- Price = typical price of each transaction (high + low + close) / 3

- Volume = number of shares/contracts traded at that price level

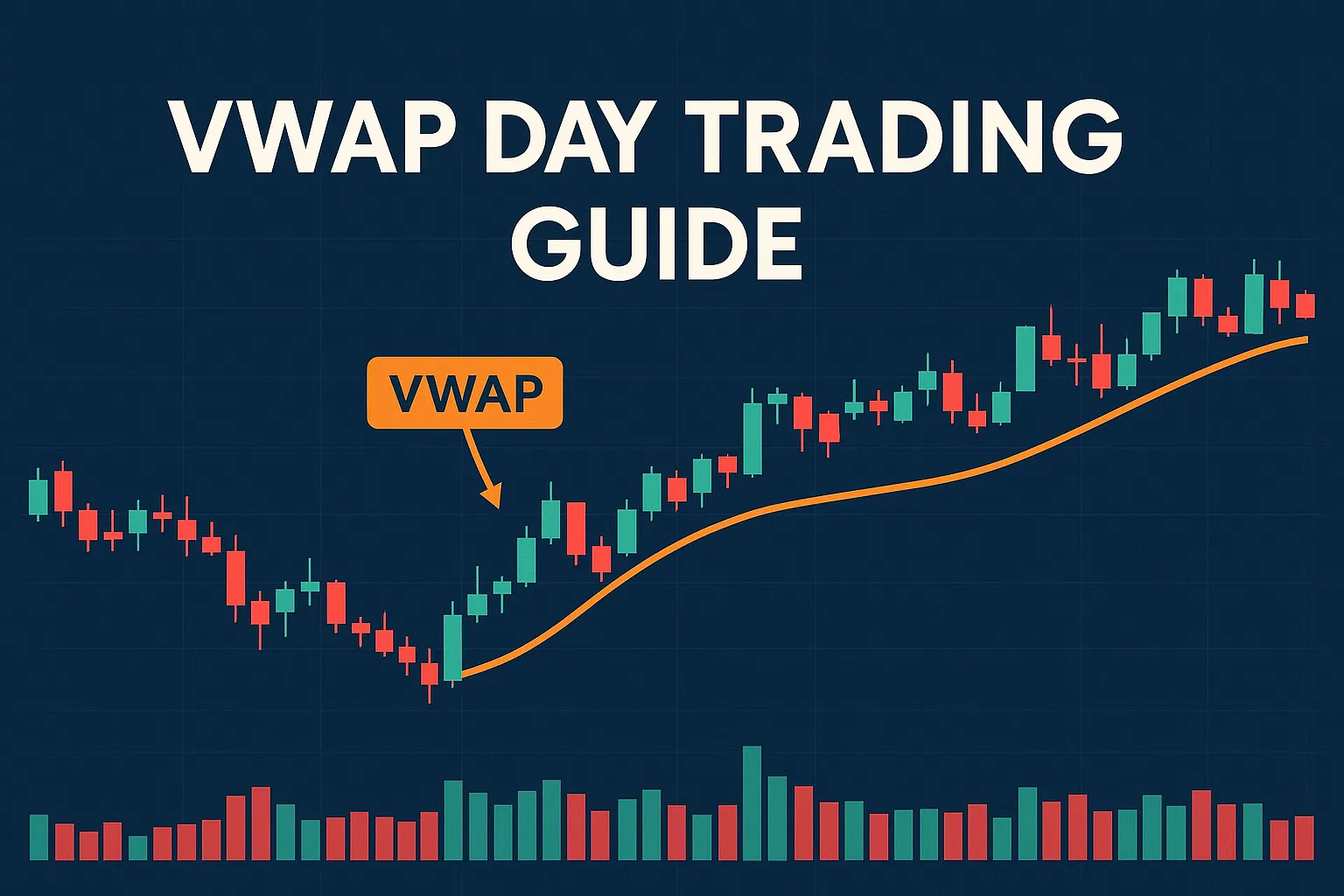

Using VWAP for day trading

Want to trade like the pros? VWAP reveals where smart money is moving — and how to ride along.

Article navigation

- Start trading VWAP for Day Trading: Mastering Volume-Weighted Average Price for Smarter Strategies

- What Is VWAP in Options Trading?

