- Identify market trends and price movement direction

- Determine entry and exit points with precision

- Filter out market noise and focus on significant price moves

- Establish support and resistance levels dynamically

- Generate buy and sell signals through crossover strategies

Comprehensive EMA Day Trading Analysis

What is Exponential Moving Average (EMA) and Why Day Traders Use Moving Averages

The Exponential Moving Average (EMA) is a refined type of moving average that assigns more significance to recent price data compared to the simple moving average (SMA). This technical indicator makes it ideal for day trading, where reaction speed to price action is critical.

Day traders use moving averages, particularly EMAs, to:

Unlike SMAs, exponential moving averages better reflect real-time price changes, allowing traders to respond more quickly to rapid market trends. This reduced lag makes EMA a superior lagging indicator for active trading strategies.

💬 “In fast-moving markets, a properly tuned EMA gives you a visual edge in spotting trend exhaustion before the price flips. It’s not predictive—but it’s anticipatory.” — Dr. Leo Andersen, Quantitative Analyst, Tokyo Asset Group

Best EMA Settings and Moving Averages Configuration for Day Trading

There’s no universal standard for what EMA to use for day trading, but experienced traders consistently return to proven moving averages combinations across different time frames.

💡 Insight 1: Trend intensity matters more than crossovers. A sharp angle on a 21 EMA often provides more reliable signals than simple crossover patterns.

Common EMA Settings for Different Trading Strategies

| EMA Length | Use Case | Time Frames | Trading Style |

|---|---|---|---|

| 9 EMA | Fast momentum detection for scalping | 1m–5m charts | Scalping, rapid entry/exit |

| 21 EMA | Short-term trend confirmation | 5m–15m charts | Intraday swing trading |

| 50 EMA | Directional bias filter, dynamic support/resistance | 15m–1h charts | Position filtering |

| 200 EMA | Long-term trend filter, psychological anchor | All time frames | Trend alignment |

Expert Perspective on Moving Averages Combinations

📌 “The 9/21 EMA crossover remains a staple because it reflects short-term consensus without overfitting. Pair it with volume analysis and you’ve got complete price action confirmation.” — Hyejin Lee, Market Technician, Quantsense Research

