phản hồi nhanh

Nền tảng Giao dịch HFX: Tính năng Chính, Lợi ích Hàng đầu & Cách Bắt đầu

Giao dịch HFX -- hay giao dịch Forex tần suất cao -- được thiết kế cho những người di chuyển nhanh, suy nghĩ nhanh và giao dịch nhanh. Đây là phong cách giao dịch được xây dựng dựa trên tốc độ, độ chính xác và cơ hội ngắn hạn. Trong bài viết này, chúng tôi sẽ giải thích nền tảng HFX là gì, chỉ cho bạn cách chúng hoạt động và xem xét kỹ hơn về Pocket Option -- một trong những nền tảng thân thiện với người dùng nhất cho giao dịch HFX.

Nền tảng Giao dịch HFX Là Gì?

Định nghĩa Nhanh

Nền tảng giao dịch HFX cho phép giao dịch tần suất cao, nơi nhiều giao dịch được thực hiện trong vài giây hoặc phút. Các nền tảng này ưu tiên tốc độ thực hiện, công cụ trực quan và hợp đồng ngắn hạn.

Yêu cầu Chính

Các Nền tảng HFX Phổ biến: So sánh Nhanh

| Nền tảng | Tính năng | Tốt nhất Cho |

|---|---|---|

| Nadex | Giao dịch nhị phân và spread có quy định | Nhà giao dịch có kinh nghiệm |

| IQ Option | Thiết kế đơn giản với giao dịch ngắn hạn | Người mới bắt đầu |

| Binary.com | Hợp đồng tùy chỉnh, chỉ số biến động | Nhà giao dịch trung cấp |

| Pocket Option | Thực hiện nhanh, giao dịch xã hội, chế độ nhanh | Mọi cấp độ kỹ năng |

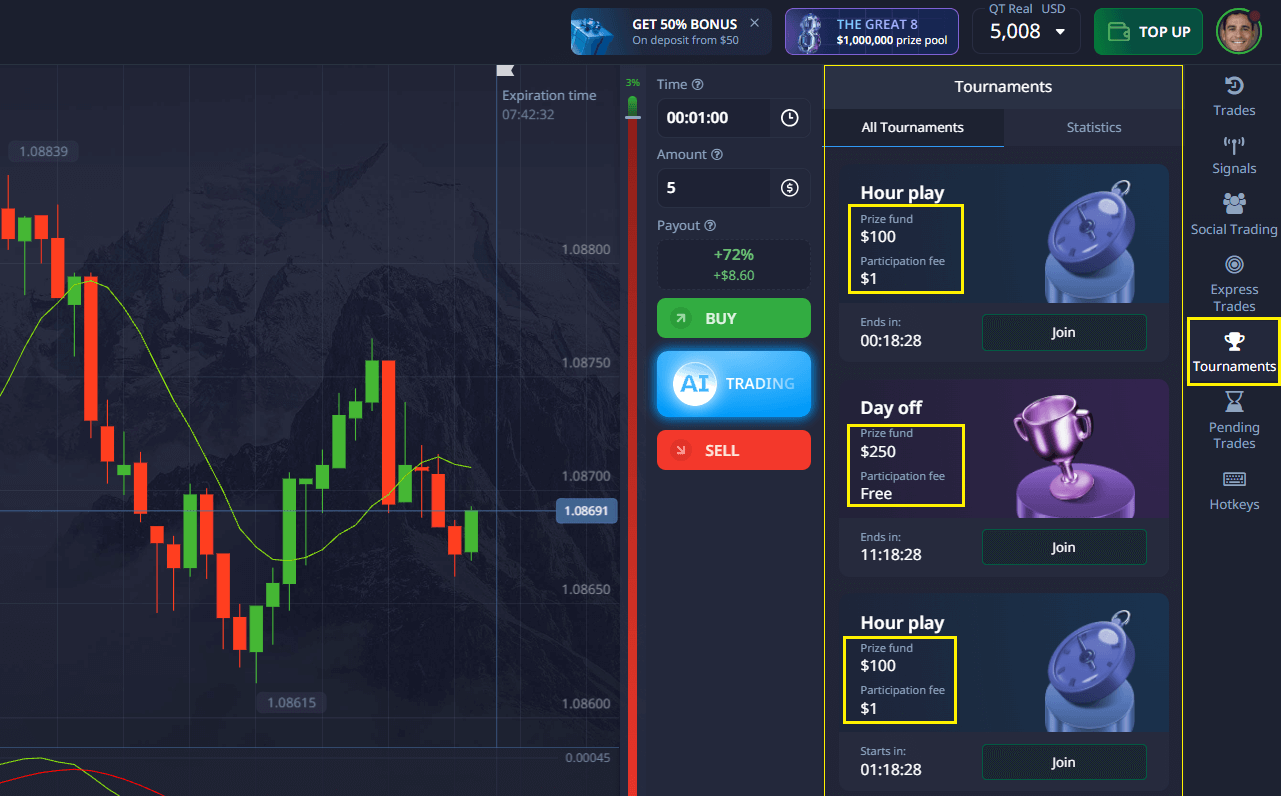

Tại sao Pocket Option Là Nền tảng Giao dịch HFX Tuyệt vời

Pocket Option kết hợp các công cụ chuyên nghiệp với khả năng sử dụng trực quan. Dù bạn là người mới hoàn toàn hay nhà giao dịch tích cực, nền tảng này thích ứng với tốc độ và chiến lược của bạn.

