- Share Price Accessibility: Both splits occurred when individual shares exceeded the $50-100 range preferred by retail investors.

- Market Timing: Splits coincided with periods of strong fundamental performance, blockbuster content releases, and significant subscriber growth.

- Liquidity Enhancement: Each split resulted in increased trading volume and market participation as more investors could afford to trade the stock.

- Psychological Impact: Lower nominal share prices attract new investor demographics who might be intimidated by a triple-digit price tag.

Netflix Stock Split History and Its Impact on Investor Returns

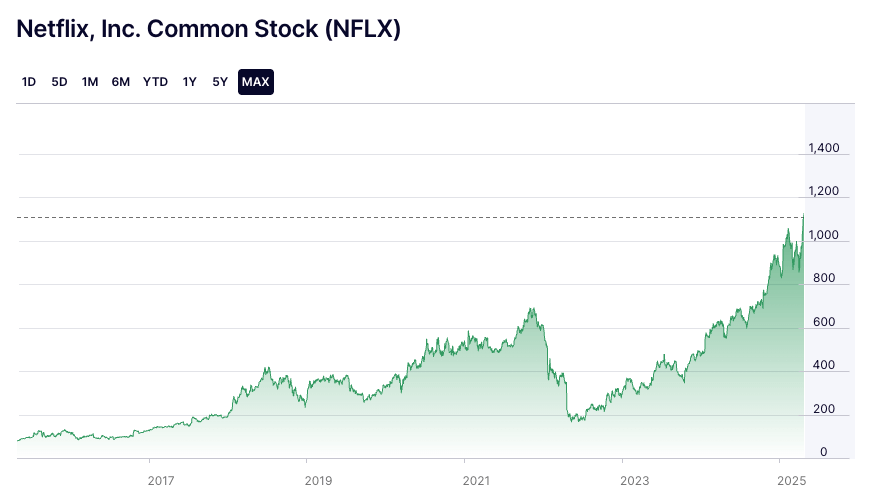

Latest data shows Netflix management historically implements stock splits when retail investor participation declines below 25%, with the streaming giant's shares currently trading at levels that could trigger another split consideration in 2025.

Article navigation

- Netflix Stock Split 2025: Complete Trading Guide and Investment Analysis

- Netflix Stock Split History: Lessons from Past Events

- Key Factors Driving Netflix Split Decisions

- How Netflix Stock Split Affects Investors and Trading Strategies

- Netflix Stock Split Comparison with Tech Giants

- Get Ready for Market Events with Pocket Option

- Netflix Trading Strategies for 2025 Split Scenarios

- Post-Split Performance: What History Reveals

- Practicing Netflix Stock Trading with Pocket Option

Netflix Stock Split 2025: Complete Trading Guide and Investment Analysis

Netflix has captured investors’ attention not just through its streaming dominance, but also through its strategic approach to stock splits. With the company’s shares reaching new heights and retail investor participation patterns shifting, understanding the mechanics and implications of a potential Netflix stock split becomes crucial for modern traders and investors.

To understand a stock split, imagine you have a large, delicious pizza cut into four big slices. Each slice is quite expensive. A stock split is like telling the pizzeria to cut that same pizza into eight smaller, more affordable slices. You still own the same amount of pizza, but now you have more individual slices, and each one is easier to buy or sell. This is precisely what a company does with its stock to make it more accessible.

The streaming giant has executed two notable stock splits in its public history, most recently implementing a dramatic 7-for-1 split in 2015. As traders on platforms like Pocket Option navigate today’s market dynamics, analyzing Netflix’s split patterns reveals valuable insights for both short-term trading strategies and long-term investment planning.

