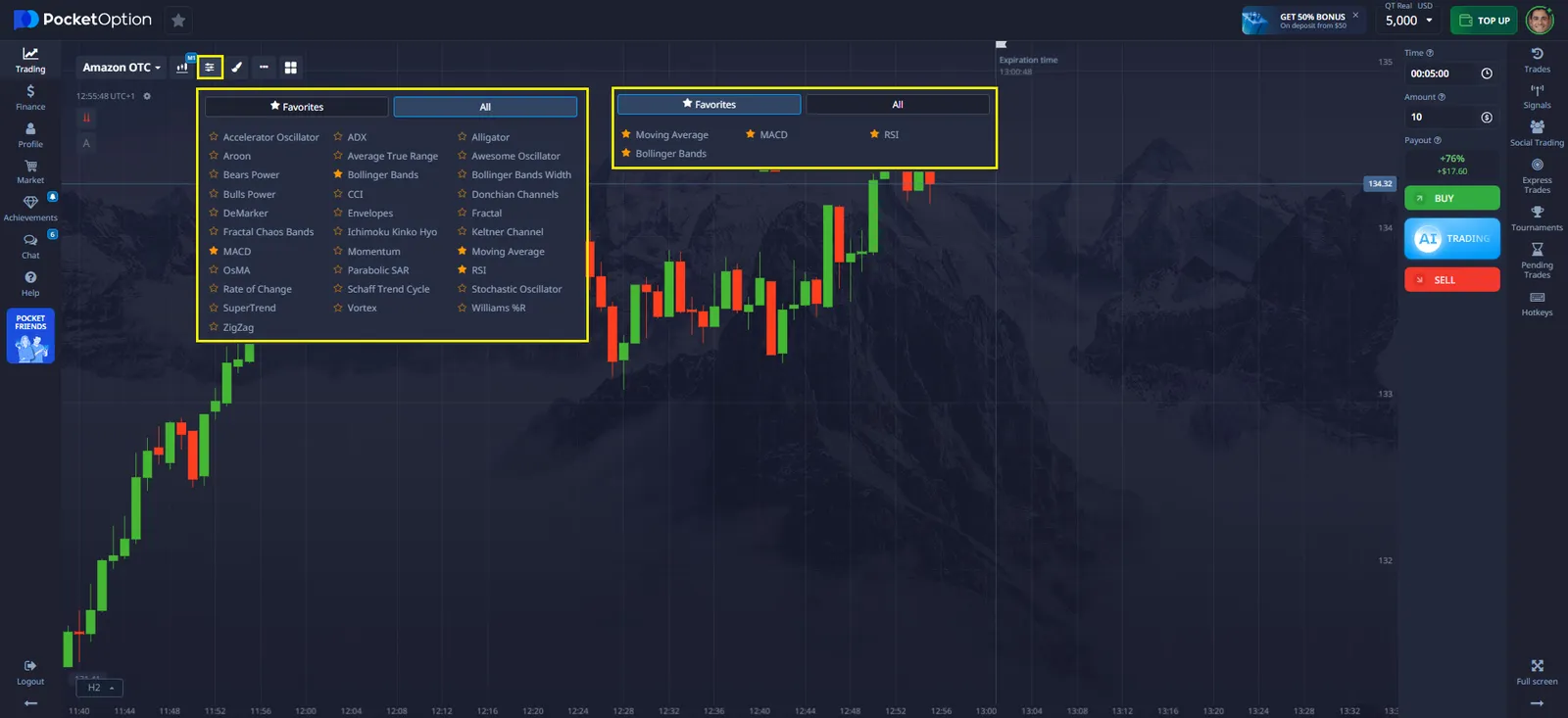

- Navigate to the Indicators section in the upper left corner of the interface.

- Select the desired indicator and click on it.

- To save an indicator as a favorite, click on the star icon next to its name.

Best Indicators for Day Trading Analysis

The financial markets require precise analysis tools for successful trading decisions. This article explores proven technical indicators and their practical applications in day trading, helping traders develop effective market strategies.

Best Indicators for Day Trading

Pocket Option offers a wide range of technical analysis tools that help traders make well-informed trading decisions. Day trading indicators assist traders in identifying market trends, determining entry and exit points, and minimizing potential risks.

For effective analysis, up to 30 indicators can be used simultaneously, with customizable parameters to suit individual strategies. Pocket option best indicator strategy

What Are the Best Indicators for Day Trading?

To select the best indicators for day trading, it is essential to consider their functionality, ease of use, and compatibility with the trading strategy. The table below presents the best day trading indicators available on Pocket Option:

| Indicator | Purpose | Key Features |

|---|---|---|

| Moving Averages (MA) | Trend identification | Simple to configure, used to detect long-term and short-term trends |

| RSI (Relative Strength Index) | Trend strength evaluation | Highlights overbought and oversold zones, helps identify reversals |

| MACD (Moving Average Convergence Divergence) | Trend change analysis | Suitable for identifying entry points based on divergences |

| Bollinger Bands | Volatility measurement | Helps identify breakout moments from a narrow market range |

All these best indicators for day trading can be found in the Indicators section on the Pocket Option platform and added to favorites for quick access.

How to Add and Customize Indicators on Pocket Option?

