- Regulatory Compliance: Licensed platforms must adhere to capital adequacy requirements and segregate client funds.

- Disclosure Standards: Transparent reporting of trader performance, fees, and risk metrics is mandatory.

- Investor Protection: Compensation schemes and dispute resolution mechanisms are often in place.

- KYC/AML Requirements: Rigorous Know Your Customer and Anti-Money Laundering protocols are enforced to prevent illicit activities.

Is Copy Trading Legit: Understanding Its Legitimacy and Potential

Recent data shows copy trading platforms have grown 47% in 2024, but legitimacy concerns remain paramount for new investors.

Article navigation

- Is Copy Trading Legit? Complete Legal Investment Strategy Analysis

- Legal Framework: Is Copy Trading Legitimate?

- A Real-Life Example: Alex’s Journey into Copy Trading

- Copy Trading Benefits: Strategic Advantages

- Getting Started with Pocket Option: A Practical Approach

- Future Outlook: Copy Trading Evolution

Is Copy Trading Legit? Complete Legal Investment Strategy Analysis

Copy trading has emerged as one of the most debated investment strategies in modern finance, raising crucial questions about legitimacy, regulatory compliance, and investor protection. As millions of retail traders seek simplified approaches to market participation, understanding the legal framework and inherent risks becomes essential for making informed decisions.

This comprehensive analysis examines the regulatory landscape, benefits, risks, and platform selection criteria for copy trading, providing clarity on whether this investment strategy deserves a place in your portfolio.

Legal Framework: Is Copy Trading Legitimate?

Copy trading operates within established legal frameworks across most major financial jurisdictions. Regulated platforms must comply with stringent oversight requirements, ensuring transparency and investor protection. The global copy trading market size was valued in the billions and is projected to grow significantly, indicating a strong trend towards its adoption and, consequently, a tightening of regulations to protect the growing user base.

“Copy trading is fundamentally a legitimate investment approach when conducted through properly regulated platforms that maintain compliance with local financial authorities.” – Financial Markets Authority Report, 2024

Finding a platform that navigates these complex regulations for you is key. 📈 With Pocket Option, you can trade with confidence, knowing you’re on a platform that respects global compliance standards.

