- ETF uses swaps and futures to achieve -3x daily performance.

- The fund rebalances daily to maintain target leverage.

- This “daily reset” can cause compounding effects over time.

Bitcoin Inverse ETF Products With Triple Leverage: Market Analysis

A bitcoin inverse ETF 3x lets you triple your gains when Bitcoin falls — and with Pocket Option’s free demo account, you can test this high-impact strategy risk-free before trading live.

Article navigation

What Is a Bitcoin Inverse ETF 3x?

A bitcoin inverse ETF 3x is a type of leveraged crypto ETF designed to deliver -3x the daily return of Bitcoin or Bitcoin futures. If Bitcoin falls 5% in one day, the ETF should rise about 15% the same day.

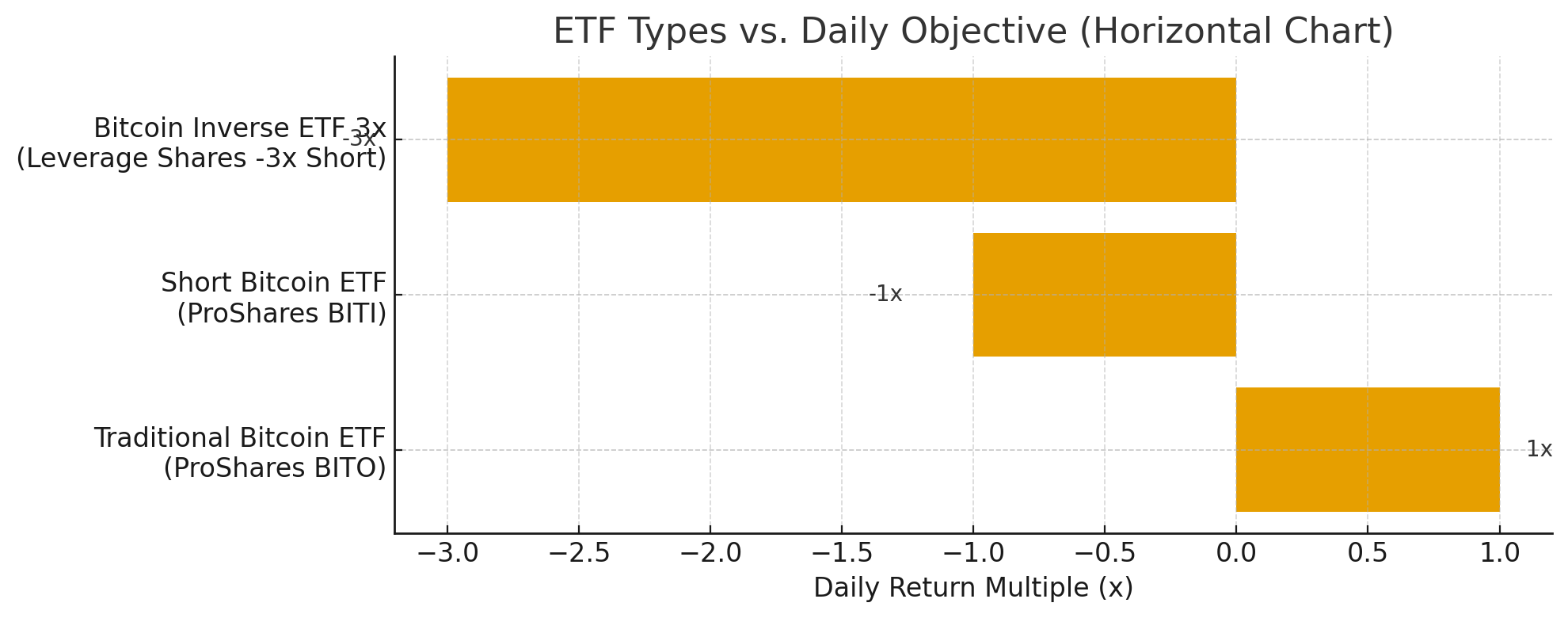

| ETF Type | Objective | Example Product |

|---|---|---|

| Traditional Bitcoin ETF | Track Bitcoin price 1:1 | ProShares BITO |

| Short Bitcoin ETF | -1x daily return | ProShares BITI |

| Bitcoin Inverse ETF 3x | -3x daily return (leveraged) | Leverage Shares -3x Short |

These ETFs are traded on major exchanges, making them accessible through standard brokerage accounts. You don’t need to short futures or manage crypto derivatives manually — the ETF handles that.

💡 Expert insight: Bloomberg Intelligence reports that demand for inverse BTC fund products has doubled year-over-year as investors hedge against volatility in the crypto market.

