- ระบุแนวโน้มของตลาดและทิศทางการเคลื่อนไหวของราคา

- กำหนดจุดเข้าและออกอย่างแม่นยำ

- กรองเสียงรบกวนในตลาดและมุ่งเน้นไปที่การเคลื่อนไหวของราคาอย่างมีนัยสำคัญ

- สร้างระดับการสนับสนุนและความต้านทานอย่างมีพลศาสตร์

- สร้างสัญญาณซื้อและขายผ่านกลยุทธ์การข้าม

การวิเคราะห์การซื้อขายในวันด้วย EMA อย่างละเอียด

Article navigation

- ค่าเฉลี่ยเคลื่อนที่แบบเอ็กซ์โพเนนเชียล (EMA) คืออะไร และทำไมเทรดเดอร์ในวันจึงใช้ค่าเฉลี่ยเคลื่อนที่

- การตั้งค่า EMA ที่ดีที่สุดและการกำหนดค่าเฉลี่ยเคลื่อนที่สำหรับการเทรดในวัน

- การตั้งค่า EMA สำหรับการเทรดในวันบนแพลตฟอร์ม Pocket Option

- ข้อดีและความเสี่ยงของกลยุทธ์การเทรดในวันด้วย EMA

- ประสบการณ์จริงจากผู้ใช้: เทรดเดอร์ใช้ EMA บน Pocket Option อย่างไร

- EMA เทียบกับตัวบ่งชี้ทางเทคนิคอื่น ๆ: การวิเคราะห์เปรียบเทียบ

- กลยุทธ์ค่าเฉลี่ยเคลื่อนที่ขั้นสูงสำหรับความสำเร็จในการเทรดในวัน

- แนวปฏิบัติที่ดีที่สุดในการวิเคราะห์ทางเทคนิคสำหรับการเทรดในวันด้วย EMA

- บทสรุป: การเชี่ยวชาญใน EMA สำหรับการเทรดในวันที่ประสบความสำเร็จ

ค่าเฉลี่ยเคลื่อนที่แบบเอ็กซ์โพเนนเชียล (EMA) คืออะไร และทำไมเทรดเดอร์ในวันจึงใช้ค่าเฉลี่ยเคลื่อนที่

ค่าเฉลี่ยเคลื่อนที่แบบเอ็กซ์โพเนนเชียล (EMA) เป็นประเภทของค่าเฉลี่ยเคลื่อนที่ ที่มีการปรับปรุงซึ่งให้ความสำคัญกับข้อมูลราคาล่าสุดมากกว่าค่าเฉลี่ยเคลื่อนที่แบบง่าย (SMA) ตัวบ่งชี้ทางเทคนิคนี้ทำให้เหมาะสำหรับการเทรดในวันซึ่งความเร็วในการตอบสนองต่อการเคลื่อนไหวของราคาเป็นสิ่งสำคัญ

เทรดเดอร์ในวันใช้ค่าเฉลี่ยเคลื่อนที่ โดยเฉพาะ EMA เพื่อ:

แตกต่างจาก SMA ค่าเฉลี่ยเคลื่อนที่แบบเอ็กซ์โพเนนเชียลสะท้อนการเปลี่ยนแปลงราคาจริงได้ดีกว่า ทำให้เทรดเดอร์ตอบสนองได้เร็วขึ้นต่อแนวโน้มตลาดที่รวดเร็ว ความล่าช้านี้ทำให้ EMA เป็นตัวบ่งชี้ที่เหนือกว่าสำหรับ กลยุทธ์การเทรดที่กระตือรือร้น

💬 “ในตลาดที่เคลื่อนไหวอย่างรวดเร็ว EMA ที่ปรับแต่งอย่างเหมาะสมจะให้คุณได้เปรียบในการมองเห็นการหมดแรงของแนวก่อนที่ราคาจะพลิกกลับ มันไม่สามารถคาดการณ์ได้—แต่สามารถคาดการณ์ได้” — ดร. ลีโอ แอนเดอร์เซน, นักวิเคราะห์เชิงปริมาณ, Tokyo Asset Group

การตั้งค่า EMA ที่ดีที่สุดและการกำหนดค่าเฉลี่ยเคลื่อนที่สำหรับการเทรดในวัน

ไม่มีมาตรฐานสากลสำหรับการใช้ EMA ในการเทรดในวัน แต่เทรดเดอร์ที่มีประสบการณ์มักจะกลับไปใช้การรวมกันของค่าเฉลี่ยเคลื่อนที่ที่พิสูจน์แล้วในกรอบเวลาที่แตกต่างกัน

💡 ข้อมูลเชิงลึก 1: ความเข้มของแนวโน้มมีความสำคัญมากกว่าการข้าม มุมที่เฉียบคมบน 21 EMA มักจะให้สัญญาณที่เชื่อถือได้มากกว่ารูปแบบการข้ามแบบง่าย