Giao dịch Nhanh – Thực hiện Giao dịch Tức thì

⚡Tốc độ rất quan trọng trong HFX. Khả năng thực hiện cực nhanh của Pocket Option cho phép bạn đặt lệnh giao dịch chỉ từ 5 giây.

| Đó Là Gì | Cách Bắt đầu | Lợi ích |

|---|---|---|

| Pocket Option xử lý Giao dịch Nhanh theo giá thị trường | Đăng nhập, chọn tài sản, đặt thời gian và số tiền giao dịch, nhấp MUA hoặc BÁN | Cho phép phản ứng thời gian thực với biến động thị trường và giảm rủi ro trượt giá |

Điều này đặc biệt có giá trị trong thị trường biến động nơi thời gian là tất cả. Không cần tải xuống, bạn có thể giao dịch ngay lập tức từ trình duyệt hoặc điện thoại di động.

📊 Các Chế độ Giao dịch Phù hợp Cho Mọi người

Pocket Option cung cấp thiết lập giao dịch linh hoạt để phù hợp với các sở thích và mức độ kinh nghiệm khác nhau.

1. Giao dịch Demo

| Đó Là Gì | Cách Bắt đầu | Lợi ích |

|---|---|---|

| Cách không rủi ro để thực hành giao dịch với tiền ảo | Đăng ký và truy cập tài khoản demo từ bảng điều khiển | Hoàn hảo cho người mới bắt đầu để kiểm tra chiến lược và học cách sử dụng nền tảng |

