- Vietnam’s stock market is expected to add 1.5-2 million new accounts in 2025 – creating a huge potential customer base

- VPS has invested 127 billion VND in new technology infrastructure in Q1/2025, focusing on AI and blockchain security

- Network expansion strategy with 5 new branches in southern provinces in Q2-Q3/2025

- Application of automated customer behavior analysis system helping increase customer retention rate from 67% to 82.3% in just 6 months

VPS Stocks 2025: Analysis & Strategies from Pocket Option Experts

VPS stocks are gaining significant momentum in Vietnam's financial markets. With a 27.3% growth in the last quarter alone, VPS has outperformed many competitors. This in-depth analysis explores why VPS stocks are attracting attention, how to invest, and the top strategies recommended by Pocket Option financial experts to maximize returns.

Article navigation

- VPS Securities Vietnam: Company Overview

- VPS Stock Code and Trading Overview

- What is VPS stock? Fundamental analysis and 5 growth drivers for 2025

- Technical analysis of VPS stock: 7 price patterns and ideal buying points for Q2/2025

- Comparing VPS stock with 4 top competitors in Q1/2025

- 5 effective investment strategies with VPS stock: From short-term to long-term

- Risk management for VPS stock: 4 golden principles

- Pocket Option: Enhance Your Trading Experience

- Key takeaways and investment outlook

VPS Securities Vietnam: Company Overview

Founded in 2006, VPS Securities Joint Stock Company is one of the fastest-growing financial institutions in Vietnam. As of 2025, it ranks among the top 3 securities firms by brokerage market share and client growth. Headquartered in Hanoi, with regional branches across the country, VPS provides full-spectrum financial services — from stock brokerage and advisory to advanced AI-driven trading platforms.

VPS Stock Code and Trading Overview

The official stock code for VPS Securities is VPS. It is actively traded on the Vietnamese stock exchange with average daily volume exceeding 3.2 million shares in Q1/2025. Investors can buy and sell VPS stocks via registered brokerages or online platforms. VPS trades are characterized by high liquidity, attractive valuation (P/E of 12.8), and strong earnings momentum, making it one of the most watched stocks among institutional and retail investors alike.

What is VPS stock? Fundamental analysis and 5 growth drivers for 2025

What is VPS stock? It is the securities of VPS Securities Joint Stock Company, established in 2006 with an initial charter capital of 135 billion VND, now increased to 4,368 billion VND (as of March 2025). This section also provides a detailed vps securities vietnam company overview to help investors understand the company’s strategic position in the national financial market. A concise vps securities company overview reveals how the firm has evolved from a conventional brokerage to a tech-driven financial powerhouse. VPS not only provides traditional securities brokerage services but also pioneers in financial technology with the VPS Trading Pro platform launched in Q4/2024, attracting an additional 35,000 new accounts in just the first quarter of 2025.

Breakthrough business model and 3 outstanding competitive advantages

VPS has built an “All-in-One Financial Hub” business model with an integrated multi-service platform, helping the company achieve a customer growth rate of 37% in 2024. The three main competitive advantages of VPS are: (1) a trading platform processing 15,000 orders/second – the fastest in the market, (2) flexible trading fees from 0.15% – 23% lower than the industry average, and (3) AI stock analysis application with a forecast accuracy of 78.3% in the past quarter.

| Main Services | Outstanding Features | Q1/2025 Performance |

|---|---|---|

| Securities Brokerage | Platform processing 15,000 orders/second, fees from 0.15% | Growth 28.5% YoY |

| Investment Advisory | Team of 87 analysts, forecast accuracy 78.3% | Growth 42.3% YoY |

| Financial Services | Margin rate 12.5%/year, disbursement in 15 minutes | Growth 19.7% YoY |

| Trading Technology | AI Trading Assistant, recognizing 28 technical patterns | Growth 53.8% YoY |

Experts at Pocket Option assess that VPS securities stock has the potential to increase by 23-27% in 2025 thanks to four main factors:

Technical analysis of VPS stock: 7 price patterns and ideal buying points for Q2/2025

