- Emotional resilience during drawdown periods

- Patience to wait for high-probability setups (which appear in only 10-20% of market conditions)

- Discipline to maintain consistent position sizing, regardless of past results

- Objectivity in analyzing losing trades without self-deception

Pocket Option Low Risk Strategy

Exploring Pocket Option low risk strategy opens a world of sustainable trading approaches for both beginners and experienced investors. This analysis provides proven methodologies that minimize risk while maintaining consistent returns, with expert insights specifically tailored for Pocket Option platform users.

Article navigation

Understanding the Pocket Option Low-Risk Strategy

The financial markets can be unforgiving to unprepared traders, making it essential for Pocket Option users to master low-risk strategies for long-term profitability.

Unlike high-risk approaches that promise substantial yet often unrealistic returns, low-risk strategies focus on systematic growth through disciplined position sizing, careful asset selection, and strategic exit planning. These methods typically generate annual returns of 15-30% while keeping drawdowns between 10-15%.

Key Components of the Pocket Option Low-Risk Strategy

Successful Pocket Option traders integrate the following critical components into their low-risk strategies:

| Component | Implementation on Pocket Option |

|---|---|

| Position Sizing | Limit each trade to 1-3% of account balance |

| Risk-Reward Ratio | Aim for a minimum 1:2 ratio for sustainable profits |

| Trade Duration | Use 4H and daily timeframes to reduce market noise |

| Diversification | Trade uncorrelated assets to avoid synchronized losses |

The Pocket Option Low-Risk Strategy Explained

The low-risk strategy in quick trading aims to reduce the chances of significant losses while capitalizing on small price movements.

Quick trading is a type of financial trading where the trader predicts whether the price of an asset (such as currency pairs, stocks, or commodities) will rise or fall within a short time frame. Unlike traditional investing, quick trading offers shorter durations, with trades typically lasting from 5 seconds to a few hours.

Here’s how you can implement it:

1. Start with a Demo Account: Before you risk real money, practice with a demo account. This allows you to test your strategies in real market conditions without financial risk

2. Choose Low Volatility Assets: In quick trading, volatility is key. For the low-risk strategy, select assets with lower volatility. These assets are less likely to experience sudden price swings, making it easier to predict price movements with higher accuracy

3. Use Technical Indicators: Utilize the technical analysis tools provided by Pocket Option, such as moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence). These indicators help you identify trends and potential reversals, giving you the confidence to make informed trading decisions.

4. Avoid Overtrading: One of the most common mistakes in quick trading is overtrading. Stick to the strategy and avoid the temptation to make impulsive trades. Only place trades when your strategy and indicators align, and don’t chase after every potential opportunity.

Practical Example of the Low-Risk Strategy

Let’s take a closer look at how you can implement the low-risk strategy with a practical example.

