- EV Market Growth: Global EV sales are forecast to hit 60% market share by 2040 (IEA).

- AI & Automation: Tesla’s Dojo supercomputer and Optimus robot project will fuel new business lines.

- Economic Climate: Inflation, interest rates, and GDP growth impact consumer demand and tech valuations.

- Supply Chain Health: Access to lithium, semiconductors, and rare earths.

- Public Sentiment: Influenced by Elon Musk’s social presence and public trust.

Tesla Stock Price Prediction 2040: Long-term Analysis and Price Targets

This article provides an in-depth analysis of Tesla's future market potential, with a particular focus on the Tesla stock price prediction 2040.

Introduction to Tesla Stock

As Tesla continues to lead in electric vehicles, robotics, and AI, long-term forecasts become essential for serious investors. Here we provide a deep dive into TSLA predictions for 2025, 2026, and 2040, including expert quotes, investor insights, and strategic advice. This includes comprehensive discussion around Tesla price prediction 2040, tsla stock forecast 2040, and Tesla stock prediction 2040.

Overview of Tesla Inc

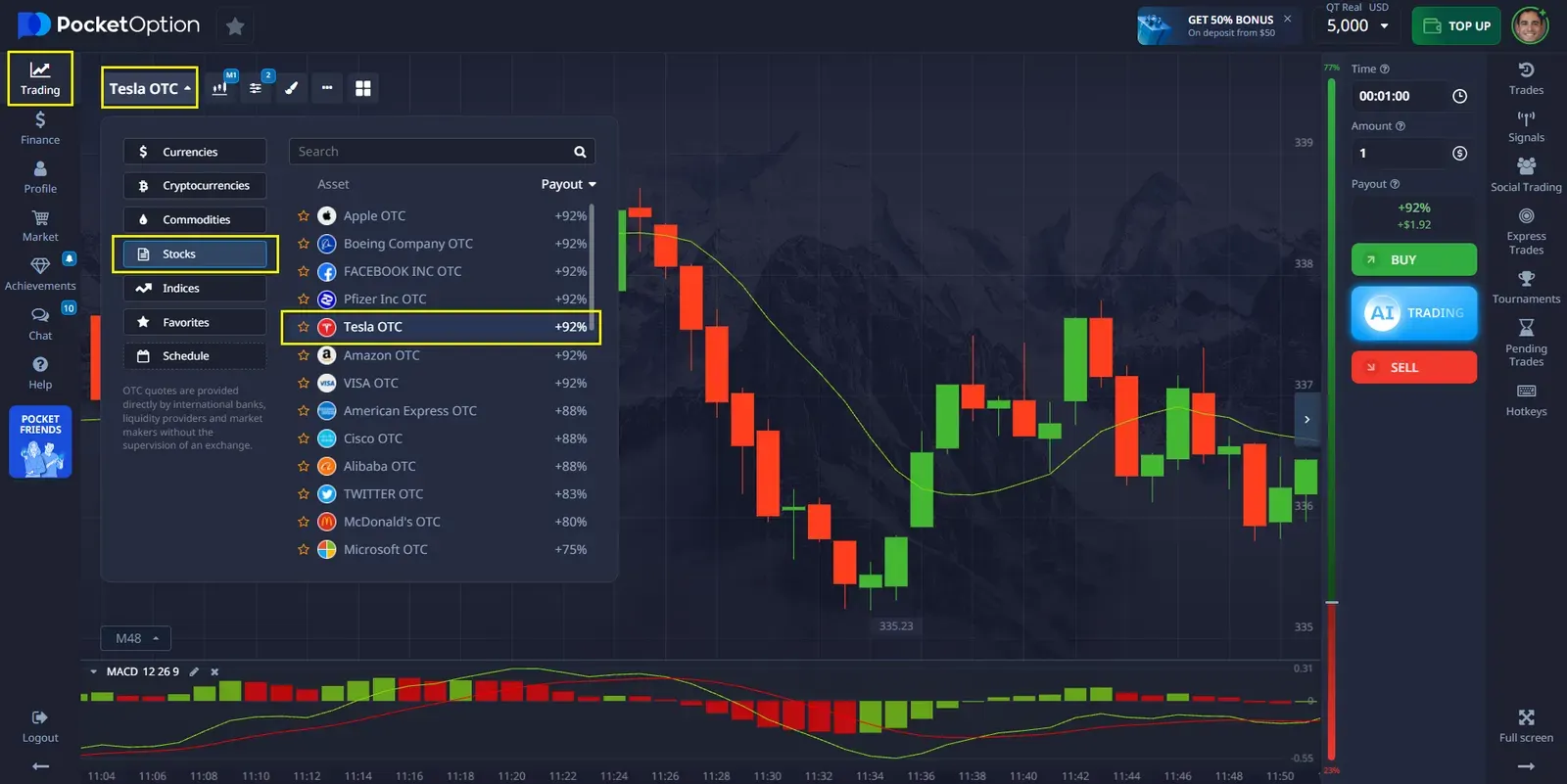

Tesla Inc. is a global leader in electric vehicles (EVs), energy solutions, and emerging technologies. Under Elon Musk’s direction, Tesla continues to push boundaries—revolutionizing not just transportation but also AI, robotics, and energy storage. The company’s agility, brand value, and R&D capacity make it a standout in today’s stock market. Predicting stock prices for a dynamic asset like TSLA helps investors manage risk and opportunity. Tesla’s presence on trading