- Meta has never announced or executed a stock split since its IPO

- Share price accessibility remains a secondary concern to fundamental value

- The company focuses on buybacks and operational efficiency instead

- Institutional ownership patterns support higher share prices

Meta Stock Split: What Investors Should Know About This Corporate Action

Recent market analysis reveals that Meta Platforms Inc. remains one of the few tech giants that has never conducted a stock split, despite shares trading above $500—a decision that significantly impacts retail investor accessibility.

Article navigation

- Meta Stock Split Analysis: Why Meta Platforms Inc. Hasn’t Split and What It Means for Investors

- Understanding Meta’s Stock Split Strategy

- Comparative Analysis: How Meta Differs from Other Tech Giants

- Market Impact of Meta’s No-Split Policy

- Strategic Implications for Investors

- How to Open a Trade on Meta (Facebook) with Pocket Option

- Future Possibilities and Market Speculation

Meta Stock Split Analysis: Why Meta Platforms Inc. Hasn’t Split and What It Means for Investors

While tech giants like Apple and Google have utilized stock splits to make their shares more accessible to retail investors, Meta Platforms Inc. has taken a different approach. This comprehensive analysis examines the implications of Meta’s decision to avoid stock splits and how modern trading platforms like Pocket Option help investors navigate these high-priced equities.

Understanding Meta’s Stock Split Strategy

Meta Platforms Inc. has maintained a unique position among FAANG stocks by never conducting a traditional stock split. This decision reflects the company’s corporate philosophy and strategic approach to share structure management.

“Meta’s approach to share structure demonstrates confidence in their long-term value proposition–they’re prioritizing fundamental growth over accessibility optics,” notes financial analyst Sarah Chen, 2025.

Even with Meta’s high share price, Pocket Option empowers every trader with fractional access, turning a challenge into an opportunity. 📈

Comparative Analysis: How Meta Differs from Other Tech Giants

To understand Meta’s position, examining how other major technology companies have approached stock splits provides valuable context for investors using platforms like Pocket Option.

| Company | Last Stock Split | Split Ratio | Current Strategy |

|---|---|---|---|

| Meta Platforms | Never | N/A | Buybacks & Growth Focus |

| Apple | August 2020 | 4:1 | Regular Accessibility Splits |

| Google (Alphabet) | July 2022 | 20:1 | Periodic Retail Access |

| Amazon | June 2022 | 20:1 | Liquidity Enhancement |

“The absence of Meta stock splits creates unique opportunities for traders who understand market dynamics–platforms like Pocket Option level the playing field through fractional access,” explains trading strategist Michael Rodriguez, 2025.

Market Impact of Meta’s No-Split Policy

Meta’s decision to avoid stock splits has created distinct market dynamics that savvy traders on Quick Trading platforms can leverage effectively.

Liquidity and Trading Volume Considerations

For example, traders using Pocket Option’s real-time market data can observe how Meta’s higher share price affects trading patterns compared to split-adjusted competitors.

- Institutional Dominance: Higher share prices naturally favor institutional investors

- Reduced Retail Participation: Psychological barriers limit smaller investor engagement

- Volatility Patterns: Different intraday movement characteristics compared to split stocks