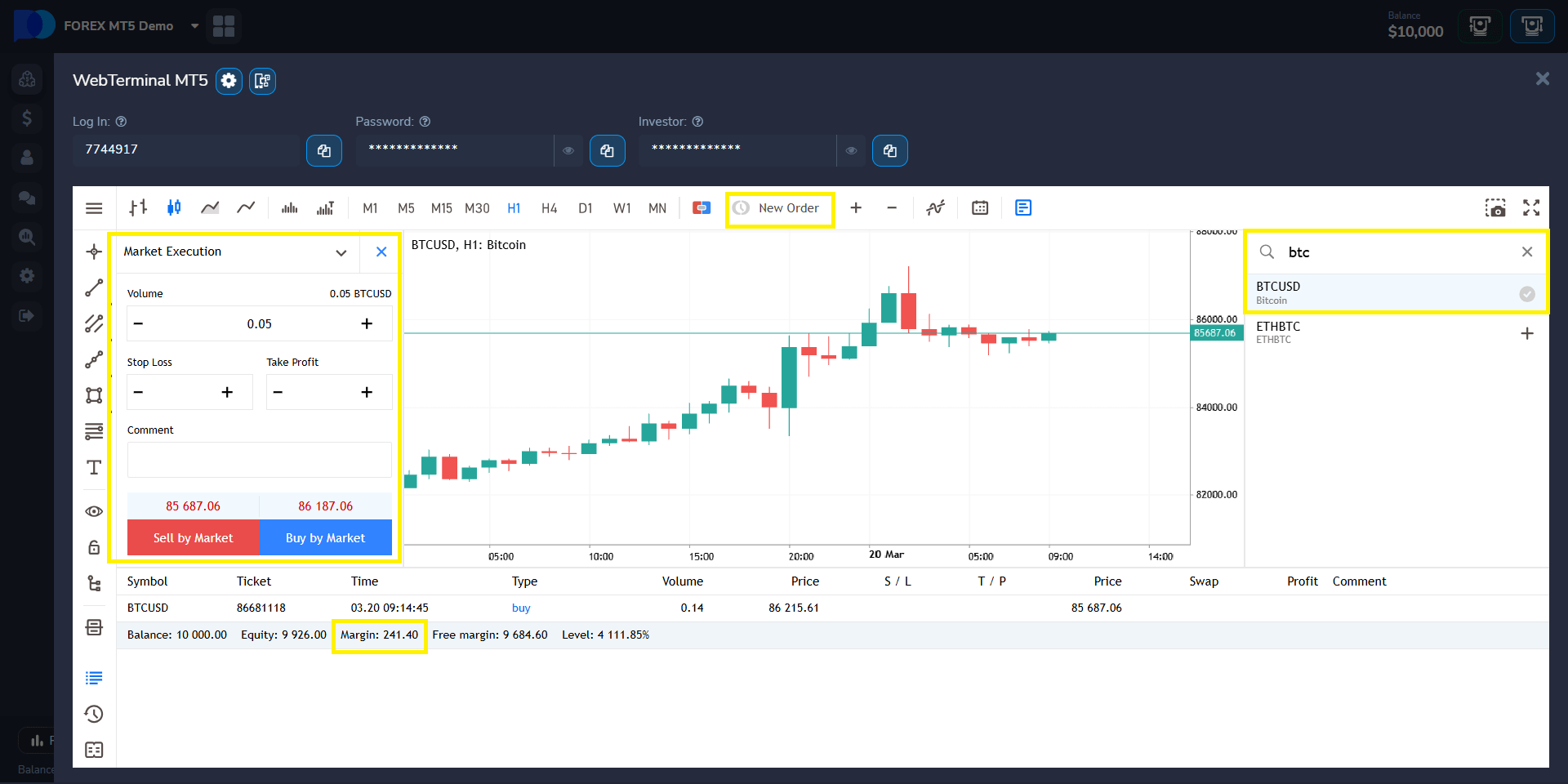

2. MetaTrader

| Đó Là Gì | Cách Bắt đầu | Lợi ích |

|---|---|---|

| Nền tảng chuyên nghiệp tích hợp với Pocket Option, hỗ trợ Forex & CFD | Đăng ký trên Pocket Option, mở MT5 hoặc MT4 từ trang web Pocket Option và đăng nhập bằng tài khoản của bạn | Công cụ biểu đồ nâng cao, nhiều khung thời gian, giao dịch thuật toán, bộ kỹ thuật đầy đủ |

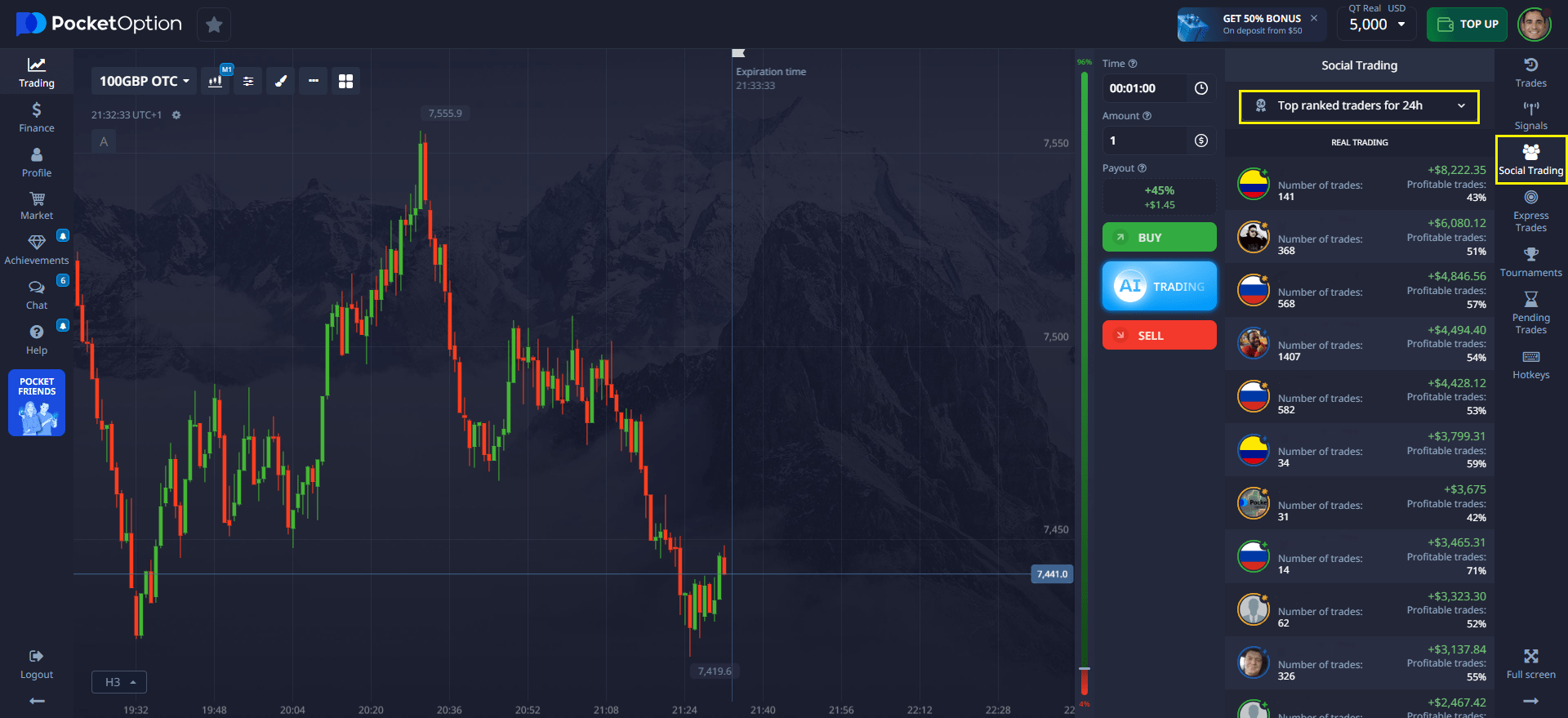

3. Giao dịch Xã hội

| Đó Là Gì | Cách Bắt đầu | Lợi ích |

|---|---|---|

| Sao chép giao dịch từ các nhà giao dịch hiệu quả nhất trong thời gian thực | Đi đến tab “Giao dịch Xã hội”, xem hồ sơ và nhấp “Theo dõi” | Học hỏi từ các nhà giao dịch có kinh nghiệm và kiếm tiền thụ động bằng cách sao chép giao dịch của họ |

