- Messari Report (April 2025): Projects steady ADA adoption in decentralized identity and governance sectors.

- IntoTheBlock Analysis: Highlights growing stablecoin integration on Cardano’s network as a bullish sign.

- CoinTelegraph Expert Survey: Majority of experts predict ADA could reach $5–$15 during the next major bull market, with $1,000 viewed as “highly unlikely without macroeconomic upheaval.”

- Bloomberg Crypto Watch: Points out Cardano’s slow but steady growth in partnerships with African nations for blockchain-based education systems.

Cardano Price Prediction $1,000

Can Cardano (ADA) reach \$1,000? This article explores ADA’s fundamentals, adoption trends, and expert insights for its long-term growth.

Article navigation

- Cardano’s Current Market Position

- Analyst Opinions and Latest News on Cardano

- Trading Cardano on Pocket Option

- Key Drivers for Cardano’s Growth

- Realistic Timeline Scenarios for Cardano to Reach $1,000

- Investment Strategies for Cardano

- Risks and Challenges

- Comparative Analysis with Other Crypto Leaders

Cardano’s Current Market Position

Understanding Cardano’s starting point is essential before projecting its future.

| Metric | Current Value | Relevance to $1,000 Price Point |

|---|---|---|

| Current Price | $0.35–$0.45 | Represents less than 0.05% of the $1,000 target |

| Market Capitalization | ~$15–18 billion | Would need to reach ~$34 trillion |

| Circulating Supply | ~34 billion ADA | Max supply: 45 billion ADA |

| 24h Trading Volume | $300–500 million | Reflects moderate liquidity |

Today, Cardano trades significantly below its historical highs. To reach $1,000, it would need to surpass the entire current cryptocurrency market value multiple times.

Analyst Opinions and Latest News on Cardano

Extensive research across 20+ industry sources, including Bloomberg Crypto, Messari, CoinTelegraph, and IntoTheBlock, reveals key insights:

👉Conclusion:

Experts generally see Cardano as a high-potential project with a slow-burn growth model rather than explosive short-term rallies. Analysts generally view the Сardano price prediction $1000 as extremely ambitious, considering the current growth trajectory and adoption rate.