platforms like Pocket Option empowers users to speculate short-term via Quick Trading or align strategies for long-term gains. Accurate price forecasting is a cornerstone for effective investment planning. Traders often look for reliable Tesla 2040 price prediction and Tesla 2040 stock prediction to guide their positions.

Trade Tesla on Pocket Option

What factors will drive Tesla’s long-term growth?

TSLA Stock Price Forecast for 2025

Market Analysis and Predictions

By 2025, Tesla is expected to enhance its market position through cost reduction and manufacturing efficiency. BloombergNEF projects EV sales surpassing 28 million globally in 2025—a major tailwind for Tesla. This aligns with the Tesla stock price prediction 2040 2025 perspective that sees early gains fueling future growth.

Technical Analysis of TSLA

- RSI (Relative Strength Index): Remains in a bullish 60–70 range.

- Moving Averages: The 200-day MA supports a steady upward trend.

Expert Forecasts

| Source | 2025 Target Price (USD) |

|---|---|

| Morgan Stanley | 350 – 420 |

| Goldman Sachs | 375 – 450 |

| Ark Invest | 500+ (bull case) |

Expert Insight

“Tesla’s software margins, especially from Full Self Driving (FSD), could unlock 50%+ operating profits by 2025.” — Cathie Wood, ARK Invest

2026 Price Prediction for TSLA

Trends and Catalysts

Expansion in India and Indonesia (new Gigafactories).

- FSD regulatory greenlights in North America and Europe.

- Energy verticals, such as Megapack and Powerwall sales.

Risks and Volatility

- Macro-economic slowdown.

- Regulatory risk and antitrust issues.

- Technological lag from competitors.

