- Shareholder votes on major acquisitions

- Leadership or ESG policy shifts

- Executive compensation controversies

- Social or AI ethics campaigns

GOOG GOOGL tutorial: What Investors Need to Know Before Choosing

Choosing between GOOG and GOOGL stock represents more than just selecting a ticker symbol. This goog googl tutorial explores the practical distinctions between these two investment classes. Whether you're building a long-term position or implementing short-term trading strategies on platforms like Pocket Option, understanding these nuances provides a meaningful edge in today's competitive market.

Article navigation

- GOOG or GOOGL Stock: Strategic Differences That Impact Your Investment

- Historical Price Performance: Do Voting Rights Command a Premium?

- When Voting Rights Actually Matter

- Liquidity and Trading Strategy: Which Is Better for Traders?

- Tax Considerations: Optimize Your Holdings Strategically

- Choosing Based on Investor Profile

- Dual-Class Structure: A Blessing in Disguise?

- How Pocket Option Helps You Trade GOOG or GOOGL

- Final Thoughts: Making the Right Choice for You

According to a 2024 Bloomberg report, over 70% of Alphabet institutional investors consider both share classes interchangeable for portfolio construction, but only 18% actively vote, highlighting a gap between access and influence.

GOOG or GOOGL Stock: Strategic Differences That Impact Your Investment

Alphabet’s dual-ticker system can be confusing. So, what’s the difference between GOOG and GOOGL stock?

| Share Class | Ticker | Voting Rights | Description |

|---|---|---|---|

| Class A | GOOGL | 1 vote/share | For investors seeking a say in corporate matters |

| Class C | GOOG | None | Ideal for traders prioritizing liquidity and cost |

The difference between GOOG and GOOGL stock emerged in 2014 after Google implemented a stock split to allow greater flexibility in issuing shares while maintaining founder control via Class B shares.

🔎 Did You Know?

The founders of Google hold Class B shares, granting them 10 votes per share, thus maintaining strategic control.

“Unless you’re holding over $10 million in GOOGL, your individual vote won’t tilt the scales–but in ESG matters, symbolism matters,” says Sarah Long, equity analyst at Morningstar.

Historical Price Performance: Do Voting Rights Command a Premium?

| Period | Avg. Price Gap | Market Insight |

|---|---|---|

| 2014-2016 | 1-3% | Voting rights were valued more initially |

| 2017-2019 | 0.5-2% | Gap began narrowing |

| 2020-2024 | 0.1-1% | Price convergence indicates equal market value |

The diminishing premium shows that the market values GOOG and GOOGL almost equally, as retail investors rarely influence outcomes due to founder dominance.

Unique Insight: An analysis by The Wall Street Journal (2024) noted that the shrinking gap reflects investor preference for liquidity and options volume over symbolic voting power.

When Voting Rights Actually Matter

Though GOOGL shares come at a premium, there are scenarios where they add real value:

Example: In 2023, shareholder votes on AI usage gained historic attention, giving GOOGL shareholders a voice.

“The AI ethics vote at Alphabet marked a turning point in retail investor engagement, even if non-binding,” stated Lydia Zhang, governance specialist at Harvard Law School.

Liquidity and Trading Strategy: Which Is Better for Traders?

If you prioritize execution efficiency and market access, GOOG may be your choice. Here’s why:

- 10-15% higher daily trading volume

- 8% tighter bid-ask spreads

- More active options market

These differences support advanced strategies, particularly useful on platforms like Pocket Option, where traders access 100+ assets 24/7 using advanced tools like AI bots and social trading.

Unique Insight: A 2025 Statista report revealed GOOG consistently ranks among the top 5 most traded tech stocks in the U.S. options market.

Tax Considerations: Optimize Your Holdings Strategically

Some investors engage in tax-loss harvesting by selling one class and buying the other, maintaining exposure while realizing losses.

- Benefit: Maintains market position

- Risk: IRS may view as wash sale

Consult a tax advisor before applying this method with GOOG or GOOGL stock.

“The IRS hasn’t definitively ruled on this, so tread carefully–document intent and transaction purpose,” advises CPA Thomas Reynolds, founder of TaxAlpha Advisory.

Choosing Based on Investor Profile

| Investor Type | Likely Preference | Reason |

|---|---|---|

| Long-Term Holder | GOOGL | Governance rights may matter over decades |

| Day Trader | GOOG | Lower spread, better liquidity |

| ESG-Oriented Investor | GOOGL | Ability to vote on ethical proposals |

Governance Example: When the Gap Spikes

In 2018, Alphabet faced backlash on privacy. GOOGL jumped 2.1% over GOOG as investors anticipated governance actions. Conversely, during strong periods like 2020-2021, the gap shrank below 0.3%.

This pattern proves that the difference between GOOG and GOOGL stock becomes critical during corporate unrest.

Dual-Class Structure: A Blessing in Disguise?

