- Speed and Customization: Its modular design allows it to bring servers integrated with the newest chips to market faster than many larger, more bureaucratic competitors.

- Energy Efficiency: SMCI has long focused on “Green Computing,” developing servers that consume less power and require less cooling. As data centers grow to monstrous sizes, energy efficiency is shifting from a bonus feature to a critical requirement, directly impacting operational costs.

- Strategic Partnerships: The company maintains a close relationship with key chipmakers like NVIDIA, Intel, and AMD, ensuring it has access to the latest technology and can optimize its systems for peak performance. The partnership with NVIDIA, in particular, has been a massive catalyst for its recent growth.

SMCI Stock Price Target 2030 Analysis

SMCI’s role in AI infrastructure is drawing investor attention. This article reviews current data, 2030 price targets, and potential risks for long-term investors.

Article navigation

- Understanding Super Micro Computer (SMCI): The Unseen Engine of the AI Boom

- Analyzing SMCI’s Recent Performance and Market Volatility

- The Core Drivers: What Will Propel or Hinder SMCI Stock by 2030?

- SMCI Stock Price Target 2030: Deconstructing Analyst Scenarios

- Navigating the Market: Long-Term Investing vs. Short-Term Trading

- Investment Considerations for SMCI stock 2030

- How to Trade Stock in the Short Term

- Trade Market Volatility with Pocket Option

- Conclusion: A Synthesized Outlook for the SMCI Stock Price Target 2030

Super Micro’s meteoric rise has placed it firmly in the spotlight. But with great growth comes great volatility and even greater questions. This article will dissect the factors driving the optimistic forecasts, weigh the significant risks that could derail its trajectory, and explore how investors and traders can approach this dynamic market.

Understanding Super Micro Computer (SMCI): The Unseen Engine of the AI Boom

Super Micro Computer Inc. is not a household name like the tech giants it serves, but it’s a critical cog in the modern digital world. Founded in 1993, the company specializes in designing and manufacturing high-performance, high-efficiency servers and storage systems. These are not your standard office servers; they are the workhorses powering data centers, cloud computing, and, most importantly, complex AI workloads.

What sets SMCI apart is its “Building Block Solutions®” philosophy. This modular approach allows the company to rapidly assemble and customize servers using the latest technologies, giving it a significant speed-to-market advantage. In the fast-paced world of AI, where new, more powerful chips from companies like NVIDIA are released frequently, this agility is a powerful economic moat.

SMCI’s Core Strengths:

Here’s a simplified look at how SMCI fits into the broader tech ecosystem:

| Company Role | Key Players | SMCI’s Position |

|---|---|---|

| Chip Design | NVIDIA, AMD, Intel | Key Customer & Partner: Integrates their latest GPUs and CPUs. |

| Server Manufacturing | Super Micro (SMCI), Dell, HPE, Quanta | Specialist & Innovator: Focuses on high-performance, custom solutions. |

| Cloud Providers | Amazon (AWS), Microsoft (Azure), Google (GCP) | Critical Supplier: Provides the server infrastructure for their data centers. |

| Enterprise AI | Various corporations across all sectors | Enabler: Sells servers directly to companies building their own AI capabilities. |

Analyzing SMCI’s Recent Performance and Market Volatility

The last few years have been a wild ride for SMCI investors. The stock has experienced explosive, multi-thousand-percent growth, transforming it from a niche hardware player into a market heavyweight. This surge was primarily fueled by the insatiable demand for AI servers, particularly those equipped with NVIDIA’s high-end GPUs. Every major earnings report has been scrutinized, with massive price swings following beats or misses on revenue and guidance.

💬 Expert Quote:

“Super Micro has transitioned from a niche server provider to a systemically relevant infrastructure player in the AI ecosystem,” noted Aaron Rakers, analyst at Wells Fargo. “But with that growth comes intense scrutiny and expectations, which naturally amplifies stock volatility.”

However, this volatility is a double-edged sword. It highlights the immense potential of AI infrastructure investment but also exposes the risks inherent in hardware supplier stocks. Unlike software companies with recurring revenue models, SMCI’s fortunes are tied to cyclical hardware sales, supply chain stability, and the capital expenditure budgets of a few very large customers. A delay in a new chip launch or a decision by a major cloud provider to cut spending can have an immediate and dramatic impact on the stock. This is a key factor to consider when evaluating any long-term smci stock forecast 2030.