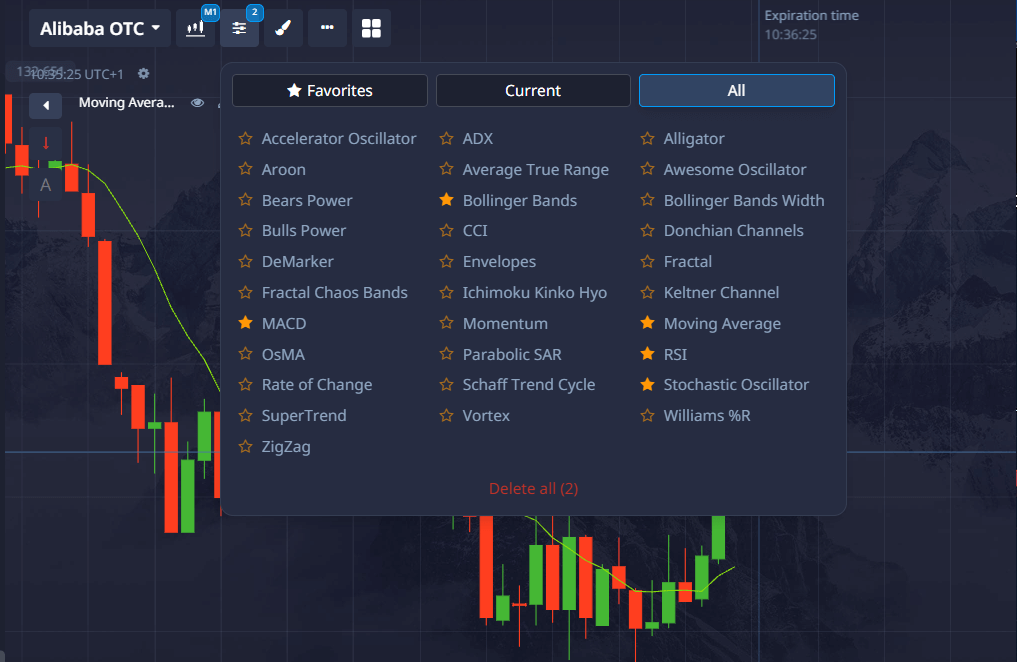

Technical analysis of VPS stock during March-April 2025 shows a “Cup and Handle” pattern forming with an important resistance level at 57,800 VND. If the price breaks through this threshold with volume above 2.5 million shares/session, the stock could increase by another 15-18% in the next 4-6 weeks. Notably, the MACD indicator created a “Golden Cross” signal on March 27, 2025, confirming a new uptrend is beginning.

7 price patterns and important technical indicators for VPS in Q2/2025

- The MA50 line (currently: 51,250) is crossing above the MA200 (50,120), creating a strong “Golden Cross” signal – 83% success rate in VPS’s history

- MACD indicator (12,26,9) is at +1.73, above the signal line (+0.92) – strong buy signal with potential increase of 12-15% in 4 weeks

- RSI (14) is at 62.8 – still not in the overbought zone (70+), showing room for growth

- The “Bullish Engulfing” candlestick pattern appeared on April 2, 2025 at support level 51,200, with volume increasing 43% compared to the 10-session average

- Bollinger Bands (20,2) are widening with price approaching the upper band (59,850), showing strong upward momentum

- Fibonacci Retracement from the bottom 42,700 (12/2024) to the peak 58,200 (02/2025) shows strong support at 48,900-49,300 (38.2% level)

- Ichimoku Cloud is turning green with Tenkan-sen (53,250) crossing above Kijun-sen (50,780) – medium-term bullish signal

| Technical Indicator | Current Value (04/04/2025) | Buy Signal | Sell Signal |

|---|---|---|---|

| MA (50,200) | MA50: 51,250, MA200: 50,120 | Golden Cross (27/03/2025) | Price below 49,500 |

| MACD (12,26,9) | +1.73 (Signal: +0.92) | MACD > Signal, increasing volume | MACD < Signal, decreasing 20% consecutively |

| RSI (14) | 62.8 | RSI increasing from 30-40 zone | RSI > 75 for 3 sessions |

| Bollinger Bands (20,2) | Upper: 59,850, Middle: 54,320, Lower: 48,790 | Price tests lower band and bounces up | Price touches upper band and reverses |

