- Moving Average

- SuperTrend

- Ichimoku Kinko Hyo

- Parabolic SAR

- Alligator

- Envelopes

- Bollinger Bands

- Bollinger Bands Width

- Donchian Channels

- Keltner Channel

- ZigZag

Pocket Option Best Technical Trading Indicators

Choosing the right technical indicators can boost your Pocket Option trading results. This article highlights the best tools for short-term trades.

Article navigation

- Explore Pocket Option Indicators

- Understanding the Value of Technical Indicators in Pocket Option

- Accessing and Managing Indicators on Pocket Option

- Top-Performing Indicators for Pocket Option Trading

- Powerful Indicator Combinations That Reduce False Signals

- Matching Indicators to Your Trading Psychology

- Testing Indicators in a Risk-Free Environment

- Optimizing Timeframes for Maximum Indicator Performance

- Multi-Timeframe Analysis for Precision Entries

- Practical Implementation: From Theory to Execution

Understanding the Value of Technical Indicators in Pocket Option

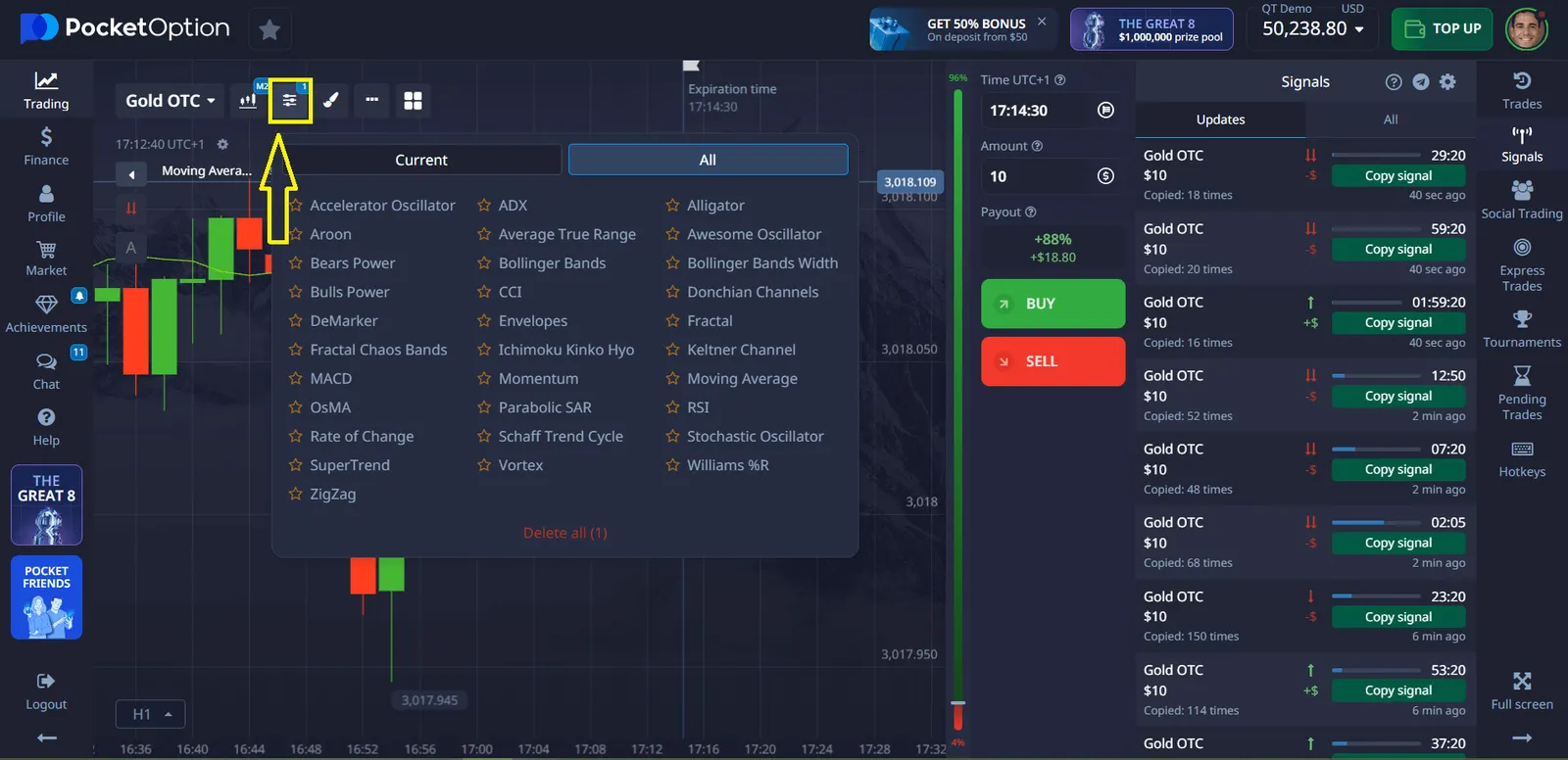

The best Pocket Option indicator isn’t the most complex–it’s the one that provides actionable signals aligned with your strategy. Pocket Option offers 30+ technical trading indicators as tools for mathematical analysis to help predict price movements and market trends. You can access these through the “Indicators” section, located on the upper left part of the trading interface near the chart type selector.

Accessing and Managing Indicators on Pocket Option

When examining the best indicator for Pocket Option trading, it’s important to know how to effectively use the platform. Once you select an indicator, it will be applied to your chart. You can add indicators to your Favorites by clicking the star icon next to them for quick access. Keep in mind that a maximum of 30 indicators can be applied across all charts. If you wish to add more, you will need to remove some existing ones.

Top-Performing Indicators for Pocket Option Trading

When selecting the best indicator for Pocket Option trading, five tools consistently outperform others across various market conditions.

| Indicator Name | Best Timeframe | Trading Style | Accuracy Rating |