การตั้งค่า EMA ทั่วไปสำหรับกลยุทธ์การเทรดที่แตกต่างกัน

| ความยาว EMA | กรณีการใช้งาน | กรอบเวลา | สไตล์การเทรด |

|---|---|---|---|

| 9 EMA | การตรวจจับโมเมนตัมที่รวดเร็วสำหรับการสเกลปิ้ง | กราฟ 1m–5m | การสเกลปิ้ง, การเข้า/ออกอย่างรวดเร็ว |

| 21 EMA | การยืนยันแนวโน้มระยะสั้น | กราฟ 5m–15m | การเทรดสวิงในวัน |

| 50 EMA | ตัวกรองอคติทิศทาง, การสนับสนุน/ความต้านทานแบบพลศาสตร์ | กราฟ 15m–1h | การกรองตำแหน่ง |

| 200 EMA | ตัวกรองแนวโน้มระยะยาว, แรงจูงใจทางจิตวิทยา | กรอบเวลาทั้งหมด | การจัดแนวแนวโน้ม |

มุมมองของผู้เชี่ยวชาญเกี่ยวกับการรวมกันของค่าเฉลี่ยเคลื่อนที่

📌 “การข้าม 9/21 EMA ยังคงเป็นมาตรฐานเพราะมันสะท้อนถึงความเห็นร่วมกันในระยะสั้นโดยไม่ทำให้เกิดการฟิตเกินไป จับคู่กับการวิเคราะห์ปริมาณและคุณจะได้การยืนยันการเคลื่อนไหวของราคาอย่างครบถ้วน” — ไฮจิน ลี, ช่างเทคนิคตลาด, Quantsense Research

