- picking the right traders,

- managing your risk,

- diversifying your portfolio.

How to Earn With Copy Trading on Pocket Option: The Ultimate Strategy

Latest 2025 data shows copy trading returns on Pocket Option averaging 15-25% monthly for experienced signal providers, making it one of the most accessible paths to automated trading profits.

Article navigation

- The Smart Investor’s Approach to Copy Trading

- Selecting Winning Traders: Beyond Performance Numbers

- Key Performance Indicators Worth Your Attention

- Optimizing Your Copy Settings for Maximum Returns

- Building a Diversified Copy Trading Portfolio

- Monitoring and Optimization: The Continuous Improvement Cycle

- The Psychology of Successful Copy Trading

- Advanced Strategies for Experienced Copy Traders

- 🔥 Live Example of a Copy Trade on Pocket Option

The Smart Investor’s Approach to Copy Trading

Imagine having a button that says “Repeat what the pro just did.” You press it, and the trades of a top-ranked trader instantly appear in your own Pocket Option account. That’s the essence of copy trading.

🔥 A live example of a copy trade is below in the article 👇! Read on and get started with confidence, starting from just $5!

The beauty of it is that you don’t need years of market experience. The system connects beginners with seasoned traders. But here’s the truth: how to earn with copy trading on Pocket Option depends less on magic buttons and more on how smartly you set things up.

Three pillars of success:

Pocket Option’s algorithm replicates trades with minimal delay, while you stay in control of risk and limits. Automation + personal oversight = the perfect balance.

💬 “Copy trading is not a shortcut to riches, it’s a bridge to learn the discipline of risk management from those already successful.” — James Lee, Senior Market Analyst

Selecting Winning Traders: Beyond Performance Numbers

One common beginner mistake? Chasing whoever made +200% last week. Often that’s pure luck. What you really want is steady, repeatable performance.

Look for traders with:

- 📈 Consistency over 6+ months — slow and steady usually beats sudden spikes.

- ⚖️ Reasonable drawdowns — if someone lost half their account and barely recovered, that’s a red flag.

- ⏱ Balanced trading frequency — not too many trades (extra fees), not too few (missed chances).

- 🔎 Transparency — a trader who explains their method, not just “trust me, it works.”

The Pocket Option copy smart way to profit is not to blindly follow the top of the leaderboard. Instead, ask: how does this trader perform in a trending market, in sideways conditions, or during news shocks?

💬 “When reviewing traders, I don’t just ask ‘how much did they earn,’ but ‘how did they handle losses?’ That’s where the real skill shows.” — Elena Morales, Professional Trader

Key Performance Indicators Worth Your Attention

Numbers can look intimidating, but here’s how to read them like a pro.

| Essential Metric | What It Reveals | Why It Matters for Profits | Typical “Good” Range |

|---|---|---|---|

| Risk-Adjusted Return | Profit compared to volatility | Shows sustainability, not luck | 1.2–1.5 Sharpe ratio |

| Maximum Drawdown | Worst losing streak | Exposes real downside risk | Under 20–25% |

| Recovery Speed | How quickly losses are recovered | Reveals resilience of strategy | 1–3 months |

| Win/Loss Ratio | Precision of trades | Tells you if it’s skill or gambling | 55–65% |

👉 Don’t obsess over just one number. A trader with slightly above-average stats across all four is usually safer than someone with extreme highs in one area but terrible in others.

💬 “Balanced traders win the marathon, not the sprint. A flashy 80% win rate means nothing if drawdowns are catastrophic.” — Marco Russo, Quant Analyst

Optimizing Your Copy Settings for Maximum Returns

Even if you find great traders, bad settings can ruin your results. Copy trading is not just “set and forget.”

Tips for setting up smartly:

- 🔹 Start with 5–10% of your capital per trader to test consistency.

- 🔹 Use your own stop-loss limits — don’t rely entirely on the trader’s risk profile.

- 🔹 Copy by percentage of balance, not fixed amounts, so risk scales with your account.

