- Reduced financial risk when learning

- Opportunity to test trading strategies

- Access to real market conditions

- Lower psychological pressure

Forex Trading Low Minimum Deposit: Affordable Options for New Traders

Starting forex trading no longer requires significant capital. With low minimum deposit options, newcomers can test strategies and gain experience without risking large sums. This article explores accessible trading platforms for those with limited initial funds, including Pocket Option — a platform that combines affordability, speed, and ease of use.

Why Low Deposit Trading Accounts Matter

The foreign exchange market is more accessible than ever before. Brokers now offer forex trading low minimum deposit requirements that range from $1 to $100, making it possible for almost anyone to start trading currencies.

Low deposit accounts provide several benefits for beginners and cautious traders:

For many people, starting with a smaller amount feels more comfortable and allows for gradual skill development without the stress of potentially losing large sums.

Why Does Pocket Option Stand Out Among Other Platforms?

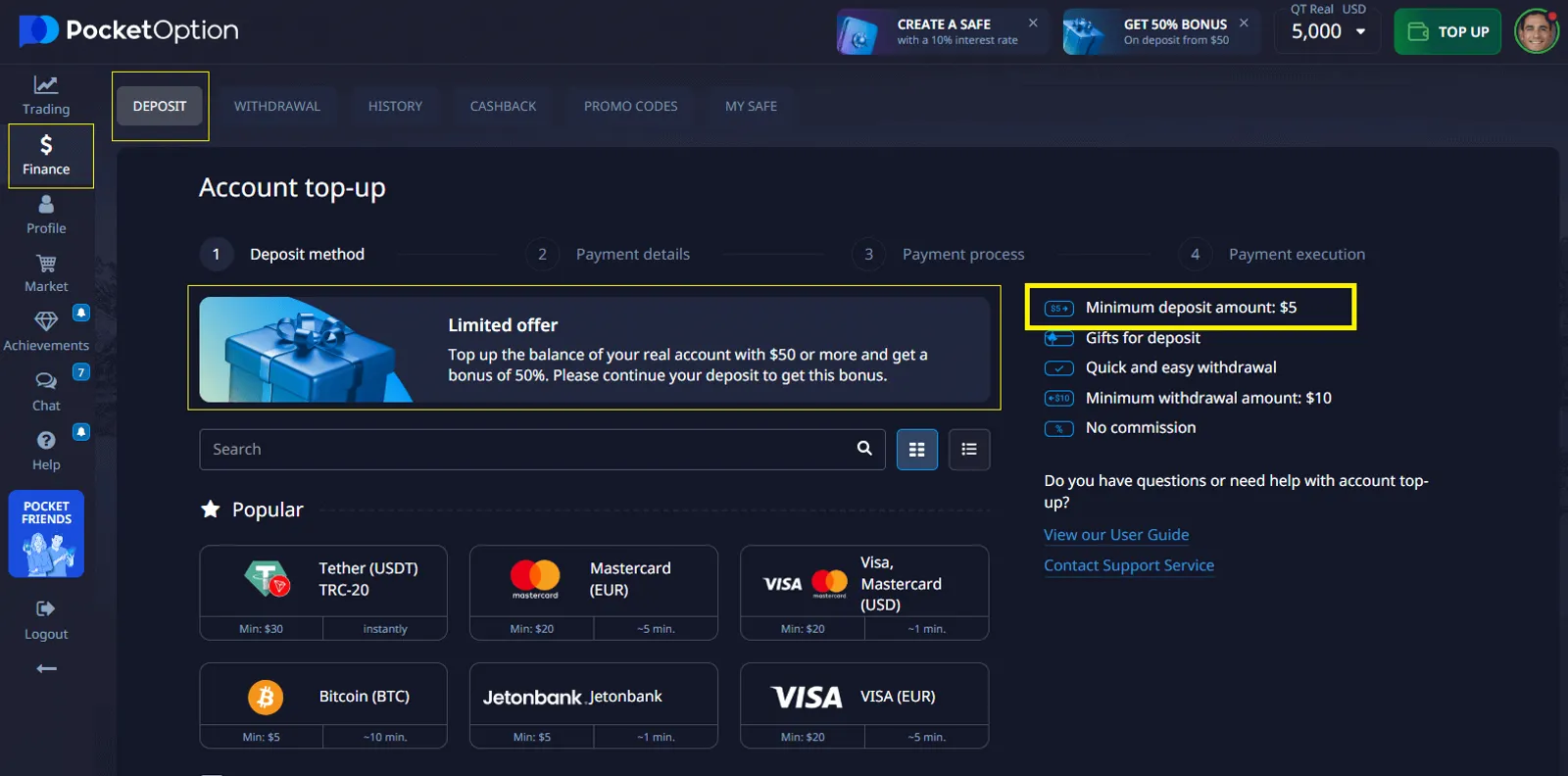

Pocket Option combines low minimum deposits from $5, ease of use, and a wide range of tools, including 20+ forex pairs, making it ideal for beginner traders. The ability to start with minimal investments, test the platform with a demo account, and choose from a variety of assets provides users with a unique opportunity for a safe and effective start in trading.

