- Annual member growth of 15-20% through 2030

- Revenue per member stabilizes around current levels

- Operating margins improve to 15-20%

- Valuation multiples align with regional banks (1.5-2x book value)

Pocket Option SoFi Stock Price Prediction 2030

Recent analysis suggests SoFi Technologies could deliver transformative returns by 2030, with analysts projecting targets ranging from $38 to over $300 based on the company's unique fintech ecosystem expansion.

Article navigation

- SoFi Stock Price Prediction 2030: Complete Valuation Analysis and Growth Scenarios

- Scenario Analysis: SoFi Future Growth Projections

- 🤔 With such a wide range of future possibilities, traders need a flexible platform. Pocket Option allows you to adapt your strategy as SoFi’s story unfolds.

- 💡SoFi’s Growth Engine: Key Drivers to 2030

- Banking Charter Impact on SoFi Valuation

- Trading in the Fintech Revolution with Pocket Option

- Technological Innovations Driving SoFi Platform Advantages

- Regulatory Shifts and Market Dynamics

- Investment Risks and Considerations

SoFi Stock Price Prediction 2030: Complete Valuation Analysis and Growth Scenarios

The financial technology sector continues to reshape traditional banking, and SoFi Technologies stands at the forefront of this revolution. With its comprehensive ecosystem approach and banking charter advantages, understanding SoFi stock price prediction 2030 requires analyzing multiple growth catalysts that extend far beyond conventional banking metrics.

SoFi’s unique positioning as a one-stop financial platform creates compound growth opportunities through member acquisition, product adoption, and operational leverage. The company’s recent performance underscores this momentum. In the second quarter of 2025, SoFi reported its seventh consecutive quarter of GAAP profitability, with net revenue soaring to a record $855 million. This was fueled by the addition of a record 850,000 new members, bringing the total to over 11.7 million. This impressive growth demonstrates the power of its integrated model and strengthening brand.

📈 Ready to act on these market insights? Pocket Option provides the tools to track SoFi’s journey and trade on market volatility with precision. 🚀