|---|---|---|---|

| Relative Strength Index (RSI) | 5-15 minutes | Reversal | High |

| Bollinger Bands | 1-5 minutes | Breakout | Medium-High |

| MACD | 15-30 minutes | Trend | Medium |

| Parabolic SAR | 5 minutes | Trend Reversal | Medium |

| Stochastic Oscillator | 5-15 minutes | Overbought/Oversold | High |

The key difference between indicators lies in their specific functions and the type of data they analyze. Each indicator provides unique insights, allowing traders to tailor their approach depending on their preferred type of analysis.

Trend Indicators

Used to determine the direction of a trend.

Oscillators

These are used to determine overbought or oversold conditions.

- RSI (Relative Strength Index)

- Stochastic Oscillator

- Awesome Oscillator

- Accelerator Oscillator

- MACD (Moving Average Convergence Divergence)

- OsMA (Moving Average of Oscillator)

- CCI (Commodity Channel Index)

- Momentum

- Williams %R

- DeMarker

- Bears Power

- Bulls Power

- ADX (Average Directional Index)

Volatility Indicators

Used to measure the degree of price volatility.

- Average True Range (ATR)

- Bollinger Bands

- Bollinger Bands Width

- Keltner Channel

- Donchian Channels

- Fractal Chaos Bands

Volume/Strength/Other Tools

- Vortex

- Aroon

- Schaff Trend Cycle

- Fractal

Powerful Indicator Combinations That Reduce False Signals

The best indicator for Pocket Option often isn’t a single tool but a system of complementary indicators that confirm signals and reduce false positives.

| Combination Name | Components | Signal Type | Performance |

|---|---|---|---|

| Triple Confirmation System | RSI + MACD + Support/Resistance | Reversal Entry | Excellent |

| Volatility Breakout Detector | Bollinger Bands + Volume + ADX | Breakout Entry | Very Good |

| Trend Momentum Package | Moving Averages + Stochastic + OBV | Trend Continuation | Good |

| Divergence Detection Suite | RSI + MACD + Price Action | Early Reversal | Very Good |

Matching Indicators to Your Trading Psychology

Even the most accurate Pocket Option indicator becomes worthless without psychological compatibility. Your temperament must align with your indicator’s characteristics for sustainable success.

