- Ron Baron is confident about Tesla’s future success, especially given their ambitious production goals.

- Ryan Brinkman expresses skepticism due to potential competition, which could limit the company’s growth.

- Adam Jonas is optimistic about Tesla’s future, anticipating significant advancements in technology.

Tesla Stock Prediction 2030

As Tesla continues to dominate the electric vehicle and energy sectors, its future stock performance remains a hot topic among investors. With ambitious growth targets and increasing competition, predicting Tesla's stock price by 2030 requires an in-depth look at key metrics such as revenue growth, production capacity, market share, and R&D spending. In this article, we'll explore these factors and how they could shape Tesla's future, offering insights into what investors can expect from the stock in the next decade.

Analyst forecast

Tesla continues to be one of the most discussed companies on the stock market. In 2023 and in the future, investors are closely monitoring the development of this tech corporation, as its ambitions and innovations could significantly impact the stock price.

Different analysts provide various forecast for Tesla stock in 2030, based on factors like the company’s plans, market conditions, and competition.

| Analyst | What will Tesla stock be worth in 2030 | Key Reasons for forecast |

|---|---|---|

| Ron Baron (Investor) | $1,500 | High demand for Tesla cars, plans to produce 20 million vehicles annually. |

| Ryan Brinkman (J.P. Morgan) | $200 | Growing competition, potential consumer protests, and political factors. |

| Adam Jonas (Morgan Stanley) | $2,000+ | Expected growth in autonomous vehicles and artificial intelligence. |

📌 What to Consider:

Thus, while forecast vary, most analysts agree that Tesla will continue to play a key role in the electric vehicle market, which could influence its stock price in the long run.

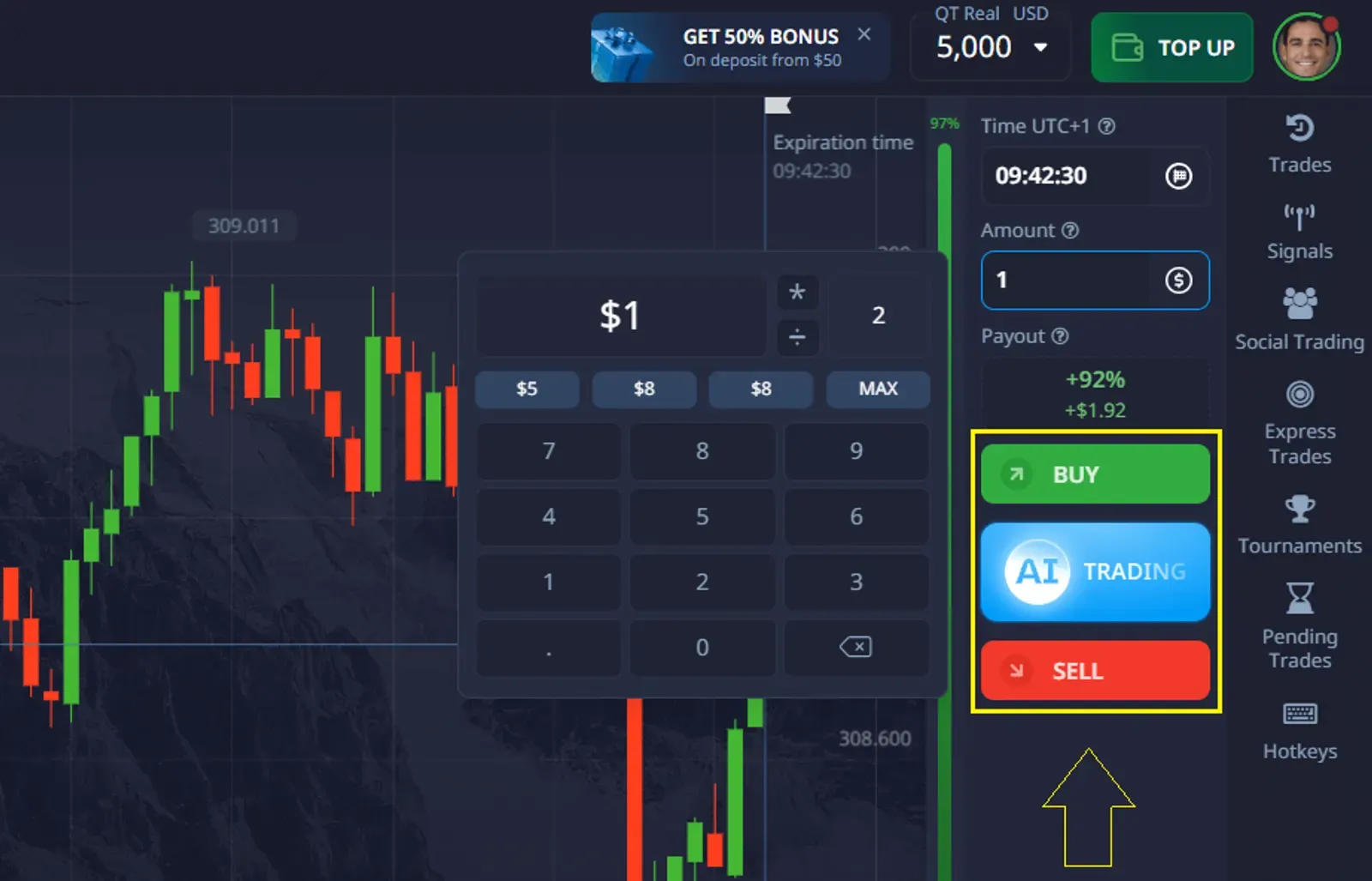

Pocket Option Trading Platform: Opportunities for forecast Tesla Stock Movements

For those who want to profit from the price fluctuations of Tesla stock, the Pocket Option platform offers a unique opportunity to make forecast and earn on price movements—without the need to actually buy or sell the asset.

