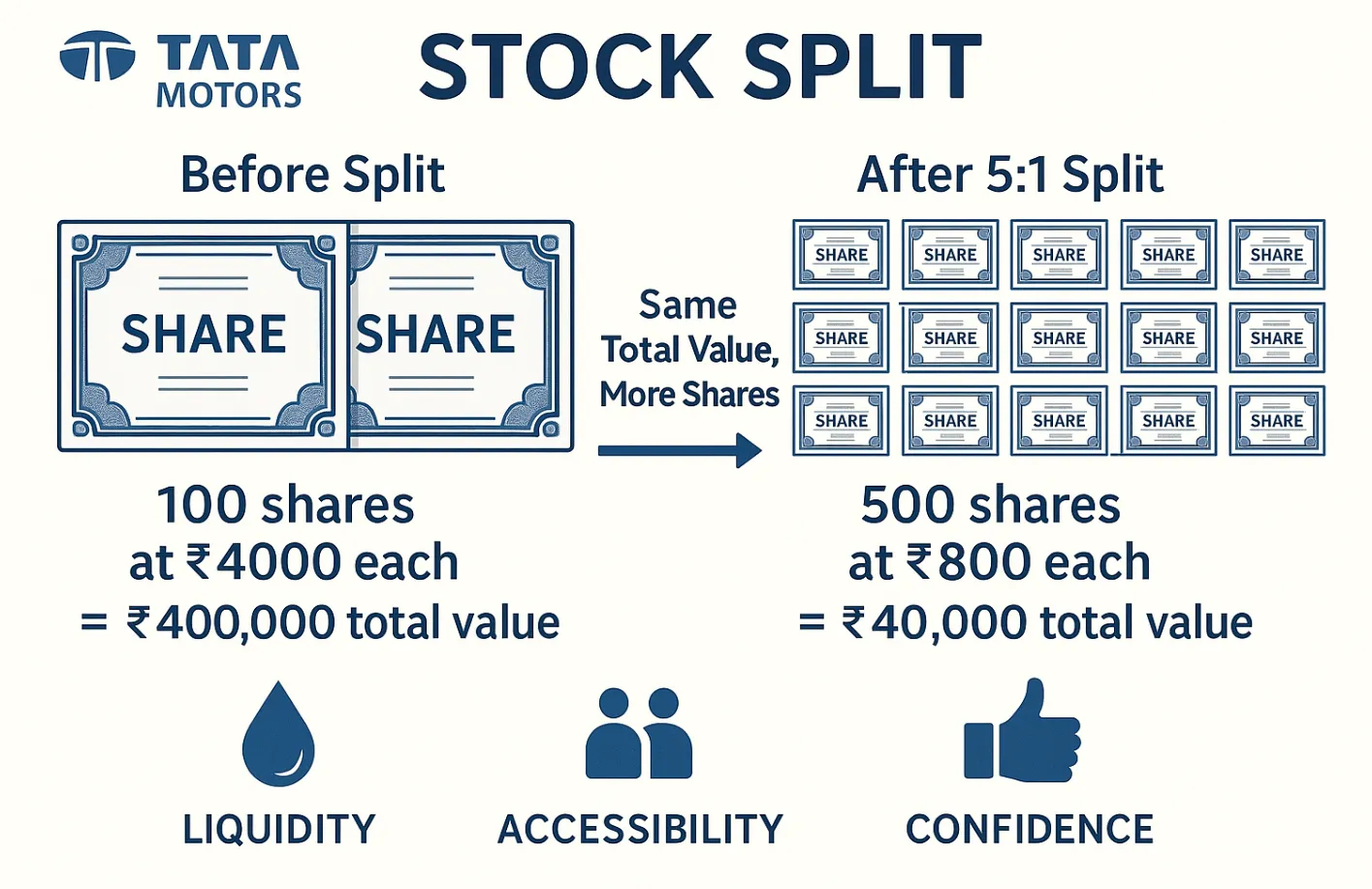

- Boosting Liquidity: A lower share price makes it easier for more people to buy and sell, increasing daily trading volume.

- Enhancing Accessibility: A price tag of ₹800 seems far more attainable to retail investors than ₹4000, broadening the investor base.

- Signaling Confidence: Management often uses a split to signal strong confidence in the company’s future growth, implying they expect the price to rise again.

