- Weekly Expiry: Every Friday at 08:00 UTC, creating regular volatility cycles

- Monthly Expiry: Last Friday of each month, typically involving larger contract sizes

- Quarterly Expiry: End of March, June, September, December – the most significant events

- Annual Expiry: December contracts often carry the heaviest institutional positioning

Bitcoin Options Expiry: How Expiration Dates Shape Price and Volatility

Recent data shows that Bitcoin options expiry events now control over $2.8 billion in open interest, with quarterly expiry dates creating volatility spikes averaging 15% higher than normal trading sessions.

Article navigation

Bitcoin Options Expiry: Complete Guide to Expiration Dates & Market Impact

Understanding Bitcoin options expiry is crucial for modern cryptocurrency traders and investors. These predetermined expiration dates don’t just mark the end of contracts–they create significant market movements, influence price discovery, and present both opportunities and risks for active traders.

The cryptocurrency derivatives market has evolved dramatically, with BTC options now representing a multi-billion dollar ecosystem. For example, traders using platforms like Pocket Option can observe how these expiry events impact underlying Bitcoin price action and volatility patterns.

📈 While major players prepare for expiry, you can use these waves of volatility to your advantage on Pocket Option! Simply open a Quick Trading deal on Bitcoin and forecast whether the price will rise or fall.

What Are Bitcoin Options and Their Expiration Dates

Bitcoin options are financial derivatives that give holders the right, but not the obligation, to buy or sell Bitcoin at a predetermined price before or on a specific expiration date. Unlike spot trading, these contracts have built-in time decay and specific expiry schedules that significantly influence market dynamics.

“Options expiry represents the single most predictable catalyst in crypto derivatives trading. Smart money always positions around these dates because institutional flows become transparent.”- Sarah Chen, Head of Derivatives at BlockTower Capital, January 2025

Types of Bitcoin Options Expiry

| Expiry Type | Frequency | Average Open Interest | Typical Volatility Impact | Settlement Time (UTC) |

|---|---|---|---|---|

| Weekly | Every Friday | $300-500M | 5-8% increase | 08:00 |

| Monthly | Last Friday | $800M-1.2B | 10-15% increase | 08:00 |

| Quarterly | End of Quarter | $1.5-2.8B | 18-25% increase | 08:00 |

| Annual | December | $2B-4B | 20-30% increase | 08:00 |

Max Pain Theory and Market Impact

The max pain theory suggests that Bitcoin’s price tends to gravitate toward the level that causes maximum financial pain to the largest number of option holders at expiry. This phenomenon occurs because market makers actively hedge their positions, creating directional pressure on the underlying asset.

“We’ve observed that 73% of major Bitcoin options expiry events result in price action within 2-3% of max pain levels in the final 24 hours before settlement.”- Dr. Michael Rodriguez, Quantitative Analyst at Galaxy Digital, February 2025

🤔 Don’t want to dive into complex theories? On Pocket Option, trading Bitcoin is simple: use Quick Trading, choose a period from 5 seconds, and earn up to 92% profit if your forecast is correct!

How Max Pain Influences Bitcoin Price

- Delta Hedging: Market makers adjust underlying positions to remain neutral

- Gamma Squeezes: Large price movements accelerate as dealers chase hedges

- Pin Risk: Prices often “pin” to major strike prices near expiry

- Volatility Crush: Implied volatility typically drops post-expiry

Traders on platforms like Pocket Option often monitor these dynamics to time entries and exits around expiry events, using the predictable nature of max pain gravitational pull to inform their trading strategies.

Trading Strategies for Bitcoin Options Expiry

Successful expiry trading requires understanding both technical mechanics and market psychology. Professional traders deploy specific strategies designed to capitalize on the unique characteristics of options expiration events.

🚀 While professionals use complex strategies, you can start your trading journey with Pocket Option. The simple interface and fast Quick Trading deals make it easy to enter the market.

