- Greater Position Sizing: Access larger positions with the same percentage risk.

- More Asset Choices: Broader access to different markets.

- Enhanced Risk Management: More room to diversify trades.

- Reduced Impact of Fees: Lower relative cost from commissions and spreads.

- Lower Psychological Pressure: Ability to absorb drawdowns more sustainably.

- Scalability: Profitable strategies can grow with capital.

- Professional Credibility: Access to higher-tier brokerage tools and mentorships.

How Much Can You Make Day Trading With 100k: Understanding Potential Returns

The question "how much can you make day trading with 100k" is one of the most common among aspiring traders and experienced investors alike. The idea of controlling a substantial capital base—like a $100,000 account—opens the door to real income potential. However, the actual profits a trader can generate depend on many factors, including strategy, risk management, trading style, market conditions, and the trader’s emotional discipline. This trading guide by Roarbiznes is designed to offer a full breakdown for traders considering day trading 100k accounts or exploring swing trading 100k capital. From daily expectations to monthly trends like day trading opportunities June may offer, this article delivers an actionable, EEAT-compliant roadmap based on industry insight and practical experience.

Understanding Day Trading: A Primer

Day trading is a fast-paced approach where traders enter and exit positions within the same trading day. The goal is to capture small price movements in highly liquid assets, such as stocks, forex, or cryptocurrencies. Traders rely on technical analysis, candlestick patterns, economic indicators, and short-term momentum to time trades precisely.

Some use leverage to enhance their returns, but that also amplifies risk. A common mistake for beginners is overtrading or revenge trading after a loss—both are psychologically damaging and financially risky. To avoid this, many traders follow strict rules and use automated alerts or algorithms.

“The key to day trading 100k isn’t just about capital—it’s about consistency, strategy, and discipline.” — James Richardson, Market Analyst

Why Trade with a 100k Account?

In contrast to smaller accounts (like $500 dollars), a 100k account gives you the tools and cushion to build a professional trading business. You’re able to avoid over-leveraging and instead focus on mastering process-driven trading.

How Much Can You Make Day Trading with 100k?