- Why Do Traders Use VWAP?

- Popular VWAP Trading Strategies (Expanded)

- Using VWAP in Trading Strategies

- Why VWAP Is Missing from Pocket Option

- VWAP Alternatives on Pocket Option

- Trading Using VWAP

- Advanced VWAP Techniques

- Integrating VWAP with Other Indicators

- Common VWAP Missteps to Avoid

- VWAP Options Trading and Market Volume

- Using VWAP in Varied Trading Contexts

- Tools and Resources

- Institutional Insights from Analysts

- Unique Expert Recommendations

VWAP for Day Trading: Mastering Volume-Weighted Average Price for Smarter Strategies

Volume-Weighted Average Price (VWAP) for day trading is one of the most respected technical indicators among professional traders. It helps day traders understand not just where the price is, but how the market is valuing that price based on actual trading volume. This weighted average price is a staple for intraday trading and a powerful tool when used correctly. In this guide, we delve deep into how the VWAP indicator works, why it’s essential for intraday trading strategies, and how to practically apply it to enhance your trading performance on platforms.

What Is VWAP in Options Trading?

Many traders wonder, “is VWAP good for option trading?” The answer is yes–it provides a real-time volume-weighted average price that helps traders avoid entries at extreme prices, especially in fast-moving options markets.

The Volume-Weighted Average Price (VWAP) is a real-time indicator that calculates the average price a security has traded at throughout the day, weighted by volume. Unlike a simple moving average, VWAP combines price and volume to deliver an accurate view of market sentiment during a single trading session. This volume-weighted average is recalculated with each transaction, making it one of the most dynamic tools available to a day trader.

VWAP Formula

VWAP = (Sum of Price × Volume) / Total Volume

Where:

This formula gives the weighted average price, factoring in the importance of volume in every price move.

Why Do Traders Use VWAP?

VWAP acts like a dynamic support/resistance level. Here’s how traders interpret it:

- Price above VWAP: Bullish bias

- Price below VWAP: Bearish bias

- Price crossing VWAP: Potential entry or exit signal

Institutions often use VWAP to ensure they’re buying/selling close to the average market price. If you’re trading below VWAP, you’re buying cheaper than most. Above VWAP? You’re paying a premium.

Popular VWAP Trading Strategies (Expanded)

Even though it seems simple, VWAP can be integrated into powerful strategies. Let’s break down a few in detail:

1. VWAP Pullback Strategy

This is a favorite of momentum traders. In a trending market, price often pulls back toward the VWAP before resuming its direction. This pullback creates a low-risk, high-reward entry opportunity.

Example: On a 5-minute chart, if price is trending upwards and pulls back to VWAP, traders look for a bullish engulfing candle or hammer to confirm support. Entry is placed on the next candle with a stop below VWAP.

💡 Pro Tip: Combine VWAP with RSI or Stochastic Oscillator to filter false pullbacks.

2. VWAP Breakout Strategy

VWAP often acts as a magnet early in the trading session. A strong breakout above or below it, supported by high volume, can signal a directional move.

Example: If a stock opens flat and builds pressure around VWAP for 30–60 minutes, a breakout on volume may initiate a momentum run. Place entry just above the high of the breakout candle. Exit near R1 pivot point or previous high.

3. VWAP Mean Reversion Strategy

When price deviates significantly from VWAP, it tends to revert. This is best in range-bound markets.

Example: If price extends more than 2% above VWAP and volume wanes, a reversal may be coming. Traders look for a bearish candle and target a return to VWAP.

⚠️ Be careful during trending days — mean reversion can trap you.

4. Anchored VWAP

Anchored VWAP allows traders to calculate the average price from a specific event — like earnings, a breakout, or a major news release. This makes it a flexible tool for assessing sentiment since that moment.

When to use:

- After a news-based spike

- Post-breakout consolidation

- Following trend reversals

“Anchored VWAP gives context to price action. You can define the market’s memory from a specific point in time.” — Brian Shannon, CMT, Author of “Technical Analysis Using Multiple Timeframes”

Pocket Option Tip:

Although Pocket Option focuses on speed and simplicity through Quick Trading, the platform provides advanced charting tools where you can simulate VWAP-like strategies using custom overlays and volume indicators.