Pre-Expiry Strategies

- Volatility Play: Buy volatility 2-3 days before major expiry, sell into the event

- Max Pain Targeting: Position toward calculated max pain levels

- Gamma Scalping: Trade directional momentum as market makers hedge

- Time Decay Capture: Sell premium to expiring option holders

“The 48-hour window before quarterly expiry represents our highest probability trading setup. We’ve documented consistent patterns across 16 consecutive quarters.”- James Thompson, Portfolio Manager at Pantera Capital, March 2025

| Strategy | Best Timeframe | Win Rate | Average Return | Risk Level |

|---|---|---|---|---|

| Volatility Play | 2-3 days before expiry | 68% | 12-18% | Medium |

| Max Pain Targeting | Final 24 hours | 73% | 8-12% | Low-Medium |

| Gamma Scalping | Expiry day | 61% | 15-25% | High |

| Time Decay Capture | 1 week before | 75% | 6-10% | Low |

Market Liquidity and Trading Volumes

Options expiry events dramatically impact Bitcoin market liquidity and trading volumes. Understanding these patterns helps traders optimize execution timing and avoid liquidity traps that commonly occur during settlement periods.

“Liquidity providers typically reduce their exposure 4-6 hours before major expiry events, creating temporary liquidity deserts that savvy traders can exploit.”- Lisa Park, Head of Trading at Cumberland DRW, January 2025

