- Lower financial barrier to entry

- Reduced risk per trade

- Ability to practice real trading with minimal capital

- Opportunity to test trading strategies with real money

Micro Forex Trading Account: Understanding Low-Deposit Trading Options

Entering the forex market has become more accessible with micro forex trading accounts. These accounts allow traders to participate in currency trading with minimal capital requirements, making it possible for beginners to gain experience without significant financial risk.

Article navigation

- What Makes Micro Trading Accounts Different

- Benefits of Using a Micro Trading Account

- How to Start Trading on Pocket Option

- How to Trade Forex with Micro Accounts on Pocket Option

- Understanding the Economics of Micro Accounts

- Common Features of Micro Accounts

- Limitations to Consider

- How to Choose the Right Micro Account Provider

- Practical Risk Management for Micro Accounts

- Conclusion

A micro forex trading account is designed for traders who want to test the market with smaller lot sizes and lower capital requirements. These accounts typically allow trading with micro lots, which represent 1,000 units of a base currency, compared to standard lots of 100,000 units.

What Makes Micro Trading Accounts Different

The primary difference between micro accounts and standard accounts is the trading volume. With a micro trading account forex, your positions are smaller, which means your potential gains and losses are proportionately reduced.

| Account Type | Minimum Deposit | Lot Size | Risk Level |

|---|---|---|---|

| Standard | $1,000-$10,000 | 100,000 units | Higher |

| Mini | $100-$1,000 | 10,000 units | Medium |

| Micro | $5-$100 | 1,000 units | Lower |

Starting with a forex micro trading account is often recommended for newcomers who are still learning the ropes of currency trading. The reduced financial commitment makes it less stressful to practice real trading.