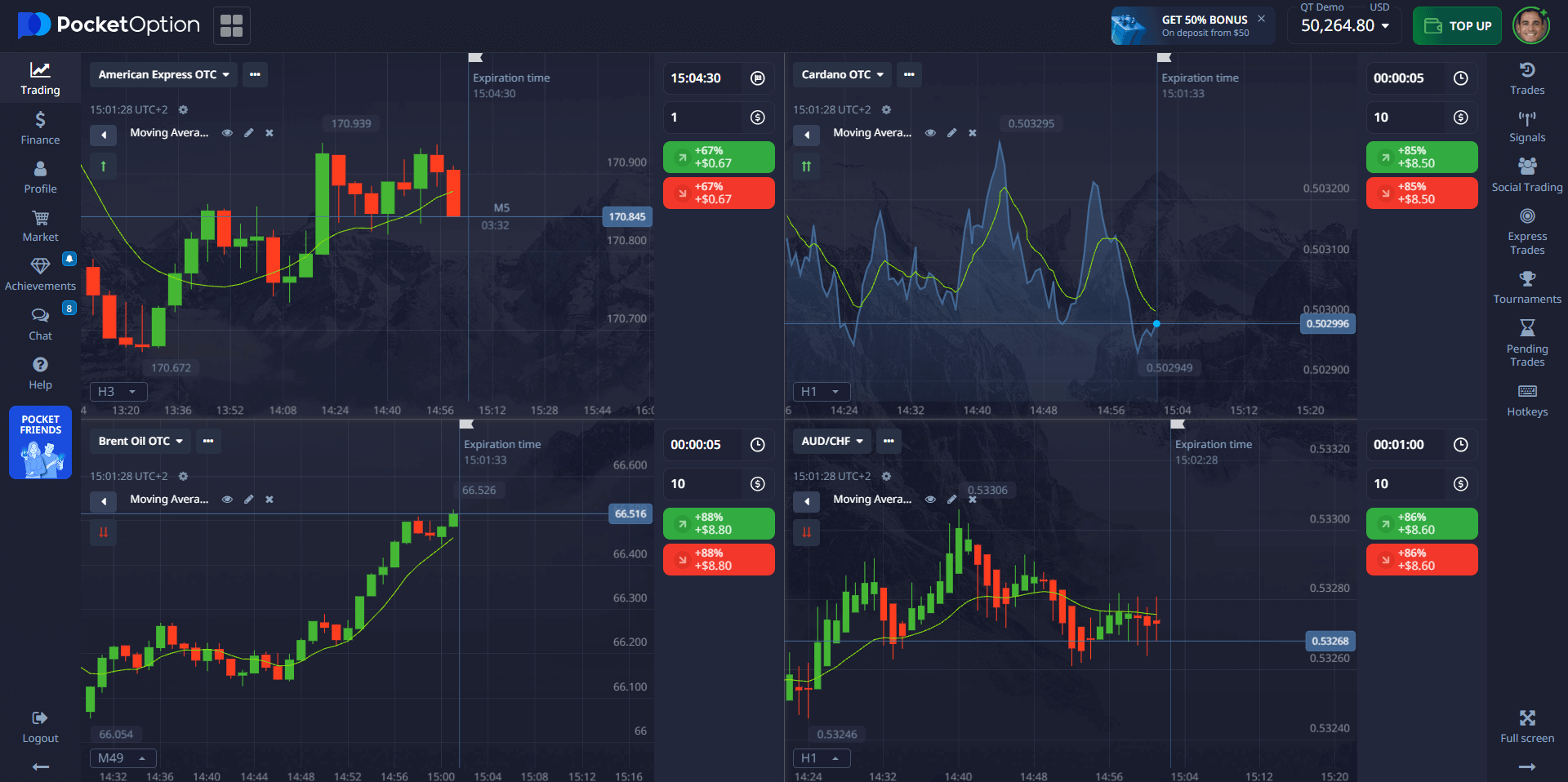

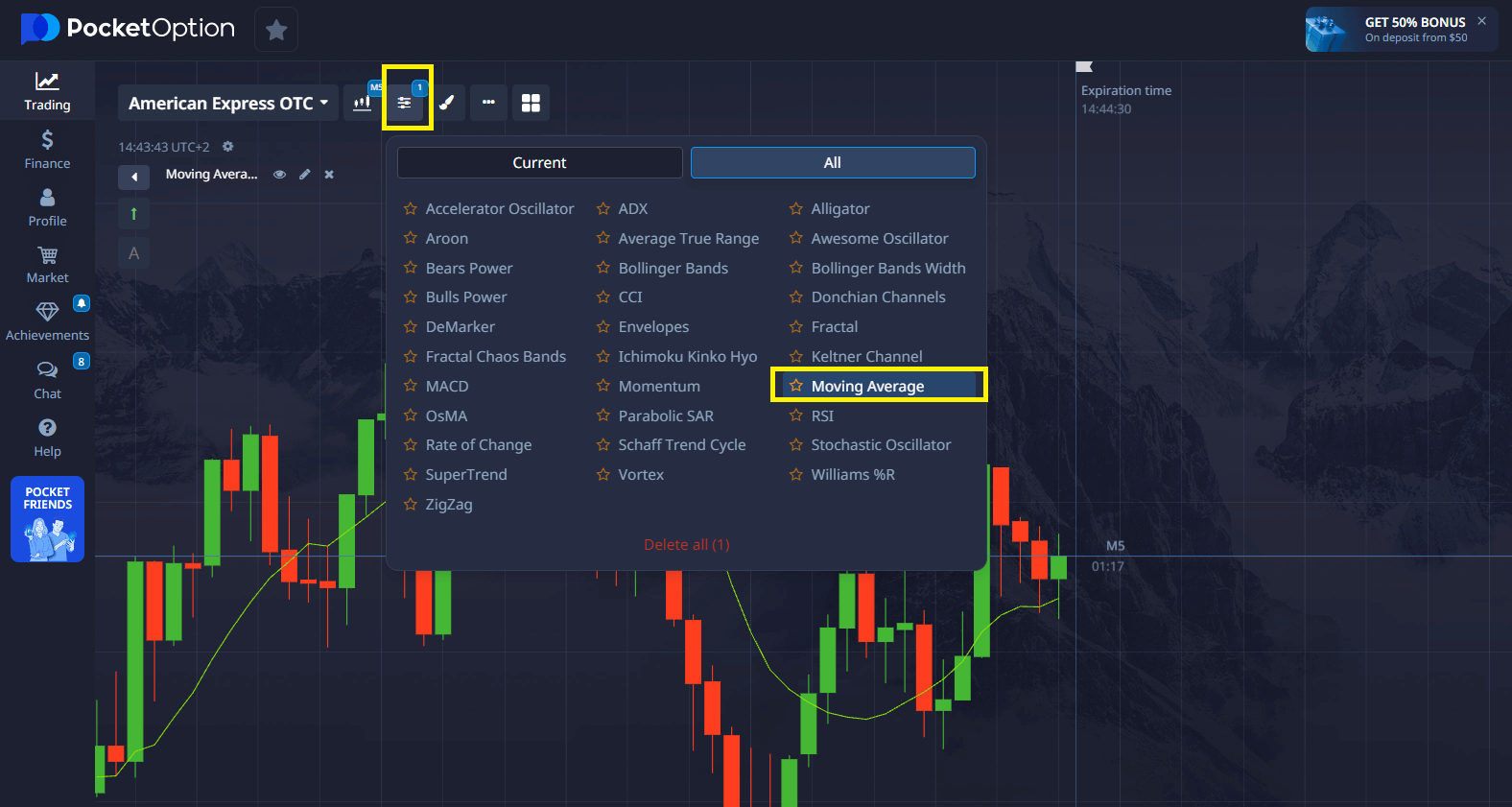

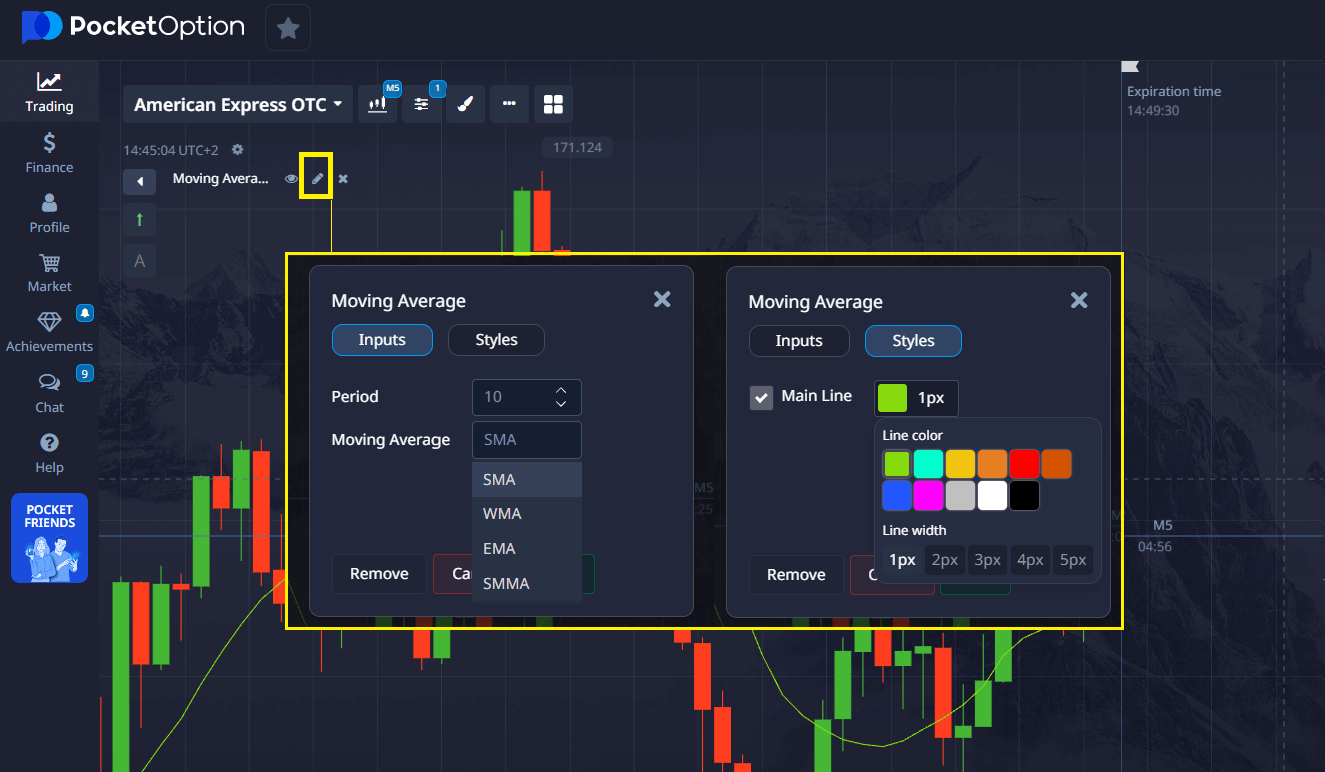

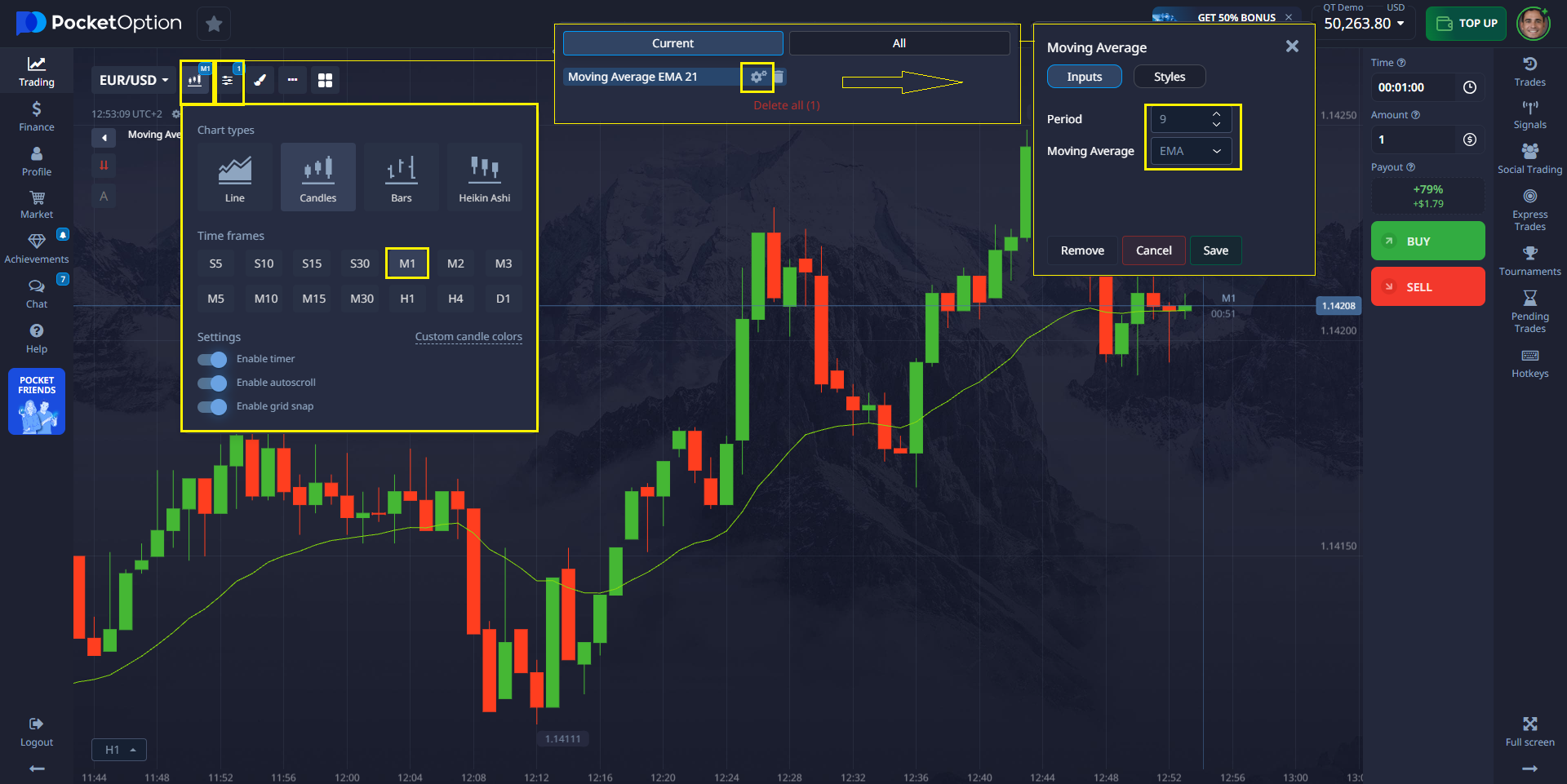

Day trading EMA settings on Pocket Option Platform

Pocket Option provides an intuitive interface where traders can manually configure any moving averages settings. The platform supports all standard exponential moving average configurations for comprehensive technical analysis.

Recommended EMA combinations for different trading approaches:

- 9 EMA + 21 EMA — Perfect for momentum breakouts on 1m–5m time frames, ideal for scalping strategies

- 21 EMA + 50 EMA — Excellent for filtering choppy price action from genuine market trends

- 200 EMA — Essential for avoiding trades that counter the long-term price movement direction

💬 “In Asia-Pacific equity pairs, we noticed that 50 EMA with Bollinger Band constraints leads to lower variance entries. It’s subtle but statistically significant.” — Marco Alvarez, Systems Developer at TradeSolvers

