- Central Bank Policies: Decisions by the Reserve Bank of Australia (RBA) and Bank of Canada (BoC) affect interest rate differentials.

- Commodities: Prices of iron ore and oil directly influence AUD and CAD.

- Economic Data: Employment, GDP, CPI data from both countries.

- Risk Sentiment: Global risk appetite often strengthens AUD over CAD.

- Geopolitical Events: Affect investor confidence and currency flows.

How to Trade AUDCAD: Comprehensive Forex Guide

The AUDCAD currency pair, comprising the Australian dollar (AUD) and Canadian dollar (CAD), is a compelling choice for forex traders due to its correlation with global commodity trends. This in-depth guide explores how to trade AUDCAD effectively, covering key influencing factors, trading strategies, sentiment insights, and how Pocket Option facilitates efficient AUDCAD CFD trading.

Understanding the AUDCAD Currency Pair

AUDCAD Currency Pair Overview: A Commodity-Driven Dynamic

Both AUD and CAD are classified as commodity currencies, influenced heavily by exports. AUD is tied to Australia’s mining sector, especially iron ore and coal, while CAD is influenced by oil due to Canada’s large energy sector. The combination creates a pair sensitive to commodity market changes and offers unique trading opportunities.

Why AUDCAD Matters in Forex Markets

AUDCAD is considered a minor forex pair but is actively traded due to its liquidity and moderate volatility. It is favored by traders using swing trading, momentum strategies, and news-based approaches. On Pocket Option, AUDCAD is available for Quick Trading, enabling real-time execution with clear Buy and Sell mechanics.

How Currency Quotation Works

In the case of AUD/CAD, if the price shows 1.00, it means 1 Australian Dollar equals 1.00 Canadian Dollar. If the quote rises to 1.05, you need 1.05 CAD to buy 1 AUD — signaling that the Australian Dollar is strengthening.

How to Interpret AUD/CAD Price Changes

If the AUD/CAD price increases, it means the Australian Dollar is gaining strength relative to the Canadian Dollar. If the price falls, it shows CAD is appreciating. For example, a move from 1.00 to 1.05 indicates the AUD has appreciated by 5%.

What is the Sentiment of AUDCAD Stock?

Sentiment for AUDCAD generally reflects broader commodity and risk sentiment. Traders monitor sentiment tools and indicators such as Commitment of Traders (COT) reports, or positioning data from major brokers. As of 2025, the sentiment leans slightly bullish with analysts highlighting potential upside due to stabilizing iron ore prices and diverging interest rate policies between Australia and Canada.

Expert Insight: “AUDCAD presents compelling swing opportunities whenever there’s divergence between RBA and BoC policies,” notes Marcus Li, Senior FX Analyst at ForexLive.

