- Ultra-short trade duration – Each position opens and closes within just 60 seconds.

- High trading frequency – Enables multiple entries per session due to rapid cycle times.

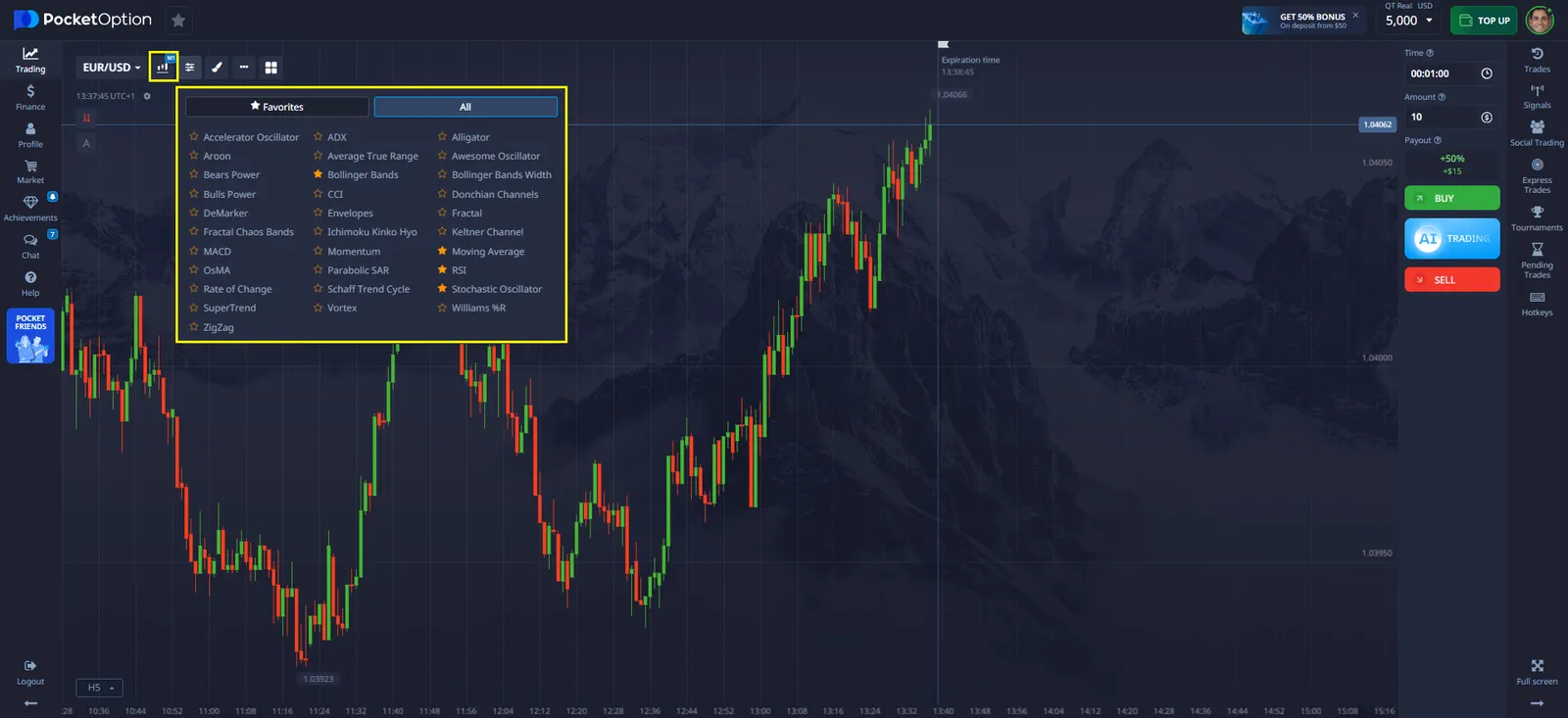

- Reliance on technical indicators – Strategy execution depends on tools like RSI, EMA, and Bollinger Bands, as well as key support/resistance levels.

- Fast decision-making – Success requires quick reactions to evolving chart conditions.