Using VWAP in Trading Strategies

| Price Relative to VWAP | Interpretation | Trader Action |

|---|---|---|

| Above VWAP line | Bullish sentiment | Look for long opportunities |

| Below VWAP | Bearish sentiment | Seek short positions |

| Near VWAP | Neutral/mean-reversion | Use scalping strategies |

VWAP may act as dynamic support or resistance based on total volume. Traders use it to time precise entries and exits with volume confirmation.

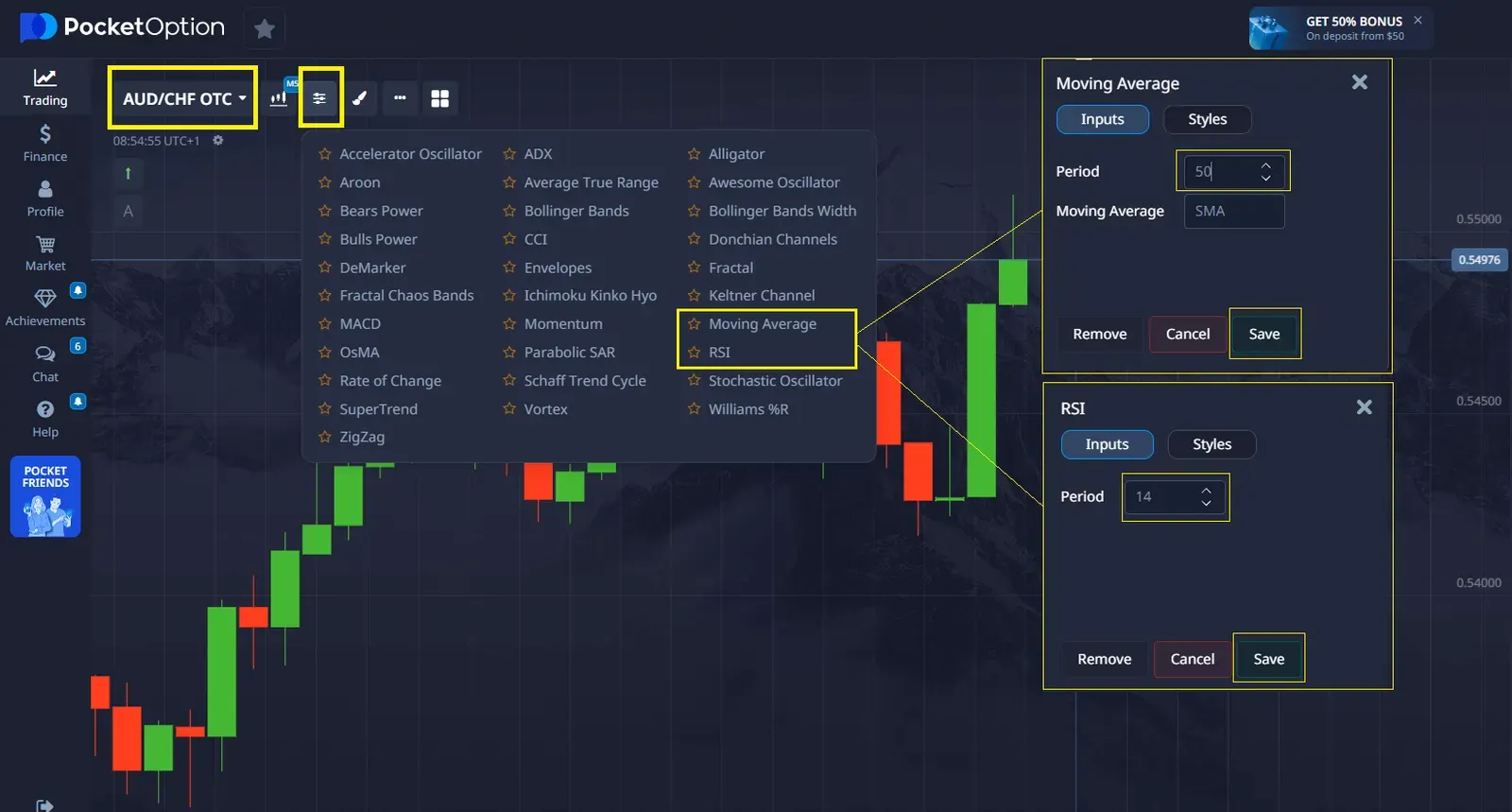

Why VWAP Is Missing from Pocket Option

At the time of writing, Pocket Option does not offer VWAP as one of its 30+ built-in indicators. This is due to its focus on simplicity, low-latency execution, and high-speed charting on Web and mobile platforms.