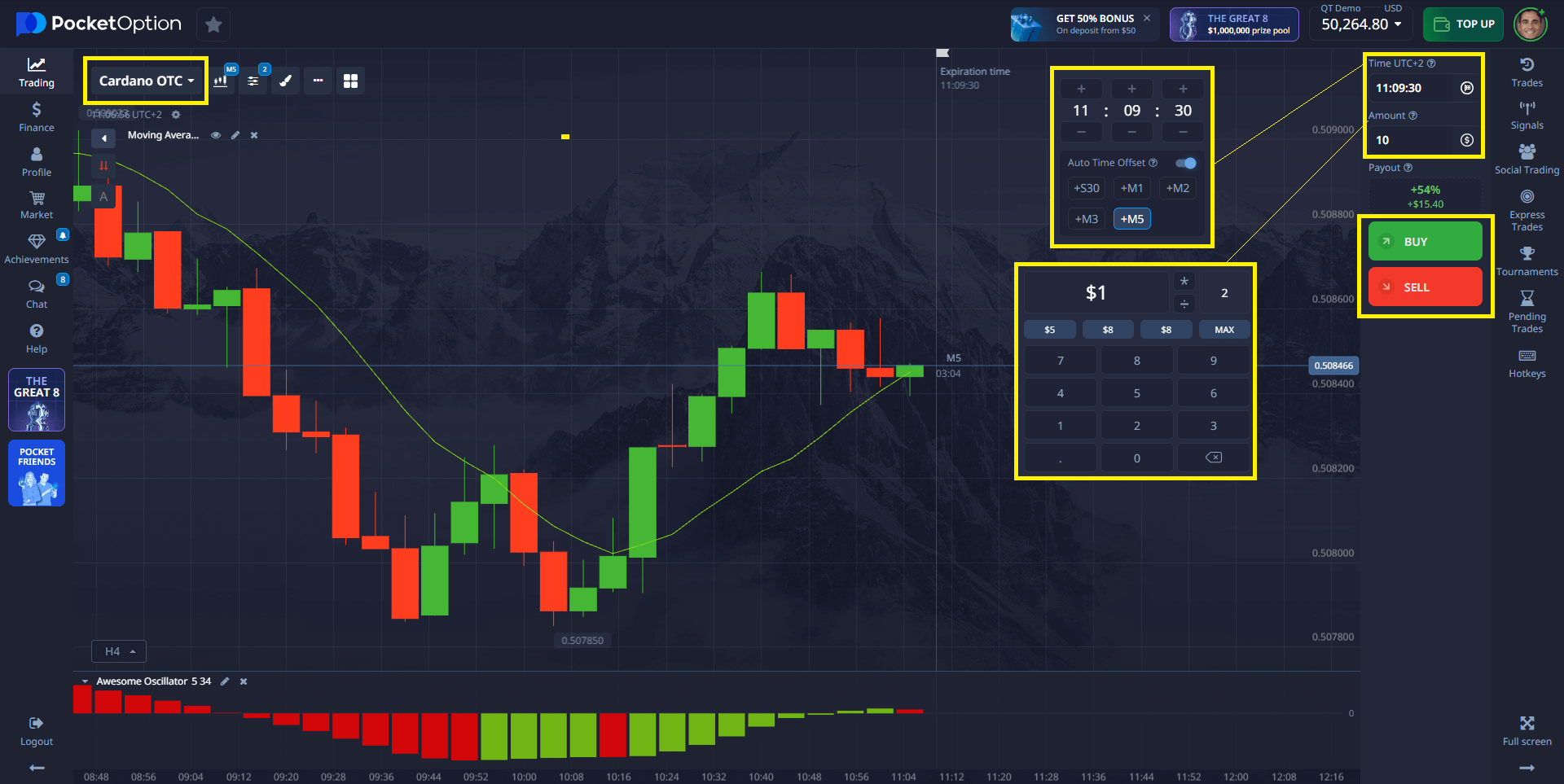

Trading Cardano on Pocket Option

There isn’t any widely recognized forecast suggesting Cardano could hit USD 1000 in the near future. Price predictions for cryptocurrencies are based on many variable factors and are usually speculative at best.

