- Set a maximum investment per trade

- Choose the percentage of capital to allocate

- Copy multiple traders simultaneously

- Monitor real-time performance

Copy Trading in Finance

Are you looking for an easier way to start investing without in-depth financial expertise? Copy trading allows you to replicate strategies of experienced traders and earn returns based on their actions. In this article, we’ll explain how copy trading works, explore strategies for different goals, and share tips on minimizing risks while staying in control of your investments.

Article navigation

Copy Trading on Pocket Option: Automated Trading for Everyone

Copy Trading on Pocket Option is a convenient tool that allows users to automatically copy the trades of successful traders. This is a perfect option for those who want to earn on financial markets without the need for independent analysis and manual trading.

How Does Copy Trading Work?

Copy Trading connects experienced traders with those who wish to copy their trades. When a professional trader opens a position, the same trade is automatically executed in the copier’s account. You can adjust copying parameters depending on your risk management strategy.

Key features of Copy Trading on Pocket Option:

How to Start Copy Trading on Pocket Option?

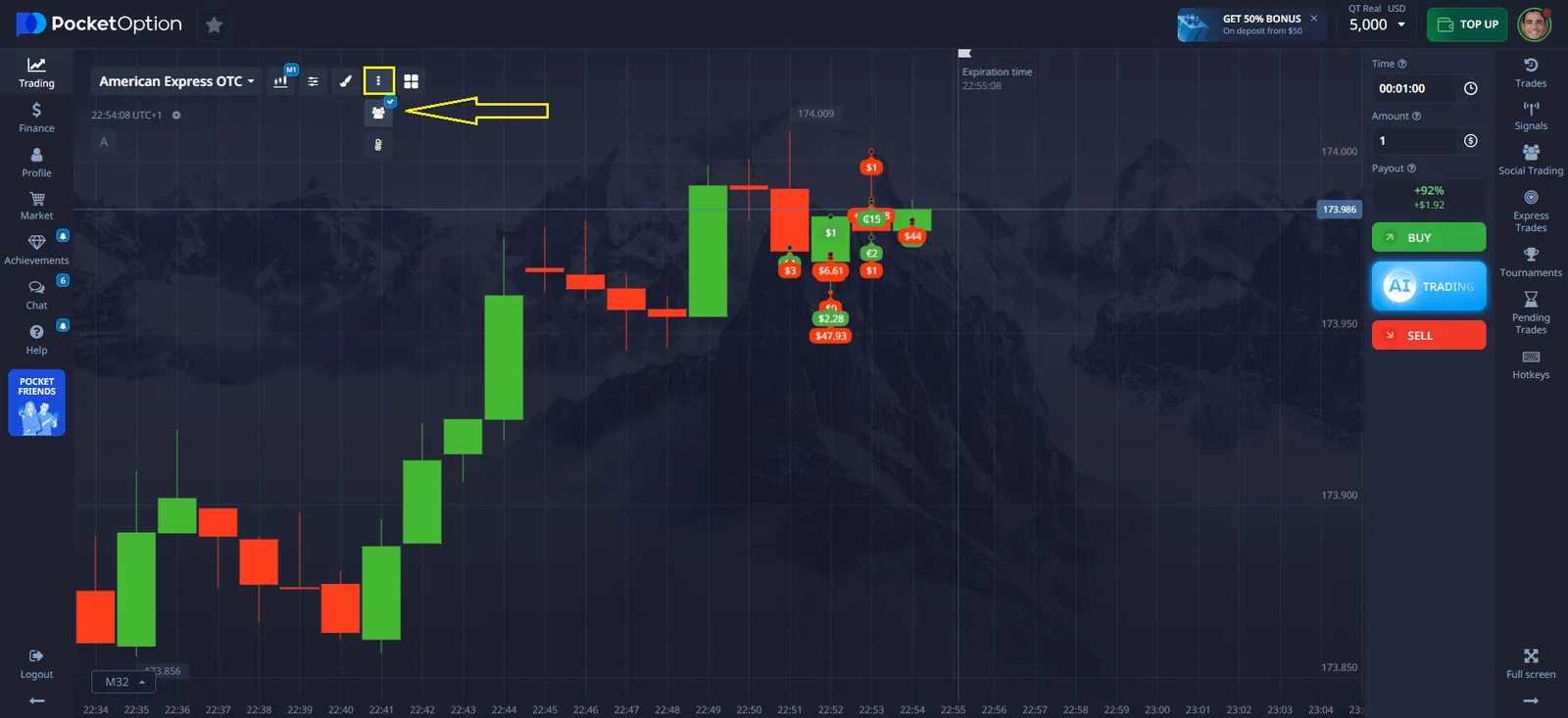

Step 1: Open the “Social Trading” Section

Log in to the Pocket Option platform and navigate to the “Social Trading” menu. Here, you’ll find a list of traders available for copying.

