- 📉 Cyclical ad spend trends influenced by inflation and GDP growth

- 📺 Global adoption of Connected TV (CTV) and decline in linear television

- 🌎 Expansion into international streaming markets with higher ARPU potential

- 🤖 Integration of AI in targeted advertising and viewer engagement analytics

Learn Roku Stock Trading: Roku Stock Price Prediction 2030

As the digital economy expands, investors are looking for ways to adapt their portfolios to the evolving stock market landscape. One company that continues to attract attention is Roku—a key player in the streaming revolution. If you want to learn Roku stock trading, you need to analyze its business model, understand technical indicators, and evaluate expert opinions on where Roku stock might be headed by 2030.

Article navigation

- Roku Stock in Focus: Business Model and Growth Trajectory

- Roku Stock Price History: Technical View

- Essential Technical Indicators to Learn Roku Stock Trading

- How to Read the Roku Stock Chart

- Roku Stock Forecast 2030: What Experts Are Saying

- Investment Strategies for Roku Stock

- Roku’s Financial Health: A Quick Audit

- What Analysts Are Publishing About Roku

- ⚠️ Risks and Upside Potential

- How to Start Trading Roku Stock: Step-by-Step Guide

- Learn Stock Trading Using Pocket Option Tools

- 🎯 Final Thoughts: Is Roku Stock Worth Watching for 2030?

🎯 This article explores Roku stock price prediction 2030, helps you assess market volatility, and gives actionable strategies to optimize your portfolio through smart risk management.

Roku Stock in Focus: Business Model and Growth Trajectory

Roku has grown beyond a device company into a robust platform generating high-margin revenues from advertising and content distribution. The company owns both hardware (streaming devices) and software (Roku OS), allowing it to monetize user engagement through ads, subscriptions, and licensing.

“Roku is not just a device maker. It’s becoming the operating system of the living room.”— Ben Weiss, Tech Media Strategist, Bloomberg Technology (2025)

Key Business Metrics (Q2 2025)

| Metric | Value |

|---|---|

| Active Accounts | 84.2 million |

| Streaming Hours | 29.9 billion |

| Ad Revenue Growth YoY | +22% |

| Roku Channel Viewers | 41 million |

With more than 80 million accounts and a rising ARPU, Roku stock stands out in the stock market for investors seeking scalable growth tied to content consumption habits.

Roku Stock Price History: Technical View

The stock price of Roku has seen wild swings in recent years, often acting as a barometer for broader tech sentiment.

| Year | Stock Price Range | Highlights |

|---|---|---|

| 2020 | $100–$300 | COVID streaming surge |

| 2021 | $300–$450 | Peak optimism, record ad revenues |

| 2022–2023 | $60–$100 | Tech sector correction |

| 2024–2025 | $90–$140 | Platform recovery, focus on efficiency |

“The volatility in Roku stock mirrors investor sentiment about the entire ad-supported streaming economy.”— MoffettNathanson 2025 Outlook

Essential Technical Indicators to Learn Roku Stock Trading

Understanding these technical tools is crucial for developing a data-backed stock trading strategy:

| Indicator | Use Case |

|---|---|

| Moving Averages | Identify long/short-term trend shifts |

| RSI | Detect overbought/oversold zones (ideal for timing entries) |

| MACD | Reveal changes in momentum before price action catches up |

✔️ Example: In May 2025, a bullish MACD crossover on Roku’s daily chart preceded a +17% rally over two weeks.

How to Read the Roku Stock Chart

If you’re building a smarter portfolio, knowing how to read a stock chart is fundamental. Here’s what to focus on when analyzing Roku stock:

| Element | What It Tells You |

|---|---|

| Candlestick Patterns | Show buying/selling pressure at micro levels |

| Trendlines | Identify ongoing direction and trend reversals |

| Volume Indicators | Confirm strength or weakness of price movements |

| Support/Resistance Levels | Predict possible breakout or reversal zones |

“Chart analysis is not magic–it’s probability management.”— Linda Raschke, Veteran Trader & Author

Roku Stock Forecast 2030: What Experts Are Saying

To make an informed roku stock forecast 2030, investors must assess not just internal company fundamentals, but also the broader macroeconomic environment and evolving trends in the digital advertising and streaming industries.

