- Current stock price analysis

- Historical performance

- Investor sentiment and market trends

- Latest Roku news and expert reactions

- Competitive position and partnership strategy

- Long-term forecast and investment risks/rewards

Roku Stock Price & News: Nasdaq Headlines Today – Why Is Roku Stock Dropping Today?

In the ever-evolving landscape of streaming platforms, Roku has consistently been a significant player. With a robust presence on the Nasdaq (nasdaq:roku), Roku's stock is often in the spotlight, attracting attention from investors and analysts alike.

Article navigation

- Why is Roku stock dropping today? A Deep-Dive Analysis and Forecast Through 2025

- Overview of Roku Stock

- Why Is Roku Stock Dropping Today?

- Current Stock Price Analysis

- Historical Performance of Roku Stock

- Roku Stock Forecast 2025: Investor Sentiment and Market Trends

- Latest Roku News and Strategic Announcements

- Long-Term Potential for Roku Stock

- Investing in Roku Stock

- Conclusion

Why is Roku stock dropping today? A Deep-Dive Analysis and Forecast Through 2025

Recently, many traders have been asking: Why is Roku stock dropping today? This article delves into several key areas to explore Roku’s current valuation, market sentiment, and long-term outlook through 2025:

Overview of Roku Stock

Roku has steadily carved out a major role in the global streaming ecosystem. With over 80 million active accounts and more than 100 billion hours streamed annually, Roku’s platform is one of the most watched in North America. As a pioneer in connected TV and ad-supported streaming, Roku’s influence spans hardware, software, and advertising–creating multiple revenue streams that attract both retail and institutional investors.

Analysts from The Motley Fool, Morningstar, and Goldman Sachs consistently highlight Roku’s long-term growth potential, especially as linear TV continues to decline. Still, volatility and fierce competition mean that Roku’s stock trajectory is far from linear.

Why Is Roku Stock Dropping Today?

One of the central search queries is: why did Roku stock drop today. In the latest trading day, roku’s share declined around 5%, and there are key catalysts:

- Lower-than-expected revenue growth: Roku reported Q1 platform revenue of $881M (+17% YoY) but guided Q2 below consensus at $1.07B vs. $1.12B expected

- Ad market pressure: As Kenneth Leon from CFRA noted: “Despite global headwinds, we expect Roku to achieve positive operating income by 2026, supported by its strong market position”

- Intensifying competition: Competitors like Amazon and Apple are ramping up. Roku counters with its partnership with Amazon, already yielding a 40% increase in unique viewer reach

- Analyst downgrades: JP Morgan’s Cory Carpenter said: “What really stood out… was the profit upside, with adjusted EBITDA turning positive two quarters earlier than expected”

- Sector-wide tech volatility: The negative market reaction in growth stocks has hit Roku along with other daily stock losers in the industry.