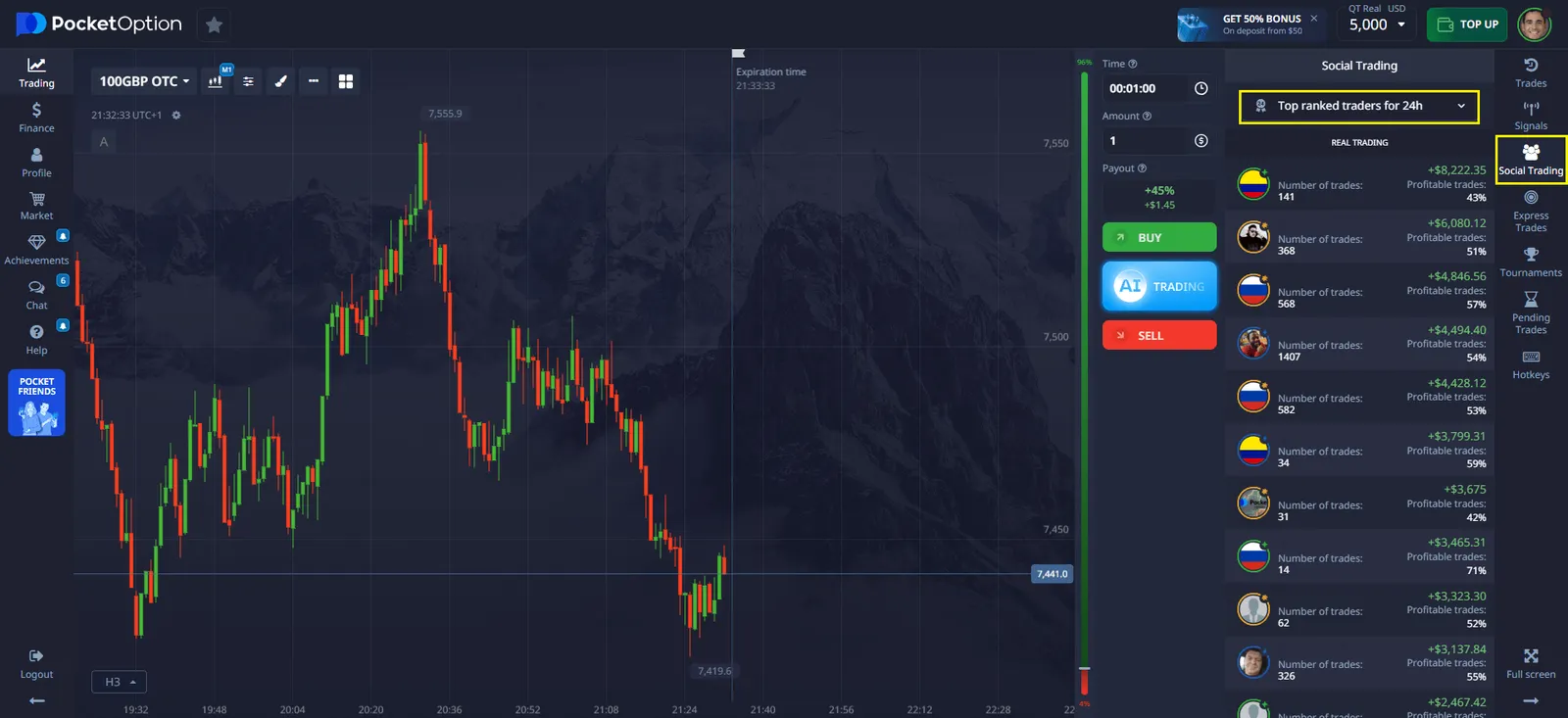

Step 2: Choose a Trader

Analyze traders’ statistics, their success rate, and profitability level. You can choose the best traders from the last 24 hours, week, or month.

