-

EUR/USD

The most traded currency pair in the world — euro versus US dollar. Known for its high liquidity and tight spreads, making it ideal for short-term trades. EUR/USD respects classic support/resistance levels, which is why it’s a favorite among day traders.

-

Cardano (ADA) OTC

A popular cryptocurrency available 24/7 on Pocket Option through OTC markets. Perfect for weekend trading and strategy testing. Cardano is known for its volatility and strong price swings, offering opportunities for scalping and momentum strategies.

-

Platinum Spot OTC

A commodity asset tracking the spot price of platinum. Traders use it to diversify portfolios and hedge against inflation. Platinum often moves faster than gold or silver, making it attractive for those looking for strong trend moves.

-

AUD/CHF

The Australian dollar versus Swiss franc pair. It reacts to commodity market news (AUD) and Swiss economic data (CHF). This pair is favored by traders who prefer smoother, less volatile charts and well-defined trends.

How Much Can You Make Day Trading? Discover Real Incomes, Tools, and Tactics

Wondering how much can you make day trading? This guide reveals realistic earning potential, expert strategies, and practical tips to help you start trading smarter with platforms like Pocket Option.

Article navigation

- Start trading

- Understanding Day Trading

- Traits of a Successful Day Trader

- How Much Can You Make Day Trading?

- Day Trader Salary vs. Other Incomes

- Choosing the Right Day Trading Platform

- Best Trading Strategies for Day Traders

- Using Leverage Wisely

- Risk Management — The Secret Weapon

- Evaluating Your Performance

- Realistic Expectations & Long-Term Growth

Understanding Day Trading

Day trading means buying and selling financial instruments — like stocks, forex, or crypto — within the same trading day. The goal is to capitalize on short-term price movements, avoid overnight risk, and secure consistent day trading income. A winning approach requires a plan, emotional discipline, and constant learning.

📊 Overview of Popular Assets on Pocket Option

Traits of a Successful Day Trader

- Discipline & Focus: Professional day traders stay calm under pressure.

- Risk Management: Limiting each trade to 1–2% of capital.

- Market Awareness: Staying updated on economic news and stock market trends.

- Consistency: Reviewing trades and refining strategies daily.

💡 Expert Insight: “Profitable traders treat day trading like a business — not a lottery ticket. Consistency matters more than a single big win,” — Laura Gomez, Bloomberg columnist.

Learn day trading strategies on Pocket Option and test them for free on a demo account!

How Much Can You Make Day Trading?