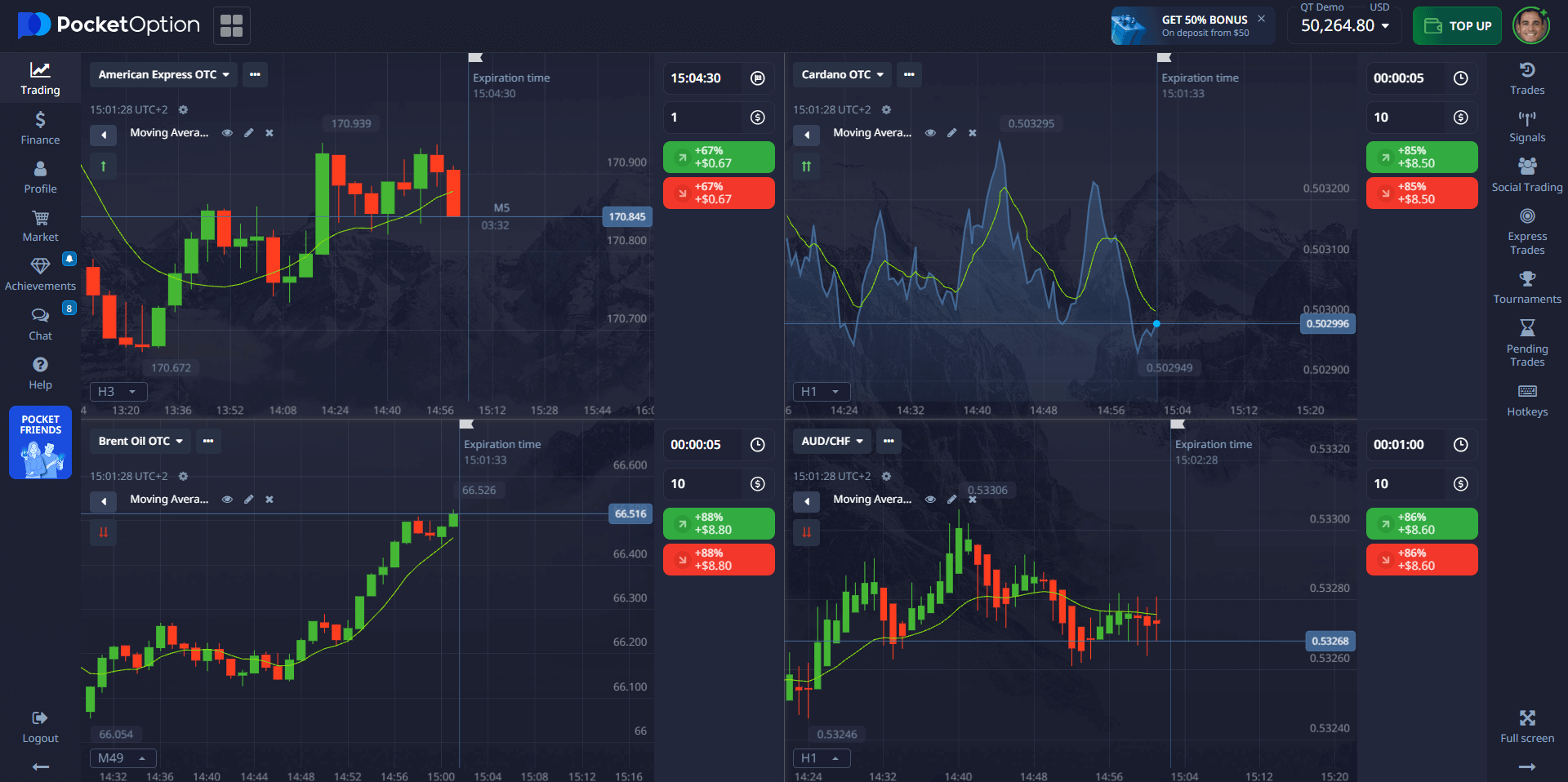

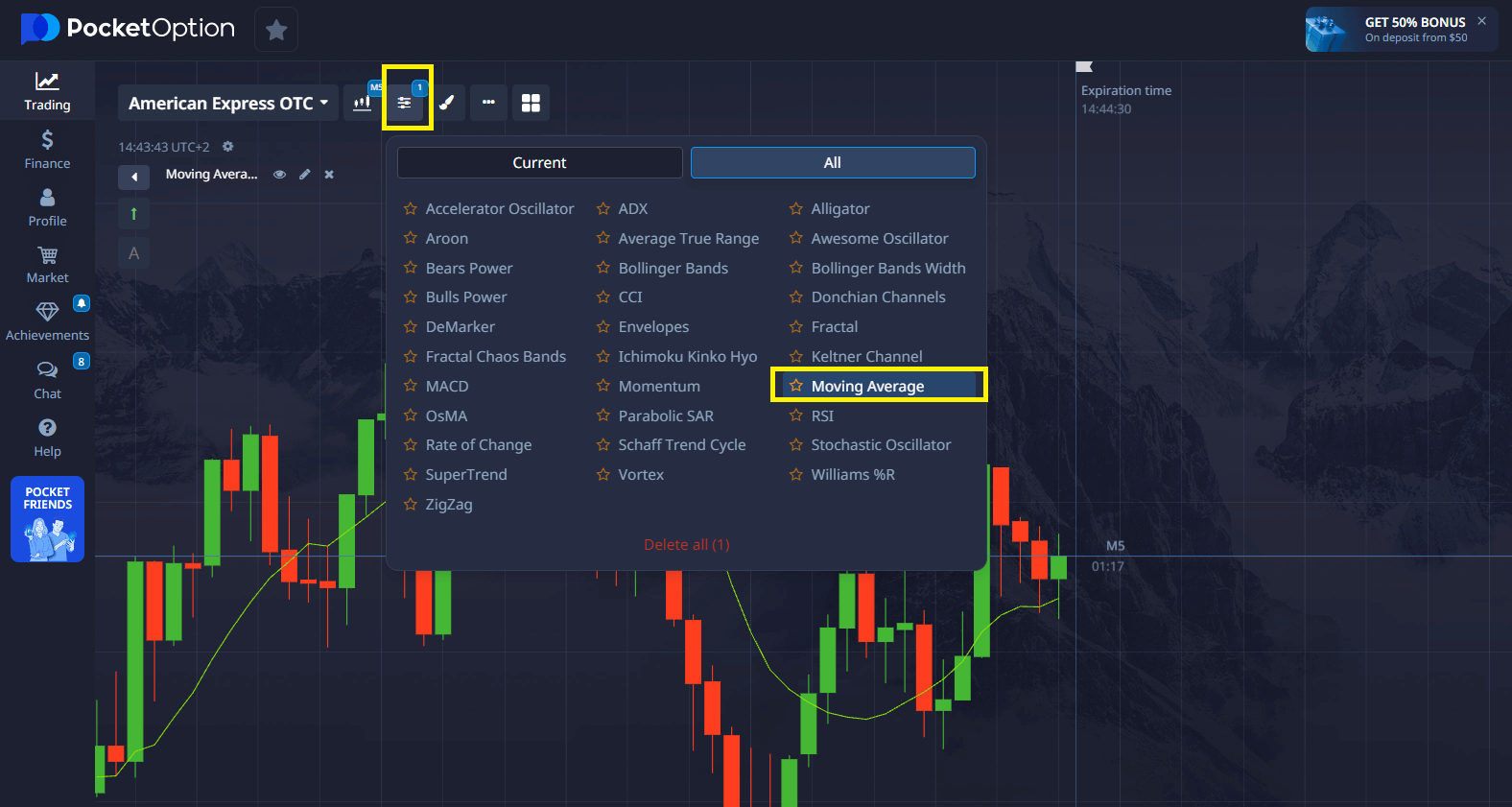

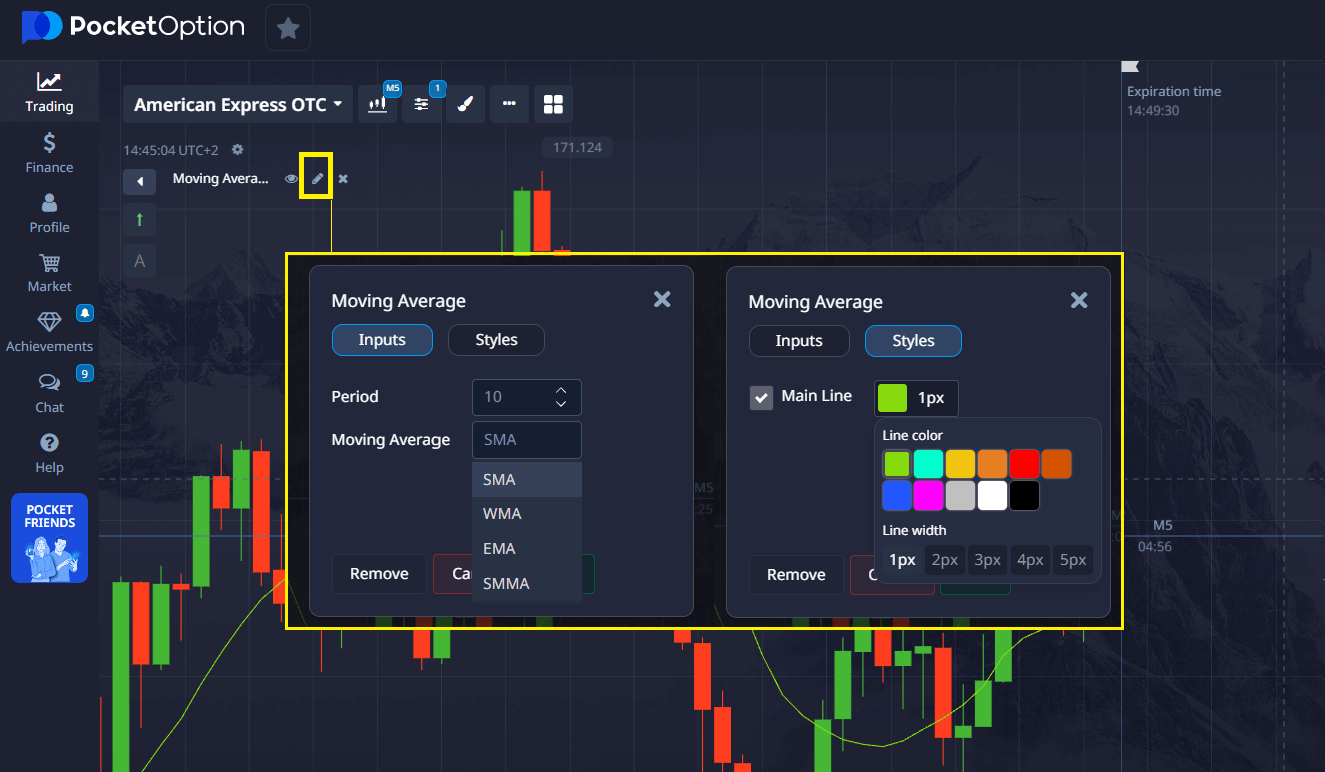

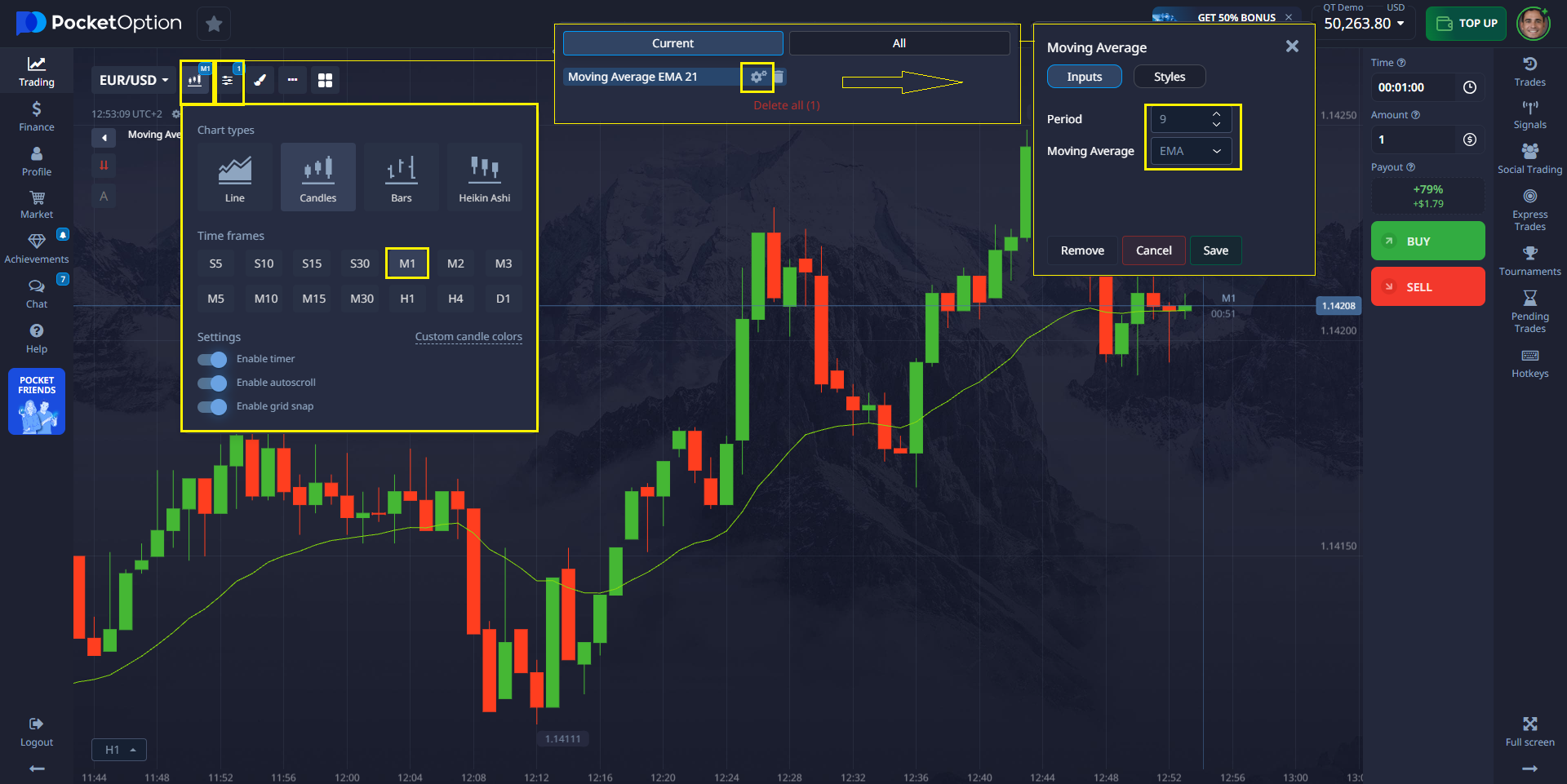

การตั้งค่า EMA สำหรับการเทรดในวันบนแพลตฟอร์ม Pocket Option

Pocket Option มีอินเทอร์เฟซที่ใช้งานง่ายซึ่งเทรดเดอร์สามารถกำหนดค่าเฉลี่ยเคลื่อนที่ได้ด้วยตนเอง แพลตฟอร์มรองรับการกำหนดค่า EMA แบบมาตรฐานทั้งหมดสำหรับการวิเคราะห์ทางเทคนิคที่ครอบคลุม

การรวมกันของ EMA ที่แนะนำสำหรับแนวทางการเทรดที่แตกต่างกัน:

- 9 EMA + 21 EMA — เหมาะสำหรับการแตกออกของโมเมนตัมในกรอบเวลา 1m–5m เหมาะสำหรับกลยุทธ์การสเกลปิ้ง

- 21 EMA + 50 EMA — ยอดเยี่ยมสำหรับการกรองการเคลื่อนไหวของราคาที่ไม่แน่นอนจากแนวโน้มตลาดที่แท้จริง

- 200 EMA — จำเป็นสำหรับการหลีกเลี่ยงการเทรดที่ตรงข้ามกับทิศทางการเคลื่อนไหวของราคาในระยะยาว

💬 “ในคู่หุ้นในเอเชียแปซิฟิก เราสังเกตว่า 50 EMA ร่วมกับข้อจำกัดของ Bollinger Band นำไปสู่การเข้าซื้อที่มีความแปรปรวนต่ำกว่า มันละเอียดอ่อนแต่มีนัยสำคัญทางสถิติ” — มาร์โก อัลวาเรซ, นักพัฒนาระบบที่ TradeSolvers

ข้อดีและความเสี่ยงของกลยุทธ์การเทรดในวันด้วย EMA

ข้อดีของการใช้ค่าเฉลี่ยเคลื่อนที่ในการเทรดในวัน

- การตอบสนองอย่างรวดเร็ว: EMA ปรับตัวได้อย่างรวดเร็วต่อข้อมูลราคาที่ใหม่ ให้สัญญาณที่ทันเวลา

- การปรับปรุงการตั้งเวลา: เพิ่มความแม่นยำในการระบุจุดเข้าและออก

- การใช้งานที่หลากหลาย: ทำงานได้อย่างมีประสิทธิภาพในหลายประเภทสินทรัพย์รวมถึงหุ้น, ฟอเร็กซ์, และคริปโต

- การสนับสนุน/ความต้านทานแบบพลศาสตร์: สร้างระดับการสนับสนุนและความต้านทานที่ปรับตัวตามการเคลื่อนไหวของราคาในปัจจุบัน