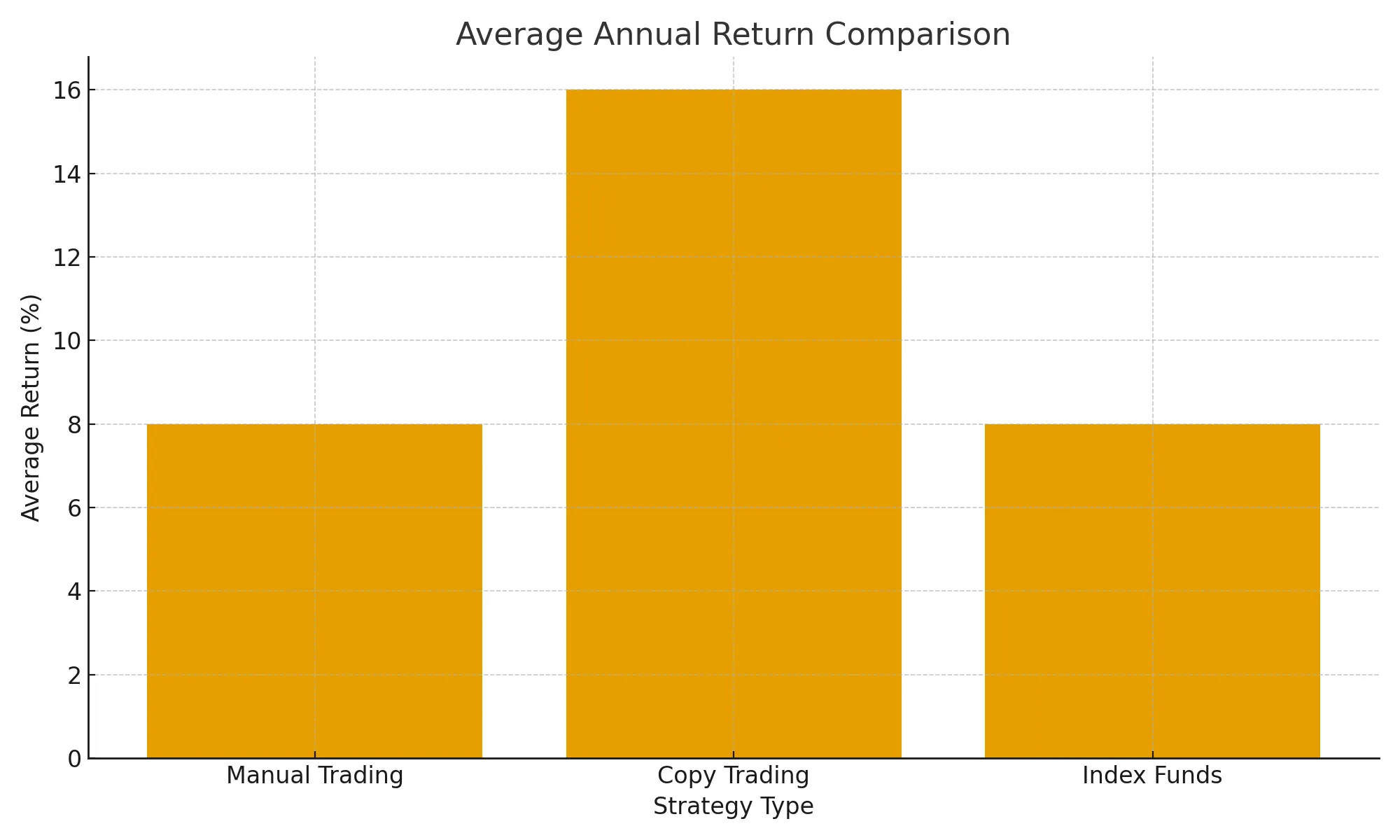

Performance Comparison Analysis

Recent market analysis shows that while past performance is not indicative of future results, a well-diversified copy trading portfolio has shown potential to outperform standard index funds, albeit with a higher risk profile.

| Strategy Type | Average Annual Return | Risk Level | Time Commitment | Learning Curve |

|---|---|---|---|---|

| Manual Trading | 8-15% | High | 40+ hours/week | Steep |

| Copy Trading | 12-20% | Medium | 5-10 hours/week | Moderate |

| Index Funds | 6-10% | Low | 1-2 hours/month | Minimal |

Regulatory Bodies and Oversight

| Jurisdiction | Regulatory Authority | Copy Trading Status | Key Requirements |

|---|---|---|---|

| United States | SEC/FINRA | Regulated | Broker-dealer registration, disclosure requirements |

| European Union | ESMA/National Regulators | MiFID II Compliant | Investor protection rules, transparency obligations |

| United Kingdom | FCA | Authorized | Client categorization, best execution policies |

| Australia | ASIC | Licensed | AFS license requirements, product disclosure |

A Real-Life Example: Alex’s Journey into Copy Trading

To make the concept tangible, let’s consider Alex, a full-time graphic designer with a keen interest in the financial markets but limited time to perform in-depth analysis. He heard about copy trading and decided to explore it.