Tata Motors Stock Split and Demerger: The Ultimate 2025 Investor's Guide

In the dynamic and ever-evolving landscape of the Indian stock market, few events capture investor attention quite like a major corporate restructuring from a blue-chip giant. The Tata Motors stock split is a classic example of such an event, sparking widespread discussion and strategic repositioning among traders. However, to truly grasp the opportunity, one must look beyond the split and understand the broader strategic shifts, including the recent landmark Tata Motors demerger. Tata Motors Stock Split 2025: Complete Demerger Analysis and Timeline

Article navigation

- The Mechanics: Understanding a Stock Split vs. a Demerger

- 👥 How the Demerger Impacts Shareholders

- Updated Timeline for Tata Motors Demerger (2024–2025)

- Historical Context: Learning from Tata Motors’ Past Splits

- The Psychological Impact: Why Splits Excite the Market 🧠

- Quantitative Analysis: The Measurable Effects of a Split

- Strategic Trading Approaches for Market Events

- Leveraging Pocket Option for Strategic Success

- Fundamental Analysis: Looking Beyond the Corporate Actions

- 🧾 Tax Implications of the Tata Motors Demerger

- 📊 Case Study: Investor A — Impact of the Tata Motors Demerger on Shareholding and Tax Base

- Conclusion: A New Chapter for Tata Motors and Its Investors

This comprehensive guide provides a deep-dive automotive stock analysis, revealing how these mechanisms impact valuation, liquidity, and investor psychology, and how traders can leverage these insights on versatile platforms like Pocket Option.

Analyzing a Tata Motors stock split or demerger requires more than a surface-level glance. It demands a sophisticated understanding of market mechanics, corporate strategy, and behavioral finance. This investigation will equip you with the actionable intelligence needed to navigate these complex events and identify unique trading opportunities.

The Mechanics: Understanding a Stock Split vs. a Demerger

Corporate actions like splits and demergers are powerful tools in a company’s arsenal, but they serve fundamentally different purposes. Understanding this distinction is the first step for any serious investor.

What is a Tata Motors Stock Split?

A stock split is a cosmetic procedure for a company’s shares. When Tata Motors announces a stock split, it increases the number of outstanding shares while proportionally decreasing the price per share. The company’s total market capitalization–the total value of all its shares–remains unchanged. Think of it as exchanging a ₹2000 note for two ₹1000 notes; the total value in your wallet is the same, but you have more individual notes.

In a 5-for-1 TML stock split, an investor holding 100 shares valued at ₹4,000 each would suddenly own 500 shares, each valued at ₹800. The total investment value remains ₹400,000.

The primary strategic goals behind a stock split are:

The Landmark Tata Motors Demerger Explained

A demerger, on the other hand, is a far more profound corporate surgery. It involves splitting a company into two or more separate, independently-run entities. In March 2024, the Tata Motors board announced a historic demerger, separating its operations into two distinct listed companies:

- Commercial Vehicles Business: The traditional backbone of Tata Motors, including trucks and buses.

- Passenger Vehicles Business: This includes its successful line of passenger cars, electric vehicles (EVs), and the prestigious Jaguar Land Rover (JLR) division.

This strategic move aims to unlock value by allowing each business to pursue its own growth trajectory, attract different types of investors, and operate with greater agility. This is not just a commercial vehicle split or a passenger vehicle split in name; it’s the creation of two new, focused powerhouses.

Here’s a clear comparison to illustrate the differences:

| Feature | Stock Split (e.g., 5-for-1) | Demerger (e.g., Tata Motors) |

|---|---|---|

| Core Action | One company remains; more shares at a lower price. | One company becomes two (or more) separate companies. |

| Shareholder Impact | Shareholders receive more shares in the same company. | Shareholders receive shares in the newly formed entities. |

| Market Capitalization | The original company’s market cap remains unchanged. | The sum of the new entities’ market caps should reflect the old one, but aims to unlock greater value over time. |

| Strategic Goal | Increase liquidity and accessibility. | Unlock value, improve focus, and create tailored growth strategies. |

| Business Operations | No change to the company’s business structure. | Fundamental separation of business divisions into independent operations. |

Understanding both these events is crucial, as they often create significant volatility and unique trading windows. 📈

👥 How the Demerger Impacts Shareholders

The Tata Motors demerger does not reduce shareholder value–it redistributes it across two specialized businesses. Here’s what it means for investors:

- Share Allocation: Shareholders of Tata Motors will receive additional shares in the newly created entity (e.g., Passenger Vehicles Co.), based on a defined ratio. This ensures proportional ownership in both post-demerger companies.