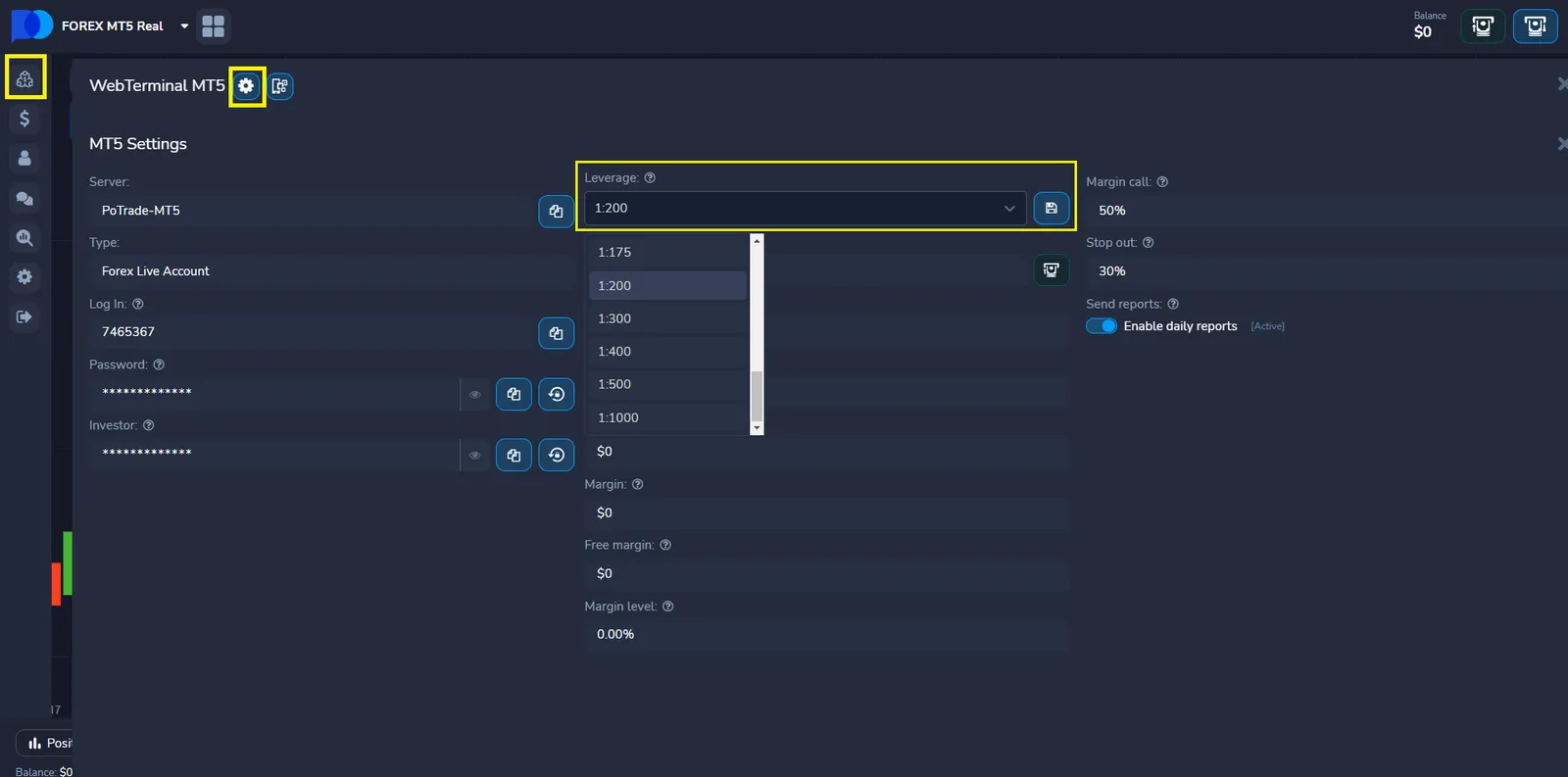

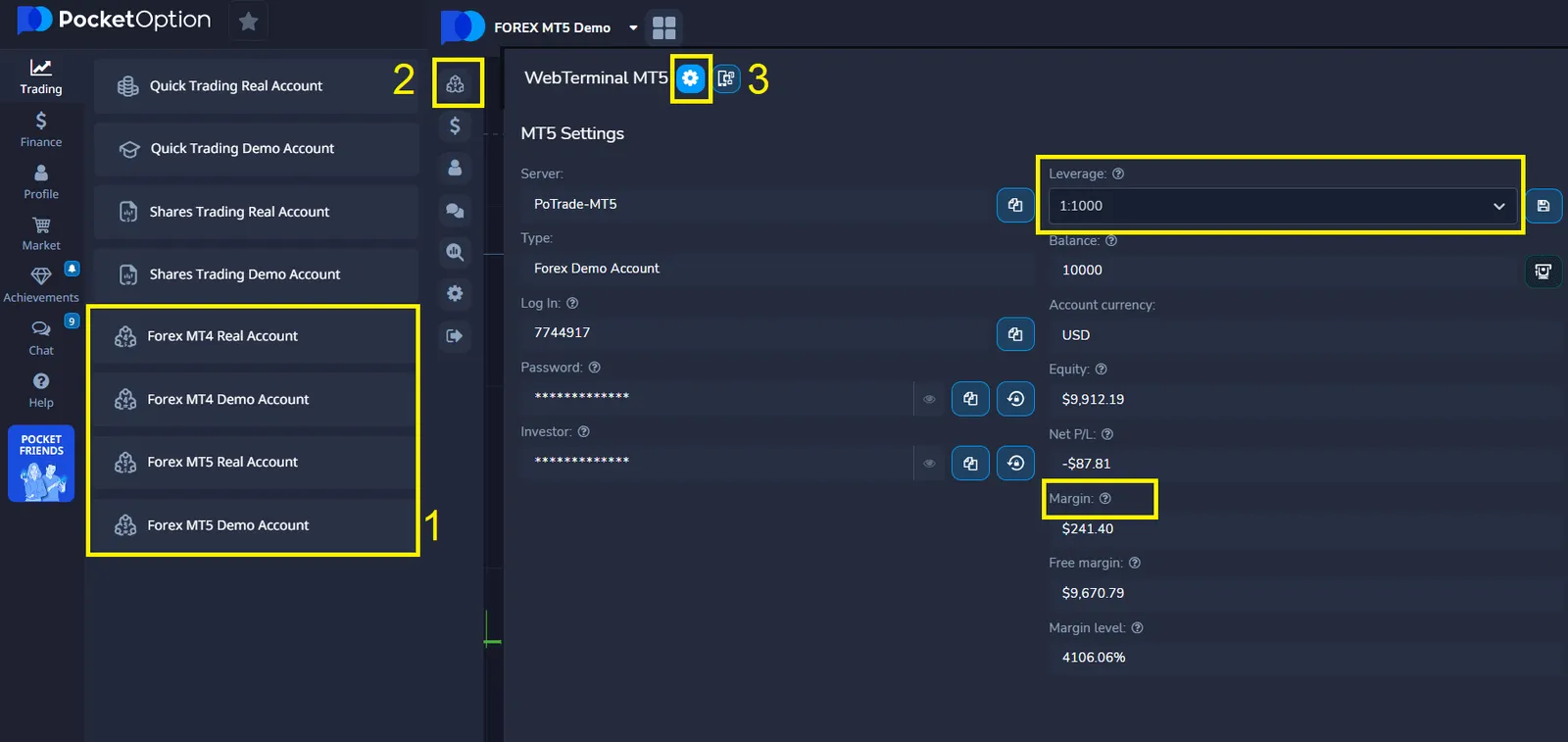

📌On the Pocket Option you can customize the leverage for your MetaTrader account in the settings, which directly influences the effective size of your trades. The leverage can be adjusted to your preference, ranging from 1:1 to 1:1000.

Benefits of Using a Micro Trading Account

There are several advantages to starting with a micro trading account rather than jumping into standard trading:

Brokers like Pocket Option offer micro accounts with competitive spreads and additional features to help new traders get started with minimal investment.

Start Trading with Just $5 — A Rare Advantage

One of the key benefits of Pocket Option is the ability to start trading with a minimum deposit of just $5. This low entry threshold makes the platform highly accessible, especially for beginners or cautious investors.

Unlike many other trading platforms that require larger initial deposits, Pocket Option allows users to explore real trading opportunities without significant financial commitment — a feature rarely offered in the industry.

Low Deposit & Small Trade Sizes — Start with $1

In addition to the low $5 minimum deposit, Pocket Option also allows you to open trades starting from just $1. This flexibility is perfect for beginners or anyone who wants to test strategies without risking large amounts.

How to Start Trading on Pocket Option

Getting started is fast and beginner-friendly:

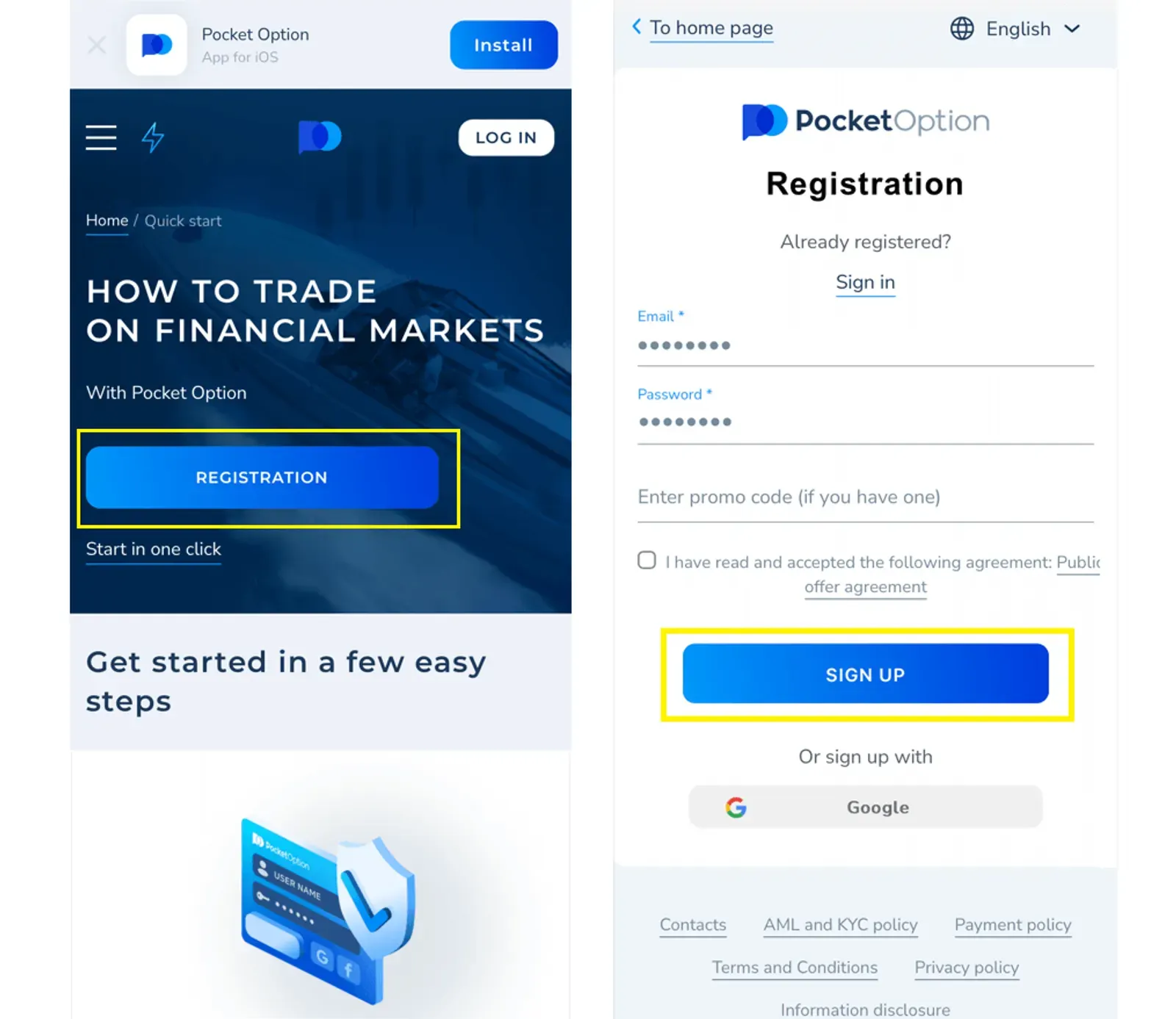

1. Sign Up — Register using your email in under a minute.

2. Learn the Platform — Access video tutorials, guides, and strategy tips.

3. Use Demo Mode — Practice risk-free forex trading with a $50,000 demo balance.

4. Go Live — Start real forex trading from just $1, with full control over your funds.

How to Trade Forex with Micro Accounts on Pocket Option

Pocket Option offers two flexible ways to trade Forex using micro amounts — ideal for beginners or those who want to manage risk with small positions. Whether you’re using just $1 per trade or testing strategies, both options give you access to the global currency market.

