- Integration of crypto staking features: Robinhood’s recent implementation of cryptocurrency staking allows users to earn passive income, which has attracted a new wave of crypto-savvy investors. This strategic move not only diversifies revenue streams but also positions Robinhood alongside other major crypto-enabled platforms.

- Expansion into international markets: The company’s gradual rollout into the EU and LATAM markets is opening access to millions of new users. By adapting to regional financial regulations and customizing offerings, Robinhood has gained an edge over traditional brokers struggling with digital transition.

- Strategic partnerships with fintech firms: Collaborations with blockchain innovators and financial AI startups have amplified Robinhood’s tech capacity. One notable partnership includes a joint initiative with Chainalysis to improve compliance and crypto transparency, boosting investor confidence and potentially reducing regulatory friction.

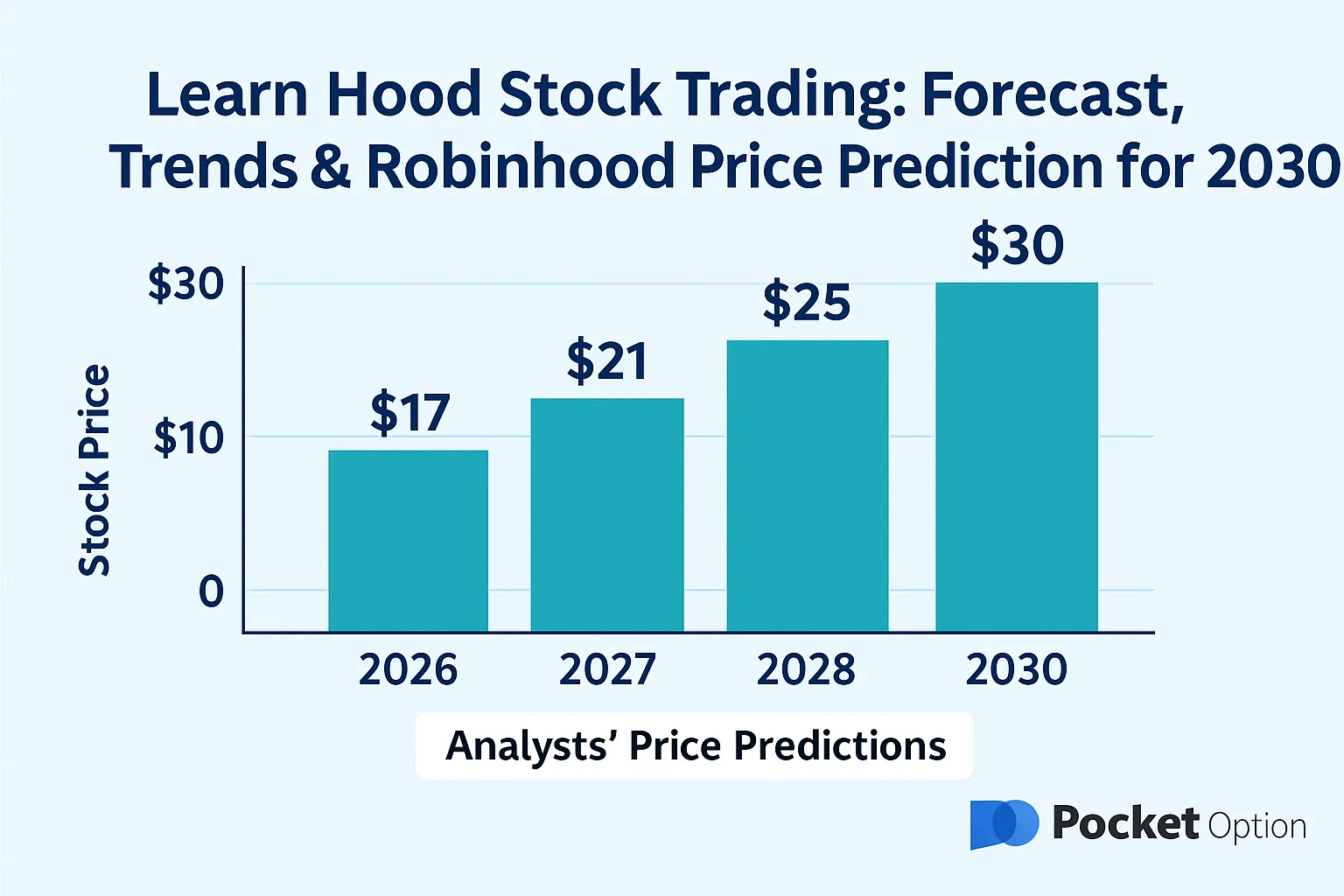

Learn Hood Stock Trading: Forecast, Trends & Robinhood Price Prediction for 2030

Looking ahead, investors want to learn Hood stock trading for long-term gains. This article covers expert Hood stock price predictions for 2030, trends, and key insights from industry leaders.

Article navigation

- Overview of Robinhood Markets Inc

- Current Price and Market Trends

- Historical Price Movements

- Long-term Forecasts: A Look Towards 2030

- Transformational Insights from Industry Leaders

- Comparative Stock Price Analysis

- Understanding Market Sentiments and Their Impact

- Learn Stock Trading on Pocket Option 📱

- Conclusion: Future of Hood Stock

Overview of Robinhood Markets Inc

Robinhood Markets Inc. has reimagined stock trading. Its mobile-first design, commission-free model, and accessible features attract over 23 million users. The platform offers access to stocks, ETFs, options, and cryptocurrency–making it one of the most versatile fintech tools for retail investors.

“Robinhood is no longer just a trading app–it’s an ecosystem,” notes Dan Dolev, fintech analyst at Mizuho Securities. “Its ability to innovate beyond the norm keeps it ahead of legacy platforms.”

Current Price and Market Trends

As of July 2025, hood stock trades at approximately $17–$19, showing resilience despite macroeconomic headwinds. Its price reflects both broad market sentiment and company-specific developments like the launch of new AI-based trading tools.