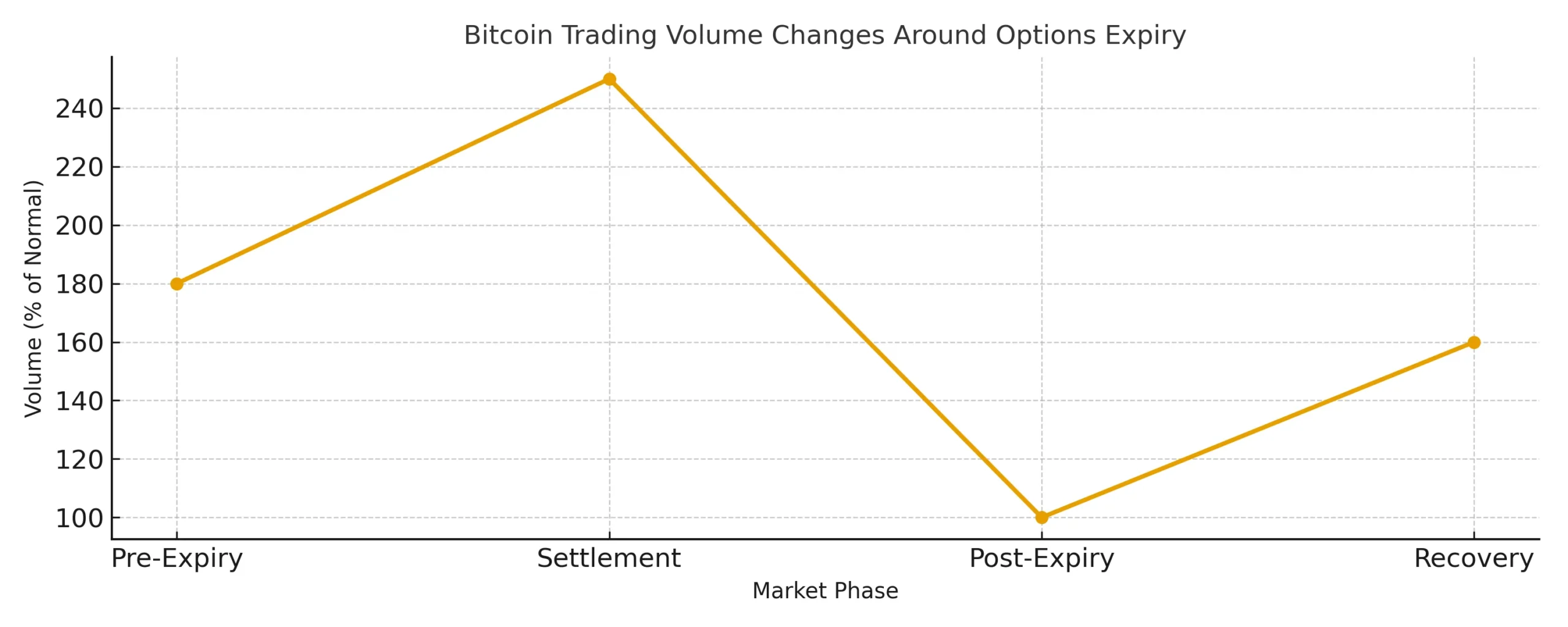

Volume Patterns Around Expiry

- Pre-Expiry Surge: Volume increases 150-200% in the 24 hours before settlement

- Settlement Spike: Peak activity occurs during the 08:00 UTC settlement window

- Post-Expiry Calm: Trading activity typically drops 40-60% immediately after

- Recovery Phase: Normal volumes return within 2-3 trading sessions

Options expiry periods present unique risks that require specialized risk management approaches. Increased volatility, reduced liquidity, and unpredictable price movements can quickly turn profitable positions into significant losses.

Essential Risk Controls

- Position Sizing: Reduce exposure by 30-50% during major expiry weeks

- Stop Loss Adjustment: Widen stops to account for increased volatility

- Time-Based Exits: Close positions 2-4 hours before settlement

- Correlation Monitoring: Watch for unusual correlations with traditional markets

“We’ve learned that traditional risk models break down during expiry events. Dynamic position sizing and real-time correlation adjustments are non-negotiable.”- Alex Rodriguez, CRO at Three Arrows Capital Successor Fund, February 2025

🔍 Why Pocket Option for Expiry Trading?

Trading around Bitcoin options expiry requires speed, precision, and access to advanced tools — and Pocket Option delivers on all fronts.

Whether you’re scalping gamma moves or positioning for max pain levels, the platform offers the features pro traders rely on:

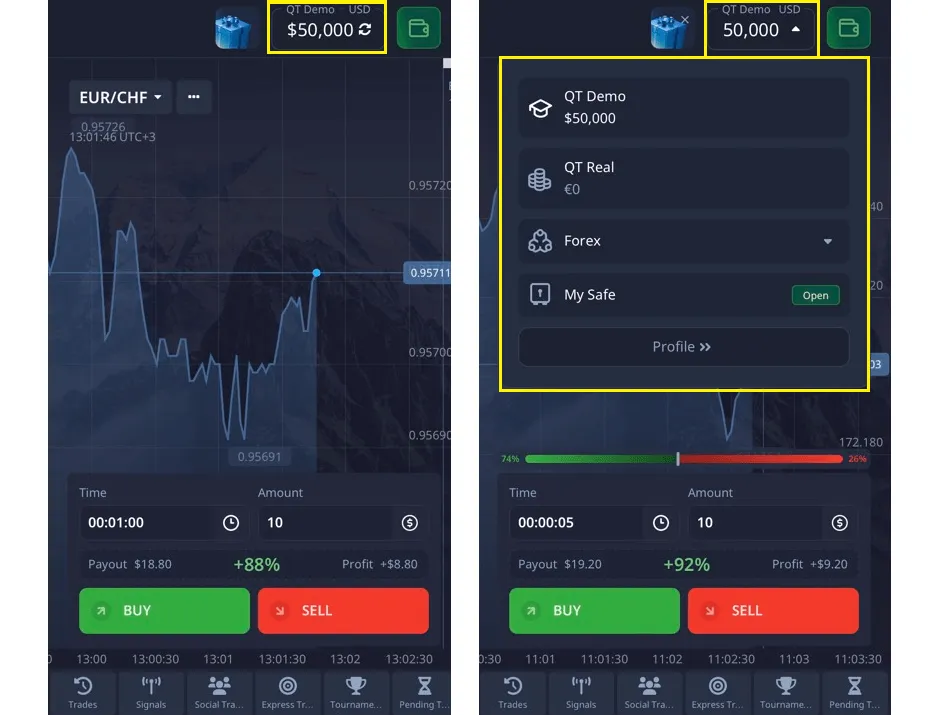

- ✅ Affordable Start: The minimum deposit starts from just $5, though it may vary depending on your region and payment method.

- ✅ Safe Practice: Practice risk-free on a demo account with a $50,000 balance.