- การยืนยันแนวโน้ม: ช่วยให้เทรดเดอร์ใช้ตัวบ่งชี้ทางเทคนิคเพื่อยืนยันแนวโน้มของตลาด

💡 ข้อมูลเชิงลึก 2: ค่าเฉลี่ยเคลื่อนที่เฉพาะช่วงเซสชันทำงานได้ดีกว่า ใช้การตั้งค่า EMA แยกกันสำหรับเซสชันลอนดอนและนิวยอร์กเนื่องจากลักษณะความผันผวนและรูปแบบการเคลื่อนไหวของราคาที่แตกต่างกัน

ข้อเสียและการจัดการความเสี่ยง

- ความเสี่ยงจากการแกว่ง: อาจสร้างสัญญาณเท็จในระหว่างการเคลื่อนไหวของราคาในแนวนอน

- การพึ่งพาบริบท: อาจทำให้เข้าใจผิดหากใช้โดยไม่มีการยืนยันจากปริมาณหรือการวิเคราะห์ตลาดที่กว้างขึ้น

- ความเสี่ยงจากการปรับแต่งเกินไป: ต้องการการทดสอบย้อนหลังที่มีระเบียบเพื่อหลีกเลี่ยงการฟิตเกินไป

- การแตกออกเท็จ: อาจกระตุ้นการเข้าเทรดก่อนกำหนดในระหว่างการกลับตัวที่ปลอม

🧠 “ตัวบ่งชี้ทางเทคนิคเพียงตัวเดียวจะไม่รักษาทุนของคุณไว้ได้ ทักษะที่แท้จริงอยู่ที่การรวมโครงสร้างตลาด, เรื่องราวพื้นฐาน, และความแม่นยำทางคณิตศาสตร์ EMA เพียงช่วยให้เทรดเดอร์ระบุโครงสร้างนั้นได้ชัดเจนยิ่งขึ้น” — เอนริเก วี., เทรดเดอร์เต็มเวลา

ประสบการณ์จริงจากผู้ใช้: เทรดเดอร์ใช้ EMA บน Pocket Option อย่างไร

- 🔹 “ฉันเทรดคู่คริปโตเป็นหลักและ 9 EMA ทำให้ฉันมีความมั่นคงในช่วงเวลาที่มีความผันผวนสูง เครื่องมือ EMA และการวิเคราะห์กราฟของ Pocket Option ทำให้การเปลี่ยนกรอบเวลาเป็นไปอย่างราบรื่นสำหรับกลยุทธ์การเทรดของฉัน” — นาตาเลีย พ.

- 🔹 “ฉันเสียการเทรดมากเกินไปเมื่อใช้ 200 EMA ในกรอบเวลาสั้น หลังจากเปลี่ยนไปใช้การรวมกัน 21/50 บนกราฟ 5 นาทีของ Pocket Option ฉันได้จุดเข้าและออกที่สม่ำเสมอมากขึ้น” — ลูคา ม.

- 🔹 “ค่าเฉลี่ยเคลื่อนที่ทำงานเมื่อคุณมีวินัยเกี่ยวกับการวิเคราะห์ทางเทคนิค ฉันทดสอบย้อนหลังทุกการตั้งค่าด้วยข้อมูลปริมาณจริงเพื่อหลีกเลี่ยงการตัดสินใจที่ขับเคลื่อนด้วยอารมณ์ อินเทอร์เฟซของ Pocket Option เร่งกระบวนการทดสอบของฉัน” — ควาเม จ.

EMA เทียบกับตัวบ่งชี้ทางเทคนิคอื่น ๆ: การวิเคราะห์เปรียบเทียบ

| ตัวบ่งชี้ | การตอบสนองต่อการเปลี่ยนแปลงราคา | ความชัดเจนของแนวโน้ม | ความเหมาะสมสำหรับการสเกลปิ้ง | ลักษณะการล่าช้า |

|---|---|---|---|---|

| EMA | สูง | กลางถึงสูง | สูง | ล่าช้าน้อย |

| SMA | ต่ำ | ต่ำ | ต่ำ | ล่าช้ามาก |

| VWAP | กลาง | สูง | กลาง | ล่าช้ากลาง |

| MACD | กลาง | สูง | ต่ำ | ตัวบ่งชี้ที่ล่าช้า |

🔎 เทรดเดอร์ในวันส่วนใหญ่ชอบค่าเฉลี่ยเคลื่อนที่แบบเอ็กซ์โพเนนเชียลสำหรับตลาดที่เคลื่อนไหวอย่างรวดเร็วเนื่องจากความล่าช้าที่ลดลง VWAP อาจดีกว่าสำหรับการวิเคราะห์การไหลของสถาบัน ในขณะที่ MACD เหมาะสำหรับกลยุทธ์การเทรดสวิงระยะยาว

