- Lower capital requirements for stock ownership

- Potential for significant percentage gains

- Accessible entry points for new traders

- Diverse sector representation

- Enhanced portfolio diversification opportunities

Investment Guru's Guide to Best Cheap Stocks for Options Trading

Recent analysis reveals that American stocks under $5 offer entry points starting at $25 per share with growth potential exceeding 300% in just 18 months, making them increasingly attractive for options strategies.

Article navigation

- Best Cheap Stocks for Options Trading: Complete 2025 Guide

- Understanding Cheap Stocks in Options Trading

- Fundamental Criteria for Stock Screening

- Option Chain Characteristics Analysis

- Technical Analysis for Options Trading

- Volatility Analysis

- Trading on Pocket Option: Your Gateway to the Markets

- Advanced Options Trading Strategies

- Risk Management and Position Sizing

- Common Mistakes to Avoid

Best Cheap Stocks for Options Trading: Complete 2025 Guide

Finding the best cheap stocks for options trading requires a strategic approach that balances affordability with liquidity and growth potential. With options trading becoming increasingly accessible, many traders seek cost-effective ways to diversify their portfolios while maintaining reasonable profit margins. This comprehensive guide explores proven strategies for identifying and trading low-priced stocks that offer excellent options opportunities.

“The key to successful options trading on cheap stocks lies in finding the perfect balance between affordability, liquidity, and volatility. Focus on quality over quantity.” – Sarah Chen, Senior Options Strategist, 2025

Understanding Cheap Stocks in Options Trading

When we discuss cheap stocks suitable for options trading, we typically refer to shares priced between $5 and $20. These securities offer several advantages for options traders:

For example, traders on Pocket Option’s Quick Trading platform often apply these principles when selecting underlying assets, utilizing the platform’s advanced screening tools to identify promising low-cost opportunities with strong options liquidity.

Examples of Cheap Stocks with Active Options Markets

To give you a practical starting point, here is a list of stocks that often fall within the “cheap” category and are known for having liquid options markets. This makes them popular candidates for the strategies discussed in this article.

- SoFi Technologies (SOFI): A fintech company that often exhibits significant options volume due to its popularity among retail traders and its position in the growing digital finance sector.

- Palantir Technologies (PLTR): A software company known for its data analytics platforms. Its stock frequently has high options activity, making it a favorite for traders looking to capitalize on volatility.

- JetBlue Airways (JBLU): As an airline stock, JetBlue can be sensitive to economic news, fuel prices, and travel demand, leading to opportunities for options traders who follow the sector closely.

- Opendoor Technologies (OPEN): A real estate technology company that can see significant price swings based on housing market trends, making its options attractive for speculative plays.

Please note: This list is for educational purposes. Always conduct your own research before trading, as market conditions and stock prices change rapidly.

Trade from $1 global stocks on Pocket Option

Fundamental Criteria for Stock Screening

Effective stock screening forms the foundation of successful options trading. When evaluating cheap stocks, consider these essential fundamental factors:

Financial Health Indicators

| Metric | Ideal Range | Significance | Red Flags |

|---|---|---|---|

| Debt-to-Equity Ratio | Below 0.5 | Financial stability | Above 1.0 |

| Current Ratio | 1.5 – 3.0 | Liquidity strength | Below 1.0 |

| Revenue Growth | 10%+ annually | Business expansion | Declining trend |

| Profit Margins | 5%+ net margin | Operational efficiency | Negative margins |

“Never compromise on fundamental analysis just because a stock is cheap. The cheapest option isn’t always the best option.” – Michael Rodriguez, Quantitative Analyst, 2025

📈 With Pocket Option, you don’t need to be a financial guru to find promising assets. Our platform offers intuitive tools and ready-made asset lists, helping you focus on what matters most – your strategy.

Industry and Market Position

Analyzing sector and industry trends helps identify companies positioned for growth. Focus on sectors experiencing:

- Technological disruption or innovation

- Regulatory changes favoring growth

- Increasing consumer demand

- Supply chain optimization opportunities

Option Chain Characteristics Analysis

Understanding option chain characteristics is crucial for successful cheap stock options trading. Key metrics to evaluate include:

Liquidity Metrics

| Component | Minimum Threshold | Preferred Range | Impact on Trading |

|---|---|---|---|

| Open Interest | 100+ contracts | 500+ contracts | Easier entry/exit |

| Daily Volume | 50+ contracts | 200+ contracts | Better pricing |

| Bid-Ask Spread | Under $0.10 | $0.05 or less | Reduced transaction costs |

| Strike Price Range | 5+ strikes | 10+ strikes | Strategy flexibility |

“Liquidity is the lifeblood of options trading. Without adequate volume and open interest, even the most promising cheap stock becomes a trading nightmare.” – Jennifer Park, Options Market Maker, 2025