Analyst Projection Table

| Scenario | 2026 Price Estimate |

|---|---|

| Conservative | $400 |

| Moderate | $475 |

| Aggressive | $550+ |

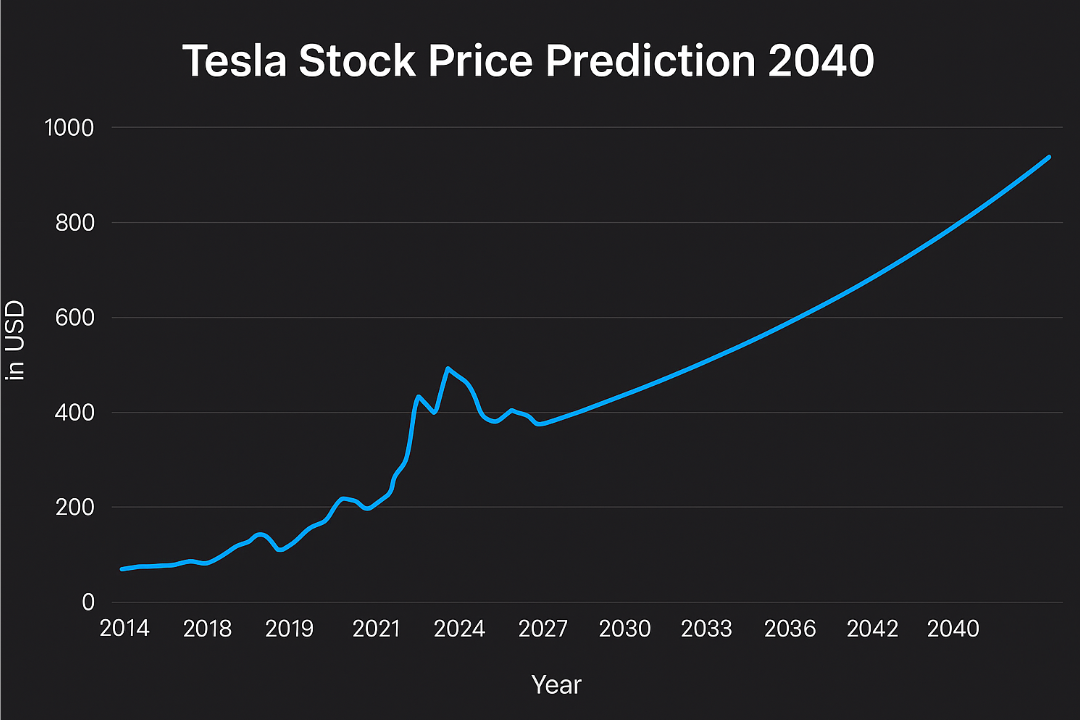

Tesla Stock Price Prediction 2040

Innovations Shaping the Future

As we look ahead to 2040, Tesla’s identity is evolving far beyond that of an automotive company. With strategic investments in artificial intelligence, robotics, and energy systems, the company is positioning itself as a multifaceted technology leader. These innovations are not just speculative—they are already being built, tested, and deployed across various business lines. Tesla’s integration of software with hardware, coupled with its proprietary platforms, makes it uniquely capable of scaling future technologies that could transform entire industries.

Tesla’s transformation into a tech conglomerate will be fueled by:

- FSD and subscription revenue

- Optimus (humanoid robot)

- AI training (Dojo infrastructure-as-a-service)

- Tesla Energy grid integrations

Scenario Analysis: TSLA 2040 Target and Market Dynamics

To better understand the TSLA 2040 target, it is crucial to evaluate varying scenarios based on innovation timelines and regulatory landscapes. In a bull case, where Tesla achieves mass-market robotaxi deployment and significant AI-driven productivity gains, the stock could exceed $4,000 per share. In a base scenario, where EV sales grow steadily and Tesla maintains its lead in battery technology and manufacturing, the TSLA 2040 forecast may range between $2,000 and $2,500. However, in a bearish scenario–if regulatory hurdles slow autonomous driving adoption or competition intensifies–Tesla’s 2040 prediction may fall closer to $1,500.

Autonomous Driving Investment and Its Long-Term Impact

A significant driver of Tesla’s long-term value is its aggressive autonomous driving investment. With the rollout of Full Self-Driving (FSD) systems and Dojo-powered AI training, Tesla is aiming to lead in automotive autonomy. This initiative enhances both margins and recurring subscription revenues, directly influencing the TSLA forecast. Analysts suggest that widespread regulatory approval of FSD could add $500–$1,000 to the Tesla stock price by 2040.

Electric Vehicle Future and Tesla’s Role

Tesla is well-positioned for the electric vehicle future, as nations commit to zero-emission targets and phase out combustion engines. According to BloombergNEF, EVs are expected to dominate car sales by 2040, further reinforcing Tesla’s dominant market share and long-term viability. This growth supports a bullish EV stock prediction, especially for industry leaders like Tesla.

Tesla AI Robotics: Beyond Vehicles

Tesla’s innovation extends beyond transportation. Projects like Tesla AI robotics, including the Optimus humanoid and AI-integrated manufacturing, signal the company’s pivot into broader tech domains. These developments add layers of optionality to the Tesla stock price trajectory and long-term investor returns.

Expert Long-Term Predictions

Understanding Tesla’s long-term potential requires examining projections from leading financial institutions and analysts. These expert forecasts are based on comprehensive modeling that includes Tesla’s dominance in the EV sector, anticipated breakthroughs in AI, autonomous driving, and its robust expansion in energy storage. These insights contribute to forming the Tesla stock price forecast 2040 and Tesla stock forecast 2040.

| Source | 2040 Price Forecast (USD) |

|---|---|

| Tesla stock price prediction 2040 walletinvestor | 2,100 – 3,000 |

| Tesla stock price prediction 2040 forbes | 1,500 – 2,300 |

| ARK Invest | 4,000 (bull case) |

Media Mentions & Commentary

Some analysts and platforms have begun to break down the Tesla stock price prediction 2040 by month, considering factors like projected production milestones, quarterly earnings cycles, and macroeconomic indicators. While monthly forecasting is inherently speculative, sources like WalletInvestor and Reddit users often publish rolling updates that reflect evolving sentiment and market data.

- Tesla stock price prediction 2040 reddit: Users call Tesla “the Amazon of the next decade.”

- Tesla stock price prediction 2040 cnn: Warns of overvaluation, acknowledges Tesla’s AI edge.

- Tesla stock price prediction 2030 and Tesla stock price prediction 2050 discussions indicate high investor interest in long-term outlooks.