Key macro factors impacting Roku stock price prediction 2030:

“By 2030, ad-supported streaming will surpass traditional TV ad budgets, and Roku has a first-mover advantage as the leading CTV platform in the U.S.”— eMarketer Digital Ad Forecast Report, 2025

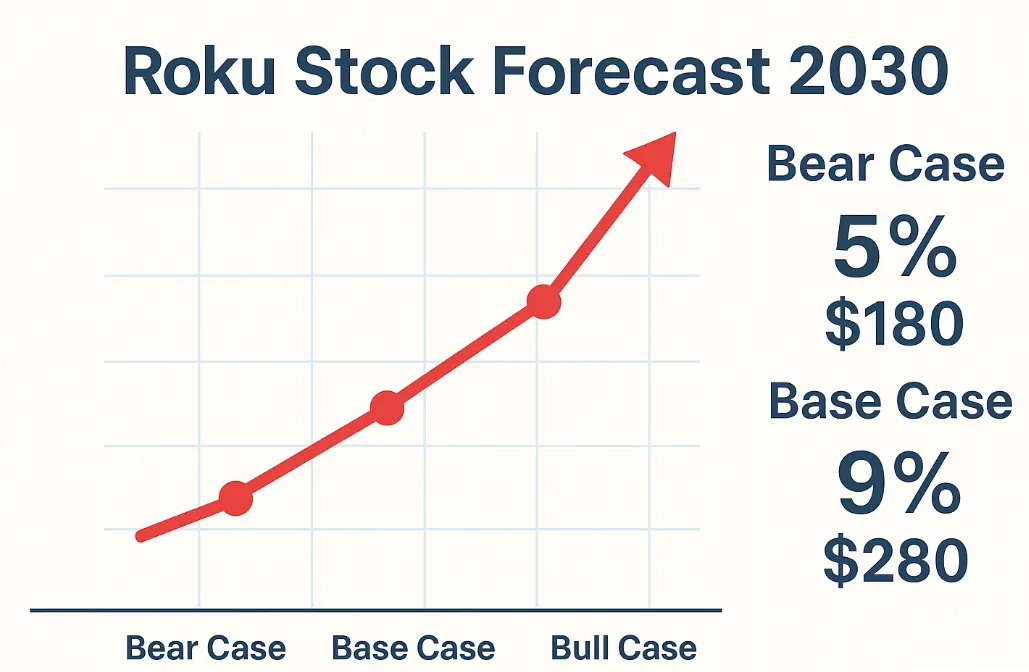

Expert Projections for Roku Stock in 2030

| Scenario | Projected CAGR | Roku Stock Price (2030) | Analysts & Notes |

|---|---|---|---|

| Bear Case | 5% | $180 | Sluggish macro growth, U.S.-centric model, pressure on hardware margins |

| Base Case | 9% | $280 | Sustained ARPU growth, positive FCF, expansion into LATAM and Western Europe |

| Bull Case | 14% | $420+ | Roku becomes dominant global CTV OS, leverages programmatic ads + AI targeting |

In the bear case, Roku struggles to maintain competitive advantage against Amazon Fire TV and Google TV, while ad budgets remain flat in key markets due to macroeconomic uncertainty.

In the base case, Roku executes well in expanding internationally, diversifying revenue from device sales, and maintaining a 20–25% YoY growth in ad impressions. Profitability is sustained through cost discipline and content licensing strategies.

The bull case envisions Roku expanding its OS to smart TVs globally, integrating machine learning for hyper-targeted advertising, and building an ecosystem similar to Android but for connected TV–a scenario that could make it a $100B company by market cap.

“If Roku captures even 5–10% of global smart TV OS share, its monetization potential via ad impressions and AVOD could rival Netflix in gross margins.”— Loup Ventures Streaming Ecosystems Report, 2025

📌 According to Morningstar (2025), Roku’s fair value estimate is $225, with a wide economic moat built on control over both distribution (devices, OS) and monetization (ad inventory, platform access). They assign it a 4-star rating, suggesting undervaluation at current levels.

“Unlike content creators who battle for subscribers, Roku earns margin on every stream–regardless of which app users prefer.”— Tom Laurents, Equity Analyst, Morningstar Tech Research

💬 The consensus among Wall Street analysts remains moderately bullish, with 24 out of 33 firms maintaining a “Buy” or “Outperform” rating as of June 2025.

Investment Strategies for Roku Stock

Long-Term Strategy: Compounding Growth in Your Portfolio

Building a long-term position in Roku stock could strengthen your tech-focused portfolio, especially if you:

- Accumulate on pullbacks during broader tech sell-offs

- Monitor Roku’s innovation in AI-powered ad delivery

- Use dollar-cost averaging to reduce volatility exposure

“Roku’s ability to scale ad revenues without needing subscription growth is a big deal.”— CNBC Fast Money, April 2025

Swing Trading Strategy: Capitalize on Earnings Volatility

Roku often makes sharp post-earnings moves (±10–15%). Swing traders should:

- Track earnings dates

- Watch for RSI divergence near support zones

- Confirm setups with volume spikes

📌 Tip: Roku tends to react more strongly to guidance than EPS figures.

