- Hedge stock portfolios against sudden market drops.

- Speculate with limited capital but high potential.

- Generate income through strategies like covered calls.

- Benefit from volatility trading, where price swings create opportunities.

Option Trading: Opportunities, Risks, and Strategies for 2025

If you’re looking for a smart way to grow your capital with flexibility, option trading offers one of the most dynamic opportunities in the financial markets.

Article navigation

- Start trading

- What Is Option Trading?

- Why Traders Choose Options

- Pocket Option: A Simple Way to Start

- Options Trading Guide: Key Terminology

- How to Trade Options: Step-by-Step

- The Role of Options Greeks

- Popular Options Strategies

- Risk Management in Option Trading

- Quick Trading vs Traditional Investing

What Is Option Trading?

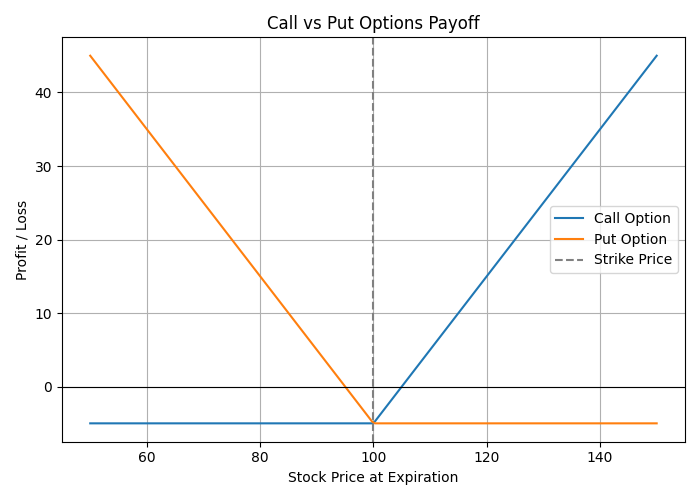

At its core, option trading means buying or selling contracts that give you the right – but not the obligation – to buy (call option) or sell (put option) an underlying asset at a predetermined price within a specific period.

This flexibility allows traders to hedge risks, speculate on price movements, and implement advanced strategies that combine calls, puts, and volatility analysis.

👉 Think of it this way: unlike buying a stock outright, options give you leverage – a way to control more value with less capital, while keeping your risk defined.

Why Traders Choose Options

Options are popular because they allow you to profit in different market conditions – rising, falling, or sideways. Traders use them to:

Expert insight: According to Investopedia analysts, retail traders using options with defined risk strategies have shown higher survival rates in volatile markets compared to traditional margin trading.

Pocket Option: A Simple Way to Start

Pocket Option offers a Quick Trading model that resembles the logic of options trading – but with a much simpler and faster execution. No complicated terms or formulas – just choose the price direction and click Buy or Sell. If your prediction is correct, you can earn up to 92% profit in a single trade.

New to trading or want to explore the platform first? Register now and start practicing with a free demo account – no risks, no deposits required.

Unlike traditional brokers with high entry barriers, Pocket Option gives you a fast track to start learning and applying strategies:

- Minimum deposit: from just $5.

- Unlimited free demo account for practicing.

- Over 100+ assets available (stocks, crypto, indices, forex).

- AI trading tools and a signal Telegram bot.

- Social Trading – copy successful traders.

- Weekly tournaments with real prizes.

- Bonuses and promo codes to boost deposits.

- Mobile app to trade anytime, anywhere 📱.

Options Trading Guide: Key Terminology

To succeed, you need to master the essential terms. Here’s a quick options trading guide in table form:

| Term | Meaning |

|---|---|

| Call Options | Contract that gives you the right to buy an asset at a fixed price. |

| Put Options | Contract that gives you the right to sell an asset at a fixed price. |

| Options Greeks | Metrics (Delta, Gamma, Theta, Vega, Rho) that measure sensitivity. |

| Strike Price | The fixed price at which the option can be exercised. |

| Expiration | The date when the option contract expires. |

| Premium | The price paid to buy the option. |

👉 Learning these basics is step one in understanding how to trade options effectively.

How to Trade Options: Step-by-Step

Many beginners ask: how to trade options without getting overwhelmed? Here’s a simple process:

- Choose your asset (e.g., Apple stock, EUR/USD, or Bitcoin).

- Select the option type – call (if you expect price to rise) or put (if you expect it to fall).

- Set strike price and expiration.

- Pay the premium to enter the contract.

- Manage the trade until expiration — decide whether to hold, sell, or exercise.

