- Technical Analysis – Studies charts, indicators, and patterns.

- Fundamental Analysis – Considers economic news and financial reports.

- Artificial Intelligence – Processes vast amounts of data and builds forecasts.

- High-Frequency Analysis – Examines instant price fluctuations to generate timely signals.

Professional Trading Solutions with Pocket Option Signals

Modern markets demand fast, informed decisions. Pocket Option signals offer real-time insights and forecasts, helping traders spot the best moments to act.

Article navigation

Coming soon on the PO Blog: a new service for traders — “Pocket AI Signals.”

A network of AI agents processes data on 2,500 stocks from the world’s major exchanges every week and compiles the key facts to forecast price moves.

Message us in chat to subscribe and be the first to get a launch notification!

Trading Signals for Effective Market Performance

By utilizing advanced technologies such as artificial intelligence and machine learning, trading signals provide real-time information. They are designed for various strategies, making them beneficial for both beginners and experienced traders. Besides general trading signals, explore specific gold trading signals that might complement Pocket Option signals.

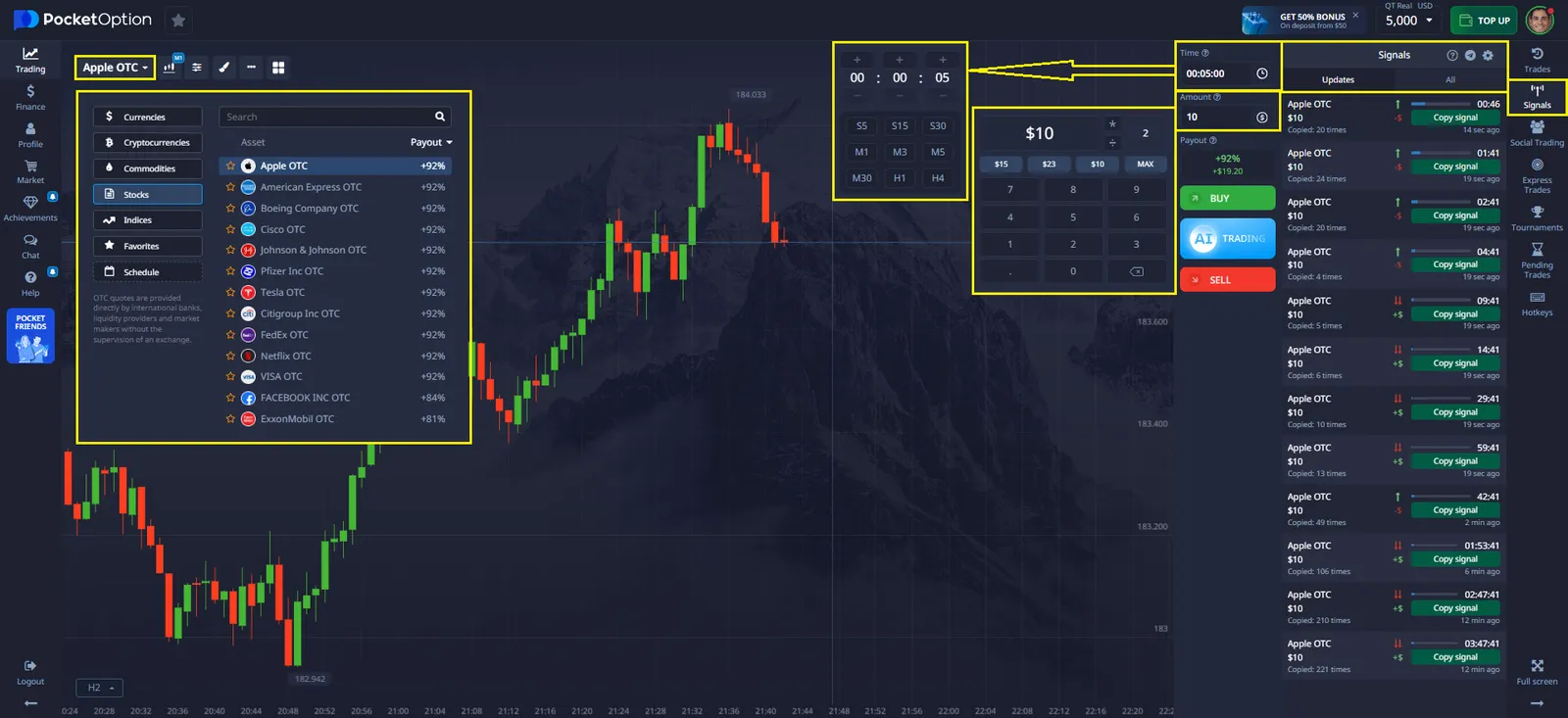

How Trading Signals Work

Algorithms analyze data from multiple sources, identifying market trends and entry points. The operation of trading signals is based on several key technologies:

Once a trend is identified, the system generates a trading signal, which is displayed on the platform.

How to Use Trading Signals

To start using signals, follow these simple steps:

- Go to the trading signals section on the platform.

- Select the appropriate timeframe.

- Review the trend directions of assets.

- Apply the obtained information to your trading strategy.

The interface is designed to ensure that signals are convenient and understandable for users of all experience levels.

📈 Maximize Your Signals — Activate Full Access with Your First Deposit!

