- Bitcoin Core client: a full node wallet that stored the entire blockchain.

- Text file backups: private keys saved in text files on local drives.

- Paper wallets: printed keys for offline storage.

Pocket Option Explores How Did People Buy Bitcoin in 2010

This article explains how Bitcoin was bought in 2010, revealing the challenges, innovations, and early market evolution.

Article navigation

- Start trading

- Did Anyone Buy Bitcoin in 2010?

- Introduction to Bitcoin in 2010

- The Birth of Bitcoin and Early Adoption

- How Much Was $1 Bitcoin in 2010?

- Understanding Bitcoin as Cryptocurrency

- How Did People Store Their Bitcoin in 2010?

- People’s Initial Interest in Bitcoin

- What if I Invested $10,000 in Bitcoin in 2010?

- Methods of Buying Bitcoin in 2010

- How Did People Buy Bitcoin in 2015

- Challenges Faced by Early Bitcoin Buyers

- Success Stories and Bitcoin Millionaires

- Comparing Bitcoin’s Worth Today

- Connecting the Evolution of Bitcoin to Modern Trading Platforms: Pocket Option

Did Anyone Buy Bitcoin in 2010?

Yes, several individuals bought or acquired Bitcoin in 2010. The first recorded commercial transaction was in May 2010, when Laszlo Hanyecz paid 10,000 BTC for two pizzas. This event became emblematic of the early adoption era. At the time, forums like Bitcointalk were hubs for Bitcoin discussion and transaction coordination.

Introduction to Bitcoin in 2010

Bitcoin’s journey began in January 2009 with the release of its first software by the pseudonymous creator, Satoshi Nakamoto. However, it wasn’t until 2010 that Bitcoin gained significant traction among early adopters and tech-savvy individuals. This period saw the birth of a burgeoning community that actively engaged in discussions on online forums like Bitcointalk, where users shared their experiences and strategies for acquiring Bitcoin. The excitement around this new cryptocurrency was palpable, as individuals sought to invest in Bitcoin and capitalize on its potential value.

The Birth of Bitcoin and Early Adoption

In 2010, Bitcoin was still a novel concept, and the methods to buy Bitcoin were limited compared to today’s vast array of crypto exchanges. The first known commercial transaction using Bitcoin occurred when a programmer purchased two pizzas for 10,000 BTC, a transaction that would later symbolize the volatile nature of Bitcoin’s price. Early adopters, including miners who contributed to the Bitcoin network, began to realize the potential of acquiring Bitcoin at a low cost. Back then, the exchange rate for Bitcoin was just a fraction of what it would later become, creating a unique opportunity for those willing to take the plunge.