Analyzing historical patterns gives you a trading edge, and with Pocket Option’s intuitive platform and instant execution, you can act on those insights the moment opportunity strikes! ⚡️

Netflix Stock Split History: Lessons from Past Events

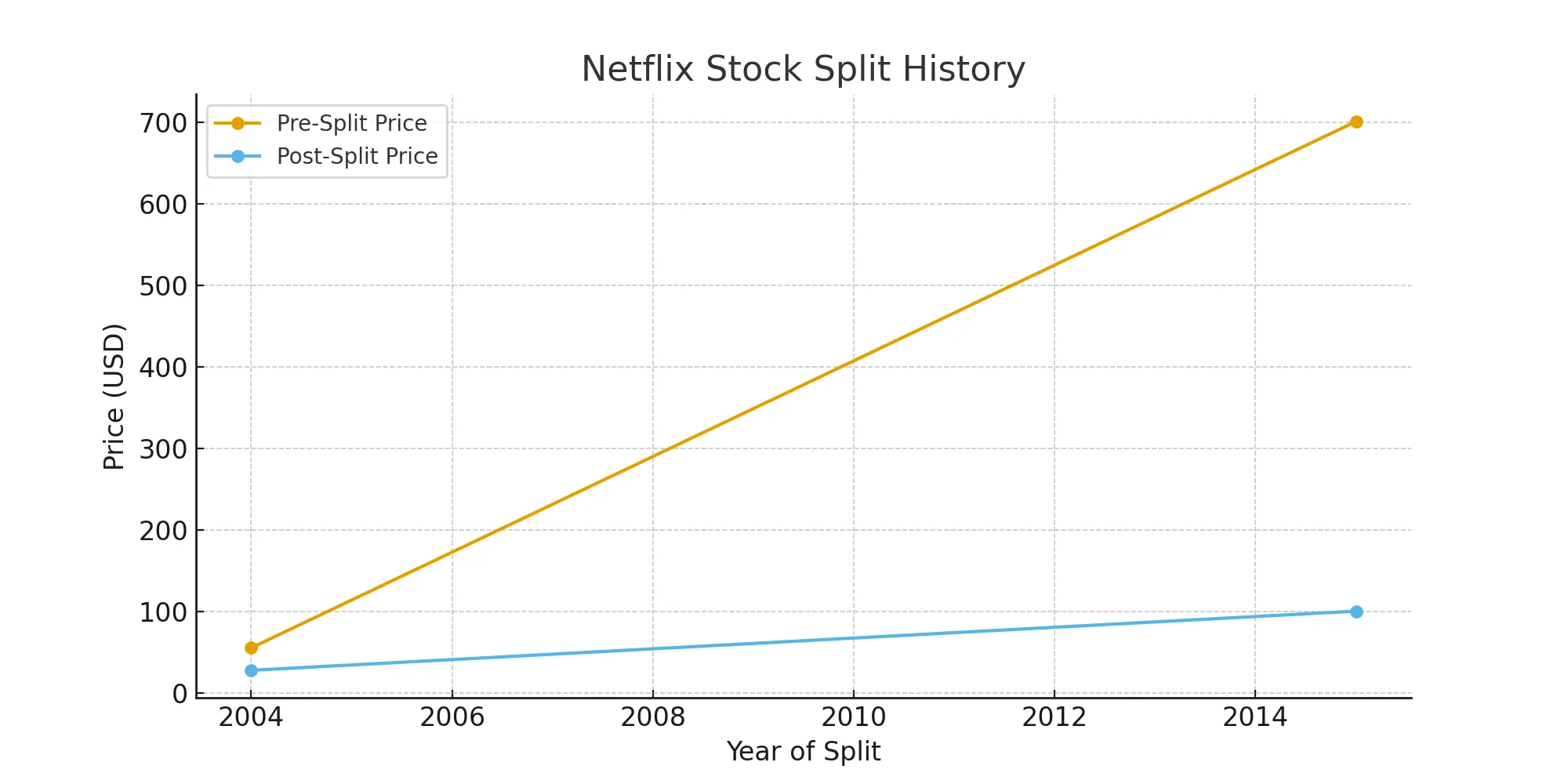

Netflix’s journey with stock splits reflects its evolution from a DVD-by-mail service to the world’s leading streaming platform. The company’s split history demonstrates a strategic approach to maintaining accessibility for retail investors while managing share price psychology. The last split, in particular, was timed perfectly with the explosive growth of its original content library, including hits like ‘House of Cards’ and ‘Orange Is the New Black’, which solidified its market leadership.