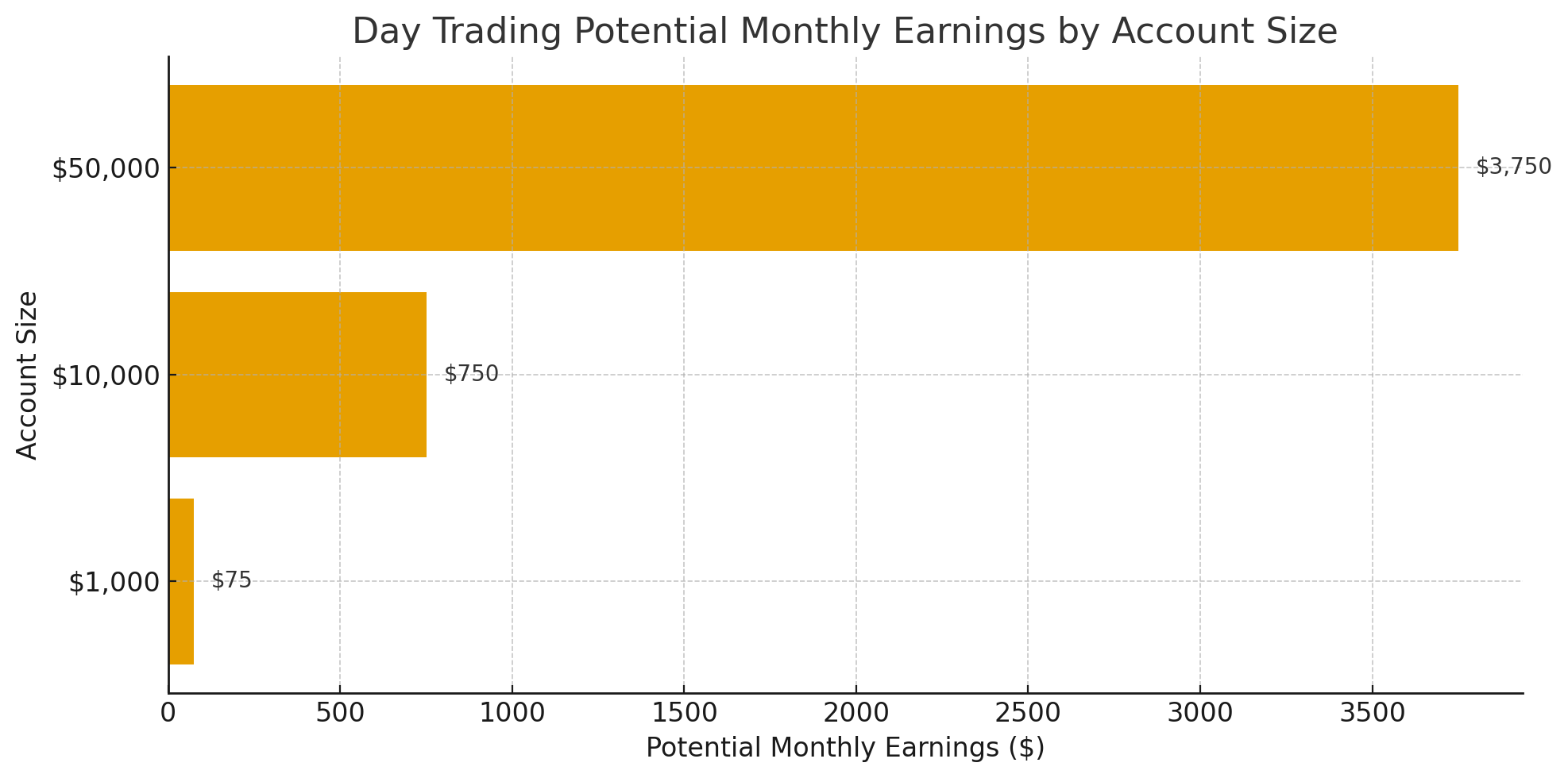

There’s no magic number — your earnings depend on account size, trading strategy, and emotional control. Below is a realistic look at potential profits from day trading:

| Account Size | Risk Per Trade | Expected Monthly ROI | Potential Monthly Earnings |

|---|---|---|---|

| $1,000 | 1% | 5–10% | $50 – $100 |

| $10,000 | 1% | 5–10% | $500 – $1,000 |

| $50,000 | 1% | 5–10% | $2,500 – $5,000 |

📈 Expert Quote: “Aim for consistent 5–10% returns monthly — compounding is your best friend,” — Kevin Brooks, CFA, MarketWatch.