Technical Analysis for Options Trading

Technical analysis provides valuable timing insights for options entry and exit points. Essential technical indicators for cheap stocks include:

- Moving Average Convergence Divergence (MACD) – Identifies momentum shifts

- Relative Strength Index (RSI) – Detects overbought/oversold conditions

- Bollinger Bands – Measures volatility and price extremes

- Volume Profile – Reveals support and resistance levels

- Candlestick Patterns – Indicates potential reversal points

In practice, traders often apply these technical tools within Pocket Option’s comprehensive charting suite, combining multiple timeframes to validate trade signals and optimize entry timing.

🚀Pocket Option turns complex technical analysis into a simple and visual process. Use our built-in indicators and charting tools to make informed decisions without having to switch between windows.

Volatility Analysis

Understanding volatility skew helps identify mispriced options opportunities. Monitor these volatility indicators:

- Historical volatility vs. implied volatility

- Volatility term structure

- Put-call volatility skew

- Volatility smile patterns

“Volatility is an options trader’s best friend when properly understood and managed. The key is recognizing when implied volatility deviates from historical norms.” – David Thompson, Volatility Specialist, 2025

Trading on Pocket Option: Your Gateway to the Markets

Trading on Pocket Option: Your Gateway to the Markets

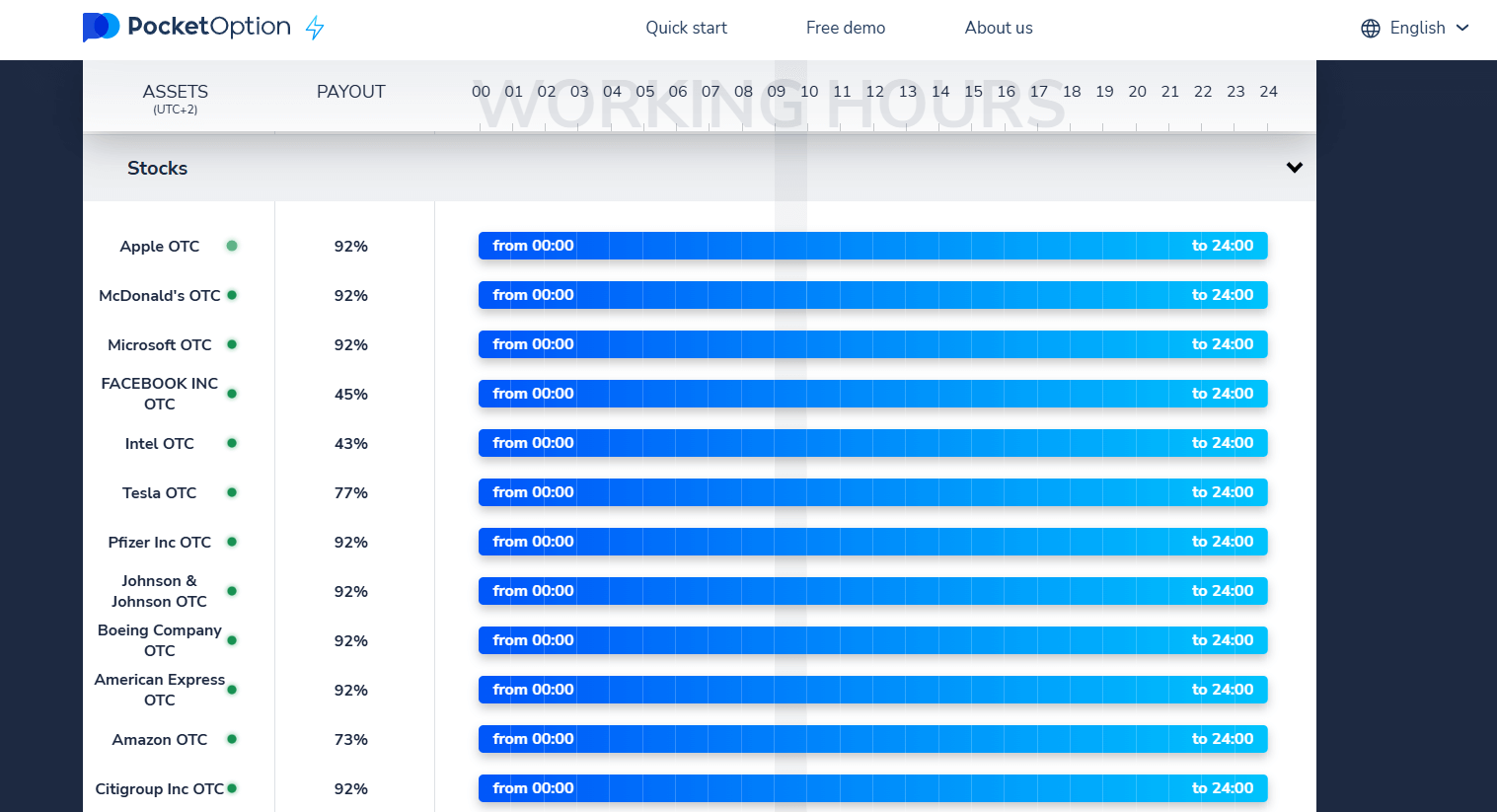

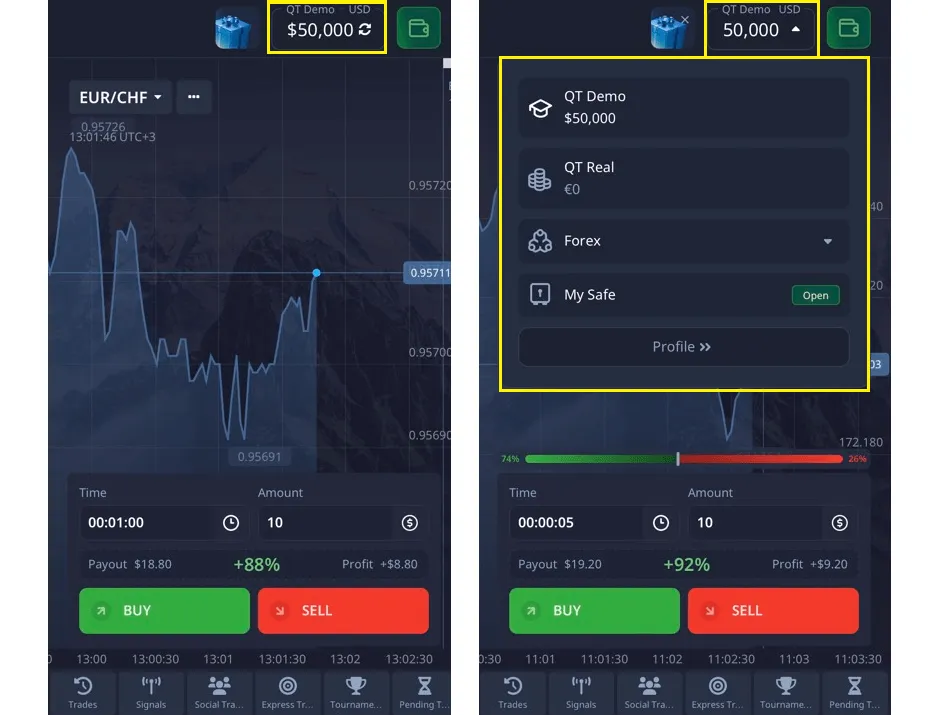

Applying theoretical knowledge is the most important step, and on Pocket Option, you can transition from theory to practice seamlessly. While the specific stocks discussed in this guide may not always be available, the principles of analysis are universal.

Pocket Option provides the ideal environment to hone your skills. Here’s how:

- Low Entry Barrier: Start your trading journey with a minimal deposit from just $5, depending on your region and payment method. 💵

- Risk-Free Practice: Before using real capital, master every strategy on a free demo account loaded with $50,000 in virtual funds. 🎓

- Diverse Opportunities: Explore over 100 trading assets, including currencies, commodities, and stocks, ensuring you always have new markets to analyze. 🌍

- Free Education Hub: Accelerate your growth with our extensive knowledge base, filled with trading strategies, educational videos, and Forex guides to build a solid foundation for your career. 📚

- Competitive Spirit: Test your skills and strategies against other traders by participating in our regular trading tournaments. 🏆

With these tools at your disposal, Pocket Option empowers you to start building a successful trading career.