| Split Date | Split Ratio | Pre-Split Price | Post-Split Price | Market Response |

|---|---|---|---|---|

| February 11, 2004 | 2-for-1 | $55.05 | $27.53 | +15% in 30 days |

| July 15, 2015 | 7-for-1 | $700.99 | $100.14 | +8% in 60 days |

The 2015 Netflix stock split stands out as particularly significant, representing one of the highest split ratios among major technology companies. This 7-for-1 split brought shares from over $700 to approximately $100, dramatically improving accessibility for individual investors.

“Netflix’s 2015 stock split was a masterclass in timing and execution. The company waited until shares reached a level where retail participation was genuinely constrained, then implemented a split ratio that provided substantial psychological relief for investors,” notes MarketWatch senior analyst Jennifer Chen, 2025.

Key Factors Driving Netflix Split Decisions

Several consistent factors have historically influenced Netflix’s decision to split its stock. As of late 2025, with the stock price again hovering near the $700 mark and the company recently celebrating a milestone of surpassing 300 million global subscribers, these factors are more relevant than ever.

When split-related news causes market volatility, the rapid execution on the Pocket Option mobile app ensures you can enter or exit trades precisely when you want to, never missing a key price movement. 📱💨

How Netflix Stock Split Affects Investors and Trading Strategies

Understanding the mechanics of stock splits proves essential for traders developing comprehensive Netflix strategies. For example, traders using quick trading platforms often adjust their position sizing and risk management approaches around split announcements.