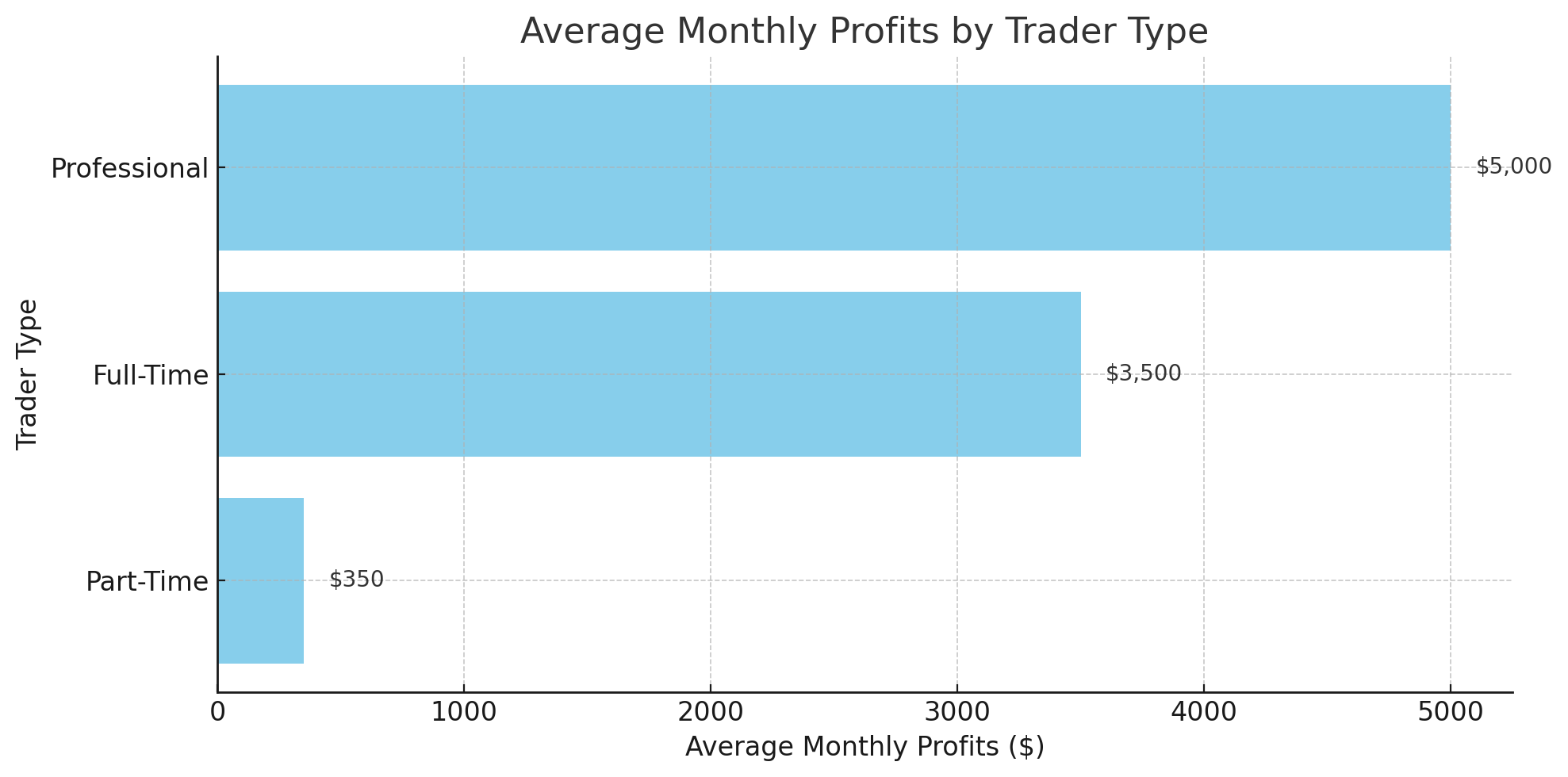

Day Trader Salary vs. Other Incomes

Day trader salary is variable — some months can outperform a 9–5 job, others may be break-even or slightly negative.

| Trader Type | Hours per Week | Average Monthly Profits |

|---|---|---|

| Part-Time | 5–10 hrs | $200 – $500 |

| Full-Time | 20–40 hrs | $2,000 – $5,000 |

| Professional | 40+ hrs | $5,000+ |

🎯 Key Takeaway: Treating trading as a business allows your earnings to grow beyond a fixed salary over time.

Choosing the Right Day Trading Platform

Execution speed and tools matter. Pocket Option offers:

- 100+ assets (stocks, forex, crypto) 24/7

- AI Trading 🤖 to automate winning strategies

- Telegram Signal Bot ⚡ for instant alerts

- Social Trading – copy top-performing traders

- Trading tournaments with real prizes 🏆

- $5 minimum (the amount may vary depending on the geo and payment method) deposit & free demo account

💬 Trader Review: “I started with $5 on Pocket Option and turned it into $80 in one weekend. The social trading feature helped me learn fast.” — Chris L.

📊 Example Trade:

EUR/USD is trending up during the London session. Price breaks above 1.0850, retests it, and shows a bullish candle. You enter Higher with a 3-minute expiration. The price closes above the entry level — trade ends in profit.