Getting Started with Pocket Option

- Register and Choose a Payment Method – Sign up on the platform and select your preferred payment method.

- Deposit as Little as $5 – Fund your account with a minimum deposit starting at just $5.

- Choose a Forex Pair – Select a forex pair from the list of available trading instruments.

- Make a Forecast – Forecast whether the price will go up or down, set the trade duration, and specify the trade amount.

- Earn Up to 92% – Profit If your forecast is correct, you can earn up to 92% profit!

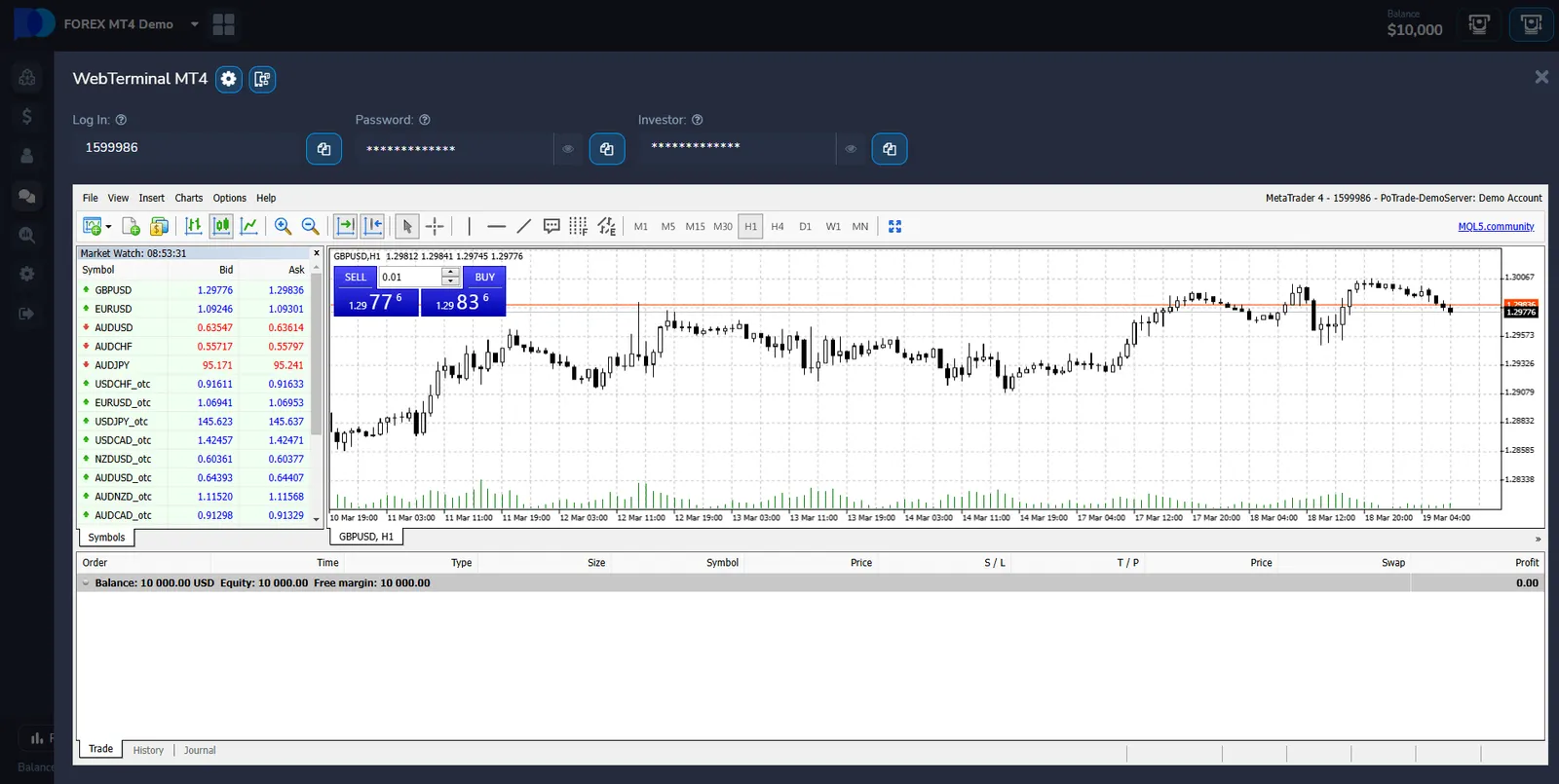

- Trade Forex on MT4 or MT5 – Also enjoy advanced trading by using MT4 or MT5, fully integrated into Pocket Option.

