- Real-time market data access

- Order placement and management

- Account information retrieval

- Historical data analysis

- Customizable alerts and notifications

Trading API Essentials

In today’s fast-moving markets, trading APIs are game-changing tools, enabling automated strategies, real-time data, and seamless platform integration.

Understanding Trading API

A trading API serves as a bridge between trading platforms and external applications, allowing developers to create custom trading solutions, automate trading strategies, and access real-time market data. By leveraging trading API, traders can enhance their decision-making process, improve execution speed, and tap into a wealth of market information.

Key Features of Trading API

Modern trading API offers a wide range of features that cater to the diverse needs of traders and developers. Some of the most important features include:

These features empower traders to create sophisticated trading systems, automate their strategies, and make data-driven decisions in real-time.

Benefits of Using Trading API

Implementing a trading API can bring numerous advantages to traders and financial institutions. Let’s explore some of the key benefits:

| Benefit | Description |

|---|---|

| Automation | Execute trades automatically based on predefined criteria |

| Speed | Faster execution and reduced latency in order placement |

| Scalability | Handle large volumes of trades and data processing |

| Customization | Develop tailored trading solutions and strategies |

| Integration | Connect with various platforms and data sources seamlessly |

Types of Trading API

There are several types of trading API available, each catering to specific needs and use cases:

- REST API: Ideal for simple, request-response based interactions

- WebSocket API: Enables real-time, bidirectional communication

- Python API: Standard protocol for electronic trading communication

- Proprietary APIs: Custom-built by brokers or exchanges for their platforms

Choosing the right type of trading API depends on factors such as trading frequency, data requirements, and the specific features needed for your trading strategy.