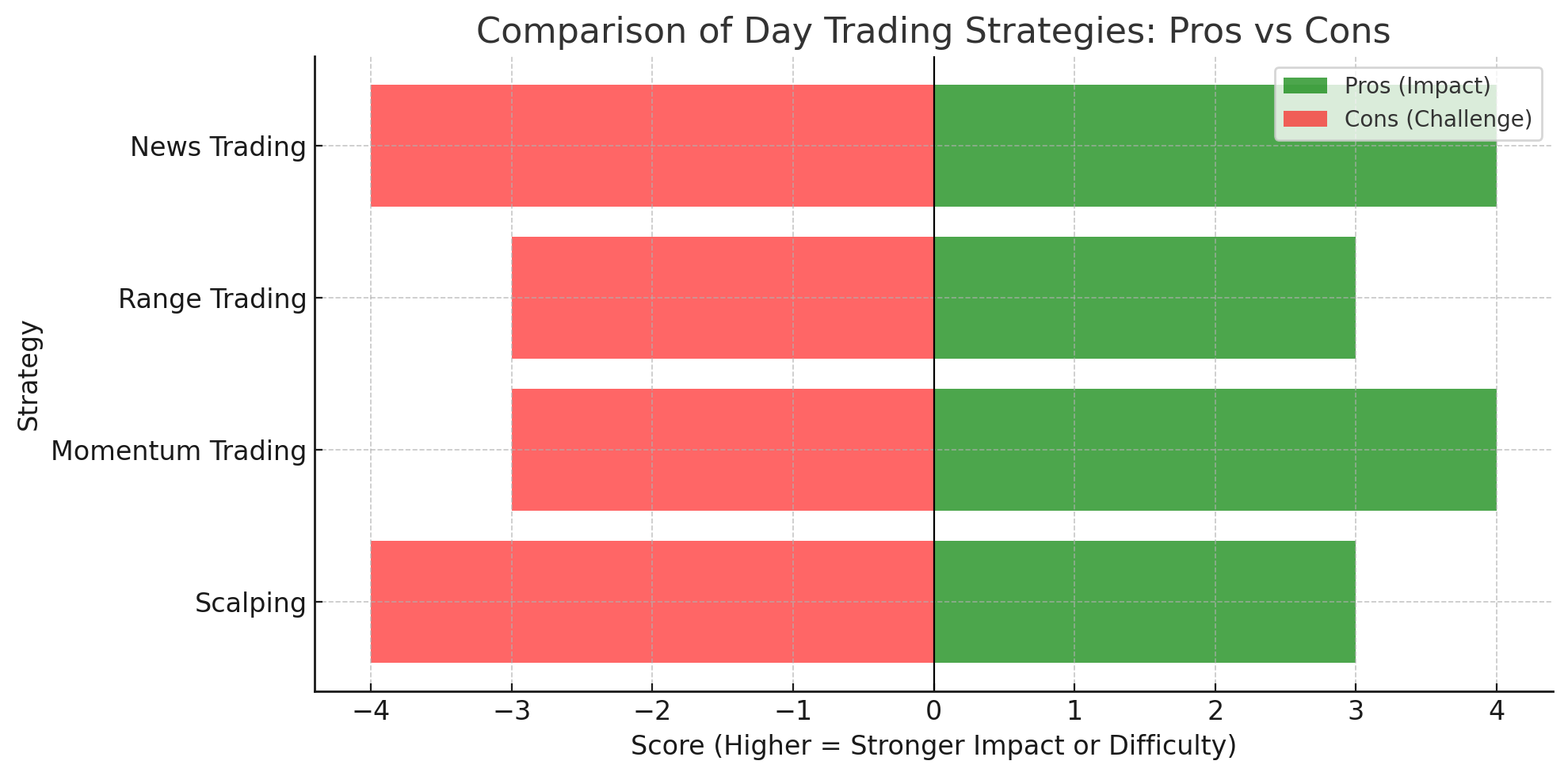

Best Trading Strategies for Day Traders

| Strategy | Best For | Pros | Cons |

|---|---|---|---|

| Scalping | Fast movers | Many small profits | High commissions can eat returns |

| Momentum Trading | Trending markets | Large wins possible | Risk of late entries |

| Range Trading | Sideways markets | Clear risk levels | Breakouts can trigger losses |

| News Trading | Economic events | High volatility moves | Requires fast reaction |

💡 Expert Tip: “Keep a journal. Document every trade and emotion — you’ll spot patterns you can fix,” — Maya Stern, trader & coach.