Scenario Analysis: SoFi Future Growth Projections

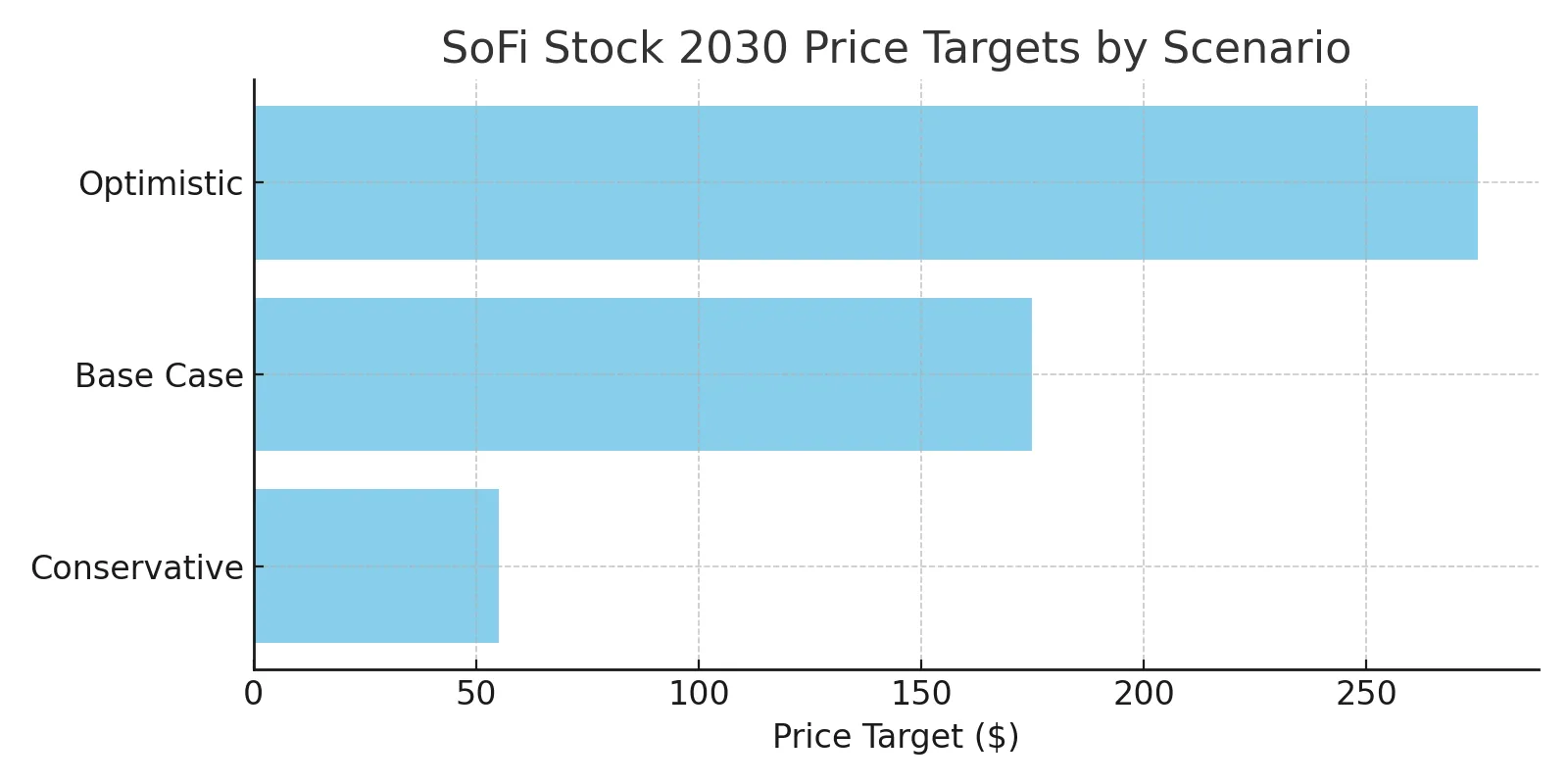

Professional investors often use comprehensive scenario modeling when evaluating fintech ecosystem potential. Based on current growth trajectories and market dynamics, several valuation scenarios emerge for SoFi’s 2030 stock forecast. However, it’s worth noting that near-term analyst sentiment is mixed, with a consensus “Hold” rating and an average 12-month price target of around $19-$21, suggesting caution despite strong performance.

“The convergence of SoFi’s banking charter, member growth, and product expansion creates a unique investment thesis that could support valuations ranging from conservative banking multiples to premium technology company metrics,” explains investment strategist Michael Torres, 2025.

Conservative Scenario: $45-65 Price Target

This scenario applies traditional banking valuation methods, assuming SoFi achieves steady member growth but faces increased competition and margin pressure. Key assumptions include:

Base Case Scenario: $150-200 Price Target

The base case recognizes SoFi’s hybrid fintech-banking model, incorporating both ecosystem benefits and operational leverage. This scenario assumes successful execution of the company’s platform strategy with moderate market expansion.

“SoFi’s ability to combine the regulatory advantages of banking with the growth profile of technology creates a valuation framework that sits between traditional sectors,” notes equity researcher Lisa Park, 2025.

Optimistic Scenario: $250-300+ Price Target

The bull case scenario envisions SoFi capturing significant market share in multiple financial services categories while maintaining high growth rates and expanding internationally. Key catalysts include:

- Successful penetration of business banking and wealth management

- International expansion creating new growth markets, such as its recent partnership with one of Argentina’s largest banks.