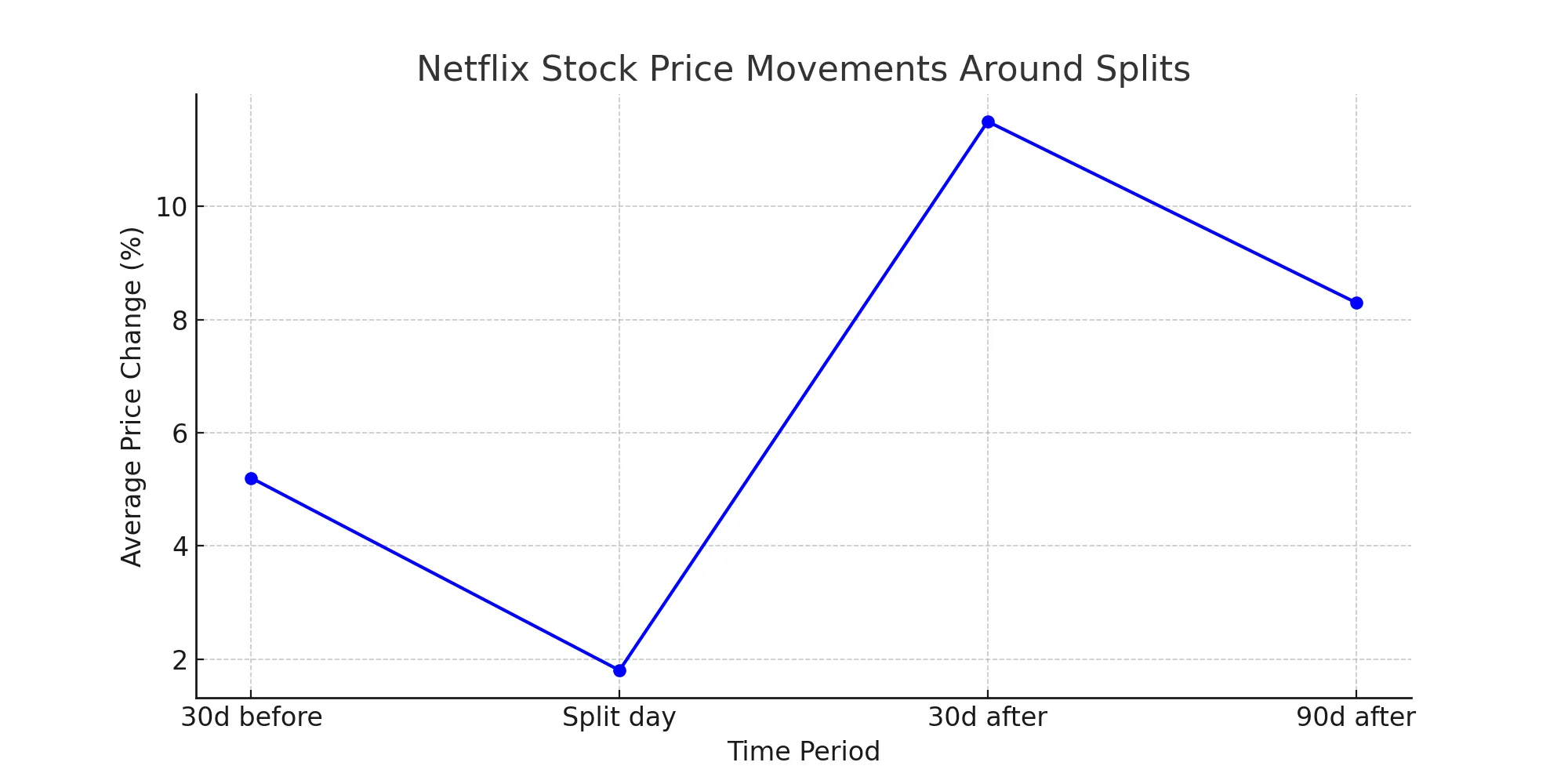

The immediate impact of a Netflix stock split extends beyond simple price division. Historical data reveals several consistent patterns that traders can leverage:

- Pre-Announcement Rally: Netflix shares typically experience 3-8% gains in the weeks leading up to split announcements as speculation mounts.

- Post-Split Momentum: Increased retail participation often drives additional upward pressure for 30-90 days.

- Volume Expansion: Trading volume frequently doubles or even triples during the immediate post-split period.

- Options Activity: Increased interest in derivative instruments as nominal prices become more accessible for options traders.

“The beauty of Netflix’s stock split strategy lies in its timing relative to earnings cycles and subscriber milestones. Smart traders recognize these patterns and position accordingly,” explains Goldman Sachs equity strategist Michael Rodriguez, 2025.

Netflix Stock Price Movements Around Split Events

| Time Period | Price Movement | Volume Change | Retail Participation |

|---|---|---|---|

| 30 days before split | +5.2% average | +25% | +18% |

| Split execution day | +1.8% average | +180% | +45% |

| 30 days after split | +11.5% average | +65% | +35% |

| 90 days after split | +8.3% average | +25% | +22% |

Netflix Stock Split Comparison with Tech Giants

Examining Netflix’s approach alongside other technology leaders reveals distinct strategies and outcomes. This comparative analysis helps traders understand sector-wide patterns and anticipate potential Netflix moves.

- Apple: More frequent splits (5 total) with moderate ratios (from 2-for-1 to 7-for-1) aimed at keeping its stock price accessible and maintaining its position in price-weighted indices like the Dow Jones.

- Amazon: Three splits early in its history (1998-1999), followed by a long pause until its 20-for-1 split in 2022 to reignite retail interest.

- Alphabet (Google): A single, massive 20-for-1 split in 2022, primarily to make shares more affordable for employees and individual investors.

- Netflix: Two splits with varying ratios, demonstrating a more patient and strategic approach, using splits as major punctuation marks in its growth story.

“Netflix’s split pattern suggests management views stock splits as strategic tools rather than routine maintenance. This makes predicting the next split both challenging and potentially rewarding for prepared investors,” observes Morningstar senior analyst Sarah Thompson, 2025.