📌 Insight:

In a June report, analysts at Goldman Sachs projected that 60% of total server market growth by 2030 will be driven solely by AI workloads. Super Micro is strategically positioned to capture a significant portion of this demand, dramatically expanding its addressable market.

The Core Drivers: What Will Propel or Hinder SMCI Stock by 2030?

Forecasting a stock price nearly a decade out is an exercise in analyzing long-term trends. For SMCI, the path to 2030 will be paved by several powerful forces, both positive and negative.

💬 Analyst Commentary:

According to J.P. Morgan, the global number of data centers is expected to grow at 16–18% annually through 2030, with AI servers accounting for up to 35% of all infrastructure by 2027. This suggests SMCI can benefit not only from hyperscaler demand, but also from enterprise-driven AI expansion.

Bullish Catalysts Driving Growth 🚀

- Explosive Data Center Growth: The world is creating data at an exponential rate. The expansion of cloud computing, the Internet of Things (IoT), and 5G all require massive data centers. This trend alone provides a solid baseline for server demand.

- The AI Arms Race: We are in the early innings of a global AI arms race. Countries and corporations are pouring billions into building out their AI capabilities. This requires a historic level of AI infrastructure investment, with SMCI being a direct beneficiary. The current focus is on AI training, but the next wave–AI inference, where models are put to practical use–could trigger an even larger and longer-lasting demand cycle.

- Liquid Cooling Revolution: As processors become more powerful, traditional air cooling is reaching its limits. SMCI is a pioneer in direct liquid cooling (DLC) solutions, which are far more efficient. This technological edge could become a major differentiator and a source of higher-margin sales as the industry transitions to this new standard.

- Edge Computing Expansion: Not all data processing will happen in massive, centralized clouds. A growing number of applications (like autonomous vehicles and smart factories) require “edge” data centers located closer to the source of data. This creates a new market for specialized, compact servers, playing directly to SMCI’s strengths in customization.

📌 Insight:

If SMCI succeeds in expanding into the edge AI segment — including autonomous vehicles and 5G-enabled smart factories — it could unlock a new wave of high-margin growth, distinct from the highly competitive cloud data center market.

Bearish Headwinds and Significant Risks 📉

- Intensifying Competition: SMCI’s success has not gone unnoticed. Giants like Dell and HP are aggressively moving into the AI server market. Furthermore, Asian original design manufacturers (ODMs) like Quanta and Wistron, who have long built servers for cloud giants, could increase their competitive pressure, potentially leading to narrower margins.

- Customer Concentration: A significant portion of SMCI’s revenue comes from a small number of very large customers. If one of these hyperscalers decides to diversify its suppliers or, worse, bring server design in-house (as some have experimented with), it would be a major blow to SMCI’s revenue.

- Supply Chain Vulnerability: The semiconductor supply chain is a complex global network with significant geopolitical risks, particularly concerning Taiwan. Any disruption could impact SMCI’s ability to source the components it needs to build its servers.

- Commodification and Margin Pressure: What is cutting-edge today becomes standard tomorrow. As AI hardware matures, there is a risk of commoditization, where servers become interchangeable and competition is based purely on price. This would erode the premium Super Micro valuation and squeeze profit margins.

SMCI Stock Price Target 2030: Deconstructing Analyst Scenarios

Given these powerful cross-currents, it’s no surprise that the SMCI stock price target 2030 varies wildly among analysts. The final outcome will depend on which of these trends proves to be the most dominant. We can model this uncertainty by looking at several distinct scenarios. The smci stock price prediction 2030 is not a single point but a range of possibilities.

💬 Industry Statistic:

According to the McKinsey Technology Outlook 2025, the global AI infrastructure market (including servers and cooling solutions) is expected to reach $400 billion by 2030. If SMCI captures even 3–4% of this market, it could generate $12–16 billion in annual revenue, nearly triple its current level.