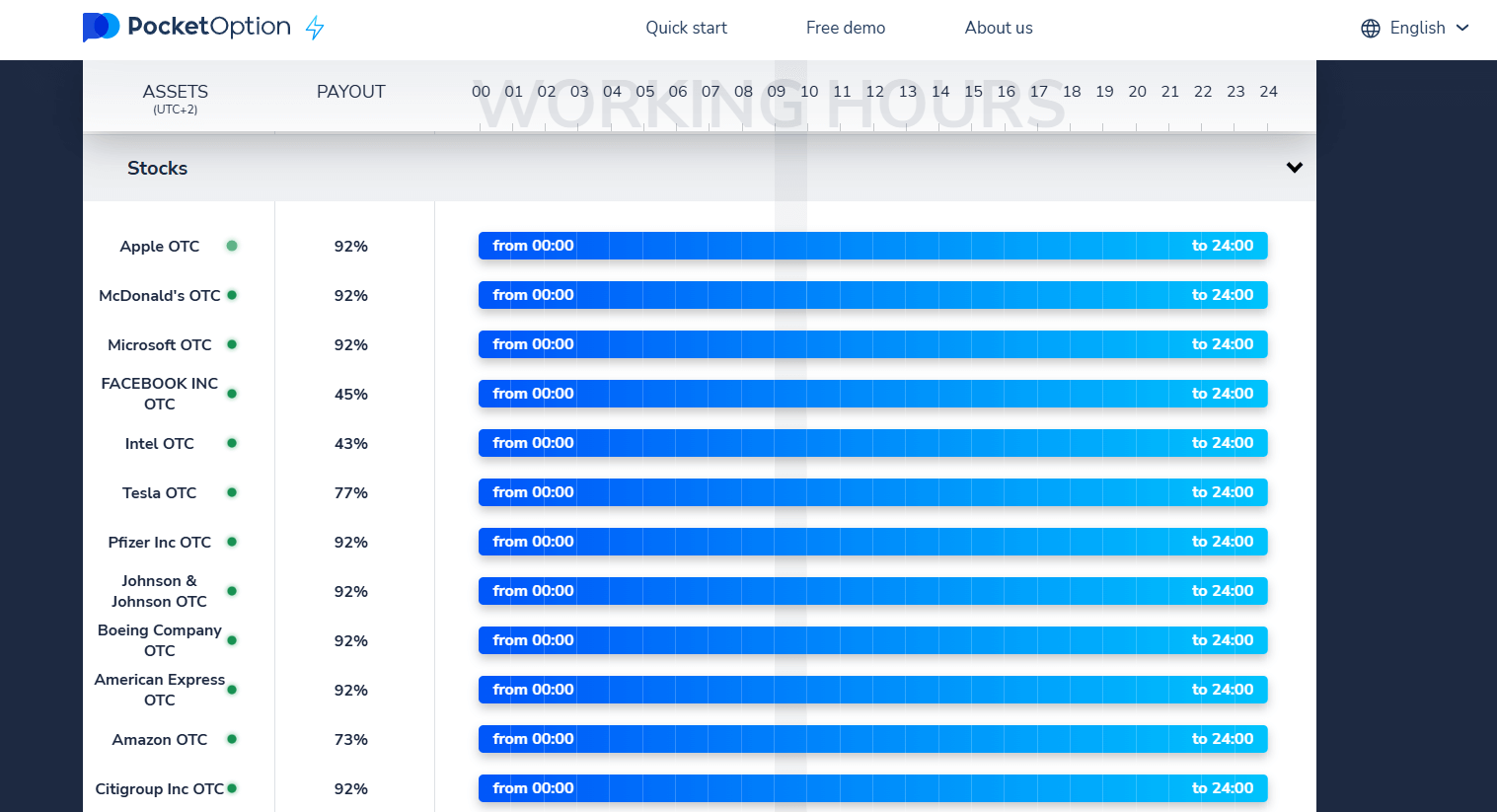

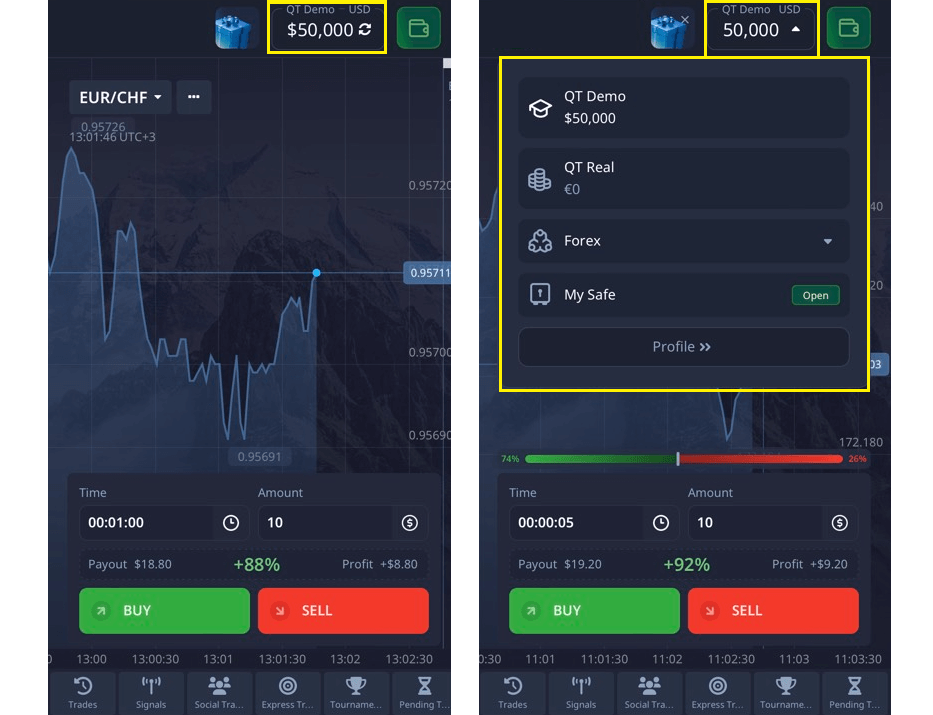

Also, many traders explore alternatives via Pocket Option login, which offers 100+ tradable assets 24/7 if Roku slides.