Factors driving the current price:

Historical Price Movements

Since its IPO in 2021, Robinhood has experienced both euphoria and correction. Key moments:

| Year | Price Range | Highlights |

|---|---|---|

| 2021 | $34 — $85 | IPO launch, meme stock boom 📈 |

| 2022 | $7 — $14 | Market downturn, crypto winter |

| 2023–2024 | $9 — $20 | Recovery, crypto integration, margin products |

Price Prediction for Robinhood Stock

Forecasting Techniques for Hood Stock

Predicting the hood stock forecast 2030 involves a mix of classical market analysis, advanced statistics, and cutting-edge artificial intelligence tools, providing a multifaceted view of potential price targets.

- Technical analysis: Traders and analysts rely on technical indicators such as RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands to understand price momentum, identify overbought or oversold conditions, and project potential breakouts or reversals. These tools are essential for short- to medium-term price movements and help set dynamic entry and exit points.

- Quantitative models: Quant analysts use methods like Monte Carlo simulations to run thousands of future market scenarios based on historical volatility and correlations. ARIMA (AutoRegressive Integrated Moving Average) models, meanwhile, forecast future stock values based on trends and seasonality, often applied to time-series price data to produce statistically sound price forecasts.

- AI tools and machine learning: AI-driven prediction models analyze vast datasets, including social sentiment from platforms like Reddit and Twitter, macroeconomic indicators, and real-time order flow data. Neural networks and natural language processing (NLP) algorithms are increasingly used to detect early signs of bullish or bearish sentiment before they reflect in the current price. Some hedge funds already use reinforcement learning bots to optimize trade execution for Robinhood shares.

A 2024 Goldman Sachs model placed Robinhood in the “top 5% of fintechs” likely to outperform the Nasdaq by 2030 due to its strong digital infrastructure.

Factors Influencing Stock Price Movements

Key variables:

- Regulatory landscape: Changes to crypto taxation.

- Interest rates: Affects margin trading.

- User base growth: Monthly Active Users (MAU) exceeding 30 million would be a strong bullish indicator.

- Technology: Launch of AI-powered investing assistants.