💡 ข้อมูลเชิงลึก 3: อย่าตามสัญญาณการข้ามอย่างตาบอด รอให้ปิด เทียน อย่างสมบูรณ์เกินกว่า EMA ที่รวดเร็วก่อนที่จะดำเนินการเทรดเพื่อหลีกเลี่ยงการแตกออกเท็จ

กลยุทธ์ค่าเฉลี่ยเคลื่อนที่ขั้นสูงสำหรับความสำเร็จในการเทรดในวัน

การวิเคราะห์ EMA หลายกรอบเวลา

- กราฟ 1 นาที: 9 EMA สำหรับการเคลื่อนไหวของราคาในทันที

- กราฟ 5 นาที: 21 EMA สำหรับการยืนยันแนวโน้มระยะสั้น

- กราฟ 15 นาที: 50 EMA สำหรับบริบทตลาดที่กว้างขึ้น

สัญญาณ EMA ที่มีน้ำหนักตามปริมาณ

- รวมค่าเฉลี่ยเคลื่อนที่แบบเอ็กซ์โพเนนเชียลกับ การวิเคราะห์ปริมาณ เพื่อยืนยัน:

- การแตกออกของ EMA ที่มีปริมาณสูง (สัญญาณที่แข็งแกร่งกว่า)

- การข้ามที่มีปริมาณต่ำ (สัญญาณเท็จที่อาจเกิดขึ้น)

- รูปแบบการเบี่ยงเบนระหว่างปริมาณและการเคลื่อนไหวของราคา

การจัดการความเสี่ยงด้วยค่าเฉลี่ยเคลื่อนที่

- ตั้งค่าหยุดขาดทุนต่ำกว่าหรือสูงกว่าระดับ EMA ที่สำคัญ

- ใช้ความชันของ EMA เพื่อประเมินความแข็งแกร่งของแนวโน้ม

- ใช้ขนาดตำแหน่งตามความผันผวนของ EMA

แนวปฏิบัติที่ดีที่สุดในการวิเคราะห์ทางเทคนิคสำหรับการเทรดในวันด้วย EMA

- ข้อกำหนดการทดสอบย้อนหลัง: ทดสอบการตั้งค่าค่าเฉลี่ยเคลื่อนที่ทั้งหมดบนข้อมูลราคาประวัติศาสตร์

- การปรับตัวตามสภาพตลาด: ปรับพารามิเตอร์ EMA สำหรับตลาดที่มีแนวโน้มและตลาดที่มีการเคลื่อนไหวในแนวนอน

- การยืนยันหลายครั้ง: อย่าพึ่งพาตัวบ่งชี้ทางเทคนิคเพียงตัวเดียว

- การตระหนักถึงเซสชัน: พิจารณารูปแบบความผันผวนที่แตกต่างกันในช่วงเซสชันการเทรด

- การบันทึก: รักษาบันทึกการเทรดที่ละเอียดเพื่อการปรับปรุงกลยุทธ์

บทสรุป: การเชี่ยวชาญใน EMA สำหรับการเทรดในวันที่ประสบความสำเร็จ

ค่าเฉลี่ยเคลื่อนที่แบบเอ็กซ์โพเนนเชียลยังคงเป็นหนึ่งในตัวบ่งชี้ทางเทคนิคที่ปรับตัวได้มากที่สุดสำหรับเทรดเดอร์ระยะสั้นที่มุ่งเน้นการวิเคราะห์การเคลื่อนไหวของราคา แม้ว่า EMA จะไม่สามารถคาดการณ์การเคลื่อนไหวของราคาในอนาคตได้ แต่ก็ตอบสนองได้อย่างมีประสิทธิภาพต่อข้อมูลราคาล่าสุด ทำให้เทรดเดอร์มีพื้นฐานทางสถิติที่มั่นคงในการตัดสินใจเข้าและออก

ปัจจัยสำคัญในการประสบความสำเร็จ:

- รวมค่าเฉลี่ยเคลื่อนที่กับการจัดการความเสี่ยงที่มีโครงสร้าง

- ดำเนินการทดสอบย้อนหลังอย่างละเอียดในสภาพตลาดที่แตกต่างกัน

- รักษาการติดตามและวิเคราะห์ประสิทธิภาพอย่างละเอียด

- ปรับการตั้งค่า EMA ให้เหมาะสมกับสินทรัพย์และกรอบเวลาเฉพาะ

- อย่าพึ่งพาสัญญาณจากตัวบ่งชี้ทางเทคนิคเพียงตัวเดียว

✅ คำแนะนำสุดท้าย: รักษาความสงสัยในการวิเคราะห์ ปรับแต่งการตั้งค่าค่าเฉลี่ยเคลื่อนที่สำหรับแต่ละประเภทสินทรัพย์ และใช้สัญญาณการยืนยันหลายครั้งเสมอ เทรดเดอร์ในวันที่ประสบความสำเร็จจะบันทึกการเทรดทุกครั้ง วิเคราะห์รูปแบบประสิทธิภาพ และปรับกลยุทธ์ของตนอย่างต่อเนื่องตามข้อเสนอแนะแบบตลาด