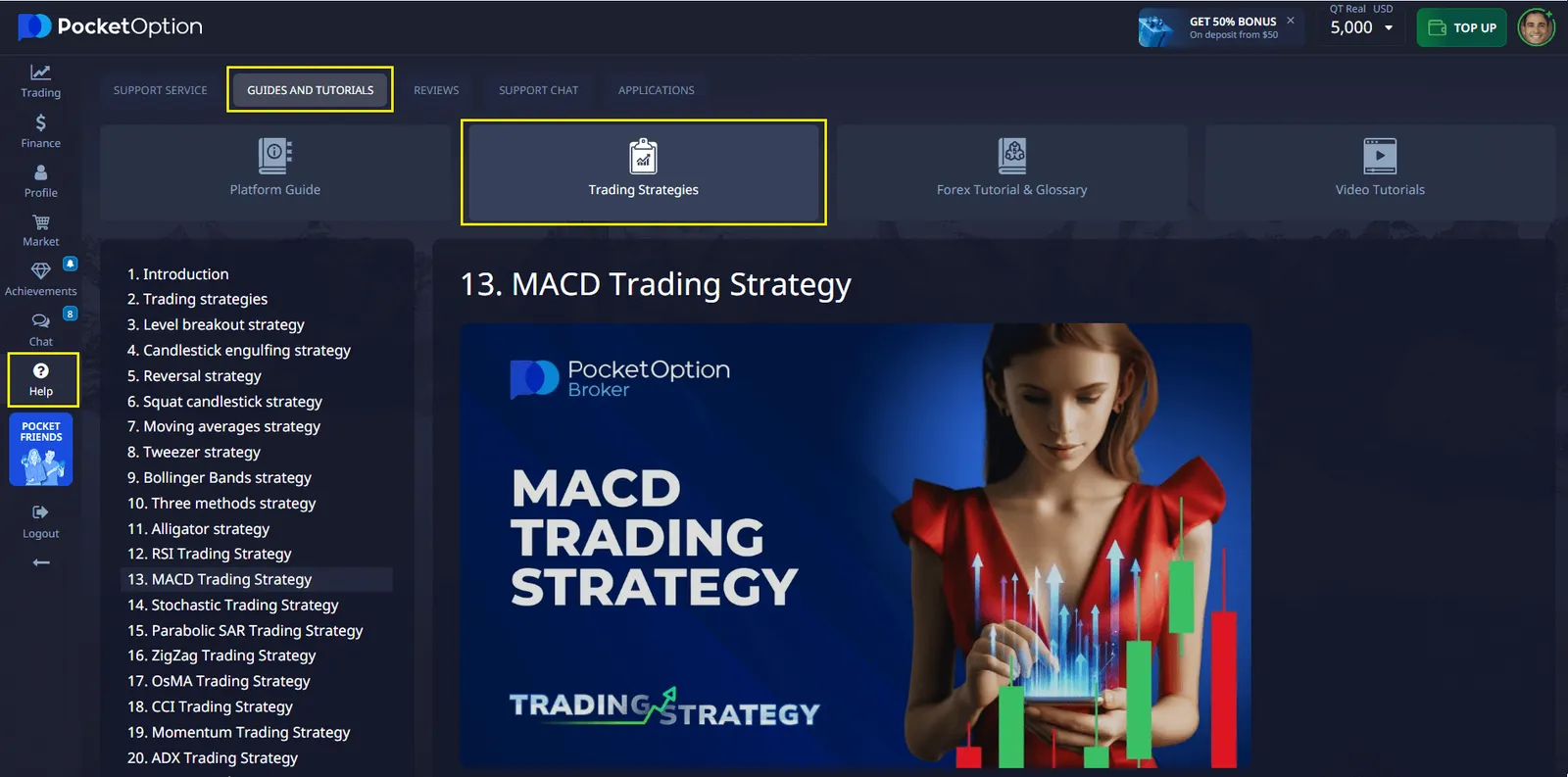

Effective Trading Strategies for Small Accounts

- Trading with a small account requires specific strategies to manage risk and gradually grow your capital:

- Strict risk management (limit exposure to 1-2% per trade)

- Focus on higher probability setups

- Avoid overtrading

- Consider using smaller position sizes

Starting with a low deposit trading account doesn’t mean expected returns should be unrealistic. Focus on percentage gains rather than dollar amounts to maintain perspective.