The Role of Options Greeks

Professional traders rely heavily on options Greeks to measure risk and probability:

| Greek | What It Measures | Why It Matters |

|---|---|---|

| Delta | Sensitivity of option to $1 move in underlying | Helps forecast potential profit/loss |

| Gamma | Rate of change of Delta | Shows how Delta changes as price moves |

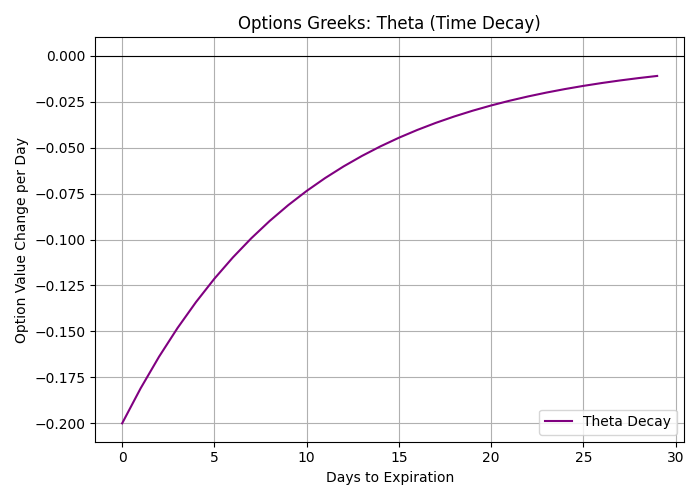

| Theta | Time decay | Tells how much value you lose each day ⏳ |

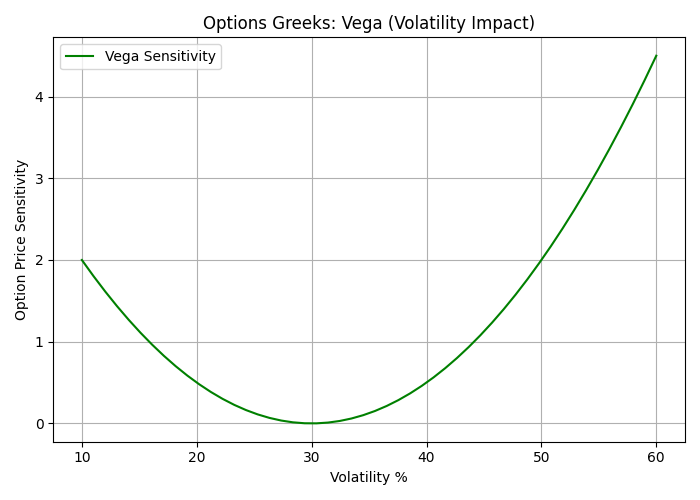

| Vega | Sensitivity to volatility | Crucial for volatility trading |

| Rho | Sensitivity to interest rates | Important in long-term option pricing |

👉 By combining Greeks, traders design options strategies that align with risk tolerance.

Popular Options Strategies

Let’s explore some practical options strategies for 2025:

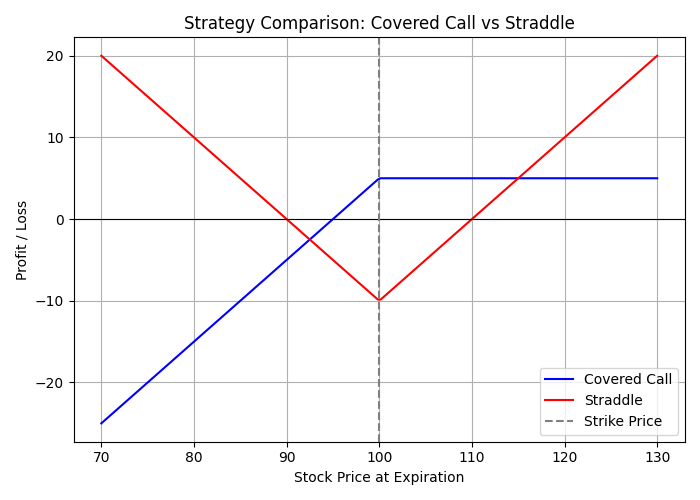

1. Covered Calls

A conservative strategy: own 100 shares of a stock and sell a call option on it.

- Pros: Generates steady income.

- Cons: Caps upside if stock rises sharply.

2. Protective Puts: Buy a put option on a stock you own to hedge against losses.

3. Straddles (Volatility Trading): Buy both a call and a put at the same strike — perfect when you expect big moves but don’t know the direction.