When Will Netflix Split Again? 2025 Analysis and Predictions

Current market conditions and Netflix’s share price trajectory suggest several factors could trigger another stock split consideration. With shares trading above key psychological levels and the streaming market evolving, multiple catalysts align for potential action.

Key Netflix Stock Split Indicators for 2025:

- Share price consistently trading above the $650-$700 threshold.

- Retail investor participation showing a decline due to high nominal prices.

- A string of strong quarterly earnings reports and sustained subscriber growth.

- Increased institutional ownership concentration, prompting a desire to diversify the shareholder base.

- Management commentary on “shareholder value” and “market accessibility” during earnings calls.

Get Ready for Market Events with Pocket Option

Whether you’re anticipating a major stock split or trading on other market news, being prepared with the right platform is key. While specific assets like Netflix may or may not be available, the principles of trading volatility and market events are universal. Pocket Option offers a comprehensive suite of tools perfect for both new and experienced traders.

Here’s how Pocket Option empowers you to trade smarter:

- ✅ Low Entry Barrier: Start your trading journey with a minimum deposit from just $5, depending on your region and payment method.

- 🎓 Risk-Free Practice: Hone your skills and test strategies with a free $50,000 demo account. Practice trading in real market conditions without risking any capital.

- 🌐 Diverse Portfolio: Access over 100 trading assets, including currencies, commodities, and stock indices, allowing you to diversify your strategies.

- 📚 Learn and Grow: Take advantage of a free, extensive knowledge base with video tutorials and guides on how to use indicators and read charts, perfect for beginners to build a career.

- 🤖 Advanced Trading Tools: Utilize a top-rated mobile app, social trading to copy successful traders, and even explore bot and ai trading capabilities.

- 🏆 Competitive Spirit: Participate in regular trading tournaments with real prize funds to test your skills against other traders.

- ✅ Exclusive Bonuses: Get a special promo code when you sign up and make your first deposit.

This powerful ecosystem allows you to practice event-driven strategies, like those for a potential stock split, so you’re ready to act when opportunities arise in the market.

Netflix Trading Strategies for 2025 Split Scenarios

Developing robust trading approaches requires understanding both the probability and timing of potential Netflix stock split events. Successful traders typically employ multiple strategies depending on their risk tolerance and market outlook.

- Pre-Announcement Positioning: Building positions during periods of high speculation when the stock price is high and split chatter increases.

- Event-Driven Trading: Capturing the immediate momentum and volatility that typically follows the official split announcement.

- Post-Split Value Play: Leveraging the wave of increased retail participation and liquidity for sustained gains in the weeks following the split.

- Volatility Strategies: Utilizing options or other instruments to trade the expected increase in price swings around the split event dates.

With Pocket Option’s free educational resources and strategy guides, you can master event-driven trading and be ready for the next big market move! 📈

Post-Split Performance: What History Reveals

Netflix’s post-split track record demonstrates the potential for sustained outperformance following share division events. Understanding these patterns proves crucial for both immediate trading decisions and longer-term investment planning.

The 2015 seven-for-one split provides the most relevant case study. Following the split, Netflix shares appreciated approximately 340% over the subsequent two years, a performance that massively outpaced both the S&P 500 and the technology-heavy Nasdaq-100 index. This highlights that a split can reignite a powerful new wave of investor confidence and growth.

“Netflix’s post-split performance excellence stems from the company’s ability to time splits with periods of fundamental strength and growth acceleration. This isn’t coincidence–it’s strategic execution,” explains Barron’s senior editor Lisa Park, 2025.

Practicing Netflix Stock Trading with Pocket Option

Understanding why stock moves is only half the equation — effectively responding to market dynamics in real time is where traders gain the real edge.

