- Declining EPS or slowing e-commerce revenue growth

- Significant impact from tariffs or interest rate hikes

- Walmart’s valuation exceeding its historical range without corresponding sales growth

When Should I Sell My Walmart Stock – Analysis

Learn when to sell Walmart stock with key signals and strategies to maximize gains and minimize losses.

Article navigation

- The Art and Science of Timing Walmart Stock Sales

- Historical and Seasonal Trends of WMT Stock: When Should I Sell My Walmart Stock?

- Goal-Based Selling Triggers for Walmart Stock

- Should I Sell or Hold Walmart Stock?

- At What Point Should You Sell a Stock?

- Analyst Ratings and Their Meaning

- Technical Analysis Selling Frameworks

- Do I Have to Pay Taxes When I Sell My Walmart Stock?

- Enhance Your Trading Strategy with Pocket Option Tools

- Walmart Stock Prediction 2025 and Long-Term Outlook

- Strategic Wrap-Up: Is It Time to Buy or Sell Walmart Stock?

The Art and Science of Timing Walmart Stock Sales

For retail investors holding Walmart (WMT) shares, one question inevitably arises: when should I sell my Walmart stock? This decision involves balancing personal financial goals, market conditions, technical indicators, and business fundamentals. At Pocket Option, we’ve found that selling decisions often impact portfolio performance more significantly than buying decisions.

Understanding how to sell my Walmart stock is just as crucial. Many investors use platforms like Computershare Walmart stock services. Depending on your brokerage, how long does Walmart stock take to sell typically ranges from same-day execution to 2–3 business days.

Historical and Seasonal Trends of WMT Stock: When Should I Sell My Walmart Stock?

Historical and Seasonal Trends of WMT Stock: When Should I Sell My Walmart Stock?

