- Automatic AI-powered trades: based on historical data and indicators

- Telegram trading bot, with automatic and manual trading

- Use AI tools directly in the chart interface and match them with existing indicators for confirmation.

Pocket Option: Revolutionizing Pocket Option Best Indicator Strategy with Technology

Master Pocket Option indicators: over 30 tools to build strategies, plus tutorials and a $50,000 demo account for risk-free practice.

Article navigation

- Try Pocket Option Demo Now

- Pocket Option AI: Real Benefits for Real Traders

- What makes Pocket Option AI smart? Real-world use

- Step-by-Step Guide: How to Start Using AI on Pocket Option

- Pocket Option best indicator strategy: why Indicators Matter More Than Ever in 2025

- Real Pocket Option Strategy Example 1: Volume + RSI

- Explore Pocket Option’s Built-In Strategy Hub 🎯

- Key Features of Pocket Option Indicator Strategy

- Real Pocket Option Strategy Example 2: 5-Second EMA Bounce

- Pocket Option Indicator Strategy: Designed for All Levels

- What Is the Most Accurate Indicator on Pocket Option?

- Unique Advantages Only on Pocket Option

- Conclusion: The Smartest Way to Start with Indicators

Pocket Option AI: Real Benefits for Real Traders

Pocket Option now integrates AI directly into its platform, making technology previously only available to institutions available to everyone. Unlike classic tools like RSI or MACD with static parameters, Pocket Option’s AI system automatically adapts to market changes, improving decision making without the need for programming skills.

📌 The platform currently offers ready-to-use AI tools, including:

What makes Pocket Option AI smart? Real-world use

Pocket Option doesn’t just label strategies as “AI” — it applies machine learning models such as:

| AI Engine | What It Does | The Outcome for the Trader |

|---|---|---|

| Adaptive RSI | Adjusts the RSI period and thresholds to the current volatility | 26% earlier entries, fewer fast saws |

| Neural Signal Filter | Learns on thousands of models to reduce noise | Accuracy up to 79% in trend phases |

| Risk Profiling Engine | Classifies settings into conservative/moderate/aggressive | Helps avoid emotional entries |

🧠 Example: A trader using the AI signal assistant on EUR/USD received a buy alert after a sharp drop in RSI. The signal was backed by both historical success rates and real-time volatility adjustments, resulting in a 4 out of 5 wins on the 5-second strategy.

These tools are fully automated and require no API integration or manual setup.