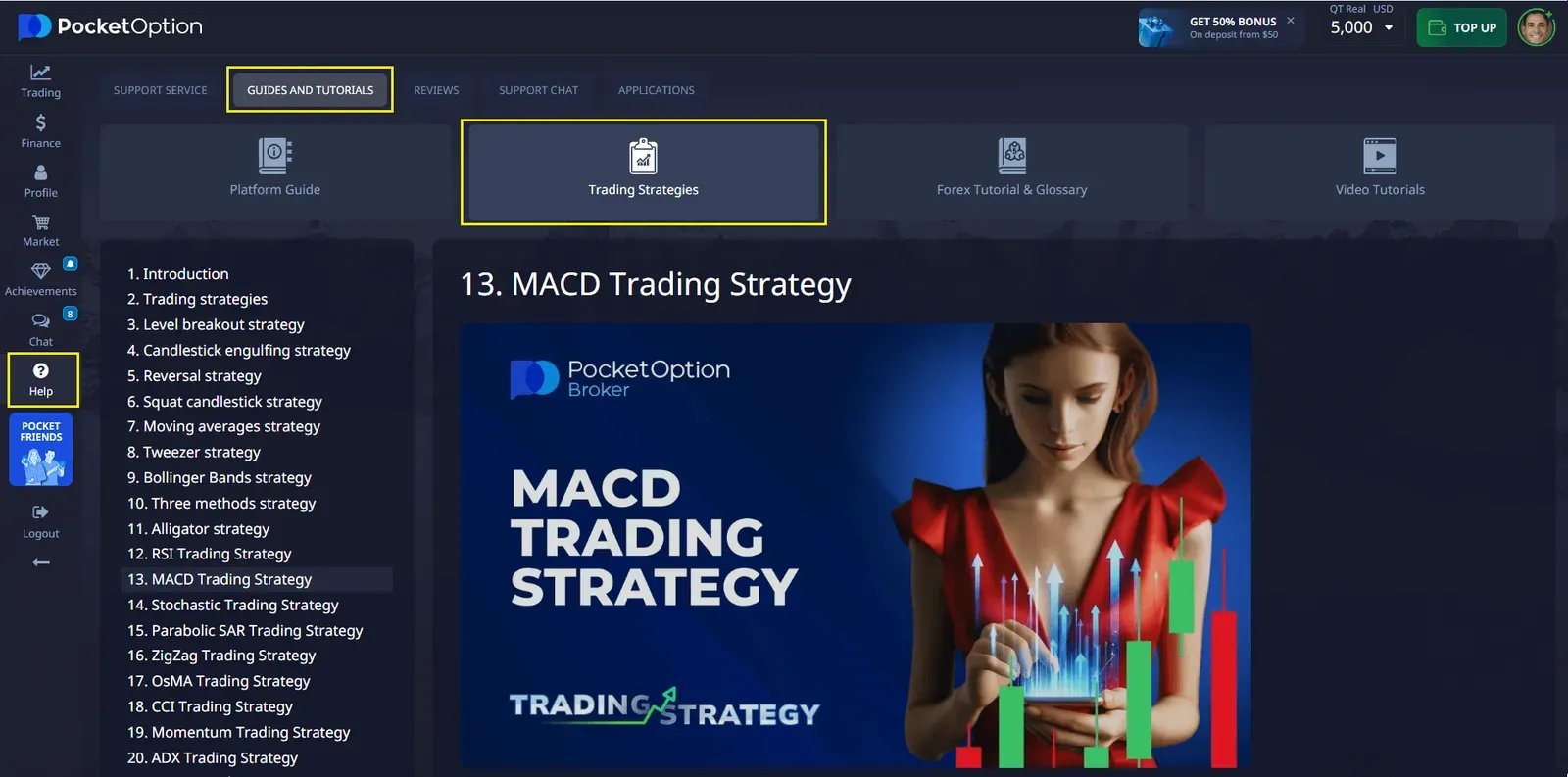

- Built-in learning resources – The platform’s “Guides & Tutorials” section offers step-by-step instructions for indicator setup and usage.

The Pocket Option 1 minute scalping strategy offers an efficient way to trade short-term price movements using 60-second positions. This method is built for fast-paced execution, requiring sharp focus, technical precision, and disciplined risk control. When applied properly, it can deliver consistent results and accelerate trader development.