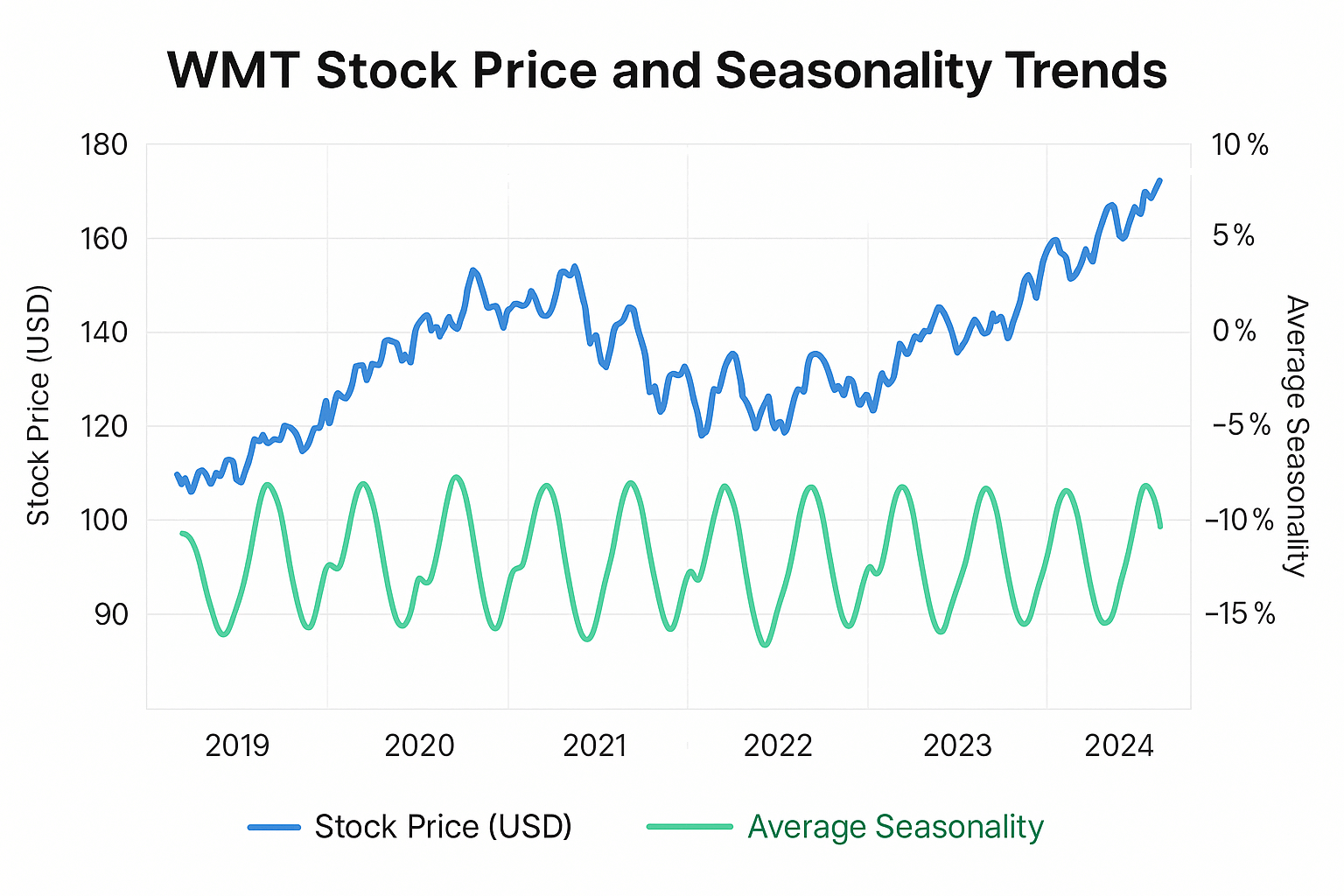

Historically, Walmart stock has demonstrated resilience during downturns and strong performance during the holiday season. These seasonal trends, particularly leading up to fiscal year-end in January, can offer valuable insights for timing exits. A post-holiday pullback is common, creating a window for strategic selling. Pairing seasonal analysis with technical indicators helps define the best time to sell Walmart stock.

Goal-Based Selling Triggers for Walmart Stock

Pocket Option’s investment specialists emphasize that successful Walmart investors align selling decisions with predefined goals rather than emotional reactions. Many investors search for “how do I sell my Walmart stock” or “sell Walmart stock” because they haven’t defined clear exit criteria. Here are some practical frameworks:

| Financial Goal | Potential Selling Trigger | Consideration Factors |

|---|---|---|

| Retirement Funding | Target portfolio allocation adjustment | Time horizon, alternative income sources |

| Major Purchase | Specific dollar amount achievement | Timeline flexibility, financing alternatives |

| Capital Preservation | Fundamental deterioration signs | Risk tolerance, portfolio diversification |

Should I Sell or Hold Walmart Stock?

The question should I sell my Walmart stock depends on your portfolio strategy and financial needs. If Walmart’s fundamentals remain intact and your investment goals are long-term, holding may be wise. However, if valuation metrics exceed historical norms or if strategic goals shift, it’s time to reevaluate.

Dividend stability is a key factor. Walmart has a consistent history of paying and increasing dividends. If your portfolio depends on stable income, evaluate if the current dividend yield still justifies holding WMT shares.

Investors often ask how to sell Walmart stock efficiently. Ensure your shares are accessible through your brokerage or Computershare Walmart account. If you’re uncertain about how do I access my Walmart stock, check your employer’s benefit portal or contact support.

Real Trader Feedback:

“Pocket Option helped me visualize sell signals through advanced charts—simplified my entire timing strategy.” — Lucas M.

“Their technical dashboard showed me where I was missing RSI divergence. I avoided a 7% dip on WMT.” — Elena R.

At What Point Should You Sell a Stock?

Rather than reacting to short-term price movements, monitor these business health indicators when considering should I sell my Walmart stock:

External elements like tariffs, inflation, or policy changes can affect Walmart stock valuation. When EPS declines or margins compress in response to these pressures, selling may be warranted.

If you’re asking how long does Walmart stock take to sell, most retail brokers settle trades within T+2 (two business days). Processing time may vary for those using Computershare Walmart stock services.

Visual summary of key business indicators that often signal the right time to sell Walmart stock.

Analyst Ratings and Their Meaning

Many analysts track Walmart and issue forecasts for WMT stock. Their recommendations are based on indicators like EPS, sector performance, and growth outlook. As of 2024, the majority remain cautiously optimistic but monitor competition from e-commerce and cost pressures.

“The current EPS trajectory doesn’t fully price in margin risk if inflation persists into 2025,” noted Richard Keene, retail equity strategist.

Ratings from “strong buy” to “sell” can influence investor behavior. Multiple “sell” calls may indicate doubts over Walmart’s ability to sustain dividend growth or margin stability. Review these opinions along with your financial plan when deciding whether to sell Walmart stock.