Expert Predictions for 2025

| Analyst | Bullish Target | Bearish Target | Basis |

|---|---|---|---|

| Ark Invest | $32 | $14 | Fintech growth model |

| JP Morgan | $28 | $10 | Competitive pressure |

| Wedbush | $30 | $12 | User acquisition |

Long-term Forecasts: A Look Towards 2030

📊 Bullish Case: Robinhood as a Tech-Driven Fintech Leader

Robinhood’s bullish scenario is anchored in three main drivers: surging crypto volumes, rising average revenue per user (ARPU), and next-gen AI integrations.

“The more Robinhood blends financial automation with retail experience, the more likely it becomes a magnet for the new wave of investors,” says Morgan Stanley fintech strategist Julia Hayes.

Increased adoption of crypto assets, especially among younger investors using mobile-first platforms, fuels daily transaction volume. Analysts also highlight Robinhood’s AI-based portfolio tools that provide personalized investment strategies, which could significantly increase premium subscriptions and engagement.

Premium features like technical screeners, market sentiment indicators, and real-time alerts are pushing users toward higher ARPU, strengthening its monetization model.

🔴 Bearish Scenario: Regulatory and Structural Headwinds

While innovation is a core strength, Robinhood still operates under tight regulatory scrutiny. Payment-for-order-flow, a key revenue stream, has faced criticism and could be limited by future legislation.

“Any regulatory clampdown on Robinhood’s order execution practices could hit margins and user trust,” warns Kenneth Morse, senior equity analyst at Morningstar.

Retail trading enthusiasm, which surged during the pandemic, has shown signs of waning. A prolonged macro downturn or interest in alternative platforms could reduce Robinhood’s daily active users. Additionally, by 2027–2028, the North American market may reach saturation, prompting Robinhood to rely heavily on overseas expansion–a strategy that carries geopolitical, legal, and competitive risks.

Predictions for Robinhood Markets Inc Stock Price

| Year | Bullish Target | Bearish Target | Mean Estimate |

|---|---|---|---|

| 2026 | $30 | $18 | $25 |

| 2027 | $35 | $22 | $28 |

| 2030 | $65 | $32 | $48 |

Transformational Insights from Industry Leaders

“In the next five years, platforms that fail to integrate AI trading will become obsolete,” says Katherine Wu, partner at Archetype VC.

Key drivers for Robinhood’s success:

- AI integration into investment tools.

- Gamification through trading tournaments.

- Strategic education initiatives for new users.

Comparative Stock Price Analysis

Comparing Robinhood to Competitors

| Platform | Avg Price 2025 | Strength |

|---|---|---|

| Robinhood | $28 | Crypto access, mobile-first |

| SoFi | $11 | Full banking + investing |

| E*TRADE | $95 | Institutional-grade tools |

Stock Price Forecasts Across the Fintech Sector

Fintech leaders like PayPal, Square, and Robinhood show high correlation with Bitcoin and Ethereum movements. Analysts forecast that fintech stocks may enter a supercycle by 2027.

Understanding Market Sentiments and Their Impact

Market sentiment plays a pivotal role. Events like SEC lawsuits or Bitcoin ETFs approvals can swing prices sharply.

Indicators to watch:

- Google Trends for “hood stock”