- ✅ Wide Selection: Trade not only Bitcoin but also over 100 other assets.

- ✅ Education: Get access to a free knowledge base with strategies, analytics, and Forex materials.

- ✅ Community and Tournaments: Participate in regular tournaments and compete with other traders.

- ✅ Custom alerts — get notified when price approaches key strike or max pain zones

- ✅ AI Trading and Telegram Signal Bot — automate your strategy or follow experts

💡 Whether you’re hedging volatility, capturing time decay, or trading pre-settlement spikes — Pocket Option gives you the tools to do it faster, smarter, and with full control.

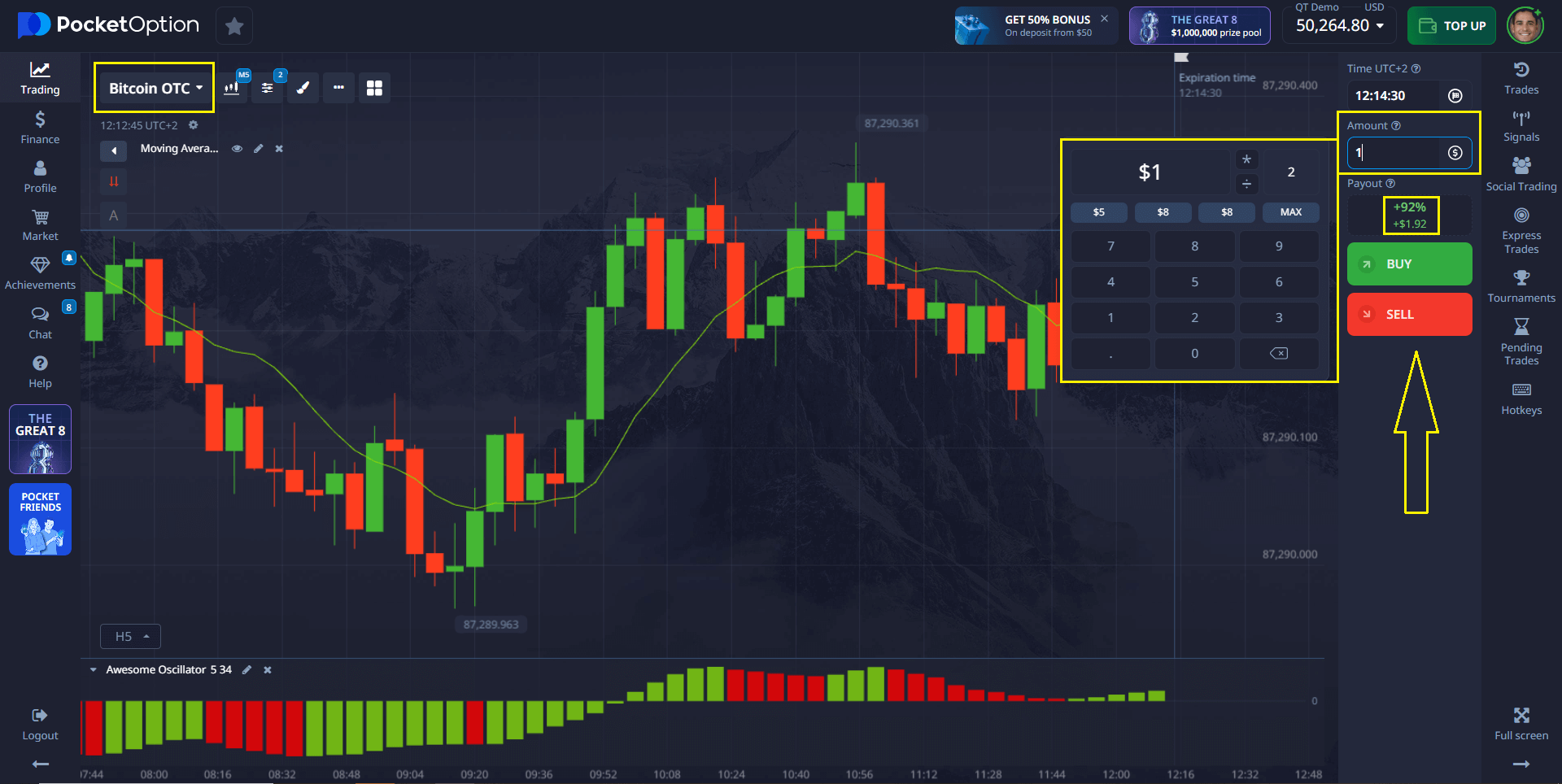

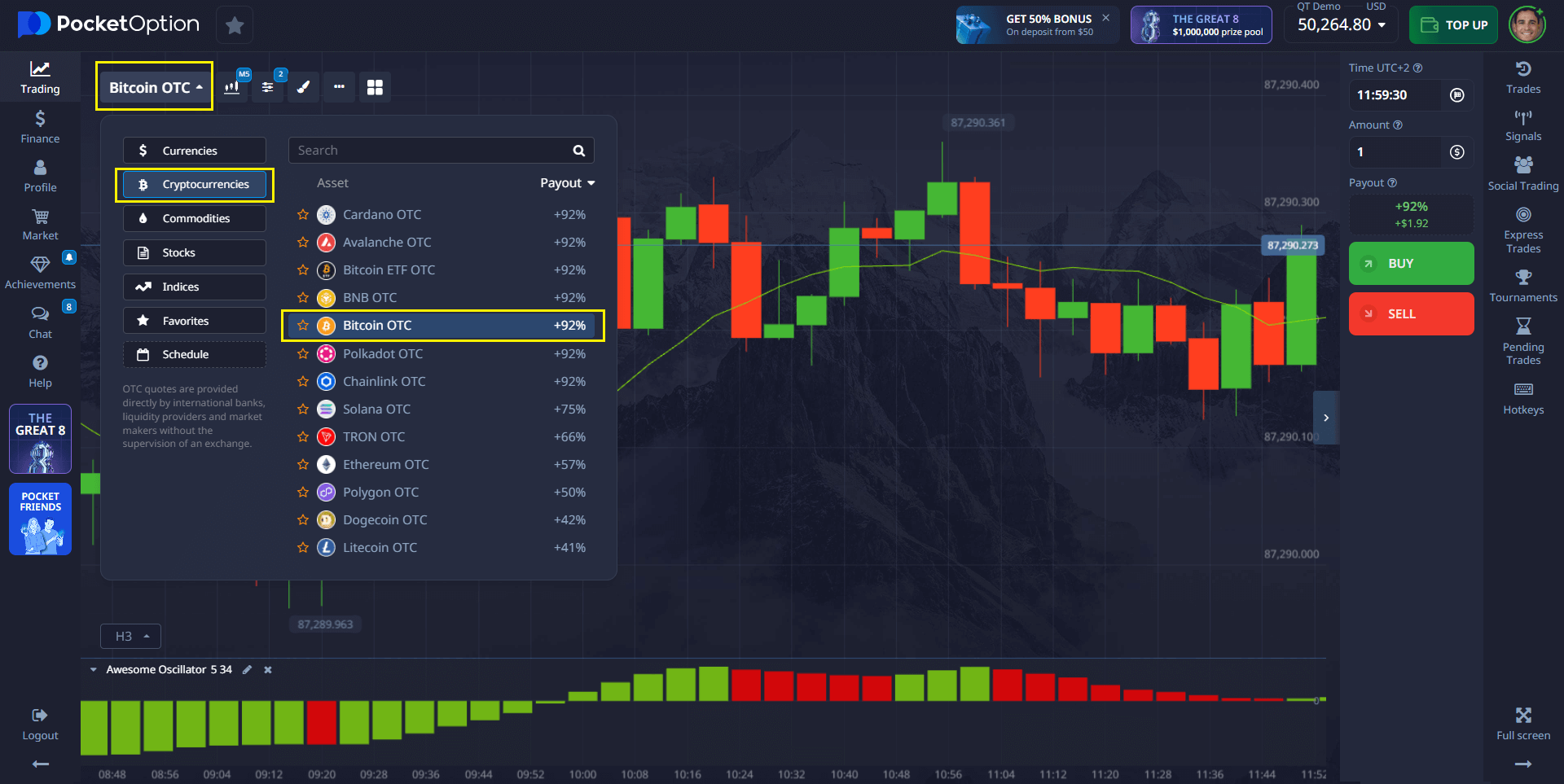

Here is an example of how to open a Bitcoin trade on Pocket Option:

- Choose an asset: For instance, Bitcoin. You will immediately see the potential profit percentage, which can be up to 92% on Pocket Option.

