- Introducing premium experiences like Dolby Cinema and recliner seating

- Collaborating with major studios for exclusive screenings

- Accepting cryptocurrency payments and launching AMC-branded popcorn in retail stores

How to Buy AMC Stock: learn AMC stock trading

Investing in AMC Entertainment Holdings has captured widespread attention since the 2021 meme stock frenzy. As the world's largest movie theater chain, AMC has become a symbol of both traditional entertainment and volatile market trends. Whether you're a seasoned trader or new to investing, this guide will help you learn AMC stock trading, covering key concepts like stock fundamentals, short squeeze potential, borrow rates, and trading strategies.

Understanding AMC and Its Stock

AMC Entertainment Holdings (NYSE: AMC) is a global leader in theatrical exhibition. Operating thousands of screens across the United States and abroad, AMC became a pop culture icon during the COVID-19 pandemic and the subsequent retail investor movement in 2021.

Despite reporting a net loss during the pandemic, AMC has rebounded with creative strategies such as:

AMC stock represents an equity stake in this ongoing transformation.

🎯 Expert Insight: According to Eric Wold, analyst at B. Riley Securities: “AMC’s value proposition lies in its ability to innovate and monetize loyalty beyond the theater experience.”

What Is AMC Stock?

AMC stock (ticker: AMC) is a publicly traded equity that gives investors ownership in AMC Entertainment. The stock price reflects market sentiment, company performance, and broader economic conditions. Traders and investors watch AMC closely due to its unique position in the entertainment industry and frequent media attention.

Key factors influencing AMC stock price:

- Quarterly earnings reports

- Box office performance

- Investor sentiment (especially among retail traders)

- CTB AMC stock and AMC stock cost to borrow

Meme Stock Phenomenon: What You Need to Know

AMC became a meme stock in 2021 due to widespread buying activity driven by communities like Reddit’s r/WallStreetBets. This retail movement triggered a short squeeze, a situation where short sellers were forced to cover their positions, further pushing the price up.

Example: The 2021 Short Squeeze

In January and June 2021, AMC’s stock price surged from under $5 to over $60 per share, fueled by:

- Social media hype

- High AMC stock borrow rate (often exceeding 20%)

- Institutional short interest

While profitable for some, many traders ended up losing money due to extreme volatility. Thus, meme stock trading requires robust risk management and an understanding of market psychology.

📊 Market Commentary: CNBC noted, “The AMC saga reflects a new age of investing where online communities can challenge institutional dominance.”

Buying AMC Shares: Step-by-Step

Step 1: Choose the Right Broker

To buy AMC stock, you need a brokerage account. Selecting a suitable broker is crucial.

