- Manual: Generated by experienced analysts or trading groups

- Automated: Derived from algorithms scanning technical indicators and price patterns

Easy Trading Signals: A Thorough Path to Smarter Trading

Boost your trading with Easy Trading Signals for smarter, faster market decisions.

Easy Trading Signals

Easy Trading Signals are more than just alerts—they’re a bridge between strategic insight and execution. In this article, you’ll discover practical techniques, expert recommendations, and real trader feedback to help you trade smarter using modern trading signals live and proven trading strategies.

What Are Easy Trading Signals?

Easy Trading Signals are notifications or alerts suggesting when to open or close a position based on market data analysis. These trading signals can be:

They are typically delivered via platforms such as trading terminals, apps, or more commonly today—Trading signals Telegram channels, providing traders with real-time insights without the need for constant monitoring.

Why Signals Are Essential in Forex

Forex markets operate 24/5, with rapid price movements and complex interdependencies. Easy Trading Signals offer:

- Fast reaction to price action and trend changes

- Clarity in chaotic markets

- Entry/exit timing accuracy using buy or sell triggers

- Reduced emotional trading

According to Mark Hastings, a senior analyst at ForexEdge Labs: “Incorporating structured trading signals into your workflow can reduce cognitive bias and improve long-term profitability.”

Traders looking for 100% accurate forex signals free should temper expectations—while accuracy is crucial, consistent performance and risk management matter more.

Types of Trading Signals

Easy Forex Trading Signals with Technical Indicators

These are generated using technical tools:

- Moving Averages: Highlight trend directions

- RSI (Relative Strength Index): Detects overbought/oversold zones

- MACD (Moving Average Convergence Divergence): Identifies trend strength and reversals

- Stochastic Oscillator: Spots price extremes

- Bollinger Bands: Indicates volatility and breakout points

When multiple indicators align, signal strength increases, especially during strong trend formations or before reversal points.

Chart Patterns and Live Signal Feeds

Patterns such as head and shoulders, double tops, triangles, and wedges predict reversals or continuations. Combined with support/resistance levels and indicators, they help pinpoint entry and exit levels.

Real-time signal feeds such as forex signals live buy/sell are distributed through Easy trading signals free platforms or paid services. Delivery is typically via apps or Easy trading signals Telegram channels.