Using indicators on Pocket Option enhances the accuracy of market analysis. To add indicators, follow these steps:

Adding Indicators

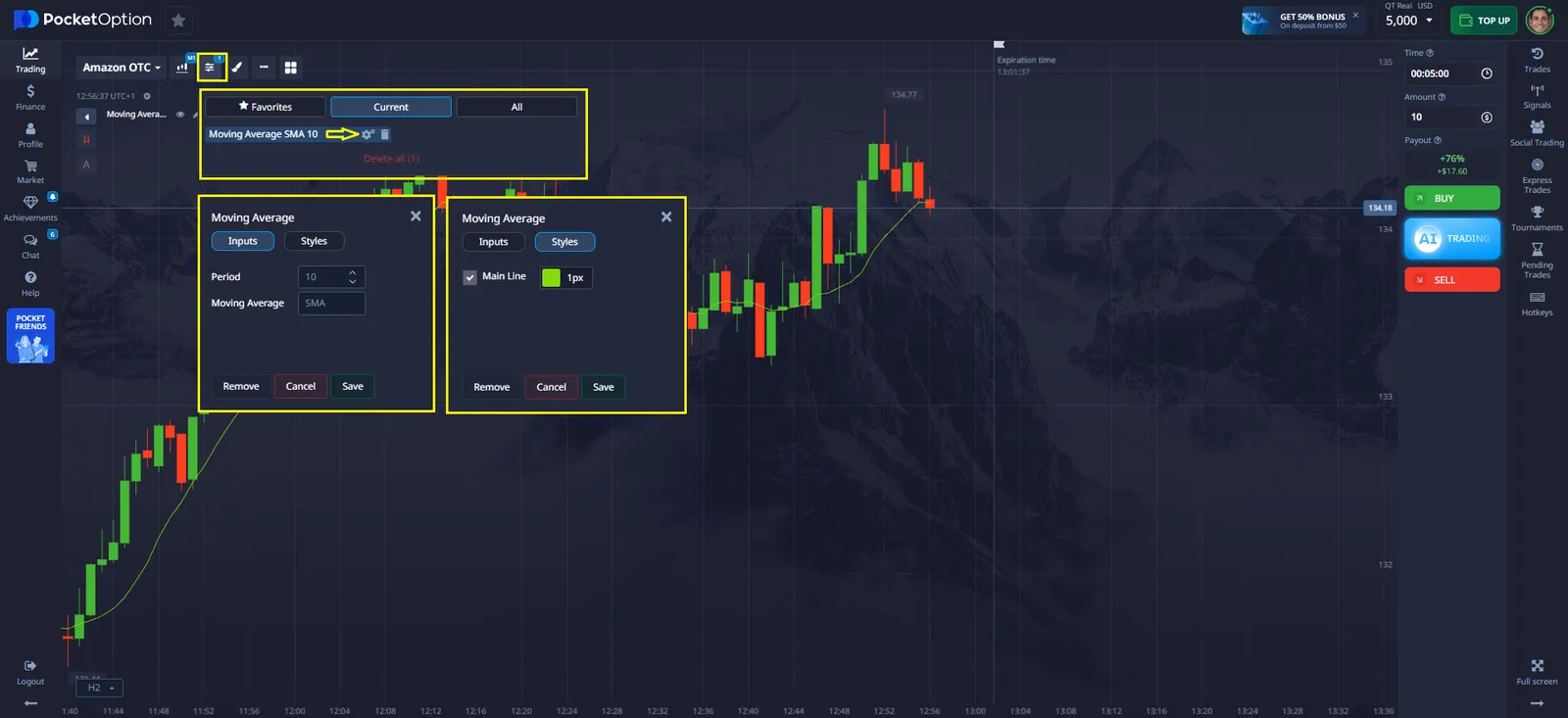

Adjusting Parameters

- Each indicator allows modifications such as color, line thickness, calculation period, and other settings.

- Settings are available through the settings icon next to the active indicator.

Removing Indicators

- Open the Indicators section, go to Active, and click the trash bin icon next to the indicator.

- To remove all indicators, use the “Remove All” button.

Conclusion

Indicators are an essential part of day trading, enabling traders to analyze the market and make well-informed decisions. Utilizing technical analysis helps identify trends, determine optimal entry and exit points, and minimize risks.

The Pocket Option platform offers a variety of analysis tools that can be customized to fit individual trading strategies. Proper use of indicators enhances forecasting accuracy and contributes to more effective trade management.

FAQ

What combination of indicators works best for day trading?

The most effective combination typically includes one trend indicator (like Moving Averages), one momentum indicator (such as RSI), and one volume indicator. This provides a comprehensive view of market conditions while avoiding indicator overlap.

How many indicators should I use simultaneously?

Most successful traders use 3-5 indicators simultaneously. Using too many can lead to analysis paralysis and conflicting signals.

Which timeframes are most effective for day trading indicators?

The most effective timeframes are 1-minute, 5-minute, and 15-minute charts for day trading. These provide sufficient detail for short-term analysis while filtering out market noise.

Can indicators forecast market reversals accurately?

While indicators can suggest potential reversals, they should not be used in isolation. Combining multiple indicators with price action analysis increases the reliability of reversal signals.

How do volume indicators complement price action?

Volume indicators confirm price movements by showing trading activity strength. Strong volume supports price trends, while low volume may indicate potential reversals.

How to choose best indicators for day trading in Brazil?

Popular options include MACD, RSI, and Moving Averages; test them on a demo account before live use.