Critics argue it undermines governance. However, Alphabet has:

- Retained high R&D spending

- Pivoted successfully into cloud & AI

- Protected long-term strategies from short-term market noise

“This structure allowed Alphabet to out-invest competitors during downturns,” noted James Healy, partner at GrowthTech Capital.

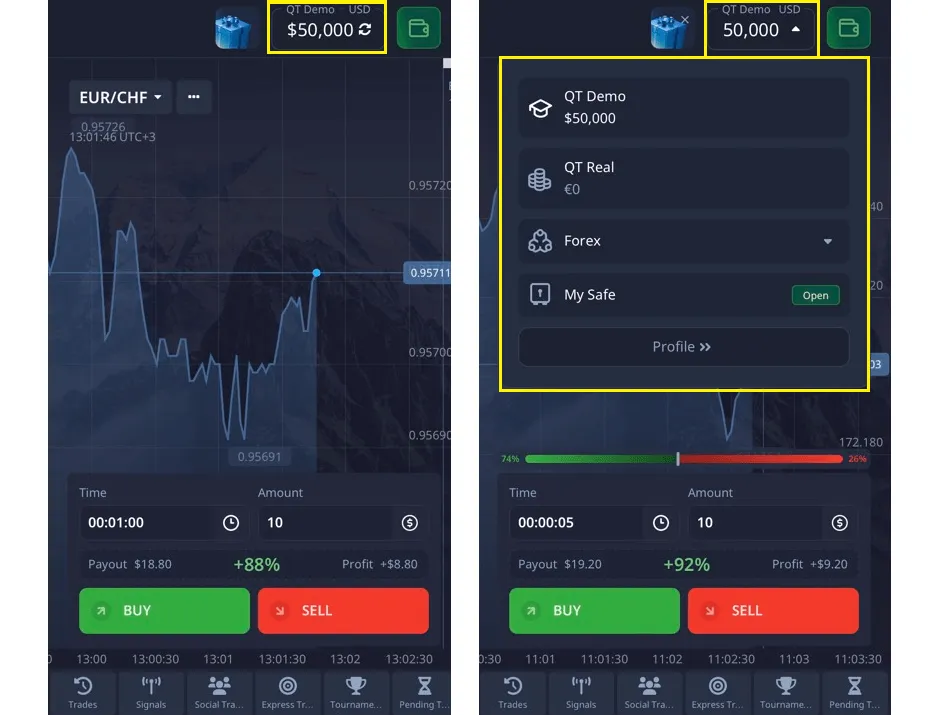

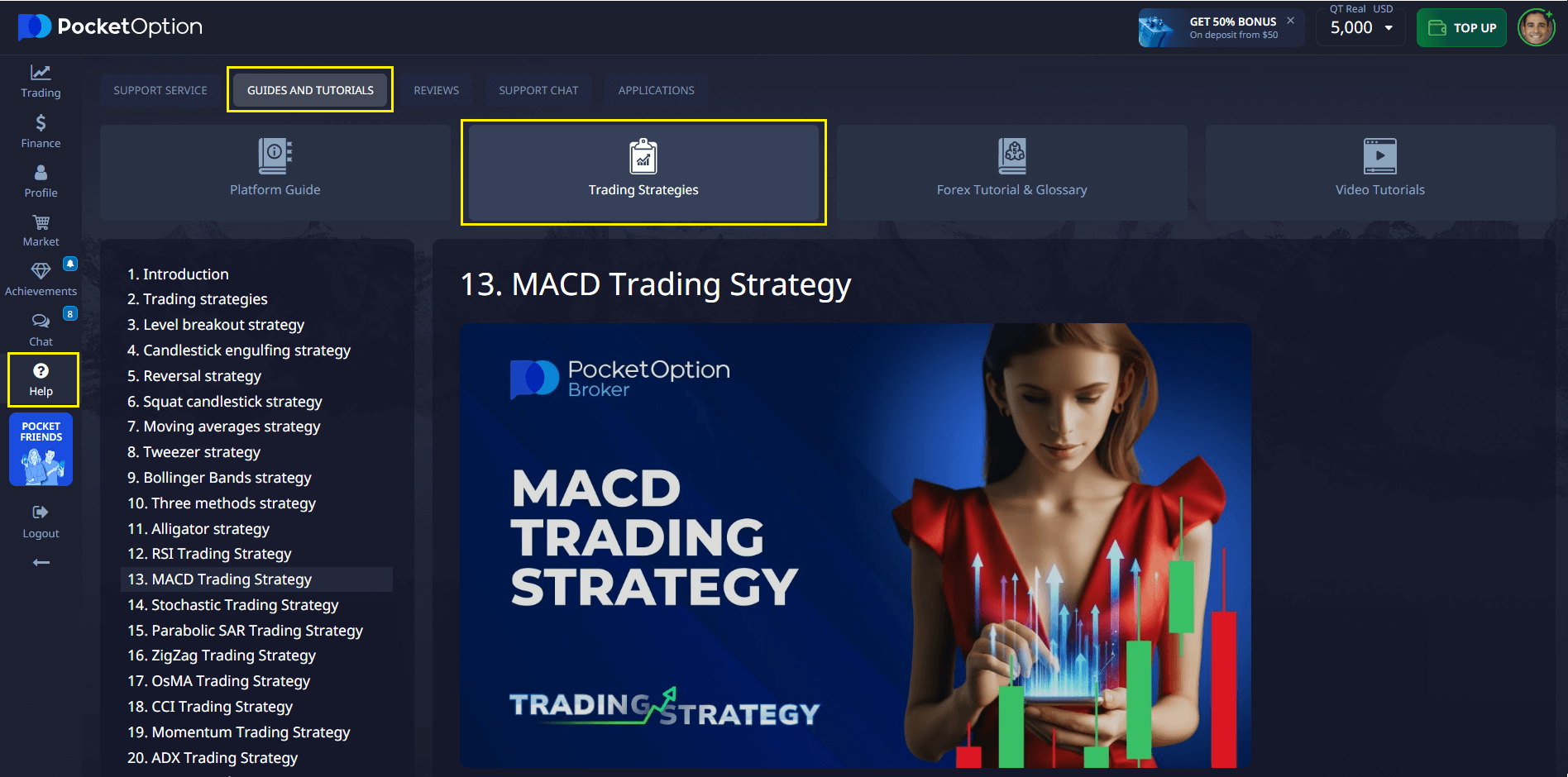

How Pocket Option Helps You Trade GOOG or GOOGL

Pocket Option offers access to both GOOG and GOOGL stocks 24/7 alongside 100+ other assets. Traders benefit from:

- ✅ AI trading and bots for automation

- ✅ Social trading to mirror top performers

- ✅ Learning materials and reliable support

- ✅ Bonuses and flexible payments

Final Thoughts: Making the Right Choice for You

When deciding between GOOG or GOOGL stock, use this goog googl tutorial to assess:

- Your investment horizon

- Trading style and volume

- Views on shareholder influence

Ultimately, both provide nearly identical exposure to Alphabet’s business. The minor price variance can offer trading opportunities or long-term governance value.

📊 Many savvy investors maintain positions in both to stay flexible.

“Investing in both share classes can serve as a volatility hedge in times of governance risk or strategic pivots,” suggests Dr. Ivan Müller, analyst at Swiss Investment Institute.

FAQ

What's the difference between GOOG and GOOGL stock?

GOOGL includes voting rights; GOOG does not.

Why do both stocks exist?

To let founders retain control while expanding equity.

Can I trade GOOG or GOOGL on Pocket Option?

Yes! You can trade 100+ assets, including Alphabet stocks, any time.

What is the difference between GOOG and GOOGL stock?

GOOG and GOOGL are different share classes of Alphabet Inc. (Google's parent company). GOOGL represents Class A shares that come with one voting right per share, allowing shareholders to vote on company matters like board elections and major corporate decisions. GOOG represents Class C shares that have no voting rights. Both share classes represent ownership in the same company and typically trade at very similar prices, with GOOGL occasionally commanding a small premium (0.5-2%) due to its voting rights.