- 🔹 Set maximum position sizes to avoid one trade swallowing your whole balance.

Think of your copy settings as your personal “safety net” on top of the trader’s strategy.

💬 “Your copy settings are like the seatbelt in a car — you hope not to need them, but when the market crashes, they save you.” — Priya Nand, Risk Consultant

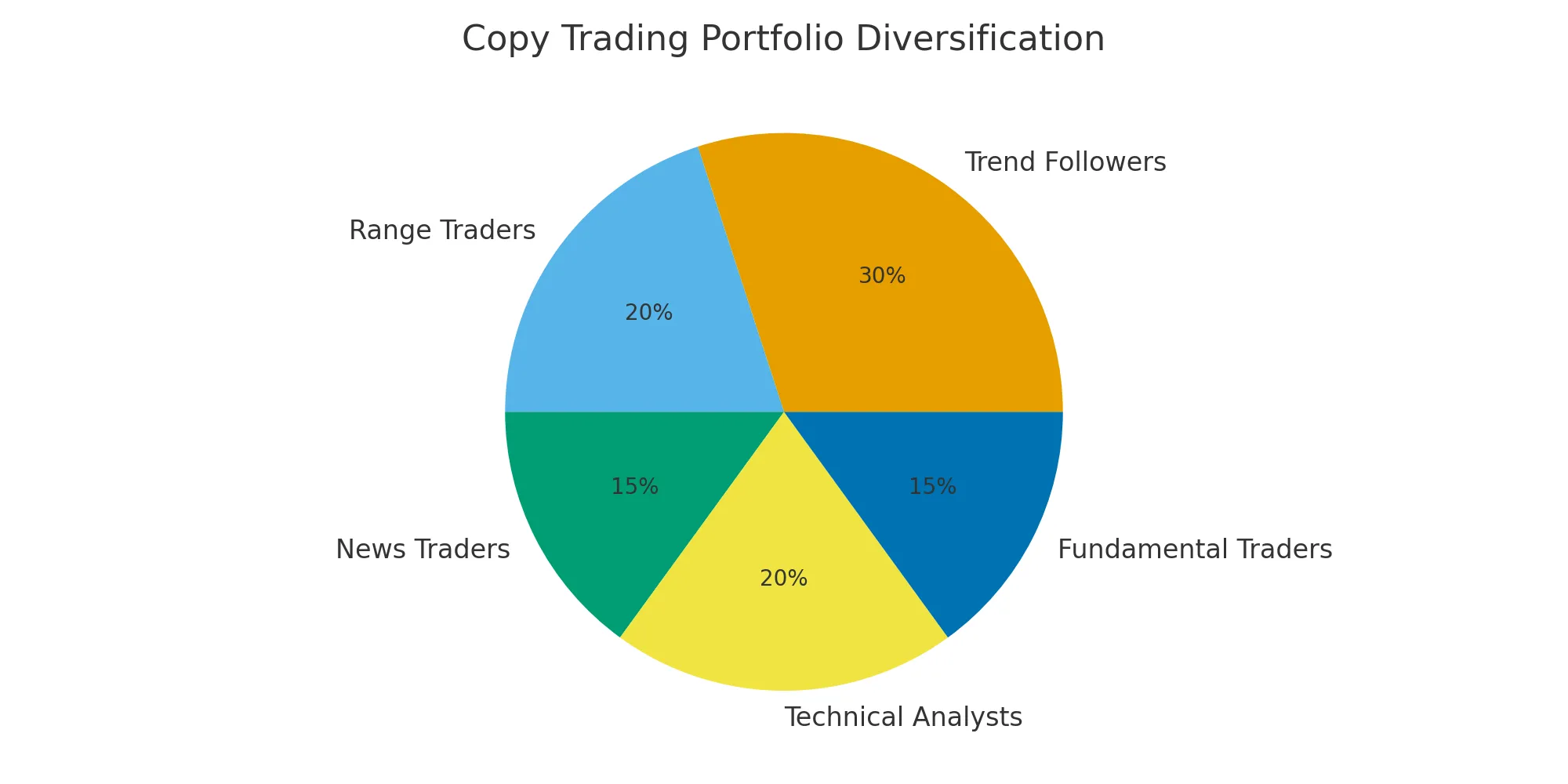

Building a Diversified Copy Trading Portfolio

Your copy trading portfolio should look like a balanced sports team. If you only have strikers (trend traders), you’ll get crushed when the market flips.