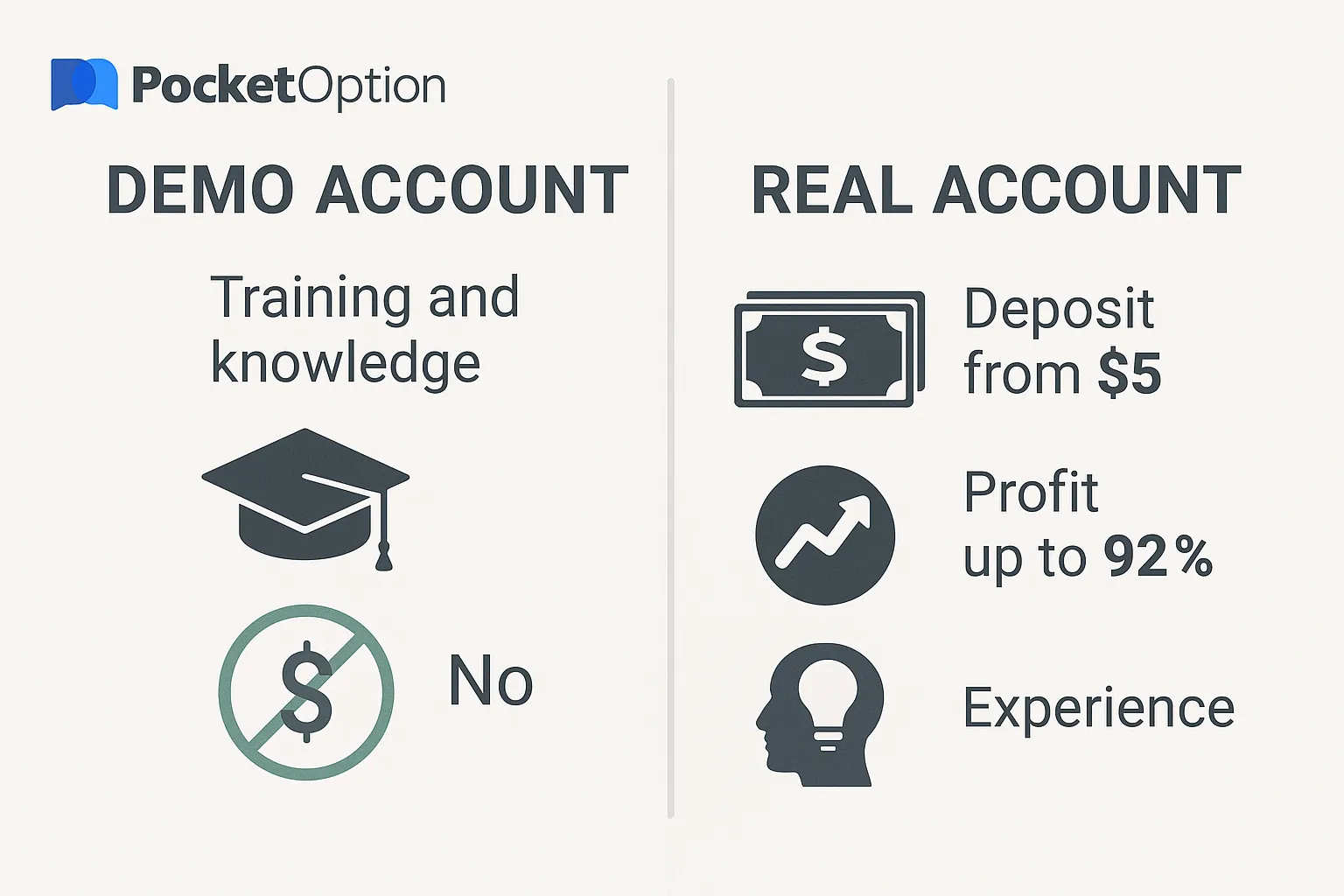

Pocket Option trading signals are powerful — but they’re just the beginning. Unlock the full trading experience by making your first deposit today:

- 🎯 Use AI-driven signals in real time — spot opportunities as they emerge

- 💰 Start with only $5 and trades from $1 — ideal for testing your strategy

- 📲 Receive signals directly to your app or Telegram — no delays

- 🔄 Switch freely between real and demo accounts

🎁 BONUS: Use promo code 50START when you deposit and get up to $25 extra instantly!

🚀 Take control of your trading decisions — deposit now and let the signals guide your next move. Conditions may change, so don’t miss your moment!

