- Adoption rates of AI in enterprise operations

- CapEx spending trends by major cloud providers

- Semiconductor supply chain resilience

- Regulatory changes in data infrastructure and AI deployment

Interest in Super Micro Computer Inc. has grown sharply due to its integral role in AI-related infrastructure. For investors assessing long-term positions, understanding the SMCI stock price target 2030 is critical. This review offers an objective look at current data, projected scenarios, and associated risks.

Overview of Super Micro Computer Inc. (SMCI)

Super Micro Computer Inc. designs and manufactures high-performance computing servers. These systems are essential for data centers, AI workloads, and cloud infrastructure. As AI and machine learning expand, SMCI benefits from increased server demand across global markets.

The company’s client base includes hyperscale cloud providers, government institutions, and enterprise tech firms. Its focus on modular, energy-efficient servers positions it as a core supplier in a market driven by compute-intensive processes.

*Trade 100+ assets with forecasts starting from 5 seconds — no need to buy the asset.

Current Stock Performance and Volatility

In the past three years, SMCI has shown dramatic stock price movement, with growth fueled by demand for AI server hardware. This volatility also reflects broader trends in technology equities and interest rate fluctuations.

The current price range is heavily influenced by speculative AI investment, supply chain risks, and market sentiment. As of Q2 2025, SMCI trades at levels well above its 2020 baseline, but short-term price instability remains a factor.

SMCI stock forecast 2030: What Analysts Are Watching

Forecasts for SMCI stock in 2030 vary widely. Some models suggest aggressive growth based on AI integration in public infrastructure and commercial services. Others anticipate corrections if hardware becomes commoditized or if competition intensifies from lower-cost providers.

| Scenario Type | Assumption Basis | Estimated Price Range |

|---|---|---|

| AI Infrastructure Boom | AI server demand grows 15–20% CAGR | $1,200 – $1,500 |

| Competitive Saturation | Margins narrow due to Chinese competitors | $400 – $600 |

| Steady Growth Path | Balanced enterprise and hyperscaler adoption | $800 – $1,000 |

| Hardware Innovation Lag | Software overtakes need for custom hardware | $300 – $500 |

How SMCI stock price prediction 2030 Is Modeled

Price prediction for 2030 uses discounted cash flow, sector correlation, and historical performance benchmarks. The upper bounds often rely on SMCI maintaining dominance in high-performance server markets. Lower bounds account for macroeconomic shifts or disruption in hardware supply.

Valuation models assume net revenue growth of 10–20% annually if current momentum continues. However, projections drop significantly under scenarios where AI hardware becomes standardized or regulated.

Investment Considerations for SMCI stock 2030

When assessing SMCI for 2030, investors should consider portfolio allocation risks, including exposure to hardware-only suppliers and geopolitical factors affecting semiconductor logistics. Unlike software companies, SMCI remains highly dependent on physical production cycles.

- Will SMCI maintain its edge in AI hardware design through 2030?

- Are hyperscalers likely to shift to in-house server solutions?

- Can SMCI pivot if demand shifts from servers to other form factors?