But this doesn’t mean you’re left in the dark. There are workarounds.

VWAP Alternatives on Pocket Option

You can approximate VWAP behavior using combinations of existing tools. Here are three effective setups:

1. EMA + Volume + Candlestick Confirmation

VWAP often acts like a weighted moving average. Using a 20-period or 50-period EMA with volume bars can provide similar signals.

Entry: When price pulls back to EMA and volume confirms a bounce.

Exit: When price moves too far from EMA or shows reversal candlestick.

2. Volume Profile Analysis

Pocket Option allows horizontal volume analysis via charts and zone recognition. Use key volume zones as support/resistance areas.

Entry: At Point of Control (PoC) areas or high-volume nodes.

Exit: At low-volume rejection zones.

3. On-Balance Volume (OBV) + Moving Averages

If you want to factor in volume but don’t have VWAP, OBV + MA crossover can hint at direction confirmation.

“VWAP is not the only volume-sensitive indicator. Combining OBV with trend lines can reveal institutional footprints too.” — Zoe Palmer, Trading Strategist at MarketAlpha

Trading Using VWAP

Traders on Pocket Option can replicate VWAP strategies using tools like moving average overlays and price action patterns. One way to use VWAP logic is by tracking weighted average price behavior using customizable chart tools.

VWAP Strategy Highlight

Practical Example: VWAP Trade

Imagine a trader on monitors the EUR/USD pair during the London session. The price surges 15 pips above the VWAP line on the 1-minute chart by 10:30 AM GMT.

- Signal: The spike in price is accompanied by decreasing volume, suggesting exhaustion.

- Confirmation: A bearish engulfing candlestick forms at the top.

- Entry: The trader enters a SELL position at 1.0920 with a target near the VWAP line at 1.0905.

- Stop-Loss: Placed at 1.0930 above the high.

- Outcome: Within 7 minutes, the price reverts to the VWAP line, reaching the target for a +15 pip gain.

This example shows how volume and price action around the VWAP can create high-probability Trading opportunities.

- Identify a stock price move significantly away from the VWAP line.

- Confirm with a volume spike and reversal pattern.

- Enter trade toward the average price.

- Set stop-loss at the nearest pivot point.

Advanced VWAP Techniques

Anchored VWAP

Anchoring the volume-weighted average price to specific events like earnings or breakouts improves precision. For instance, Brian Shannon (founder of Alphatrends) recommends using Anchored VWAP to confirm breakout retests, enhancing both long and short setups.

VWAP TradingView

If you’re searching for “what is the best VWAP setting for day trading”, most professionals recommend using a standard VWAP with daily reset and observing it on 1-minute or 5-minute charts. This setup captures short-term momentum while reflecting institutional sentiment.

Best VWAP Settings TradingView:

- Use standard intraday VWAP with reset each day

- Anchor from major news or support levels

- Overlay with a short-term moving average for divergence insight

“VWAP tells you what the crowd thinks is fair value. Trade above it, and you’re paying a premium; below it, you’re getting a discount.”— Linda Raschke, Professional Trader and Market Wizard

Integrating VWAP with Other Indicators

- Moving average lines: Use to compare momentum versus average price

- Price action: Confirm breakouts or rejections around VWAP zones

- Volume overlays: Match with VWAP slope changes for better confirmation

Common VWAP Missteps to Avoid

- Ignoring volume trends: VWAP loses relevance without volume weight

- Blind faith in the VWAP line: Use it in context with overall price action

- Failing to reset or re-anchor: Daily VWAP and Anchored VWAP serve different purposes

VWAP Options Trading and Market Volume

Wondering how to use VWAP in option trading? This approach involves aligning your option entry point with moments when the underlying asset’s price pulls back to or breaks through the VWAP line. For example, when a call option is purchased near a VWAP-based support level, it can improve the likelihood of profiting from upward momentum with lower entry risk.

