- CoinCodex projects BTC may reach $8.9M by 2040 assuming 34% CAGR continues.

- A conservative CAGR (9.25%) aligned with equity markets yields ~$415K.

- Telegaon and PricePrediction provide bullish forecasts in the $1.9M–$5.6M range.

- Cryptomus anticipates ~$2.6M by 2040.

Bitcoin price prediction 2040

Explore Bitcoin price predictions for 2040, expert projections, and trading strategies. Learn how to trade BTC 24/7 on Pocket Option with 100+ assets.

Introduction: Why Bitcoin price prediction 2040 matters now

Understanding Bitcoin prediction 2040 is more than academic—it’s strategic. With nearly 98% of Bitcoin expected to be mined by 2040 due to scheduled halvings, supply-side scarcity becomes an ever-stronger driver of price. At the same time, growing institutional interest and adoption amplify the demand side. For Pocket Option users, where you can Quick Trade Bitcoin using buy/sell buttons anytime, this long-term forecast helps shape investment horizon and risk management. Bitcoin in 2040 could be a very different asset—scarcer, more valuable, and more integrated into mainstream finance.

Data-driven forecast models for Bitcoin in 2040

Bitcoin Price Prediction Models – Pocket Option Overview

| Model | Projected Range (USD) | Accuracy | Notes |

|---|---|---|---|

| Stock‑to‑Flow | $1 M – $5 M | 73% | Based on halving-driven scarcity (sources: tradingview.com, tastycrypto.com) |

| Log‑Regression | $750 K – $2.5 M | 68% | Uses historical price via log trends (sources: barrons.com, marketwatch.com) |

| Power‑Law Corridor | $350 K – $3.5 M | 79% | Upper/lower boundaries from past cycles (sources: thecryptobasic.com, stealthex.io) |

| Metcalfe’s Law Adaptation | $800 K – $4.2 M | 65% | Demand linked to network growth (general consensus among network effect analysts) |

Median aggregate forecast: $920,000 by 2040. This median helps contextualize the projected Bitcoin price 2040 across a range of models.

Analyst forecasts & institutional outlook

Expert insights:

- Cathie Wood: BTC to $1.5M by 2030 (ARK Invest).

- Michael Saylor: 29% CAGR suggests $5M–$13M range mid-2040s.

- Raphael Zagury: “$620K case” based on production cost and gold correlation.

These opinions are a strong part of the Bitcoin forecast 2040 narrative.

Key drivers influencing Bitcoin 2040

- Scarcity & supply

By 2040, over 98% of Bitcoin will be mined. - Lost wallets shrink tradable supply further.

- Institutional adoption

ETF approval, corporate treasury adoption (MicroStrategy, Tesla). - Regulatory clarity

Supportive jurisdictions (e.g. U.S., UAE) could unlock vast institutional flows. - Technological strength

Lightning Network, Taproot, and second-layer protocols improve scalability.

💡 Insight: The Bitcoin Lightning Network processed over 5,000 BTC monthly in 2024—double from 2023—indicating rapid adoption for microtransactions.

Scenario outcomes & Bitcoin forecast 2040

- Bear case: $85K (adverse regulation).

- Base case: $920K (median model consensus).

- Bull case: $2M–$5M+ (mass adoption, reserve status).

Comparative forecast table

| Source/Model | 2040 Forecast |

|---|---|

| Stock‑to‑Flow | $1M–$5M |

| CoinCodex | $8.9M |

| Equity Market-Aligned Model | $415K |

| Telegaon & PricePrediction | $1.9M–$5.6M |

| Cryptomus | $2.6M |

| Saylor (MicroStrategy) | $5M–$13M |

Expert sentiment highlights

- Gil Luria: “1–2% chance BTC replaces all fiat globally—$5M potential.”

- Cathie Wood: “$1.5M target by 2030 implies multi-million BTC by 2040.”

- Zagury: “$620K as a fair value baseline.”