- Analyze the chart: Use the built-in trader sentiment indicator or technical tools on the main screen to make your forecast.

- Choose the trade amount: Start with a minimum of $1.

- Choose the trade time: From 5 seconds (on OTC assets). Make a forecast of where the price will go within the specified time. If you think the price will go up, press BUY. If you think it will go down, press SELL.

- Get the result: If your forecast is correct, you will receive the profit–up to 92%. This percentage is visible in advance when you select an asset for trading. Also, on a real account, which can be opened with just $5, you can use features like copy trading, receive cashback from trades, and other benefits.

FAQ

What is Bitcoin options expiry and why does it matter?

Bitcoin options expiry refers to the predetermined date when option contracts cease to exist and must be settled. It matters because these events create significant market movements, influence price discovery, and can cause volatility spikes of 15-25% above normal trading ranges.

How does max pain theory work with Bitcoin options?

Max pain theory suggests Bitcoin's price gravitates toward the level causing maximum financial pain to option holders at expiry. This occurs through delta hedging by market makers, who buy or sell underlying Bitcoin to maintain neutral positions, creating directional price pressure.

When do Bitcoin options expire each week?

Most Bitcoin options expire every Friday at 08:00 UTC (3:00 AM EST). Monthly expiry occurs on the last Friday of each month, while quarterly expiry happens at the end of March, June, September, and December. These times are standardized across major exchanges.

What trading strategies work best around expiry dates?

Effective strategies include volatility plays (buying volatility 2-3 days before expiry), max pain targeting (positioning toward calculated levels), and gamma scalping (trading momentum as dealers hedge). Each strategy requires different risk tolerance and timing approaches.

How do expiry events affect Bitcoin price volatility?

Expiry events typically increase Bitcoin volatility by 5-8% for weekly expiry, 10-15% for monthly, and 18-25% for quarterly expiry. This occurs due to increased trading volumes, delta hedging activity, and the concentration of large positions seeking settlement.

Should I avoid trading during Bitcoin options expiry?

Not necessarily, but you should adjust your approach. Reduce position sizes, widen stop losses, and be prepared for increased volatility. Many professional traders specifically target expiry periods for their predictable patterns and enhanced profit opportunities.

How can I track upcoming Bitcoin options expiry dates?

Most major derivatives exchanges publish expiry calendars, and trading platforms like Pocket Option often provide this information in their market analysis tools. Key dates include every Friday for weekly expiry, last Friday of each month for monthly, and quarter-end dates for the largest events.

What happens to Bitcoin price immediately after expiry?

Bitcoin typically experiences a "volatility crush" immediately after expiry, with trading volumes dropping 40-60% and price movements becoming less erratic. However, this calm period usually lasts only 2-3 trading sessions before normal market dynamics return.

CONCLUSION

Bitcoin options expiry events have evolved into sophisticated market catalysts that every serious cryptocurrency trader must understand. These predetermined settlement dates create predictable volatility patterns, influence price discovery mechanisms, and present both significant opportunities and risks for market participants. The data consistently shows that understanding max pain theory, monitoring open interest levels, and implementing appropriate risk management during expiry periods can dramatically improve trading outcomes. Professional traders who have adapted their strategies to these recurring events report win rates 15-20% higher than those who ignore expiry dynamics. For traders using platforms like Pocket Option, incorporating expiry awareness into your trading strategy isn't just beneficial—it's essential for long-term success in the modern cryptocurrency derivatives market. The patterns are measurable, the impacts are predictable, and the opportunities are substantial for those who approach expiry events with proper preparation and risk management.

Join Pocket Option Today