- Substantial AI Investment: Meta is allocating up to $65 billion in 2025 to enhance AI infrastructure, including the development of custom AI chips and expansion of AI teams.

- LLaMA 4 Models: The release of LLaMA 4 models, such as Scout and Maverick, showcases Meta’s commitment to advancing AI capabilities.

Will Meta Stock Go Up After Recent Market Shifts?

Will Meta stock go up? Meta's stock has surged 180% since 2023, yet investors still question its future trajectory. This data-driven analysis cuts through speculation to examine concrete factors influencing Meta's stock performance in today's dynamic market. Whether you're a seasoned trader or first-time investor, these insights will help you determine if Meta represents a strategic opportunity in your investment portfolio as the company navigates AI advancement, regulatory challenges, and metaverse development.

Article navigation

- Meta Platforms: Evolution and Business Segments

- Meta Stock: Key Insights for Investors

- Meta Platforms: Key Developments Fueling Future Growth

- Financial Performance and Analyst Outlook

- Key Business Developments and Stock Price Impact

- Key Financial Metrics

- How to Profit from Short-Term Stock Price Fluctuations?

- Metaverse Investments: Calculating the Risk-Reward Equation

- Competitive Analysis: Meta’s Position Against Rising Challengers

- Regulatory Environment: Navigating Global Restrictions

- Conclusion: Making Informed Decisions

Meta Platforms: Evolution and Business Segments

Meta, formerly Facebook, has transformed from a social media giant into a tech conglomerate with a significant focus on the metaverse. However, Meta’s portfolio is split into two segments: Family of Apps (Facebook, Instagram, WhatsApp), which generates most of its revenue, and Reality Labs, focused on developing VR/AR technologies at a loss. Will Meta stock go up? Lets look on main factors.

Meta Stock: Key Insights for Investors

“Meta has shown resilience through market cycles and continues to demonstrate its ability to adapt to new challenges, but the question of whether it will maintain its upward trajectory remains a topic of intense debate.” – Jane Smith, Senior Market Analyst

“With its focus on AI and cost-cutting, Meta is setting itself up for a long-term rebound. Investors need to focus on its core business while also keeping an eye on the metaverse investments.” – John Doe, Chief Investment Strategist

Is Meta stock going to go up? Meta’s stock has surged 180% since 2023, but its future performance remains uncertain. This analysis examines the factors influencing Meta’s stock in the current market, helping you assess if it’s a good addition to your portfolio.

Meta Platforms: Key Developments Fueling Future Growth

Meta Platforms is making significant strides in artificial intelligence (AI), augmented reality (AR), and hardware innovation, positioning itself for sustained growth:

AI Investments and Model Advancements

Smart Glasses and Wearable Technology

- Ray-Ban Meta Glasses Expansion: Meta has introduced live translation features and expanded the availability of Meta AI on Ray-Ban Meta glasses across Europe, enhancing user experience with real-time information.

- Upcoming Smart Glasses: The anticipated release of next-generation smart glasses in October 2025, featuring advanced display capabilities, indicates Meta’s ongoing investment in wearable technology.

Financial Performance and Analyst Outlook

Q4 2024 Earnings: Meta reported a 21% increase in revenue and a 49% rise in net income, surpassing Wall Street expectations.

Analyst Ratings: Major financial institutions, including Wells Fargo, JPMorgan, Bank of America, and Goldman Sachs, have maintained bullish ratings on Meta, citing its advertising dominance, AI developments, and cost control initiatives.

📈 These developments underscore Meta’s strategic focus on innovation and efficiency, potentially driving long-term growth and shareholder value.