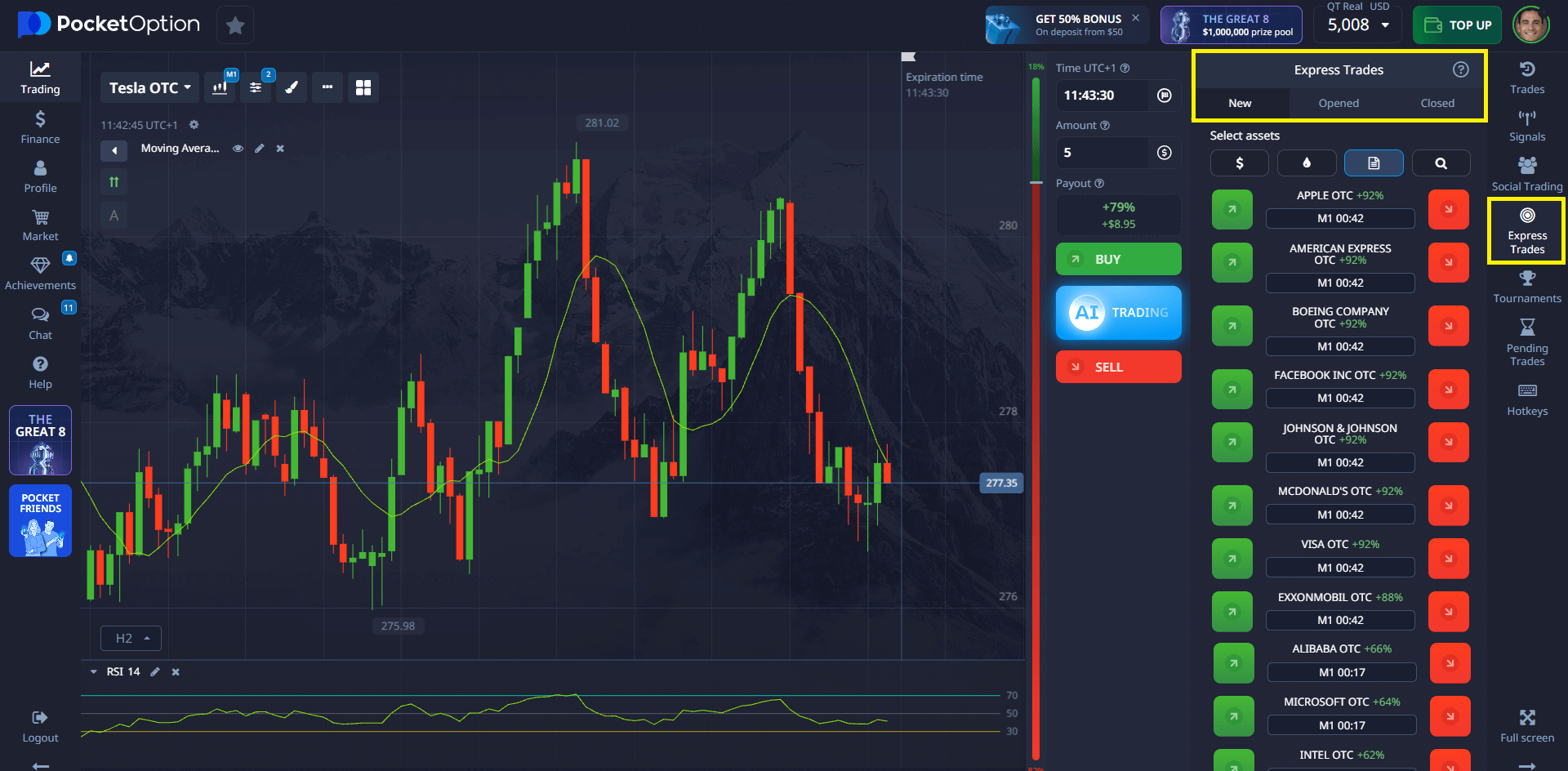

3. Giao dịch Nhanh

| Đó Là Gì | Cách Bắt đầu | Lợi ích |

|---|---|---|

| Kết hợp nhiều giao dịch thành một cược duy nhất để tăng tiềm năng thanh toán | Chọn “Nhanh” trong giao diện giao dịch, chọn một số tài sản, đặt giao dịch nhanh | Thanh toán cao hơn với dự báo kết hợp; thêm sự đa dạng chiến lược |