Here is a detailed breakdown of potential future paths for SMCI:

| Scenario Type | Core Assumptions | Key Drivers & Risks | Estimated Price Range (2030) |

|---|---|---|---|

| Hyper-Growth Dominance | AI adoption accelerates beyond current expectations. SMCI maintains its technological lead in liquid cooling and speed-to-market. Competition fails to catch up. | Drivers: Unprecedented AI infrastructure investment, successful expansion into inference and edge markets. Risks: Market becomes overheated. | $2,000 — $2,500+ |

| Steady Growth & Maturation | The AI market grows robustly but in line with more conservative forecasts. SMCI retains a strong market share but faces increased competition, leading to moderate margin compression. | Drivers: Continued data center growth, solid enterprise adoption. Risks: Market share erosion to Dell/HPE. | $1,000 — $1,500 |

| Competitive Saturation | Competition from both established players and Asian ODMs intensifies significantly. AI server hardware becomes more commoditized, and pricing power diminishes. | Drivers: Market growth is captured by lower-cost providers. Risks: SMCI loses its innovation edge; hyperscalers shift to in-house designs. | $400 — $700 |

| Hardware Disruption / Stagnation | A major shift in AI computing trends reduces the need for specialized server hardware (e.g., breakthroughs in software or algorithmic efficiency). Or, a severe global recession halts capital spending. | Drivers: Macroeconomic downturn, geopolitical supply chain shock. Risks: SMCI’s core market shrinks or stagnates. | $200 — $400 |

Modeling the Super Micro valuation for 2030 involves techniques like Discounted Cash Flow (DCF), which projects future earnings and discounts them to the present. The high-end scenarios assume sustained revenue growth of 20-30% annually, while the lower-end scenarios see growth slowing to single digits or even declining.

📌 Insight:

Even under a “Steady Growth” scenario, SMCI’s leadership in direct liquid cooling and custom rack-level integration may allow it to preserve premium margins and resist the price-based competition that will likely dominate among mass-market OEMs.

Navigating the Market: Long-Term Investing vs. Short-Term Trading

Analyzing the long-term outlook for smci stock 2030 is a classic investor’s exercise. It requires patience, a deep understanding of fundamentals, and the conviction to hold through periods of extreme volatility.

However, that same volatility creates a very different kind of opportunity for short-term traders. Traders aren’t necessarily concerned with where the stock will be in 2030; they are focused on capitalizing on the price movements happening right now–today, this week, or this month. They thrive on the news flow, earnings reports, and shifts in market sentiment that cause rapid price swings.

💬 Expert Advice:

“For long-term exposure to AI infrastructure, investors should look beyond Nvidia and consider the ecosystem enablers like Super Micro,” says Dan Ives, Managing Director at Wedbush Securities. “They offer high-beta AI exposure with hardware optionality, albeit with higher risk.”

While SMCI is a fascinating case study, it may not be directly available on all trading platforms. But the principles of trading volatile, high-profile assets are universal. Whether it’s a hot tech stock, a major cryptocurrency, or a global commodity, the goal is the same: forecast the direction of the price and execute a trade to profit from that movement. This is where having a powerful and flexible trading platform becomes essential. 🧠

📌 Recommendation:

To reduce risk, investors could apply a barbell strategy–pairing high-volatility stocks like SMCI with more stable AI beneficiaries such as Microsoft or Broadcom. This balances potential AI upside with broader market resilience.

Investment Considerations for SMCI stock 2030

When assessing SMCI for 2030, investors should consider portfolio allocation risks, including exposure to hardware-only suppliers and geopolitical factors affecting semiconductor logistics. Unlike software companies, SMCI remains highly dependent on physical production cycles.

- Will SMCI maintain its edge in AI hardware design through 2030?

- Are hyperscalers likely to shift to in-house server solutions?

- Can SMCI pivot if demand shifts from servers to other form factors?