| Factor | Current Impact on AUDCAD |

|---|---|

| Iron Ore Prices | Positive for AUD |

| Oil Prices | Neutral to Slightly Negative for CAD |

| RBA Policy | Dovish Stance |

| BoC Policy | Slightly Hawkish |

Key Factors Influencing the AUDCAD Exchange Rate

How to Trade AUDCAD Using Technical and Fundamental Analysis

Technical Analysis for AUDCAD Traders

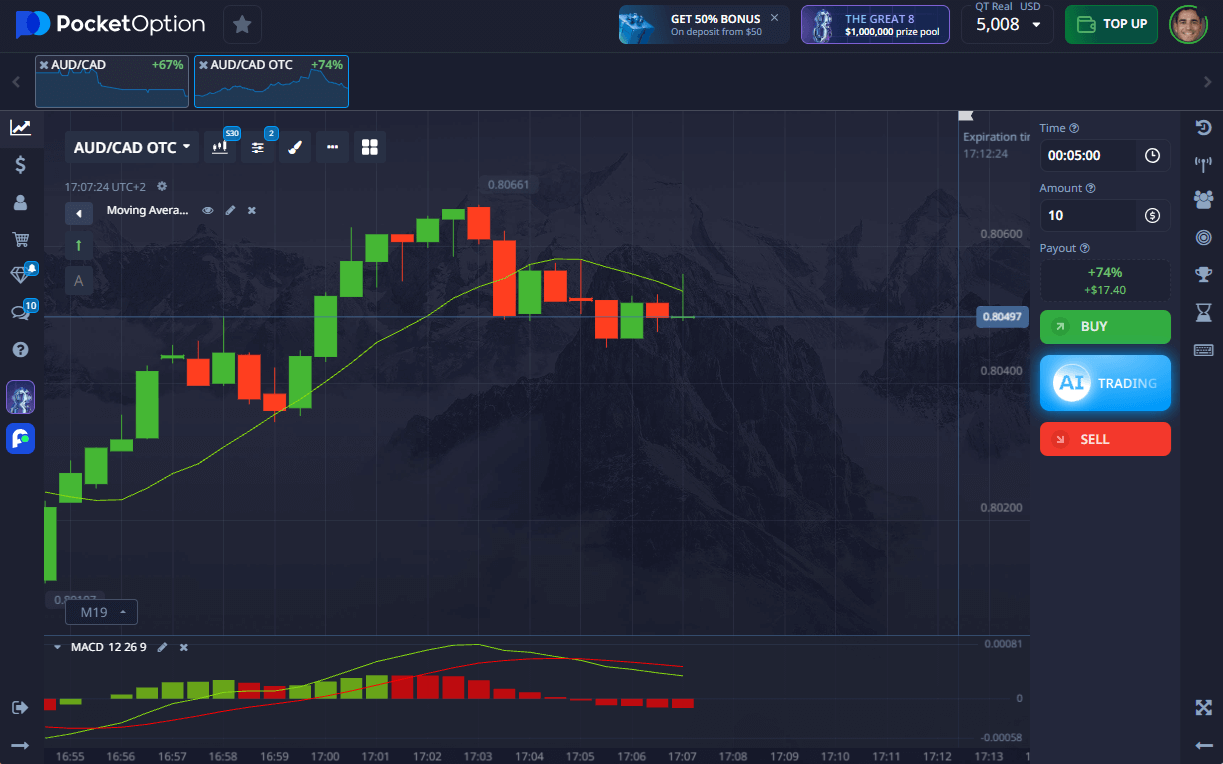

Effective technical tools for AUDCAD include:

- Moving Averages (SMA, EMA)

- RSI for identifying overbought/oversold levels

- MACD for trend confirmation

- Fibonacci retracement for key support/resistance

- Candlestick patterns like Doji, Engulfing, and Hammer

Example Strategy: 50 EMA Crossover + RSI below 30 => BUY AUDCAD

Fundamental Analysis Insights: Economic and Policy Drivers

Monitor:

- RBA & BoC interest rate decisions

- Australia: iron ore exports, China trade

- Canada: oil inventory data, U.S. trade relations

Expert Opinion: “Understanding the macroeconomic backdrop is essential for AUDCAD. Watch BoC commentary especially closely when oil markets are volatile,” advises Elina Khoury, FX strategist at MarketWatch.

Step-by-Step Quick Trading Example on AUDCAD

- Log in to your Pocket Option account

- Search for AUDCAD or AUDCAD OTC in the asset list

- Apply indicators like RSI or Bollinger Bands

- Set trade amount (minimum $1)

- Choose duration (from 5 seconds to several hours)

- Predict price direction:

- Click BUY if expecting a rise

- Click SELL if expecting a drop

- Earn up to 92% return if correct

Tip: Start with the $50,000 Pocket Option demo account to practice without risk.

Market Insights: What is Happening with AUDCAD Stock Today?