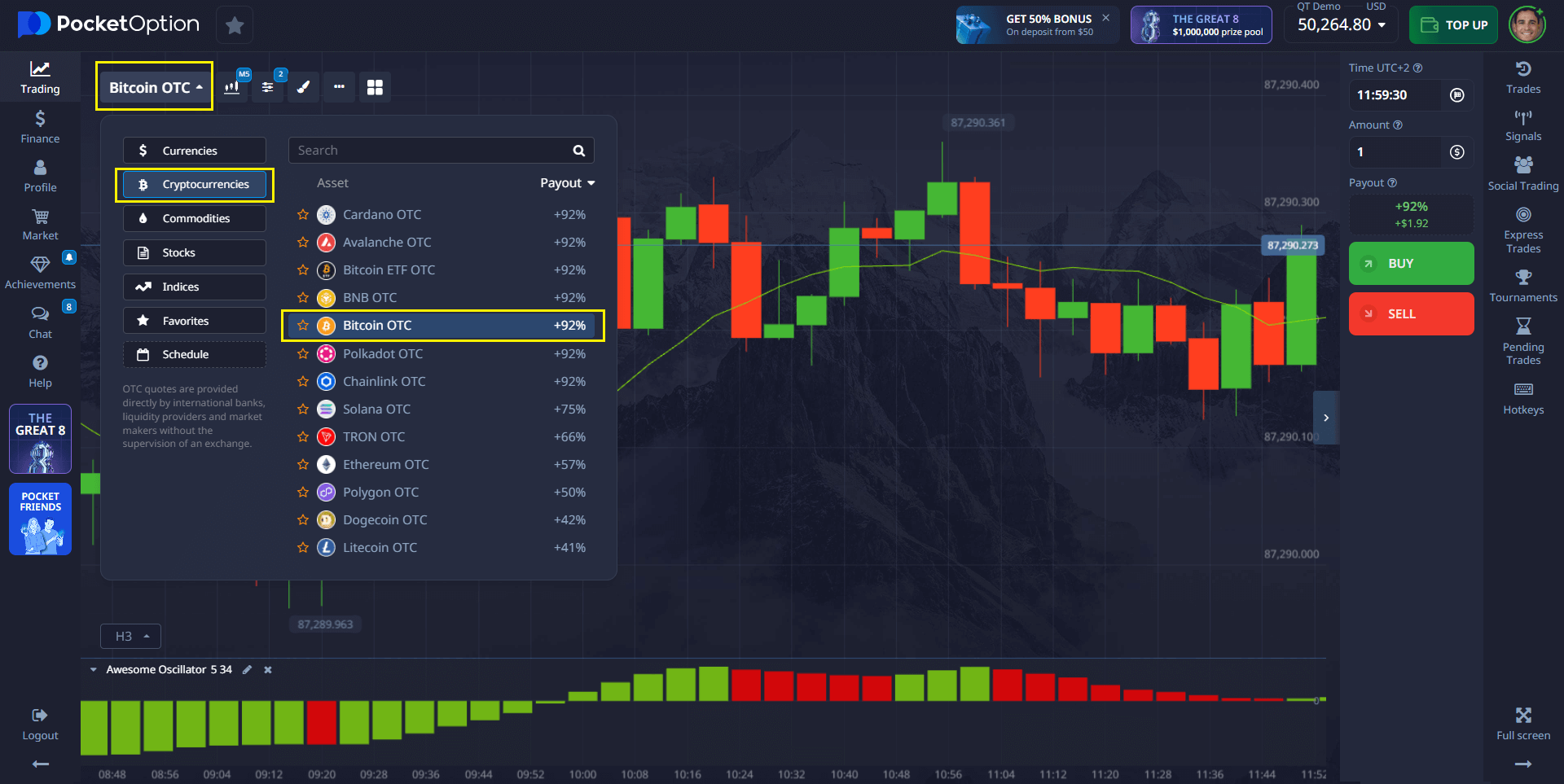

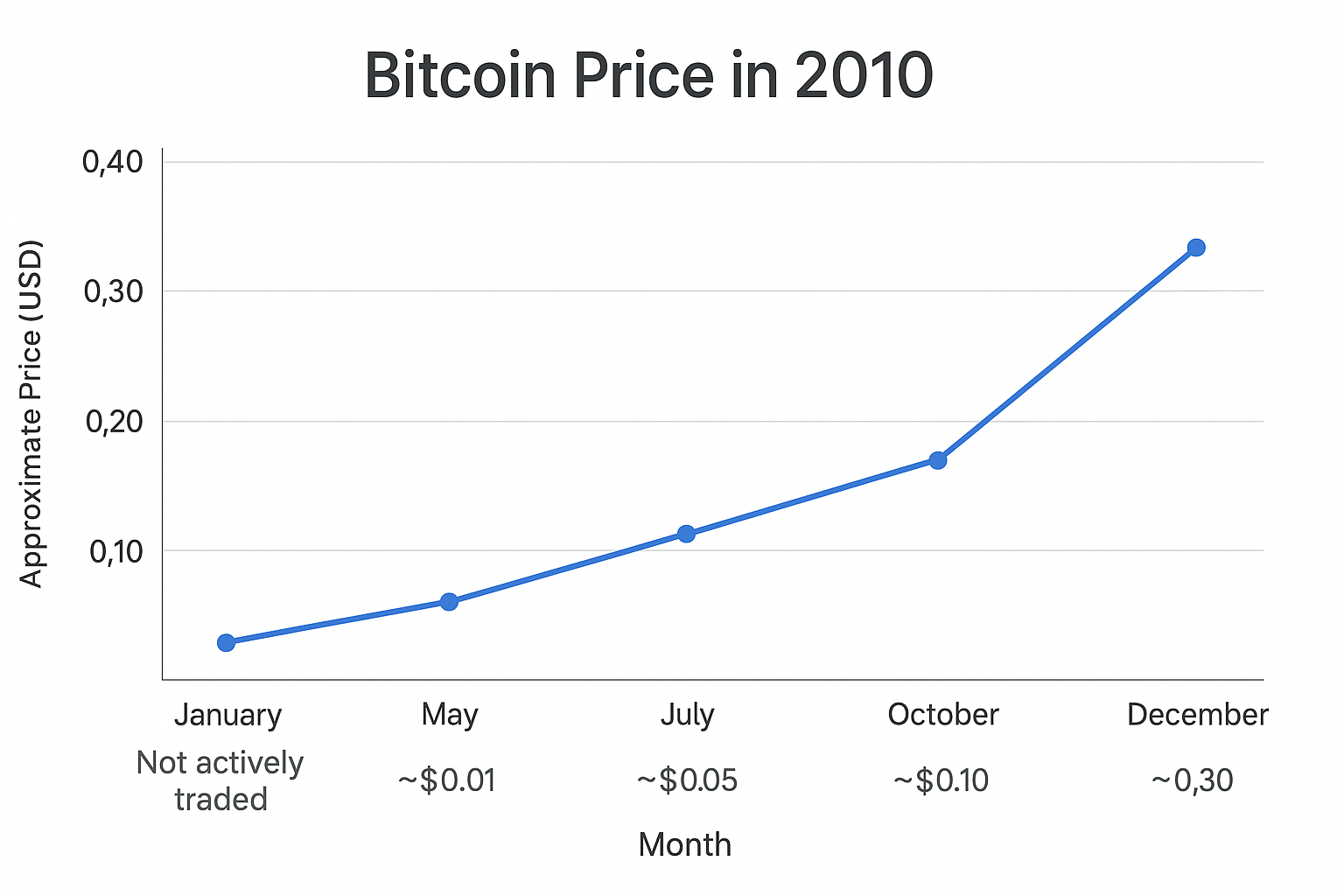

How Much Was $1 Bitcoin in 2010?

In 2010, Bitcoin’s value fluctuated as it began trading on early platforms. Initially, it was priced around $0.003 to $0.08 per BTC. By the end of 2010, 1 BTC was worth approximately $0.30. The table below outlines average Bitcoin prices during key months in 2010:

| Month | Approximate BTC Price (USD) |

|---|---|

| January | Not actively traded |

| May | ~$0.01 |

| July | ~$0.05 |

| October | ~$0.10 |

| December | ~$0.30 |

Understanding Bitcoin as Cryptocurrency

Bitcoin is a decentralized digital currency that operates on a blockchain, a public ledger that records all transactions. This innovative technology allows for peer-to-peer transactions without the need for intermediaries, such as banks. In 2010, many individuals were still learning the fundamentals of cryptocurrency and how to securely store their bitcoins in wallets. The concept of owning a wallet and managing private keys was new to most, and early adopters had to navigate the complexities of this emerging digital economy while being cautious of the volatility associated with Bitcoin’s price.

How Did People Store Their Bitcoin in 2010?

Security practices were basic, making users vulnerable to hacks and data loss. Cold storage and hardware wallets had not yet been developed.

People’s Initial Interest in Bitcoin

People’s initial interest in Bitcoin stemmed from a variety of factors, including the potential for wealth accumulation, the allure of a decentralized financial system, and a desire to be part of a technological revolution. Many individuals who decided to invest in Bitcoin were drawn by the idea of becoming a Bitcoin millionaire, as stories of early adopters who amassed significant wealth circulated within the community. The enigmatic figure of Satoshi Nakamoto further fueled this fascination, as people speculated about the identity of the creator and the future of Bitcoin as a transformative financial tool.

What if I Invested $10,000 in Bitcoin in 2010?

- Initial BTC price: ~$0.05

- BTC bought: 200,000

- Peak value (2021): ~$60,000

- Potential worth: $12 billion

Methods of Buying Bitcoin in 2010

Peer-to-Peer Transactions

Back in 2010, one of the most prominent methods to buy Bitcoin was through peer-to-peer transactions. Individuals could trade Bitcoin directly with one another, often facilitated by online forums such as Bitcointalk. These transactions allowed users to negotiate terms, including the price and payment method, creating a personal and direct market for acquiring Bitcoin. This model not only fostered a sense of community among early adopters but also set the stage for the growth of decentralized exchanges that would emerge later in the cryptocurrency space.