How to Trade SMCI Stock in the Short Term

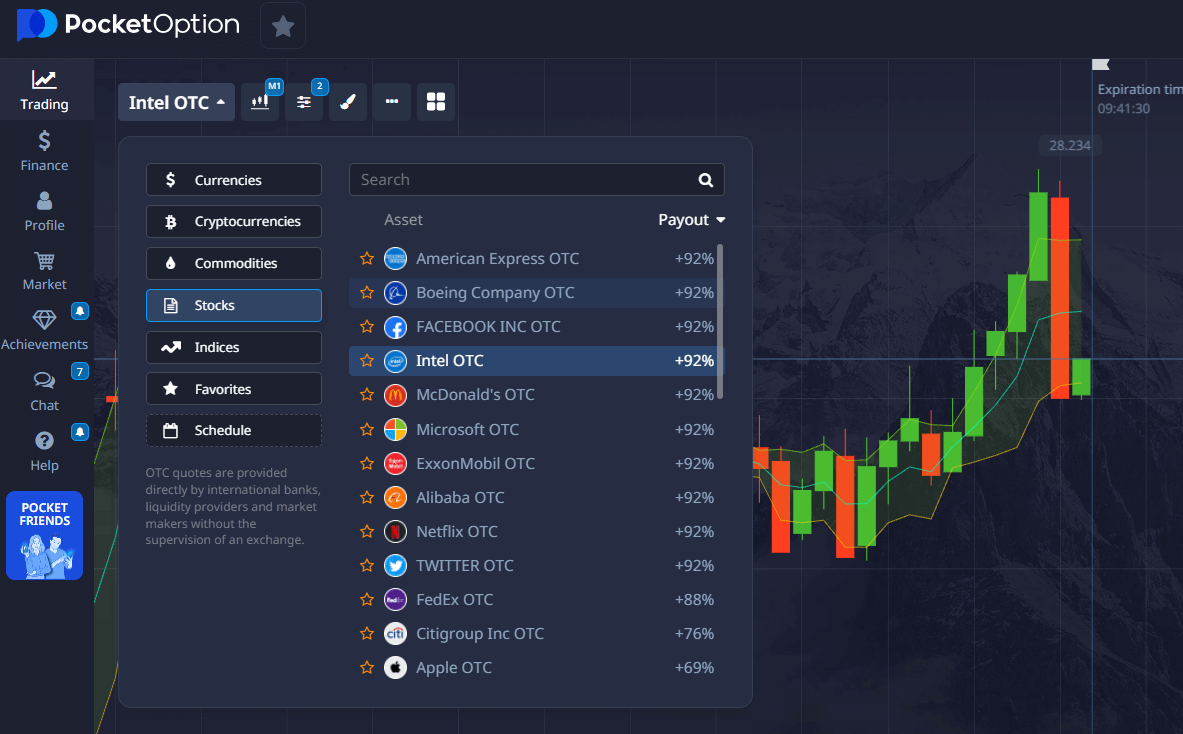

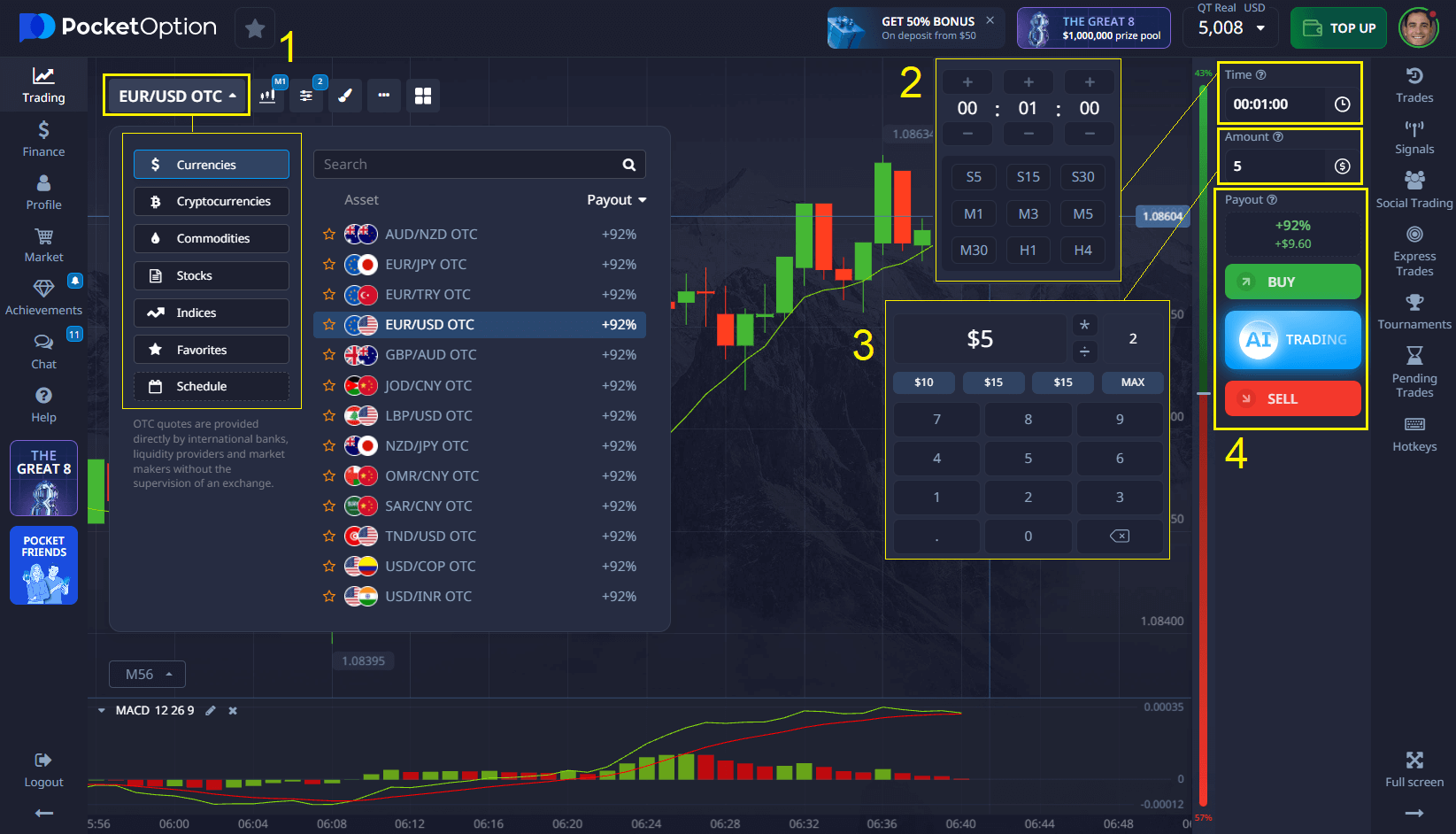

While SMCI is not directly available on the Pocket Option platform, traders can explore short-term opportunities in over 100 other assets including stocks, crypto, commodities, indices, and forex pairs.