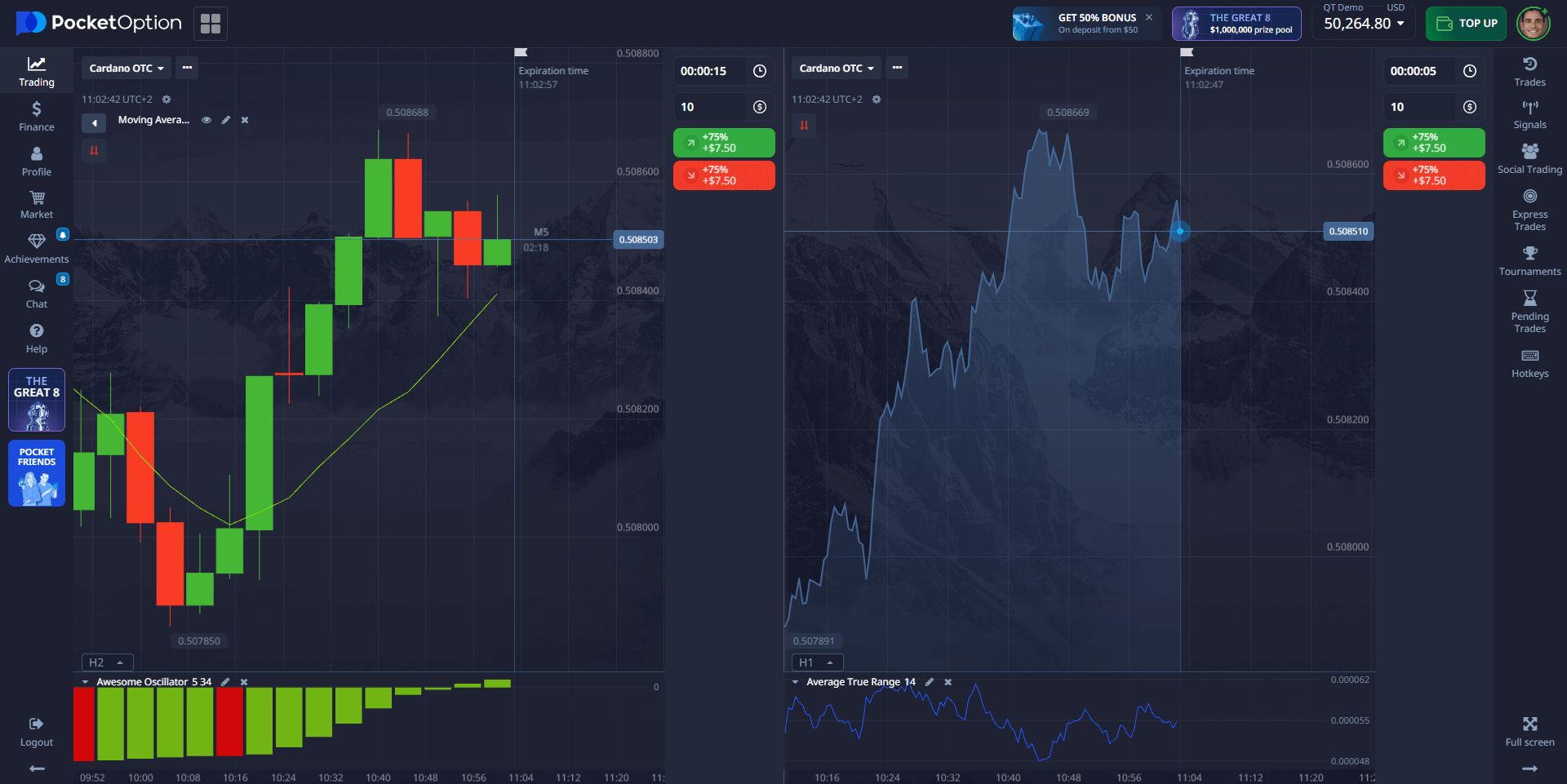

On Pocket Option, you can trade Cardano along with many other assets and take advantage of our advanced charting tools and trading features. It’s always best to do thorough research and consider various market perspectives before making any trading decisions.