How the Pocket Option 1-Minute Scalping Strategy Works

Unlike traditional approaches that hold trades for hours, the Pocket Option 1 min scalping strategy focuses on ultra-fast execution — trades last exactly 60 seconds. It’s similar to high-frequency trading adapted for individual traders.

Key Features of the 1-Minute Strategy

Risk: Trading on a 1-minute timeframe can involve higher volatility due to the rapid market movements that occur in a short period. This means that while you may have the opportunity to secure quick profits, you also need to be prepared for sudden market fluctuations that could lead to losses.

Try on demo! At Pocket Option, we offer a range of analytical tools and risk management features, helping you monitor the market in real time and set stop-loss orders to minimize potential risks. It’s important to thoroughly understand the strategy and manage your risk carefully before engaging in short-term trading.

Technical Setup for Pocket Option 1-Minute Trading

Due to high market noise on short timeframes, the Pocket Option 1 minute trading strategy relies on specially optimized indicators. Here’s a setup proven across 10,000+ trades:

- Moving Averages (EMA): 5, 10, and 21 periods. Entry signal occurs when price crosses EMA(5).

- Bollinger Bands: Period 20, deviation 2.0. Band touches signal likely reversal zones.

- RSI: 7-period with adjusted 40/60 levels to improve signal speed.

- Volume: Use 10-period average. Look for spikes above 150% to confirm breakout momentum.

This strategy emphasizes indicator confluence rather than isolated readings. When multiple conditions align — such as RSI under 30, price near the lower Bollinger Band, and low selling volume near EMA(21) — the trade setup has a documented 70%+ win rate.

On 1-minute charts, price reflects liquidity shifts and retail behavior, not news events. This makes it ideal for identifying recurring micro-patterns, the core of the Pocket Option 1 minute scalping method.

Example Trade Using the 1-Minute Strategy

Here’s how a real 60-second trade might look using RSI as the main signal:

Trade Details

- Asset: EUR/USD

- Timeframe: 1 minute

- Indicator: RSI (7)

- Signal: RSI falls below 30 (indicating possible upward reversal)