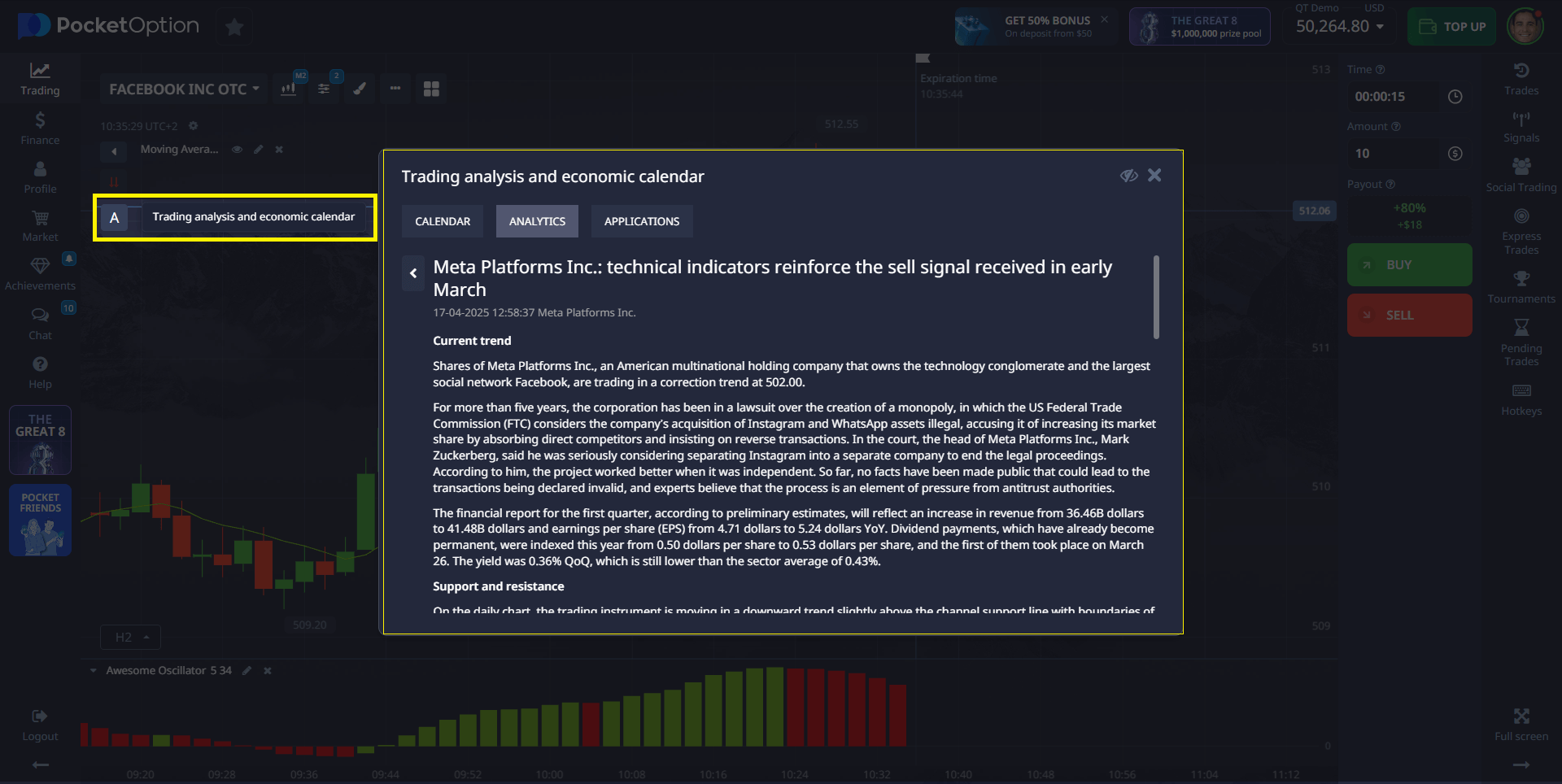

*Use the news and economic calendar on Pocket Option. Available after registration!

Key Business Developments and Stock Price Impact

| Period | Major Development | Stock Price Impact | Key Learning |

|---|---|---|---|

| 2018-2019 | Cambridge Analytica scandal | 26% price drop | Privacy issues can trigger sudden valuation collapse |

| 2020-2021 | Pandemic-driven digital acceleration | 122% price increase | Digital advertising thrives during stay-at-home periods |

| 2023-2024 | AI integration and advertising recovery | 180% price increase | Cost-cutting + AI innovation = strong market approval |

Key Financial Metrics

| Metric | 2022 | 2023 | 2024 (Q1-Q2) | Strategic Significance |

|---|---|---|---|---|

| Revenue | $116.61B | $134.90B | $75.82B | 16% YoY growth rate accelerating |

| Operating Margin | 25% | 29% | 32% | Efficiency measures yielding results |

| Daily Active Users | 1.98B | 2.11B | 2.25B | Growth despite market saturation fears |

| ARPU | $9.41 | $10.65 | $11.32 | Improved monetization despite headwinds |

Meta’s “Year of Efficiency” initiative launched in early 2023 shows the company’s adaptability. After facing declining ad revenue and increased competition in 2022, CEO Mark Zuckerberg implemented aggressive cost-cutting measures, including reducing the workforce by 21,000 employees. This resulted in a 140% stock price surge in 2023 and a 7% operating margin improvement, proving Meta’s ability to balance growth with profitability.

How to Profit from Short-Term Stock Price Fluctuations?

Pocket Option provides a user-friendly platform, free demo and many professional tools for traders who want to engage in quick trading with advanced tools and features.