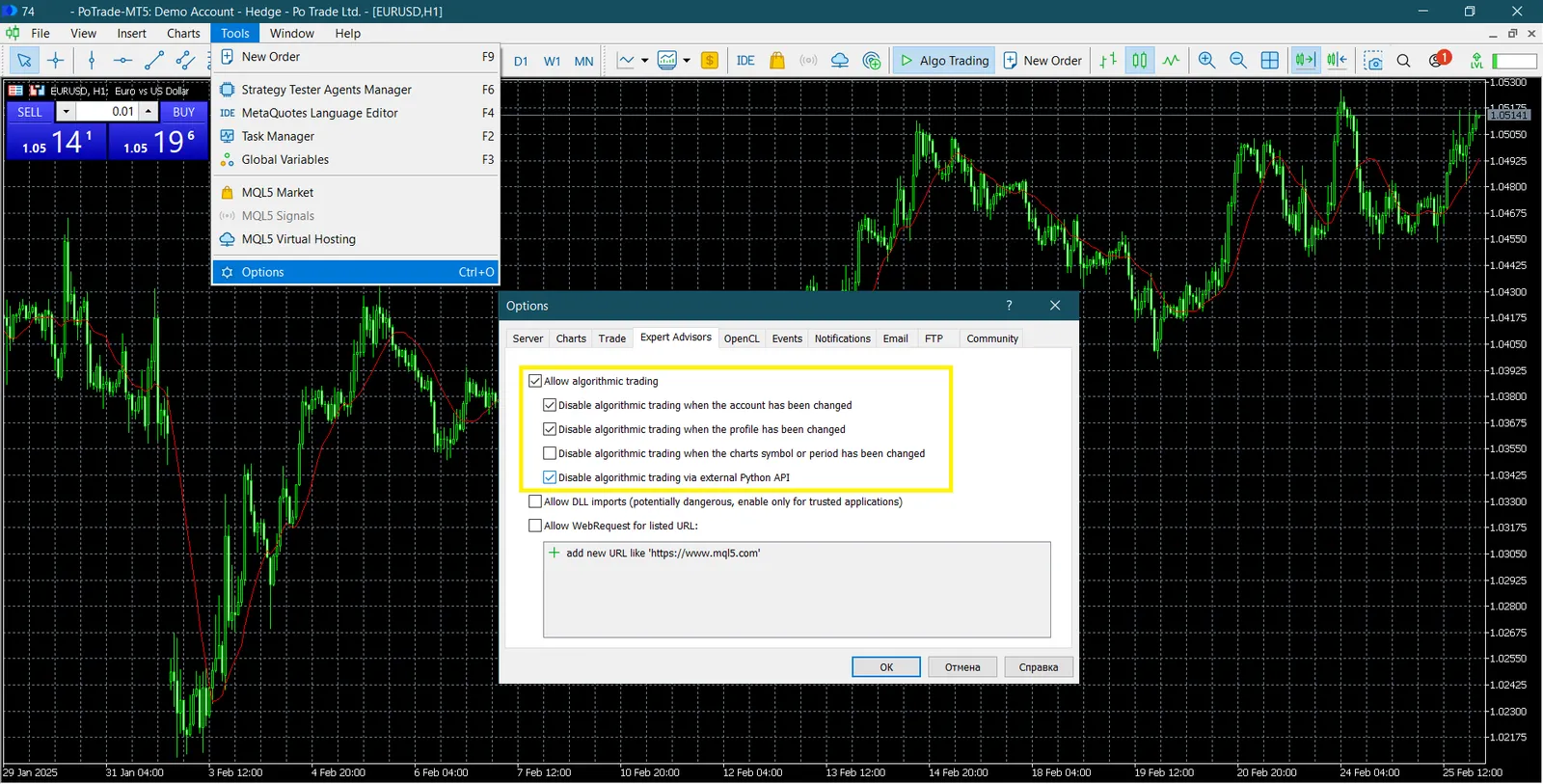

Implementing Trading API in Your Strategy

To effectively implement a trading API in your trading strategy, consider the following steps:

- Identify your trading needs and goals

- Research and select an appropriate API trading platform

- Familiarize yourself with the API documentation

- Develop and test your trading algorithms

- Implement risk management measures

- Monitor and optimize your automated trading system

By following these steps, you can create a robust and efficient trading system that leverages the power of trading API.

Choosing an Online API Trading Broker

When selecting an online API trading broker, traders should consider factors such as API reliability, order execution speed, available markets, and fees. A reliable broker should provide seamless integration, real-time market data streaming, and low-latency order execution.

Automated Stock Trading API

An automated stock trading API enables traders to develop algorithmic strategies that automatically execute trades based on predefined parameters. These APIs provide access to market data, portfolio management tools, and order execution capabilities, helping traders optimize their trading process.

FAQ

Who offers the best trading API for capital markets infrastructure?

Interactive Brokers is widely regarded as offering one of the best trading APIs for capital markets infrastructure. Their API supports a broad range of asset classes, provides robust documentation, and ensures low-latency connections for institutional-grade trading.

What is API trading in crypto?

API trading in crypto enables programmatic access to cryptocurrency exchanges. Traders can use APIs to automate trades, retrieve real-time price data, and execute multiple orders simultaneously. This enhances efficiency and allows for more sophisticated trading strategies.

What is API trading in Binance?

Binance’s API allows traders to access their platform programmatically, enabling the automation of trading strategies, retrieval of real-time market data, and execution of orders. It supports both REST and WebSocket protocols, catering to various trading needs.

How do I integrate a trading bot with a specific exchange API?

To integrate a trading bot with an exchange API: Obtain API keys from the exchange (e.g., Binance, Bybit). Use the exchange’s API documentation to understand endpoints and parameters. Develop or configure the bot using a programming language (e.g., Python). Test the setup in a demo environment. Ensure security by storing API keys securely and limiting permissions.

How does Bybit's new real-time liquidation data API impact crypto trading strategies?

Bybit’s real-time liquidation data API provides traders with up-to-the-second insights into liquidation events. This helps in identifying high-volatility moments, optimizing strategies for risk management, and leveraging market opportunities during significant price movements.

What is API in algo trading?

In algo trading, an API (Application Programming Interface) acts as a bridge between trading algorithms and financial markets. It allows for the automation of trading strategies, access to real-time data, and execution of trades with minimal latency, making it an essential tool for algorithmic traders.

CONCLUSION

Trading API has become an indispensable tool in the modern financial markets, offering traders and developers unprecedented access to market data and trading capabilities. By leveraging the power of trading API, market participants can create sophisticated trading systems, automate their strategies, and gain a competitive edge in the fast-paced world of trading.

Start trading

Comments 2