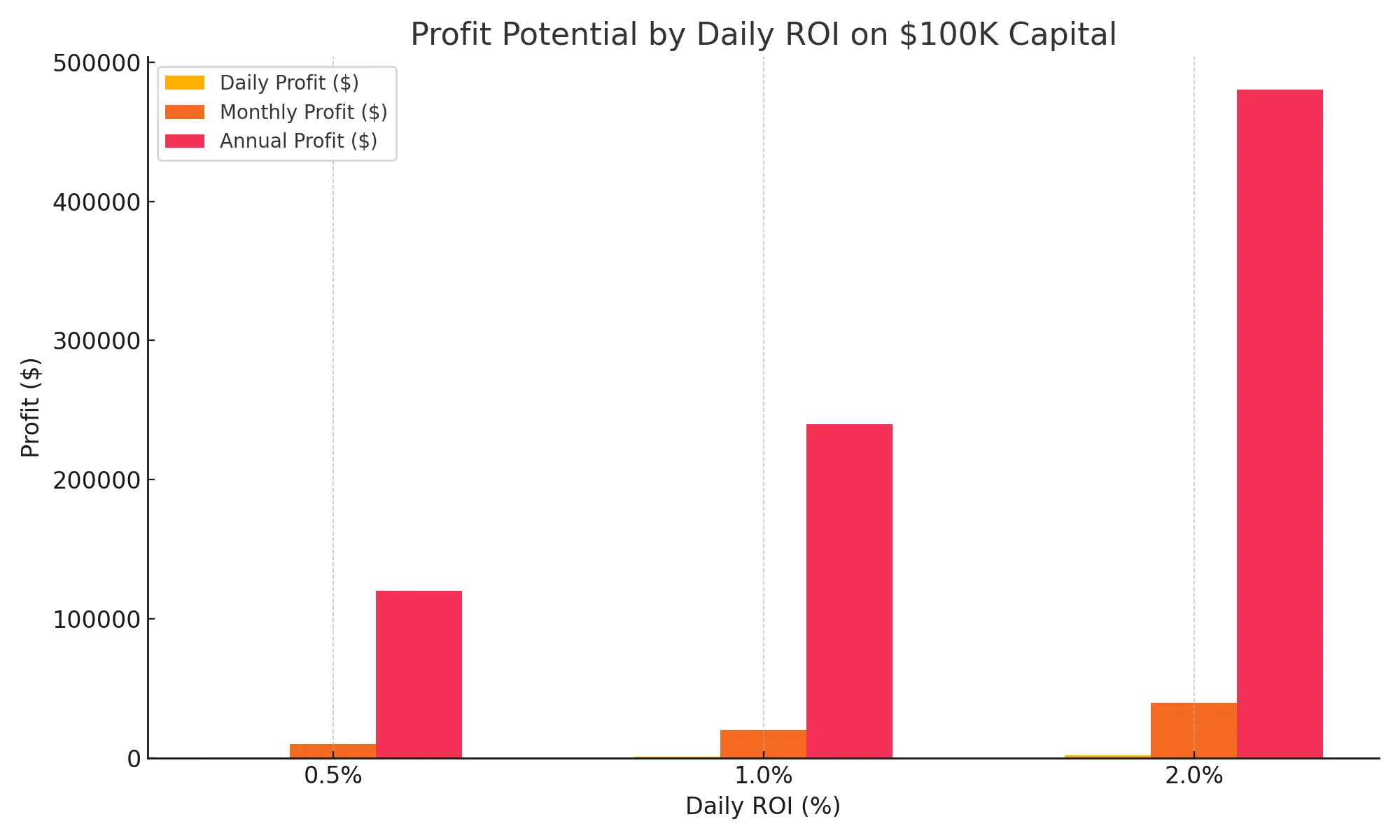

Profitability in day trading is not guaranteed, but with strong risk management, many traders aim for daily returns between 0.5% and 2%. Here’s what that looks like:

| Daily Return | Profit on $100K | Monthly (20 days) | Annual Estimate |

|---|---|---|---|

| 0.5% | $500 | $10,000 | $120,000 |

| 1.0% | $1,000 | $20,000 | $240,000 |

| 2.0% | $2,000 | $40,000 | $480,000 |

These numbers can be enticing, but traders must understand the consistency required to reach them. A single large loss can set back several days or even weeks of work.

How Much Money Do Day Traders with $50,000 Accounts Make Per Day on Average?

On average, successful day traders with a $50,000 account make between $250–$500 daily. This represents 0.5%–1% daily ROI. However, most new traders will earn less while gaining experience. Losses are part of the journey, and breakeven months are considered success during the learning phase.

| Account Size | Conservative Target | Aggressive Target |

|---|---|---|

| $50,000 | $250 | $500 |

| $100,000 | $500 | $1,000 |

| $200,000 | $1,000 | $2,000 |

Trading Style Comparison: Day Trading vs Swing Trading 100k

| Day Trading 100k | Swing Trading 100k |

|---|---|

| Requires full-time focus | Ideal for part-time traders or those with other jobs |

| Fast feedback loop for skill development | Holds positions for days or weeks |

| Higher transaction costs from volume | Fewer trades, lower commissions |

| More trading opportunities daily | Larger trend capture |

| Greater emotional strain | Requires patience and broader market analysis |

| Shorter trade durations = less exposure to overnight risks | Lower stress, more flexibility |

Which is better? It depends on your lifestyle, trading experience, and time commitment. Some traders blend both styles for flexibility and diversification.

Advanced Strategies for Day Trading with 100k

- Momentum Trading

Focuses on stocks or assets that are moving significantly on volume.

Traders buy on strength and exit quickly before momentum fades. - Breakout Trading

Trades are placed when price breaks above resistance or below support.

Requires volume confirmation. - Scalping

Executes dozens or hundreds of trades daily for small profits.

Very high speed and precision required. - News-Based Trading

Profits from market reactions to economic releases or earnings reports.

Volatility is both a friend and enemy here.

Each of these strategies can be profitable with 100k if properly tested and implemented.

Best Practices for Risk and Capital Management

Protecting capital is your #1 priority. Here’s a proven framework:

- Never risk more than 1-2% per trade.

- Use stop-loss orders religiously.

- Limit open trades to avoid mental overload.

- Set daily/weekly max loss rules.

- Log every trade. Analyze what works—and what doesn’t.

- Stay emotionally neutral—do not overtrade to recover losses.

Top traders use a risk-reward ratio of at least 1:2 or better. That means for every dollar risked, two or more are targeted in gains. This ratio is crucial to sustaining profitability, especially during losing streaks.