- Technology licensing revenue from other financial institutions

- Ecosystem network effects driving exponential member value

| Scenario | 2030 Price Target | Total Return | Key Assumptions |

|---|---|---|---|

| Conservative | $45-65 | 300-500% | Traditional banking valuation |

| Base Case | $150-200 | 1,200-1,600% | Hybrid fintech-banking model |

| Optimistic | $250-300+ | 2,000-2,400%+ | Ecosystem dominance |

🤔 With such a wide range of future possibilities, traders need a flexible platform. Pocket Option allows you to adapt your strategy as SoFi’s story unfolds.

💡SoFi’s Growth Engine: Key Drivers to 2030

The foundation of any accurate SoFi valuation rests on understanding the company’s core growth mechanisms. Unlike traditional financial institutions, SoFi operates as a comprehensive fintech ecosystem that benefits from network effects and cross-selling opportunities.

“SoFi’s member-centric model creates exponential value as each new customer potentially uses multiple products, driving both revenue per user and lifetime value metrics significantly higher than traditional banking models,” notes fintech analyst Sarah Chen, 2025.

Recent results validate this strategy, with SoFi adding a record 1.26 million new products in Q2 2025, bringing its total to 17.1 million. Crucially, 35% of these new products were taken by existing members, highlighting the effectiveness of its cross-selling engine.

The key growth drivers include:

- Member Acquisition Acceleration: SoFi’s digital-first approach enables rapid customer acquisition at lower costs than traditional banks, with a 34% year-over-year increase in members as of Q2 2025.

- Product Cross-Selling: The ecosystem model encourages existing members to adopt additional financial products, with Financial Services products growing 35% year-over-year to 14.9 million.

- Banking Charter Benefits: Full banking capabilities reduce funding costs and improve margins, a key factor in its recent profitability.

- Technological Innovation: Advanced data analytics and AI-driven personalization enhance customer experience. SoFi has announced upcoming features like “Cash Coach” and plans for blockchain-enabled money transfers to further this advantage.

- Market Share Expansion: Growing penetration in lending, investing, and banking services, with record loan originations of $8.8 billion in Q2 2025.