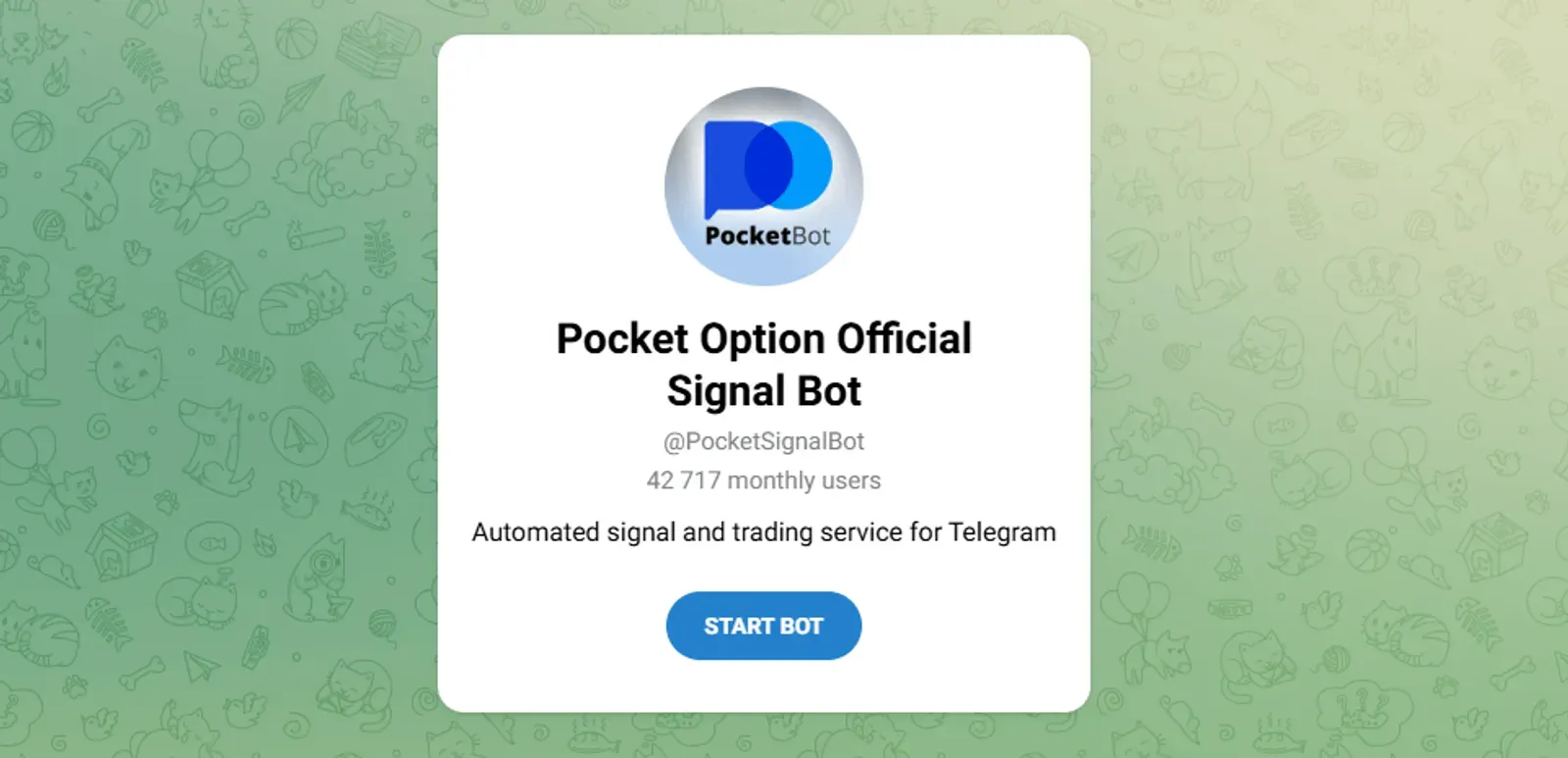

Pocket Option Telegram Bot: Signal-Based Trading Automation

Pocket Option’s official Telegram bot bridges the gap between trading signals and execution. This free tool allows users to automate trades based on real-time signals, with customizable risk parameters.