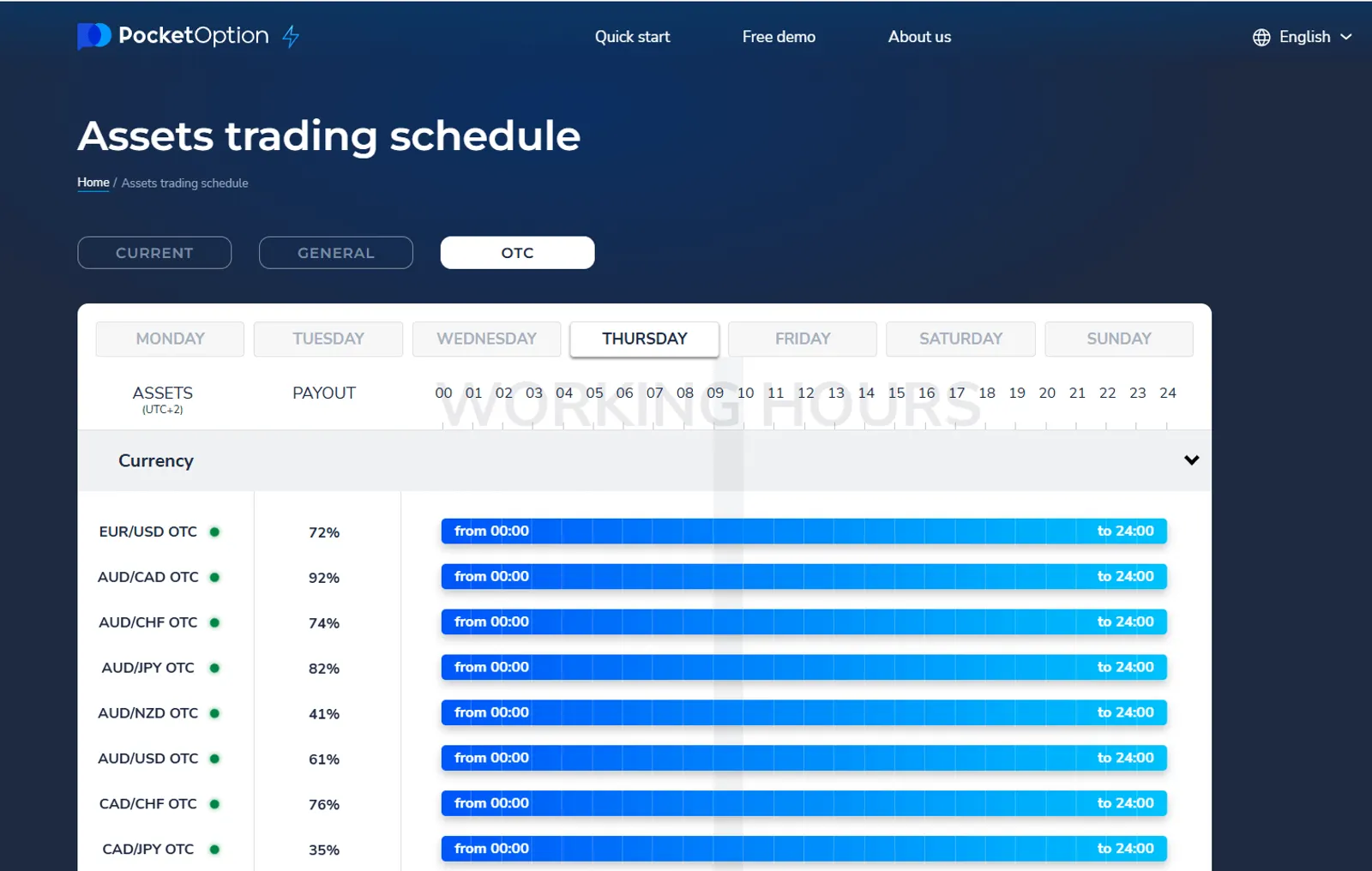

Option 1: Quick Forex Trading (OTC 24/7)

This built-in feature is perfect for fast, intuitive trades with minimal setup.

- Access the Platform: Log in to your Pocket Option account.

- Choose Forex: Select “Forex” from the list of available assets.

- Set Trade Parameters: You can start trading with as little as $1, choosing trade duration and direction (up or down).

- Execute a Trade: Predict price movement and open your position.

- Monitor and Exit: Track real-time price changes. If your prediction is correct, earn up to 92% return on your trade.

This mode is well-suited for users seeking simplicity, speed, and the flexibility to trade anytime — even on weekends via Forex OTC.