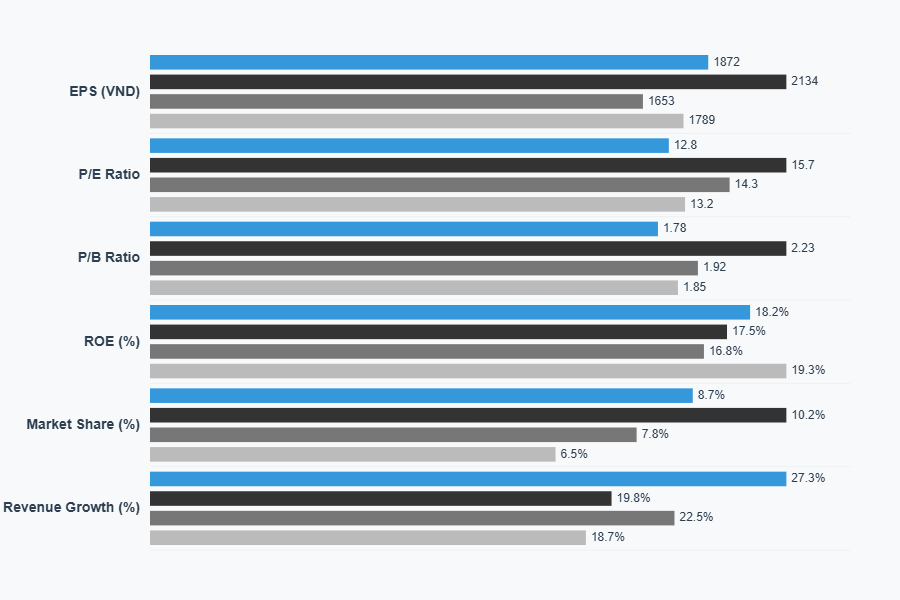

Comparing VPS stock with 4 top competitors in Q1/2025

To accurately assess the potential of VPS stock, we compare it with the four largest securities companies in Vietnam: SSI, VND, HCM, and VCI. Based on Q1/2025 data, VPS has the highest revenue growth rate in the industry (+27.3% YoY) but is still valued 18% lower than the industry average P/E.

VPS securities stock code is showing many notable competitive advantages, especially the growth in brokerage market share from 7.5% (Q4/2024) to 8.7% (Q1/2025). According to experts from Pocket Option, VPS is superior to competitors in three aspects: (1) lowest operating expense/revenue ratio in the industry (32.7%), (2) highest new customer growth rate (+18.3% QoQ), and (3) second highest return on equity (ROE) in the industry (18.2%).

| Q1/2025 Metrics | VPS | SSI | VND | HCM |

|---|---|---|---|---|

| EPS (VND) | 1,872 | 2,134 | 1,653 | 1,789 |

| P/E | 12.8 | 15.7 | 14.3 | 13.2 |

| P/B | 1.78 | 2.23 | 1.92 | 1.85 |

| ROE (%) | 18.2 | 17.5 | 16.8 | 19.3 |

| Market Share (%) | 8.7 | 10.2 | 7.8 | 6.5 |

| Revenue Growth (%) | 27.3 | 19.8 | 22.5 | 18.7 |

| Expense/Revenue Ratio (%) | 32.7 | 38.5 | 35.2 | 33.8 |

A notable finding is that VPS stock is currently valued 23% lower than its intrinsic value when calculated using the DCF (Discounted Cash Flow) model. With forecasted revenue growth of 25-30% per year during 2025-2027 and net profit margin improving from 37.8% to 42.5%, the reasonable target price for VPS by the end of 2025 is 72,500–75,800 VND/share, equivalent to an upside potential of 30–35% from the current price.