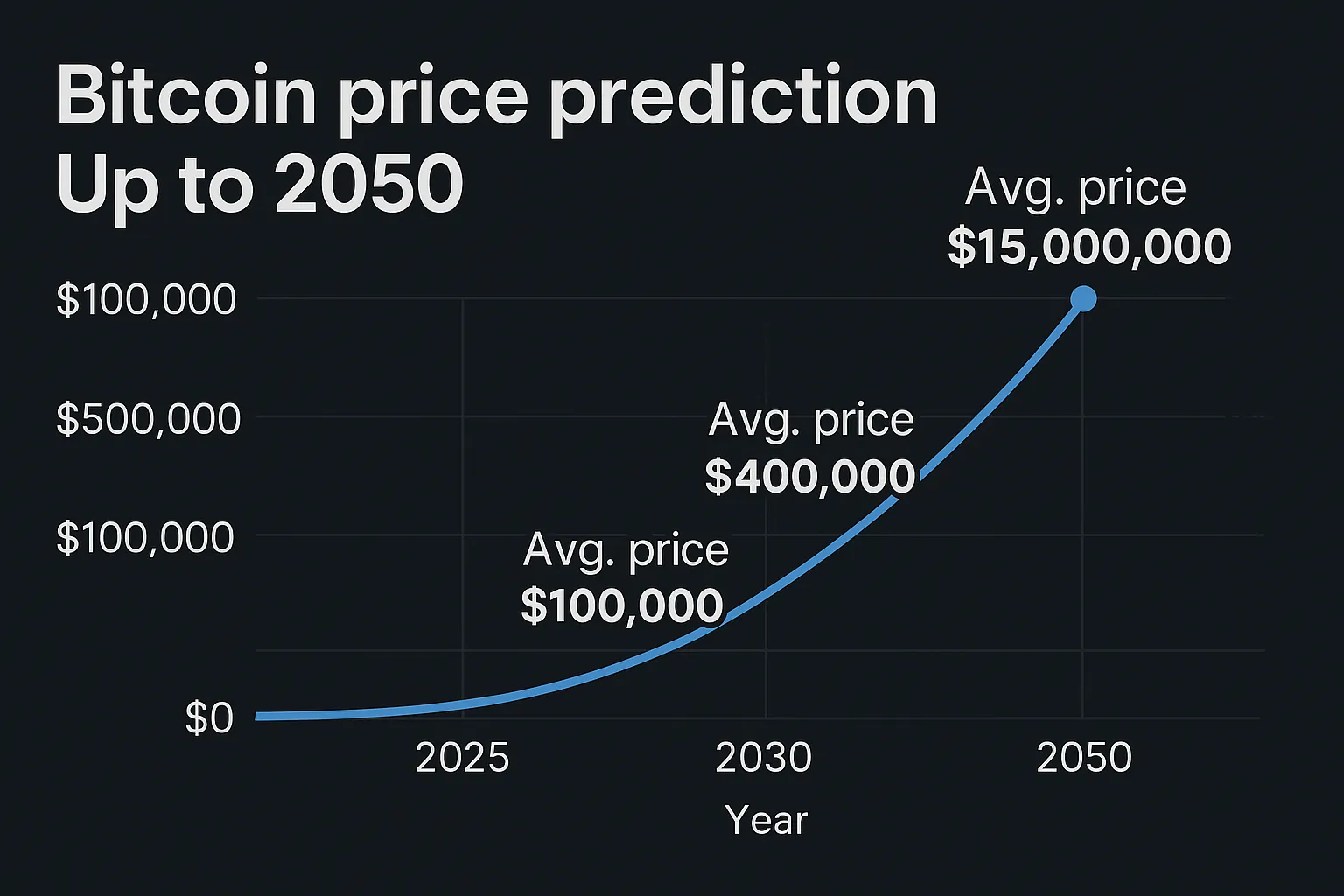

Related forecasts: 2025, 2030, 2050

- Bitcoin price prediction 2025: $70K–$150K.

- Bitcoin price prediction 2030: $200K–$1.5M+.

- Bitcoin price prediction 2050: Up to $20M per BTC.

What this means for Bitcoin price prediction 2040 USD

Forecasts consolidate around:

- Conservative: ~$350K–$415K.

- Median: ~$920K.

- Bullish: $2M–$5M+.

- Balanced outlook: $1M–$3M.