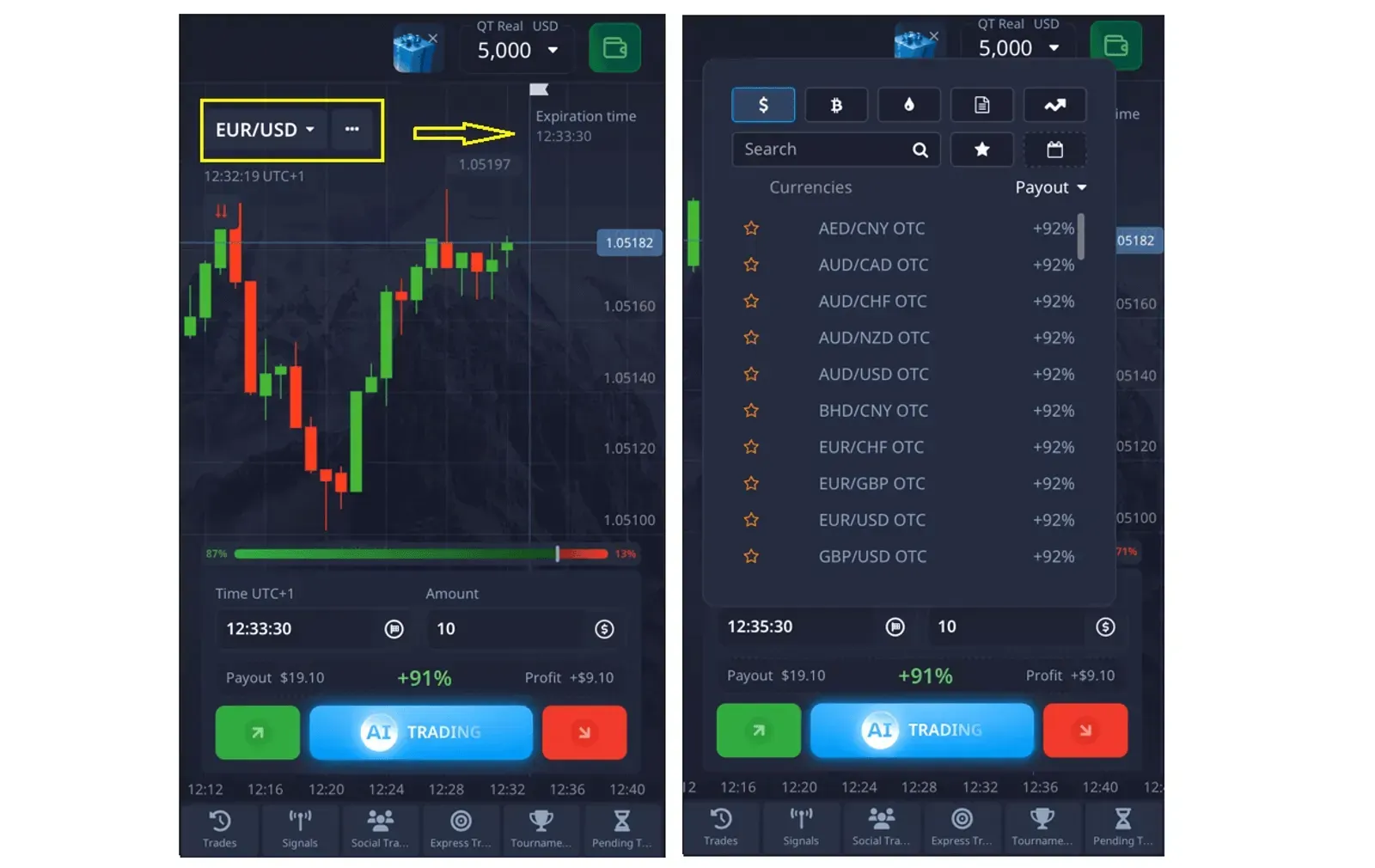

Step 1: Select an Asset You decide to trade EUR/USD because it’s a stable asset with moderate volatility, making it a good candidate for low-risk strategies.

Step 2: Apply Technical Indicators You apply the MACD indicator, which shows the asset is oversold, indicating a potential upward movement in price. You also apply the moving average and notice that the short-term average is crossing above the long-term average, signaling a possible buy.

Step 3: Place a Trade Based on your analysis, you place a Call option (Buy) for a 1-minute duration.

✔️ If your forecast is correct, you receive the profit percentage that was specified. It’s great that you can instantly see the potential profit percentage and open a trade for as little as $1! This is also an important aspect of the low-risk platform, ensuring transparency in trades on the platform.

Why This Strategy Works

This low-risk approach works because it focuses on reducing exposure to market fluctuations while maximizing potential profit. By choosing assets with lower volatility, using technical indicators to confirm your trades, and setting clear stop-loss and take-profit levels, you can trade confidently and steadily.

With a profit potential of up to 92%, it’s essential to stick to the strategy and avoid emotional decision-making, which is crucial for long-term success in quick trading.