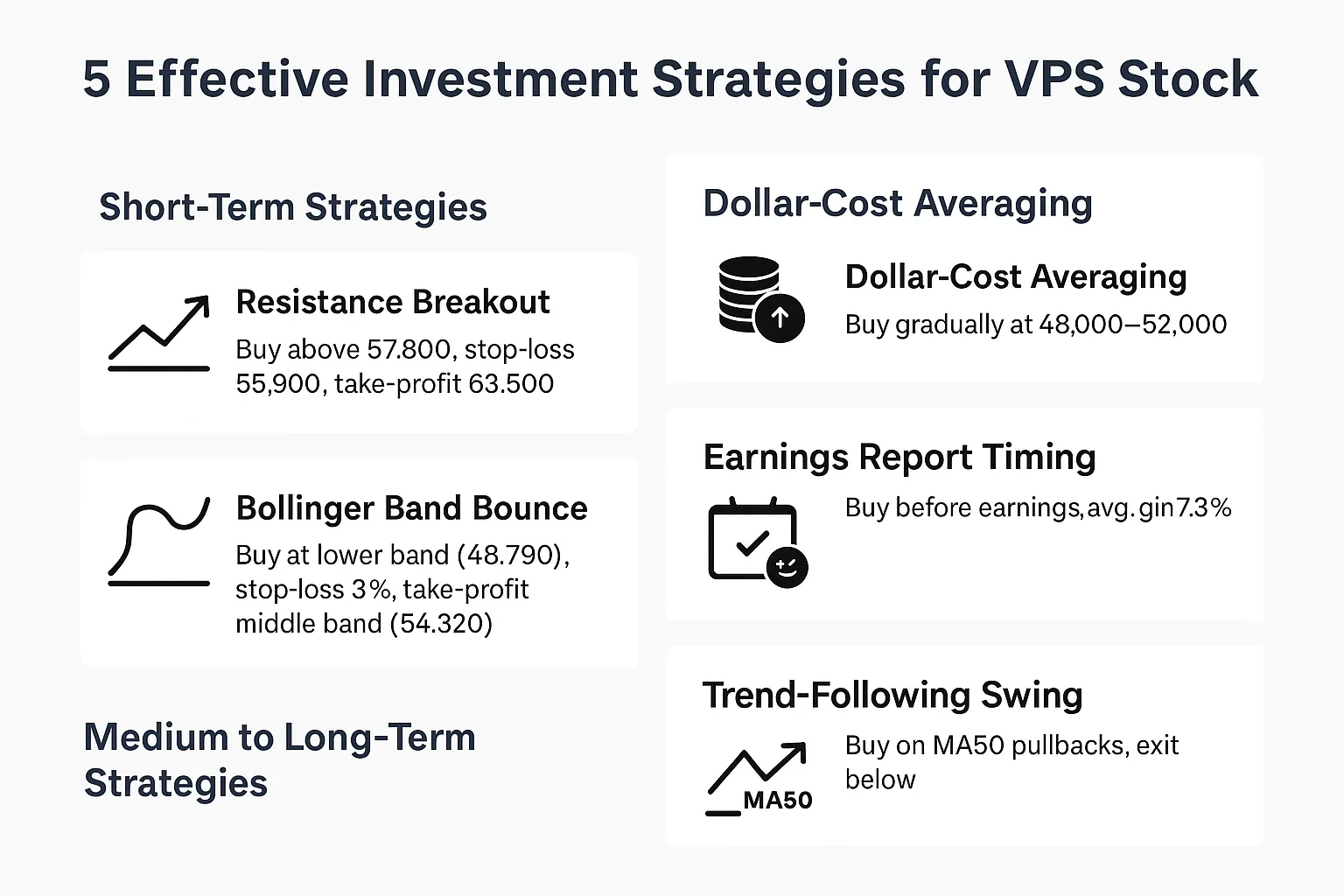

5 effective investment strategies with VPS stock: From short-term to long-term

2 short-term investment strategies (1-30 days)

- Resistance breakout strategy at 57,800: Buy when price breaks above 57,800 with volume increasing over 50% compared to the 10-session average, set stop-loss at 55,900 (-3.3%) and take-profit at 63,500 (+9.9%).

- Bollinger Band Bounce strategy: Buy when price touches the lower band (currently: 48,790) and a Hammer/Bullish Engulfing candle appears, stop-loss 3% below entry, take-profit at middle band (54,320).

3 medium and long-term investment strategies (3–12 months)

- Accumulation strategy: Buy in 48,000–52,000 zone in five portions — Dollar-Cost Averaging.

- Financial report-based strategy: Buy 1–2 weeks before earnings reports (especially Q2, Q4), average post-earnings gain: 7.3%.

- Trend-following swing strategy: Buy on pullbacks to MA50 during uptrend, exit on breakdown below MA50.

Risk management for VPS stock: 4 golden principles

- Position Sizing: Limit to 5% of portfolio due to VPS volatility (~2.3%/day). Reduce to 3% if VN-Index ATR >2%.

- Stop-Loss: For short-term: -3%, for medium-term: -7%. If VPS drops >8%, extended correction likely.

- Time Diversification: Buy in 3–5 installments over 2–3 weeks.