Technical Analysis Selling Frameworks

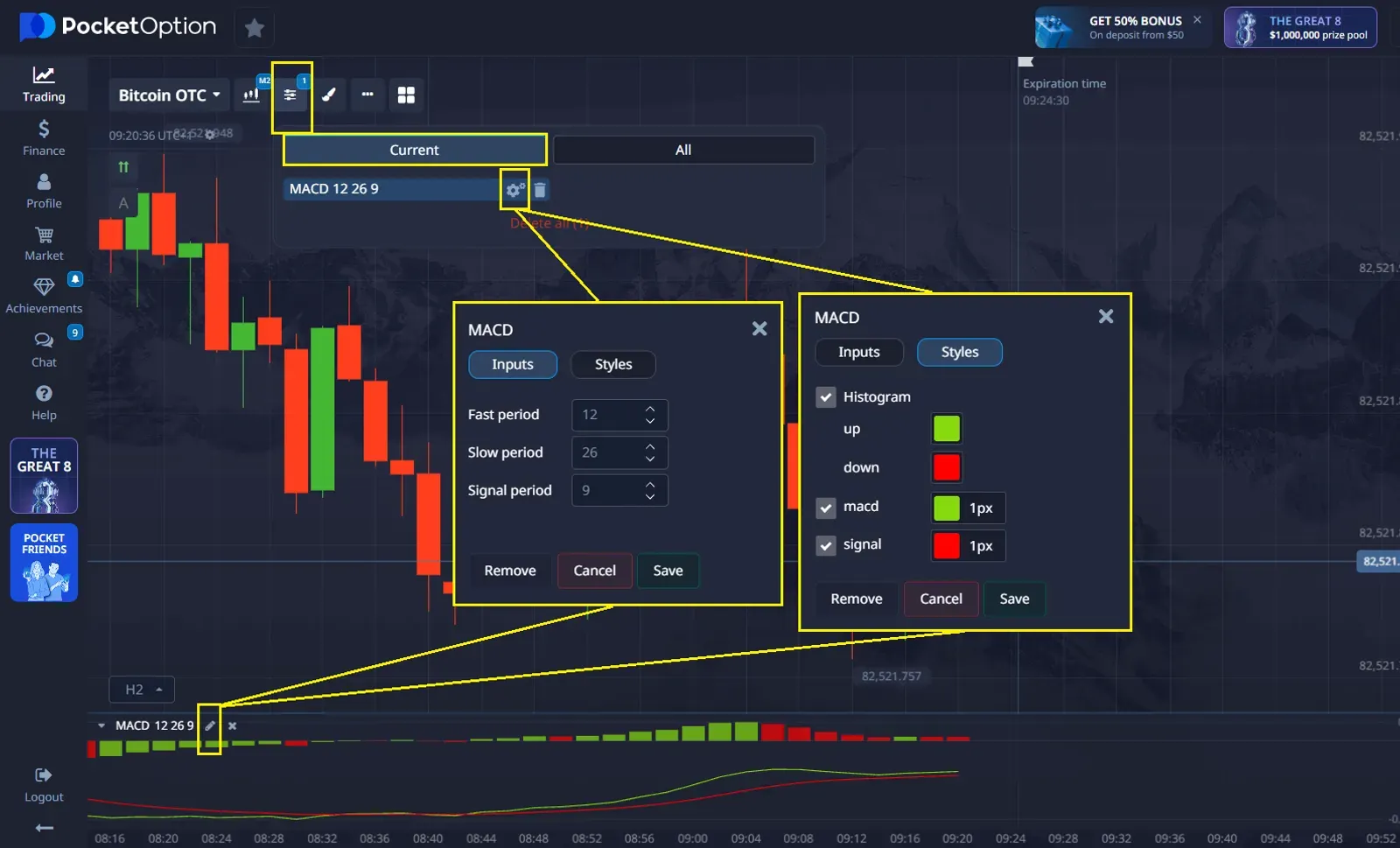

Pocket Option’s technical specialists identify several reliable patterns specific to Walmart stock movements:

| Technical Indicator | Selling Signal Description | Historical Reliability |

|---|---|---|

| RSI | Above 75 with price divergence | High – ~78% accuracy |

| Volume-Price Divergence | Rising prices with declining volume | High |

| MA Crossovers | 50-day crosses below 200-day moving average | Moderate – ~65% |

Do I Have to Pay Taxes When I Sell My Walmart Stock?

Yes. U.S. capital gains tax applies to all profitable stock sales:

- Short-term gains (held < 1 year): taxed as ordinary income

- Long-term gains (held ≥ 1 year): taxed at favorable capital gains rate

Strategies for optimization:

- Offset gains with losses in other investments

- Donate appreciated shares to reduce taxable income

- Use covered calls for gradual exit

Enhance Your Trading Strategy with Pocket Option Tools

While Pocket Option does not offer direct access to Walmart (WMT) stock, it provides a powerful set of tools that help traders improve decision-making and develop timing strategies applicable across various assets.