Bitcoin Exchanges: The First Platforms

The introduction of Bitcoin exchanges in 2010 marked a significant shift in how people bought Bitcoin. Platforms like Mt. Gox became some of the first online exchanges, allowing users to buy and sell Bitcoin with greater ease. These exchanges provided a more structured environment for trading, complete with exchange rates for Bitcoin and the ability to exchange Bitcoin for fiat currency. However, it is crucial to note that these early exchanges were often plagued with security issues, leading to concerns among early adopters about the safety of their investments in Bitcoin.

Using Bitcoin Wallets for Storage

As individuals began acquiring Bitcoin in 2010, the necessity of secure storage emerged. Bitcoin wallets became essential tools for users to store their BTC safely. Back then, wallets were still a new concept, and users had to learn about managing private keys and the importance of securing their wallets against potential theft. The introduction of various wallet types, including desktop and online wallets, laid the foundation for the ongoing development of secure storage solutions within the Bitcoin ecosystem. Understanding how to use these wallets was crucial for those looking to invest in Bitcoin.

How Did People Buy Bitcoin in 2015

- Crypto exchanges like Coinbase, Bitstamp, and Kraken.

- Bitcoin ATMs in major cities.

- Peer-to-peer platforms such as LocalBitcoins.

Expert insight: According to Andreas Antonopoulos in a 2015 lecture, “2015 was the year Bitcoin began transitioning from an experiment to a global financial technology.”

Challenges Faced by Early Bitcoin Buyers

Security Concerns with Transactions

Security was a paramount concern for individuals looking to buy Bitcoin in 2010. The lack of established regulations and protections made early adopters vulnerable to hacks and scams. Instances of compromised wallets and fraudulent exchanges were not uncommon, leading many users to lose their investments in Bitcoin. Early adopters had to remain vigilant and educate themselves about the various security measures available, such as two-factor authentication and cold storage, to protect their holdings in a volatile market characterized by uncertainty and risk.

Regulatory Environment and Its Impact

The regulatory landscape surrounding Bitcoin in 2010 was largely undefined, which posed challenges for early buyers. As governments and financial institutions grappled with understanding cryptocurrencies, the absence of clear regulations created an environment of uncertainty. Many potential investors hesitated to buy Bitcoin due to concerns about legal implications and the future of digital currencies. This regulatory ambiguity impacted the Bitcoin market, as it hindered broader adoption and led to a cautious approach among those considering an investment in Bitcoin.

Learning Curve for New Users

The learning curve for new users attempting to buy Bitcoin in 2010 was steep. Many individuals were unfamiliar with blockchain technology and the principles of cryptocurrencies, which made navigating the Bitcoin ecosystem a challenge. Understanding how to buy and sell Bitcoin, manage wallets, and engage in mining Bitcoin required a significant investment of time and effort. This complexity often deterred potential investors from entering the market, limiting early adoption to those who were willing to dedicate themselves to learning about this revolutionary digital currency.

Success Stories and Bitcoin Millionaires

Notable Early Adopters

Among the notable early adopters of Bitcoin were individuals who recognized the potential of the cryptocurrency early on. Some of these pioneers, including programmers and tech enthusiasts, began investing in Bitcoin back in 2010 when the price was still relatively low. Their foresight led to substantial gains, with many transforming modest investments into fortunes. Stories of these Bitcoin millionaires have become legendary, showcasing how a few early adopters managed to navigate the complexities of the Bitcoin market and capitalize on the opportunities presented by this new digital currency.

How Early Investments Changed Lives

For many early adopters, investing in Bitcoin was not just a financial decision; it was a life-changing event. Individuals who bought Bitcoin in 2010 at a fraction of its future worth often found themselves in a position of financial freedom. These investments allowed some to pay off debts, buy homes, or even start their businesses. The transformative power of Bitcoin on personal finances illustrates how early investments in cryptocurrency can lead to significant lifestyle changes, highlighting the impact of being in the right place at the right time within the evolving Bitcoin market.

Lessons from Bitcoin Millionaires

The success of Bitcoin millionaires offers invaluable lessons for potential investors today. One key takeaway is the importance of doing thorough research before investing in Bitcoin or any cryptocurrency. Many early adopters learned the hard way about the volatility of Bitcoin’s price, emphasizing the need for a sound investment strategy. Additionally, these stories underscore the significance of being patient and willing to hold onto assets long-term, as many millionaires did. Their journey serves as a testament to the potential rewards of investing wisely in the cryptocurrency landscape.

