- Identify significant swing points on higher timeframes (4H, Daily)

- Switch to lower timeframe (5–30 min) and detect patterns

- Confirm validity with volume, candlestick size, and proximity to levels

Pocket Option Trading Analysis: A Data-Driven Approach To Consistent Profits

Effective Pocket Option Trading analysis integrates multi-timeframe confluence, volume patterns, and psychological price barriers. This framework reveals how experienced traders achieve 67–73% win rates while maintaining risk-reward ratios above 1:1.8, with specific implementation steps you can apply immediately.

Article navigation

- Beyond Basic Indicators: The Professional Edge

- Price Action: The Foundation of Market Reading

- Built-In Tools for Smarter Decisions

- Volume Analysis: The Missing Dimension

- Support/Resistance: Mapping Market Memory

- Strategic Indicator Integration

- Market Context: The Environment Matters

- Practical Example: Using Analysis on Pocket Option

- From Analysis to Execution

- Build Your Analytical Edge

Beyond Basic Indicators: The Professional Edge

Sophisticated Pocket Option trading analysis requires a comprehensive framework integrating multiple data sources rather than relying on isolated indicators. Experienced traders build systems combining price action, volume patterns, market structure, and psychological levels.

The difference between novice and expert analysis lies in methodology:

| Trading Style | Description | Win Rate Range | Risk:Reward Ratio | Strength |

|---|---|---|---|---|

| Single Indicator | Uses only one signal (e.g., RSI or MACD alone) | 38–45% | 1:0.8 | Very simple, but often unreliable |

| Multiple Indicators | Combines 2–3 tools (e.g., RSI + MA + MACD) | 52–58% | 1:1.2 | More stable, filters weak signals |

| Smart Strategy Combo | Combines patterns, levels, and volume | 67–73% | 1:1.8 | Clear context, stronger decisions |

| Expert System | Fully adapted system with conditions and filters | 72–78% | 1:2.3 | Flexible and highly consistent |

“Consistency in Quick Trading comes not just from strategy, but from execution discipline and understanding when not to trade. Volume and context are often ignored, but they make all the difference.” — Michael Torres, market analyst and performance coach

Price Action: The Foundation of Market Reading

Price action forms the cornerstone of effective Pocket Option Trading analysis, offering essential context for interpreting indicators. As indicators lag due to being derived from price, skilled price action interpretation identifies reversals and continuations ahead of signals.

Common patterns in Quick Trading include:

| Price Pattern | Market Signal | Success Rate | Best Timeframe |

|---|---|---|---|

| Pin Bar / Rejection | Potential reversal | 68% with confluence | 15-minute+ |

| Engulfing Pattern | Momentum shift | 72% at key levels | 5-minute+ |

| Inside Bar | Consolidation/breakout | 64% with volume confirm | 1-hour+ |

| Double Top/Bottom | Reversal pattern | 76% with divergence | 30-minute+ |

Three-Step Price Action Method:

Built-In Tools for Smarter Decisions

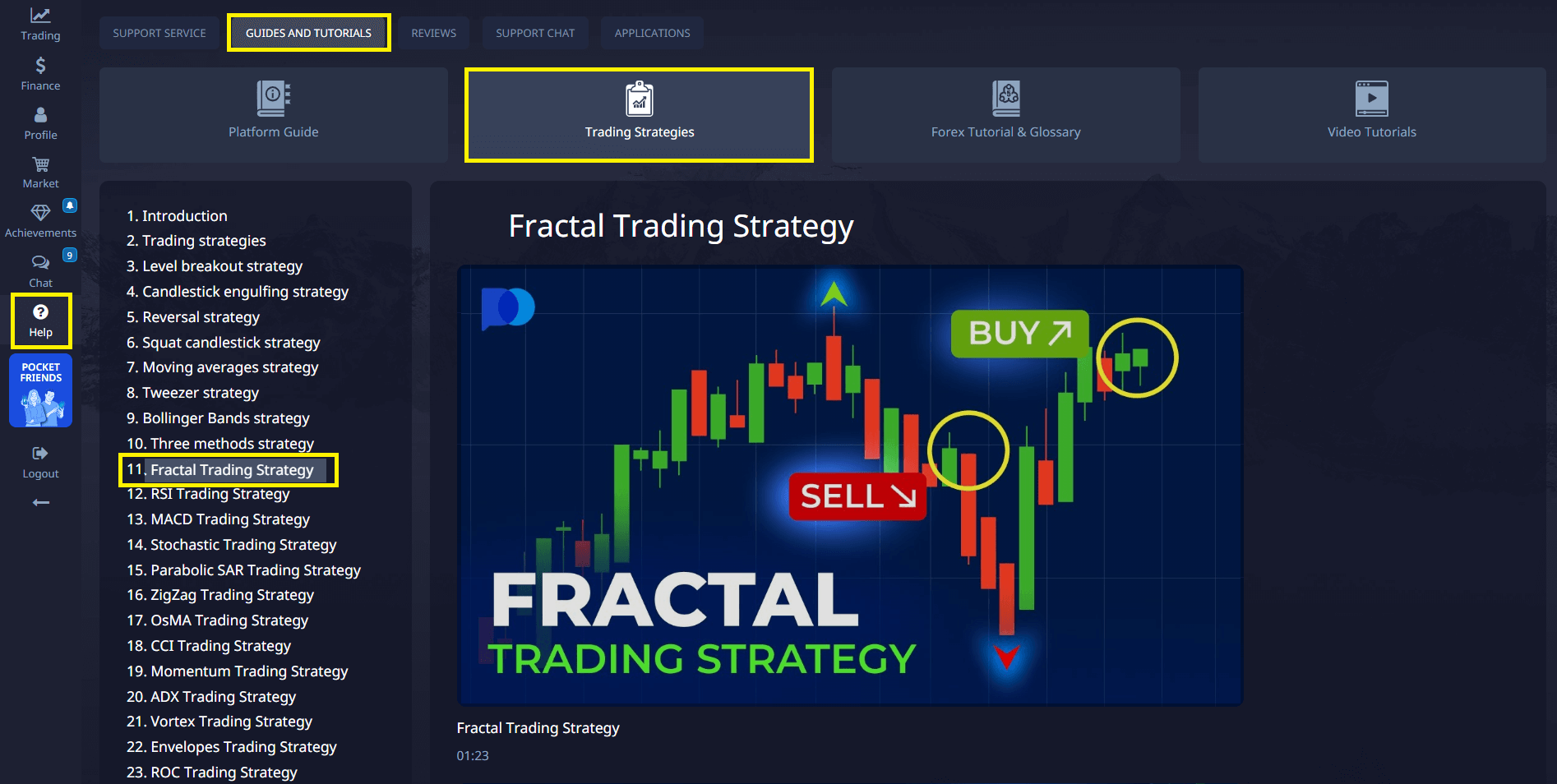

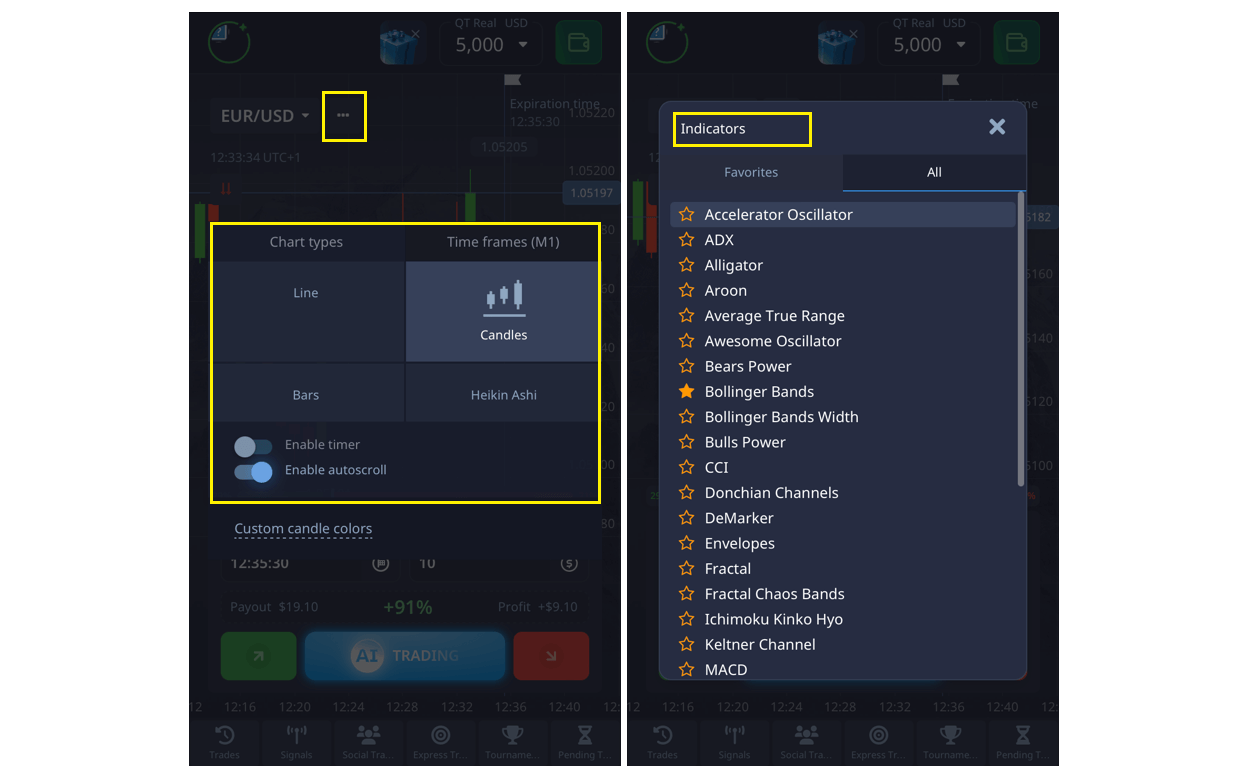

Pocket Option provides a diverse range of analytical tools designed to help you understand market trends and make well-informed decisions.

Key features include:

- Fast visual tools and intuitive chart layouts to reflect current market conditions (Use candlestick, line charts, heiken ashi and bars)

- Detailed payout percentages to help you understand your profit potential

- A strategy library offering integrated approaches to refine your trading method

- Risk management tools that help protect and optimize your trades

These features work together to deliver clear insights and a smooth trading experience.

Volume Analysis: The Missing Dimension

Volume reveals the conviction behind price movements. Professionals use:

- Volume Climax: Extreme spike, signals potential exhaustion

- Volume Confirmation: Rising volume validating price direction

- Volume Divergence: Decreasing volume at price extremes

- Low-Volume Pullback: Weak retracement = healthy trend

Volume Pocket Option Trading analysis becomes especially valuable during breakouts and at key support/resistance levels. A breakout with 200%+ average volume shows much higher sustainability than similar moves on average or below-average volume.

Find out more about volume indicator in our article

Support/Resistance: Mapping Market Memory

Support and resistance levels function as market memory points where past buyer/seller activity influences future price behavior. Effective Pocket Option trading analysis requires systematically identifying and ranking these levels based on their probable price impact.

Not all levels carry equal significance. Professional traders prioritize these levels based on specific characteristics:

| Level Type | Significance | Identification Method |

|---|---|---|

| Multi-timeframe Confluence | Very High | Aligned levels across timeframes |

| Major Swing Points | High | Significant past highs/lows |

| Round Numbers | Moderate-High | Psychological levels (e.g., 1.2000, 50.00) |

| Fibonacci Levels | Moderate | 38.2%, 50%, 61.8% retracement areas |

Strategic Indicator Integration

Expert traders use indicators for distinct analytical dimensions:

| Market Dimension | Indicators | Insight Provided |

|---|---|---|