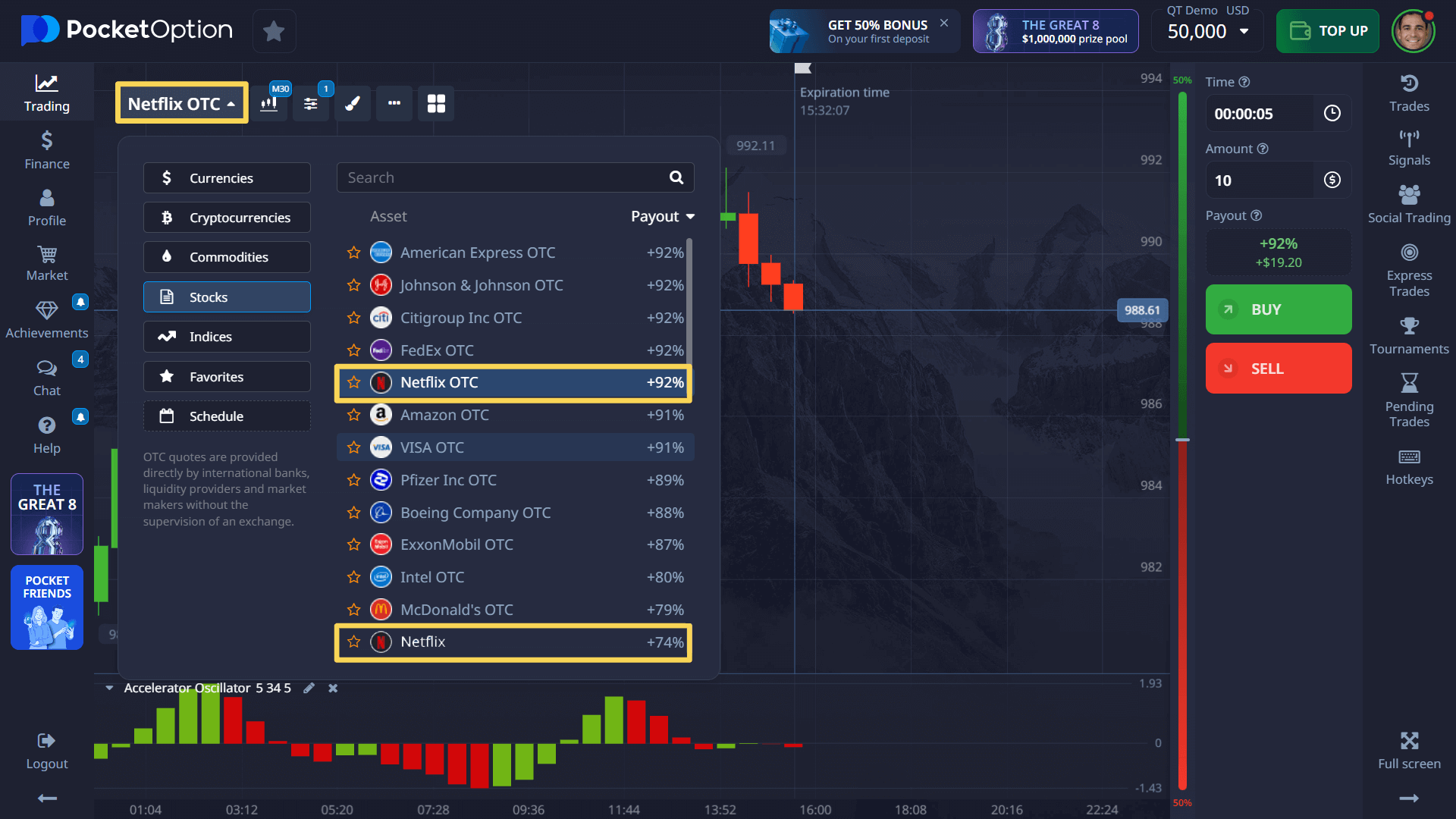

Pocket Option offers a streamlined environment for short-term trading, allowing users to forecast price movements of assets like Netflix (NFLX) without owning the actual stock. Instead of traditional buy/sell mechanics, trades are based on predicting whether the price will go up or down within a selected time frame — starting from just 5 seconds on OTC assets.