Benefits and Risks of EMA Day Trading Strategies

Advantages of Using Moving Averages in Day Trading

- Rapid Response: EMAs adjust quickly to new price data, providing timely signals

- Enhanced Timing: Improves precision for entry and exit points identification

- Versatile Application: Works effectively across different asset classes including stocks, forex, and crypto

- Dynamic Support/Resistance: Creates adaptive support and resistance levels based on recent price action

- Trend Confirmation: Helps traders use technical indicators to confirm market trends

💡 Insight 2: Session-specific moving averages work better. Use separate EMA settings for London and New York sessions due to differing volatility characteristics and price moves patterns.

Drawbacks and Risk Management

- Whipsaw Susceptibility: Can generate false signals during sideways price movement

- Context Dependency: May mislead if used without volume confirmation or broader market analysis

- Over-optimization Risk: Requires disciplined backtesting to avoid curve-fitting

- False Breakouts: May trigger premature entries during fake reversals

🧠 “A single technical indicator won’t preserve your capital. Real skill lies in combining market structure, fundamental narrative, and mathematical precision. EMAs just help traders identify that structure more clearly.” — Enrique V., Full-Time Trader

Real User Experiences: How Traders Use EMA on Pocket Option

- 🔹 “I primarily trade crypto pairs and the 9 EMA keeps me grounded during high volatility periods. Pocket Option ema and charting tools make switching between time frames seamless for my trading strategies.” — Natalia P.

- 🔹 “I lost too many trades using 200 EMA on short time frames. After switching to 21/50 combination on Pocket Option’s 5-minute charts, I’ve achieved more consistent entry and exit points.” — Luca M.

- 🔹 “Moving averages work when you’re disciplined about technical analysis. I backtest every setup with real volume data to avoid emotion-driven decisions. Pocket Option’s interface accelerates my testing process.” — Kwame J.

EMA vs Other Technical Indicators: Comparative Analysis

| Indicator | Reactivity to Price Changes | Trend Clarity | Suitability for Scalping | Lag Characteristics |

|---|---|---|---|---|

| EMA | High | Medium to High | High | Low lag |

| SMA | Low | Low | Low | High lag |

| VWAP | Medium | High | Medium | Medium lag |

| MACD | Medium | High | Low | Lagging indicator |

🔎 Most day traders prefer exponential moving averages for fast-paced markets due to reduced lag. VWAP may be superior for institutional flow analysis, while MACD suits longer-term swing trading strategies.