One of the fastest methods for active traders is the 5-second strategy — check out the full guide on Pocket Option’s blog here.

Using Leverage Wisely

Leverage is one of the most powerful — and dangerous — tools in day trading. It allows traders to control a much larger position with a relatively small amount of capital. For example, with 5:1 leverage, a $1,000 account can control $5,000 worth of assets. This means even a small 2% market move could result in a $100 gain — or a $100 loss — which is 10% of your entire account.

To use leverage effectively:

- Set strict stop-losses to protect capital when trades go against you.

- Limit leverage to 2–3x until you have a consistent profitable record.

- Avoid over-leveraging after losing trades — revenge trading can wipe an account quickly.

- Combine leverage with risk management so no single trade risks more than 1–2% of account equity.

💡 Expert Insight: “Leverage is a double-edged sword — it can accelerate growth but also accelerate failure. Control position sizing before chasing larger profits,” — Ethan Moore, senior trader at AlphaDesk.

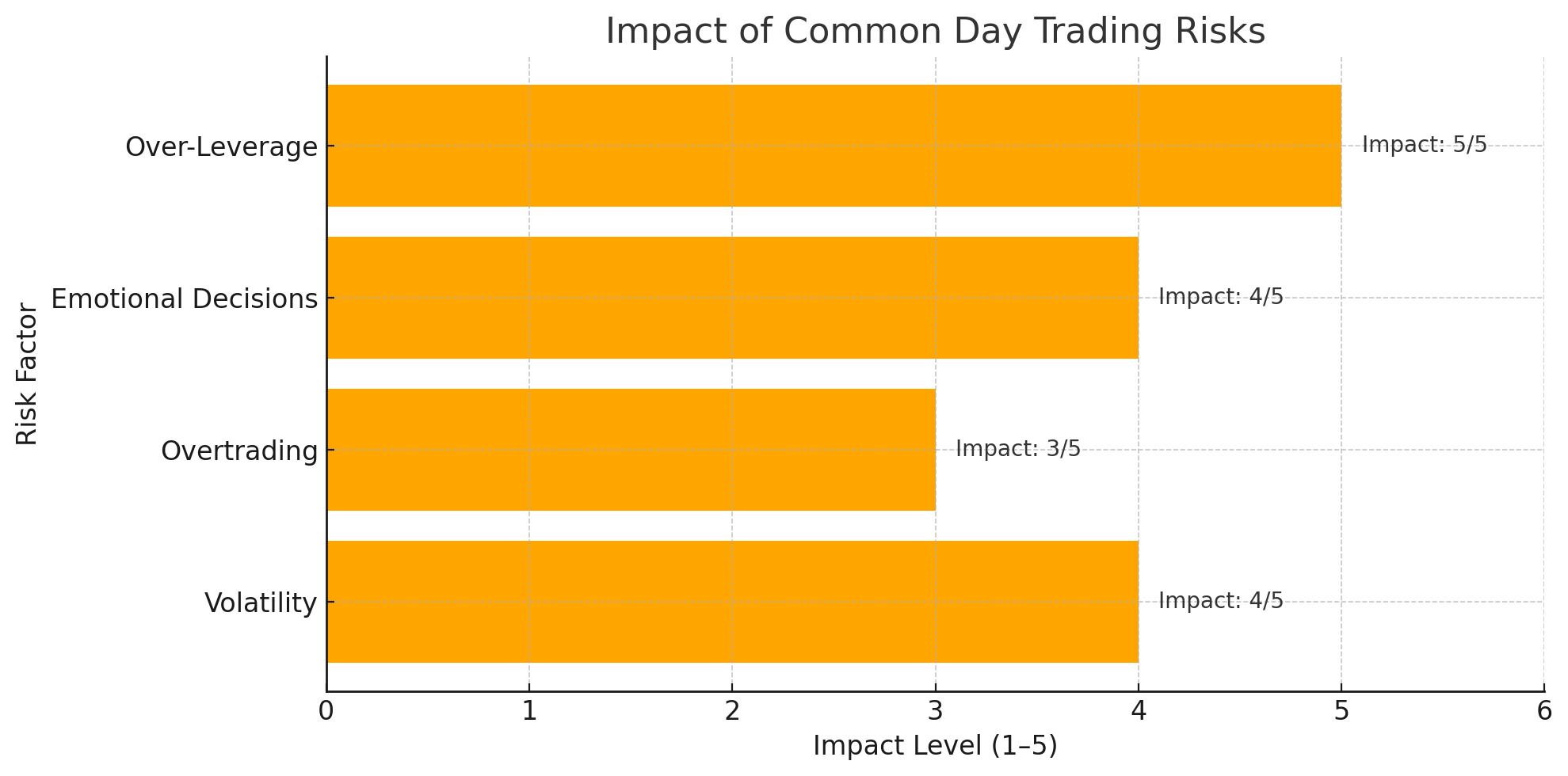

Risk Management — The Secret Weapon

| Risk | Impact | Solution |

|---|---|---|

| Volatility | Unexpected losses | Use stop-losses & proper lot sizes |

| Overtrading | Account drawdown | Trade only A+ setups |

| Emotional Decisions | Revenge trades | Step away after 2 losses |

| Over-Leverage | Total account loss | Limit leverage to 2–3x |

✅ Pro Advice: Risk no more than 1–2% of your account per trade.

Evaluating Your Performance

Evaluating your performance is a critical habit for every serious trader. Keeping detailed records helps you spot what’s working and what isn’t, turning random trading into a measurable process.

| Metric | Why It Matters | How to Track |

| Win/Loss Ratio | Shows if strategy is profitable | Count winning vs. losing trades weekly |

| Average Gain vs. Loss | Reveals risk/reward balance | Calculate average $ gained per win vs. lost per loss |

| Risk per Trade | Keeps losses controlled | Ensure each trade risks ≤2% of equity |

| Adherence to Plan | Builds discipline | Mark whether each trade followed rules |