Whether you’re managing traditional investments elsewhere or refining your approach with forex, crypto, or commodities on Pocket Option, here’s how the platform adds value:

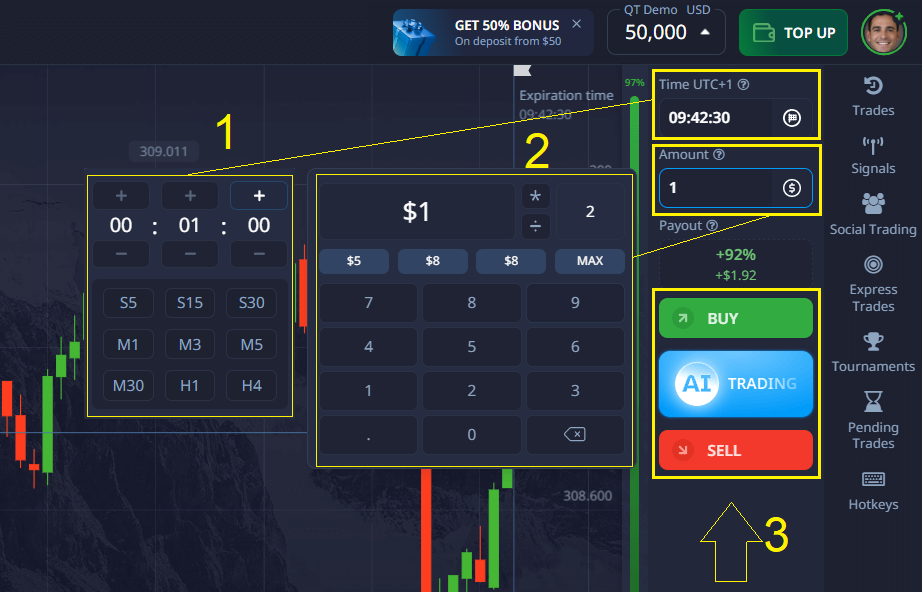

- Practice risk-free: Use the demo account to simulate selling decisions, test indicators like RSI and moving averages, and train your market timing instincts without financial risk.

- Social trading insights: Learn from top-performing traders using Pocket Option’s copy trading feature. Observe how experienced users time their exits in volatile markets.

- Quick trade execution: Benefit from fast order processing and instant deposits/withdrawals to adapt swiftly to market changes across a wide asset spectrum.

- Accessible everywhere: Analyze market signals anytime, anywhere with a user-friendly mobile and desktop platform—ideal for staying in sync with macroeconomic news that impacts stocks like Walmart.

Use Pocket Option to sharpen your technical analysis, test exit frameworks, and build the discipline required to make confident, data-backed selling decisions.

Walmart Stock Prediction 2025 and Long-Term Outlook

Looking into 2025, Walmart’s success depends on its e-commerce strategy, cost efficiency, and macro trends like interest rates. If initiatives like automation and supply chain digitization succeed, WMT stock may rise, making it worth holding. However, if execution falters or competition erodes market share, that may be your signal to sell.

Strategic Wrap-Up: Is It Time to Buy or Sell Walmart Stock?

If you’re asking yourself when should I sell my Walmart stock, the answer hinges on valuation data, your time horizon, and external market conditions. Avoid making emotional decisions—develop a strategy informed by analytics and personal goals. Whether you hold WMT for dividends or growth, periodic reevaluation is essential.

Explore smart tools, monitor indicators, and use platforms like Pocket Option to support data-driven decisions. For example, understanding how much is 100 shares of Walmart stock today can help you assess the weight of this position in your portfolio and decide whether it’s time to buy, hold, or sell.

FAQ

What are the most reliable technical indicators for timing Walmart stock sales?

RSI readings above 75 combined with bearish divergence patterns have historically proven most reliable for Walmart stock. Volume-price divergence (increasing price with decreasing volume) has also shown strong predictive value for identifying potential selling opportunities.

Should I sell Walmart stock during economic downturns?

Walmart often demonstrates defensive characteristics during economic contractions, outperforming the broader market. Unless fundamental business metrics deteriorate or your personal financial situation requires liquidation, economic downturns typically aren't optimal selling periods for Walmart shares.

How does Walmart's dividend policy affect selling decisions?

Walmart's consistent dividend growth history provides a value floor for the stock and should factor into selling calculations. Consider the dividend yield relative to both historical averages and alternative income-generating investments before selling positions held primarily for income.

What valuation metric best indicates Walmart is overvalued?

Price-to-sales ratio exceeding 1.0x without corresponding growth acceleration has historically signaled overvaluation for Walmart. This metric is particularly useful because it's less susceptible to one-time earnings adjustments that can distort P/E ratios.

How should I incorporate Pocket Option's analysis when deciding to sell Walmart stock?

Pocket Option's analytical tools provide objective valuation and technical indicators specific to retail sector stocks like Walmart. Use our custom alert system to establish personalized selling triggers based on your investment goals and risk tolerance rather than relying on emotional reactions.