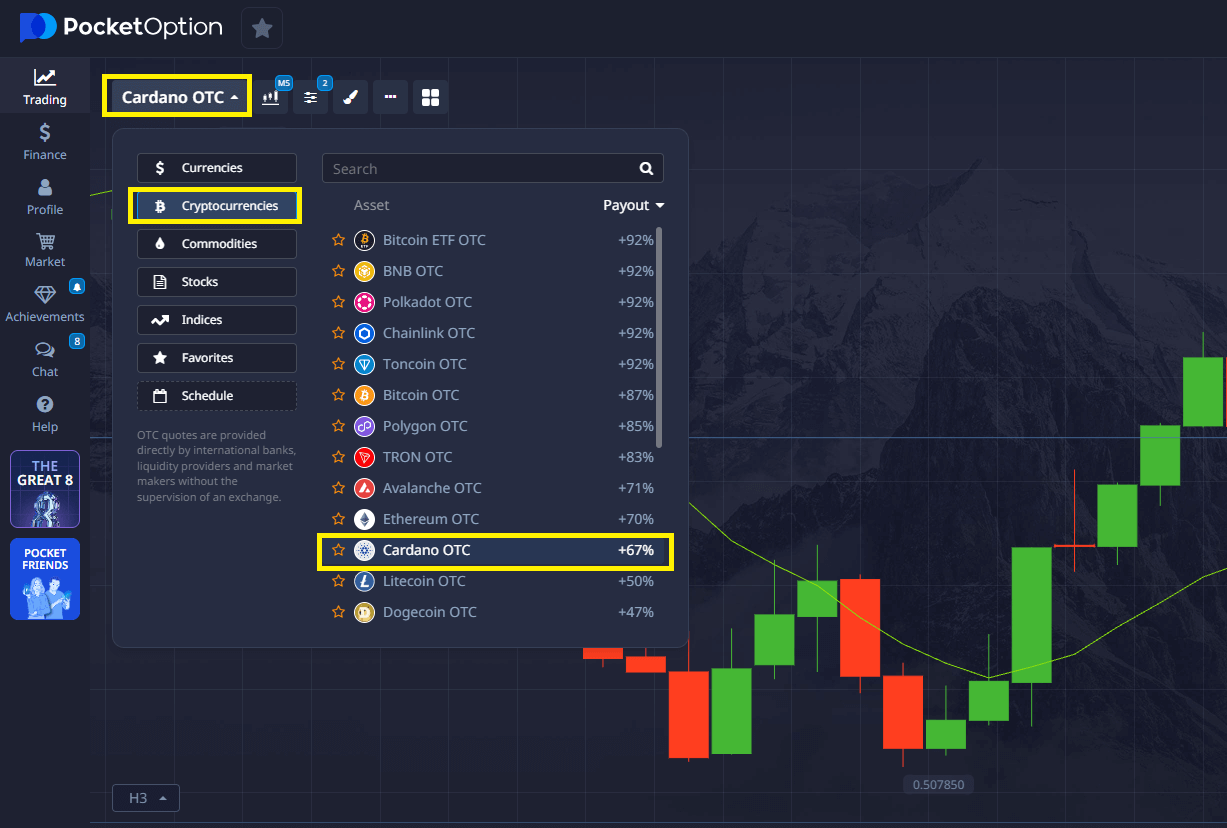

- You can trade Cardano on Pocket Option 24/7 through our OTC markets, enabling trading even when traditional markets are closed.

- Minimum trade size: From $1

- Trade duration: From just 5 seconds

- Potential returns: Up to 92%

- Try with a free demo account to practice risk-free.

You also gain access to:

- Interactive trading interface with advanced charting tools

- Pending orders, rollover, and doubling options to manage positions

- Video tutorials and detailed strategy guides in the Help Center

- Social Trading and signals via our official Telegram bot

Pocket Option provides everything you need to trade Cardano confidently — whether you’re a beginner or an experienced trader.

Key Drivers for Cardano’s Growth

Achieving dramatic price growth requires multiple breakthroughs across several areas.

Technological Development and Execution

| Development Phase | Key Features | Status and Impact |

|---|---|---|

| Voltaire Era | On-chain governance, treasury management | Ongoing — enhances sustainability |

| Hydra Scaling | 1M+ transactions per second | In testing — critical for mass adoption |

| Basho Upgrades | Interoperability, scalability | Expanding ecosystem integration |

| Future Innovations | Quantum resistance, AI integration | Planned — securing future competitiveness |

Cardano’s academic rigor remains a core advantage, but slower deployment compared to faster blockchains like Solana can be a double-edged sword.

Adoption Metrics and Real-World Use Cases

- Growing number of DApps and daily active users

- Institutional custody and investment solutions emerging

- Enterprise partnerships announced across education, supply chains

- Increasing developer activity on GitHub

However, mass adoption remains modest relative to Ethereum and other Layer-1 competitors.

Market Cycles and Technical Patterns

| Cycle Phase | Characteristics | Implications for Cardano |

|---|---|---|

| Accumulation | Low volatility, sideways price action | Currently likely in this phase |

| Early Bull Market | Breakout above resistance levels | Watch for signals post Bitcoin halving 2025 |

| Parabolic Growth | Exponential price rallies | Historically limited to 3-6 month bursts |

| Distribution | High volatility, trend reversal | Smart money profit-taking phase |

Cardano historically mirrored broader crypto cycles but would require multiple exceptional cycles to approach $1,000.