| Trend Direction | Moving Averages, ADX | Trend direction and strength |

| Momentum | RSI, MACD, Stochastic | Rate of price change |

| Volatility | Bollinger Bands, ATR | Volatility, breakout signals |

| Volume | OBV, Volume Profile | Market participation, strength of move |

Indicators should answer unique questions, not confirm each other redundantly. The strongest support/resistance levels typically show:

- Multiple tests with precise reactions (indicates market recognition)

- Higher timeframe significance (daily levels outweigh 15-minute levels)

- Recent relevance (levels that recently affected price matter more)

- Volume confirmation (high-volume reactions reinforce level strength)

- Multiple technical confluences (level aligns with other technical factors)

When conducting Pocket Option Trading analysis, the most profitable opportunities emerge when multiple support/resistance factors align at similar price points, creating “confluence zones” with significantly higher reaction probability.

Market Context: The Environment Matters

Market context determines which analytical techniques will be most effective. Successful Pocket Option trading analysis begins with identifying the current market environment, as different conditions require different approaches.

| Market Type | Identification | Best Focus | Common Errors |

|---|---|---|---|

| Strong Trend | ADX > 25, clear direction | Trend continuation, pullbacks | Premature reversals |

| Range-Bound | Horizontal support/resistance | Bounces at key levels | Anticipating unconfirmed breakouts |

| Breakout/Breakdown | Breach + strong volume | Momentum entry, retests | Chasing late entries |

| Transition | Mixed volatility, structure | Smaller positions, tighter filters | Using trend methods in chop |

Practical Example: Using Analysis on Pocket Option

To apply the analytical strategies described above, follow this hands-on example using the Pocket Option platform:

- Register or log in to your Pocket Option account — You can use a demo account or switch to a live account.

- Choose your asset — Select a popular instrument (e.g., EUR/USD) from the asset panel.

- Open the chart — Switch to the advanced chart mode for better visualization.

- Select indicators — For example, apply a Moving Average (trend), RSI (momentum), and Volume Profile (participation).