- Options Market Impact: Higher underlying prices affect derivative strategies

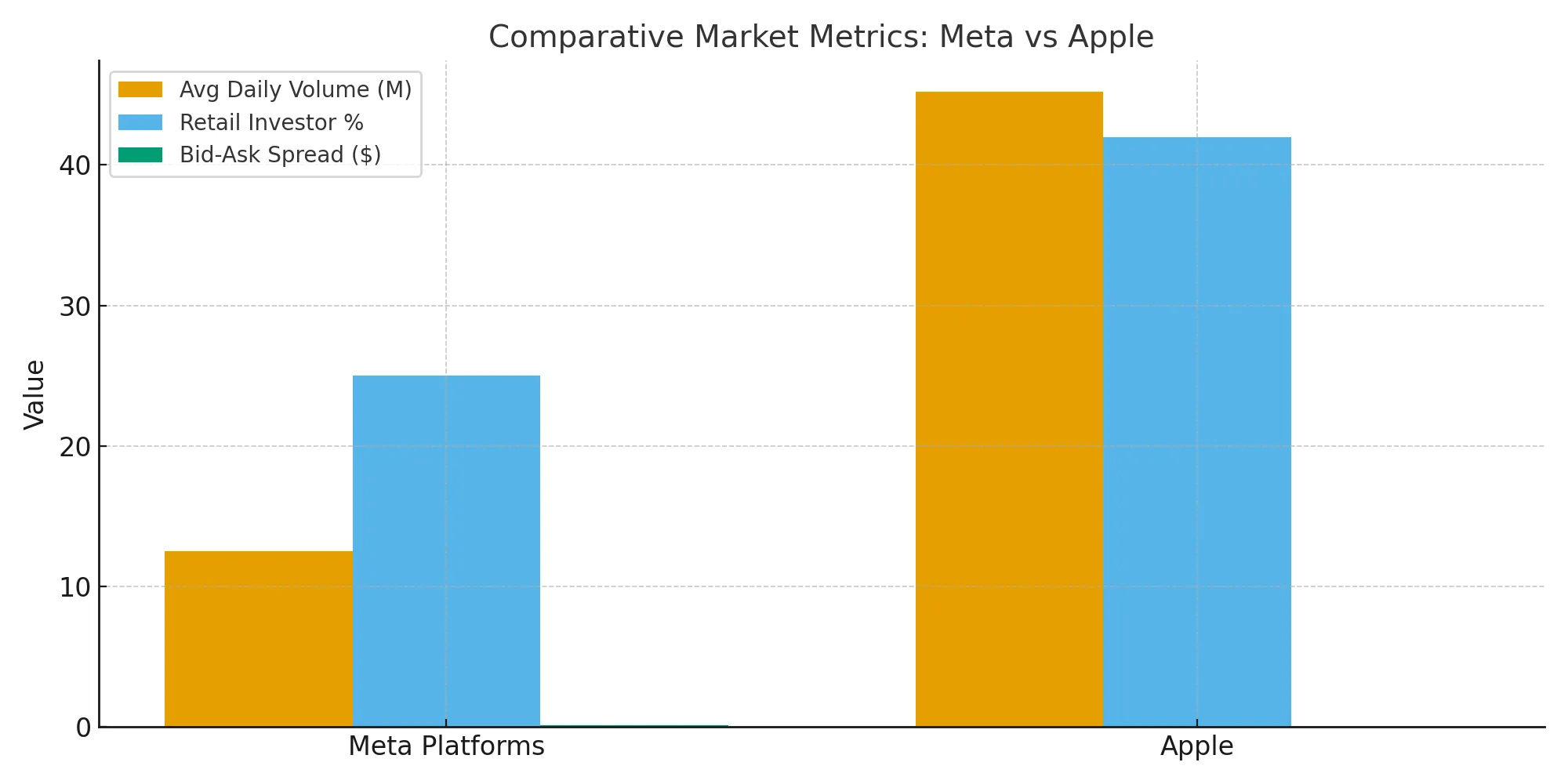

| Metric | Meta (No Splits) | Apple (Regular Splits) | Impact |

|---|---|---|---|

| Average Daily Volume | 12.5M shares | 45.2M shares | Lower retail participation |

| Retail Investor % | 25% | 42% | Institutional focus |

| Bid-Ask Spread | $0.08-0.12 | $0.02-0.04 | Higher trading costs |

Mastering the unique volatility of stocks like Meta is easier when you can practice risk-free. With Pocket Option’s free $50,000 demo account, you can hone your strategy before trading for real. 💰

Strategic Implications for Investors

“Modern trading platforms have essentially eliminated the accessibility argument for stock splits–what matters now is understanding the strategic signals these decisions send,” states portfolio manager Lisa Zhang, 2025.

In practice, traders often apply different strategies when dealing with high-priced stocks like Meta compared to split-adjusted equities. Pocket Option’s advanced tools, free knowledge base with strategies, and educational videos help investors navigate these nuances effectively.

- Position Sizing: Higher share prices require more precise capital allocation

- Risk Management: Dollar-based stops become more critical than percentage-based

- Entry Timing: Fractional share capabilities become essential for optimal entries

- Portfolio Weighting: Single share purchases can significantly impact small portfolios

Don’t let high share prices intimidate you! Pocket Option lets you start with a real account from just $5 and utilize powerful features like Social Trading and cashback to maximize your potential. 🚀

How to Open a Trade on Meta (Facebook) with Pocket Option

Here is a simple example of how to open a trade on stock using the Pocket Option platform:

- Choose the Asset: Select Facebook from the list of over 100 available assets.

- Analyze the Chart: Use the Trader’s Mood indicator or other technical tools available on your workspace to analyze the price chart and form a hypothesis.

- Choose the Trade Amount: Enter the amount you wish to invest, starting from just $1.

- Choose the Trade Time and Make a Forecast: Select the expiration time for your trade, starting from 5 seconds on OTC assets. Predict the price direction:

- If you believe the price will go UP, press the BUY button.

- If you believe the price will go DOWN, press the SELL button.

- Collect Your Profit: If your forecast is correct, you will receive a profit of up to 92% of your investment. This potential profit percentage is clearly displayed before you open the trade.

By opening a real account, which requires a minimum deposit from as low as $5 (may vary depending on your region and payment method), you unlock even more powerful features like Social Trading (to copy the trades of successful users), cashback on your trades, participation in tournaments, and many other benefits.

Future Possibilities and Market Speculation

“While Meta hasn’t split historically, market conditions and shareholder composition changes could influence future corporate actions–staying informed through reliable platforms is crucial,” advises market analyst David Park, 2025.