- Reddit/WallStreetBets sentiment

- Insider selling/buying data

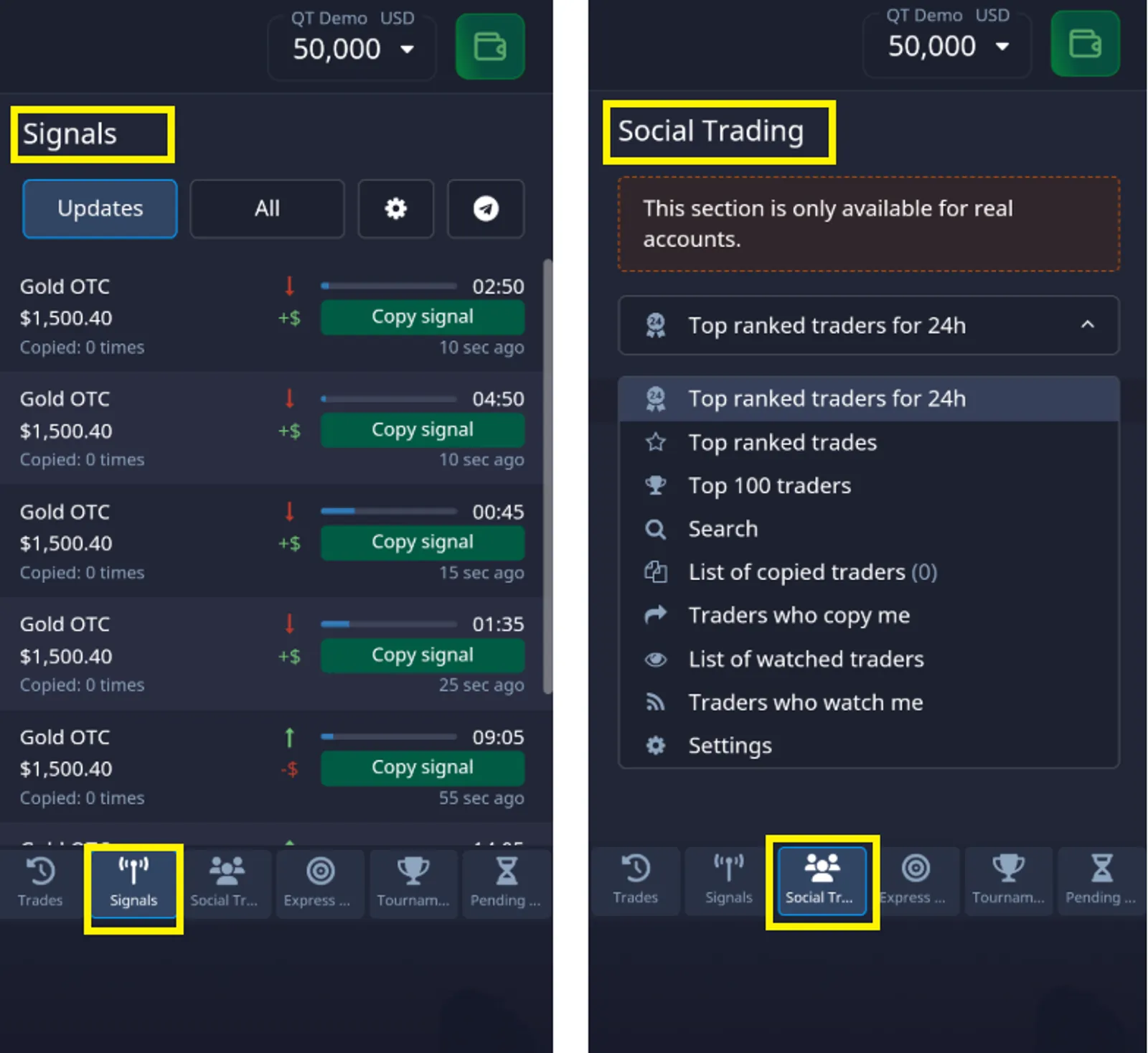

Learn Stock Trading on Pocket Option 📱

Whether you’re a beginner or an advanced trader, Pocket Option makes it easy to start trading:

- 📊 100+ assets including stocks, crypto, and commodities.

- 🤖 AI trading bots and auto-analysis tools.

- 📱 Mobile trading for real-time access.

- 🎯 Tournaments and copy trading to fast-track success.

- 💰 Bonuses and promo codes for better value.

Conclusion: Future of Hood Stock

Robinhood’s future depends on innovation, regulatory navigation, and user engagement. While the road may be volatile, the long-term hood stock forecast 2030 remains optimistic.

If Robinhood sustains its growth, “it may become the Apple of fintech platforms,” says Mike Novogratz of Galaxy Digital.

Now is a smart time to start learning and testing your strategy–especially with Pocket Option’s extensive toolkit.

FAQ

What are common hood stock trading mistakes?

One of the biggest mistakes in hood stock trading is chasing hype without using proper technical analysis. Others include taking on excessive risk with margin accounts and failing to follow major regulatory news that can impact stock price predictions.

What are the costs of learn hood stock trading?