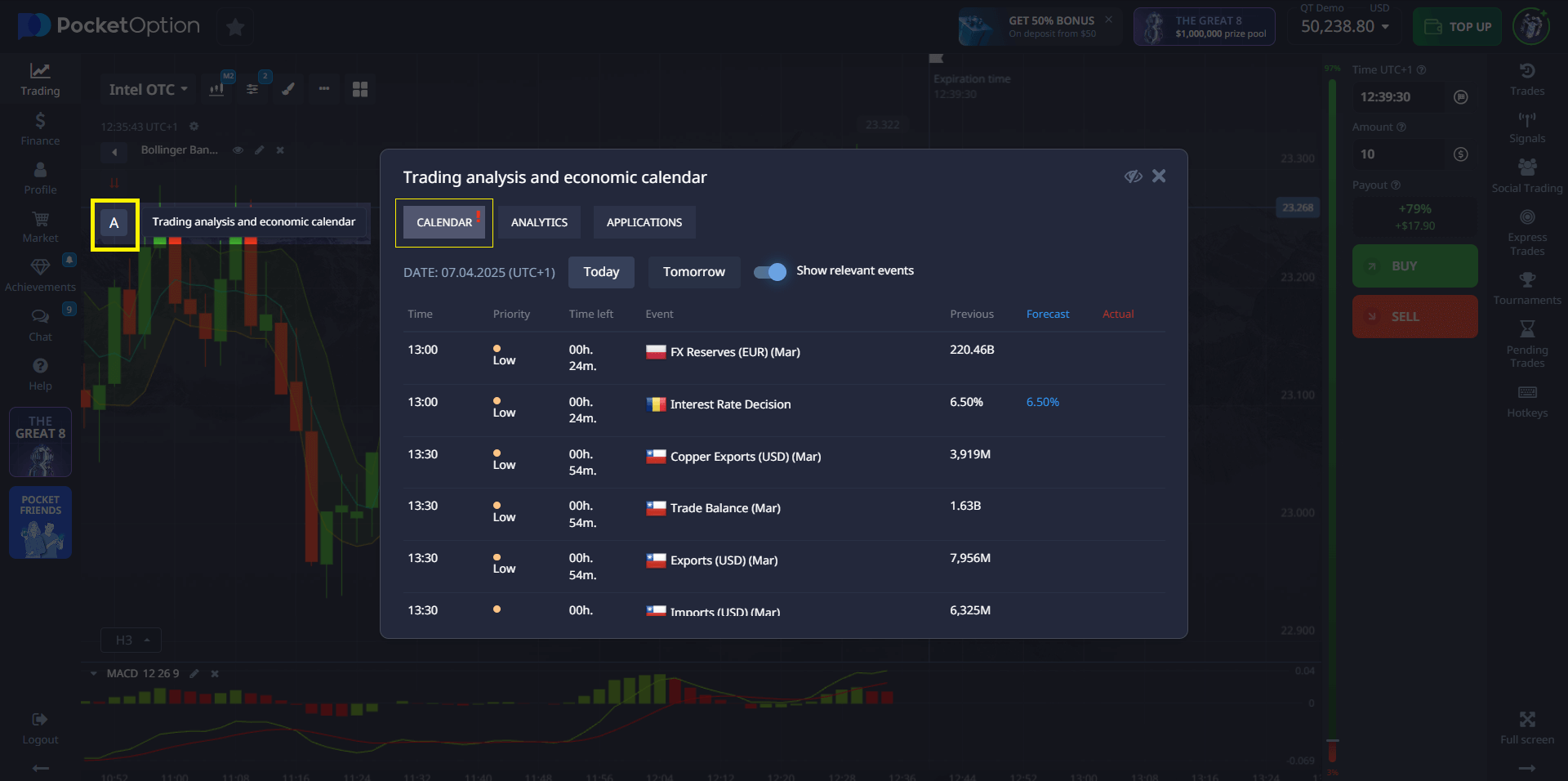

On Pocket Option, the interface allows you to create delayed trades that automatically execute based on time or price conditions. You don’t need to buy or sell the asset — just forecast if the price will go up or down. A correct forecast can yield up to 92% profit. Signals from automated bots are also available to assist with entry timing.

To access full functionality of Pocket Option:

- Register for an account

- Try the $50,000 demo account

- Use promo code 50START to receive +50% on your first deposit

- More than 50 deposit/withdrawal methods are supported

Conclusion

The SMCI stock price target 2030 reflects a range of possible outcomes tied closely to AI adoption, hardware demand, and global tech infrastructure. While upside potential exists, risk is significant. A careful, data-driven approach is essential for investors considering long-term positions in SMCI.

FAQ

What are the most important factors that will determine SMCI's stock price in 2030?

The most critical factors in determining SMCI's stock price by 2030 include: AI infrastructure market growth rate (accounting for approximately 41% of forecast variance), competitive market share evolution (22%), gross margin sustainability (18%), capital expenditure requirements (11%), and various other factors (8%). The company's ability to maintain technological leadership in high-density computing, power efficiency, and thermal management solutions will significantly influence these variables.

How reliable are long-term stock price predictions for companies in the technology sector?

Long-term stock price predictions, particularly for technology companies like SMCI, inherently contain significant uncertainty. Historical analysis shows that 6-year forecasts typically have a mean absolute percentage error (MAPE) of 40-65% for technology hardware companies. However, probabilistic approaches that present a range of outcomes with assigned probabilities provide more value than single-point estimates. Investors should view these forecasts as frameworks for decision-making rather than precise predictions.