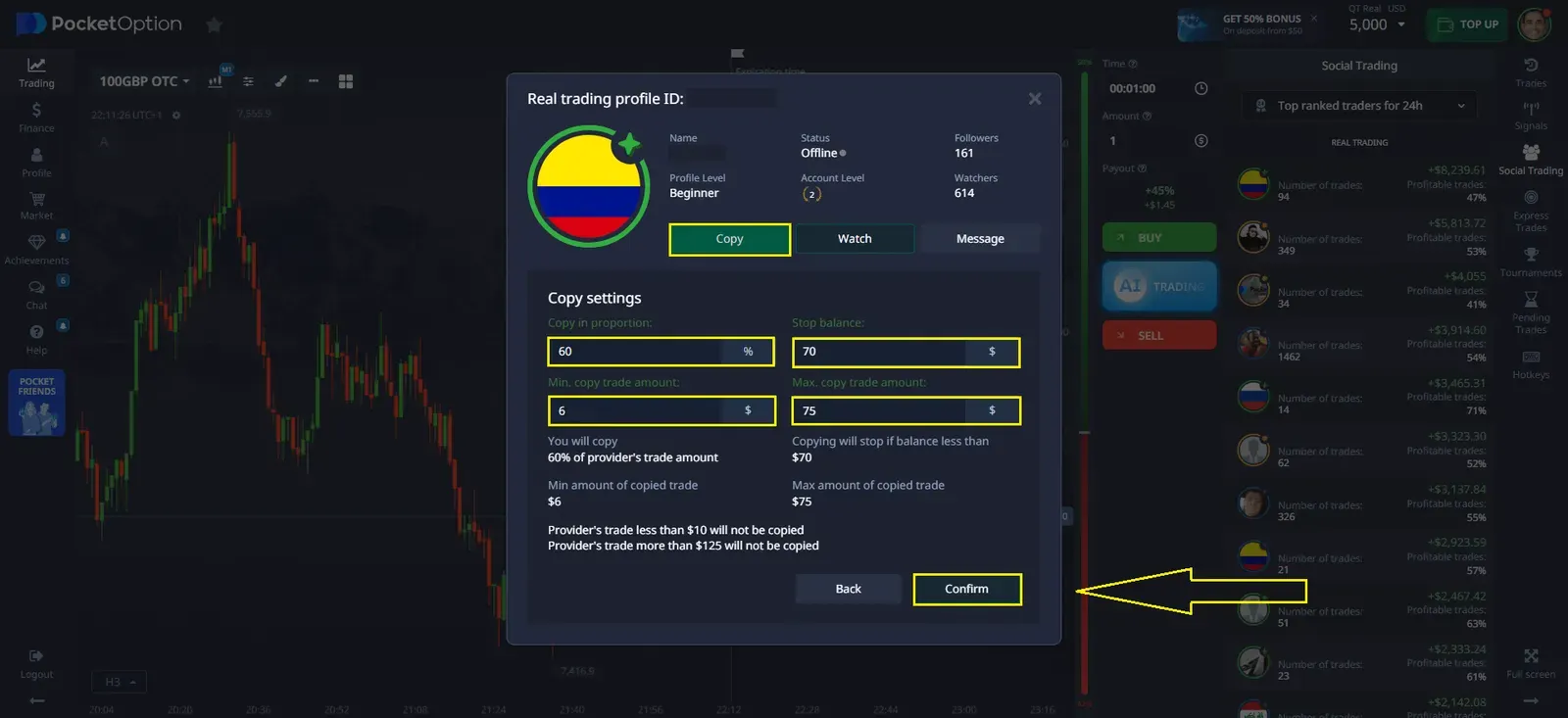

Alex opened an account on a platform with social trading features, like Pocket Option. He started with a demo account to get a feel for the interface. He browsed the leaderboards, not just looking at the highest returns, but focusing on traders with over a year of consistent performance, a moderate risk score, and a clear strategy description.

- He chose to copy two different traders: one focused on major currency pairs with a long-term approach, and another who specialized in short-term commodity trades.

- He allocated a small portion of his investment capital, following the rule of not putting more than 20% with a single trader. In the first month, he saw a modest gain of 7%, which was far better than his bank’s savings account.

- However, in the second month, the commodity trader hit a losing streak, and Alex’s portfolio dipped by 3%. Instead of panicking, he reviewed the trader’s history, saw that such drawdowns were normal, and decided to stick with his strategy.