Types of traders worth mixing:

- 🚀 Trend followers (great in strong market moves)

- ⚡ Range traders (profit in sideways markets)

- 📰 News traders (capitalize on volatility after big events)

- 📊 Technical analysts (charts, indicators, price action)

- 💼 Fundamental traders (economic reports, long-term bets)

Spread your capital across different styles. That way, no matter what the market throws at you, someone in your lineup is working in your favor.

💬 “Diversification is your insurance policy. You don’t buy car insurance hoping to crash — you buy it so a crash doesn’t ruin you.” — Daniel Cho, Hedge Fund Manager

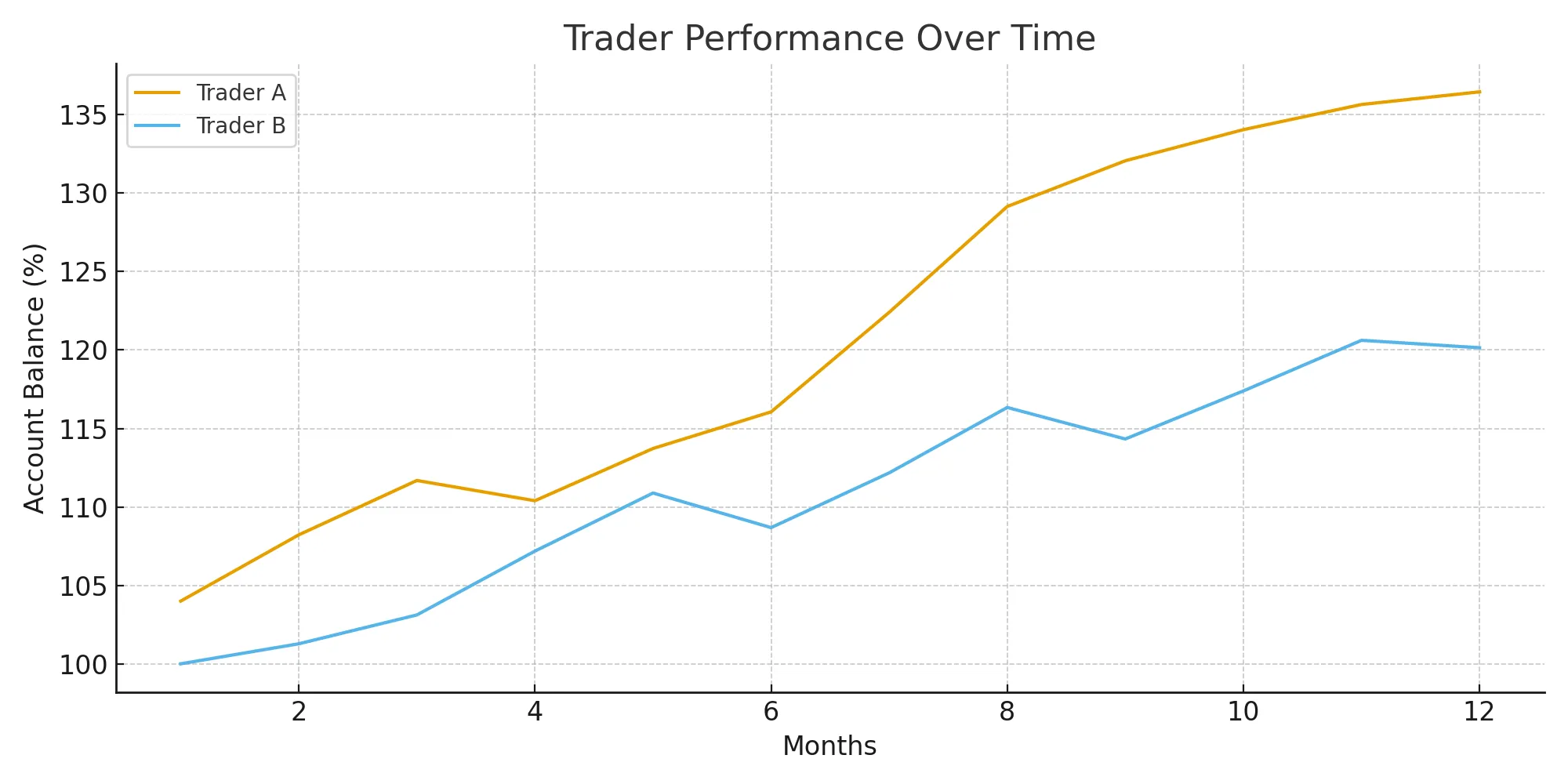

Monitoring and Optimization: The Continuous Improvement Cycle

Copy trading is not a Netflix subscription. You can’t just set it up once and binge profits. You need to keep an eye on things.

Here’s a simple routine:

- Weekly: check each trader’s performance against the market.

- Check overlap: if two traders make 90% identical trades, that’s not diversification.

- Monthly: adjust allocations — drop underperformers, add new talent.

Remember: how to earn with copy trading on Pocket Option long-term comes down to constant fine-tuning. Yesterday’s top trader might be today’s weak link.

💬 “Markets evolve every quarter. The trader who thrived in Q1 may struggle in Q3 — adapt or get left behind.” — Sarah Whitman, Market Strategist

The Psychology of Successful Copy Trading

The biggest reason people fail? Emotions.

Key mental skills to master:

- Patience during inevitable drawdowns.

- Discipline to stick with your rules.

- Detachment from short-term red numbers.

- Realistic expectations (no, you won’t double your balance in a week).

Even the best traders lose sometimes. Your reaction to those moments matters more than the trades themselves.

💬 “The real profit in copy trading comes from patience. Pulling out after the first losing streak is like quitting the gym after your muscles hurt.” — Alex Novak, Trading Coach

Advanced Strategies for Experienced Copy Traders

Once you’ve nailed the basics, here are ways to push further:

- 🔄 Seasonal rotation — adjust trader mix based on time of year and historical patterns.

- ↔️ Counter-cyclical allocation — keep traders in your lineup who thrive when others fail.

- 📊 Performance-based rebalancing — shift capital systematically toward those currently delivering.

The Pocket Option copy smart way to profit is not just about copying; it’s about managing your own little ecosystem of traders.

💬 “Think like a portfolio manager, not a fan club. Don’t marry your traders — rotate them when the data says so.” — Tom Becker, Portfolio Strategist