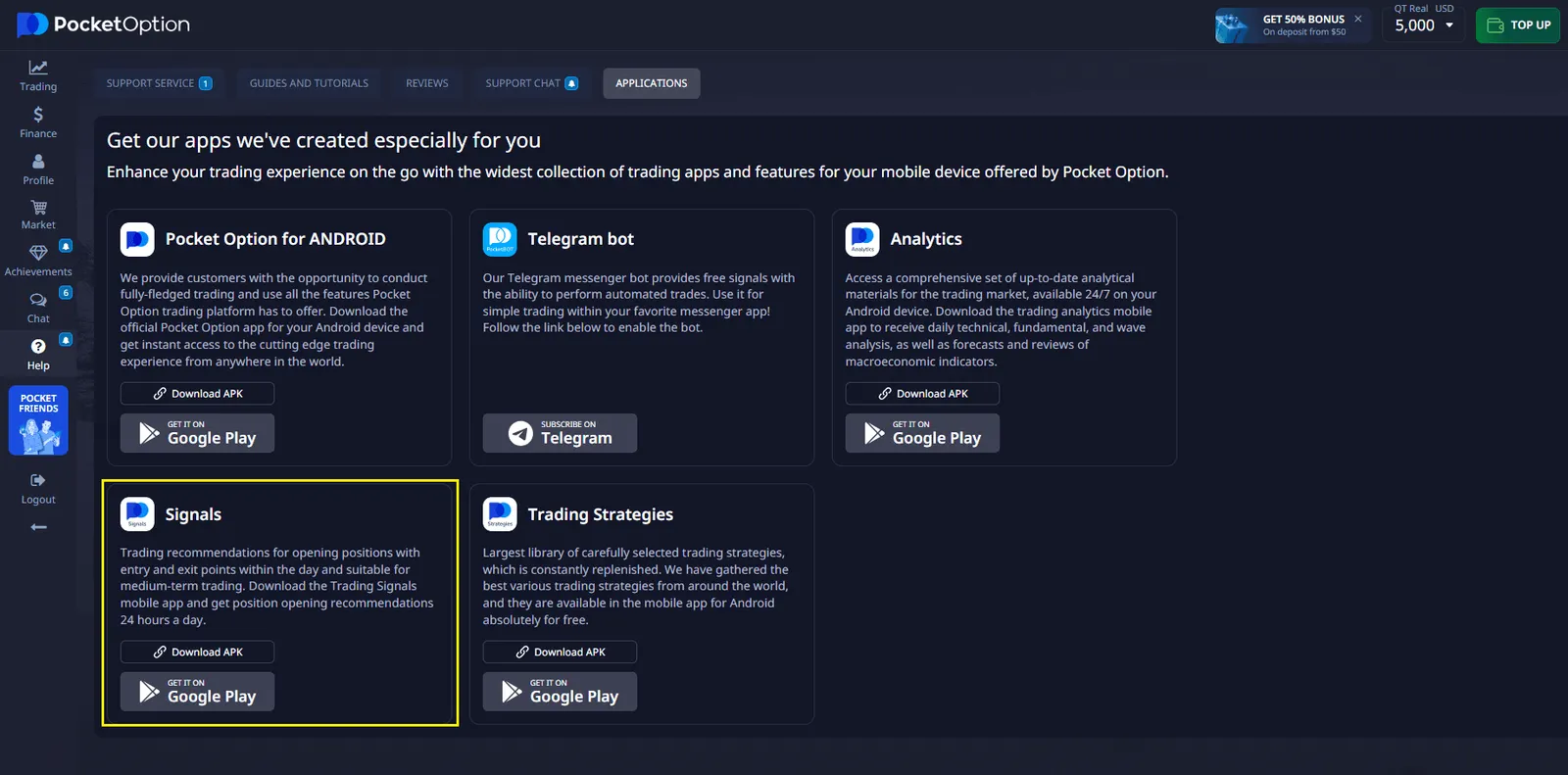

In addition to signals on the platform, Pocket Option users can also:

1. Download the Signals app in the apps section

2. Use the Telegram bot. Read more about this in the post about the bot.

Advantages of Automated Signals

Using signals helps traders optimize their trading process. The key benefits include:

- Fast processing – Algorithms analyze data within milliseconds.

- No emotional influence – Eliminates decision-making based on intuition or emotions.

- Flexibility – Allows users to customize signals according to their trading strategy.

- Accessibility – Signals can be received via mobile applications and push notifications.

Trading signals help traders respond faster to market changes, but it is crucial to consider risks and implement a sound capital management strategy.

FAQ

What are the main types of trading signals available?

Trading signals include trend indicators, reversal patterns, and volatility measurements that help identify market opportunities.

How reliable are Pocket Option signals?

Signal reliability varies by timeframe and market conditions, typically showing 70-85% accuracy when properly analyzed.

Can beginners use trading signals effectively?

Yes, beginners can use signals with proper education and risk management strategies.

What makes Pocket Option signals different?

Pocket Option provides integrated analysis tools and customizable signal parameters for various trading styles.

How often should traders check trading signals?

Signal monitoring frequency depends on trading strategy timeframes, from minutes for day trading to daily for longer-term positions.

Can I fully rely on trading signals?

Signals are an auxiliary tool and do not guarantee profit. It is recommended to combine them with personal analysis.

How can I check the accuracy of signals?

To evaluate effectiveness, you can use a demo account and review past signal statistics.

Where can I receive signal notifications?

Notifications are available in the mobile app, through push alerts, and other communication channels.

CONCLUSION

Trading signals leverage advanced technology to deliver real-time market insights for traders at all experience levels. By combining technical analysis, fundamental evaluation, AI, and high-frequency data processing, these automated systems provide objective, customizable, and accessible trading recommendations. While signals offer significant advantages in speed and emotional detachment, traders should remember that effective implementation still requires proper risk assessment and capital management strategies. This powerful tool can enhance decision-making and market responsiveness when used as part of a comprehensive trading approach

Start trading

Comments 4