Market observers continue to speculate about potential Meta stock split scenarios, particularly as share prices reach new highs and retail investor interest grows.

Factors That Could Trigger a Future Split

Traders using Quick Trading platforms should monitor several key indicators that might signal a change in Meta’s stock split policy:

- Share price reaching psychological resistance levels ($1,000+)

- Significant changes in retail investor advocacy

- Board composition shifts favoring accessibility measures

- Competitive pressure from other tech giants’ policies

- Index inclusion considerations requiring enhanced liquidity

“The key is not predicting if Meta will split, but understanding how to capitalize on the current structure while staying prepared for potential changes,” notes trading educator Amanda Foster, 2025.

FAQ

Why hasn't Meta conducted a stock split?

Meta prioritizes fundamental value growth over share price accessibility. The company believes that serious investors will invest regardless of per-share price, and focuses on buybacks and operational efficiency instead of splits.

Has META done a stock split?

No, Meta Platforms has not conducted a stock split since its IPO in 2012. This absence of historical splits adds significance to the growing buzz around a potential Meta stock split 2025. Many analysts view a future split as a landmark event given the company's consistent stock price growth and mature market presence.

Which stock will split in 2025?

Several companies are candidates, but Meta frequently tops the list. It is widely discussed in investor forums like Meta stock split Reddit and is regularly highlighted in reports by analysts tracking high-growth tech firms. Its consistently high stock price, combined with strong fundamentals, makes it a strong contender.

Can META stock reach $1000?

Yes, many market analysts believe META stock could approach or exceed the $1,000 mark based on its revenue trajectory, advancements in AI, and dominant market share across digital platforms. Reaching this psychological price level could be a major trigger for a Meta Platforms stock split announced.

Is META a good stock to buy in 2025?

Meta remains a compelling choice for 2025 due to its strong financial performance, innovation in AI and VR, and growing ad revenues. A potential stock split would be an additional indicator of management's confidence and may increase accessibility and demand, especially from retail investors.

What are expert insights on a Meta stock split?

According to equity analyst Michael Trane, "A Meta stock split wouldn't just be cosmetic. It aligns perfectly with the company’s long-term strategy to grow its shareholder base and reward loyal investors. It may also lead to improved stock liquidity, which benefits both institutional and individual investors."

How can traders prepare for a Meta stock split?

Traders can stay prepared by actively monitoring news, earnings, and any corporate announcements. Practicing on platforms like Pocket Option using a demo account is an effective way to simulate market responses and adapt to increased volatility before and after the event.

How do trading platforms handle high-priced stocks like Meta?

Professional trading platforms provide fractional share access, precise order types, and risk management tools specifically designed for high-priced equities. Features like dollar-based position sizing and fractional stop-losses become essential for effective Meta trading.

What should investors do while waiting for a potential Meta stock split?

Focus on fundamental analysis rather than split speculation. Use fractional trading capabilities, monitor quarterly earnings and growth metrics, and maintain position sizing appropriate for the current share price structure.

How does Meta's approach compare to other FAANG stocks?

Meta stands alone among FAANG companies in never conducting a stock split. Apple, Google, and Amazon have all used splits to maintain share price accessibility, while Meta relies on alternative strategies like buybacks.

What are the advantages of Meta's high share price?

High share prices can indicate strong fundamental performance, attract serious long-term investors, reduce excessive speculative trading, and demonstrate management confidence in sustained value growth.

How do I trade Meta stock without a full share purchase?

Modern trading platforms offer fractional share trading, allowing investors to purchase portions of Meta stock with smaller capital requirements. This effectively eliminates the accessibility barrier that traditional stock splits address.

Could Meta announce a stock split in 2025?

While possible, Meta has shown no historical inclination toward splits. Any change would likely require significant shifts in management philosophy or extraordinary share price levels that create genuine liquidity concerns.

How does Meta's no-split policy affect retail investors?

Higher share prices can create psychological barriers for smaller investors, though platforms like Pocket Option offer fractional trading capabilities that mitigate this issue. The main impact is reduced casual retail participation compared to split-adjusted competitors.

CONCLUSION

Meta Platforms Inc.'s decision to avoid stock splits represents a distinctive corporate philosophy that prioritizes fundamental value over accessibility optics. While this approach may limit casual retail participation, it reflects confidence in long-term value creation and attracts committed institutional investors. For individual investors, understanding these dynamics becomes crucial for effective portfolio management. Modern Quick Trading platforms have essentially eliminated the practical barriers that traditional stock splits addressed, making fractional ownership and precise position sizing more accessible than ever. The key takeaway is that successful Meta investing depends more on fundamental analysis and strategic timing than speculating about potential stock splits. Whether Meta eventually splits or maintains its current structure, informed investors will find opportunities by focusing on the company's core business performance and growth trajectory.

Start trading