- Automation: Deploy algorithmic strategies that execute trades 24/7 using your API connection.

- Speed: Millisecond-level trade execution using WebSockets and FIX APIs.

- Scalability: Manage hundreds of assets simultaneously through a robust API setup.

- Data Access: Real-time and historical price feeds obtained via market data APIs to enhance backtesting.

- Adaptability: Integrate your API-based trading strategies into multiple trading platforms or custom dashboards.

Forex Trading APIs for 2025: Best Broker & Trade Options

In the rapidly evolving world of currency markets, the forex trading API has become an essential tool for modern traders. As we approach 2025, understanding how to leverage a forex trading API for strategy development, real-time execution, and automation is key to gaining a competitive edge. These APIs grant access to real-time forex data, facilitate automated strategies, and enable integration with trading platforms like MetaTrader.

Article navigation

Today, many professional traders depend on APIs to streamline their trading operations, using features like REST API, WebSocket connectivity, and high-speed FIX protocol integrations.

Understanding Forex Trading APIs

What Is a Forex Trading API?

A forex trading API (Application Programming Interface) allows traders and developers to connect directly to a broker’s platform, automating trade execution and data analysis. Through REST APIs, WebSockets, and FIX APIs, users can tap into live forex feeds, execute orders, and develop custom strategies. REST API usage is particularly popular for tasks like fetching market data, managing account orders, and retrieving historical data.

| API Type | Description |

|---|---|

| REST API | Standard web-based API for order management and data |

| WebSocket | Real-time streaming of prices and trade execution |

| FIX API | High-speed, institution-level financial messaging |

These APIs bridge the gap between human decision-making and machine execution, transforming how professionals and hobbyists approach API forex trading. They are essential in online forex trading API environments where speed and accuracy are paramount.

Build and test strategies on a Pocket Option demo account

Benefits of Using Forex Trading APIs

According to a 2024 FXAlgoTech report, over 60% of forex volume is now algorithmically driven–much of it powered by trading APIs and real-time API feeds.

Key Features of Modern Forex Trading APIs

Advanced Functionality for Developers and Traders

A modern forex trading API provides far more than just data access. Here are critical capabilities:

| Feature | Details |

|---|---|

| Currency Pair Coverage | Trade majors, minors, exotics, and even synthetic pairs via your API |

| Order Types | Support for market, limit, stop-loss, and OCO orders via REST APIs |

| Data Accessibility | Live quotes, tick-by-tick updates, and deep historical datasets |

| Programming Language | Integration with Python, JavaScript, C++, and more via API SDKs |

| Authentication | Secure API keys, IP whitelisting, and OAuth2.0 for safe connectivity |

Many free and paid options are available, with platforms offering forex trading API free trials to attract developers and algo traders. Traders often rely on GitHub to access API templates and connect their codebase to brokers like OANDA API or forex.com API documentation.

Use Cases: How Traders Leverage APIs

- High-Frequency Trading (HFT) — Execute dozens of trades per second using WebSocket APIs.

- Arbitrage — Detect price discrepancies across fx broker APIs and automate responses.

- Sentiment Analysis Bots — Use external APIs for news and sentiment feeds in tandem with forex.com API documentation for contextual insights.

- Currency Correlation Bots — Monitor currency pairs via real-time forex data API free sources and place trades accordingly.

- Custom Strategy Deployment — Run cloud-based strategies using your REST API client and real-time forex feeds.

“APIs have democratized access to the FX market’s infrastructure. What used to be available only to institutional traders is now in the hands of the retail trader. It’s a game-changer.”- Alex Krüger, Economist and Crypto Analyst

Top Forex Brokers Offering Trading APIs

Evaluation Criteria

When selecting an FX broker API, focus on:

- Low latency

- API documentation

- Access to CFDs and currency data

- REST API and WebSocket support

- Authentication and API key security

Comparative Table

| Broker | API Type | Highlights | Free Access | Languages |

|---|---|---|---|---|

| OANDA | REST, FIX | Rich documentation, Python SDK, fast execution | ✅ | Python, Java |

| Forex.com | REST | Easy onboarding, detailed API guide | ✅ | Python, C# |

| IG Markets | REST, Web | Broad asset access, CFD integration | Partial | JavaScript, R |

| Alpaca FX | REST, Web | Commission-free US trading API | ✅ | Python |

| Interactive Brokers | REST, FIX | Professional-grade, 135+ markets | ❌ | Java, C++ |

Automating Forex Trades Using APIs

Why Use Automation?