Platform Features:

- Simple Interface: A user-friendly and intuitive space for traders.

- Access to Over 100 Assets: Includes stocks, indices, cryptocurrencies, commodities, and currency pairs.

- $50,000 Demo Account: Perfect for beginners to practice trading without risk.

- 50% First Deposit Bonus Promo Code: Use the code 50START for a 50% bonus on your deposit.

On Pocket Option, you don’t buy or sell Tesla stock, but you make forecast on whether the price will move up or down. If your forecast is correct, you can earn up to 92% profit!

Example of a Simple Trade with Tesla Stock

You decide to make a forecast on Tesla stock on the Pocket Option platform. Tesla stock is trading at $330. You expect the price will rise in the next 1 minute.

- Choose the Asset: Select Tesla stock.

- Open Trade: You forecast the price will go up- click “Buy”

- Trade Amount: You invest $10 in the forecast .

- Trade Time: 1 minute.

After 1 minute, Tesla stock reaches $331, and your forecast is correct. You earn $9.2 (including your profit of 92% on the invested amount). It is easy, try now!

Key Metrics for Tesla Stock Prediction 2030: Real-World Insights

To make a reliable prediction for Tesla’s stock price by 2030, analysts must evaluate several key metrics that directly influence the company’s market performance. Below are some critical indicators, backed by actual data and forecasts:

1. Revenue Growth Rate

Tesla’s revenue has grown rapidly, reaching $81.5 billion in 2022. Analysts expect this to exceed $100 billion in 2023 and could hit $300 billion by 2030, driven by strong sales of EVs and energy products.

Real-World Insight: This growth is fueled by Tesla’s market expansion and scaling production, especially in key regions like the US, Europe, and China.

2. Gross Margin

Tesla’s gross margin in Q4 2022 was 25.9%, but is expected to stabilize around 20-25% in the coming years, with fluctuations due to new model introductions and price cuts.

Real-World Insight: Despite some decline in margin, Tesla’s efforts in reducing production costs and increasing efficiency may lead to recovery over time.

3. Production Capacity and Utilization

Tesla produced 1.37 million vehicles in 2022, with plans to ramp up production to 20 million vehicles per year by 2030. This ambitious goal depends on the capacity of Gigafactories and improvements in manufacturing efficiency.

Real-World Insight: New factories in Berlin and Texas will play a crucial role in achieving this target, although scaling to 20 million units will require overcoming several challenges.

4. Market Share in the EV Industry

Tesla holds around 20-25% of the global EV market. While competition from brands like BYD and Volkswagen increases, Tesla is likely to maintain a significant share, potentially stabilizing at 15-20% by 2030.

Real-World Insight: Tesla’s strong brand, advanced technology, and new products such as robotaxis may help it retain market leadership, even as competition intensifies.

5. Research and Development (R&D) Expenses

Tesla spent $2.6 billion on R&D in 2022. This is expected to rise significantly, with projections of $10 billion annually by 2030, focusing on autonomous driving, battery tech, and robotaxi development.

Real-World Insight: Increased R&D spending will drive innovation in key areas, securing Tesla’s position in the tech and energy sectors.

Summary of Key Metrics:

| Metric | Current Value | 2030 Estimate | Key Drivers/Factors |

|---|---|---|---|

| Revenue Growth Rate | $81.5 billion (2022) | $300 billion | EV sales, energy products, new models, global expansion |

| Gross Margin | 25.9% (Q4 2022) | 20-25% | Production efficiency, cost control, product pricing |

| Production Capacity | 1.37 million vehicles (2022) | 20 million vehicles per year | Gigafactory expansion, automation, scaling production |

| Market Share (EV) | 20-25% | 15-20% | Competition, technology leadership, brand loyalty |

| R&D Expenses | $2.6 billion (2022) | $10 billion per year | Autonomous driving, battery innovation, new products |

Conclusion

The Pocket Option platform offers a unique opportunity to forecast Tesla stock price movements and other assets without the need to purchase them. With an easy-to-use interface and access to over 100 assets, it’s a great place for both beginners and experienced traders looking to profit from short-term market fluctuations.

FAQ

What factors most significantly influence Tesla stock forecast 2030?

Key factors include Tesla's revenue growth, production capacity, technological innovations, market share in the EV industry, and broader economic conditions.

How accurate can long-term stock forecast be?

Long-term forecast inherently carry uncertainty. While mathematical models can provide valuable insights, they should be used as guides rather than guarantees, and regularly updated as new information becomes available.

What are the best mathematical models for Tesla stock forecast 2030?

A combination of time series analysis, machine learning algorithms, Monte Carlo simulations, and fundamental analysis often yields the most comprehensive forecasts.

How does Tesla's performance in non-automotive sectors affect its stock forecast ?

Tesla's ventures in energy storage, solar power, and artificial intelligence can significantly impact its future valuation and should be factored into long-term stock forecast.

What role do external factors play in TSLA stock forecast 2030?

External factors such as government policies, global economic conditions, and competition in the EV market play crucial roles and must be carefully considered in any long-term stock forecast.