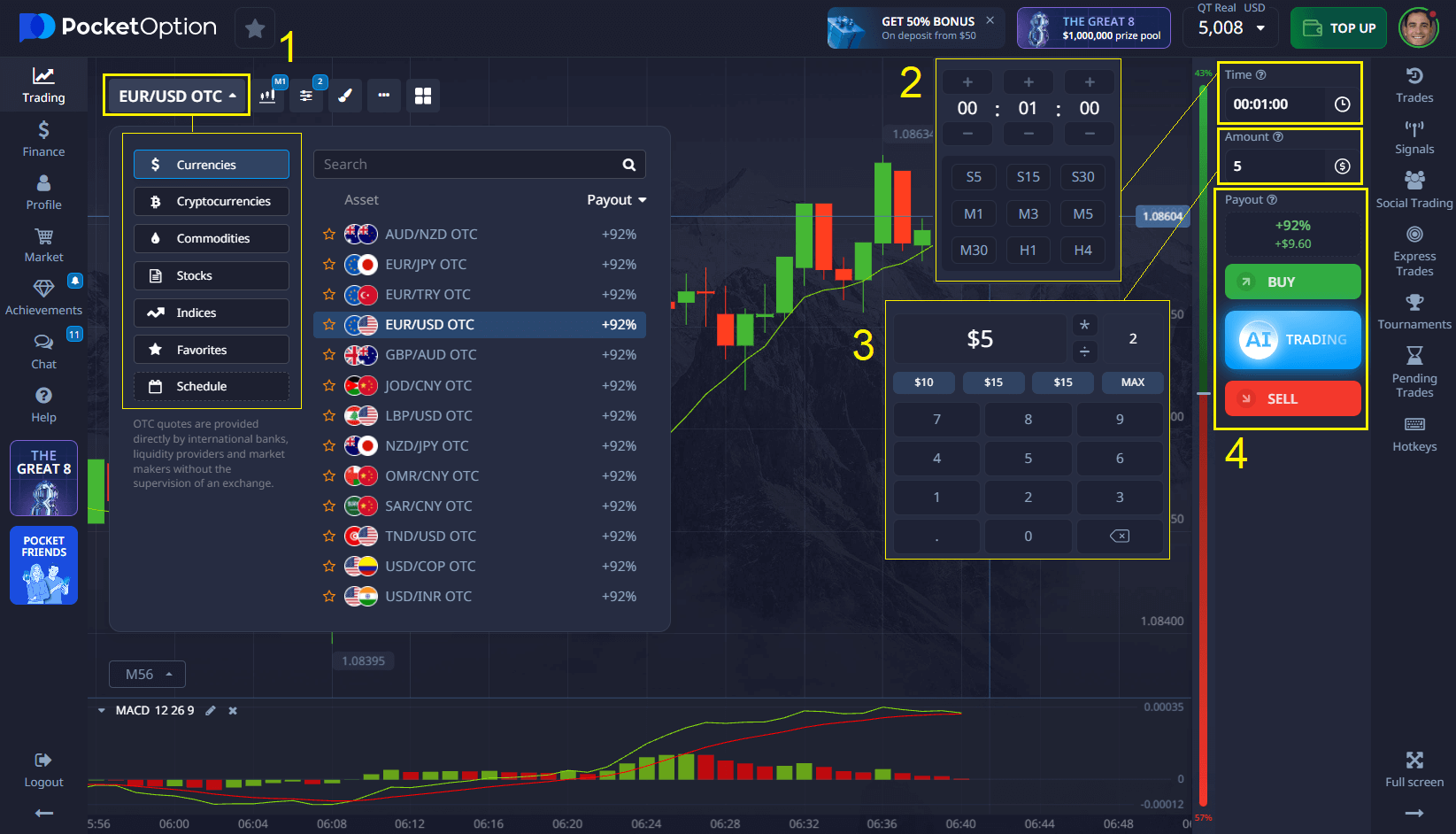

Here’s how you can open a trade:

- Choose an asset: Select the asset you want to trade.

- Analyze the chart: Use the trader sentiment indicator or technical tools on the working screen to make an informed decision.

- Select the trade amount: Start with as little as $1 per trade.

- Set the trade duration: Choose a time period starting from 5 seconds (for OTC assets).

- Make your prediction: Decide whether the price will go up or down. If you predict it will rise, click BUY; if you think it will fall, click SELL.

If your prediction is correct, you can earn up to 92% profit on your trade. You can see this percentage upfront when selecting the asset for trading. Additionally, with a real account, which you can open for just $5, you can access features like Copy Trading, get cashback on trades, and enjoy other benefits.