💡 Insight 3: Don’t chase crossover signals blindly. Wait for complete candle close beyond the fast EMA before executing trades to avoid false breakouts.

Advanced Moving Averages Strategies for Day Trading Success

Multi-Timeframe EMA Analysis

- 1-minute charts: 9 EMA for immediate price action

- 5-minute charts: 21 EMA for short-term trend confirmation

- 15-minute charts: 50 EMA for broader market context

Volume-Weighted EMA Signals

- Combine exponential moving averages with volume analysis to validate:

- High volume EMA breakouts (stronger signals)

- Low volume crossovers (potential false signals)

- Divergence patterns between volume and price movement

Risk Management with Moving Averages

- Set stop-losses below/above key EMA levels

- Use EMA slopes to gauge trend strength

- Implement position sizing based on EMA volatility

Technical Analysis Best Practices for EMA Day Trading

- Backtesting Requirements: Test all moving averages settings on historical price data

- Market Condition Adaptation: Adjust EMA parameters for trending vs. ranging markets

- Multiple Confirmation: Never rely solely on one technical indicator

- Session Awareness: Consider different volatility patterns across trading sessions

- Documentation: Maintain detailed trading journals for strategy refinement

Conclusion: Mastering EMA for Successful Day Trading

The exponential moving average remains one of the most adaptable technical indicators for short-term traders who focus on price action analysis. While EMAs don’t predict future price movement, they respond effectively to recent price data, providing traders with statistically sound foundations for making entry and exit decisions.

Key Success Factors:

- Combine moving averages with structured risk management

- Conduct thorough backtesting across different market conditions

- Maintain detailed performance tracking and analysis

- Adapt EMA settings to specific assets and time frames

- Never rely exclusively on single technical indicator signals

✅ Final Recommendations: Maintain analytical skepticism, optimize moving averages settings for each asset class, and always use multiple confirmation signals. Successful day traders document every trade, analyze performance patterns, and continuously iterate their strategies based on market feedback.

The traders who achieve consistent profitability are those who master technical analysis fundamentals, understand price action dynamics, and adapt their moving averages strategies to evolving market conditions. 📢 Join the Discussion: Share your EMA trading experiences and advanced technical analysis insights in our trading community!

FAQ

How do I set up EMA indicators on my trading platform?

Most platforms allow easy setup through the indicators menu. Select EMA and input your desired periods.

Can I use EMA for all markets?

Yes, EMA can be applied to any market with sufficient liquidity and price movement.

What timeframe works best with EMA?

The 5-minute and 15-minute timeframes are popular for day trading with EMA indicators.

How many EMAs should I use simultaneously?

Start with two EMAs (fast and slow) and add more as you become comfortable with the strategy.

Which is better, 50 day or 200 day moving average?

For day trading, 50 EMA is better as it responds faster to price changes and provides more relevant signals for short-term trades. The 200 EMA is more suitable for swing trading and long-term trend identification. Day traders typically use 50 EMA for directional bias and 200 EMA only for major trend context.

What is the 5 10 20 EMA strategy?

The 5-10-20 EMA strategy is a triple moving average system where 5 EMA provides fast signals, 10 EMA confirms short-term trends, and 20 EMA filters out noise. Buy signals occur when price closes above all three EMAs in ascending order, with stop-loss below the 20 EMA.

What is the 5 8 13 21 EMA strategy?

The 5-8-13-21 EMA strategy uses multiple exponential moving averages to identify trend strength and momentum. When all EMAs align (5>8>13>21 for uptrend), it signals strong bullish momentum. Crossovers between these levels provide entry signals, while divergence indicates potential reversals.

What is a good EMA for day trading?

The best EMA settings for day trading are 9 EMA for scalping (1-5 minute charts), 21 EMA for short-term trends (5-15 minute charts), and 50 EMA for directional bias filtering. Most successful day traders use 9/21 EMA combination for optimal entry and exit points.