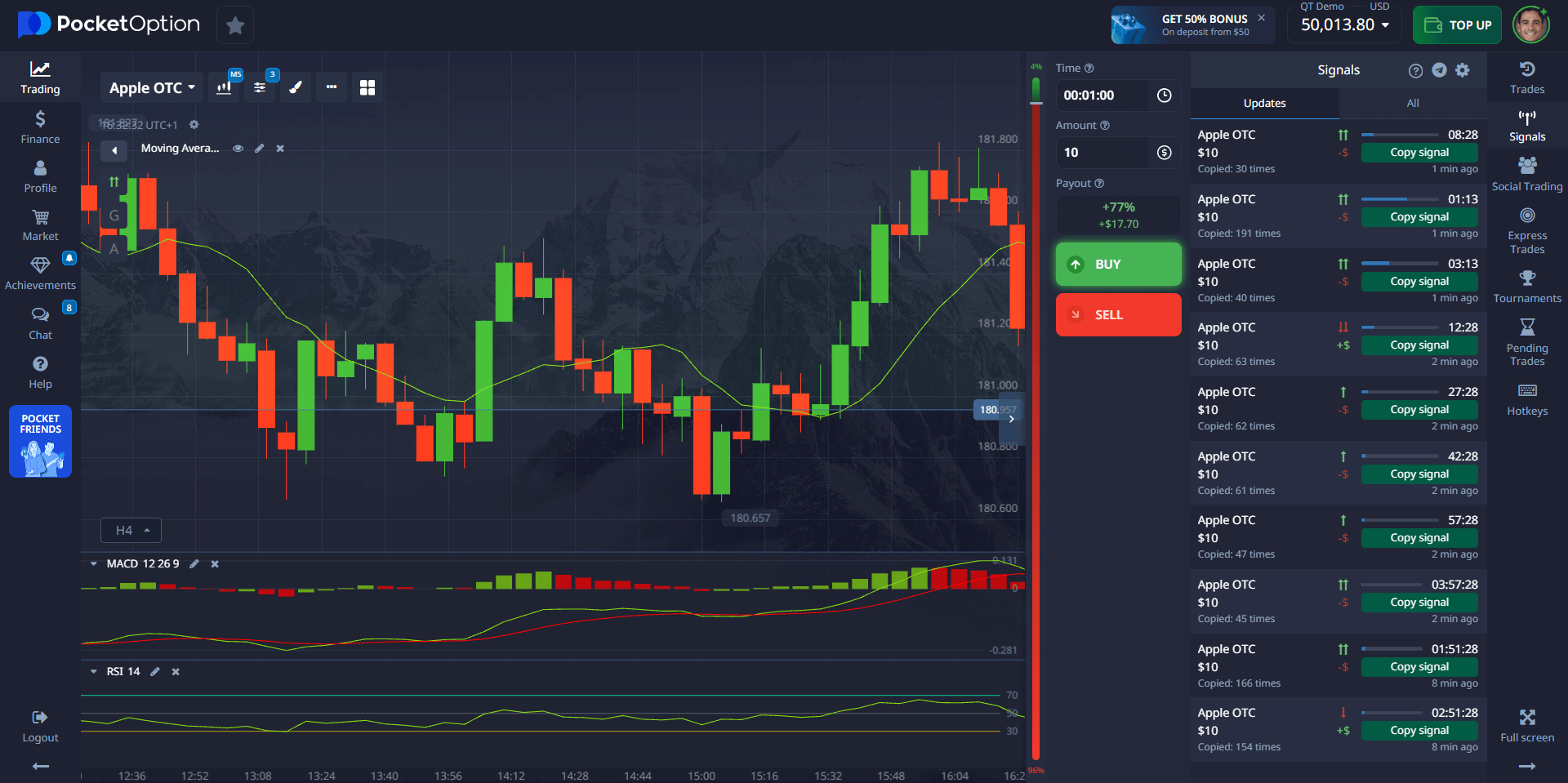

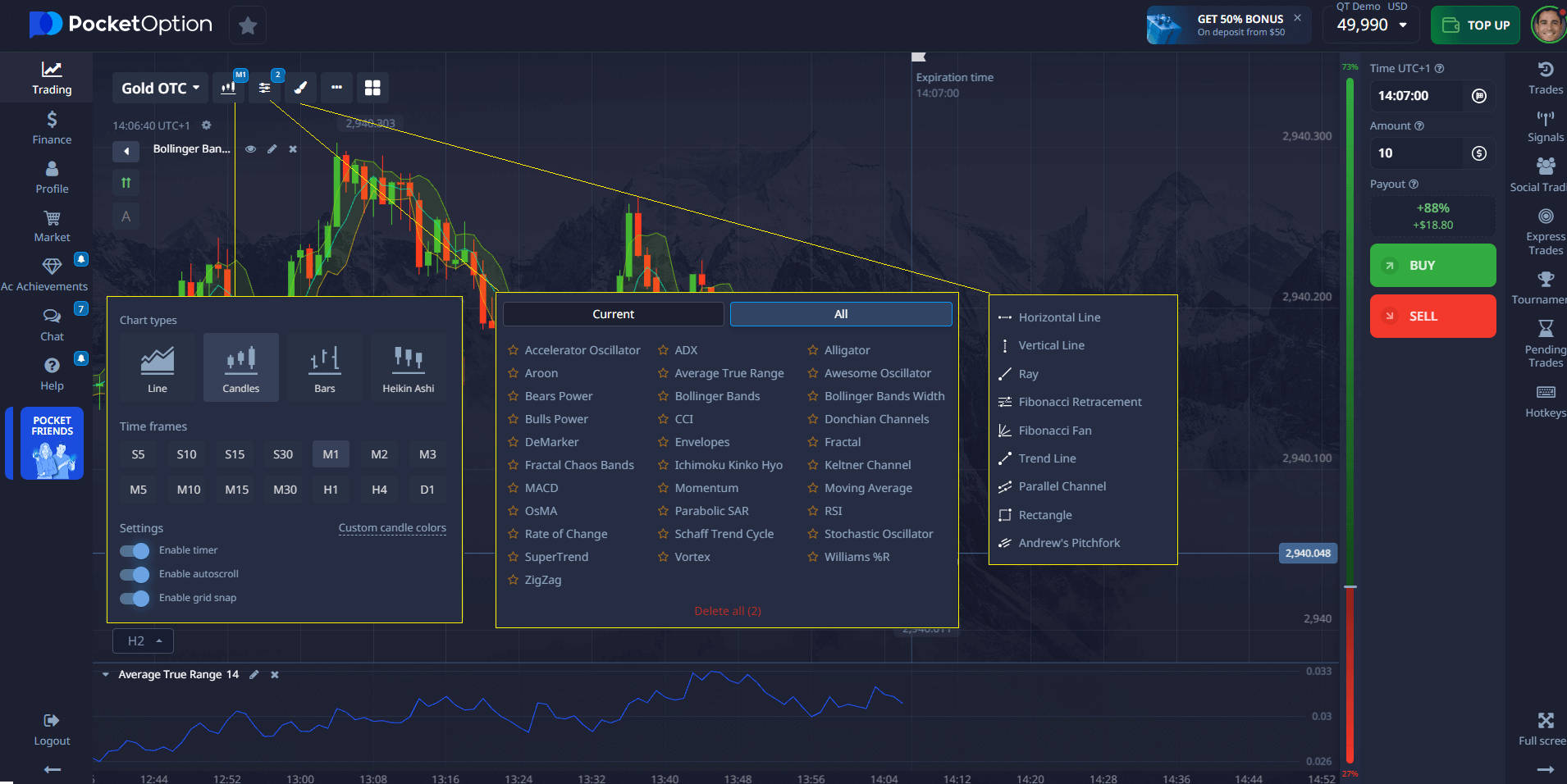

📈 Công cụ Phân tích và Dự báo Tích hợp

Đưa ra quyết định thông minh hơn với các công cụ được tích hợp sẵn trong nền tảng.

| Tính năng | Đó Là Gì | Cách Sử dụng | Lợi ích |

|---|---|---|---|

| Chỉ báo Tâm lý Nhà giao dịch | Hiển thị cách người dùng khác dự đoán hướng giá | Xem chỉ báo bên dưới biểu đồ tài sản trước khi mở giao dịch | Hữu ích cho phân tích đám đông và tâm lý thị trường |

| Công cụ Biểu đồ | Bao gồm các chỉ báo kỹ thuật như RSI, Bollinger Bands, MACD | Nhấp “Chỉ báo” trên bảng bên trái và chọn công cụ để hiển thị trên biểu đồ | Giúp phân tích xu hướng và phát hiện điểm vào/ra tiềm năng |

| Lịch sử Giao dịch | Xem nhật ký chi tiết các giao dịch trước đây | Truy cập “Lịch sử” từ menu bên trái | Học hỏi từ hiệu suất trước đây, cải thiện chiến lược của bạn |