Current Stock Price Analysis

Many traders are now asking why is Roku stock down, especially as the company continues to report growth in users and advertising reach but struggles to meet Wall Street expectations on profitability.

As of the most recent trading day, Roku stock trades around $65–well below its all-time high near $479 in July 2021. Despite being far from its peak, Roku remains on the radar of investors due to its consistent presence among Nasdaq’s most active stocks. Day-to-day price volatility has prompted many to search: why is Roku stock dropping today, as fluctuations are often rapid and news-driven.

Factors currently influencing Roku’s share price:

- Increased ad revenue from Amazon partnership (+40% reach expansion)

- Lower-than-expected guidance for Q3 2025, which missed Wall Street expectations

- Mixed analyst revisions, with some increasing price targets, while others cite risk due to macroeconomic uncertainty

| Metric | Value |

|---|---|

| Share Price (Jul 2025) | ~$65 |

| Market Cap | $9.1 Billion |

| P/S Ratio | 3.2x |

| Daily Volume | ~5.8M shares/day |

| 52-week Range | $51 — $98 |

| PE Ratio | N/A (loss-generating) |

Historical Performance of Roku Stock

Understanding Roku’s past is essential to evaluating its future. Since its IPO in 2017 at $14, Roku stock has experienced explosive growth, followed by deep corrections. The first quarter of 2021 marked a key turning point when Roku’s average revenue per user (ARPU) jumped dramatically, reaching $44. Despite subsequent volatility, that period validated the scalability of Roku’s advertising model.

- Q2 2024: Roku beat expectations (revenue $908M, +15% YoY) and shares jumped 13% post-earnings; Pivotal Research and Needham increased targets to $120–125

- Feb 2025 Q4: Shares rose ~15% pre-market after Q4 beat, JPMorgan raised its price target from $92 to $115

- Jul 1, 2025: +10.4% surge on Amazon ad partnership, targeting more than 80 million U.S. connected TV households

These stock jumps were driven by partnerships and evidence of improved digital advertising revenue, pushing Roku back onto daily stock gainers lists.

| Period | Key Event | Market Reaction |

|---|---|---|

| Q3 2017 | IPO: $14 per share | Closed Day 1 at $23.50 |

| 2020 Pandemic | Streaming surge | Stock surged 300%+ |

| Q1 2021 | Record ARPU, bullish sentiment | Stock peaked at $479 |

| Q4 2022 | Ad market slowdown | Fell to ~$60 |

| Q2 2024 | Recovery signs + Amazon deal | Stabilized near $75 |

Expert insight – Erin Lash (Morningstar): “Roku’s advertising infrastructure is maturing. Their ability to extract more per user while keeping engagement high bodes well for margin expansion, especially through 2026.”

Roku Stock Forecast 2025: Investor Sentiment and Market Trends

Investor sentiment around Roku is dynamic. While some institutional investors view Roku as undervalued and positioned for long-term growth, others are cautious due to profitability concerns.

What is the sentiment of Roku, Inc. stock? According to most Wall Street analysts, the stock sits in neutral territory, with upside potential linked to ad revenue growth and international expansion. However, the lack of sustained profitability and market competition continue to weigh on bullish momentum.

According to Zacks Investment Research, Roku holds a “Hold” consensus rating, with a Zacks Rank of #3, indicating neutral expectations. Meanwhile, The Motley Fool, which holds positions in and recommends Roku, continues to emphasize Roku’s scalability, particularly in international markets.

Recent Wall Street Highlights:

- Barclays: Reaffirmed “Overweight” with $88 target. “Roku’s platform scale is underappreciated, especially with FAST monetization ramping up.”

- Guggenheim’s Michael Morris: “Amazon DSP integration is key to defending market share from Apple and Google. We believe Roku will remain a top ad destination.”

- CFRA Research (Kenneth Leon): “We expect Roku to achieve positive operating income by mid-2026.”

- Zacks currently rates Roku as “Neutral.” TipRanks shows 42% Buy, 58% Hold/Sell. The Motley Fool has positions in and recommends Roku, emphasizing its scalability.