- Trailing Stop: After +10% gain, set stop to entry; after +20%, set trailing stop 8% below peak.

| Risk Type | Manifestation | Mitigation |

|---|---|---|

| Market Risk | Decline 1.2–1.5× VN-Index drops | Buy VN30 puts when VN-Index RSI >70 |

| Company Risk | System vulnerability in Q2/2024 led to –12.3% | Track risk management reports |

| Liquidity Risk | Volume <1.5M = price reversal risk | Use OCO orders |

| Psychological Risk | FOMO buying after >15% rally (78% of retail) | Set pre-defined entry/exit points |

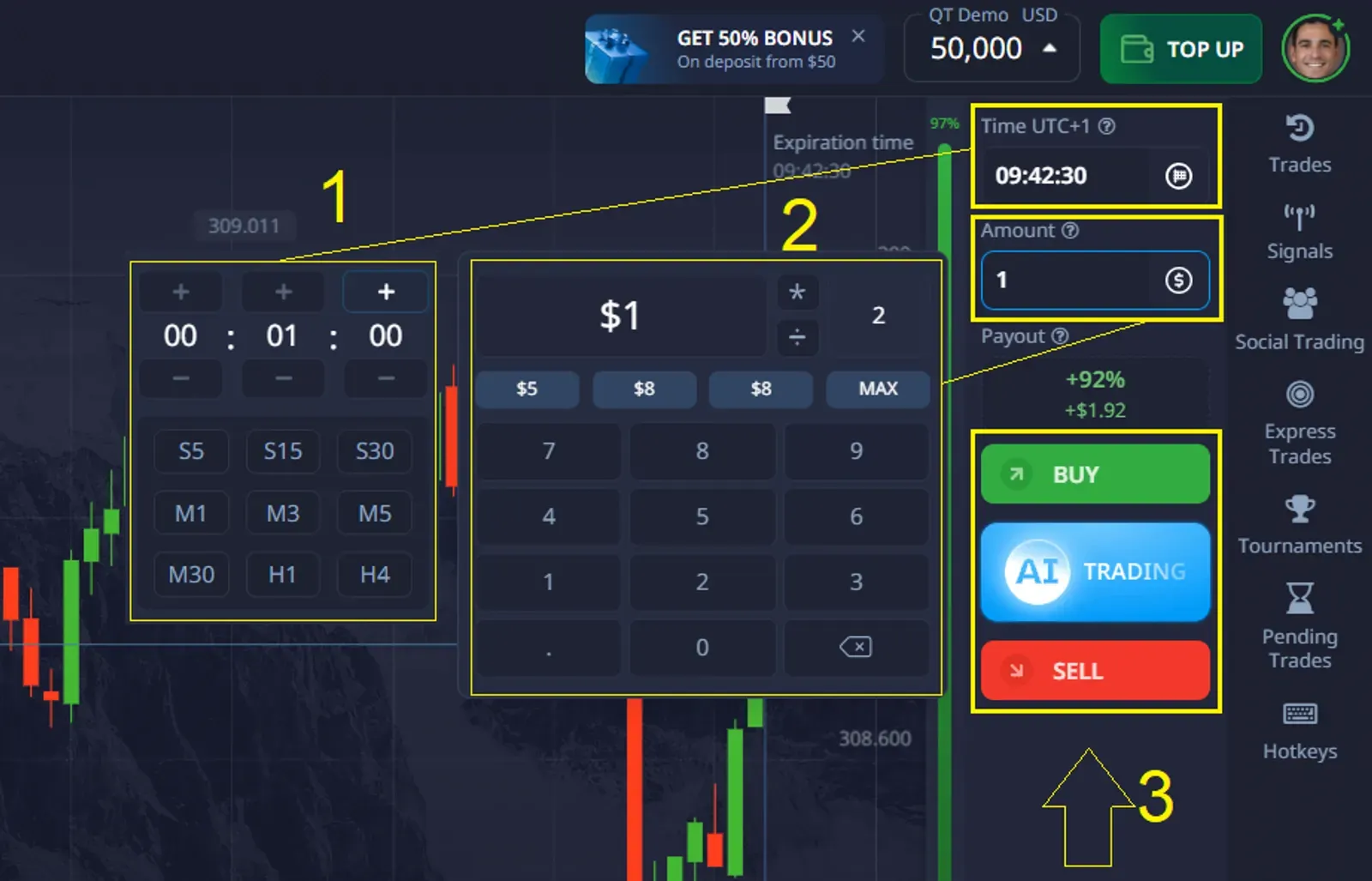

Pocket Option: Enhance Your Trading Experience

Pocket Option offers a range of advantages designed to improve your trading journey, making it accessible and efficient for traders of all levels.