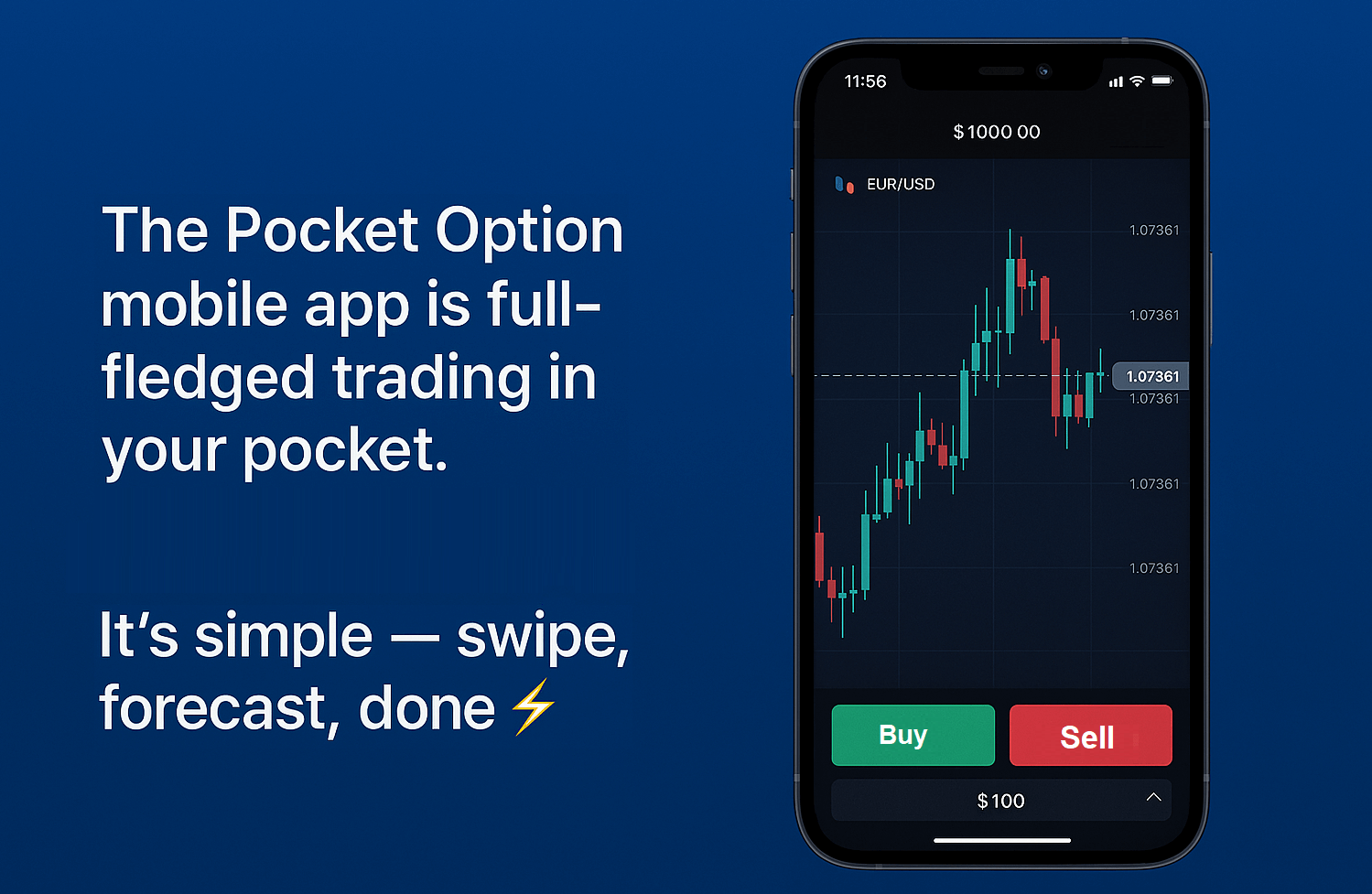

📱 Giao dịch Ở mọi nơi, Mọi lúc

Dù bạn đang ở bàn làm việc hay đang di chuyển, Pocket Option giữ cho bạn luôn kết nối.

Cách giao dịch:

- Trình duyệt Web: Nền tảng đầy đủ chức năng, không cần tải xuống.

- Ứng dụng Di động: Có sẵn cho iOS và Android, với đầy đủ công cụ giao dịch.

Bạn luôn chỉ cách một lần chạm để phân tích, dự đoán và thực hiện giao dịch.