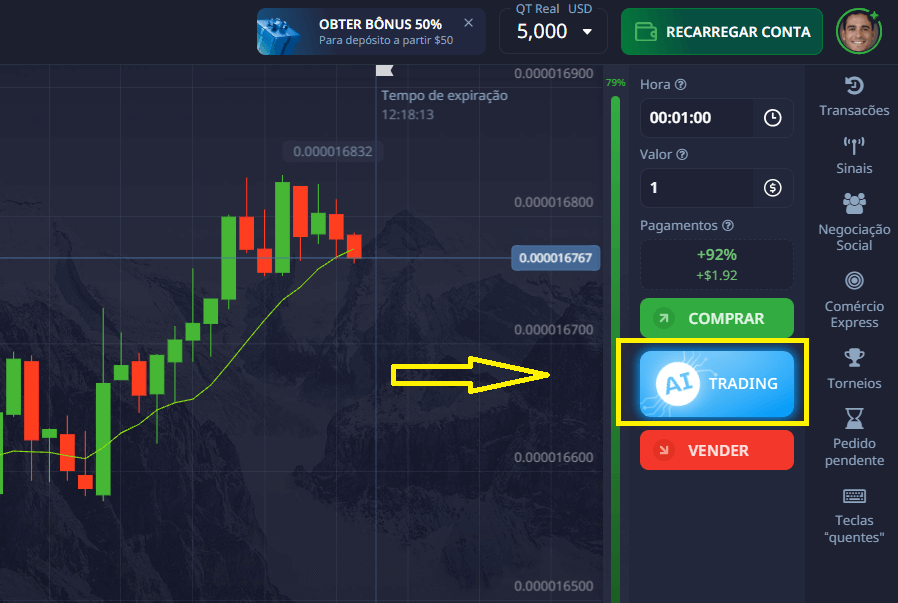

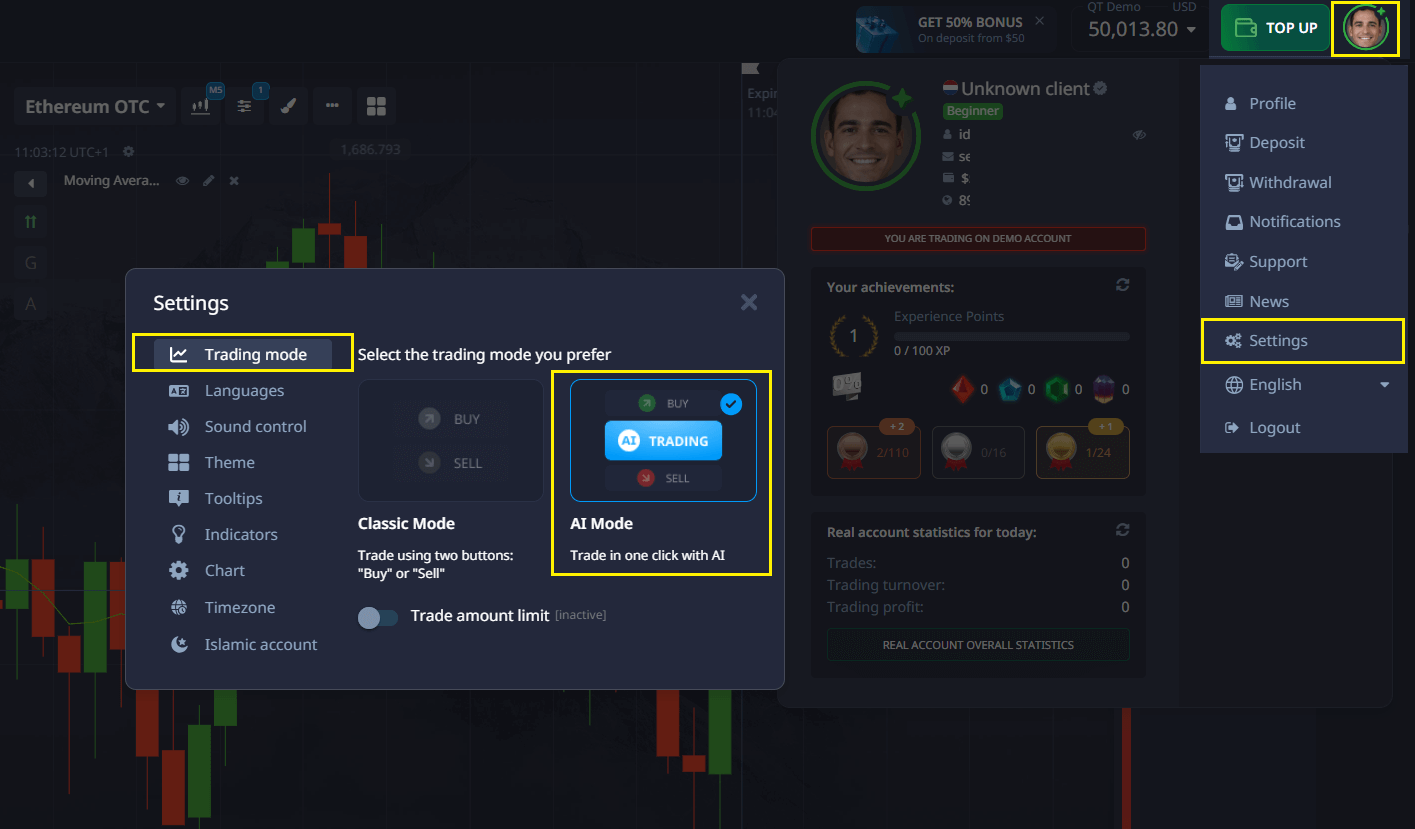

Step-by-Step Guide: How to Start Using AI on Pocket Option

Whether you are a beginner or an experienced trader, getting started with AI is quick and risk-free:

- Open an account

- Go to any chart, click the “AI Trading” tab

- Track results directly in the trading history

Remember: AI does not replace strategy, it enhances it. Traders who combine AI alerts with basic confirmation (such as support/resistance) tend to perform better.