Leveraged Crypto ETF Trading: Opportunities and Risks

Leveraged ETFs use derivatives (like futures and swaps) to amplify daily performance. This makes them powerful tools for traders looking to profit from short-term moves — but also risky if held too long.

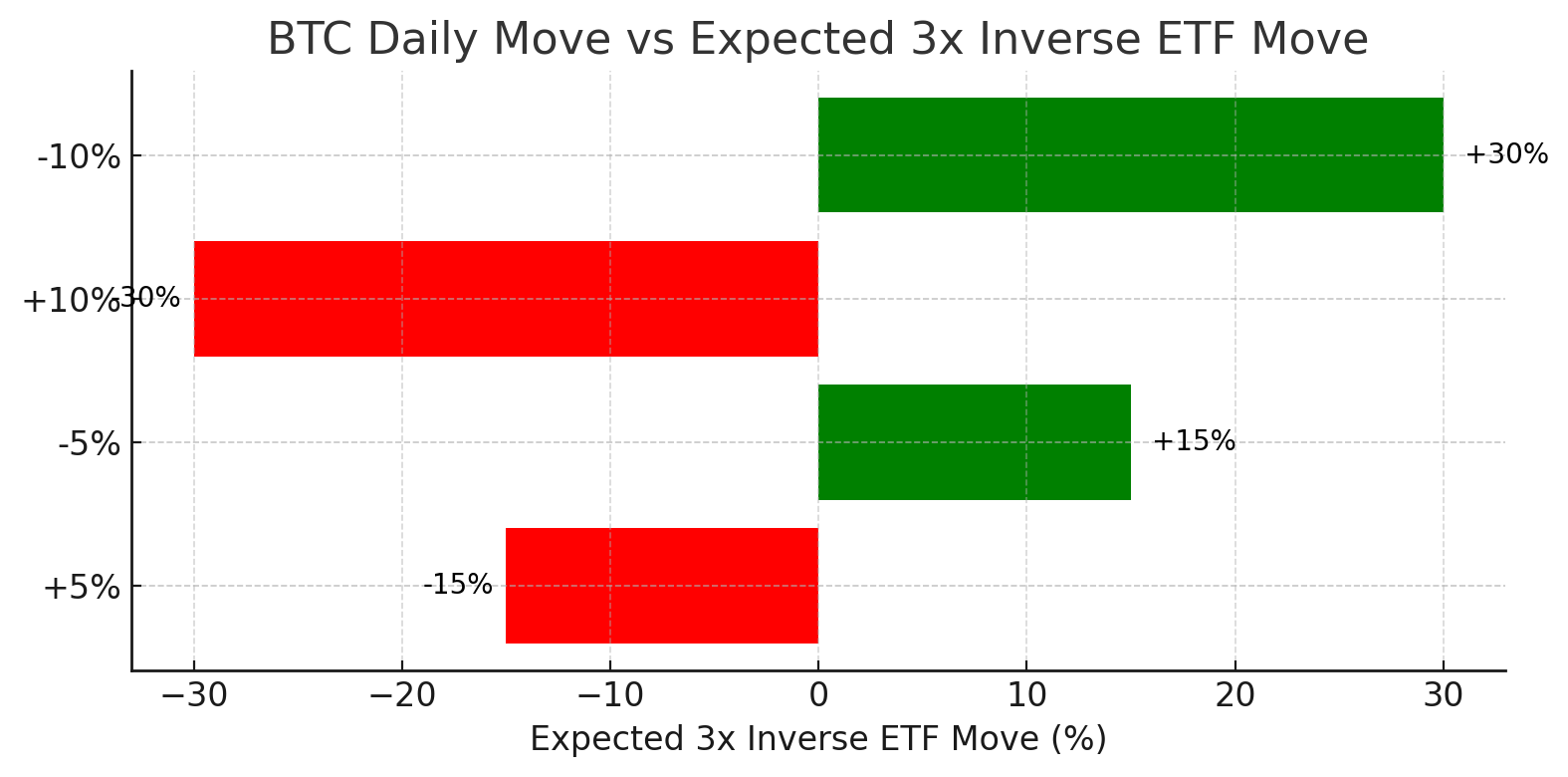

How 3x Leverage Works

| Scenario (BTC Daily Move) | Expected 3x Inverse ETF Move |

|---|---|

| +5% | ≈ -15% |

| -5% | ≈ +15% |

| +10% | ≈ -30% |

| -10% | ≈ +30% |

⚠️ Morgan Stanley warns that leveraged crypto ETF products should be used for short-term tactical trades — not long-term holding — because daily rebalancing can lead to unexpected results in sideways or volatile markets.