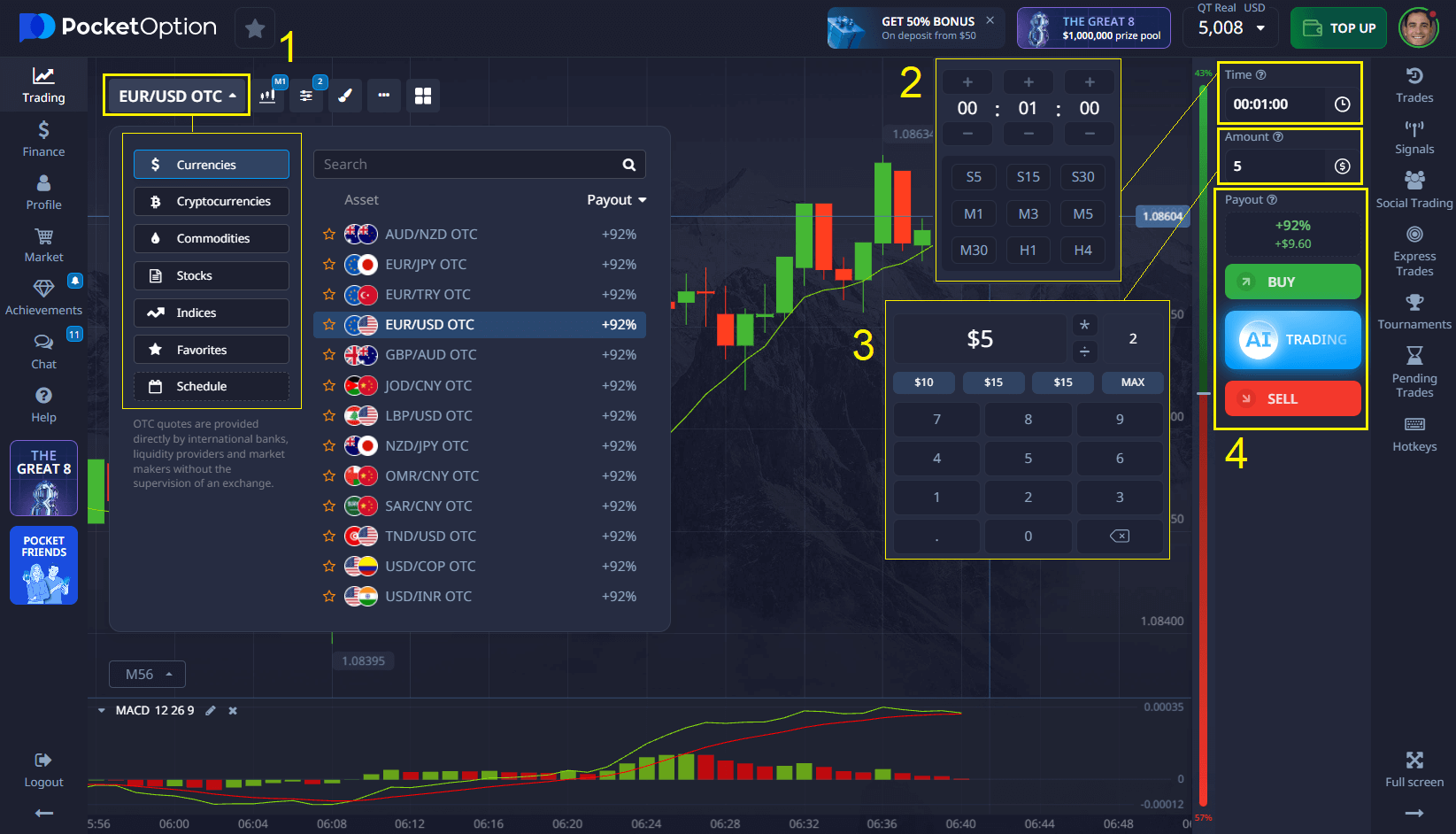

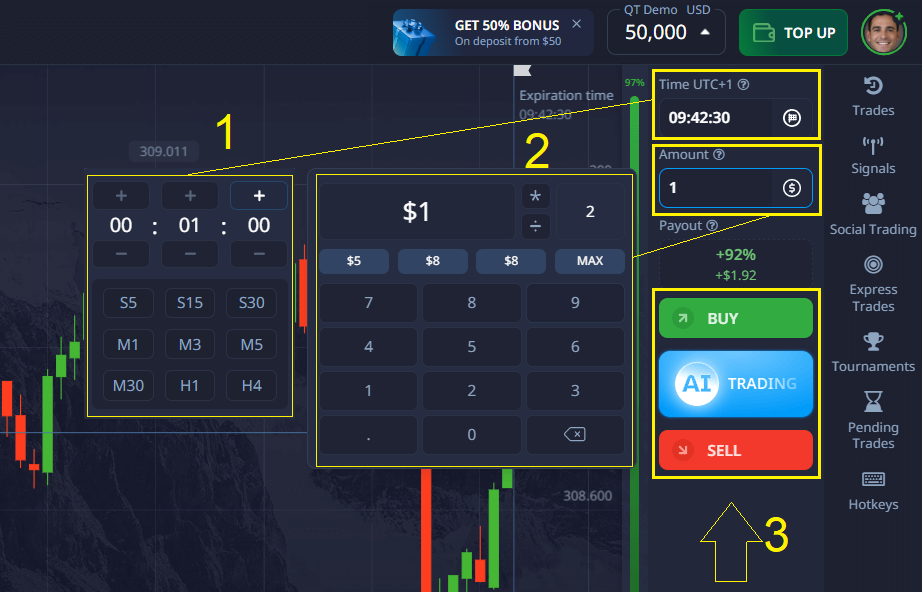

📌 Cách Thực hiện Giao dịch Nhanh trên Pocket Option

Làm theo các bước sau để đặt giao dịch HFX đầu tiên của bạn trong chưa đầy một phút:

- Chọn một tài sản (ví dụ: EUR/USD, cổ phiếu Tesla, Bitcoin)

- Phân tích biểu đồ bằng chỉ báo hoặc công cụ tâm lý

- Đặt số tiền giao dịch (tối thiểu $1) và thời gian (từ 5 giây)

- Dự đoán hướng:

- Nhấp MUA nếu bạn nghĩ giá sẽ tăng

- Nhấp BÁN nếu bạn kỳ vọng nó sẽ giảm

- Đợi hết hạn — nếu dự báo của bạn đúng, bạn sẽ kiếm được lợi nhuận lên đến 92%

🎯 Tính năng Bổ sung Tạo nên Sự khác biệt

- Không cần tải xuống — giao dịch trong trình duyệt của bạn

- Ngưỡng tham gia thấp — bắt đầu với chỉ $5 tiền gửi

- Hỗ trợ đa ngôn ngữ — nền tảng có sẵn hơn 20 ngôn ngữ

- Tài khoản demo miễn phí — chuyển đổi bất cứ lúc nào

- Hệ thống thưởng — phần thưởng cho tiền gửi và hoạt động giao dịch

Kết luận

Giao dịch HFX là tất cả về quyết định nhanh, di chuyển nhanh và lợi nhuận nhanh. Nếu bạn đã sẵn sàng khám phá phong cách giao dịch này, Pocket Option là nơi hoàn hảo để bắt đầu. Nó kết hợp thực hiện tức thì, công cụ thông minh và thiết kế ưu tiên người dùng giúp giao dịch tần suất cao trở nên dễ tiếp cận với mọi người.

Thiết lập tài khoản demo của bạn ngay hôm nay, khám phá nền tảng và xem liệu HFX có phù hợp với chiến lược của bạn không — từng giây một.

Không tải xuống, không căng thẳng — chỉ cần mở, nhấp và bắt đầu!

FAQ

HFX có nghĩa là gì trong giao dịch?

Nó là viết tắt của giao dịch Forex tần suất cao -- một phong cách mà bạn thực hiện nhiều giao dịch với thời gian rất ngắn.

Pocket Option có tốt cho giao dịch HFX không?

Có. Nó cung cấp thực hiện nhanh, giao diện đơn giản và nhiều tùy chọn giao dịch ngắn hạn.

Tôi có thể thử HFX trên Pocket Option mà không cần tiền thật không?

Hoàn toàn có thể. Bạn nhận được tài khoản demo miễn phí với tiền ảo để thực hành không rủi ro.

Số tiền tối thiểu để bắt đầu giao dịch là bao nhiêu?

Bạn có thể gửi ít nhất $5 và bắt đầu giao dịch với $1 cho mỗi giao dịch.

Tôi có cần tải xuống bất cứ thứ gì để sử dụng Pocket Option không?

Không -- bạn có thể giao dịch trực tiếp từ trình duyệt web của mình, hoặc tải xuống ứng dụng di động nếu bạn thích.