This experience taught him a valuable lesson in risk management and the psychological resilience required in trading. Through observation, Alex began to understand market logic, risk-reward ratios, and the importance of diversification firsthand.

Copy Trading Benefits: Strategic Advantages

The legitimacy of copy trading stems partly from its genuine benefits for retail investors seeking market exposure without extensive expertise requirements.

“For beginner traders, copy trading provides access to professional strategies while maintaining learning opportunities through observation and analysis.” – Trading Psychology Institute, 2024

- Professional Strategy Access: Leverage experienced traders’ market knowledge and timing.

- Time Efficiency: Automated execution eliminates constant market monitoring requirements.

- Educational Value: Observe professional decision-making processes in real-time.

- Diversification Opportunities: Follow multiple traders across different markets and strategies.

- Scalable Investment: Start with small amounts while learning market dynamics.

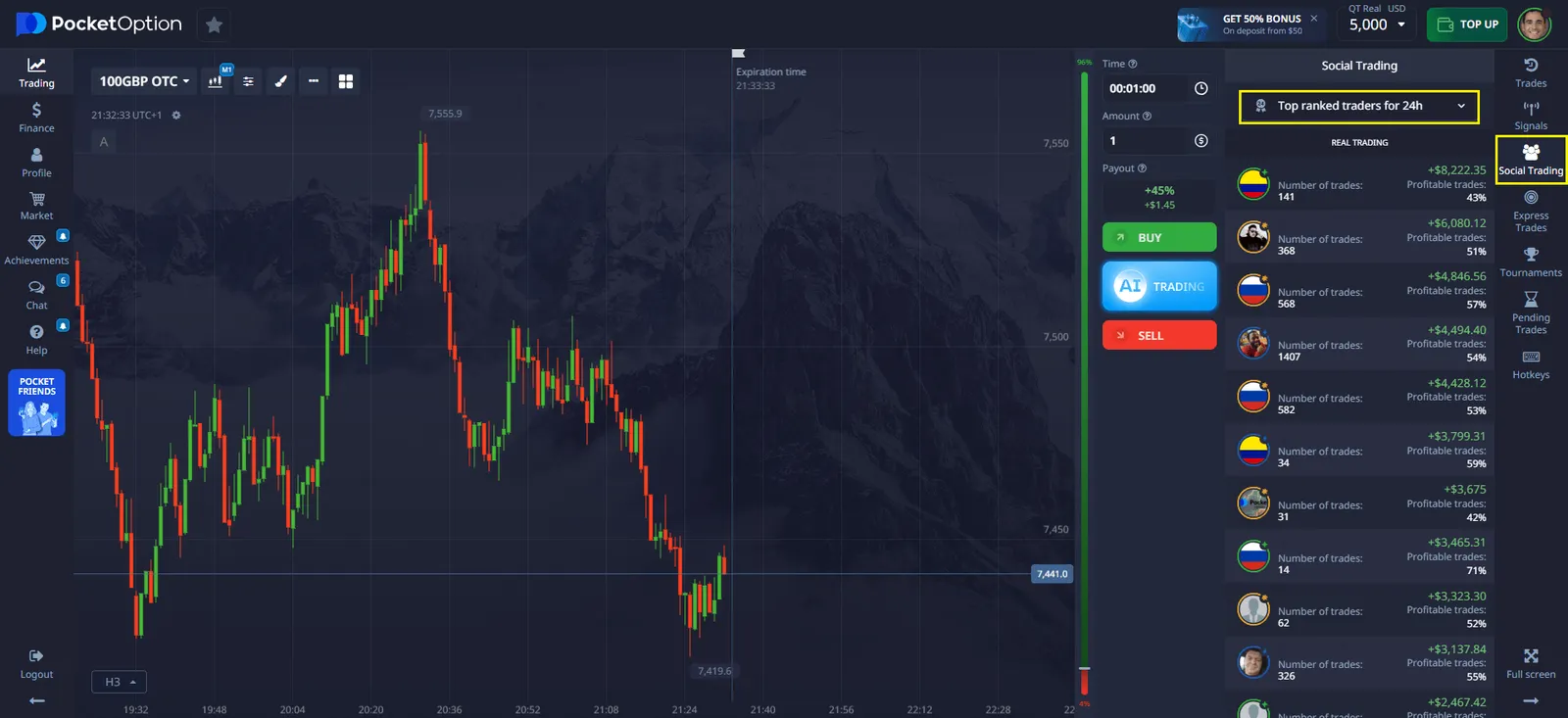

For example, traders on platforms like Pocket Option’s social trading features can observe how experienced practitioners handle market volatility, risk management, and position sizing – valuable insights that traditional investment approaches rarely provide.

Ready to learn from the pros? 🎓 Pocket Option’s social trading feature turns the market into your classroom, allowing you to see and replicate expert strategies in real-time.