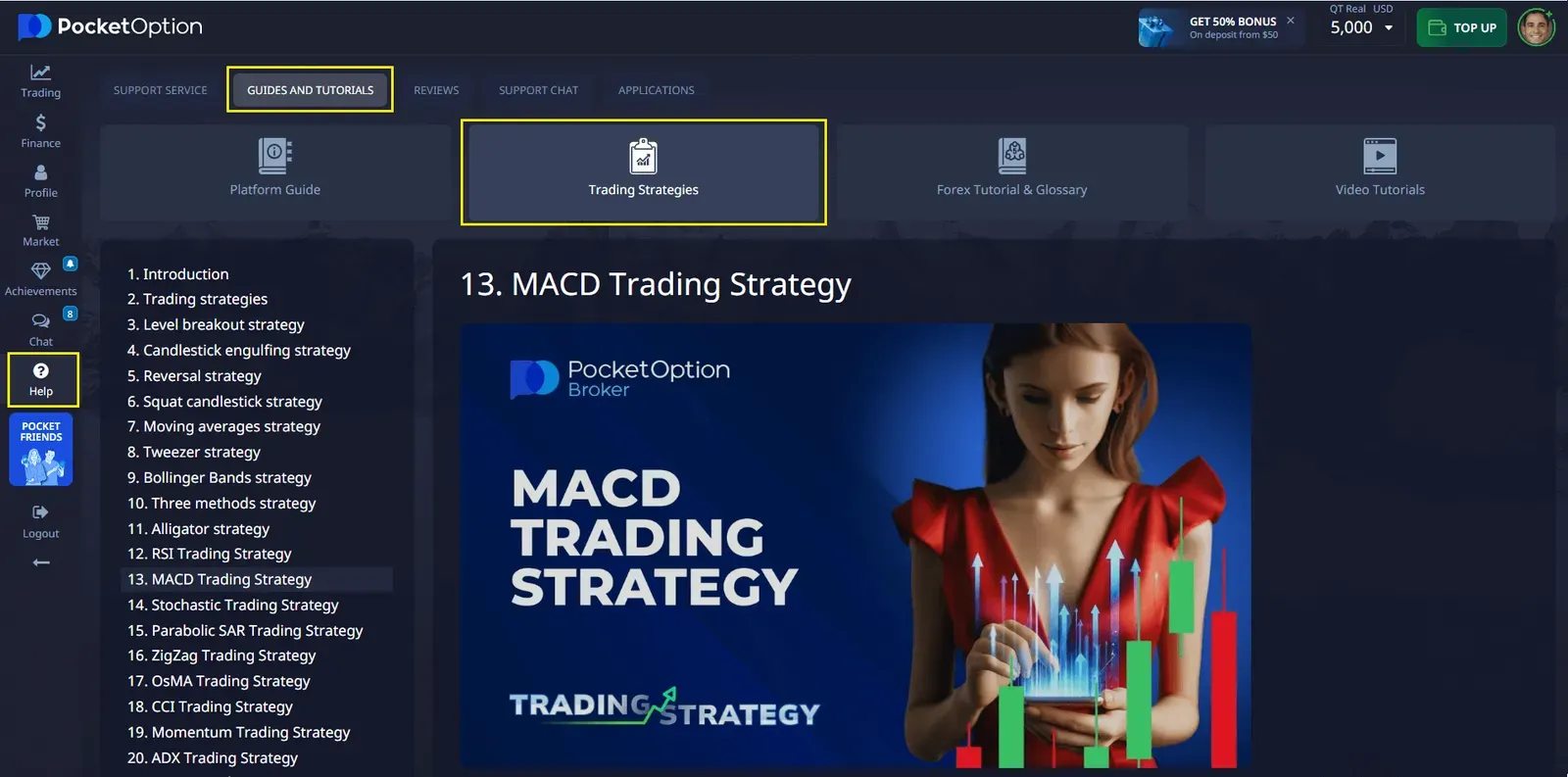

📌In the Help – Guides and Tutorials section of Pocket Option, you’ll find a wealth of information on various trading strategies and how to use them effectively. These resources cover everything from basic to advanced strategies, providing clear guidance to help you trade smarter and more confidently.

The Psychology Behind Low-Risk Trading Success

Successfully implementing a Pocket Option low-risk strategy requires certain psychological traits, which can often be more important than technical knowledge:

Conclusion

The top Pocket Option strategy low risk l can be a great way for beginners to get started in the world of online trading. By focusing on stability, utilizing technical indicators, and being disciplined with your trades, you can increase your chances of making profitable trades and managing risks effectively. Start small, practice with a demo account, and gradually increase your confidence and trading skills.

FAQ

What is the best way to reduce risk in quick trading?

The best way to reduce risk is to select assets with lower volatility, use technical indicators to confirm your trades, and set stop-loss and take-profit levels to protect your capital.

How can I improve my results with the low-risk strategy?

Consistent practice, discipline, and continuous learning are key. Use the demo account to refine your strategy, and gradually increase the complexity of your trades as you gain experience.

Is the low-risk strategy suitable for all types of assets?

While the low-risk strategy works best with assets that have lower volatility, it can be adapted for different markets. It’s essential to analyze the market conditions of each asset before deciding on your strategy.

How do I know when to enter a trade?

Look for clear signals from technical indicators like the RSI, moving averages, or MACD. These will help you identify trends and reversals in the market, guiding you to make informed decisions about when to enter a trade.

Can I start using the low-risk strategy with a small account?

Yes, the low-risk strategy is ideal for small accounts because it emphasizes steady, consistent profits over risky high-reward trades. You can start with small amounts and gradually build your trading capital.