Key Features

- One-click setup via Pocket Option account

- Trade automation on demo or live accounts

- Customizable trade volume, timeframes, asset filters

- Set profit/loss limits, payout thresholds, volatility filters

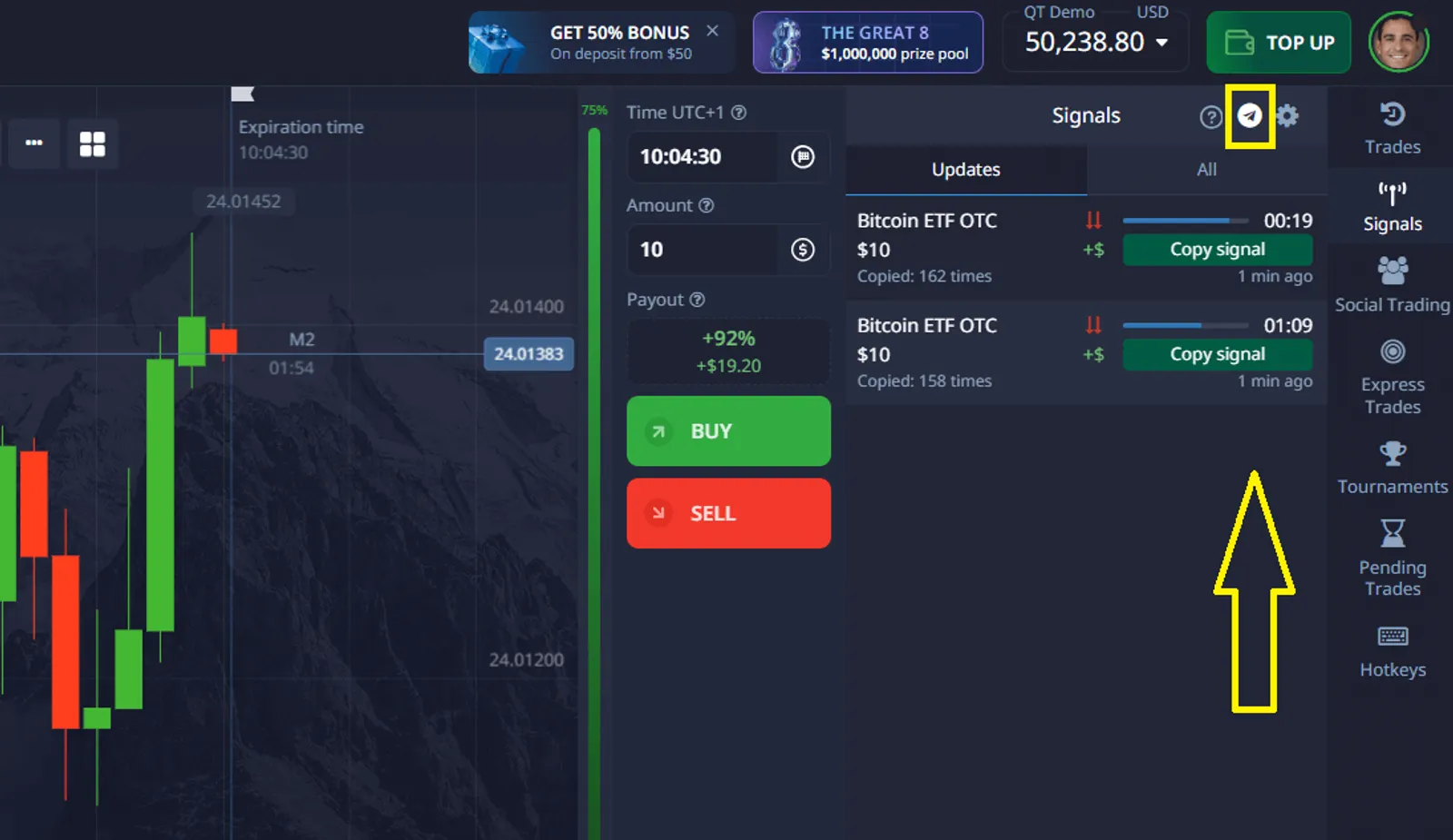

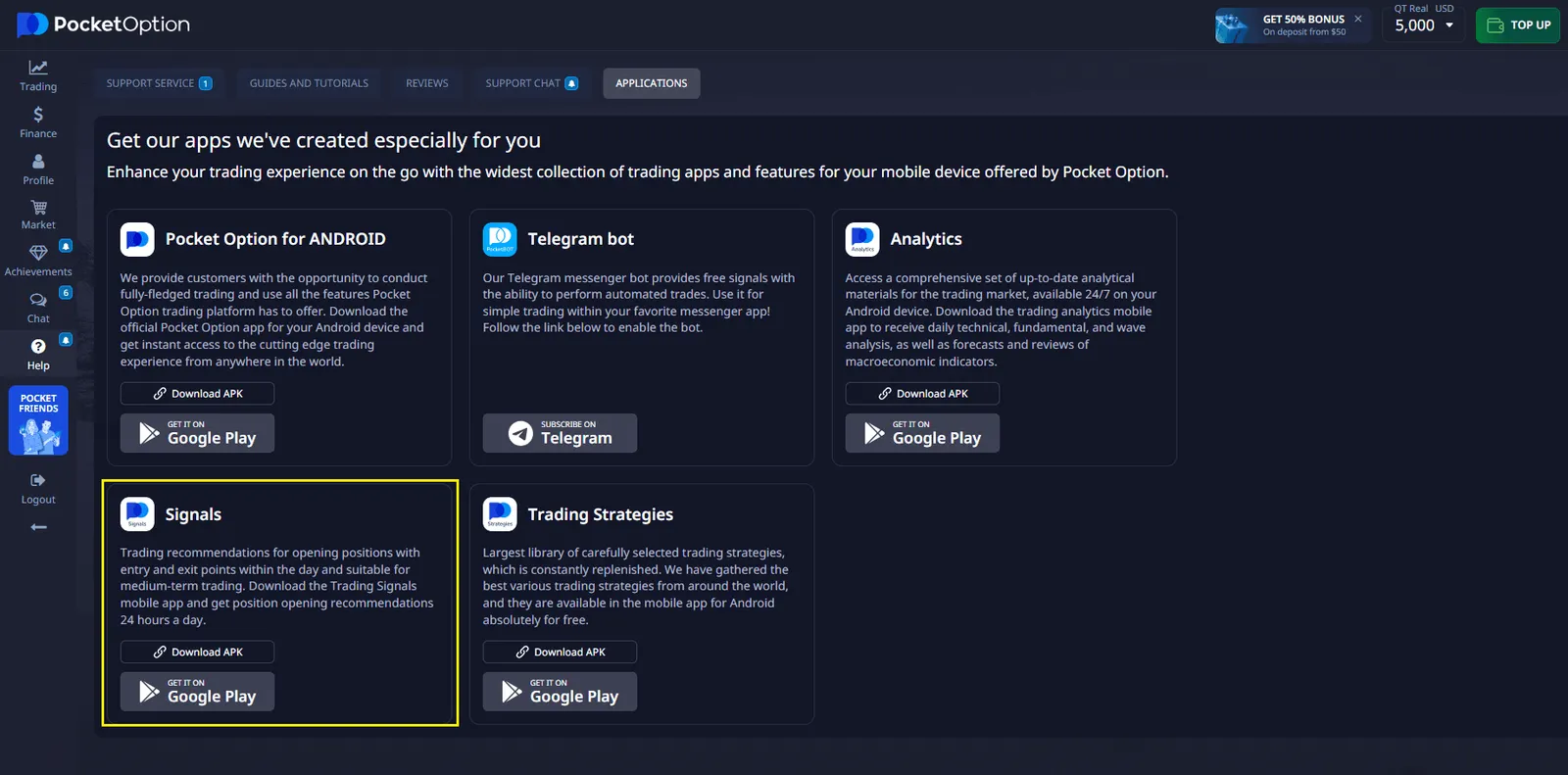

Setup Instructions

- Log into Pocket Option

- Go to Help > Applications or open the Signals tab

- Activate and link the Telegram bot

- Customize trading rules within Telegram: trade size, asset type, strategy filters

Maria Lopez, fintech automation consultant, shares: “The Pocket Option bot’s simplicity belies its power. With proper setup, it serves as a 24/7 assistant—reacting faster than a human could.”

Real Trader Reviews

- “The Pocket Option bot transformed how I trade. I set it up once, and it handles my favorite forex pairs with zero stress.” — Jonathan M.

- “Getting trade alerts via Telegram with one-click execution changed the game for me.” — Aisha T.

- “As someone working full-time, Pocket Option’s bot gives me access to markets I couldn’t otherwise follow.” — Elias R.

Setting Alerts for Signal-Based Trading

Trading alerts improve decision-making:

- Platform Alerts: Set on MT4/MT5 or web platforms based on indicators

- Telegram Bots: Use tools like the Pocket Option bot or external signal channels

- Mobile Apps: Get push notifications when predefined criteria are met

These systems ensure traders never miss critical signals—especially when markets move quickly or experience volatility.