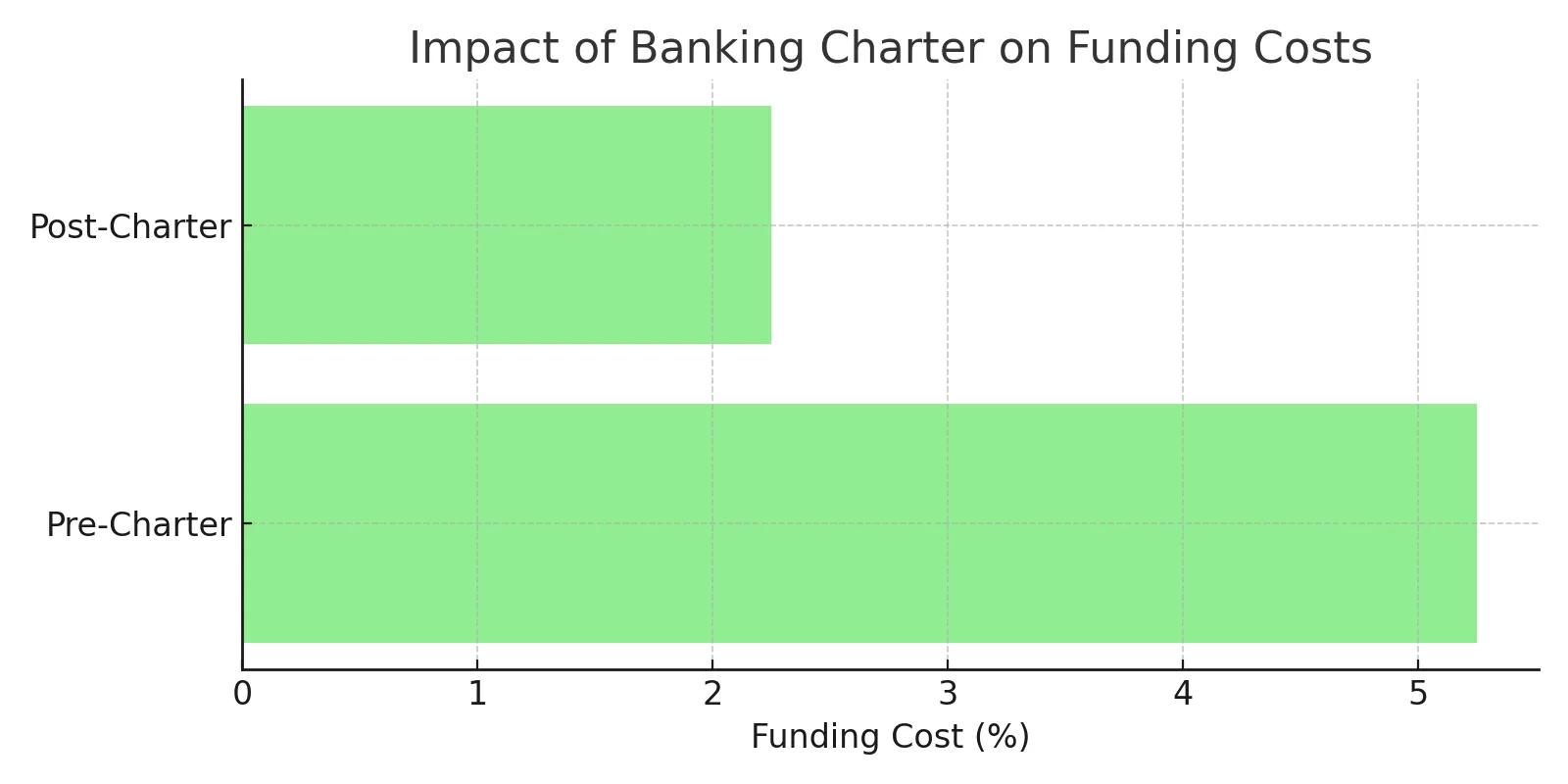

Banking Charter Impact on SoFi Valuation

The acquisition of SoFi’s banking charter represents a fundamental shift in the company’s economics. This regulatory approval enables direct deposit relationships, lower funding costs, and expanded product offerings that traditional fintech companies cannot match.

| Metric | Pre-Charter | Post-Charter | Impact |

|---|---|---|---|

| Funding Cost | 4.5-6% | 1.5-3% | 300-450 bps improvement |

| Product Offerings | Limited | Full Banking Suite | 5x revenue potential per member |