- Risk-averse traders benefit from multiple confirmation systems despite potentially missing early entries

- Aggressive traders prefer leading indicators like RSI despite higher false positive rates

- Systematic traders find mechanical indicators with clear rules easier to implement

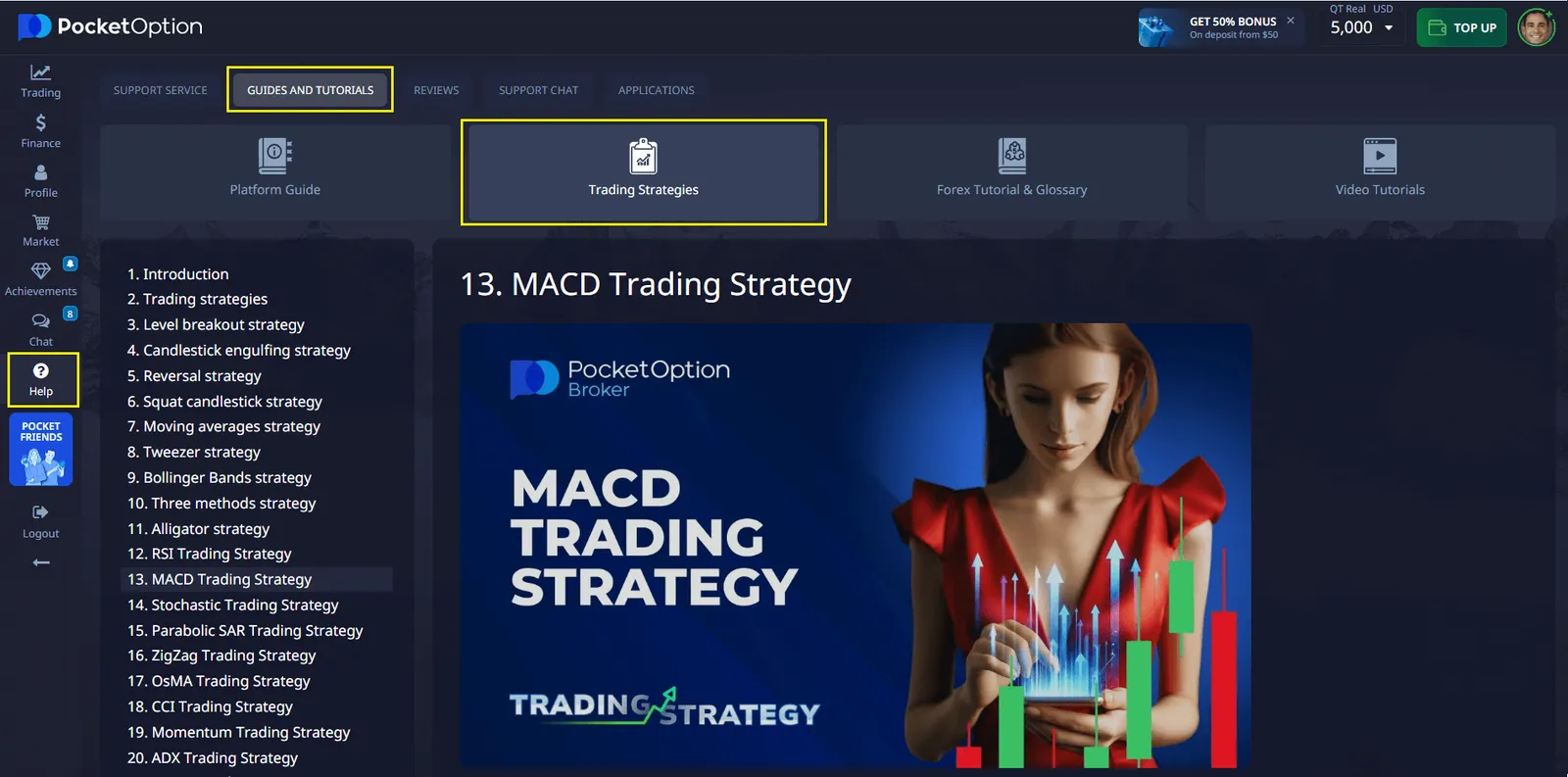

The Pocket Option trading platform features a comprehensive strategy section that many traders overlook. Within this valuable resource, you’ll discover potentially game-changing indicator approaches you haven’t yet incorporated into your investment arsenal. Exploring these untapped strategic options could be the key to optimizing your trading performance and potentially enhancing your returns.