Comparing Bitcoin’s Worth Today

Bitcoin’s Growth Over 15 Years

Over the past 15 years, Bitcoin has experienced exponential growth, evolving from a niche digital currency to a globally recognized asset. The initial exchange rate for Bitcoin in 2010 was a mere fraction of a dollar, but as awareness and adoption increased, the price surged dramatically. Today, Bitcoin’s worth is often measured in tens of thousands of dollars per BTC. This remarkable growth trajectory highlights the transformative nature of Bitcoin and its potential to reshape financial systems worldwide, attracting both retail and institutional investors alike.

Market Trends and Historical Data

Analyzing market trends and historical data reveals significant patterns in Bitcoin’s price movements. The cryptocurrency market is known for its volatility, with Bitcoin experiencing dramatic price swings influenced by various factors, including regulatory changes, technological advancements, and shifts in investor sentiment. Historical data shows that while Bitcoin has faced challenges, such as market corrections, its long-term trajectory remains upward. Understanding these trends can provide insights for those looking to invest in Bitcoin or trade on crypto exchanges, emphasizing the importance of market awareness in making informed decisions.

The Future of Bitcoin and Cryptocurrency

The future of Bitcoin and the broader cryptocurrency landscape remains a topic of intense speculation and interest. As more individuals and institutions begin to accept Bitcoin as a legitimate form of investment and payment, its adoption is poised to grow further. Innovations in blockchain technology and the development of decentralized finance (DeFi) are also likely to influence Bitcoin’s evolution. With ongoing discussions around regulation and integration into traditional financial systems, the future holds promising possibilities for Bitcoin, making it an intriguing asset for potential investors and cryptocurrency enthusiasts alike.