| Member Stickiness | Medium | High | 2-3x lifetime value |

| Regulatory Moat | None | Strong | Competitive advantage |

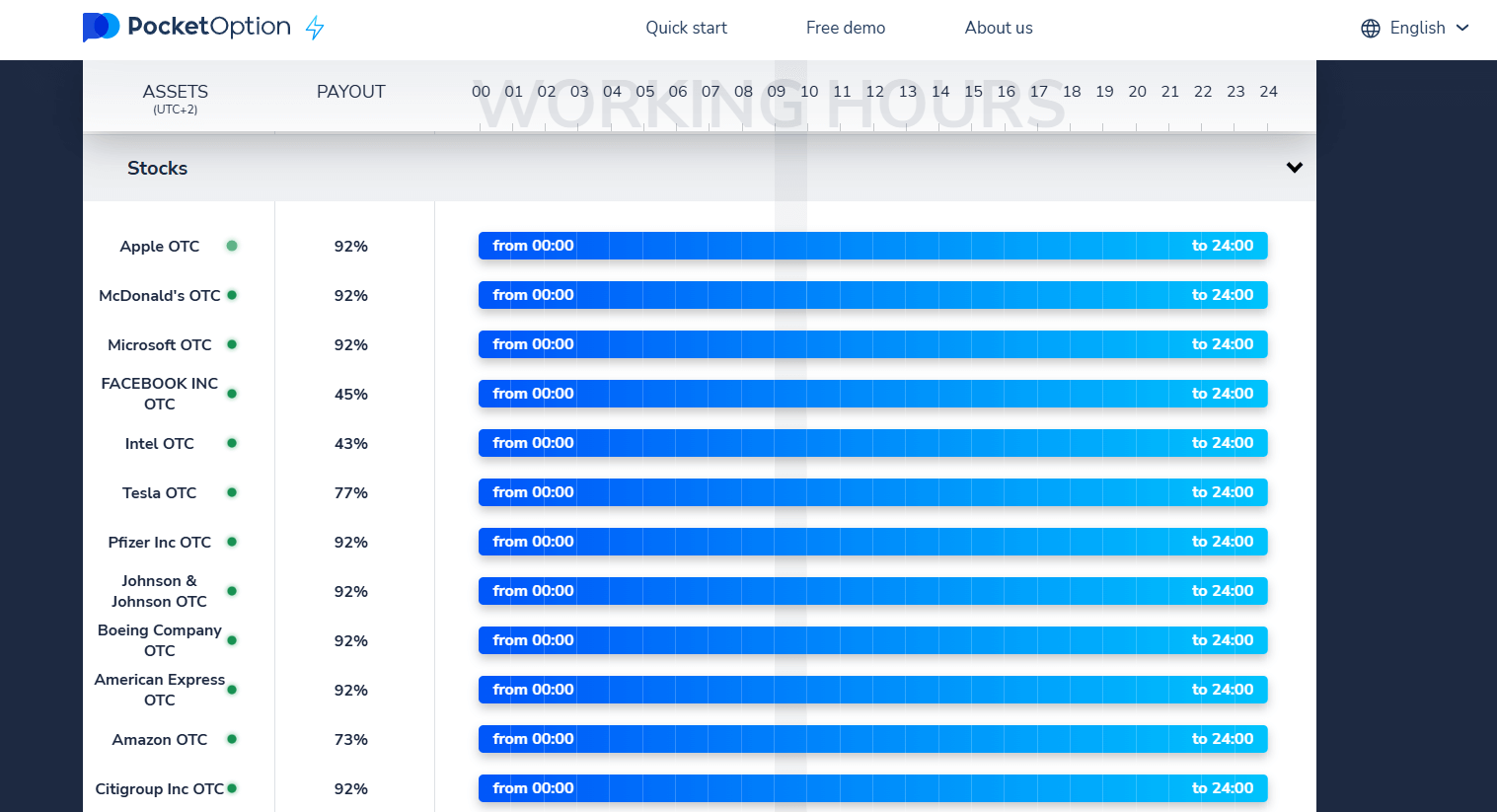

Trading in the Fintech Revolution with Pocket Option

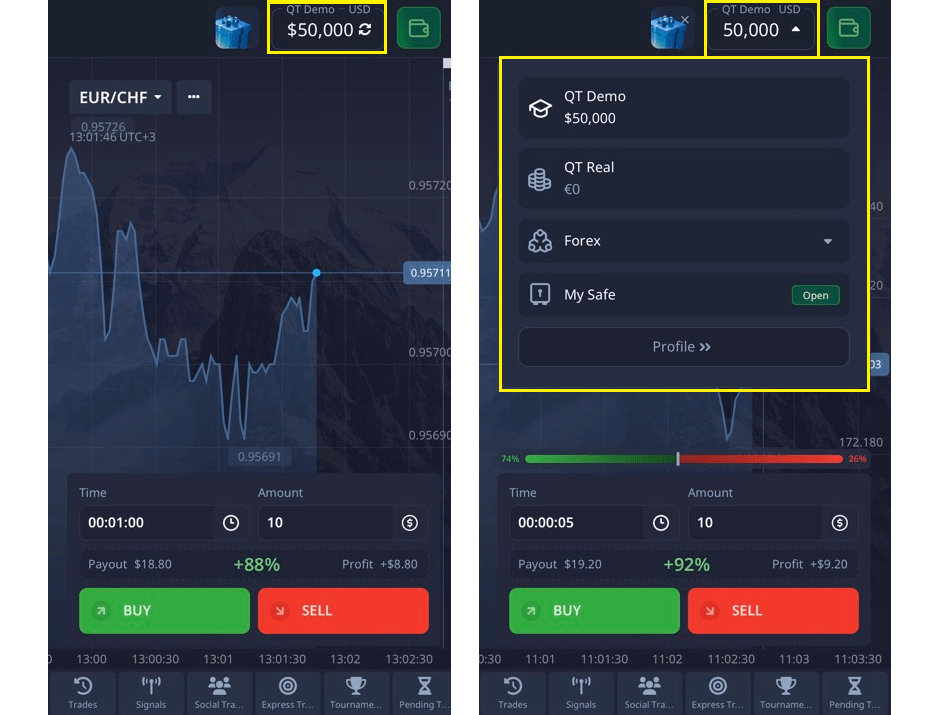

Analyzing a dynamic stock like SoFi requires powerful tools and a solid understanding of trading principles. While SoFi stock itself may not be available on all platforms, traders can engage with the broader fintech market and practice their strategies. Platforms like Pocket Option are designed to empower both new and experienced traders on this journey. By understanding market movements and practicing with different assets, you can sharpen the skills needed to identify opportunities in a rapidly evolving sector.

Here’s how Pocket Option supports your trading career:

- Low Barrier to Entry: Start trading with a minimum deposit of just $5, which may vary depending on your region and payment method.

- Risk-Free Practice: Hone your strategies with a $50,000 replenishable demo account before committing real capital.

- Diverse Asset Portfolio: Access over 100 assets, including currency pairs, commodities, and other market instruments.

- Comprehensive Learning Hub: Utilize a free, extensive knowledge base with video tutorials and guides on trading strategies and market analysis.

- Competitive Environment: Participate in trading tournaments to test your skills against other traders and win prizes.

This combination of features provides a robust environment for learning the ropes and developing the confidence to trade effectively.

Technological Innovations Driving SoFi Platform Advantages

SoFi’s technological infrastructure provides significant competitive advantages that support higher valuation multiples compared to traditional financial institutions. The company’s investment in artificial intelligence, data analytics, and user experience creates sustainable differentiation.