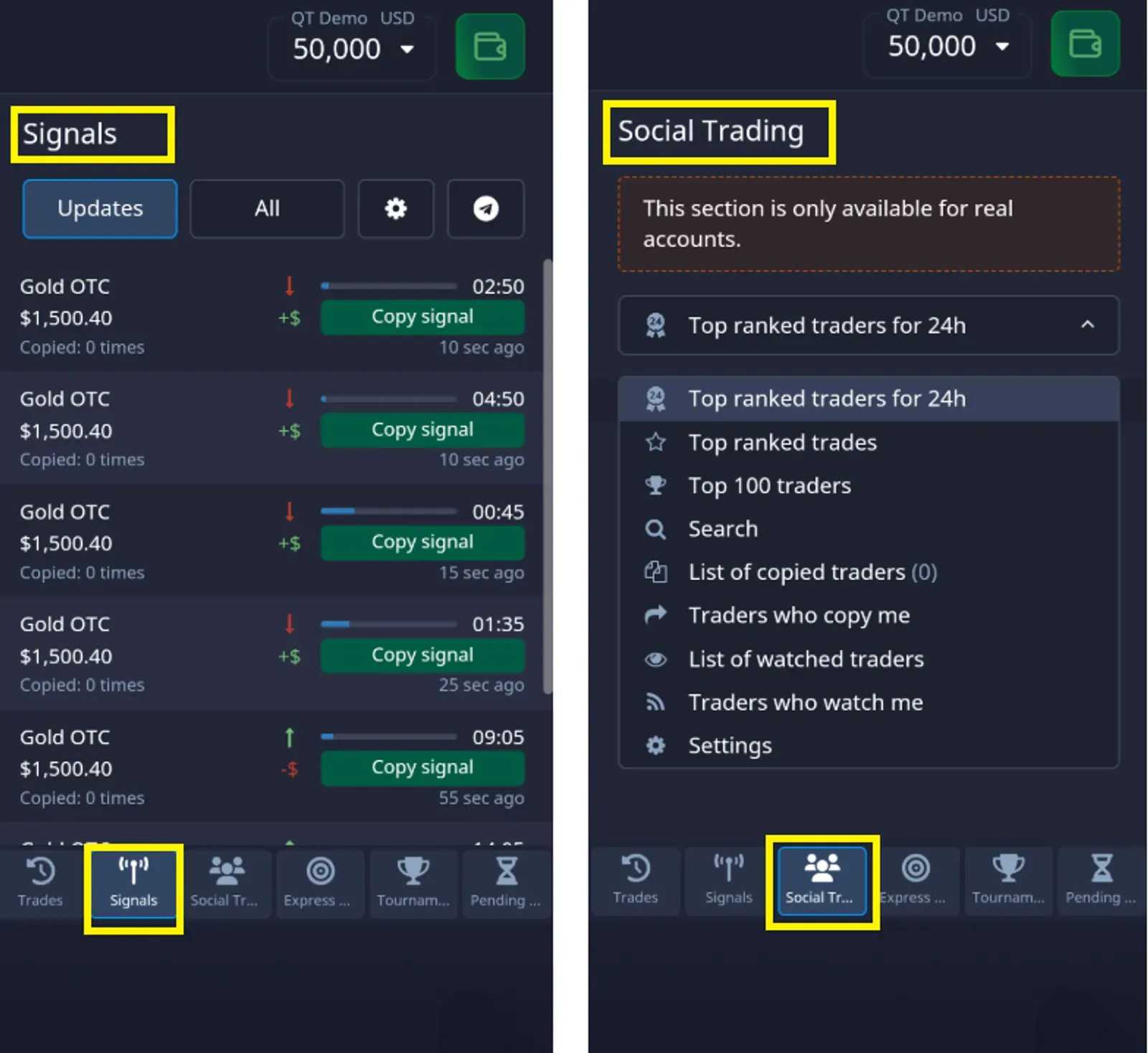

Getting Started with Pocket Option: A Practical Approach

Choosing the right platform is the first step to a successful copy trading career.

Pocket Option is designed to lower the barrier to entry while providing robust tools for both beginners and experienced traders. Here’s what makes it an excellent starting point:

- Low Entry Barrier: You can start trading with a minimum deposit of just $5, though this can vary based on your region and payment method. This allows you to test the waters with minimal financial commitment.

- Free Demo Account: Before risking real money, you can practice with a $50,000 demo account. This is a perfect environment to explore the platform, test copy trading, and build your confidence.

- Vast Asset Selection: With over 100 assets available, including currencies, commodities, stocks, and cryptocurrencies, you can diversify your copied portfolios across various markets.

- Comprehensive Learning Resources: Pocket Option offers a free, extensive knowledge base filled with trading strategies, tutorials, and educational videos. This is invaluable for understanding the “why” behind the trades you are copying.

- Engaging Community and Tools: Participate in trading tournaments, use the mobile app for trading on the go, and explore advanced features like AI-powered analytics and bots to supplement your trading strategy.

This combination of accessibility, education, and advanced tools ensures that you can start your copy trading journey on the right foot, with a focus on learning and risk management.

Copy Trading Risks: Critical Considerations

While legitimate, copy trading carries inherent risks that investors must understand before committing capital. These risks extend beyond typical market volatility. Recent reports highlight that the biggest losses in copy trading often come from emotional decisions, such as copying a trader at the peak of a winning streak or abandoning a solid strategy during a minor drawdown.

“The primary risk in copy trading isn’t the strategy itself, but the lack of diversification and over-reliance on individual trader performance.” – Risk Management Association, 2024

- Performance Dependency: Your returns directly correlate with copied traders’ success or failure.

- Limited Control: You cannot modify individual positions or timing once copying begins.

- Hidden Costs: Be aware of spread markups, performance fees, and platform charges.

- Market Correlation: All copied traders may face similar adverse market conditions simultaneously.

- Psychological Pressure: There is a strong tendency to abandon strategies during temporary losses.