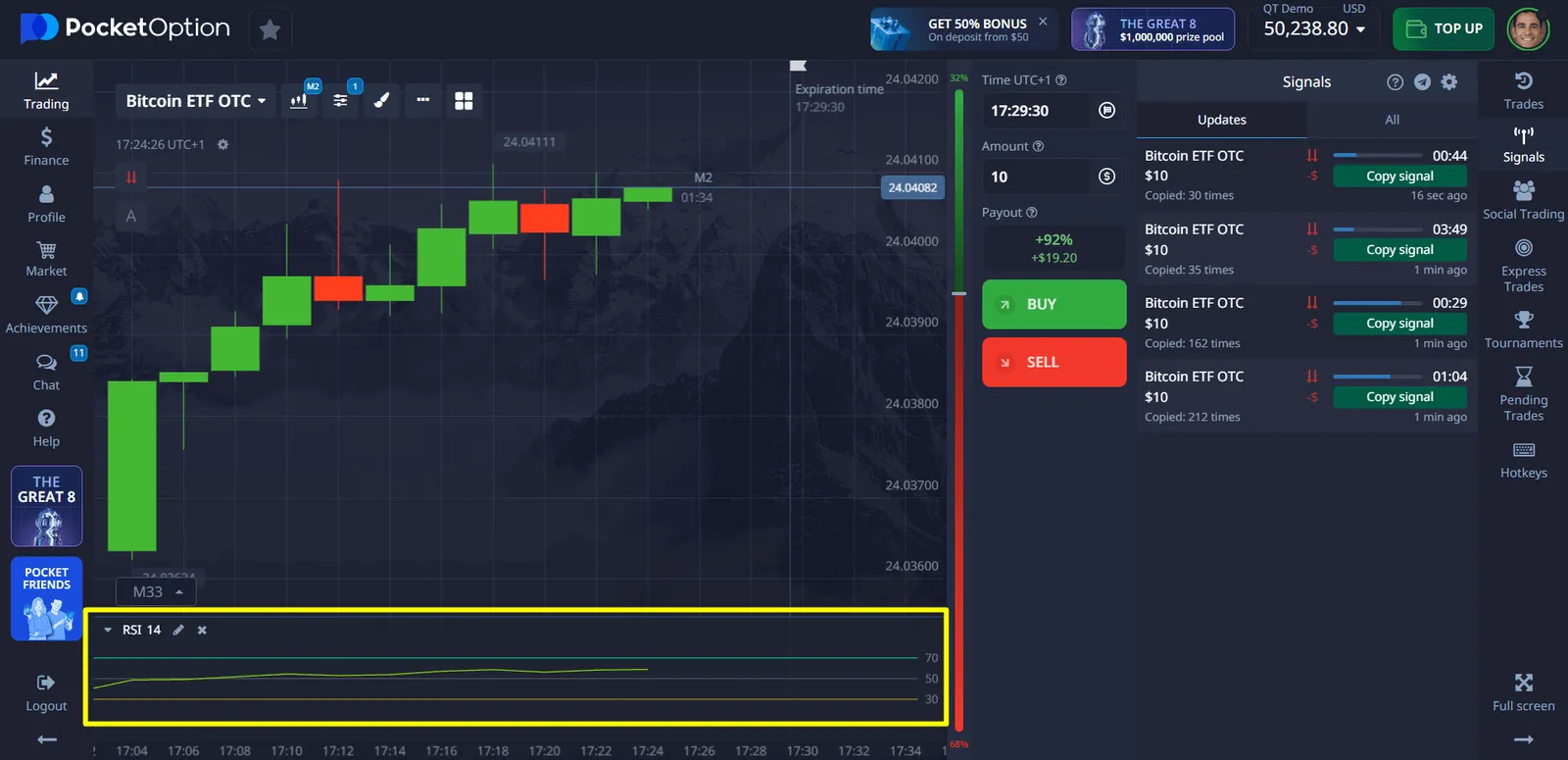

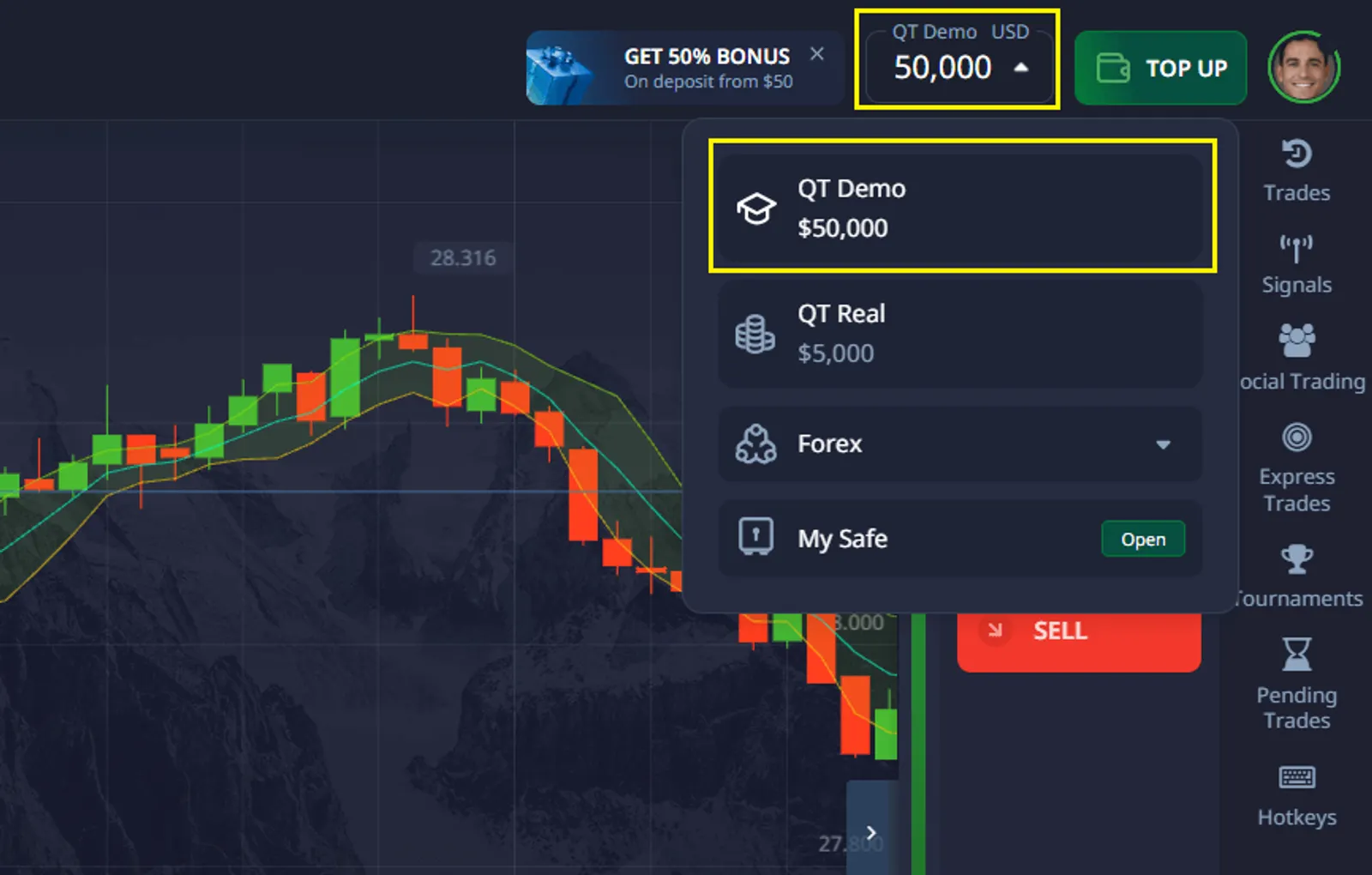

Testing Indicators in a Risk-Free Environment

Before implementing any trading system with real capital, experienced traders always validate their approach using Pocket Option’s demo account with $50000. This practice environment is invaluable when evaluating the best Pocket Option indicator for your strategy. When testing indicators like RSI or MACD combinations, a demo account provides authentic market conditions without financial consequences. By logging at least 50 trades with your chosen indicator setup, you’ll gather meaningful data about its effectiveness across different market phases.

Register and test your strategies in Free Demo mode✔️

Optimizing Timeframes for Maximum Indicator Performance

The effectiveness of any indicator for Pocket Option trading varies dramatically across different timeframes.

| Trading Timeframe | Best Indicators | Recommended Expiry | Signal Quality |

|---|---|---|---|

| 1-minute charts | RSI, Bollinger Bands | 1-3 minutes | Moderate |

| 5-minute charts | MACD, Stochastic, Parabolic SAR | 15-30 minutes | Good |

| 15-minute charts | Moving Averages, RSI, ADX | 30-60 minutes | Very Good |

| 1-hour charts | Ichimoku Cloud, MACD, Fibonacci | End of day | Excellent |

Multi-Timeframe Analysis for Precision Entries