Market Trends Impacting Roku

Beyond company-specific developments, Roku’s stock is affected by broader market dynamics in the streaming and ad-tech industries.

Macro Trends to Watch:

- Shift toward ad-supported streaming: As consumers grow weary of multiple paid subscriptions, platforms like Roku Channel gain traction by offering free content monetized via ads.

- Cord-cutting acceleration: Traditional cable usage continues to drop, pushing advertisers toward connected TV platforms like Roku.

- Ad spend fluctuations: Roku is vulnerable to ad budget cuts during economic slowdowns, making revenue growth cyclical.

| Metric | Value (Q1 2025) |

|---|---|

| Active Accounts | 83.7 million |

| Streaming Hours | 29.9 billion |

| ARPU (Trailing 12 Months) | $44.25 |

| Platform Revenue YoY Growth | +17% |

| EBITDA | -$29 million |

Expert Insight — Nicole Perrin, eMarketer:

“Connected TV ad spend will reach $35 billion in the U.S. by 2026, and Roku is well positioned to capture a growing share, particularly with its direct DSP integrations.”

Latest Roku News and Strategic Announcements

Roku remains among Nasdaq’s most active stocks due to product innovations and evolving strategy.

Roku stock news today live:

- Jul 2025 — Roku shares jump 10.4% after expanding Amazon ad partnership (Investors.com).

- May 2025 — Full-year revenue guidance lowered to $4.55B amid tariff pressure (Reuters).

- Feb 2025 — Strong Q4: revenue $1.20B (+22%), narrower loss, JPMorgan raises PT to $115.

Partnerships & Collaborations

Roku’s strategic partnerships help combat volatility and maintain its standing. Amazon, Paramount+, and Frndly TV have all integrated into Roku’s home screen and content feed. These collaborations increase per-user revenue and diversify monetization.

Michael Morris (Guggenheim): “This is the next phase of monetization for Roku.”