Short Bitcoin ETF and Hedging Strategies

A short bitcoin ETF allows traders to profit when Bitcoin declines without opening a futures account or margin position. For instance, ProShares BITI provides -1x daily return of Bitcoin futures, while leverage shares -3x short products magnify the move threefold.

Practical Use Cases

- Hedging: If you hold spot Bitcoin and fear a short-term drop, you can buy a bitcoin inverse ETF 3x to offset potential losses.

- Speculation: Expecting a big market sell-off? A leveraged crypto ETF can magnify gains from that move.

- Portfolio Diversification: Inverse BTC fund positions can balance a portfolio heavily exposed to crypto.

✔️ Real trader feedback:

“I use short bitcoin ETFs to protect my long-term holdings. When BTC drops sharply, my hedge often covers 70–80% of the loss.” — Daniel, swing trader

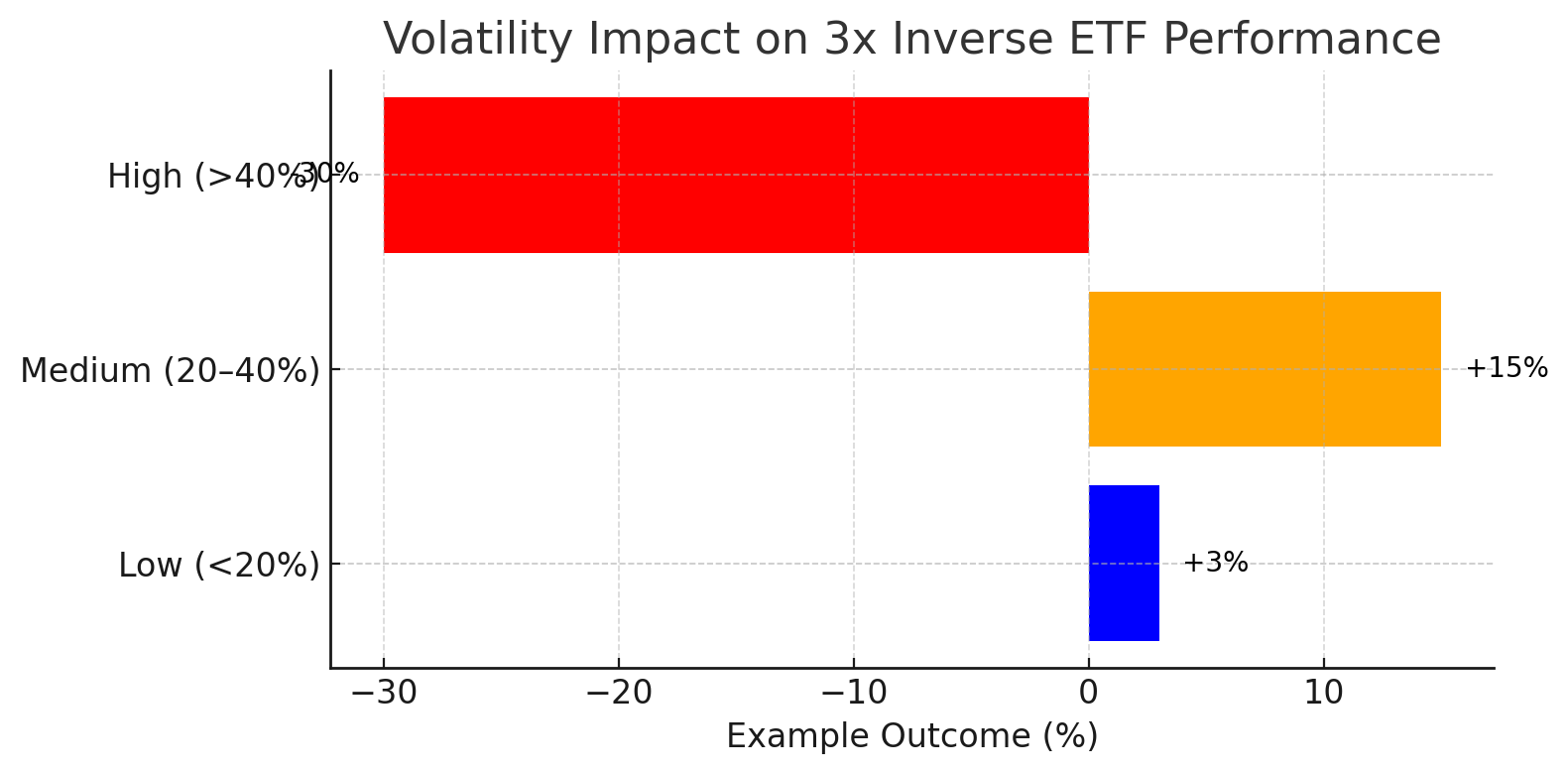

Volatility: Friend or Foe?