4. Iron Condor: Sell two out-of-the-money options (call and put) and buy two further out-of-the-money options. Profits from low volatility.

📊 Strategy Comparison:

| Strategy | Best For | Risk Level | Profit Potential |

|---|---|---|---|

| Covered Calls | Income generation | Low | Limited |

| Protective Put | Hedging | Medium | Unlimited downside protection |

| Straddle | Volatility trading | Medium | High if big movement |

| Iron Condor | Range-bound markets | Medium | Moderate, consistent |

Expert Insights: Financial author John Hull, in Options, Futures, and Other Derivatives, emphasizes that mastering volatility trading and Greeks is what separates beginners from professionals. Traders who stick to simple calls and puts without understanding Theta (time decay) often lose money, while those who analyze volatility can profit even in sideways markets.

Risk Management in Option Trading

Even though options have defined risk, poor planning can drain accounts fast. Some tips:

- Never risk more than 2–5% of your capital on one trade.

- Plan your profit/loss limits before entering a trade.

- Diversify across asset classes (stocks, forex, crypto).

- Track your risk/reward ratio.

👉 Example: Investing $100 in a single option with potential $300 upside but $100 max loss is more sustainable than risking $1000 at once.

Quick Trading vs Traditional Investing

| Aspect | Quick Option Trading | Traditional Stock Investing |

|---|---|---|

| Risk | Defined, limited | Variable, market-dependent |

| Capital Required | Low (from $5 at Pocket Option) | Higher, must buy full shares |

| Profit Potential | Fast, leveraged | Long-term growth, dividends |

| Complexity | Moderate (needs education) | Lower, buy & hold |

| Asset Ownership | No ownership | Full ownership of stock |

FAQ

What is option trading?

Option trading is the process of buying and selling contracts, known as options, that give a trader the right but not the obligation to buy, in the case of a call option, or to sell, in the case of a put option, an underlying asset such as a stock, currency pair, index, or cryptocurrency at a predetermined price within a specific timeframe. A call option is chosen when a trader expects the price to rise, while a put option is chosen when the expectation is a decline. Unlike buying stocks outright, option trading provides leverage and flexibility while keeping risk defined and limited to the premium paid.

Can I trade using my mobile device?

Yes, many platforms support mobile trading, allowing you to manage trades and monitor markets directly from your smartphone or tablet.

How to start trading options?

To begin trading options, a trader first needs to understand the key concepts such as calls, puts, strike prices, expiration dates, and premiums. The next step is choosing a reliable platform, and brokers like Pocket Option make the process easier by offering a minimum deposit from just five dollars, an unlimited demo account for practice, and access to more than one hundred assets that can be traded around the clock. After funding an account, the trader selects whether to buy a call or a put based on their market outlook, sets the strike price and expiration, and manages the position until the contract closes. Beginners are strongly advised to practice first on a demo account in order to build confidence before switching to live trading.

What are the best option strategies?

The most effective option strategies depend on a trader’s goals and risk appetite. Covered calls are widely used to generate consistent income by selling calls against stocks already owned, while protective puts serve as insurance to guard portfolios against sharp declines. Traders expecting large moves often turn to straddles, which involve buying both a call and a put at the same strike price to profit from volatility in either direction. For those who believe the market will remain within a certain range, an iron condor can provide steady returns by combining several options into one position. Beginners usually prefer simple approaches such as covered calls or protective puts, while more advanced traders experiment with volatility strategies.

Is option trading profitable?

Option trading can be profitable, but success depends heavily on education, discipline, and consistent risk management. Its biggest advantage is flexibility: unlike traditional investing, options can generate profits in bullish, bearish, or even sideways markets. Many newcomers, however, lose money because they underestimate time decay or volatility, or because they trade without a clear plan. Profitable traders typically focus on protecting capital, choosing the right strategies for current market conditions, and practicing extensively before scaling up. With the right preparation and access to a user-friendly platform such as Pocket Option, option trading can become a rewarding and sustainable way to build wealth.

Final Thoughts

Option trading offers unmatched flexibility to profit in bull, bear, or sideways markets. With strategies ranging from covered calls to volatility trading, traders can adapt to any condition. The key is education, discipline, and practice — and that’s where platforms like Pocket Option stand out. By providing a demo account, small entry deposits, and advanced tools like AI trading and social trading, Pocket Option makes it easier than ever to learn and grow as an options trader. 🔥 Whether you’re exploring an options trading guide for the first time, or refining your portfolio with advanced options Greeks and strategies, now is the perfect time to step into the market.

Start trading