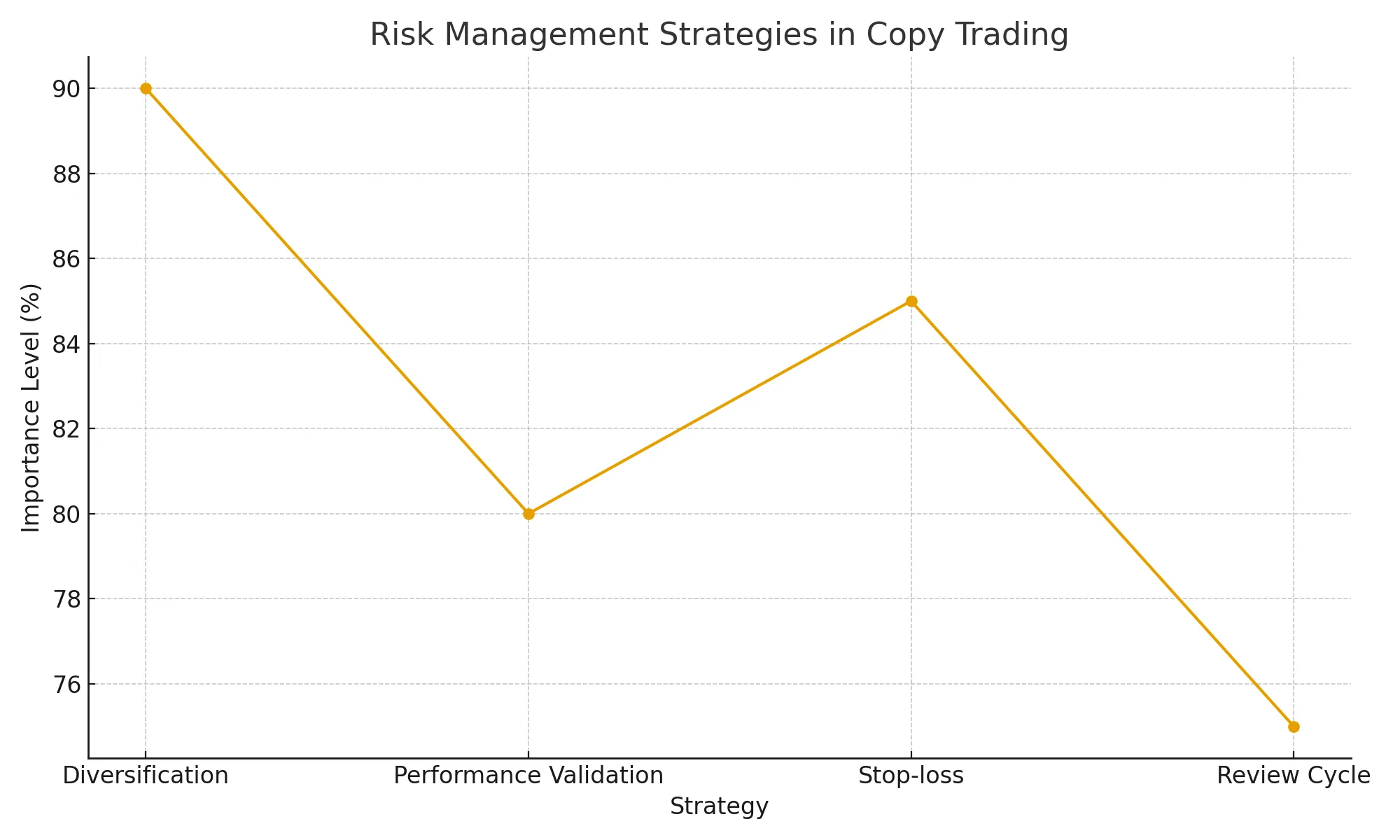

Risk Mitigation Strategies

Professional risk management in copy trading requires systematic approaches to trader selection, allocation, and monitoring:

- Diversification Rules: Never allocate more than 20% of your copy trading capital to any single trader.

- Performance Validation: Analyze at least 12 months of a trader’s history before copying, paying close attention to their maximum drawdown.

- Stop-Loss Implementation: Set a maximum acceptable loss level for each trader you copy to protect your capital from severe downturns.

- Regular Review Cycles: Reassess copied traders monthly or quarterly for performance consistency and adherence to their stated strategy.

Don’t just trade, trade smarter! 🧠 Pocket Option provides advanced risk management tools and transparent trader statistics, empowering you to make informed decisions and protect your capital.

Choosing Regulated Copy Trading Platforms

Platform selection represents the most critical decision in copy trading legitimacy. Regulated platforms provide essential investor protections and operational transparency.

“The difference between legitimate copy trading and potential fraud often comes down to platform regulation and transparency standards.” – International Securities Commission, 2024

In practice, traders often apply specific criteria when evaluating platforms. Consider these essential factors:

- Regulatory Status: Verify licenses from recognized financial authorities.