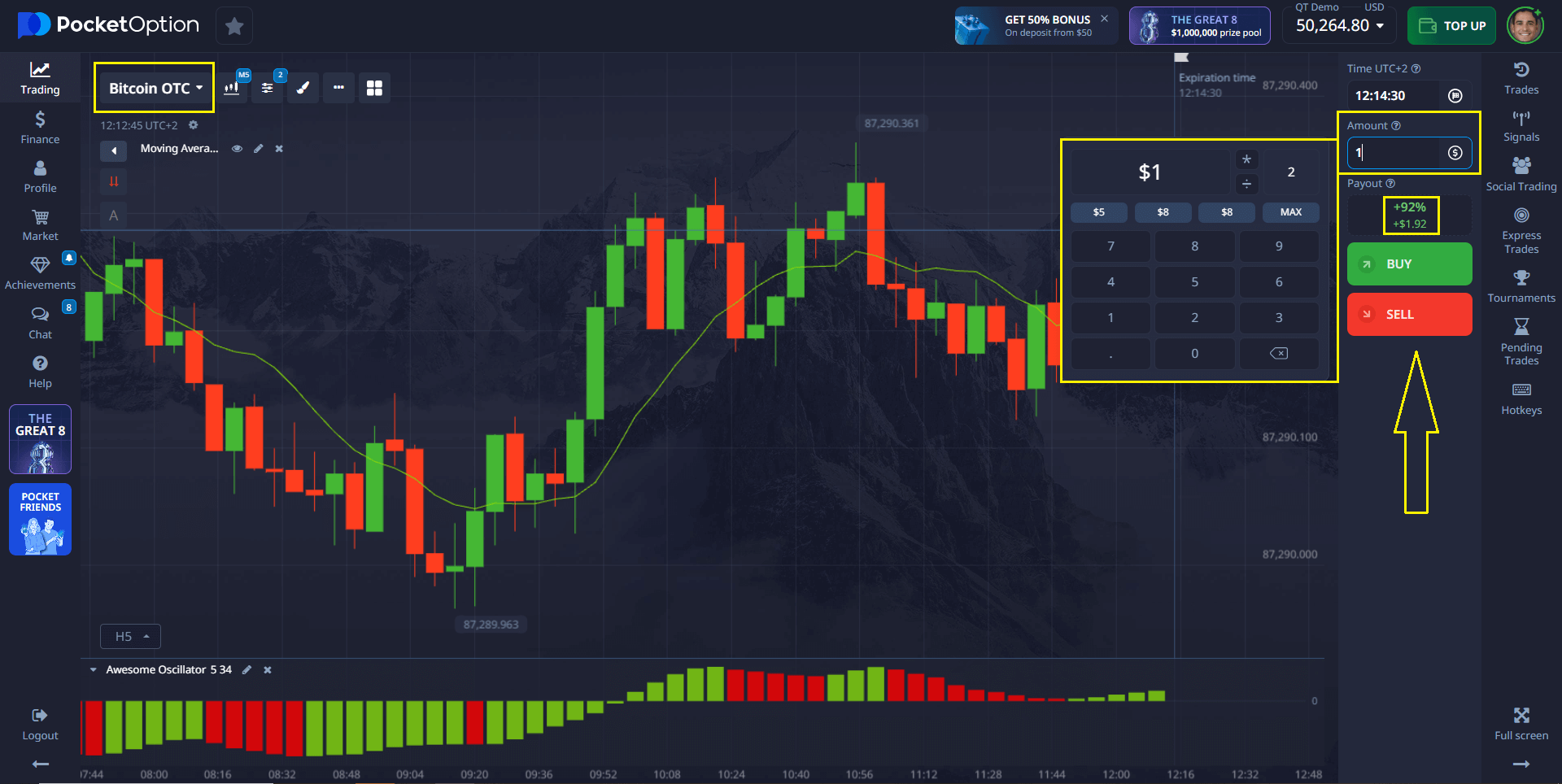

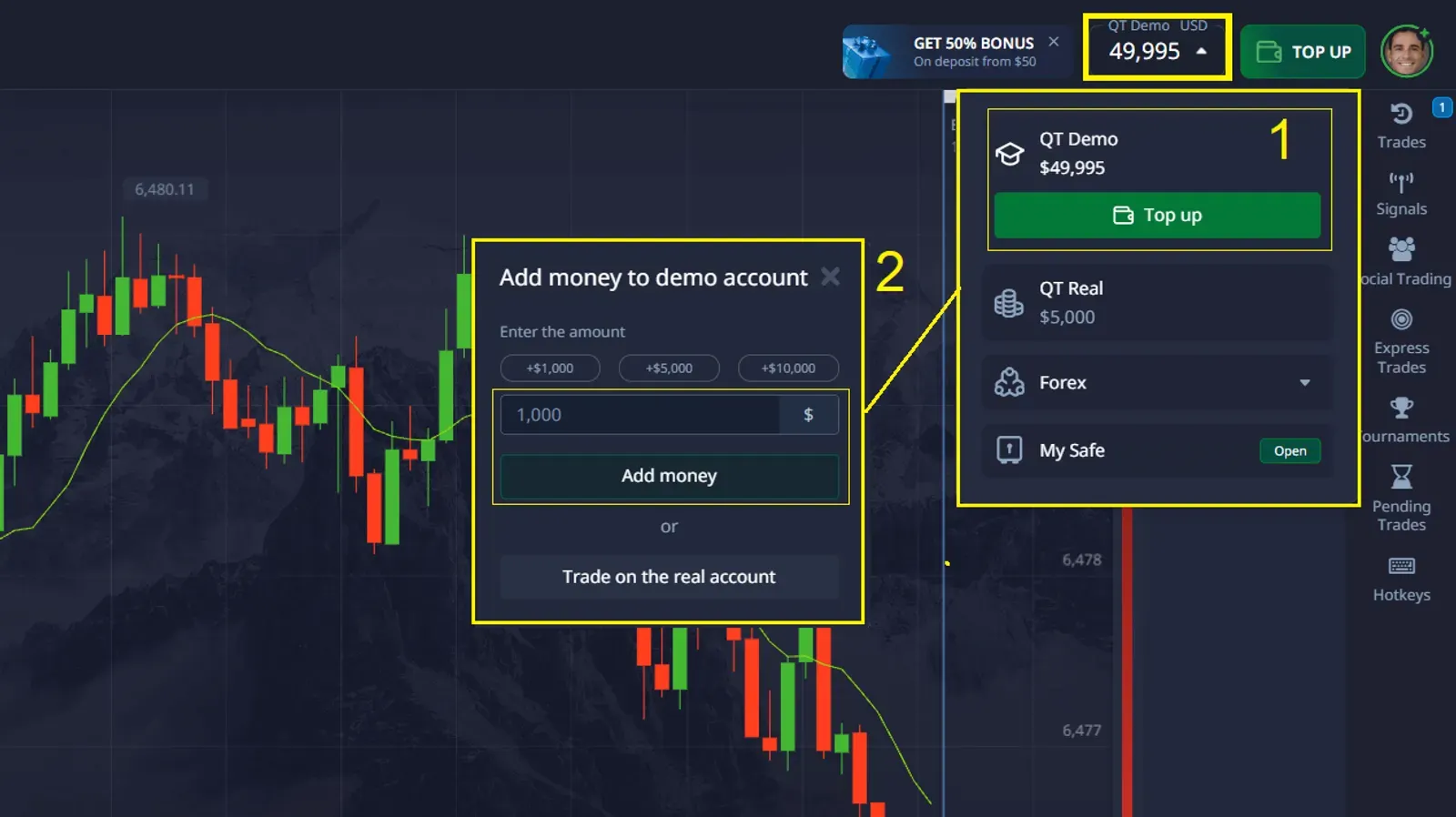

Connecting the Evolution of Bitcoin to Modern Trading Platforms: Pocket Option

The journey of Bitcoin from a niche concept in 2010 to a globally recognized asset in 2025 mirrors the evolution of trading platforms. Pocket Option exemplifies this shift. As a platform offering Quick Trading, Pocket Option provides users with a streamlined way to speculate on asset price movements using intuitive Buy and Sell mechanics. The minimum deposit starts from $5 USD depending on the region.

- Instant access to global markets

- Integrated copy trading tools

- Secure deposit options including debit cards and e-wallets

Real trader feedback: “Using Pocket Option, I was able to apply technical strategies I previously used with crypto exchanges, but in a more agile environment.” — James R., active trader

FAQ

How much was Bitcoin worth in 2010?

Bitcoin's price in 2010 ranged from approximately $0.003 in early January to $0.30 by December. The cryptocurrency experienced its first major price movements during this year, with a peak-to-trough volatility exceeding 150%. Most transactions occurred at prices below $0.10, with the famous "pizza transaction" in May establishing a reference price of about $0.003 per bitcoin.

Did people use credit cards to buy Bitcoin in 2010?

No, credit card purchases of Bitcoin were not possible in 2010. Early Bitcoin acquisitions occurred primarily through mining, bank transfers to primitive exchanges, or person-to-person transactions using cash, PayPal, or barter arrangements. Credit card infrastructure for cryptocurrency purchases wasn't established until several years later, as financial institutions initially avoided the nascent and unregulated market.

How many Bitcoins were mined daily in 2010?