AUDCAD currently trades around 0.91–0.92 range, reflecting stable commodity prices. Today’s movement is influenced by:

- Australian GDP report showing 0.8% quarterly growth

- Slight uptick in oil futures after OPEC comments

- Mixed risk appetite in global markets

Analyst View: According to Reuters, “AUDCAD may see short-term resistance at 0.9260 unless oil prices correct more sharply.”

Historical Performance and Future Projections

| Year | Average Rate | Key Events |

|---|---|---|

| 2020 | 0.9150 | COVID-19 shock |

| 2022 | 0.9050 | China slowdown impacts AUD |

| 2024 | 0.9350 | Commodity recovery boosts AUD |

Outlook: Bloomberg FX outlook anticipates a rise toward 0.95 by Q4 2025 if iron ore remains above $120/ton and BoC holds rates.

CFDs and Risk Management for AUDCAD Traders

What are CFDs?

Contracts for Difference (CFDs) allow trading on the price movement of AUDCAD without owning the underlying currencies. Traders can go long or short with leverage but should be mindful of the risks.

Managing Risk When Trading AUDCAD

- Use stop-loss orders

- Avoid overleveraging

- Limit exposure to single trades

- Monitor economic calendar for key news events

Best Practices for Successful AUDCAD Trading

- Analyze with both fundamental and technical tools

- Use demo account for practice

- Stay updated on AUD/CAD news

- Apply risk/reward ratio of at least 1:2

- Review performance weekly

Pocket Option: Your Gateway to AUDCAD Trading

Pocket Option offers:

- 100+ tradable assets including AUDCAD and AUDCAD OTC

- 24/7 trading access

- $50,000 demo for practice

- Minimum deposit from $5

- Quick Trade functionality with transparent interface

- Real-time trading tools and sentiment indicators

Trader Testimonials

Lucas M.: “Pocket Option helped me master AUDCAD. I love the simplicity and profit potential.”

Amina K.: “Having access to AUDCAD OTC 24/7 is a game changer. I trade even after hours with confidence.”

Download and Trade Anywhere

Available on Windows, macOS, Android, and iOS platforms. Explore Pocket Option on your favorite device and trade AUDCAD on the go.

Final Thoughts: Unique Insights for How to Trade AUDCAD

Knowing how to trade AUDCAD requires a multi-faceted strategy. Based on current trends, it’s wise to:

- Monitor China’s industrial activity as a proxy for AUD

- Track OPEC output decisions for CAD impact

- Align trades with central bank rate expectations

Expert Summary: “In 2025, successful AUDCAD traders will be those who blend commodity macro trends with precise technical execution,” summarizes John Weller, Chief Market Analyst at FXEcho.

FAQ

How to buy AUDCAD?

To buy AUDCAD, simply select the pair on your trading platform and choose whether you want to buy or sell based on your market analysis.

How to invest in AUDCAD?

Investing in AUDCAD involves purchasing the currency pair through a broker platform, monitoring economic factors, and making informed decisions based on market trends.

How to trade AUDCAD?

To trade AUDCAD, analyze the market, predict its price movement, select a trade amount, and choose the direction (up or down) to execute your trade.

What is AUDCAD?

AUDCAD is the currency pair representing the Australian Dollar and the Canadian Dollar. It shows how much CAD you need to buy 1 AUD.

Is AUDCAD stock?

No, AUDCAD is not a stock; it is a currency pair that represents the exchange rate between the Australian Dollar and the Canadian Dollar.

Is AUD USD easy to trade?

Yes. AUD/USD is one of the major pairs with high liquidity and predictable patterns, especially during Asian and U.S. sessions — great for beginners and experienced traders.

How to trade in AUT Roblox?

In “A Universal Time” (AUT) on Roblox, trading involves meeting another player, opening the trade menu, and exchanging items or stands within the game’s rules.

Is AUDCAD a good pair to trade?

Yes. AUDCAD is stable, moderately volatile, and influenced by commodity prices, making it ideal for both technical and fundamental strategies.