Real-Time Trading Tips for Roku Stock

Smart real-time tactics can amplify gains:

- Follow Roku’s announcements on ad platform updates

- Monitor sentiment on platforms like Seeking Alpha and Reddit

- Set alerts around $10–$15 price zones near key support/resistance

“Don’t trade Roku in a vacuum–always track the stock market reaction to Netflix and YouTube trends too.”— EquityPulse.io Weekly Briefing

📍 Even though Roku isn’t available on Pocket Option, traders can test similar setups using top tech stocks via OTC markets.

Roku’s Financial Health: A Quick Audit

| Financial Metric | Meaning |

|---|---|

| Free Cash Flow | Supports R&D and platform expansion |

| Revenue per User (ARPU) | Measures monetization effectiveness |

| Debt/Equity Ratio | Indicates leverage and balance sheet risk |

🧾 As per Roku’s Q2 2025 report, free cash flow has turned positive for the first time since 2021–a milestone that suggests durable profitability.

What Analysts Are Publishing About Roku

To understand the broader sentiment surrounding Roku stock, it’s essential to look beyond raw numbers and examine how top-tier financial publications and investment banks are framing Roku’s narrative in the evolving stock market.

| Source | Quote or Insight |

|---|---|

| Barron’s | “Roku may be one of the last independent streaming OS giants.” |

| MarketWatch | “Strong Q2 ad impressions growth gives Roku a leg up in H2 2025.” |

| Goldman Sachs | “Roku’s earnings quality has improved significantly post-2023 reset.” |

📌 This underscores Roku’s strategic rarity as most major streaming platforms (Apple, Amazon, Google) are vertically integrated, while Roku remains a neutral aggregator, making it a valuable partner–and potentially an acquisition target.

📊 In Q2 2025, Roku reported a 24% YoY increase in ad impressions, driven by programmatic ad demand and increased engagement on the Roku Channel. Analysts note this momentum could lead to beat-and-raise quarters in the second half.

🔍 Goldman highlighted Roku’s improved cost controls, stable gross margins in platform revenue (~55%), and declining customer acquisition costs as signs of a healthier growth profile. The firm raised Roku’s 12-month price target to $230 (Q2 2025).

“The platform’s neutrality in content hosting, combined with increasing user hours, makes it one of the most attractive advertising channels in digital media today.”— Sarah Michelson, Equity Strategist, Deutsche Bank Media Insights, 2025

Additionally, CNBC analysts in June 2025 noted that “Roku’s pricing power in the AVOD space is growing, especially as advertisers diversify away from Meta and YouTube due to brand safety concerns.”

📈 These insights strengthen the case for including Roku stock in a tech-oriented portfolio, especially for investors seeking exposure to digital ad trends without taking on the content creation risk that platforms like Netflix or Disney carry.

💼 Analysts emphasize Roku’s leverage in its dual identity–as both a hardware gateway and a monetizable software ecosystem–positioning it uniquely in the next wave of CTV dominance.

⚠️ Risks and Upside Potential

| Risks | Upside Triggers |

|---|---|

| Aggressive competition from Amazon Fire and Google TV | Growth in AVOD (ad-based video on demand) |

| Ad spending is cyclical and prone to macro pressure | Entry into international smart TV manufacturing |

| Hardware pricing pressure from overseas suppliers | Acquisitions of smaller streaming players |

📌 Risk-adjusted strategies with trailing stops and hedging via tech indices can help balance the trade.

How to Start Trading Roku Stock: Step-by-Step Guide

Trading Roku stock can be a powerful way to benefit from the growth of the streaming industry–whether you’re swing trading short-term price movements or investing for the long haul. Here’s a beginner-friendly guide to get started:

1. 📑 Open a Brokerage Account

To trade Roku, you need access to the U.S. stock market via a regulated brokerage.

- Choose a broker that offers U.S. stocks (e.g., Fidelity, TD Ameritrade, Interactive Brokers, eToro)

- For beginners, consider brokers with low or zero commissions

- Many modern platforms allow fractional shares, so you don’t need to buy a full Roku share (~$90–$140 in 2025)

✅ Tip: Look for platforms that offer integrated stock charts, indicators (MACD, RSI), and earnings calendars.

2. 💸 Fund Your Account

- Link your bank account or preferred payment method

- Deposit a starting amount (some brokers accept as little as $10–$50 for fractional trading)

✅ Don’t invest money you can’t afford to lose–start small and scale gradually as you gain confidence.