Bitcoin is one of the most volatile assets globally, with a 30-day average volatility near 42% in 2024 (Kaiko data). This volatility creates both opportunities and risks for ETF trading:

- ✅ Opportunity: Large price swings mean big potential profits for correctly timed trades.

- ❌ Risk: Rapid reversals can trigger stop-outs and compounding losses.

| Volatility Level | Market Impact on 3x ETFs | Example Outcome |

|---|---|---|

| Low (<20%) | Small daily moves, low profit potential | +3% ETF gain on -1% BTC |

| Medium (20–40%) | Predictable swings allow tactical plays | +15% ETF gain on -5% BTC |

| High (>40%) | Extreme price shocks can lead to large gains or wipeouts | -30% ETF loss on +10% BTC |

📉 Key takeaway: Volatility is the lifeblood of leveraged ETF trading — but risk management is essential.

Pocket Option Advantage for ETF Traders

Pocket Option doesn’t offer a Bitcoin inverse ETF 3x — but you can trade Bitcoin and 100+ other assets right now! 📈 Simply predict whether the price will rise or fall in the next few seconds or minutes and earn up to 92% profit for a correct forecast. Deals start from just $1, making it easy to test your strategy and grow your skills in a real market environment.

Why Use Pocket Option

- ✔️ AI Trading – Automate trades with algorithmic strategies ⚡

- ✔️ Social Trading – Copy top ETF and crypto traders in one click

- ✔️ Signal Telegram Bot – Get real-time alerts for market moves

- ✔️ Tournaments – Compete for prizes and sharpen your skills 🏆

- ✔️ $5 Minimum Deposit – Start small, scale as you gain confidence

- ✔️ Unlimited Demo Account – Test without risking capital

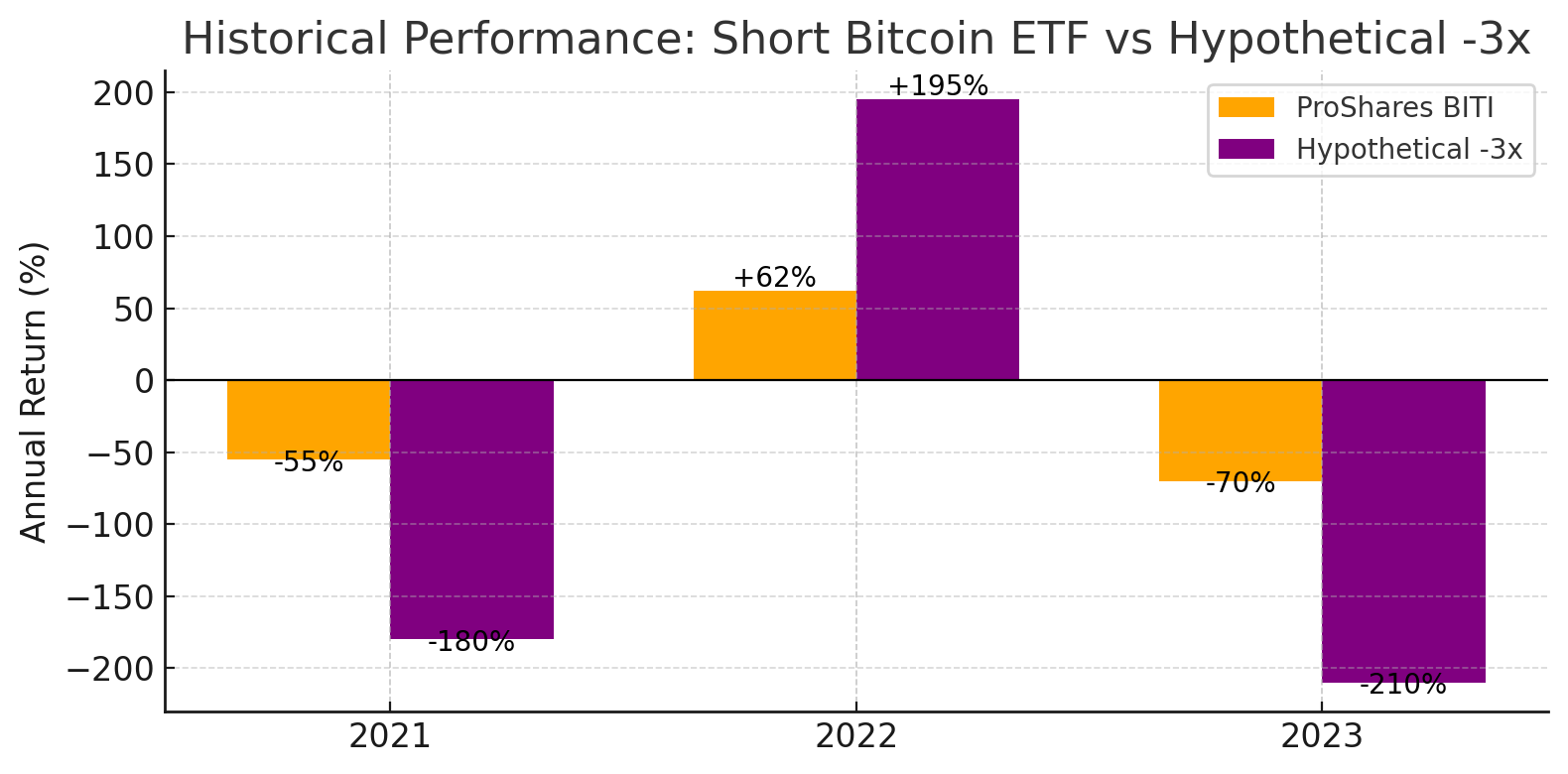

Historical Performance of Inverse ETFs

Reviewing historical performance helps set realistic expectations.

| Year | BTC Annual Return | ProShares BITI (approx.) | Hypothetical -3x Return |

|---|---|---|---|

| 2021 | +60% | -55% | -180% |

| 2022 | -65% | +62% | +195% |

| 2023 | +155% | -70% | -210% |

💡 Observation: The compounding effect means that long holding periods can produce results far from -3x of the total move. These funds are designed for daily performance, not multi-month exposure.

Strategies for Using Bitcoin Inverse ETF 3x

Here are three practical strategies for traders:

- Intraday Trading: Use bitcoin inverse ETF 3x to capture intraday drops when BTC is overbought.

- Volatility Breakouts: Enter positions after big news events (FOMC decisions, ETF approvals).

- Hedging During Risk Events: Hedge during CPI data releases or crypto exchange stress events.