Common Pitfalls to Avoid with Small Deposits

| Pitfall | Why It’s Dangerous | How to Avoid |

|---|---|---|

| Overleveraging | Can quickly deplete small accounts | Use lower leverage ratios (1:50 or less) |

| Emotional Trading | Leads to poor decision-making | Follow a trading plan and set rules |

| Chasing Losses | Compounds negative results | Accept small losses and move on |

Many traders with small accounts make the mistake of using excessive leverage to compensate for the small deposit. This typically leads to account depletion rather than growth.

Realistic Expectations for Small Deposit Trading

- Focus on learning rather than immediate profits

- Set achievable monthly growth targets (5-10%)

- Consider periodic small deposits to increase account size

- Understand that consistency matters more than single large wins

Starting with a small deposit doesn’t limit long-term potential, but it does require patience and disciplined trading practices.

Advantages of Pocket Option for Beginner Traders

In addition to a small deposit, when trading forex, take advantage of additional benefits:

Start Trading with Just $1

You don’t need a big budget to begin trading on Pocket Option. With a minimum deposit of only $1, you can start exploring the forex market and other assets.

Quick Trading with up to 92% profit

Pocket Option’s quick trading feature allows you to take advantage of short-term market movements. Whether you’re trading forex, stocks, or cryptocurrencies, this feature is perfect for those who want fast-paced trading opportunities.

MT4/MT5 Support

For those looking for professional tools, Pocket Option provides access to the popular MT4 and MT5 platforms. These platforms allow for deep market analysis and the use of automated strategies.

Demo Account Without Registration

Not ready to deposit right away? Try the platform for free! Pocket Option offers a demo account that replicates real market conditions. You can practice strategies, test tools, and get comfortable without financial risk. How to start with a demo account:

- Visit the Pocket Option website.

- Click “Try Demo” (no registration required).

- Practice trading with virtual funds.

Wide Variety of Assets

With Pocket Option, you can trade over 100 assets, including:

- Forex currency pairs

- Stocks

- Cryptocurrencies

- Commodities

- Indices

This diversity allows you to experiment with different markets and find what works best for you.

Fast Deposits and Withdrawals

Pocket Option supports multiple payment methods without fees, including bank cards, e-wallets, and cryptocurrencies. Deposits are instant, and withdrawals are processed quickly, ensuring you can access your funds when you need them.

Conclusion

Forex trading low minimum deposit options have democratized access to financial markets. Beginners can now start with as little as $1-$5 through brokers like Pocket Option and others. While small accounts present challenges, they also provide valuable learning opportunities with limited financial risk. By focusing on proper risk management, realistic expectations, and continuous education, traders can build skills that may lead to consistent results regardless of account size.

FAQ

Can I really start forex trading with just $5?

Yes, several reputable brokers including Pocket Option offer accounts with minimum deposits as low as $5. While trading with such a small amount has limitations in terms of position size and profit potential, it provides a genuine market experience with minimal financial risk.

What is the best forex trading no minimum deposit option?

Some brokers offer no-deposit bonuses that allow you to trade without making an initial deposit. However, these typically come with restrictions on withdrawals. Demo accounts are another option to practice without depositing funds, though they lack the psychological element of risking real money.

How much can I realistically earn with a small forex account?

With small accounts, focus on percentage growth rather than dollar amounts. A skilled trader might aim for 5-15% monthly returns, meaning a $100 account might grow by $5-15 per month. Building consistent performance is more important than rapid returns.

Are forex trading brokers with low minimum deposit requirements trustworthy?

Not all are equal. Look for regulated brokers with good reputations, transparent fee structures, and reasonable withdrawal processes. Low deposit requirements alone shouldn't be the determining factor when choosing a broker.

What's the difference between a micro lot and a standard lot in low deposit trading?

A standard lot represents 100,000 units of currency (typically requiring larger accounts), while a micro lot is just 1,000 units. Most low deposit trading accounts allow micro lot trading, making it possible to take positions with very small amounts of capital.