How to Trade Stock in the Short Term

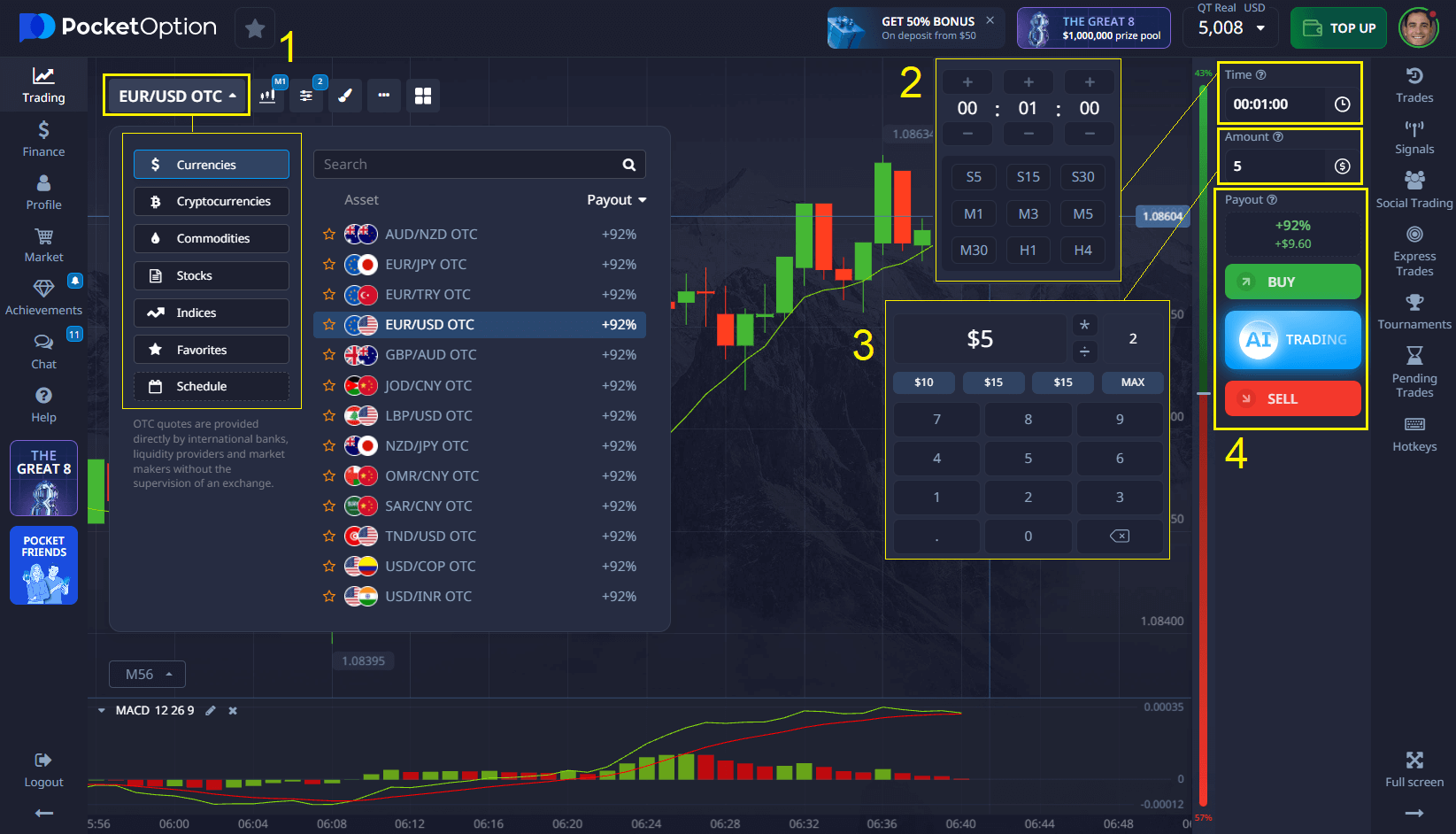

While SMCI is not directly available on the Pocket Option platform, traders can explore short-term opportunities in over 100 other assets including stocks, crypto, commodities, indices, and forex pairs.