Analyze the chart:

- Start from a higher timeframe (e.g., 4H) to identify key levels

- Switch to a trading timeframe (e.g., 5M or 15M)

- Look for price patterns such as an engulfing candle or at a support/resistance zone

- Confirm with volume — Ensure volume supports the price move (e.g., increasing on breakout, declining on pullback)

Plan your trade:

- Define your risk (1–2% of account balance)

- Decide on entry type (e.g., at market or limit order on pullback)

- Execute and monitor — Enter the trade, monitor real-time performance, and exit according to your strategy.

“The visual simplicity of Pocket Option’s tools combined with multi-timeframe charting makes it my go-to platform. No clutter — just clear, efficient execution.”— Eva Müller, full-time trader

Try om mobile!

From Analysis to Execution

Bridge Pocket Option Trading analysis and action with structured steps:

- Setup Identification

- Confirmation via volume/pattern/context

- Risk Management — stops based on structure, risk 1–2%

- Precise Entry — avoid ambiguity

- Position Management — multiple exit strategies

- Trade Logging — record setups, outcomes, and lessons

Execution depends on:

- Defined entry criteria

- Stop-loss anchored to price structure

- Position sizing based on stop distance

- Partial profits and trailing exits

- Performance tracking

Build Your Analytical Edge

Progression path:

- Learn indicators

- Master price action

- Recognize context

- Integrate methods

- Apply structured execution

Strengthen your Pocket Option Trading analysis using the demo account to test strategies risk-free. Explore copy trading to align with top performers and gain further market insight. Discuss this and other topics in our community!

✔️ Start integrating this system today using real-time charts available via Pocket Option’s desktop, browser, and mobile apps.

FAQ

What technical indicators work best for Pocket Option trading analysis?

The most effective indicators combine trend identification with precise entry timing. The RSI (14-period) excels at identifying overbought/oversold conditions, especially with readings above 70 or below 30 confirmed by price patterns. Moving averages (20/50/200-period) establish trend direction across timeframes. Bollinger Bands identify volatility contractions before significant movements. Rather than using these in isolation, combine trend indicators (moving averages), momentum indicators (RSI/MACD), and volatility indicators (Bollinger Bands) to create a comprehensive framework. This multi-dimensional approach substantially outperforms single-indicator strategies by providing context across different market aspects.

How important is multi-timeframe analysis when trading on Pocket Option?

Multi-timeframe analysis is critical for Pocket Option trading analysis, providing both strategic direction and tactical precision. Start with higher timeframes (1-hour, 4-hour) to identify market structure and key support/resistance levels. Then move to your trading timeframe (5-15 minutes) for specific setups, and finally to lower timeframes (1-minute) for precise entries. This approach ensures short-term trades align with larger market forces. Traders using structured multi-timeframe analysis achieve 52-67% higher profitability than those using single timeframes. Higher timeframes show what to trade, while lower timeframes reveal when to execute.

What win rate can I realistically expect with proper trading analysis?

With disciplined implementation of sophisticated Pocket Option trading analysis, experienced traders typically achieve 62-68% win rates on high-probability setups. This requires selective trading rather than forcing positions in suboptimal conditions. Beginners implementing basic frameworks can expect 50-55% win rates while developing skills. Remember that win rate alone doesn't determine profitability—risk-reward ratio is equally important. A system with 45% win rate but 1:3 risk-reward ratio outperforms a 65% win rate system with 1:0.5 risk-reward. Focus on techniques that maintain favorable risk-reward profiles rather than maximizing win rate alone.

How should I adapt my analysis to different market conditions?

Market conditions dramatically impact which analytical techniques work best. During strong trends (ADX > 25), focus on continuation patterns and pullback entries while avoiding counter-trend positions. In range-bound markets, emphasize support/resistance reactions and overbought/oversold reversals. During breakouts, prioritize momentum confirmation and volume analysis to distinguish between valid and false breakouts. The biggest mistake is applying techniques suited to one market condition during different environments. Develop specific templates for each market context: trend, range, breakout, and transitional. Begin each session by identifying current conditions before applying the appropriate framework.

How long should I practice before expecting consistent results?

Developing proficient Pocket Option trading analysis typically requires 3-6 months of dedicated practice before achieving consistency. This assumes regular practice (10+ hours weekly), systematic skill development, and proper performance tracking. Begin with paper trading until demonstrating profitability over 100+ trades with proper risk management. Then transition to minimal position sizing for another 50-100 trades while maintaining disciplined documentation. Many traders increase position size too early, leading to significant drawdowns during the learning phase. Focus on process over outcomes—executing your analysis correctly matters more than short-term results. Most dedicated traders achieve analytical proficiency within 6-12 months with consistent practice.