- Value Unlocking: Markets may assign a premium to focused entities, especially those with high growth potential like the EV segment, leading to greater valuation transparency.

- Portfolio Flexibility: Investors can independently evaluate or divest from the commercial or passenger business, depending on personal strategy or risk tolerance.

This structural shift enables investors to refine their exposure to different automotive sub-sectors while maintaining their overall investment in the Tata ecosystem.

Updated Timeline for Tata Motors Demerger (2024–2025)

With the Tata Motors demerger process officially announced in March 2024, the execution is proceeding through several regulatory and operational phases. Here is the most recent timeline based on official disclosures:

| Date | Milestone |

|---|---|

| March 2024 | Demerger announcement by Tata Motors Board |

| Q2 2024 | Shareholder and regulatory approvals initiated |

| Q3 2024 | Filing with SEBI and stock exchanges |

| Q1 2025 (expected) | Record date and entitlement announcement |

| Q2 2025 (expected) | Final execution of demerger and listing of new entities |

Investors are advised to track Tata Motors’ official announcements and SEBI circulars to stay updated on exact execution dates. Regulatory timelines may shift due to approvals or market conditions.

Historical Context: Learning from Tata Motors’ Past Splits

Tata Motors has a history of using strategic stock splits to navigate different market cycles. Examining these precedents provides invaluable lessons for anticipating market reactions to any future Indian auto stock split.

| Date | Split Ratio | Pre-Split Price (Approx. ₹) | Post-Split Price (Approx. ₹) | 6-Month Performance Post-Split |

|---|---|---|---|---|

| September 2011 | 10-for-1 | 989 | 98.9 | +18.7% |

| June 2004 | 2-for-1 | 438 | 219 | +12.3% |

| August 2000 | 5-for-1 | 520 | 104 | +8.5% |

These splits were not random acts. They were carefully timed to coincide with periods of strategic expansion, new product launches, or financial consolidation. This historical data shows a clear pattern: a Tata Motors stock split often precedes a period of positive performance, driven by renewed investor interest and the underlying business momentum.

The Psychological Impact: Why Splits Excite the Market 🧠

Financial theory dictates that a stock split should be a neutral event, as it doesn’t change a company’s fundamental value. However, human psychology ensures the market rarely behaves so rationally. Understanding these cognitive biases is key to successful trading.

- Perception of Affordability: A lower share price creates a powerful illusion of being “cheaper” and more accessible, especially for new and small-scale retail investors.

- The Anchoring Effect: Investors often mentally “anchor” to the pre-split price. When the stock, now at ₹800, starts climbing back towards previous psychological levels, it feels like a bargain with huge upside potential.

- Signal of Confidence: As mentioned, a split is widely interpreted as a bullish signal from the company’s leadership. It’s a non-verbal cue that says, “We are confident our growth will continue to drive the share price up.”

- Anticipation of Liquidity: The expectation of increased trading volume becomes a self-fulfilling prophecy. Traders jump in, anticipating more activity, which in turn creates that very activity.

This predictable-yet-irrational market behavior creates short-term inefficiencies. For traders on platforms like Pocket Option, these periods of heightened volatility and volume are ripe with opportunity, especially when using advanced tools to time entries and exits.

Quantitative Analysis: The Measurable Effects of a Split

Beyond the psychology, a Tata Motors stock split has tangible, measurable impacts on key financial metrics. A smart investor knows which numbers change and which stay the same.

| Financial Metric | Impact of a Stock Split | Investment Significance |

|---|---|---|

| Earnings Per Share (EPS) | Reduces proportionally | No change in the company’s overall profitability. |

| Price-to-Earnings (P/E) Ratio | Mathematically unchanged | The company’s valuation relative to its earnings remains consistent. |

| Total Market Capitalization | Unchanged | The overall value of the company is preserved at the moment of the split. |

| Dividend Per Share | Reduces proportionally | The dividend yield (percentage return) remains the same. |

| Beta Coefficient (Volatility) | Tends to increase temporarily | The stock may become more volatile in the short term, indicating higher risk and reward. |

Empirical data from past splits reveals telling patterns:

- Abnormal Returns: Stocks often see average abnormal returns of 2-4% in the week following a split announcement.