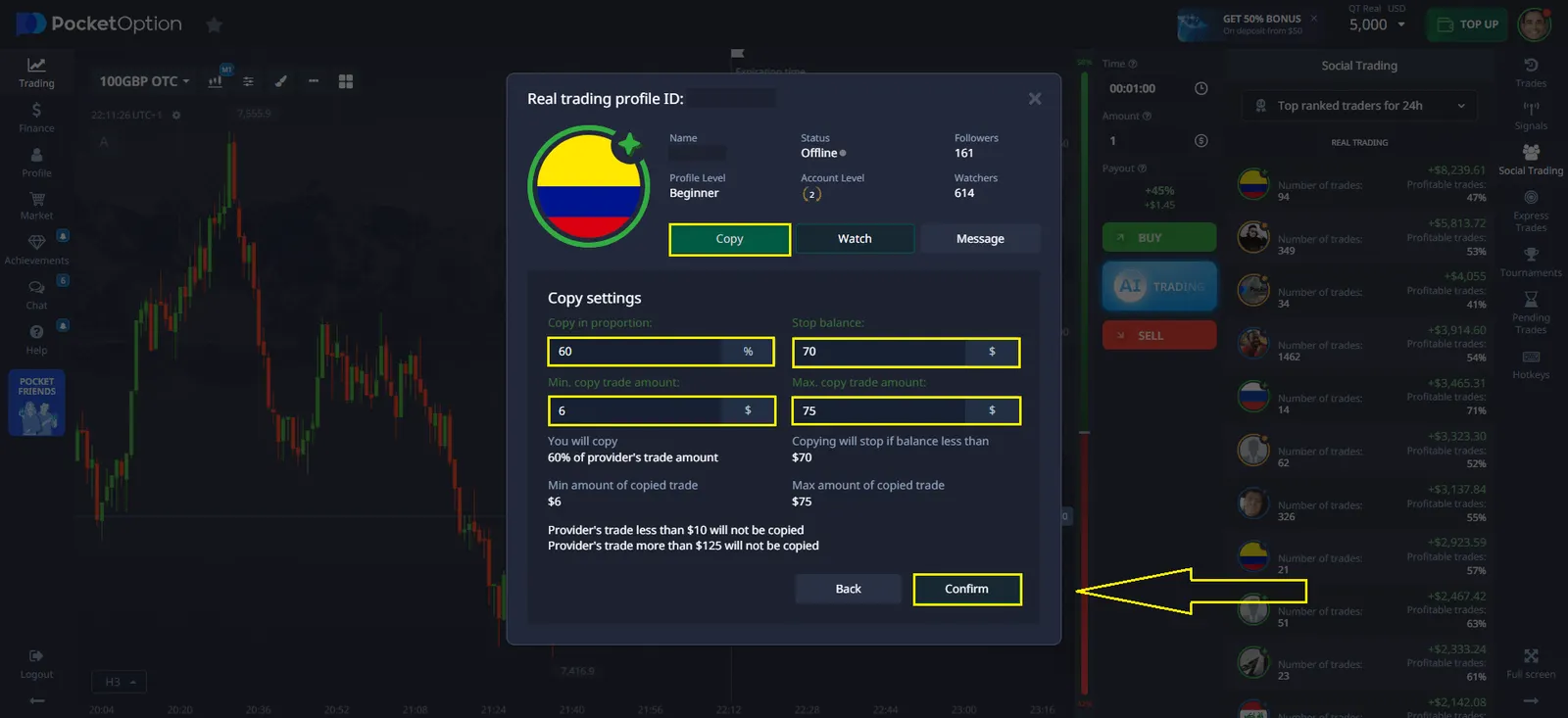

Step 3: Set Copying Parameters

Before starting, it’s important to configure key settings:

- Copy Proportion: The percentage of the trader’s trade to be copied.

- Stop Balance: Copying will stop once this balance limit is reached.

- Min. & Max. Trade Amount: Limits the amount per copied trade.

Step 4: Confirm & Start Copying

After selecting a trader and setting the parameters, click “Copy”. The system will now automatically replicate the chosen trader’s moves.

Example of Copying Trades

Let’s say you selected Trader A, who opened a $100 trade, and you set your copying proportion to 50%.

- Original trader’s deal: $100

- Your copy proportion: 50%

- Final trade amount in your account: $50

If the trader earns a profit, your balance increases accordingly. However, keep in mind that even experienced traders can sometimes incur losses.

User Reviews on Copy Trading at Pocket Option

Jonathan: “I’m new to trading, but thanks to Copy Trading, I’ve already made my first profits. I selected a few successful traders, and now my deposit is steadily growing!”

Maria : “Simple and convenient! I set up copying in just a few clicks, and trades started replicating automatically. The key is choosing the right trader and managing risks.”

Samir: “Pocket Option is the good choice for Copy Trading. I managed to double my deposit in a month by following professional traders!”

Luis : “I love the trader filtering system. You can choose the top traders from the last 24 hours and instantly start copying them.”

Emily: “Copy Trading is a real chance to earn even without experience. I used the 50% promo code and continue testing my strategy!”

Bonus: 50% Promo Code on Your First Deposit

To start Copy Trading with an additional bonus, use promo code “50START” when making your first deposit and receive +50% extra funds.

Conclusion

Copy Trading on Pocket Option is a great opportunity for those who want to profit from trading without spending time on market analysis. Simply choose an experienced trader, configure your settings, and watch your deposit grow. However, remember that all trading involves risks, so it’s crucial to manage your capital wisely and select reliable traders.

Start copying trades now – your path to passive income begins with Pocket Option!

FAQ

How is copy trading different from traditional investing?

Copy trading allows you to replicate the trades of other investors automatically, while traditional investing typically involves making independent decisions based on your own research.

Is copy trading suitable for beginners?

Yes, copy trading can be a great starting point for beginners. It offers a chance to learn from experienced traders while giving you control over how much you invest and your risk level.

How do I choose which traders to copy?

Look for traders with a consistent performance history, suitable risk levels, and a trading style that aligns with your goals. Community feedback and ratings can also provide valuable insights.

Can I modify or stop copied trades?

Yes, you can set stop-loss limits, adjust the amount of capital allocated, or manually close copied trades to maintain control over your investments.

What risks should I be aware of in copy trading?

Key risks include losses if the copied trader underperforms, reliance on others’ strategies, and the potential for selecting traders whose risk tolerance does not match your own. Diversifying your portfolio and regularly reviewing performance can help mitigate these risks.