📊 Expert Insight: “Regular reviews are what turn beginners into consistent earners. The best traders act like scientists — they collect data, analyze patterns, and adjust,” — Sarah N., financial educator.

Realistic Expectations & Long-Term Growth

Many new traders ask: how much can you make day trading in your first year? Expect break-even or small profits at first. Your first 6–12 months are for learning — consider them tuition.

💡 Veteran Insight: “I lost for 3 months straight before I turned profitable. Discipline was the game-changer,” — Mark D., full-time trader.

FAQ

How much does an average day trader make?

According to industry data, average day trader earnings range between $50 and $500 per day, depending on account size, leverage, and trading strategies.

Can you make a living from day trading?

Yes — many full-time traders do. However, it requires consistent discipline, risk management, and at least a medium-sized account to cover monthly living expenses.

What is a realistic income from day trading?

A realistic target is 5–10% monthly ROI. On a $10,000 account, that’s $500–$1,000 per month — enough to supplement income, and potentially grow into a full-time day trader salary over time.

How long does it take to become profitable at day trading?

Most successful traders need 6-12 months of consistent practice to develop profitable strategies and emotional control.

What are the most profitable day trading strategies?

Trend following, breakout trading, and price action strategies can be profitable when properly executed with strong risk management.

Final Tips for Maximum Profits

Day trading can be one of the most rewarding ways to participate in the stock market — if you approach it with discipline, patience, and a solid plan. This guide showed you how much can you make day trading, what realistic day trading income looks like, and how to manage risk while applying proven trading strategies. Whether you are starting with a small account or aiming to grow into a full-time career, consistency and risk management are your best allies. Platforms like Pocket Option make the process more accessible with their free demo, AI Trading, and 24/7 access to 100+ assets. Focus on learning, improving step by step, and staying disciplined — profits from day trading will follow.

Start trading