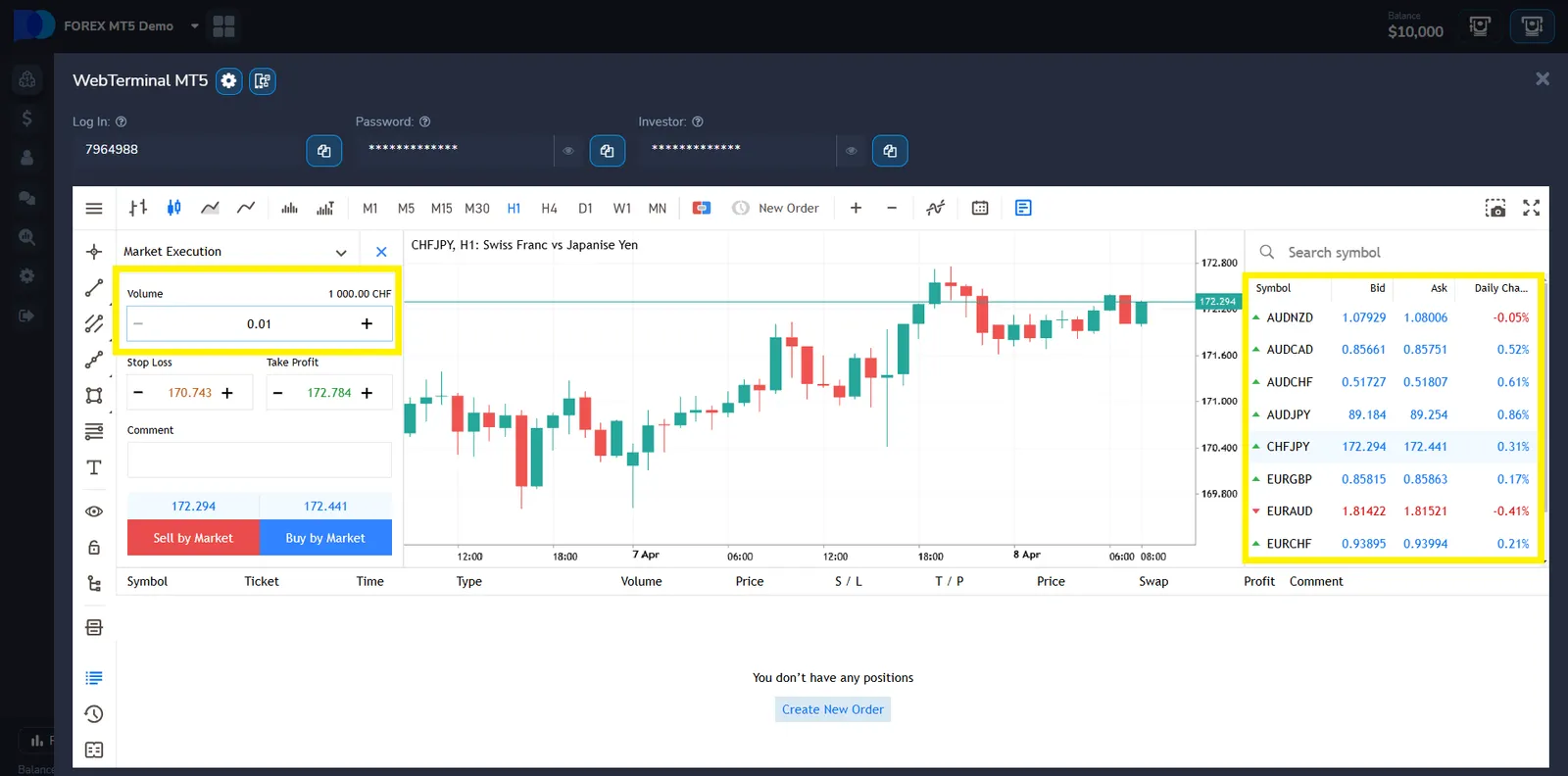

Option 2: Advanced Forex Trading via MetaTrader

For those who prefer a full-featured trading terminal, Pocket Option provides access to MetaTrader 5 (MT5) and MT4 — the industry standard for Forex analysis and strategy.

- Launch MT5: Open MetaTrader 5 directly through Pocket Option’s web or desktop platform.

- Log In: Use your Pocket Option MT5 credentials to access the platform.