- Avoid emotional trading decisions

- Speed up execution using real-time APIs

- Backtest trading strategies with historical data

- Build AI/ML-powered systems via Python and TensorFlow

“Backtesting over 10 years of historical FX data is non-negotiable before deploying an API strategy live.”- Sarah Mitchell, Quantitative Strategist at FXVision Capital

Watch: “How Hedge Funds Use Forex APIs for Execution” — Bloomberg TechTalks, 2024

Forecasting the Future of Forex APIs in 2025

Key Trends

- Cloud-native FX API infrastructure

- Widespread Python and GitHub bot use

- Real-time compliance (RegTech via API)

- AI agents integrating APIs and LLMs

Statista forecasts the API trading market will exceed $8.5B by 2025.

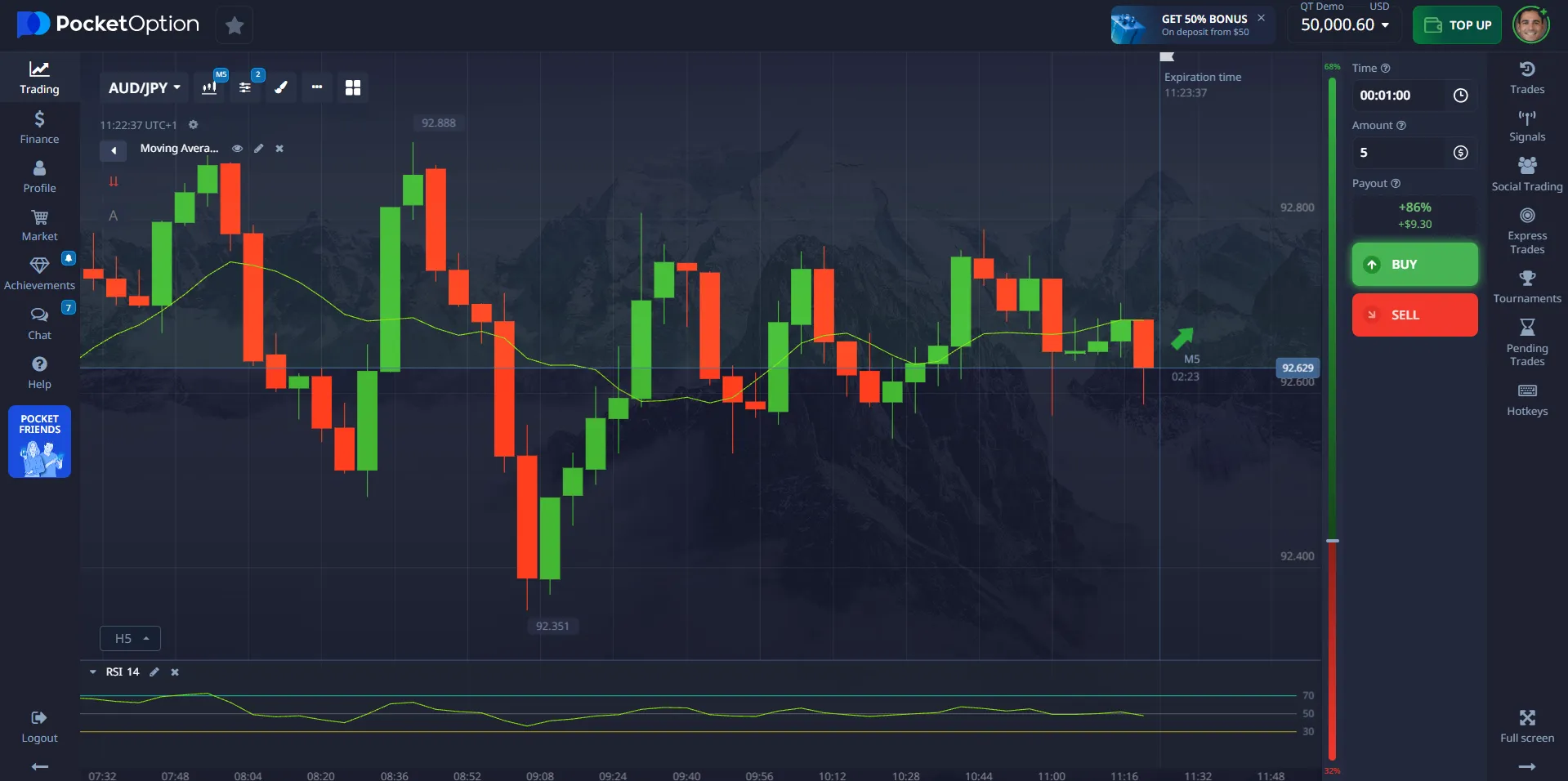

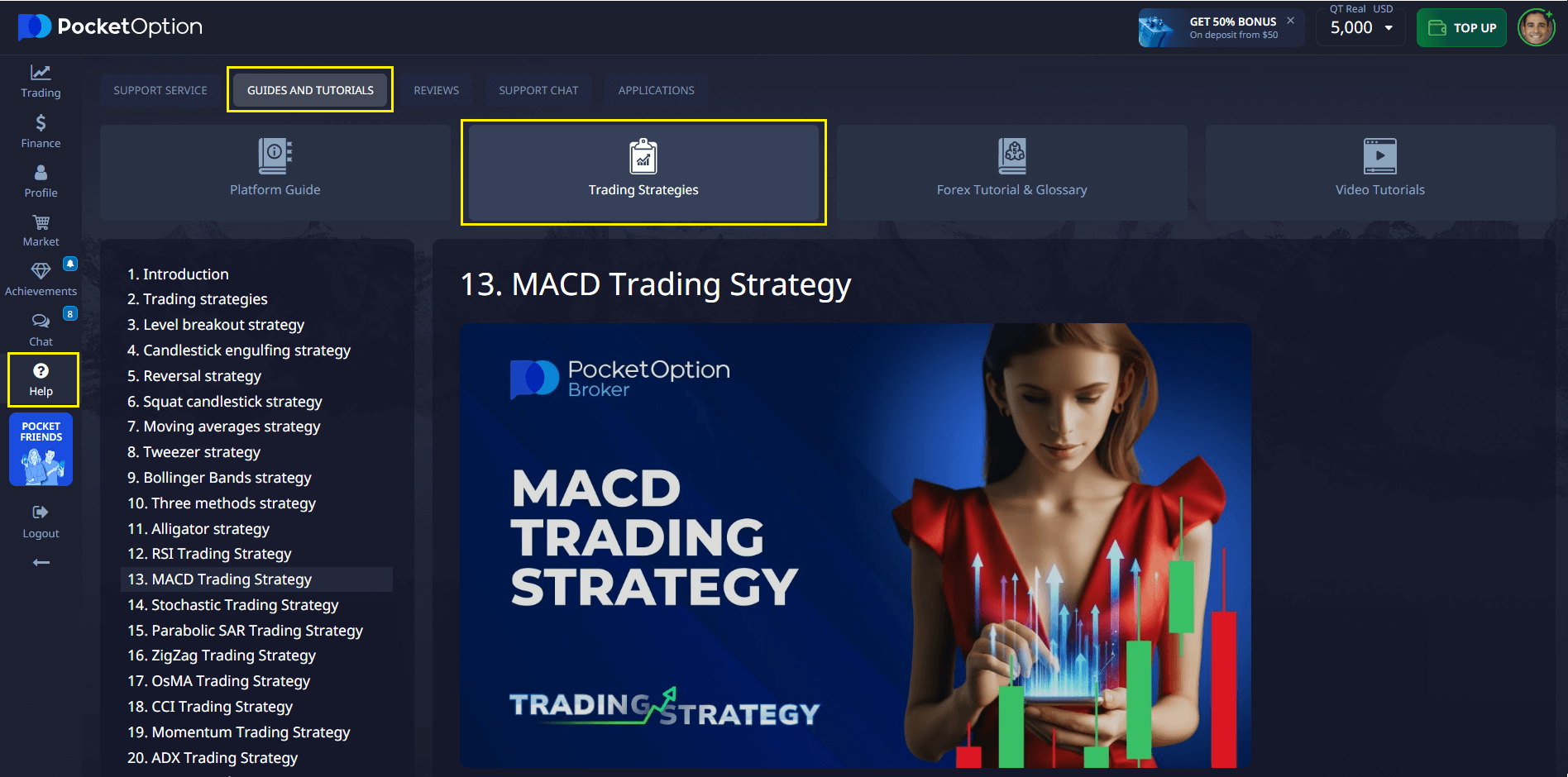

Role of Pocket Option

Although Pocket Option doesn’t offer direct API access, it enables 24/7 trading of 100+ instruments (including stocks, forex, and crypto) via OTC — ideal for traders not yet ready to build with APIs.

Best Practices

If you’re just starting out, consider a Forex trading API download from your broker’s developer portal or Forex trading api GitHub repository. This gives you pre-built SDKs, example scripts, and configuration files to get started faster.

- Monitor API limits and throttle usage

- Secure your API key and use HTTPS

- Use logging systems for debugging

- Test REST and WebSocket responses

- Store historical data for strategy adjustment

FAQ

What is a forex trading API?

An API that lets you automate trading and access market data from brokers.

Is there a free forex trading API?

Yes. OANDA, Forex.com, and others offer limited free API access.

Does MetaTrader offer API support?

Yes. MetaTrader API supports EAs, DLLs, and integration for advanced trading.

What is the most popular and Best forex trading API in 2025?

OANDA API — due to documentation, historical data, and REST functionality.

Can I trade 24/7 using APIs?

Yes — especially via crypto pairs or brokers with OTC access.

What is API in forex?

It’s a software interface that lets traders programmatically interact with forex brokers.

Is bot trading illegal in forex?

No — it’s legal in most countries, as long as it complies with broker policies.

Which trading API is best?

OANDA and Forex.com rank highest for features, speed, and community support.