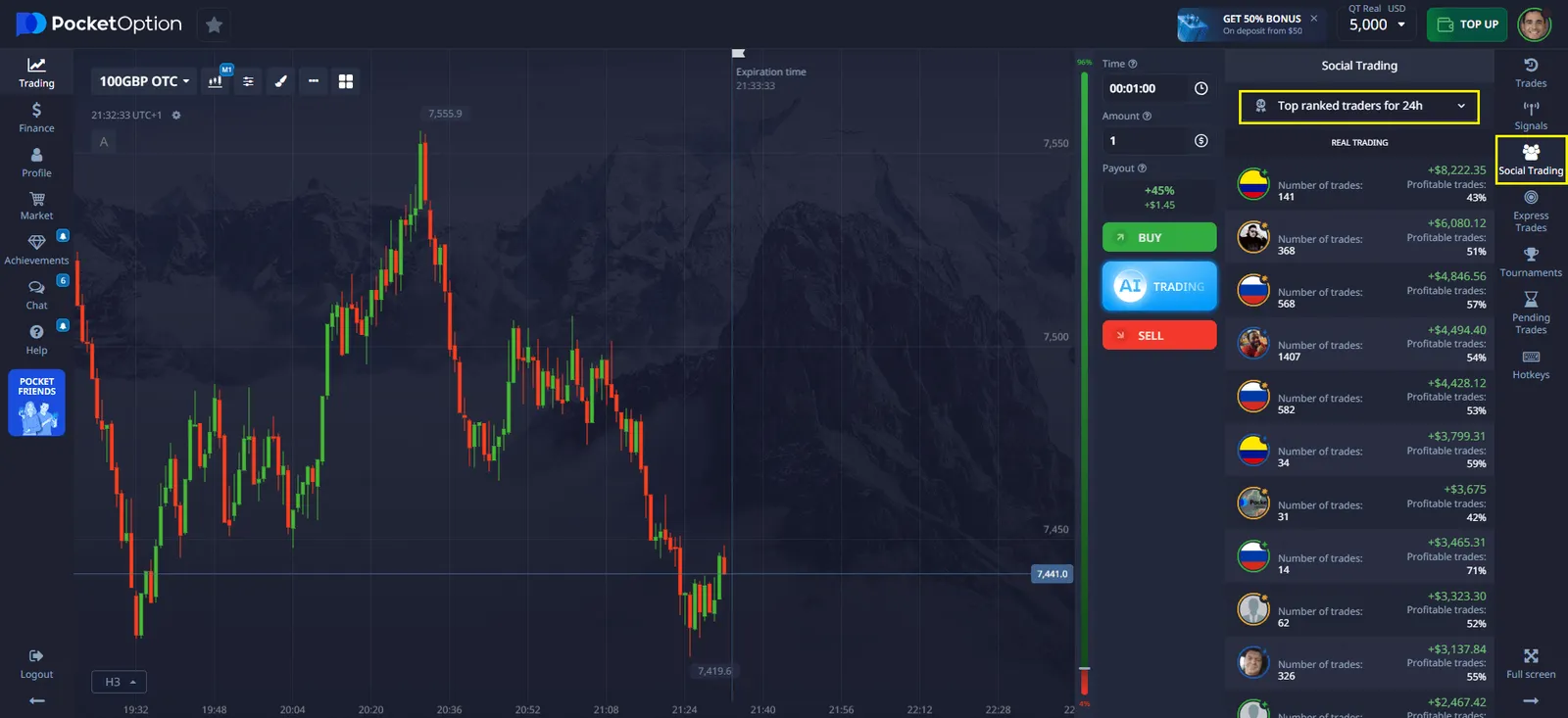

🔥 Live Example of a Copy Trade on Pocket Option

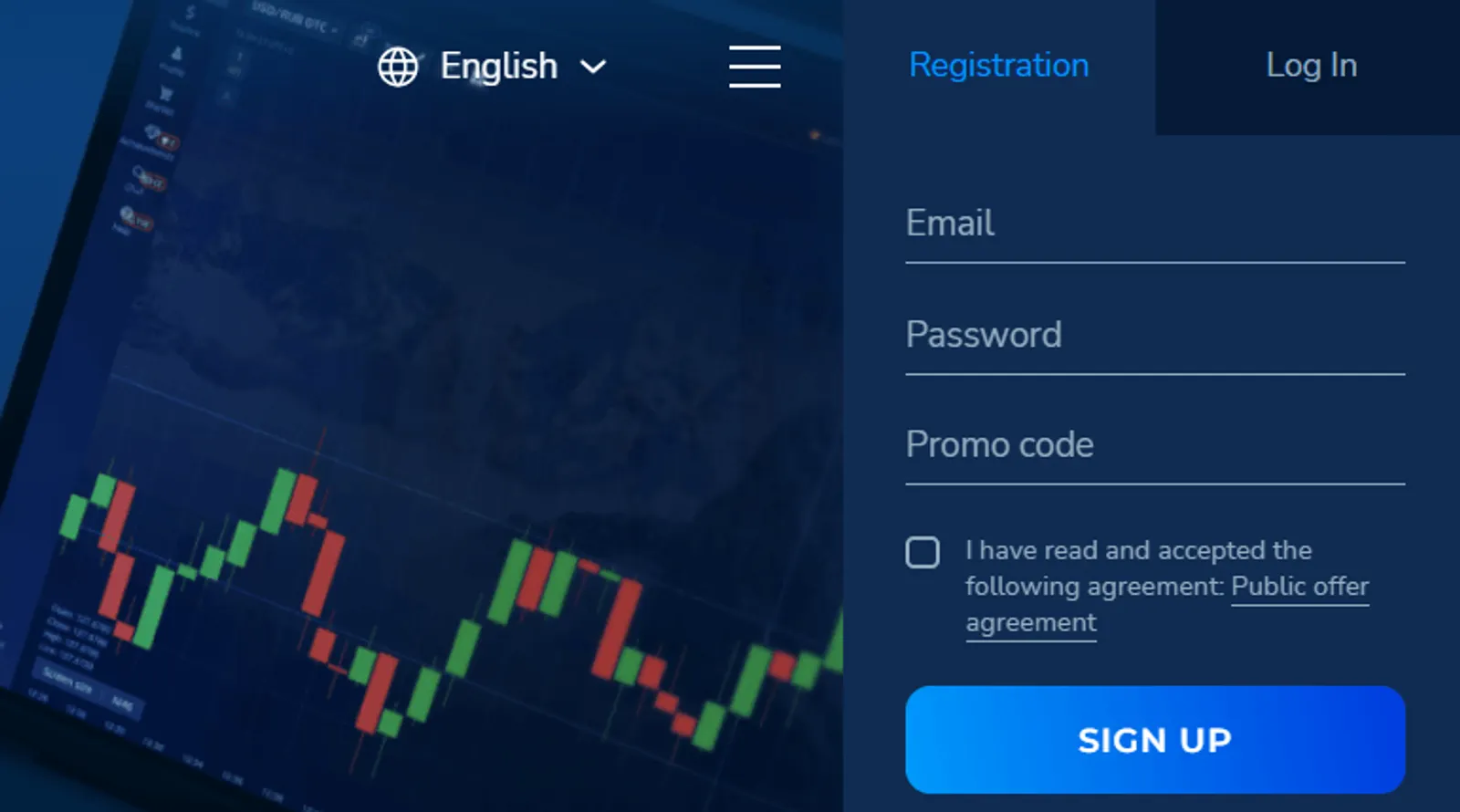

Theory is great, but let’s get practical. You can launch your copy trading journey in under 15 minutes:

1. Logging in

You open your Pocket Option account and click on Social Trading. The Top ranked traders list pops up — it refreshes every minute.

2. Choosing a trader

Let’s say you notice a trader named “AlexTrend”:

- 7 months of consistent profits,

- average monthly return ~12%,

- maximum drawdown 18%,

- trading style: trend following.

Looks like a solid pick.