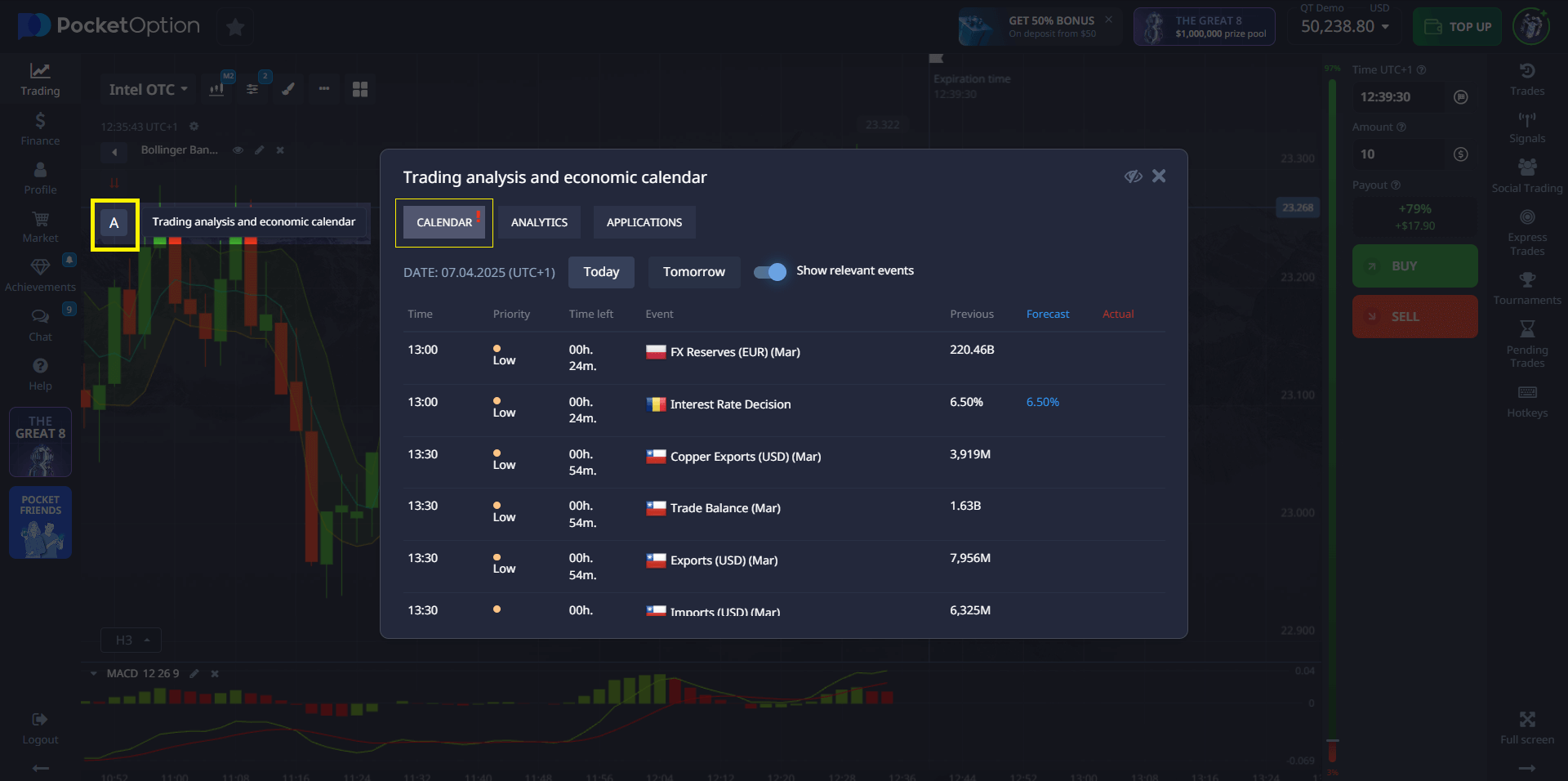

On Pocket Option, the interface allows you to create delayed trades that automatically execute based on time or price conditions. You don’t need to buy or sell the asset — just forecast if the price will go up or down. A correct forecast can yield up to 92% profit. Signals from automated bots are also available to assist with entry timing.

To access full functionality of Pocket Option:

- Register for an account

- Try the $50,000 demo account

- Use promo code 50START to receive +50% on your first deposit

- More than 50 deposit/withdrawal methods are supported

Trade Market Volatility with Pocket Option

For traders looking to engage with the dynamic movements of the global markets, Pocket Option provides a comprehensive and accessible platform. While you can’t trade SMCI directly, you can apply the same analytical skills to over 100 other assets, including popular stocks (available 24/7 as OTC assets), forex pairs, cryptocurrencies, and commodities.

Pocket Option is designed for both novice and experienced traders, offering a suite of powerful tools to help you succeed:

- Low Barrier to Entry: Start trading with a minimal deposit of just $5 and explore the platform risk-free with a $50,000 demo account.

- Powerful Trading Tools: Leverage cutting-edge features to enhance your strategy.

- 🤖 AI Trading: Automate your trades using smart algorithms for improved efficiency.

- 📈 Signals & Social Trading: Use the Telegram Signal Bot for trade ideas or copy the trades of successful users to learn and profit from their expertise.

Engaging Community Features:

- 🏆 Tournaments: Compete against other traders in regular tournaments to win prizes and prove your skills.