Evaluating Signal Providers

Choosing Reliable Easy Trading Signals Free Services

Key Criteria:

- Accuracy: Measured over weeks/months, not just isolated results

- Transparency: Public track record or verified stats

- Methodology: Clear, logical signal generation

- Delivery: Real-time alerts via Trading signals Telegram or app

Free Trials and Demo Testing

Use trials with Easy trading signals free to test:

- Signal timing

- Asset coverage (forex, commodities, stocks)

- Alignment with your trading strategies

Demo testing helps evaluate real-world compatibility without risking capital.

Technical Analysis and Easy Trading Signals

Role of Technical Analysis

It helps:

- Forecast market trends

- Spot optimal entry/exit zones

- Validate signals with tools like RSI, MACD, or Stochastic Oscillator

Combining Indicators for High-Probability Trades

Examples:

- MACD + RSI confirmation for entries

- Bollinger Bands + Stochastic for breakouts

- Use of bearish patterns for early reversal detection

Julien Moreau, an independent systems trader, recommends: “Use Easy Trading Signals as your tactical layer—but always verify context with multi-timeframe analysis.”

Practical Implementation of Easy Trading Signals

Step-by-Step Strategy

- Define risk profile and strategy

- Choose signal source (Telegram, bot, app)

- Backtest signals using demo or past data

- Set up automated or manual alerts

- Implement trades with discipline

Risk Management Tips

- Include: Maximum loss per trade

- Daily/weekly drawdown limits

- Stop loss and take profit rules

- Signal filtering by asset, volatility

Automation helps but must be supervised—especially when using Free Forex Signals Telegram.

Final Thoughts

Easy Trading Signals provide a scalable, data-driven method to engage financial markets with confidence. Whether you prefer easy forex trading signals, fully automated bots, or manual confirmation setups, trading signals help eliminate guesswork.

With Pocket Option’s Telegram bot, you gain access to real-time alerts, customizable automation, and efficient trade execution—all free of charge. As you integrate these tools into your strategy, you’ll see enhanced timing, fewer emotional decisions, and more systematic results. Discuss this and other topics in our community!

FAQ

What are easy trading signals and what advantages do they offer to traders?

Easy trading signals are alerts that suggest potential trading opportunities, benefiting traders by simplifying decision-making, reducing emotional stress, and boosting trading efficiency.

How do easy trading signals function with platforms like Pocket Option?

Platforms such as Pocket Option utilize easy trading signals to offer traders real-time insights, swift execution options, and access to diverse assets, facilitating effective signal application in trading strategies.

Are there any downsides to depending on easy trading signals?

While easy trading signals are efficient, they might not consider all market factors and could lead to over-dependence. It's crucial to use them alongside other strategies like risk management and diversification.

How can traders ensure they are using easy trading signals effectively?

Traders can maximize the effectiveness of easy trading signals by understanding the underlying analysis, leveraging platforms like Pocket Option for swift execution, and continuously learning about market trends.

What lies ahead for easy trading signals in the financial markets?

The future of easy trading signals is promising, with advancements in AI and machine learning expected to deliver more accurate and personalized trading recommendations, further enhancing traders' capabilities.

Which signal is best for trading?

The best trading signal depends on your strategy, market conditions, and risk tolerance. Commonly used signals are based on technical indicators such as Moving Averages, RSI (Relative Strength Index), and MACD. It's recommended to combine multiple signals for more accurate predictions and avoid relying on a single indicator.

What is the 5-3-1 rule in trading?

The 5-3-1 rule is a risk management principle used by traders to manage their exposure. It suggests that traders should risk no more than 5% of their account balance per week, 3% per day, and 1% per trade. This helps minimize potential losses and protect long-term capital.

What is the easiest indicator for trading?

The easiest indicator for trading is often considered to be the Moving Average. It is simple to use and effective for identifying trends. Moving Averages help traders recognize market direction, support, and resistance levels, and provide basic buy/sell signals, making it ideal for beginners.