“The integration of advanced analytics into every aspect of SoFi’s member experience creates compounding returns on investment that traditional banks cannot match,” emphasizes technology analyst David Liu, 2025.

💻 As SoFi pushes technological boundaries, stay ahead of the curve. Use the advanced charting tools on Pocket Option to analyze the impact of every innovation. 📊

Digital Infrastructure and Customer Experience

SoFi’s digital-first approach enables rapid product development, personalized financial advice, and seamless user experiences that drive higher engagement and retention rates. These technological advantages translate directly into financial performance through:

- Reduced customer acquisition costs through viral growth mechanisms

- Higher average revenue per user through intelligent product recommendations

- Lower operational costs through automation and self-service capabilities

- Improved risk management through real-time data analysis

Regulatory Shifts and Market Dynamics

The evolving regulatory landscape presents both opportunities and challenges for SoFi’s growth trajectory. Recent developments in fintech regulation, open banking initiatives, and digital asset integration could significantly impact the company’s 2030 valuation.

“Regulatory clarity in fintech creates opportunities for established players like SoFi to expand their market share while new entrants face higher barriers to entry,” notes regulatory expert Jennifer Walsh, 2025.

Key regulatory factors influencing SoFi Technologies financial outlook include:

- Open banking regulations enabling enhanced data sharing and competition.

- Digital asset regulations potentially opening new revenue streams, with SoFi planning a return to crypto investing.

- Consumer protection requirements that favor established, compliant platforms.

- Capital requirement changes affecting competitive positioning.