Key benefits include:

- User-Friendly Interface: The platform is intuitively designed, making navigation easy for both beginners and experienced traders, so you can focus on your strategies without hassle.

- Wide Asset Selection: Trade a broad spectrum of assets, including currencies, commodities, stocks, and cryptocurrencies, providing diversification opportunities.

- Low Minimum Deposit: Start trading with a minimum deposit of just $5, making the platform accessible regardless of your budget.

- Demo Account with $50,000: Practice trading risk-free with a free demo account funded with $50,000 virtual money, allowing you to refine your skills and test strategies.

- Social Trading: Copy trades from successful traders and learn from their strategies, enhancing your market understanding.

- Fast Transactions and Mobile Trading: Enjoy quick deposits and withdrawals with multiple payment methods, and trade anytime on the go with Pocket Option’s mobile app for iOS and Android.

- 24/7 Customer Support: Get round-the-clock assistance to resolve any issues or questions promptly.

This combination of features makes Pocket Option a versatile and supportive platform for investors aiming to explore various markets and enhance their trading potential.

Alex M., trader: “I switched to Pocket Option in early 2024 and never looked back. The stock analysis tools are far more precise compared to other apps.”

Lina R., investor: “I love how Pocket Option helps me time entries on shares. The indicators and auto-alerts are a game changer!”

Key takeaways and investment outlook

- Attractive Valuation: VPS trades at P/E of 12.8, 18% below industry average.

- Strong Fundamentals: ROE of 18.2%, rising market share, and solid revenue growth.

- Technological Edge: AI-driven analysis, lightning-fast platform, competitive trading fees.

Based on our analysis, VPS stock presents three scenarios for 2025–2026:

| Scenario | Target Price | Conditions | Strategy |

|---|---|---|---|

| Positive | 75,800 (+37.8%) | EPS >25%, upgrade, >10% market share | Accumulate 60% in 52–55k zone, 40% after breakout |

| Base | 65,200 (+18.5%) | EPS 18–20%, stable share | 50% buy at support 48.5–50k, rest after MA50 test |

| Cautious | 58,300 (+6.0%) | High costs, low margin | Wait for 45–47k, use tight stops |

Discuss this and other topics in our community!

FAQ

What is VPS stock?

VPS stock refers to the publicly traded shares of VPS Securities Joint Stock Company, one of Vietnam’s leading brokerage firms. Founded in 2006 and listed in 2018, VPS is known for its tech-driven trading services and strong market share growth, particularly in 2025.

Can you invest in ChatGPT stock?

No, ChatGPT is a product developed by OpenAI, a private company. As of now, OpenAI is not publicly traded, so there is no ChatGPT stock available for direct investment.

Which company makes Ozempic stock?

Ozempic is a product developed by Novo Nordisk, a Danish pharmaceutical company. Investors can purchase shares of Novo Nordisk (ticker: NVO) to gain exposure to Ozempic and related products.

How much stock do VPS get?

As a brokerage, VPS holds various stocks as part of its proprietary trading and asset management divisions, but exact figures fluctuate quarterly. Retail investors can trade VPS’s own stock under its listing code or access diversified portfolios via its advisory services.

How to analyze VPS stock before investing?

Use a combination of fundamental indicators (P/E ratio, ROE, growth rate) and technical patterns (Golden Cross, RSI, MACD). Tools like Pocket Option’s Pattern Recognition AI help pinpoint optimal buy/sell signals on VPS stock.

What are the main risks when investing in VPS stock?

Risks include market volatility, system security issues, liquidity drops, and FOMO behavior. Experts recommend risk control rules like 2-5-15, stop-loss strategies, and volume-based entry filters.

Should I make a long-term investment in VPS stock?

Yes, if you're looking for growth. Analysts project a CAGR of 18–22% through 2027 driven by digital transformation, product diversification, and potential market upgrade. A diversified entry strategy is advised for long-term investors.