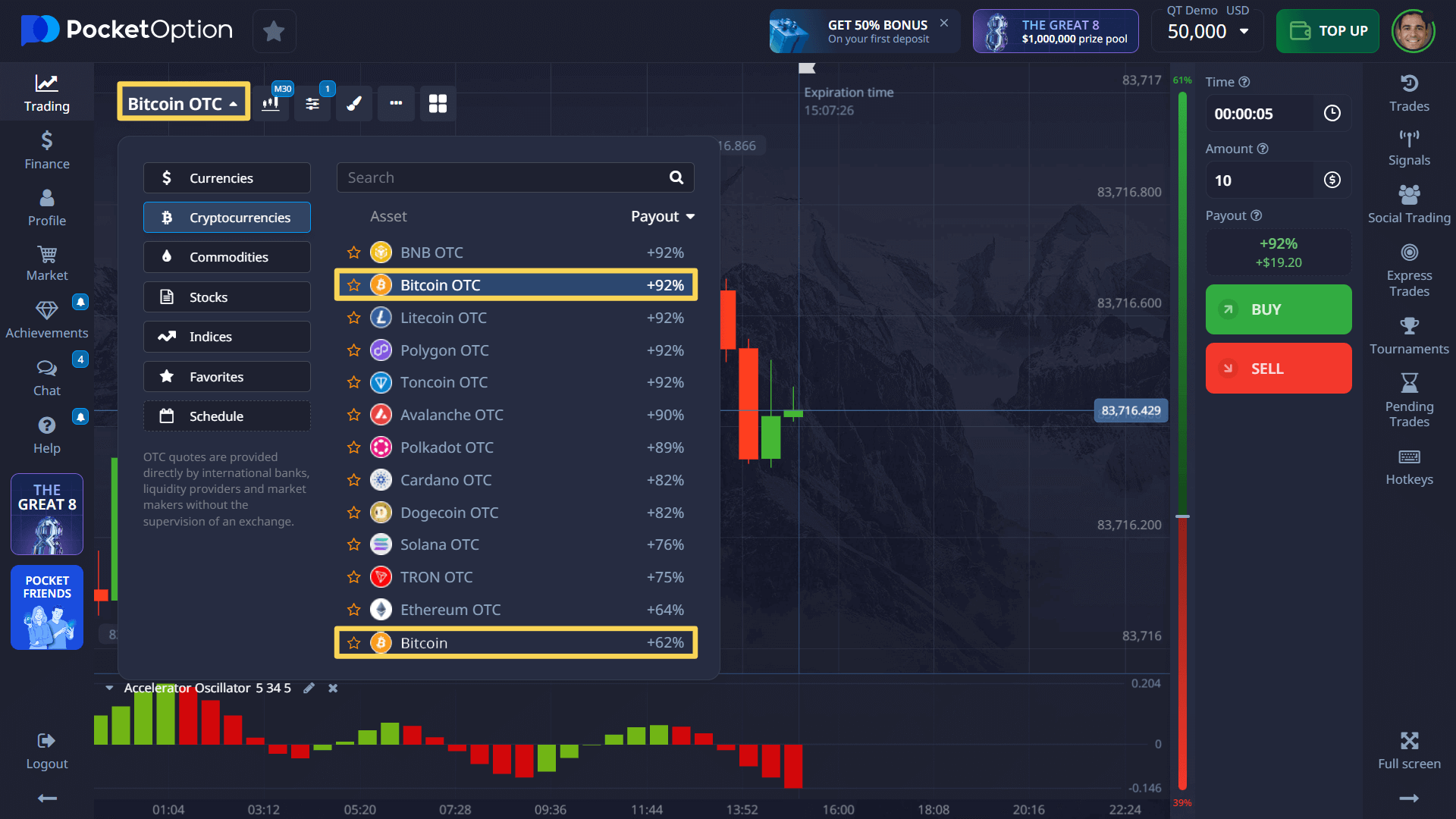

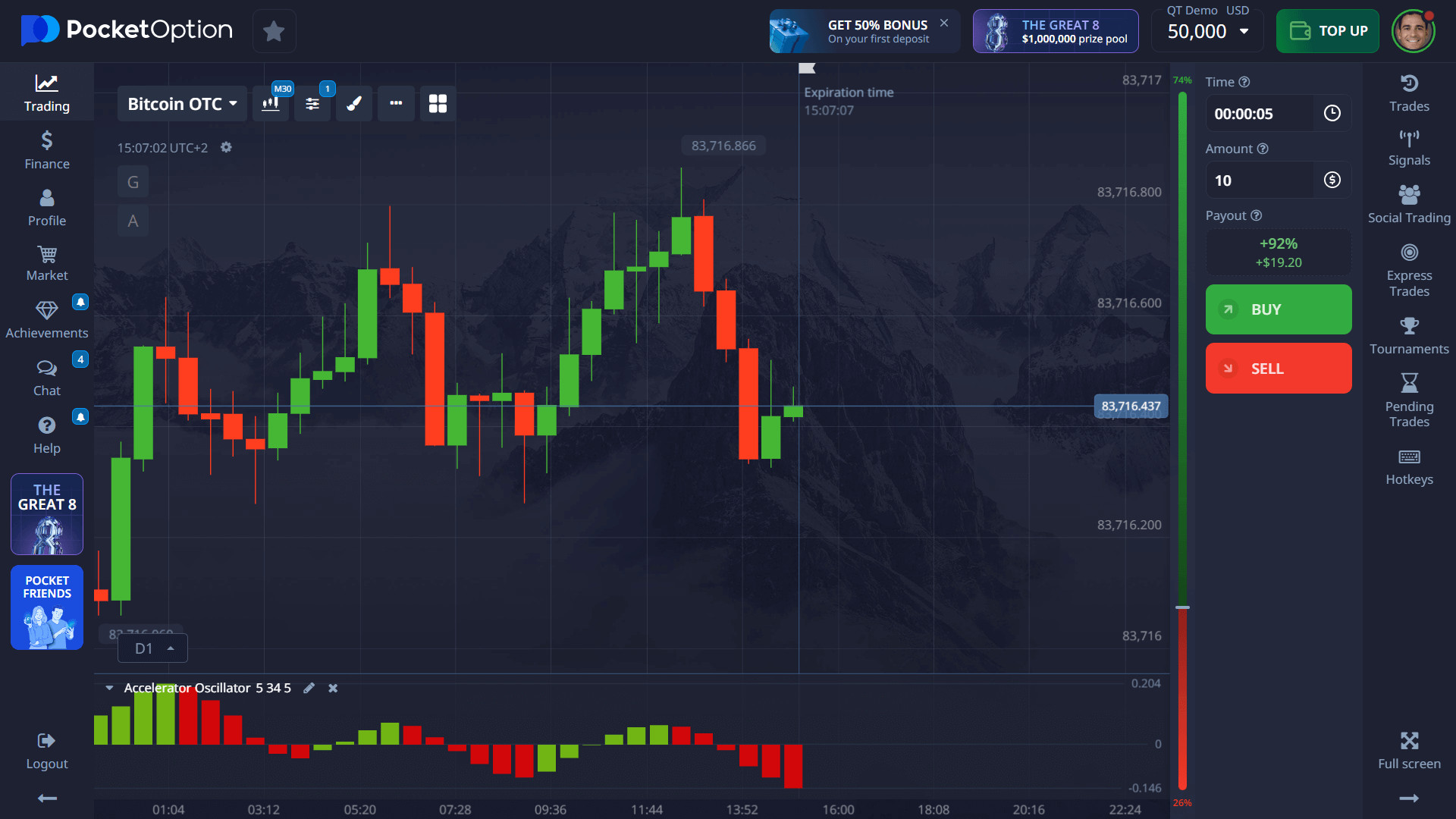

Quick Trading example: BTC on Pocket Option

Scenario:

For those exploring how to buy Bitcoin and trade effectively, follow these steps:

- Select Bitcoin: Choose Bitcoin or Bitcoin OTC (available 24/7) from the asset list.

- Analyze: Use Pocket Option’s tools:

- Moving averages for trend identification

- RSI for overbought/oversold conditions

- Volume indicators for confirmation

- Set Amount: Start from $1, risking only 1-3% per trade.

- Choose Timeframe: Select from 5 seconds to multiple days based on your strategy.

- Predict Direction:

- Select “BUY” for expected rises

- Select “SELL” for anticipated drops

- Execute and Monitor: Confirm parameters and track your position.

Starting requires only registration and a $5 minimum deposit.

Benefits:

- Trade 100+ assets 24/7 (stocks, crypto, forex).

- Low minimum deposit ($5, varies by region).

- Ideal for applying long-term insights like Bitcoin projections 2040.

Strategic tips for long-term Bitcoin trading

- DCA: Automate recurring buys (e.g., $100/month).

- Diversify: Combine BTC with other Pocket Option assets.

- Manage risk: Set trade limits; avoid overexposure.

- Stay informed: Track ETF approvals, halving cycles, macro data.

Final thoughts on Bitcoin price prediction 2040

The journey to 2040 offers both opportunity and uncertainty. From conservative $350K forecasts to bullish $5M projections, the path is shaped by halving cycles, adoption trends, regulation, and innovation. For investors, Bitcoin 2040 price prediction is more than a number—it’s a signal of a maturing, globally integrated financial evolution. Stay informed, stay strategic, and consider your exposure wisely.