Investment Risks and Considerations

While the growth potential for SoFi remains substantial, investors must consider several risk factors that could impact the company’s ability to achieve optimistic price targets by 2030.

Competition and Market Saturation

The fintech space continues to attract new entrants and traditional bank investments, potentially limiting SoFi’s market share growth. Additionally, large technology companies entering financial services could disrupt the ecosystem model.

Interest Rate Sensitivity

As a financial services company, SoFi’s profitability remains sensitive to interest rate changes, which could impact lending margins and deposit costs throughout the decade. Recent analysis shows its net interest margin has been under some pressure.

Execution Risk

The ambitious growth projections require successful execution across multiple business lines simultaneously, including member acquisition, product development, and international expansion. High operating expenses, largely from marketing, highlight the costly nature of its growth strategy.

“The key to SoFi’s success lies in maintaining rapid growth while building sustainable competitive advantages through technology and customer relationships,” emphasizes investment advisor Robert Chen, 2025.

FAQ

Can SoFi reach $300 by 2030?

How does SoFi differ from legacy banks?

SoFi operates as a technology-first financial platform with lower operational costs, higher growth potential, superior user experience, and an ecosystem model that creates multiple revenue streams per customer compared to traditional banks' product-siloed approach.

What are the main risks for SoFi stock by 2030?

Key risks include increased competition from big tech and traditional banks, interest rate sensitivity affecting lending margins, execution challenges across multiple business lines, and potential regulatory changes that could limit growth opportunities.

How should investors approach SoFi stock for long-term holdings?

Long-term SoFi investors should focus on member growth metrics, product adoption rates, and ecosystem expansion rather than quarterly earnings volatility. The stock requires patience as the company builds its platform advantages and achieves operational leverage.

What valuation method works best for SoFi?

SoFi requires hybrid valuation approaches combining discounted cash flow analysis for the banking business and growth multiples for the technology platform, as traditional banking metrics alone don't capture the ecosystem's full value potential.

When might SoFi achieve profitability milestones?

SoFi is expected to reach consistent profitability as operational leverage improves and the banking charter benefits fully materialize, with significant margin expansion anticipated throughout the mid-to-late 2020s as the platform scales.

How does SoFi's international expansion impact 2030 projections?

International expansion could significantly boost SoFi's 2030 valuation by accessing new markets and diversifying revenue streams, though execution complexity and regulatory challenges in different jurisdictions present both opportunities and risks.

What fuels SoFi's ecosystem growth?

SoFi's ecosystem growth is driven by network effects where each new member increases the value for existing members, cross-selling opportunities across financial products, and the banking charter enabling lower funding costs and expanded product offerings.

CONCLUSION

Conclusion: SoFi's Path to 2030 The SoFi stock price prediction 2030 analysis reveals a company positioned at the intersection of multiple transformative trends in financial services. With its unique combination of banking charter benefits, technological innovation, and ecosystem approach, SoFi presents compelling long-term growth potential that could deliver substantial shareholder returns. The wide range of valuation scenarios—from conservative $45 targets to optimistic $300+ projections—reflects both the significant opportunity and inherent uncertainty in fintech ecosystem investing. Success will depend on SoFi's ability to execute its platform strategy while navigating competitive pressures and regulatory changes. For investors considering SoFi exposure, the company's technological advantages and regulatory positioning create sustainable competitive moats that support premium valuations relative to traditional financial institutions. However, the investment requires patience and tolerance for volatility as the fintech ecosystem matures. The next five years will be critical for SoFi's long-term trajectory, with member growth acceleration, product adoption rates, and international expansion serving as key performance indicators for achieving ambitious 2030 price targets. "The intersection of traditional banking stability with fintech innovation creates unprecedented opportunities for companies like SoFi to redefine financial services and deliver exceptional long-term returns for patient investors," concludes financial strategist Amanda Rodriguez, 2025.

Explore Market Analysis Tools