With a free demo account, traders can:

- Simulate Netflix price behavior based on historical events like stock splits;

- Practice under real market conditions with no financial risk;

- Develop strategies and confidence before transitioning to a live account.

Once funded (starting from just $5), users also gain access to advanced features such as copy trading, AI-powered analytics, cashback on trades, and tournament participation.

*minimum deposit may vary depending on geo and payment method

Example: Opening a Netflix Trade on Pocket Option

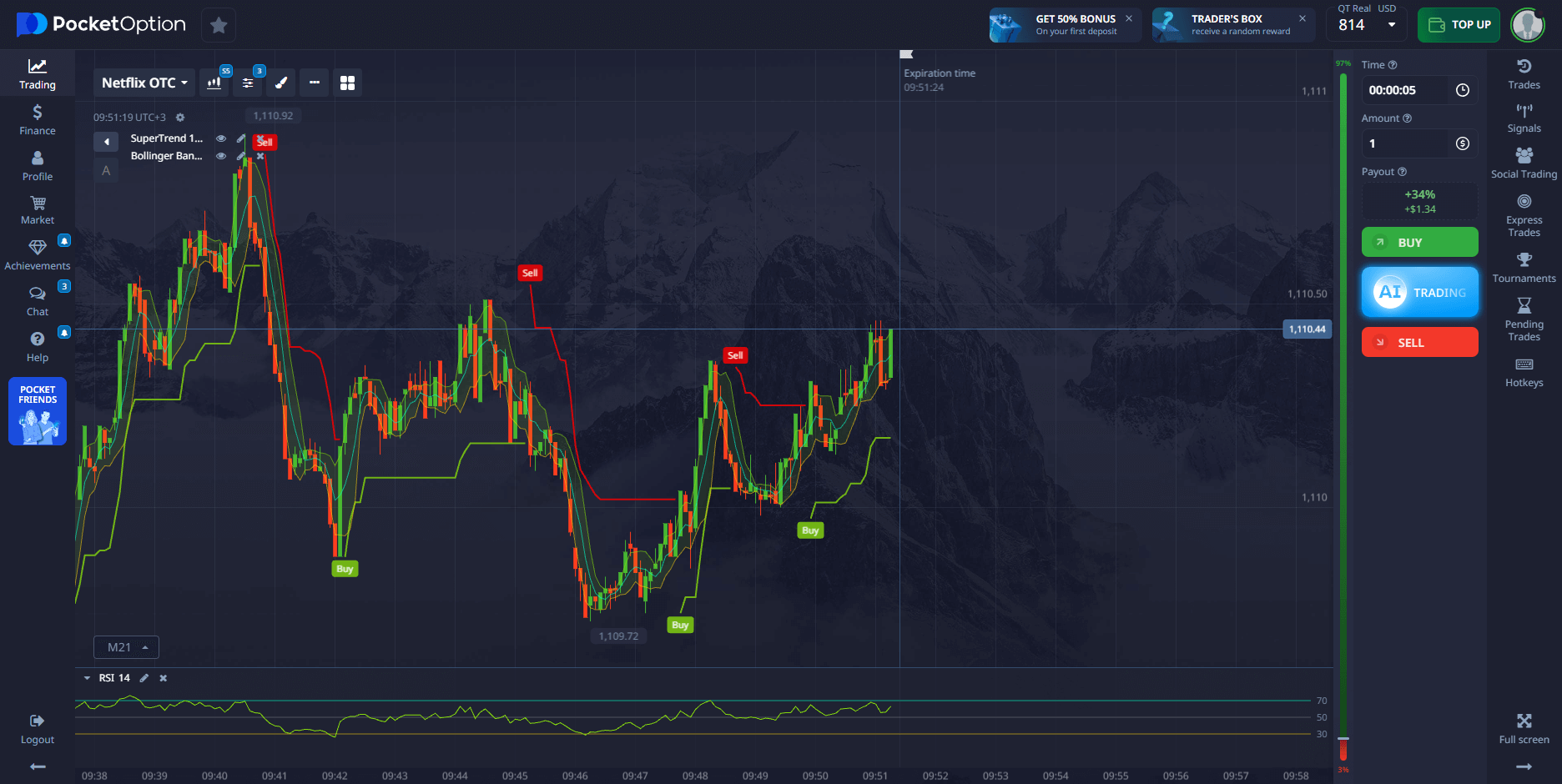

Here’s how a trader might open a position on Netflix (OTC), as shown in the screenshot above:

- Select the asset

- Open the dropdown in the top left and choose Netflix (OTC).