Advanced Options Trading Strategies

Once you’ve identified suitable cheap stocks, implement these proven strategies:

Calendar Spreads

Calendar spreads work exceptionally well with cheap stocks due to their time decay characteristics. This strategy involves:

- Selling near-term options

- Buying longer-term options at the same strike

- Profiting from time decay differentials

- Managing volatility expansion risks

Gamma Scalping Techniques

Gamma scalping becomes particularly effective with volatile cheap stocks. Key implementation steps include:

- Establish long gamma positions

- Delta hedge dynamically

- Capture volatility profits

- Manage transaction costs carefully

“Gamma scalping on cheap stocks requires discipline and automation. The profits come from consistent execution rather than timing market moves perfectly.” – Amanda Foster, Algorithmic Trader, 2025

Risk Management and Position Sizing

Effective risk management becomes even more critical when trading cheap stocks, as their volatility can lead to significant losses. Implement these risk controls:

- Never risk more than 2-3% of capital per trade

- Diversify across multiple positions

- Set stop-losses at 50% of premium paid

- Monitor position Greeks daily

- Adjust hedges as market conditions change

💡 Practice risk management without losses! Pocket Option’s $50,000 demo account is your personal sandbox for practicing the boldest strategies and strict risk management rules..

Common Mistakes to Avoid

Learn from these frequent errors that trap novice options traders:

| Mistake | Why It Happens | How to Avoid | Alternative Approach |

|---|---|---|---|

| Chasing cheap premiums | Low cost appears attractive | Focus on probability of profit | Quality over quantity |

| Ignoring liquidity | Overlooking exit difficulty | Check volume before entry | Stick to liquid options |

| Over-leveraging positions | Small premiums enable large positions | Maintain position size discipline | Risk-based position sizing |

| Neglecting time decay | Focus on directional moves only | Monitor theta impact daily | Time-conscious strategies |

FAQ

What makes a cheap stock suitable for options trading?

A cheap stock becomes suitable for options trading when it combines affordability with adequate liquidity, reasonable bid-ask spreads, and sufficient open interest. Look for stocks with daily options volume exceeding 50 contracts and open interest above 100 contracts per strike.

How do I analyze option liquidity for cheap stocks?

Analyze option liquidity by examining three key metrics: daily volume (minimum 50 contracts), open interest (at least 100 contracts), and bid-ask spreads (preferably under $0.10). These factors determine how easily you can enter and exit positions.

What's the difference between historical and implied volatility in cheap stocks?

Historical volatility measures past price movements, while implied volatility reflects market expectations for future volatility. For cheap stocks, implied volatility often exceeds historical volatility, creating opportunities for volatility sellers.

Which technical indicators work best for timing cheap stock options entries?

RSI for identifying overbought/oversold conditions, MACD for momentum confirmation, and Bollinger Bands for volatility assessment work exceptionally well. Combine multiple indicators for higher probability setups.

How do I manage risk when trading volatile cheap stock options?

Implement strict position sizing (never exceed 3% per trade), set stop losses at 50% of premium paid, diversify across multiple positions, and monitor position Greeks daily. Consider paper trading strategies before risking real capital.

What are the advantages of calendar spreads on cheap stocks?

Calendar spreads on cheap stocks benefit from high time decay rates, lower capital requirements, and the ability to profit from sideways price movement. They're particularly effective when volatility is expected to remain stable.

How much capital should I allocate to cheap stock options trading?

Limit individual positions to 2-3% of your total trading capital and maintain overall options exposure below 20% of your portfolio. This approach allows for adequate diversification while managing the higher volatility associated with cheap stocks.

What are the best sectors for finding cheap options-friendly stocks?

Technology, healthcare, energy, and financial sectors typically offer the best combination of cheap stocks with active options markets. These sectors present companies with growth potential and sufficient market interest to maintain options liquidity.

CONCLUSION

Successfully identifying the best cheap stocks for options trading requires a disciplined approach combining fundamental analysis, technical evaluation, and rigorous risk management. The strategies outlined in this guide provide a comprehensive framework for navigating this specialized market segment. As markets continue evolving in 2025, technological advances and increased retail participation are creating new opportunities in the cheap stock options space. Focus on maintaining proper due diligence, managing risk effectively, and continuously educating yourself about market dynamics. "The future of cheap stock options trading lies in combining traditional analysis with modern technology. Platforms that offer comprehensive screening tools and real-time analytics will give traders the competitive edge." - Robert Kim, Market Strategist, 2025 Remember that successful options trading requires patience, discipline, and continuous learning. Whether you're using Pocket Option's Quick Trading platform or other trading solutions, the principles outlined here will help you make more informed decisions and improve your trading outcomes.

Start trading