Pocket Option best indicator strategy: why Indicators Matter More Than Ever in 2025

While AI and machine learning are revolutionizing trading, it’s indicators that remain the core decision-making tools. On Pocket Option, a successful indicator strategy leverages both traditional formulas and smart enhancements to detect patterns, trends, and reversal points with greater accuracy. According to Stanford’s 2024 quantitative trading report, traders who used adaptive indicators outperformed static systems by over 40%.

Real Pocket Option Strategy Example 1: Volume + RSI

“During a high-volatility session on EUR/USD, I noticed RSI dipping below 30 while the volume meter spiked sharply. This alignment suggested a strong reversal setup. I entered a 5-second trade just as the RSI hit 28 and the price bottomed out. Within seconds, the asset reversed direction. Four out of five trades executed on that setup closed in profit.”

- 📊 Strategy Used: RSI + Volume

- 🕒 Timeframe: 5s Quick Trading

- 📈 Asset: EUR/USD

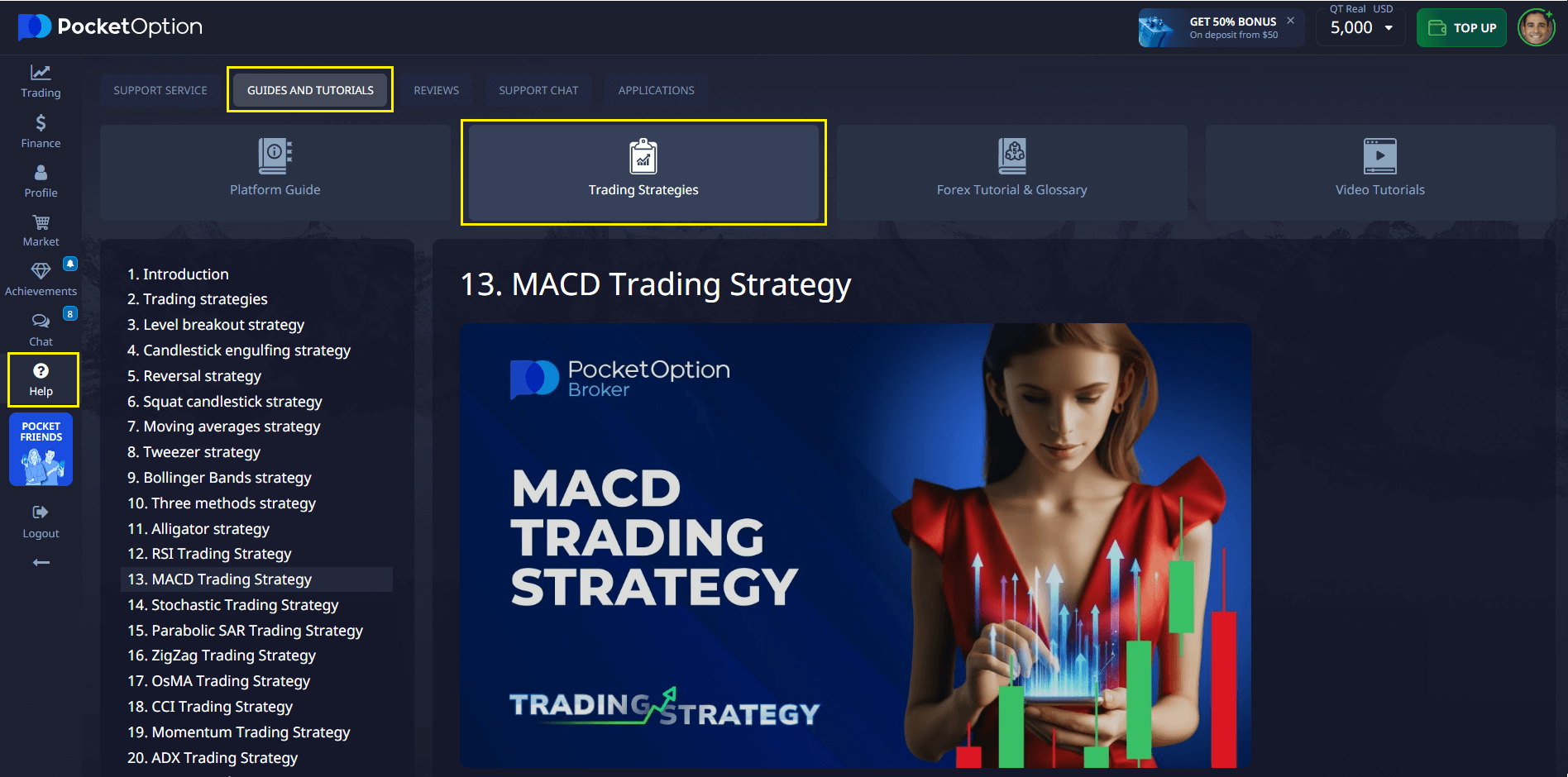

Explore Pocket Option’s Built-In Strategy Hub 🎯

| Feature | Description |

|---|---|

| Video Strategy Center | Access pre-built templates like TrendAI, NewsImpact |

| Video Library | Walkthroughs for beginner and pro strategies |

| $50,000 Demo Mode | Test everything risk-free, instantly |

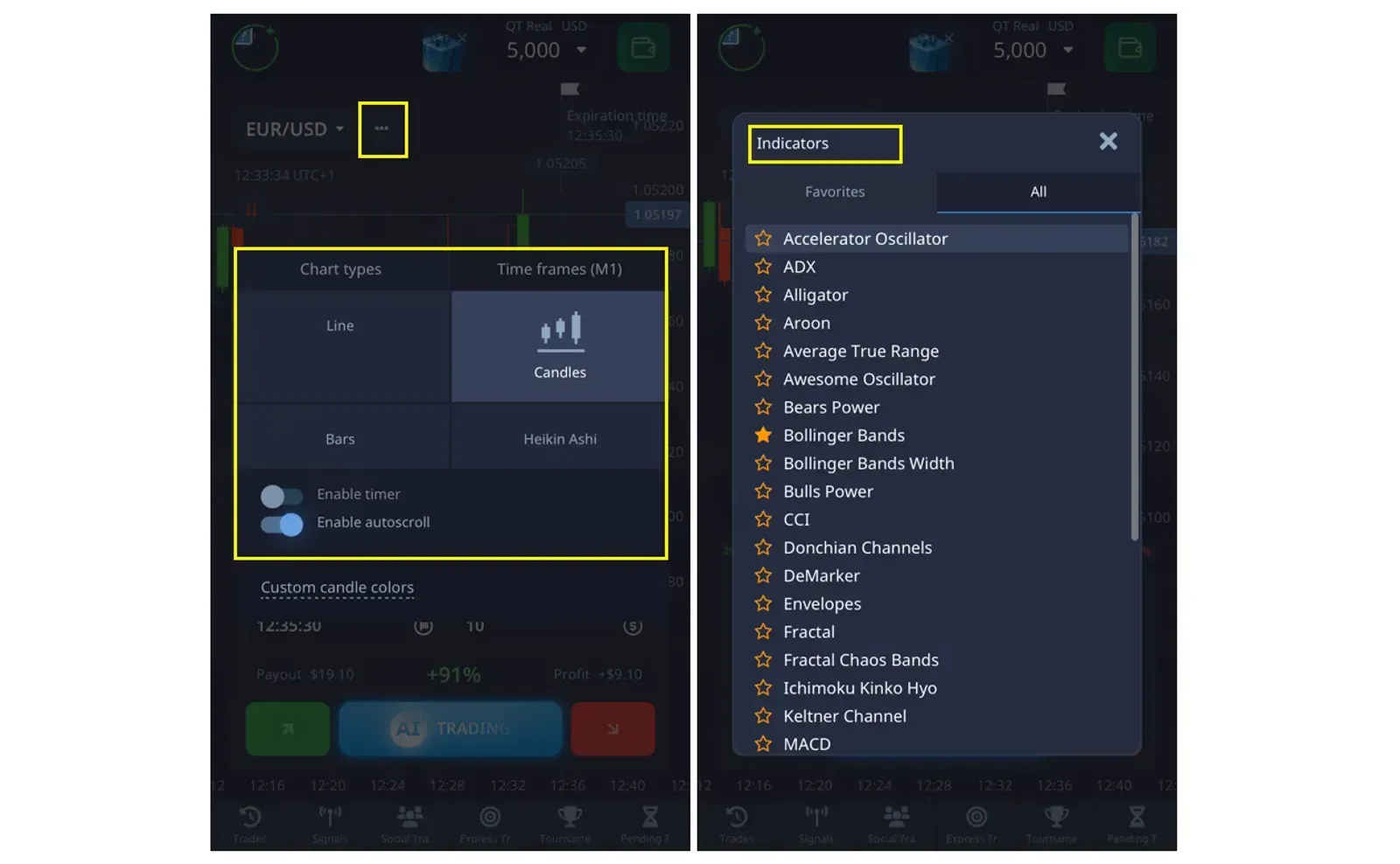

Key Features of Pocket Option Indicator Strategy

Core Functionalities That Power Every Pocket Option Indicator Strategy

Pocket Option includes a rich set of tools that enhance your ability to build and execute strategies:

| Functionality | Description |

|---|---|

| Indicator Layering | Combine tools like RSI, MACD, Bollinger with smart filters |

| Built-in Signal Tools | Use tools like Signal Strength and Sentiment Bars to assist decision-making |

| Over 30 Indicators | Platform includes ~30 built-in indicators like RSI, EMA, Bollinger Bands, Parabolic SAR |

| Web-Based Interface | Everything works directly in your browser — no installations needed |