Unmatched Flexibility and Support:

- 💸 Bonuses & Flexible Payments: Boost your initial capital with a promo code (50START gives you a 50% bonus on your first deposit) and use over 50 convenient deposit/withdrawal methods.

- 📱 Trade On-the-Go: The powerful mobile app ensures you never miss an opportunity. Make a forecast in just a minute, whether you’re on your way to work or have a spare moment.

Explore 100+ Assets with Instant Market Forecasts

Conclusion: A Synthesized Outlook for the SMCI Stock Price Target 2030

The journey of Super Micro Computer to 2030 is poised to be as dynamic as the AI revolution itself. The bull case is compelling: a perfectly positioned company with a technological edge, riding a historic wave of server demand forecast and AI infrastructure investment. In a best-case scenario, SMCI could solidify its position as an indispensable partner in the new technological age, leading to a valuation that dwarfs its current one.

📌 Insight: Despite volatility, Super Micro possesses a rare combination of competitive advantages: rapid product deployment, energy efficiency, modular customization, and deep strategic alliances. This makes SMCI a potential core holding in AI-focused portfolios heading into 2030–especially as demand shifts from AI model training to large-scale real-world inference.

However, the risks are equally real and substantial. Competition is fierce, supply chains are fragile, and the tech landscape is littered with former high-flyers who failed to adapt. The ultimate SMCI stock price target 2030 is not a predetermined fate but a spectrum of possibilities that will be shaped by the company’s execution, the choices of its giant customers, and the broader technological and macroeconomic environment.

For long-term investors, this requires a careful, data-driven approach and a strong stomach for volatility. For short-term traders, the constant news flow and price action in stocks like SMCI provide a rich environment of opportunity. By using the right tools and strategies, you can engage with this market excitement and aim to profit from its predictable unpredictability.

FAQ

What are the most important factors that will determine SMCI's stock price in 2030?

The most critical factors in determining SMCI's stock price by 2030 include: AI infrastructure market growth rate (accounting for approximately 41% of forecast variance), competitive market share evolution (22%), gross margin sustainability (18%), capital expenditure requirements (11%), and various other factors (8%). The company's ability to maintain technological leadership in high-density computing, power efficiency, and thermal management solutions will significantly influence these variables.

How reliable are long-term stock price predictions for companies in the technology sector?

Long-term stock price predictions, particularly for technology companies like SMCI, inherently contain significant uncertainty. Historical analysis shows that 6-year forecasts typically have a mean absolute percentage error (MAPE) of 40-65% for technology hardware companies. However, probabilistic approaches that present a range of outcomes with assigned probabilities provide more value than single-point estimates. Investors should view these forecasts as frameworks for decision-making rather than precise predictions.

What mathematical models are most effective for long-term stock price forecasting?

The most effective approach combines multiple mathematical models, each capturing different aspects of price dynamics. Fundamental models like discounted cash flow (DCF) provide a valuation foundation, while time series models capture cyclical patterns. Machine learning algorithms including LSTM networks, gradient boosting trees, and random forests excel at identifying non-linear relationships. Finally, Monte Carlo simulations incorporate randomness to generate probability distributions. No single model outperforms consistently, making ensemble approaches optimal.

How does SMCI's valuation compare to other companies in the server and data center infrastructure sector?

SMCI currently trades at valuation multiples that reflect its strong positioning in high-growth segments including AI infrastructure and liquid cooling solutions. The company's current P/E ratio of approximately 38.5 compares to a sector average of 35.9, representing a modest premium. However, when adjusted for growth rates (PEG ratio), SMCI's valuation of 1.4 is slightly below the sector average of 1.45, potentially indicating relative value. By 2030, we expect sector multiples to normalize as growth rates moderate, with SMCI's P/E ratio likely falling to the 22-32 range.

What investment strategy is recommended for investors interested in SMCI's long-term potential?

Given the wide distribution of potential outcomes in SMCI stock price target 2030 projections, a staged investment approach is advisable. This includes: (1) Establishing a core position sized according to risk tolerance and portfolio constraints; (2) Implementing a value-adjusted dollar-cost averaging strategy that increases investment rate when price falls below calculated intrinsic value; (3) Setting predefined review points at which fundamental assumptions are reassessed; and (4) Using options strategies for tail-risk protection against extreme downside scenarios. This structured approach balances conviction in SMCI's long-term potential with appropriate risk management.