Day Trading Opportunities June 2025

June is historically volatile due to mid-year economic reports and fiscal policy announcements. Specific day trading opportunities June 2025 might include:

- Tech Stocks: AI-driven gains or pullbacks

- Energy Markets: Summer demand surges, geopolitical tensions

- Forex: Rate decisions by major central banks (e.g., FED, ECB)

- Indices: Mid-year rebalancing (e.g., S&P 500)

- Cryptocurrencies: Halving cycles, ETF news

Stay informed via platforms like ForexFactory, Investing.com, and your broker’s news feed.

Tools and Platforms for Day Trading

To succeed, you’ll need a reliable platform with advanced features:

- MetaTrader (MT4/MT5) — Popular with forex and CFD traders

- TradingView — Powerful for chart analysis and community scripts

- ThinkorSwim — Great for U.S. equity markets

- Pocket Option — User-friendly, fast execution for Quick Trading

Also use add-ons like:

- Economic calendar

- Volume heatmaps

- Real-time news alerts

Pro Tip: Use demo accounts to test setups. Many funded programs offer virtual evaluations before granting capital.

What’s the 100K Funded Account Price?

If you’re buying into a proprietary trading firm or evaluation program, typical 100K funded account price ranges from $150 to $500. Compare:

- FTMO: $540 (with profit share up to 90%)

- MyForexFunds: $499

- TopStep: $300 (for futures)

Choose programs with transparent terms, flexible rules, and realistic targets.

Real Case Study: Trader Performance with 100K

John D., a U.S.-based trader, started trading a 100K funded account in early 2024. His average stats over 6 months:

- Win rate: 58%

- Risk/reward: 1:2.3

- Avg daily profit: $750

- Losing days: 35%

- Largest drawdown: 7%

He noted that his performance improved drastically after creating a fixed routine, using one setup, and reviewing trades daily. His biggest lesson: “The money follows routine, not emotion.”

Day Trading with Pocket Option Platform

Pocket Option provides a contemporary and refined platform for trading on financial markets, offering traders the opportunity to utilize various trading features and opportunities to enhance their earnings. For day traders working with substantial capital like $100K, choosing the right platform becomes crucial for success.

Platform Features for Day Trading

Pocket Option offers several features that make it suitable for day trading activities:

- Real-time market data and advanced charting tools

- Multiple asset classes including forex, commodities, and indices

- Low minimum trade requirements starting from small amounts

- User-friendly interface suitable for both beginners and professionals

- Mobile trading capabilities for on-the-go management

Key Takeaways

- With discipline, day trading with 100k can realistically generate $500–$2,000 daily.

- Risk management and psychology are more important than strategy.

- Swing trading 100k may suit those who prefer slower-paced decisions.

- Day trading opportunities June look promising across tech, energy, and forex.

- Use reliable platforms and log every trade.

- Whether you’re starting with $500 dollars or aiming for a professional account, the fundamentals are the same: control risk, build skill, and trade with purpose.

Start with Pocket Option’s demo environment and join thousands of traders progressing toward real capital!

FAQ

How much can you make on a 100k funded account?

On a 100k funded account, experienced traders can potentially earn $500-$2,000 daily, translating to $10,000-$40,000 monthly. However, this depends on market conditions, trading strategy effectiveness, and risk management practices. Beginners should expect lower returns initially while developing their skills.

How much leverage should I use when day trading with $100,000?

With $100,000, conservative traders typically use 1:1 leverage (no leverage) to 2:1 leverage. More experienced traders might use 3:1 to 4:1 in specific situations. Higher leverage increases both potential profits and risks, so it should be approached cautiously even with substantial capital.

Is $100,000 enough to day trade full-time?

$100,000 is generally sufficient for full-time day trading, particularly for stocks, options, and futures. It provides enough capital to generate meaningful returns while allowing proper risk management. However, success depends more on strategy and discipline than account size.

What percentage of day traders with $100,000 accounts become profitable?

Studies suggest only 10-30% of day traders maintain profitability over time, even with adequate capital like $100,000. Success rates improve with proper education, mentorship, and at least 1-2 years of experience. Having $100,000 helps overcome certain challenges but doesn't guarantee success without proper skills.

How much money do day traders with $50,000 accounts make per day on average?

Typically between $250 and $500/day, depending on skill and market conditions.

Is swing trading with 100k less profitable than day trading?

Not necessarily. Swing trades target larger moves with fewer entries. Long-term ROI may be comparable.

What’s the best market to trade with 100k?

Highly liquid markets: major forex pairs, index futures, large-cap U.S. stocks, and crypto with volume.

Can I start with $500 dollars and grow to 100k?

Yes, but it requires time, compounding, and consistency. Many traders use a $500 account to learn before scaling up.