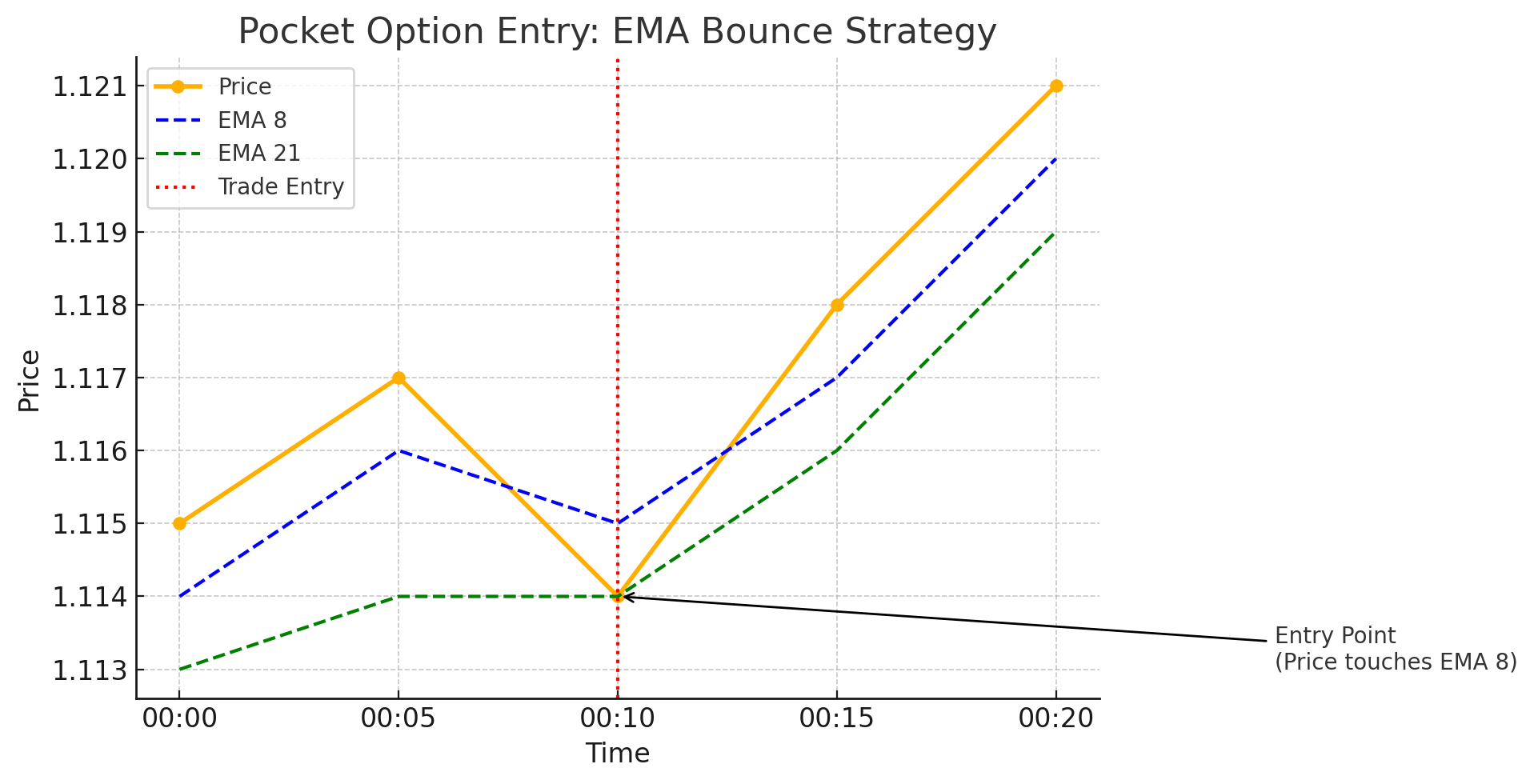

Real Pocket Option Strategy Example 2: 5-Second EMA Bounce

“I was tracking GBP/USD and noticed the price pulling back toward the 8 EMA during a clear uptrend. As soon as the candle touched the EMA line and volume confirmed direction, I opened a 5-second up trade. That minor retracement was just noise — the trend held. This bounce strategy gave me 3 wins in a row before market conditions shifted.”

- 📊 Strategy Used: EMA (8 & 21)

- 🕒 Timeframe: 5s Quick Trading

- 📈 Asset: GBP/USD

Pocket Option Indicator Strategy: Designed for All Levels

Each trader has a different skill level, so Pocket Option tailors experiences:

| Experience Level | Recommended Approach | Tools Available on Pocket Option |

|---|---|---|

| Beginner | RSI + Volume | Strategy videos + demo mode |

| Intermediate | Bollinger + TrendAI | AI packs + webinars |

| Advanced | Custom scripts + ML | Python API + data connectors |

What Is the Most Accurate Indicator on Pocket Option?

No single indicator is always “most accurate.” Instead, combinations tend to perform best. That said, Pocket Option traders have reported high success using:

- Volume indicator + RSI: This combination remains highly effective in volatile markets

- Bollinger Bands + EMA: Widely used to detect momentum shifts and reversals)

- MACD + Parabolic SAR: Offers visual confirmation and strong trend detection

All these indicators are available by default on Pocket Option and can be customized directly in the indicator settings panel.

Unique Advantages Only on Pocket Option

Platform Enhancements That Maximize Strategy Success

Pocket Option goes beyond simple charts. It boosts indicator strategy results by offering:

| Feature | Benefit |

|---|---|

| Visual Signal Overlays | Arrows and sentiment bars guide real-time decisions |

| Built-In Learning | Interactive tutorials explain indicators as you use them |