Which is better to buy, GOOG or GOOGL?

Neither GOOG nor GOOGL is inherently "better" - the choice depends on your investment priorities. If you value having voting rights and potentially participating in corporate governance, GOOGL may be preferable. If you prioritize slightly higher liquidity and potentially paying a marginally lower price, GOOG might be the better choice. For most individual investors with smaller positions, the practical difference is minimal, as both share classes offer identical economic interest in Alphabet's performance.

Why does Alphabet have two different stock tickers?

Alphabet maintains two different publicly traded share classes (GOOG and GOOGL) as part of a corporate structure designed to help the founders maintain control while still allowing public investment. When Google restructured in 2014, it created the Class C shares (GOOG) without voting rights to enable the company to issue new shares for acquisitions and employee compensation without diluting the voting power of existing shareholders, particularly the founders who hold special Class B shares with 10 votes each.

Do GOOG and GOOGL stocks perform differently?

Historical performance shows that GOOG and GOOGL stocks track very closely in price and returns. While GOOGL occasionally trades at a small premium (typically 0.5-2%) due to its voting rights, both share classes reflect the same underlying company performance. The difference in returns over longer periods has been minimal, with both classes experiencing virtually identical price movements in response to Alphabet's financial results and market conditions.

Can I convert GOOG shares to GOOGL shares or vice versa?

No, individual investors cannot directly convert between GOOG and GOOGL shares. These are distinct share classes, and there is no mechanism for shareholders to convert from one class to another. If you wish to switch from holding one class to another, you would need to sell your current shares and purchase the alternative class through normal market transactions, which would have potential tax implications and transaction costs.