Advanced traders use multi-timeframe analysis to improve signal quality: identify the daily trend direction, confirm momentum on hourly charts, then use the best Pocket Option indicator on 5-minute charts for precise entries. This approach can increase win rates by 15-20% compared to single-timeframe strategies.

Practical Implementation: From Theory to Execution

Pocket Option indicator trading requires practical considerations beyond theoretical knowledge:

- Backtest indicator settings across different market conditions before live trading

- Start with 2-3 complementary indicators rather than overcrowding charts

- Document specific entry and exit rules to prevent emotional override

FAQ

What is the most accurate indicator for Pocket Option trading?

The best indicator is difficult to determine because it all depends on the trader's strategy and skills, with RSI being one of the most popular. The RSI (Relative Strength Index) consistently delivers high accuracy for Pocket Option trading when properly calibrated. It works exceptionally well for identifying potential reversals when price reaches extreme overbought or oversold conditions.

How many indicators should I use on Pocket Option?

Use 2-3 complementary indicators that confirm each other without providing redundant information. Too many indicators lead to analysis paralysis, while too few may not provide sufficient confirmation signals.

Can I use custom indicators on Pocket Option?

Pocket Option primarily supports their pre-installed set of indicators, but you can customize parameters of existing indicators. Some advanced traders use external platforms for analysis before executing trades on Pocket Option.

What timeframe works best with Pocket Option indicators?

The 5-minute and 15-minute timeframes generally provide the best balance between signal quality and trading opportunities. These timeframes filter out noise while still capturing meaningful price movements for short-term trading.

How do I know if an indicator is working effectively?

Track your trading results meticulously over at least 50-100 trades to establish statistical significance. An effective indicator should provide a win rate consistently above 55% when used as part of a complete trading system.

CONCLUSION

The best Pocket Option indicator isn't universal--it's what works for your specific trading style and risk tolerance. Successful Pocket Option traders develop personalized systems combining technical analysis with disciplined execution and proper risk management. By selecting indicators that complement your trading approach and psychological profile, you can develop a sustainable edge in the market.

Start trading