- Select Currency Pairs: Trade a wide range of Forex pairs, from majors to exotics.

- Adjust Lot Size and Leverage: Customize micro trade sizes and set leverage up to 1:1000, allowing greater control over capital exposure.

- Analyze and Trade: Take advantage of professional tools, including technical indicators, advanced charts, and expert advisors.

Both methods support micro Forex accounts, making them suitable for testing strategies, building experience, or maintaining tighter control over capital. Quick Trading is designed for ease and accessibility, while MT5 is ideal for in-depth analysis and experienced traders.

Understanding the Economics of Micro Accounts

| Trade Size | Pip Value (USD) | 1% Risk on $100 Account |

|---|---|---|

| 0.01 lot (micro) | $0.10 | 10 pips stop loss |

| 0.1 lot (mini) | $1.00 | 1 pip stop loss |

| 1.0 lot (standard) | $10.00 | Not sustainable |

With a forex trading micro account, each pip movement typically represents a $0.10 change in your position value when trading major currency pairs. This allows for more precise risk management and position sizing.

Common Features of Micro Accounts

| Feature | Typical Offering |

|---|---|

| Minimum Deposit | $5-$100 |

| Leverage | 1:30 to 1:500 |

| Spreads | Similar to standard accounts |

| Trading Platform | Full access to platforms |

| Educational Resources | Often included |

Most brokers that offer micro forex trading accounts provide the same trading tools and platforms available to standard account holders. The main difference is the capital requirement and position size.

Limitations to Consider

While micro accounts offer many benefits, they do come with certain limitations:

- Smaller profit potential in absolute terms

- Limited ability to diversify across many positions

- Some brokers may offer fewer features

- Higher relative impact of fixed costs like commissions

| Limitation | Impact |

|---|---|

| Profit Ceiling | Lower absolute returns despite percentage gains |

| Transaction Costs | Can be proportionally higher relative to position size |

| Broker Attention | May receive less customer support priority |

| Analysis Limitations | Some premium tools may require larger accounts |

How to Choose the Right Micro Account Provider

When selecting a broker for your micro trading account forex experience, consider these factors:

- Regulation status and security measures

- Actual minimum deposit requirements

- Spread costs on micro lot trades

- Platform stability and features

- Customer support quality

Comparing multiple providers before making your choice ensures you find the best match for your trading needs and learning style.

Practical Risk Management for Micro Accounts

Even with smaller position sizes, proper risk management remains essential:

| Account Balance | Maximum Risk Per Trade (2%) | Micro Lots at 10 Pip Stop |

|---|---|---|

| $50 | $1.00 | 0.01 (10 pips) |

| $100 | $2.00 | 0.02 (10 pips) |

| $500 | $10.00 | 0.1 (10 pips) |

Conclusion

A micro forex trading account serves as an excellent starting point for new traders. With lower capital requirements and reduced risk exposure, these accounts provide practical experience without overwhelming financial pressure. As traders develop skills and confidence, they can gradually increase their position sizes or transition to larger account types.

FAQ

What is the minimum deposit needed for a micro forex trading account?

Most brokers offer micro forex trading accounts with minimum deposits ranging from $5 to $100, though this varies by company. Some may require slightly more while others might allow you to start with even less.

How much money can I make with a micro trading account?

Earnings depend on your trading skills, strategy, and capital. While percentage returns can be similar to larger accounts, the absolute dollar amounts will be smaller due to the reduced trading capital.

Can I use leverage with a micro forex trading account?

Yes, most brokers offer leverage on micro accounts, typically ranging from 1:30 to 1:500 depending on regulatory restrictions in your region and the broker's policies.

Are micro forex accounts good for beginners?

Micro accounts are particularly well-suited for beginners as they allow real market participation with minimal financial risk, making them ideal for learning trading mechanics and testing strategies.

Can I upgrade from a micro trading account to a standard account later?

Yes, most brokers allow seamless upgrades from micro to standard accounts once you've built confidence and capital. This transition typically involves a simple account funding process without needing to open a new account.