เทรดเดอร์ที่ประสบความสำเร็จในการทำกำไรอย่างสม่ำเสมอคือผู้ที่เชี่ยวชาญในพื้นฐานการวิเคราะห์ทางเทคนิค เข้าใจพลศาสตร์การเคลื่อนไหวของราคา และปรับกลยุทธ์ค่าเฉลี่ยเคลื่อนที่ของตนให้เข้ากับสภาพตลาดที่เปลี่ยนแปลง 📢 เข้าร่วมการสนทนา: แบ่งปันประสบการณ์การเทรด EMA และข้อมูลเชิงลึกในการวิเคราะห์ทางเทคนิคขั้นสูงของคุณในชุมชนการเทรดของเรา!

FAQ

ฉันจะตั้งค่า EMA indicators บนแพลตฟอร์มการเทรดของฉันได้อย่างไร?

แพลตฟอร์มส่วนใหญ่อนุญาตให้ตั้งค่าได้ง่ายผ่านเมนูตัวชี้วัด เลือก EMA และป้อนช่วงเวลาที่คุณต้องการ

ฉันสามารถใช้ EMA สำหรับทุกตลาดได้หรือไม่?

ใช่, EMA สามารถนำไปใช้กับตลาดใดก็ได้ที่มีสภาพคล่องและการเคลื่อนไหวของราคาเพียงพอ.

กรอบเวลาไหนที่เหมาะสมที่สุดกับ EMA?

กรอบเวลา 5 นาทีและ 15 นาทีเป็นที่นิยมสำหรับการซื้อขายในวันด้วยตัวบ่งชี้ EMA

ควรใช้ EMA กี่ตัวพร้อมกัน?

เริ่มต้นด้วย EMA สองตัว (เร็วและช้า) และเพิ่มมากขึ้นเมื่อคุณรู้สึกสบายใจกับกลยุทธ์นี้

ค่าเฉลี่ยเคลื่อนที่ 50 วันหรือ 200 วันอันไหนดีกว่ากัน?

สำหรับการซื้อขายในวัน 50 EMA จะดีกว่าเนื่องจากตอบสนองต่อการเปลี่ยนแปลงของราคาได้เร็วกว่าและให้สัญญาณที่เกี่ยวข้องมากขึ้นสำหรับการซื้อขายระยะสั้น 200 EMA เหมาะสมกว่าสำหรับการซื้อขายแบบสวิงและการระบุแนวโน้มระยะยาว ผู้ค้ารายวันมักใช้ 50 EMA สำหรับอคติทิศทางและใช้ 200 EMA เฉพาะในบริบทของแนวโน้มหลักเท่านั้น

กลยุทธ์ EMA 5 10 20 คืออะไร?

กลยุทธ์ 5-10-20 EMA เป็นระบบค่าเฉลี่ยเคลื่อนที่สามตัวที่ 5 EMA ให้สัญญาณที่รวดเร็ว, 10 EMA ยืนยันแนวโน้มระยะสั้น, และ 20 EMA กรองเสียงรบกวน สัญญาณซื้อเกิดขึ้นเมื่อราคาปิดสูงกว่าทั้งสาม EMA ในลำดับที่เพิ่มขึ้น โดยมีการตั้งหยุดขาดทุนต่ำกว่า 20 EMA.

กลยุทธ์ EMA 5 8 13 21 คืออะไร?

กลยุทธ์ EMA 5-8-13-21 ใช้ค่าเฉลี่ยเคลื่อนที่แบบเอ็กซ์โพเนนเชียลหลายตัวเพื่อระบุความแข็งแกร่งของแนวโน้มและโมเมนตัม เมื่อค่า EMA ทั้งหมดเรียงกัน (5>8>13>21 สำหรับแนวโน้มขาขึ้น) จะส่งสัญญาณถึงโมเมนตัมขาขึ้นที่แข็งแกร่ง การตัดกันระหว่างระดับเหล่านี้ให้สัญญาณการเข้า ในขณะที่การเบี่ยงเบนแสดงถึงการกลับตัวที่อาจเกิดขึ้น

EMA ที่ดีสำหรับการเทรดในวันคืออะไร?

การตั้งค่า EMA ที่ดีที่สุดสำหรับการซื้อขายในวันคือ 9 EMA สำหรับการสเกลป (กราฟ 1-5 นาที), 21 EMA สำหรับแนวโน้มระยะสั้น (กราฟ 5-15 นาที), และ 50 EMA สำหรับการกรองอคติทิศทาง นักเทรดในวันที่ประสบความสำเร็จส่วนใหญ่ใช้การรวมกันของ 9/21 EMA เพื่อจุดเข้าที่เหมาะสมและจุดออกที่เหมาะสม