VWAP options trading strategies help traders pinpoint better strike entry zones by understanding where the majority of volume has traded. This reduces the risk of overpaying for an option during market spikes.

Traders also examine the daily trading volume to assess when Quick Trades are most active. A spike in volume near the VWAP line typically signals strong market consensus, often providing better trade setups.

Using VWAP in Varied Trading Contexts

Many traders ask, “is VWAP only for day trading?” While it is most effective for intraday strategies due to its reset mechanism, traders can also use Anchored VWAP or apply VWAP logic to longer-term charts when paired with volume and key events.

- Trading using VWAP isn’t just limited to institutional desks. Retail traders can integrate it with other technical tools to build high-probability strategies.

- Using VWAP on day trading charts helps confirm price levels of interest, especially during the market open and close, when volume tends to be most concentrated.

- Trading under VWAP often indicates that a stock is in a downtrend, prompting traders to wait for a break back above VWAP before considering long positions.

Tools and Resources

Many traders seek communities for support. Forums like Vwap for day trading reddit provide real-time feedback, tips, and setups shared by active users. If you’re just getting started, a Vwap for day trading calculator can help visualize the indicator manually before relying on automated charting platforms. For offline study, download our VWAP trading strategy PDF to learn how to apply these concepts with step-by-step guidance.

Institutional Insights from Analysts

| Source | Key Insight |

|---|---|

| Bloomberg Terminal (2023) | VWAP executions minimized slippage by 22% over market orders |

| Nasdaq Research | VWAP outperformed limit orders in volatile sessions by 19% |

| Reddit Day Trading Poll | 67% of users prefer using VWAP in the first hour post-open for early signals |

Unique Expert Recommendations

- Use VWAP only when paired with a confirmation tool (EMA, RSI, candlestick)

- Re-anchor VWAP on breakouts or volume shocks

- Combine VWAP with demo account for scenario-based testing

FAQ

Is VWAP good for day trading?

Yes. VWAP is a crucial benchmark for both retail and institutional traders. It helps identify whether a stock is trading at a fair average price compared to the total volume traded.

What is the best indicator for day trading?

There isn't a single best indicator, but VWAP combined with moving average lines and momentum indicators like RSI or MACD provides comprehensive insight.

Can I use VWAP on Pocket Option?

No, but you can mimic it with EMA + Volume setups.

Is VWAP better than moving averages?

VWAP includes volume, which makes it more nuanced. But it's not better in every context.

How do I get access to VWAP?

Use external platforms like TradingView or TrendSpider for VWAP analysis, then execute trades on Pocket Option.

Does VWAP work on crypto, stocks, and forex?

Yes, but it's most reliable in liquid markets.

Will Pocket Option add VWAP?

Possibly in the future. Until then, use creative combinations of existing tools.

Can VWAP be used on a daily chart?

Yes, but its value is strongest for intraday trading. Anchored VWAP extends its utility across longer timeframes by adjusting the average price starting from a custom point.

Is VWAP good for scalping?

Absolutely. The VWAP line is especially helpful for identifying quick reversions or confirmations within narrow timeframes.

What is the best indicator for day trading?

There isn't a single best indicator, but VWAP combined with moving average lines and momentum indicators like RSI or MACD provides comprehensive insight.

Can VWAP be used on a daily chart?

Yes, but its value is strongest for intraday trading. Anchored VWAP extends its utility across longer timeframes by adjusting the average price starting from a custom point.

Is VWAP good for scalping?

Absolutely. The VWAP line is especially helpful for identifying quick reversions or confirmations within narrow timeframes.

CONCLUSION

The VWAP indicator offers more than just a price line—it provides context through weighted average price and volume. Traders use VWAP to align with institutional flow, reduce slippage, and sharpen entry accuracy. Whether you're a new day trader or an experienced strategist, incorporating the VWAP indicator into your routine will increase clarity and precision. Pocket Option supports such strategic growth with demo features, educational libraries, and real-time charting tools.

Test Strategy Risk-Free