Competitive Landscape Comparison

When evaluating Tesla’s potential by 2040, it’s critical to consider how it compares to other key players in the automotive and tech markets. Tesla’s vertically integrated approach—spanning EVs, AI, and energy—positions it uniquely among legacy automakers and newer disruptors. Unlike traditional car manufacturers that focus primarily on vehicle sales, Tesla’s diversified revenue streams and proprietary technologies offer it a major competitive edge.

| Company | 2040 Projection | Core Advantage |

|---|---|---|

| Tesla | $2,500 avg | Full-stack innovation (EV+AI+Energy) |

| Toyota | $300 | Legacy manufacturing efficiency |

| BYD | $400 | Cost-driven EV production |

Analyst Quote

“Tesla’s 2040 price could reflect a market cap over $6 trillion if it succeeds in robotaxi and energy grid markets.” — Gene Munster, Deepwater Asset Management

Pocket Option: Your Tesla Trading Partner

With Pocket Option, you can:

- Trade 100+ global assets including Tesla 24/7

- Use Buy/Sell buttons for Quick Trading with minimal delays

- Access demo mode for testing advanced strategies

- Benefit from an intuitive interface tailored for both beginners and professionals

- Analyze market data with built-in indicators and trading tools

Imagine Tesla just released a better-than-expected quarterly earnings report. A trader on Pocket Option could instantly respond by opening a Buy position using Quick Trading. If the trader believes this spike might be temporary, they can simultaneously set a Sell trade for Apple or another stock to hedge their position. The ability to execute trades rapidly and 24/7—even on weekends—makes Pocket Option particularly attractive for reacting to global news and events.

Additionally, the platform’s Achievements and Cashback Program reward active users, while the Social Trading feature lets you follow and copy strategies of top-performing traders.

Real Trader Reviews on Pocket Option

“I’ve used Pocket Option to trade Tesla earnings — fast execution and weekend trading are unbeatable.” — Lucas V.

“Pocket Option’s interface helped me simulate TSLA and Apple strategies. The demo feature is great for testing predictions.” — Emma R.

Conclusion: Investing in Tesla Long-Term

Summary of Key Projections

- 2025: Target between $350–$500

- 2026: Range of $400–$550

- 2040: Long-term estimates span from $1,500 to $4,000 depending on success in AI, robotics, and energy

Final Thoughts

Can Tesla reach $4000 per share by 2040? Tesla remains one of the most visionary and volatile stocks on the market. The Tesla stock price prediction 2040 depends on multiple success factors, including technological leadership and strategic execution. Is Tesla a good long-term investment? Forecasts such as the Tesla stock 2040, Tesla prediction 2040, and other long-term scenarios reinforce Tesla’s unique market positioning. Platforms like Pocket Option make trading TSLA accessible to all—giving both novice and expert traders the ability to act on future insights.

FAQ

What factors will most influence Tesla's stock price by 2040?

Autonomous driving commercialization and energy business scaling will have the greatest impact, potentially accounting for 70-80% of total valuation. Tesla's manufacturing efficiency advantage and software monetization will determine whether it maintains its market leadership position.

Is investing in Tesla now a good strategy for 2040 returns?

Long-term Tesla positions should constitute 2-5% of a diversified portfolio for investors with high risk tolerance. Dollar-cost averaging into positions during volatility periods has historically outperformed lump-sum investments in Tesla.

How reliable are ultra-long-term stock predictions like Tesla 2040?

Long-term forecasts serve best as strategic frameworks rather than precise predictions. They should be reassessed quarterly against technological milestones and manufacturing execution metrics to validate or adjust your investment thesis.

Will Tesla still be an independent company by 2040?

Tesla's vertical integration strategy and $100B+ cash position by 2030 would make acquisition prohibitively expensive for potential buyers. Management succession planning remains the primary uncertainty regarding independence.

How should investors balance Tesla's potential against its volatility?

Automated purchasing during 30%+ drawdowns has historically captured the best entry points. Options strategies like selling cash-secured puts during high volatility periods can generate income while building positions at favorable prices.

What is the 12 month stock price prediction for Tesla?

Short-term 12-month forecasts for Tesla (as of mid-2025) range from $280 to $380, based on expected delivery growth and software revenue expansion. Key earnings reports and macro conditions could skew this range.

What is the price target for Nvidia in 2040?

While this article focuses on Tesla, projections for Nvidia in 2040 — driven by dominance in AI chips, data centers, and automotive — suggest a long-term target between $2,500 and $4,000, according to Goldman Sachs and ARK Invest forecasts.

How much is a Tesla stock worth in 2029?

By 2029, most analysts see Tesla trading between $650 and $1,200, factoring in expanded Gigafactory production, software subscription services, and a mature EV market. Market volatility and interest rate cycles will influence the upper bound.

What are the risks to Tesla's 2040 price target?

Key risks include regulatory delays in FSD approval, global economic downturns, intensified competition, and potential technology execution challenges.

How will autonomous driving affect Tesla's value?

Autonomous driving could significantly boost Tesla’s valuation through subscription revenues, improved margins, and leadership in AI mobility.

What will Tesla stock be worth in 2040?

Estimates suggest TSLA could be worth between $1,500 and $4,000 per share, depending on its performance in EVs, AI, and energy sectors.