Long-Term Potential for Roku Stock

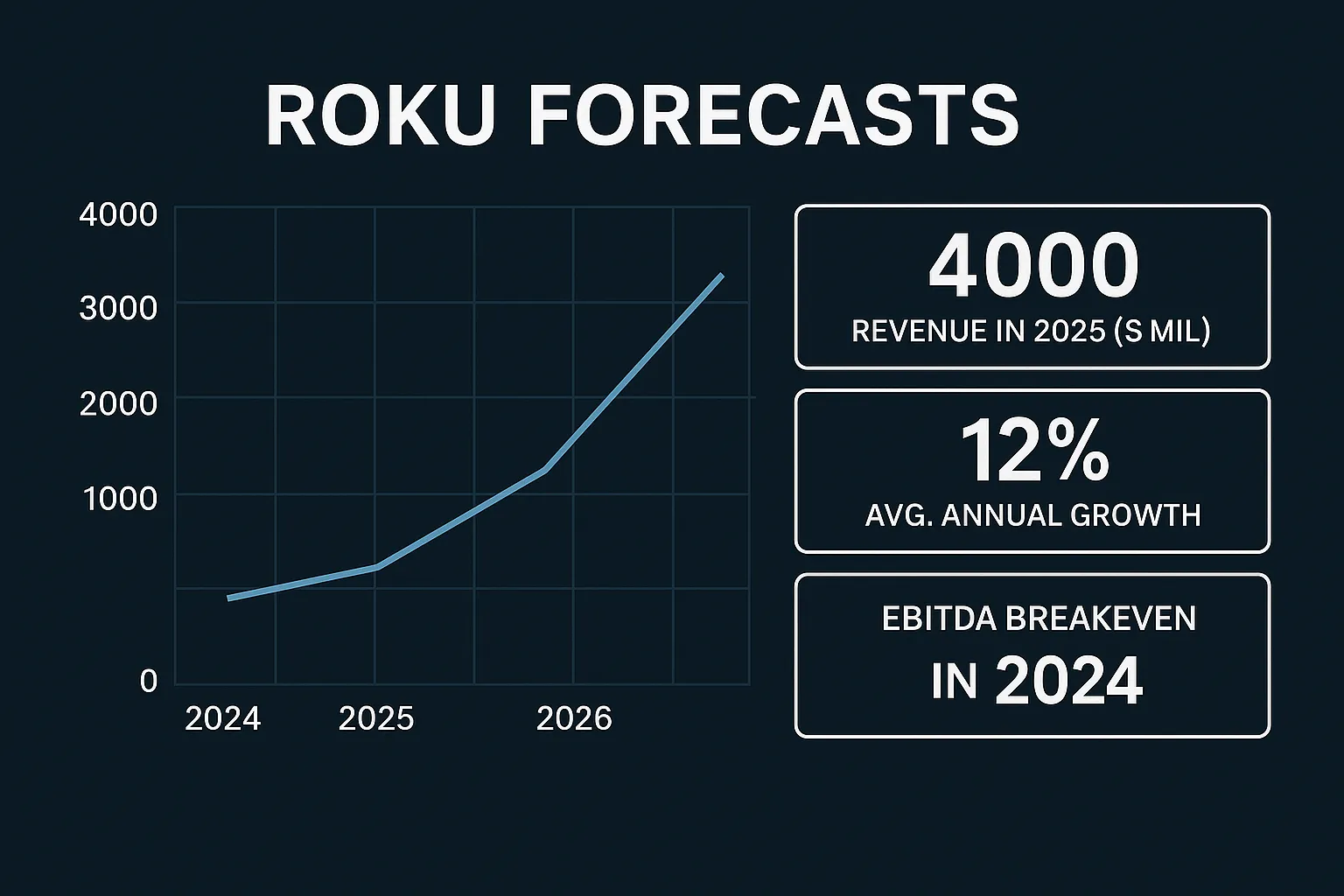

Looking toward 2025 and beyond, analysts remain cautiously optimistic. If Roku can improve its margins and expand international ad reach, it could return to previous highs.

Key growth drivers:

- Expansion of FAST and Roku Channel in LATAM, Canada, and UK

- Integration of The Trade Desk and Yahoo DSP for better targeting

- Strong average brokerage recommendation from analysts like JPMorgan, BofA

Despite volatility, Roku is well-positioned among growth stocks focused on ad-tech and streaming convergence.

Investing in Roku Stock

Strategies for Investors

- Monitor quarterly results and ARPU growth

- Evaluate analyst recommendations regularly

- Consider tech diversification using platforms like Pocket Option

Risks and Rewards

- Risks:

- Uncertainty in advertising revenue cycles

- Competitive pressure from Amazon, Google, Netflix

- Lack of dividend for income-focused investors

- Rewards:

- Leading share in connected TV OS in U.S.

- Strong partnerships (e.g., Amazon)

- Long-term shift to ad-supported models

Comparative Analysis with Competitors

| Company | Revenue | Market Cap | ARPU | Profitability |

|---|---|---|---|---|

| Roku | $3.2B | $9.1B | $44.25 | ❌ Loss-making |

| Netflix | $38B | $170B | $200+ | ✅ Profitable |

| Amazon (Fire) | N/A | $1.9T | N/A | ✅ Profitable |

Roku’s hardware-light, platform-heavy model contrasts with Netflix’s subscription focus and Amazon’s ecosystem strategy.

Conclusion

Roku is a top-tier streaming platform stock with high upside and high volatility. While it lacks profitability today, its strategy of partnerships, home screen monetization, and international expansion gives it an edge. Roku stock drop today why? The question has many answers–from revenue guidance to macro market shifts. But for patient investors, Roku’s story is still unfolding. Whether you’re holding long or seeking tech exposure on a flexible platform, Pocket Option offers trading on 100+ popular assets OTC–24/7.

Disclaimer: This article is for educational purposes only and not financial advice.

FAQ

Will Roku stock recover?

Yes, if ad revenue grows and margins improve. Analysts target $88–$115 in 2025.

Why is Roku dropping?

Missed earnings guidance and macro headwinds hurt recent performance.

Is Roku stock expected to go up?

Wall Street analysts see upside if Roku sustains ARPU growth and cost control.

Why did Roku stock jump?

Key catalysts include strong quarterly earnings and Amazon partnerships.

What is the sentiment of rokousd stock?

Mixed: Analysts see potential but warn of near-term volatility.

Why is Roku stock dropping today 2021?

Due to post-COVID ad spend normalization and overvaluation corrections.

Where will Roku stock be in 5 years?

Estimates suggest $100–$130 if trends in streaming and ad-tech continue.

Roku stock dividend?

No dividend. Roku reinvests in growth.