- Amount: $5

- Result: Trade closed in profit

Trade Process

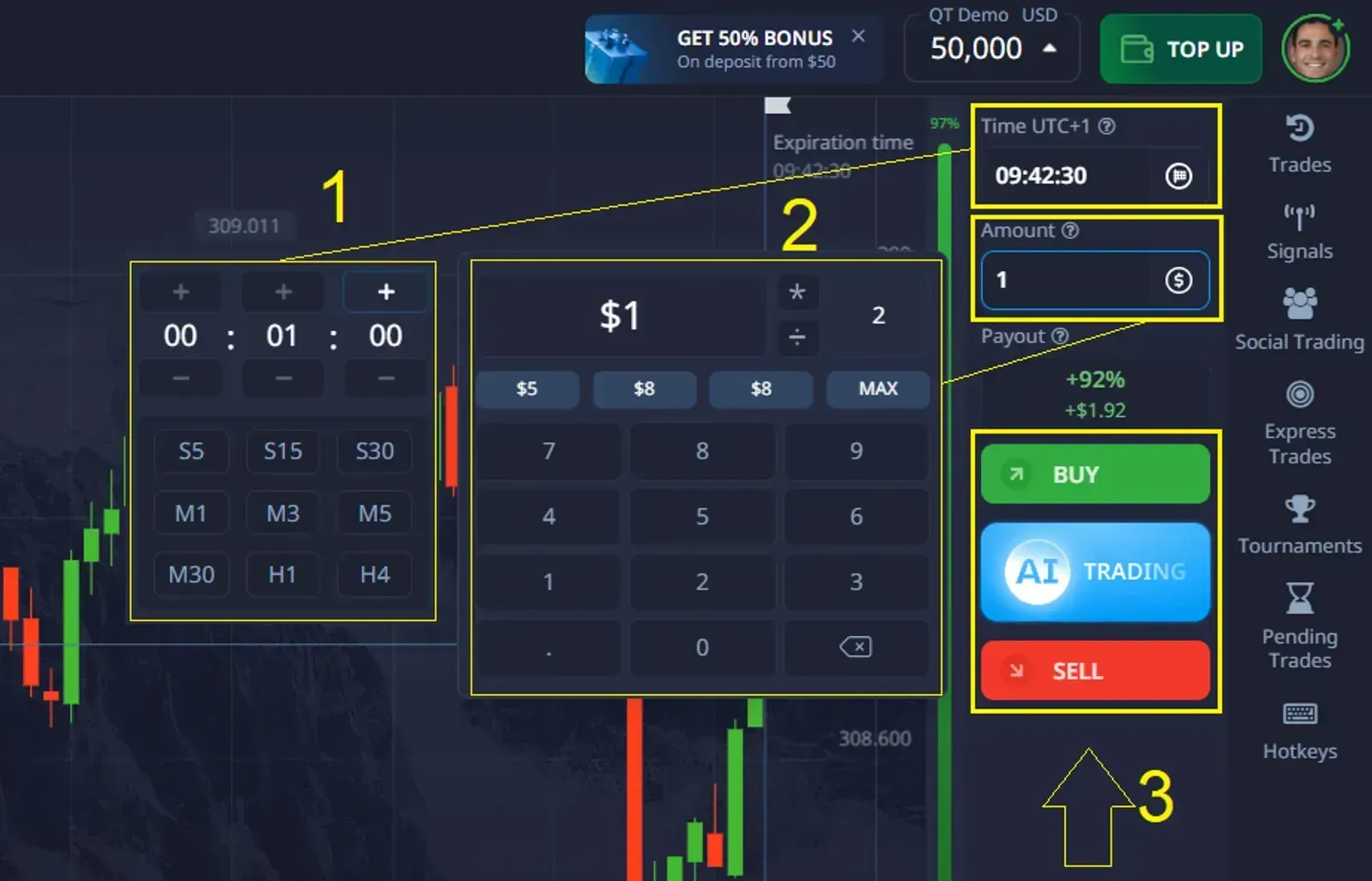

- Launch the Pocket Option platform and select the EUR/USD currency pair.

- Set trade duration to 60 seconds.

- Add the RSI indicator from the platform’s indicators menu.

- Wait for the RSI line to dip below 30 — signaling potential for price to rise.

- Once confirmed, open a Buy (UP) trade.

- After 60 seconds, the trade auto-closes. If price moved higher, you gain a profit.

This is a simple yet effective way to practice the Pocket Option 1 minute scalping setup on a demo account before going live.

Practical Risk Management Tips

To stay consistent with the Pocket Option 1 min trading approach, apply these risk rules:

- Risk only 1% of your account per trade

- Stop trading for the day after a 5% loss

- Take a 30-minute break after 3 losing trades in a row

- Keep a trade journal: note pattern used, time, result, and emotional state

This builds long-term consistency and prevents emotional overtrading.

Conclusion

The Pocket Option 1 minute trading strategy is a precise, fast-paced method that rewards discipline and technical accuracy. While it’s not suitable for everyone, those willing to invest time into training and structured testing can achieve 70%+ win rates.

Rather than looking for shortcuts, successful scalpers build a framework — combining patterns, risk control, and emotional stability. With Pocket Option’s fast execution, chart tools, and demo features, you have the environment needed to apply this method properly.

FAQ

What is the Pocket Option 1-minute scalping strategy?

It’s a fast-paced trading method using 60-second trades based on technical indicators and quick decision-making.

Is 1-minute trading risky?

1-minute trading involves fast market movements and higher volatility — offering quick profit potential but also increased risk. Pocket Option provides real-time analysis tools and risk controls to help you stay protected. Always understand the strategy and manage risk before trading short-term.

Which indicators are best for 1-minute scalping?

Traders often use RSI, Bollinger Bands, EMA, and volume — optimized for short-term signals.

Can beginners use this strategy?

Absolutely — it’s best to start on a demo account and master the setups before trading live.

How many trades can I make per session?

Depending on market conditions, you can place 10–20 trades in a single hour using this method.