📈 Pro tip: Always set position size small — many pros risk no more than 1–2% of portfolio per trade on leveraged crypto ETF positions.

Future of Crypto Derivatives and ETF Market

The ETF space continues to expand as regulators approve more crypto products. Experts expect:

- 📊 Growth of Leveraged ETFs: More 2x and 3x Bitcoin and Ethereum products.

- 🔄 Better Liquidity: Increased participation from institutional investors.

- 🛡 Hedging Tools: Advanced inverse BTC fund options for portfolio protection.

“We believe the next wave of innovation will be cross-asset crypto derivatives ETFs, giving traders more flexibility,” says ARK Invest.

FAQ

What is a Bitcoin inverse ETF?

A Bitcoin inverse ETF is an exchange-traded fund designed to deliver the opposite performance of Bitcoin or Bitcoin futures. If Bitcoin falls 5% in a day, the ETF aims to rise about 5%, letting investors profit from downward price moves without shorting futures directly.

How does a 3x leveraged ETF work?

A 3x leveraged ETF uses derivatives such as swaps and futures to provide three times the daily return of the underlying asset. For example, if Bitcoin falls 2% in a day, a bitcoin inverse ETF 3x would aim to rise roughly 6% — but it resets daily, so performance can diverge over time.

Is there a Bitcoin short ETF?

Yes — products like ProShares BITI provide -1x daily performance of Bitcoin futures, and leverage shares -3x short ETFs offer amplified short exposure for more aggressive traders.

Can I hold a bitcoin inverse etf 3x as a long-term investment?

These products are not recommended for long-term holding as daily rebalancing and the effects of compounding typically cause their performance to diverge significantly from simply multiplying Bitcoin's inverse performance by three over extended periods.

Are platforms like Pocket Option suitable for trading these products?

Platforms like Pocket Option may offer ways to gain leveraged exposure to Bitcoin price movements, but investors should carefully evaluate fee structures, execution capabilities, and regulatory protections before trading complex products on any platform.

CONCLUSION

Bitcoin inverse ETF 3x products unlock unique opportunities for traders who can time the market — but they also carry amplified risks that demand discipline and strategy. By using tools like Pocket Option’s unlimited demo account, AI Trading, and real-time signals, you can practice, refine, and execute your approach with confidence before risking real capital. 📊 Smart preparation turns volatility from a threat into an opportunity.

Start trading