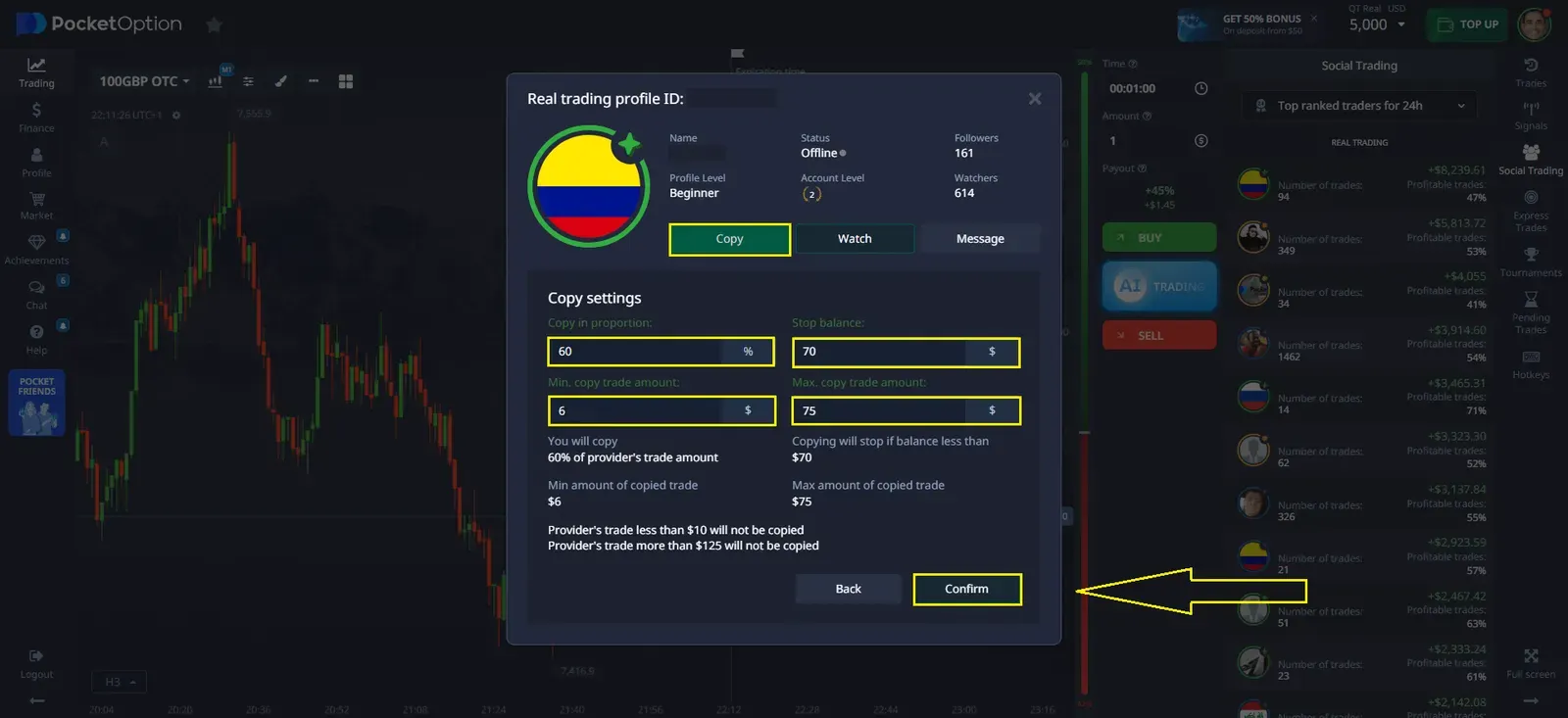

3. Setting copy parameters

- You hit “Copy” next to his profile. Pocket Option asks you to set parameters:

- 💵 Copy by percentage: 10% of your balance (with a $100 balance, each copied trade is $10).

- 🛑 Stop-loss for copying: maximum loss capped at −20% of your account.

- 📈 Max deal size: $15 (so no single trade gets too big).

- Click Confirm.

4. First copied trade

- A few minutes later, AlexTrend opens a trade on EUR/USD going up for 1 minute.

Your account instantly mirrors it: - Entry price: 1.0850

- Duration: 60 seconds

- Trade size: $10

5. Trade result

- After one minute, the price climbs to 1.0856.

- The trader wins.

- You win too.

💰 Outcome: your $10 becomes $18.5 (profit of $8.5).

6. Moving forward

- Keep copy trading active.

- Review weekly to check performance.

- Every month decide: keep following AlexTrend, adjust the percentage, or add another trader for diversification.

👉 That’s it. Copy trading on Pocket Option isn’t just about riding someone else’s wave — it’s about choosing wisely, setting safety nets, and staying consistent.