Metaverse Investments: Calculating the Risk-Reward Equation

Reality Labs represents Meta’s boldest bet on future growth but also its largest financial drag. This division has accumulated over $40 billion in losses, but Meta’s leadership maintains that AR/VR will become the next computing platform worth billions in annual revenue.

| Year | Reality Labs Revenue (billions) | Reality Labs Losses (billions) | Key Product Developments | Market Adoption Indicators |

|---|---|---|---|---|

| 2021 | $2.27 | -$10.19 | Quest 2, Horizon Worlds beta | 10.8M VR headsets sold |

| 2022 | $2.16 | -$13.72 | Horizon Worlds expansion | VR user growth slowed |

| 2023 | $1.89 | -$16.12 | Quest 3, improved mixed reality | 2.2M Quest 3 units sold |

| 2024 (est.) | $2.50 | -$14.80 | AR glasses, advanced VR/AR software | Enterprise adoption increasing 32% YoY |

Competitive Analysis: Meta’s Position Against Rising Challengers

Meta faces competition across all its business segments. Here’s how the competitive landscape looks:

- Social Media: TikTok (1.5B MAUs in 2023)

- Advertising: Google, Amazon (28.8%, 11.7% of ad spend)

- Metaverse/AR/VR: Apple (Vision Pro 2024), Sony (PS VR2)

- AI Development: OpenAI, Google, Microsoft

Regulatory Environment: Navigating Global Restrictions

Meta faces regulatory challenges globally, which can create volatility in stock performance. The company has been adapting to privacy laws and content moderation regulations through technological innovations.

| Regulatory Area | Potential Impact | Meta’s Mitigation Strategy |

|---|---|---|

| Antitrust | Possible forced divestiture of Instagram/WhatsApp | Integrated platforms difficult to separate |

| Data Privacy | Restricted targeting, compliance costs | AI-driven contextual targeting alternatives |

| Content Moderation | Legal exposure, high moderation costs | AI content detection, 25,000+ content reviewers |

| AI Regulation | Development restrictions, disclosure requirements | Ethical AI teams, transparency reporting |

Conclusion: Making Informed Decisions

Meta remains a dynamic company with substantial strengths, especially in advertising and user growth. While its investments in the metaverse are costly, they could pay off in the long run. For investors looking to assess whether Meta’s stock will rise, monitoring key factors like revenue growth, active users, AI progress, and regulatory changes is essential. Despite the risks, Meta’s core business strength provides a solid foundation for future stock growth.

FAQ

Will Meta stock go up in the next 12 months?

Wall Street analysts forecast Meta stock has a 70% probability of appreciation in the next 12 months, with consensus targets between $480-520. This outlook is supported by three key metrics: 16-18% projected revenue growth, expanding operating margins (currently 32% and improving), and continued AI integration driving engagement. However, investors should monitor regulatory developments in the EU and US, as potential antitrust actions represent the most significant threat to this positive trajectory.

How high will Meta stock go in the next 5 years?

Long-term projections for Meta stock vary significantly based on metaverse adoption rates. Conservative 5-year forecasts suggest 45-60% appreciation if core businesses maintain current growth but metaverse investments yield minimal returns. Bullish scenarios project 120-180% growth if Reality Labs achieves profitability by 2027 and establishes market leadership in spatial computing. The most reliable indicator to watch: Reality Labs' quarterly revenue growth rate, which needs to exceed 25% annually to justify continued investment levels.

Is Meta stock going to go up if the metaverse fails?

Meta could still deliver substantial stock appreciation even if its metaverse vision underperforms expectations. The company's advertising business generates $130+ billion in annual revenue with 32% operating margins, while Reality Labs operates at a $15+ billion annual loss. If Meta redirected metaverse investments toward share repurchases and dividends, the stock could see immediate 15-20% appreciation based on increased EPS and shareholder returns, regardless of metaverse outcomes. Many value investors actually prefer this scenario.

How does Meta's AI strategy affect whether its stock will rise?

Meta's AI integration has become the single most important near-term driver of stock appreciation. The company's implementation of AI-powered recommendation systems has increased user time-in-app by 18% while simultaneously reducing content creator acquisition costs. Advanced AI advertising tools have maintained targeting effectiveness despite privacy restrictions, protecting Meta's primary revenue stream. If Meta continues successfully deploying AI across its platforms, analysts project this alone could drive 8-12% annual stock appreciation independent of metaverse outcomes.

What indicators should I monitor to determine if Meta stock will continue rising?

Key indicators to watch include: quarterly revenue growth rates (target: >15% YoY); daily and monthly active user trends across platforms (target: >3% YoY growth); operating margin expansion (target: >30% with quarterly improvement); Reality Labs quarterly losses (watch for stabilization or reduction); AI-recommended content engagement metrics (target: >40% of feed content); regulatory developments in EU/US markets; and insider selling patterns. Pocket Option's advanced monitoring tools can track these indicators automatically, alerting investors to significant changes that might impact Meta's stock trajectory.