3. 🔍 Analyze Roku Stock

Before placing any trade, take time to analyze Roku stock:

- Review the latest earnings report, revenue trends, and analyst ratings

- Use technical analysis to identify entry/exit zones:

- RSI under 30 = potential buy signal

- Resistance near $140, support near $90 (as of mid-2025)

- Look for catalysts like earnings dates, product launches, or industry news

📊 Example tools to use:

- MACD crossover to detect trend shifts

- Moving Averages (50/200 EMA) to gauge direction

- Volume spikes to confirm momentum

4. 📈 Choose Your Strategy

Decide how you want to trade Roku stock based on your goals and risk tolerance:

| Strategy Type | Description |

|---|---|

| Buy & Hold | Long-term investors aiming for growth by 2030 |

| Swing Trading | Hold for days or weeks, capitalize on technical patterns & earnings cycles |

| Day Trading | Intraday trades using high volatility events |

⏱️ Roku often moves 8–15% post-earnings–this creates ideal conditions for swing traders.

5. 🛒 Place Your Trade

- Select “ROKU” (Roku Inc.) in your brokerage

- Choose trade type:

- Market Order: executes instantly at current price

- Limit Order: sets a preferred price for better entry

- Set quantity or fractional amount

- Review fees (if any) and confirm the trade

⚠️ Always set a stop-loss or alert to manage risk!

6. 🧠 Monitor and Adjust

- Track your position daily or weekly depending on your strategy

- Stay informed via financial news, Roku earnings, and ad market trends

- Adjust your position or take profits when technical or fundamental conditions change

🧪 Want to Practice First- get $50,000 demo account

Platforms like Pocket Option allow you to simulate similar trading strategies on tech stocks, using 24/7 OTC markets, technical tools (RSI, moving averages), and a $50,000 demo account.

💡 Pro Tips:

- Use an earnings calendar to avoid surprise volatility

- Pair Roku with correlated assets (like Netflix, Disney, or tech ETFs)

- Don’t chase breakouts–wait for confirmation via volume and RSI divergence

Learn Stock Trading Using Pocket Option Tools

While Roku itself isn’t available for trading on Pocket Option, you can still:

- Apply Roku-based strategies to similar OTC tech stocks

- Use advanced tools like AI Trading 🤖, RSI, and Fibonacci levels

- Join community tournaments for shared learning 💡

🎓 Plus, Pocket Option offers:

- Copy Trading to follow top traders

- 24/7 access to 100+ assets via OTC

- Quick deposits/withdrawals in 50+ methods

🎯 Final Thoughts: Is Roku Stock Worth Watching for 2030?

Absolutely. Roku is at the center of the media evolution. As TV shifts toward digital, Roku’s control of the streaming OS and monetization channels puts it in a strong position to outperform by 2030. For traders and investors alike, learning how to trade Roku stock offers a chance to capitalize on volatility and long-term tech innovation.

✅ Whether through swing strategies or portfolio allocation, the key is to stay informed, use the right tools, and manage risk intelligently.

FAQ

Is Roku stock a good long-term investment?

Yes, if you believe in the future of ad-supported streaming and Roku’s leadership in OTT platforms.

What is Roku stock price prediction 2030?

Experts forecast between $180–$420 depending on market share, ad revenue, and global expansion.

What are the risks in investing in Roku stock?

The biggest risks include ad budget cuts, hardware margin compression, and increased competition.

Can I trade Roku stock directly 24/7?

No, but you can trade other tech assets on platforms like Pocket Option using OTC markets anytime.

How can I practice Roku trading strategies?

Use demo accounts on platforms like Pocket Option to simulate swing and momentum strategies.

What are common Roku stock trading mistakes?

Typical mistakes include overtrading around earnings reports, ignoring volume confirmation on breakouts, and failing to set stop-losses in volatile conditions.

How much money do I need to trade Roku stock?

While traditional brokers may require full share purchases (currently $90–$140 per share), platforms offering fractional shares or options can allow entry with as little as $10–$50. Always ensure your capital matches your risk tolerance.

Can beginners succeed with learn Roku stock trading?

Yes—if they study Roku’s fundamentals, practice with demo tools, and apply technical analysis consistently. Starting with paper trading or using community features like Pocket Option’s copy trading can help reduce early-stage mistakes.

What are the costs of learn Roku stock trading?

Costs include broker commissions (if any), bid-ask spreads, and potential platform fees. Learning costs can also include educational subscriptions or tools, though many are available free via Pocket Option or financial news sites.

How to avoid losses in learn Roku stock trading?

Focus on risk management: set stop-loss orders, avoid emotional trades, and never risk more than 1–2% of your account per trade. Studying patterns and understanding broader stock market sentiment also helps reduce losses.