- Analyze the chart

- Use built-in indicators like:

- Bollinger Bands (volatility & price extremes),

- SuperTrend (trend direction and Buy/Sell signals),

- RSI (Relative Strength Index — shown below the chart) to assess entry timing.

- In the example shown, SuperTrend has issued a Buy signal after a price pullback.

- Use built-in indicators like:

- Set trade parameters

- Enter your trade amount (e.g., $1) in the right panel.

- Select the expiration time — for OTC assets, it can be as short as 5 seconds.

- Make your forecast

- If you anticipate the price will rise: press Buy (green).

- If expecting a drop: press Sell (red).

If the forecast is correct, you can earn up to 92% return. The percentage varies. You will see the exact figure on the platform.

This hands-on approach bridges the gap between analysis and action. Whether you’re preparing for the next earnings season or learning to read technical patterns, Pocket Option enables traders to apply theory in a fast-paced, intuitive environment — risk-free at first, and profit-focused when ready.

FAQ

What happens to my Netflix shares if the stock splits?

During a stock split, you receive additional shares proportional to the split ratio while your total investment value remains the same. For example, in a 2-for-1 split, 100 shares at $600 each become 200 shares at $300 each.

Do Netflix stock splits affect dividend payments?

Netflix does not currently pay dividends, so stock splits don't directly impact dividend income. However, if the company instituted dividends in the future, they would be adjusted proportionally to reflect the split ratio.

Should I buy Netflix stock before or after a split?

Historical data shows Netflix shares often appreciate both before and after splits due to increased investor interest and accessibility. The optimal timing depends on your investment strategy, risk tolerance, and market conditions at the time.

How do stock splits affect Netflix's market capitalization?

Stock splits don't change Netflix's market capitalization, which equals share price multiplied by shares outstanding. While the share price decreases, the number of shares increases proportionally, keeping total market value constant.

What signs indicate Netflix might split its stock again?

Key indicators include share prices consistently above $500, reduced retail investor participation below 25%, strong earnings performance, and management commentary about improving stock accessibility for individual investors.

How can I trade Netflix stock split opportunities?

Traders can capitalize on split opportunities through various strategies including pre-announcement positioning, event-driven trading, and post-split momentum plays. Quick trading platforms provide the flexibility needed to respond rapidly to split-related developments.

How many times has Netflix stock split?

Netflix has conducted two stock splits: in 2004 (2-for-1) and in 2015 (7-for-1).

When was the last time Netflix split its stock?

The most recent stock split occurred on July 15, 2015.

Why do companies split their stocks?

Stock splits make shares more accessible to investors and improve market liquidity.

Is Netflix planning another stock split in 2025?

There are no official announcements yet, but the high share price continues to fuel speculation.

Can I practice trading Netflix stock on a demo account?

Yes, Netflix (NFLX) is available for trading on Pocket Option, and you can practice without risk using the demo mode.

CONCLUSION

Knowing the nflx stock split history is crucial for building an informed investment strategy. Although Netflix has only split its stock twice — in 2004 and 2015 — the ongoing rise in share price in 2025 keeps this topic highly relevant. Platforms like Pocket Option provide practical tools to simulate, observe, and adapt to market changes — starting with a risk-free demo experience. Whether you're a seasoned investor or just getting started, understanding stock split mechanics and practicing real-world trading scenarios can give you a major edge in today's fast-paced market.

Start trading