- Volume Spike: Trading volume can surge by 150% or more in the first month post-split before settling at a new, higher baseline.

- Bid-Ask Spread: The spread (the gap between buy and sell prices) may widen briefly due to volatility before narrowing as liquidity improves.

Strategic Trading Approaches for Market Events

Whether it’s a Tata Motors stock split or a demerger, these events create distinct phases, each offering a different strategic opportunity. While Tata Motors itself may not be directly tradable on all platforms, the principles of analyzing such events are universal. On Pocket Option, you can apply these same analytical skills to a vast portfolio of over 100+ assets, including OTC stocks of major global companies, available 24/7.

Here are some strategies to consider:

- Announcement Momentum: Trading the initial hype in the first few days after a split or demerger is announced. This requires quick execution and a keen eye on market sentiment.

- Pre-Event Accumulation: Strategically buying shares in the weeks leading up to the execution date, anticipating the influx of new retail interest.

- Post-Event Volatility Trading: Capitalizing on the heightened price swings immediately after the split or demerger takes effect. This is a high-risk, high-reward strategy best suited for experienced traders.

- Fundamental Reversion: Waiting for the dust to settle (30-90 days post-event) and making a decision based on the company’s solid fundamentals, potentially at a new, more stable price point.

Leveraging Pocket Option for Strategic Success

Navigating these opportunities requires a powerful and versatile platform. Pocket Option offers a suite of advanced tools designed for modern traders:

- Social Trading: Not sure where to start? Copy the trades of successful, experienced traders on the platform to learn their strategies in real-time.

- Advanced Tools & Signals: Utilize AI-powered trading algorithms and a Telegram signal bot to automate trades and receive data-driven insights, helping you make more efficient and informed decisions.

- Mobile App: The market doesn’t wait. Whether you’re in traffic or have a spare minute, the Pocket Option mobile app allows you to make a forecast and execute a trade anytime, anywhere. 📱

- Tournaments and Bonuses: Compete with other traders in exciting tournaments to win prizes and use deposit bonuses to amplify your trading power.

Fundamental Analysis: Looking Beyond the Corporate Actions

While a TML stock split or demerger creates exciting trading dynamics, a long-term investment thesis must be grounded in the company’s fundamental health. These corporate actions change the share structure, not the underlying business. A thorough automotive stock analysis of Tata Motors reveals a complex and promising picture.

| Business Division | Key Strengths | Strategic Challenges | Long-Term Outlook |

|---|---|---|---|

| Passenger Vehicles (PV) | Dominant market share in India’s SUV segment; leader in the EV space with the Nexon EV. | Intense competition; accelerating the premium EV transition. | Strong, driven by domestic growth and EV leadership. |

| Commercial Vehicles (CV) | Market leadership in India; extensive service network. | Cyclical demand; navigating strict new emissions regulations. | Stable, with potential growth from infrastructure spending. |

| Jaguar Land Rover (JLR) | Iconic global luxury brands; strong brand equity. | Executing a costly transition to an all-electric lineup; supply chain vulnerabilities. | Cautiously optimistic, hinging on a successful “Reimagine” strategy. |

For any investor, the real questions are:

- Can the Passenger Vehicle unit maintain its lead in the hyper-competitive EV market?

- Will the demerger truly unlock operational efficiencies for the Commercial Vehicle business?

- Can JLR successfully pivot to an all-electric future without diluting its brand prestige?

The answers to these questions, not the split or demerger itself, will determine the long-term value of an investment.

🧾 Tax Implications of the Tata Motors Demerger

For most investors, the Tata Motors demerger is expected to be tax-neutral, but it’s critical to understand the accounting treatment:

- 🇮🇳 Indian Resident Investors

As per Section 47 of the Income Tax Act, the transfer of shares due to a demerger is not treated as a capital gains event.

The cost of acquisition is split between the two resulting companies in proportion to their market values on the record date.