In 2010, approximately 7,200 new Bitcoins were created daily through mining. The block reward was 50 BTC per block, with blocks generated roughly every 10 minutes (144 blocks daily). This resulted in an annual inflation rate exceeding 25% of the total supply. The mining difficulty was low enough that individual miners with standard computer hardware could reasonably expect to discover blocks and receive these rewards.

Were there Bitcoin wallets available in 2010?

In 2010, wallet options were extremely limited. The original Bitcoin-Qt client developed by Satoshi Nakamoto was the primary wallet software, requiring users to download the entire blockchain. Paper wallets and "brain wallets" (memorized private keys) were also used. No mobile wallets, hardware wallets, or multi-signature solutions existed. This limited infrastructure contributed to significant bitcoin losses through technical errors, forgotten passwords, and lost storage devices.

Could anyone have predicted Bitcoin's future value in 2010?

While some early adopters expressed optimistic price predictions, no one accurately forecasted Bitcoin's eventual valuation. Most 2010 participants viewed Bitcoin as an experimental project or speculative curiosity rather than a serious investment. Even the most bullish forum posts from 2010 typically suggested potential valuations of $1-10 per bitcoin. The cryptocurrency's future utility, adoption, and regulatory status remained highly uncertain, making accurate predictions effectively impossible.

Final Takeaways

Bitcoin’s early days were defined by curiosity, community, and complexity. Today, with platforms like Pocket Option, participation in markets is more accessible than ever. Whether reflecting on the question how did people buy bitcoin in 2010 or exploring modern trading tools, it’s clear the journey from 2010 to now showcases rapid technological and financial evolution. Want to explore more about trading and innovation? Discuss this and other topics in our community!

Start trading