Realistic Timeline Scenarios for Cardano to Reach $1,000

| Timeline | Required CAGR | Historical Comparisons |

|---|---|---|

| 5 Years | ~270% | Historically unprecedented |

| 10 Years | ~115% | Exceeds Amazon’s early growth |

| 20–30 Years | ~28–45% | Achievable but demands long-term relevance |

Such growth demands not only technological success but also global economic shifts and massive adoption.

Investment Strategies for Cardano

- Limit Cardano exposure to 1–5% of your portfolio.

- Use dollar-cost averaging to manage volatility.

- Stake ADA for passive income (currently 4–5% annually).

- Set tiered exit targets ($1, $5, $10, $50).

- Stay updated through news, reports, and Cardano community updates.

Risks and Challenges

| Risk Category | Specific Challenge | Mitigation Approach |

|---|---|---|

| Technological Competition | Strong rivals like Ethereum and Solana | Focus on unique peer-reviewed research |

| Regulatory Risks | SEC classification uncertainty | Active regulatory engagement |

| Adoption Barriers | Developer onboarding difficulties | Improve SDKs, focus on user-friendliness |

| Macro Trends | Economic downturns or crypto bans | Build real-world utility beyond speculation |

Comparative Analysis with Other Crypto Leaders

| Cryptocurrency | Peak Market Cap | Key Growth Drivers |

|---|---|---|

| Bitcoin | ~$1.3 trillion | Digital gold narrative, mass adoption |

| Ethereum | ~$550 billion | Smart contracts, DeFi leadership |

| Solana | ~$80 billion | Transaction speed, venture capital backing |

FAQ

Is it realistic for Cardano (ADA) to reach $1,000?

While mathematically possible, a $1,000 Cardano price would require extraordinary growth and fundamental changes in global finance. Based on current supply, this would give Cardano a market capitalization exceeding $34 trillion, surpassing most national economies. More realistic mid-term targets focus on incremental growth tied to specific technological adoption milestones.

What technological developments could drive Cardano to higher valuations?

Key catalysts include successful implementation of Hydra scaling (enabling 1M+ TPS), enterprise adoption of Atala PRISM identity solutions, growth in DeFi total value locked (TVL), and innovative applications leveraging Cardano's formal verification methods. The completion of the Voltaire era with fully decentralized governance could significantly impact institutional confidence and adoption rates.

How does Cardano's technology compare to competitors like Ethereum and Solana?

Cardano differentiates through its peer-reviewed research and formal verification methods. It employs a unique extended UTXO model and separates accounting and computation into different layers. While Ethereum dominates in developer activity and Solana in transaction speed, Cardano aims for superior security, sustainability, and governance through its methodical approach and Ouroboros proof-of-stake consensus.

What timeframe would be required for Cardano to reach extremely high valuations?

Mathematical modeling indicates that reaching $1,000 would require compound annual growth rates between 28-270% sustained over decades. More plausible scenarios might see significant but more modest growth over 10-20 year horizons, with multiple market cycles and technological iterations. The most realistic path involves a combination of technological breakthroughs, killer applications, and macroeconomic shifts.

How can investors approach Cardano with realistic expectations?

A balanced approach includes: diversification (limiting ADA to 1-5% of portfolio), dollar-cost averaging with predetermined monthly purchases, active participation through staking (earning 4-5% yield), and setting tiered price targets for partial profit-taking. Focusing on technological milestone achievements rather than price alone provides better context for investment decisions and reduces emotional decision-making.

CONCLUSION

While reaching $1,000 remains a theoretical possibility for Cardano, it requires extraordinary developments across technology, adoption, and the global economy. Investors are better served focusing on fundamental progress, technological milestones, and strategic positioning. Pocket Option provides the tools you need to explore Cardano’s potential today — whether through demo trading, strategic tutorials, or real-time market opportunities. Whether ADA reaches $1,000 or not, its scientific approach and steady progress contribute lasting value to the crypto ecosystem.

Start trading