No immediate tax is triggered upon receiving new shares. - 🌍 International Shareholders

Non-resident investors should review DTAA provisions between India and their country of residence.

The new shareholding may need to be declared, and future disposals could be subject to local capital gains tax.

Some jurisdictions may not automatically recognize Indian tax neutrality–professional tax advice is recommended.

Understanding these implications helps investors avoid unexpected tax bills and ensures accurate capital gains calculations in the future.

📊 Case Study: Investor A — Impact of the Tata Motors Demerger on Shareholding and Tax Base

Let’s assume Investor A held 200 shares of Tata Motors prior to the demerger announcement in March 2024. At that time, the market price per share was ₹1,200, and their total investment value was:

200 shares × ₹1,200 = ₹240,000

➤ Step 1: Demerger Execution

In Q2 2025, Tata Motors completes the demerger and allots 1:1 shares of the newly formed Passenger Vehicle Company (PV Co) for each share held in the original Tata Motors (now CV Co).

Post-demerger holdings:

- 200 shares in CV Co (Commercial Vehicles)

- 200 shares in PV Co (Passenger Vehicles)

➤ Step 2: Market Revaluation

Let’s say, immediately after listing:

- PV Co trades at ₹700 per share

- CV Co trades at ₹500 per share

New market value = (200 × ₹700) + (200 × ₹500) = ₹140,000 + ₹100,000 = ₹240,000

✅ Total value unchanged — confirms tax neutrality.

➤ Step 3: Tax Cost Base Allocation

The cost of acquisition (₹240,000) is now split proportionally between the two entities, based on their relative market values at listing:

| Entity | Market Value | % Allocation | Cost Base |

|---|---|---|---|

| PV Co | ₹140,000 | 58.33% | ₹140,000 |

| CV Co | ₹100,000 | 41.67% | ₹100,000 |

New cost per share:

- PV Co = ₹140,000 ÷ 200 = ₹700

- CV Co = ₹100,000 ÷ 200 = ₹500

Investor A can now track gains/losses accurately for each company based on these adjusted cost bases when selling.

📌 Key Insight: While the number of shares increases post-demerger, the overall value remains the same and the tax cost base must be split proportionally. This is critical for future capital gains reporting.

Conclusion: A New Chapter for Tata Motors and Its Investors

The Tata Motors stock split and the more recent Tata Motors demerger are not just financial headlines; they are pivotal moments in the company’s history. They represent a strategic unbundling designed to create more focused, agile, and ultimately more valuable enterprises. 🚀

For the strategic investor, these events are a goldmine of opportunity. They create predictable patterns in market psychology and trading dynamics that, when understood, can be leveraged for significant returns. The key is to combine a technical understanding of the event with a deep, fundamental analysis of the business itself.

Remember, while corporate restructuring can create temporary market inefficiencies perfect for trading, long-term success always comes back to the core business. Its innovation, competitive positioning, and ability to execute its strategy are what truly matter.

By using a balanced approach and leveraging the powerful analytical and trading tools available on platforms like Pocket Option, you can develop sophisticated strategies to navigate these events, manage risk, and position yourself for success in any market condition.

FAQ

When will Tata Motors stock split happen?

As of now, Tata Motors has not announced a new stock split date beyond its previous corporate actions. Investors should monitor official filings and press releases for any future stock split announcements.

What is the Tata Motors demerger timeline?

The demerger was announced in March 2024. Regulatory approvals and operational steps are expected to continue through Q1 2025, with the final execution and listing of the separated entities anticipated in Q2 2025.

How does a stock split affect shareholders?

A stock split increases the number of shares each shareholder owns while reducing the price per share proportionally. The total investment value remains the same, but the lower price improves liquidity and market accessibility.

Should I buy Tata Motors before the split?

Buying before a split can provide strategic advantages, especially if market psychology drives post-split price appreciation. However, decisions should be based on fundamentals, not just split mechanics.

What are the benefits of the Tata Motors split?

The stock split boosts liquidity, increases retail investor participation, and often signals management’s confidence in future growth. It may also attract more trading volume and market attention.

How will the split impact Tata Motors valuation?

A stock split is valuation-neutral in financial terms—it does not affect the company’s market capitalization. However, short-term price movements may occur due to investor psychology and increased demand.