For additional assistance with any aspect of copy trading, the Pocket Option support bot remains available through the dedicated “Chat” interface:

FAQ

Is copy trading suitable for complete beginners?

Copy trading can be an excellent starting point for beginners as it provides market exposure without requiring extensive knowledge. However, successful copy trading still requires understanding basic risk management, provider selection criteria, and platform features. Start with demo accounts to understand the process before committing real capital.

How do I monitor and manage my copy trading performance?

Use Pocket Option's analytics dashboard to track real-time performance, review weekly profit/loss reports, and analyze provider performance trends. Implement regular review cycles (weekly or monthly) to assess whether providers still meet your criteria and adjust allocations accordingly.

What fees are associated with copy trading on Pocket Option?

Copy trading fees vary by provider, typically ranging from 10-30% of profits generated through copied trades. The platform may also charge small transaction fees, but these are generally minimal compared to traditional investment management fees. Always review fee structures before committing capital.

How much money do I need to start copy trading effectively?

While you can start with minimal amounts, effective copy trading typically requires at least $500-1000 to properly diversify across multiple providers with appropriate position sizing. This allows for meaningful position sizes while maintaining proper risk management protocols.

Can I customize which trades get copied from my chosen providers?

Yes, Pocket Option allows selective copying where you can exclude specific instruments, trade sizes, or types from replication. This enables customized risk profiles while still benefiting from provider expertise in your preferred markets or trading styles.

What are the main risks of copy trading?

Primary risks include signal provider underperformance, lack of diversification, excessive position sizes, and following providers during their poor performance periods. Mitigate these risks by diversifying across multiple providers, implementing stop-losses, and never allocating more than 20% of capital to any single provider.

What is copy trading and how does it work on Pocket Option?

Copy trading is an automated investment strategy where your account automatically replicates the trades of experienced signal providers. On Pocket Option, when a signal provider opens a position, the platform calculates proportional position sizes for all followers based on their allocated capital, creating synchronized trading across multiple accounts.

How do I choose the best signal providers to copy?

Focus on providers with consistent performance metrics: win rates above 60%, monthly returns between 12-20%, maximum drawdowns under 15%, and at least 6 months of trading history. Avoid providers with spectacular short-term gains but high volatility, as these often lead to significant losses over time.

How do I stop copy trading on Pocket Option?

Access your trading dashboard and locate the "List of Copied Traders" panel. Select the trader whose strategies you wish to discontinue following and click the "Stop Copying" option. Confirm the action.

How do I identify the best traders to copy on Pocket Option?

Focus on consistent long-term performance (6+ months), controlled drawdowns, strategic risk management, and trading styles that match current market conditions rather than just recent high returns. You can find top Pocket Option traders in the “Top ranked traders” list.

Can I customize how much risk I take when copy trading?

Yes, Pocket Option lets you set custom parameters including copy percentage, maximum position sizes, and additional stop-loss levels to align with your personal risk tolerance.

How long should I give a trader before deciding whether to continue copying them?

Evaluate performance over at least 1-3 months rather than making decisions based on short-term results, as even skilled traders experience natural drawdown periods.

Is it better to copy many traders or focus on just a few top performers?

A balanced approach of 4-8 traders with complementary strategies provides better diversification than concentrating on 1-2 traders or diluting capital across too many. This creates stability across different market conditions.

Conclusion

Mastering how to earn with copy trading on Pocket Option requires strategic trader selection, careful risk management, thoughtful diversification, and ongoing optimization. The platform provides all the necessary tools, but your systematic implementation will determine your results. Start with modest allocations across diverse trader styles, closely monitor performance, and make data-driven adjustments. This methodical approach transforms copy trading from a passive activity into a strategic component of your investment strategy. Remember that Pocket Option trading copy leading for profit is accessible to investors at all experience levels--but those who approach it systematically will consistently outperform those seeking shortcuts.

Start trading