Financially, costs are minimal—primarily small initial investments and time. Platforms like Pocket Option offer a free demo account to help you learn hood stock trading without financial risk.

Can beginners succeed with learn hood stock trading?

Yes, especially when they use tools like copy trading and AI strategies on platforms such as Pocket Option. Consistent effort, practice, and access to market insights help accelerate learning.

How long does it take to learn hood stock trading?

Most new traders can understand the basics within a few months, especially with focused training. Mastering it to the point of long-term profitability can take several years of disciplined practice.

How to avoid losses in learn hood stock trading?

To reduce risks, it's essential to apply stop-loss strategies, stay informed about price forecasts, and diversify trades. Regularly updating your strategy based on market indicators is also critical.

What are the most significant growth drivers for Robinhood that could impact its 2030 valuation?

Five critical growth drivers will determine Robinhood's 2030 valuation trajectory: 1) Banking and cash management services expansion, valued at $18.3-22.7 billion in potential market cap contribution by 2030 if the company successfully grows deposits above $25 billion by 2028 and develops lending capabilities with spreads exceeding 1.8%; 2) Cryptocurrency platform evolution, valued at $12.5-30.3 billion depending on regulatory clarity by 2026 and successful wallet expansion exceeding 5 million active users with over $1.5 billion in TVL for staking products; 3) International expansion, potentially adding $15.4-25.8 billion if the company navigates regulatory requirements across 12+ markets with its tier 1 strategy targeting UK, EU, and Australia first; 4) Wealth management services, contributing $10.8-15.2 billion through advisory capabilities by 2025 and retirement asset growth exceeding 20% CAGR; and 5) Core brokerage platform enhancements, adding $25.7-30.2 billion through sustained engagement metrics (DAU/MAU >22%) and expanded product offerings. Alex Fernandez's component-based analysis shows success across all vectors could drive hood stock price to $150-180 by 2030, while limited execution would restrict growth to $25-40 according to Eleanor Wright's probabilistic scenario assessment.

How do professional investors evaluate Robinhood differently from traditional financial companies?

Professional investors use specialized frameworks to evaluate Robinhood that differ substantially from traditional financial valuation models in five key ways: 1) They assign significantly higher weighting (35% vs. typical 5-10%) to user acquisition cost-to-lifetime value ratio, recognizing Robinhood's superior 1:7.3 ratio compared to traditional finance's 1:3.1 average; 2) They measure product adoption velocity, which shows Robinhood users adopt new financial products in 3.2 months versus 10.4 months for traditional bank customers; 3) They analyze platform engagement metrics, noting Robinhood's 7.3 monthly sessions versus 2.1 for traditional brokerages; 4) They evaluate revenue diversification potential, identifying 8 viable revenue streams versus 4 recognized by traditional models; 5) They incorporate demographic positioning, acknowledging that 83% of users are under 40, positioning the company for the upcoming $68.4 trillion wealth transfer through 2042. These alternative metrics explain why quantitative trader Sarah Johnson projects potential 2030 price targets of $95-140, while venture capitalist Alex Fernandez estimates $85-125, both substantially above consensus estimates derived from traditional valuation methods.

What operational metrics should investors track to assess Robinhood's progress toward long-term value creation?

Investors should monitor five specific operational metrics that serve as leading indicators of Robinhood's long-term value creation: 1) User retention cohort analysis, where improvement from the current 65.3% twelve-month retention rate to the target 80%+ adds approximately $7.4-8.2 per share for each 5% improvement; 2) Assets under custody growth, with each $100 billion increase from the current $85.7 billion adding approximately $9.3-11.2 per share; 3) Revenue diversification, where each 5% shift from transaction-based revenue (currently 62.8% of total) to recurring revenue sources adds $5.2-6.7 per share; 4) Monthly active user ratio, with each 5% improvement from the current 35.4% MAU/total users ratio adding approximately $4.7-5.3 per share; 5) Product adoption depth, where each 0.5 product per user increase from the current 1.8 average adds approximately $8.2-10.1 per share. Alex Fernandez's research demonstrates these metrics typically lead valuation changes by 3-5 quarters, making them particularly valuable for developing hood stock forecast 2025 projections.