What mathematical models are most effective for long-term stock price forecasting?

The most effective approach combines multiple mathematical models, each capturing different aspects of price dynamics. Fundamental models like discounted cash flow (DCF) provide a valuation foundation, while time series models capture cyclical patterns. Machine learning algorithms including LSTM networks, gradient boosting trees, and random forests excel at identifying non-linear relationships. Finally, Monte Carlo simulations incorporate randomness to generate probability distributions. No single model outperforms consistently, making ensemble approaches optimal.

How does SMCI's valuation compare to other companies in the server and data center infrastructure sector?

SMCI currently trades at valuation multiples that reflect its strong positioning in high-growth segments including AI infrastructure and liquid cooling solutions. The company's current P/E ratio of approximately 38.5 compares to a sector average of 35.9, representing a modest premium. However, when adjusted for growth rates (PEG ratio), SMCI's valuation of 1.4 is slightly below the sector average of 1.45, potentially indicating relative value. By 2030, we expect sector multiples to normalize as growth rates moderate, with SMCI's P/E ratio likely falling to the 22-32 range.

What investment strategy is recommended for investors interested in SMCI's long-term potential?

Given the wide distribution of potential outcomes in SMCI stock price target 2030 projections, a staged investment approach is advisable. This includes: (1) Establishing a core position sized according to risk tolerance and portfolio constraints; (2) Implementing a value-adjusted dollar-cost averaging strategy that increases investment rate when price falls below calculated intrinsic value; (3) Setting predefined review points at which fundamental assumptions are reassessed; and (4) Using options strategies for tail-risk protection against extreme downside scenarios. This structured approach balances conviction in SMCI's long-term potential with appropriate risk management.