- Fund Segregation: Ensure client funds are held in separate accounts from the company’s operational capital.

- Performance Transparency: Look for detailed, unfiltered historical data and real-time reporting.

- Fee Structure: Demand clear and upfront disclosure of all charges, spreads, and commission rates.

- Risk Management Tools: The platform must offer stop-loss options, position sizing controls, and diversification features.

Pocket Option’s Quick Trading platform, for example, provides comprehensive trader statistics, performance metrics, and risk management tools that help users make informed copying decisions while maintaining transparency in all operations.

Avoiding Copy Trading Scams

The legitimacy question often arises from fraudulent platforms masquerading as regulated copy trading services. Recognizing red flags protects investors from potential losses.

“Fraudulent copy trading schemes typically promise unrealistic returns while lacking proper regulatory oversight or transparent performance reporting.”- Financial Fraud Prevention Bureau, 2024

Red Flag Indicators

- Guaranteed Profits: Promises of guaranteed or unrealistically high returns are a major warning sign.

- Lack of Regulation: Vague or non-existent claims about regulatory licensing.

- Pressure Tactics: Aggressive sales tactics pushing for immediate or large deposits.

- Hidden Fees: An unclear or convoluted fee structure.

- Poor Support: No accessible customer service or unresponsive support channels.

- Fabricated Histories: Limited, curated, or unverifiable trader performance histories.

By staying informed and choosing a reputable platform, you can confidently and legitimately incorporate copy trading into your investment portfolio.

Future Outlook: Copy Trading Evolution

The copy trading landscape continues evolving with enhanced regulation, improved transparency, and technological advancement. Artificial intelligence integration and sophisticated risk management tools promise better investor outcomes.

“We expect copy trading platforms to implement more sophisticated AI-driven risk assessment and automated diversification tools by 2026, further enhancing legitimacy and investor protection.” – FinTech Innovation Council, 2024

Regulatory harmonization across jurisdictions will likely standardize investor protections and operational requirements, making platform comparison easier for retail investors.

FAQ

How much money should I start with in copy trading?

Start with amounts you can afford to lose completely. Many experts recommend beginning with $500-1000 to test strategies and platform functionality before larger investments.

Is copy trading suitable for beginners?

Copy trading can benefit beginners by providing market exposure and learning opportunities, but requires understanding of risks, proper diversification, and careful trader selection processes.

What fees should I expect with copy trading?

Typical fees include platform charges (0.5-2%), performance fees (10-30% of profits), spread markups, and potential withdrawal fees. Always review complete fee structures before starting.

How do I choose the best traders to copy?

Evaluate traders based on consistent performance over 12+ months, reasonable risk-reward ratios, transparent trading history, diversified strategies, and manageable drawdown periods.

Can I lose more money than I invest in copy trading?

On regulated platforms with proper risk management, losses are typically limited to your invested capital. However, some strategies may use leverage, potentially amplifying losses beyond initial investment.

What are the main risks of copy trading?

Primary risks include performance dependency on copied traders, limited position control, hidden fees, market correlation effects, and psychological pressure during losing periods.

How can I verify if a copy trading platform is legitimate?

Check the platform's regulatory status with financial authorities, verify fund segregation practices, review transparent fee disclosures, and examine detailed trader performance histories before investing.

CONCLUSION

Copy trading represents a legitimate investment strategy when approached through regulated platforms with proper due diligence. While genuine benefits exist for retail investors seeking professional market exposure, understanding inherent risks and selecting appropriate platforms remains crucial for success. The legitimacy question ultimately depends on platform choice, regulatory compliance, and individual risk management practices. Regulated platforms providing transparency, investor protection, and comprehensive risk management tools offer viable paths to market participation. Success in copy trading requires continuous education, careful trader selection, proper diversification, and realistic return expectations. As the industry matures with enhanced regulation and technological advancement, copy trading will likely become an increasingly mainstream investment approach.

Start Copy Trading Today