| Cross-Platform Sync | Indicators sync seamlessly across web, mobile, and offline |

| Social Strategy Copying | Track and replicate trades from high-performing users |

Conclusion: The Smartest Way to Start with Indicators

If you’re looking for the Pocket Option best indicator strategy, start by focusing on what Pocket Option already provides:

- Free $50,000 demo account to test all indicators

- Access to 30+ built-in indicators such as RSI, MACD, Bollinger Bands, Alligator, Stochastic, Ichimoku, ADX, and more

- Real-time trade examples from blog-tested setups

- Guided videos and tutorials for every level

Start small, test combinations, then scale with confidence. Every successful trader starts with strategy — Pocket Option makes it easy to find yours.

FAQ

What is the most accurate indicator on Pocket Option?

Many traders rely on proven combinations like RSI + Volume, Bollinger Bands + EMA, or MACD + Parabolic SAR. The best choice depends on market conditions and asset volatility., but accuracy improves when used in combination. RSI + Volume and EMA + MACD are popular combos.

Can I use custom indicators on Pocket Option?

Currently, Pocket Option offers a fixed set of around 30 indicators, which can be customized but not extended with external code or scripts.. You can import TradingView scripts or use marketplace packages.

Do indicators work on mobile?

Yes — Pocket Option’s mobile app supports all core and premium indicators with sync from desktop.

What’s the best indicator combo for beginners?

Try RSI + Volume or Stochastic Oscillator + Moving Average — these combinations offer clarity and are beginner-friendly. — both offer visual clarity and simple confirmation logic.

Is it free to try these strategies?

Yes. All indicators and strategy packs can be tested with the $50,000 demo account. No payment or commitment required.