- Bitcoin price prediction 2040 reddit discussions reflect similar expectations, often aligning with bullish sentiment.

- Some analysts, including speculative platforms, have even shared Bitcoin price prediction 2060 and Bitcoin price prediction 2035 scenarios, extending the outlook.

- A few media outlets, including Bitcoin price prediction 2040 Forbes, have recently highlighted the long-term store-of-value potential of BTC.

FAQ

What mathematical models provide the most reliable bitcoin price prediction 2040?

The most statistically robust models for long-term Bitcoin price forecasting combine stock-to-flow calculations with network effect quantification (Metcalfe's Law). Stock-to-flow models account for Bitcoin's decreasing supply growth, while Metcalfe-based calculations quantify value growth from increasing adoption. When these models are combined with Monte Carlo simulations that incorporate thousands of potential scenarios, they provide probability distributions rather than single price targets. No model offers perfect reliability over such extended timeframes, but these approaches provide structured frameworks for analyzing potential valuations.

How does halving mathematically impact what will bitcoin be worth in 2040?

Bitcoin's halving events mathematically reduce new supply entering the market approximately every four years. By 2040, Bitcoin will have undergone several more halvings, reducing the block reward to less than 0.2 BTC per block. Mathematically, this represents a supply shock multiplier of approximately 16.9x compared to 2023 emission rates. Historical analysis indicates price appreciation following supply reductions with a lag of 12-18 months. The compound effect of multiple additional halvings before 2040 creates exponential rather than linear impact on potential price development, assuming demand maintains or increases.

What adoption rate is required to reach a bitcoin price 2040 of $1 million?

According to mathematical models based on modified Metcalfe's Law, Bitcoin would need to reach approximately 1 billion users (roughly 10% of projected 2040 global population) to support sustainable valuations around $1 million per coin. This calculation incorporates network value growing proportionally to n*log(n), where n represents user count. Alternative formulations suggest that institutional adoption could accelerate this threshold, with approximately 5% allocation from global financial assets potentially supporting similar valuations with fewer individual users. The precise relationship depends on wealth distribution among users and velocity of coins.

How do platforms like Pocket Option help investors utilize bitcoin price prediction 2040 models?

Pocket Option provides analytical tools that allow investors to implement systematic strategies based on mathematical forecasting models. These include customizable dollar-cost averaging algorithms, volatility-based position sizing calculators, and scenario analysis frameworks. Additionally, the platform offers portfolio simulation tools that allow investors to test different accumulation strategies against historical data and projected scenarios. These capabilities help translate theoretical bitcoin price 2040 models into practical investment approaches calibrated to individual risk tolerance and time horizons.

What risks could invalidate mathematical bitcoin price prediction 2040 models?

Several risk factors could potentially invalidate mathematical price models: 1) Technological obsolescence through superior cryptocurrency alternatives, 2) Catastrophic protocol failure or security breach, 3) Coordinated global regulatory prohibition, 4) Quantum computing breakthroughs that compromise cryptographic security, and 5) Macroeconomic paradigm shifts that fundamentally alter store-of-value dynamics. Comprehensive mathematical models incorporate these risks as probability-weighted scenarios, typically assigning combined probability of approximately 15-30% to severely adverse outcomes. Sensitivity analysis allows investors to understand how each risk factor impacts potential valuations.

Will Bitcoin reach $10 million?

Reaching $10 million per Bitcoin is possible, though speculative. Some bullish forecasts, particularly from analysts like Michael Saylor, predict that Bitcoin could reach as high as $10 million if it experiences exponential growth, widespread institutional adoption, and global economic shifts toward decentralized assets. However, it is considered a highly optimistic scenario, and such a price point would depend on factors like mass adoption, Bitcoin’s role in global finance, and its position in the market relative to other assets.

How much will Bitcoin be worth in 2045?

While predictions for 2045 are speculative, some projections suggest Bitcoin could be valued anywhere from $5 million to $13 million. This estimate assumes sustained growth due to continued adoption, scarcity driven by halvings, and its potential to replace or complement fiat currencies in global markets

What is the expected price of BTC in 2030?

Forecasts for Bitcoin's price in 2030 generally range between $200,000 and $1.5 million, depending on adoption rates, macroeconomic conditions, and technological advancements like the Lightning Network. Some analysts are more optimistic, predicting even higher values if Bitcoin solidifies its role as a global reserve asset.