| Feature | What to Look For |

|---|---|

| Fees | Low commissions or zero-fee trading |

| Platform | User-friendly with real-time charts |

| Assets | Access to U.S. stocks like AMC and ETFs |

| Education | Guides, tutorials, and analysis tools |

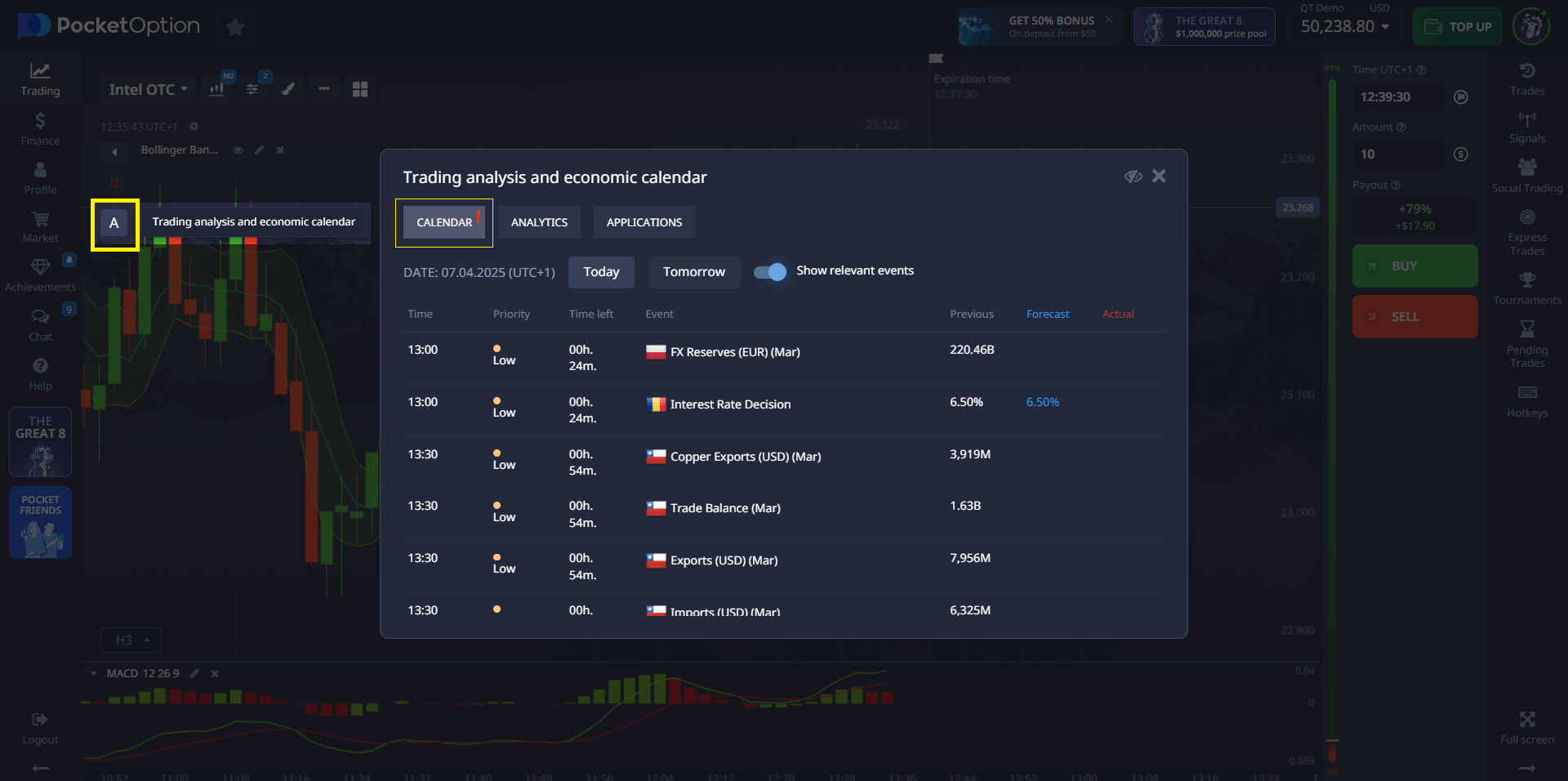

Pocket Option doesn’t offer AMC stock but provides 100+ tradable assets, including stocks of popular companies via OTC (over-the-counter) trading, available 24/7.

Step 2: Open and Fund a Brokerage Account

To set up your account:

- Submit personal information (e.g., ID and tax info)

- Link your bank account

- Fund your account via wire, ACH, or card

This enables you to place trades and manage your investments easily.

Step 3: Place a Buy Order

You can purchase AMC stock using two primary methods:

- Market order: Buy instantly at current price

- Limit order: Set a maximum price you’re willing to pay

Most retail traders begin with a market order. For example:

If AMC stock is trading at $10.50 and you place a market order for 10 shares, your cost will be approximately $105 (plus broker fees).

🧠 Pro Tip: Consider using limit orders to avoid unexpected price spikes in volatile markets.

Short Squeeze Potential and CTB Analysis

What Is CTB AMC Stock?

CTB (Cost to Borrow) refers to the fee short sellers pay to borrow AMC shares. A higher CTB signals scarcity and potentially high short interest. AMC’s stock CTB has spiked over 100% in some cases, making it one of the most expensive stocks to short.

Monitoring Borrow Rate

| Date | AMC Stock CTB | Short Interest |

|---|---|---|

| Jan 2021 | 95% | 90 million shares |

| Mar 2022 | 23% | 80 million shares |

| Jun 2023 | 32% | 100 million shares |

📈 Expert Observation: “CTB over 20% should alert traders to a possible squeeze scenario,” says Ortex Analytics.

Long-Term vs. Short-Term Strategies

Long-Term Holding

If you believe in AMC’s future in theatrical and digital innovation, a long-term investment approach might suit you. Consider the following:

- AMC’s diversification strategy (retail popcorn, NFTs)

- The rebound of global movie theaters post-COVID

- Brand loyalty and market dominance

Short-Term Trading

Short-term traders focus on:

- Technical analysis

- Volatility

- News catalysts and CTB data

💡 Unique Insight: Experts suggest using moving averages and RSI indicators to time entries in volatile stocks like AMC.

Economic calendar on Pocket Option

Evaluating AMC’s Financial Health

To determine if AMC is a good investment, analyze:

- Quarterly revenue and EBITDA

- Cash flow from operations

- Debt-to-equity ratio

- Capital investments and innovation

AMC reported $4.9B in revenue in 2023 but still faces significant debt. Future success hinges on managing liabilities and increasing foot traffic.

🧾 Analyst Comment: S&P Global notes, “AMC’s long-term viability will depend on its ability to restructure debt while boosting per-theater profitability.”

Final Thoughts: Should You Buy AMC Stock?

Buying AMC stock can be both thrilling and risky. Whether you’re aiming to learn AMC stock trading, capitalize on a short squeeze, or hold for long-term recovery, due diligence is key. Monitor CTB metrics, evaluate quarterly earnings, and remain updated on investor sentiment.

Even though AMC isn’t listed on Pocket Option, the platform offers 24/7 trading on 100+ assets including top global stocks via OTC. It’s an ideal environment for practicing stock trading strategies before entering the live market.

FAQ

What is the current AMC stock cost to borrow?

It fluctuates daily but has ranged from 15% to over 100%, depending on short interest and stock availability.

Can I trade AMC stock on Pocket Option?

AMC is not listed, but you can trade 100+ stocks and crypto pairs via OTC anytime.

What happened to AMC stock in 2021?

A retail-driven short squeeze sent AMC’s price soaring from under $5 to over $60 per share.

How do I buy AMC stock as a beginner?

Choose a trusted broker, fund your account, and place a market or limit order. Always research before buying.

What are common AMC stock trading mistakes?

Chasing price spikes, ignoring fundamentals, trading without a plan, and not accounting for CTB volatility.

How to start trading AMC stock for beginners?

Start by choosing a reputable broker, funding your account, and researching AMC’s recent performance and market dynamics. Practice with demo trading if possible.

How to avoid losses in learn AMC stock trading?

Set stop-losses, use limit orders, diversify your investments, and never trade based on hype alone. Use real-time data and tools.

What are the costs of learn AMC stock trading?

Costs include brokerage fees, potential losses, market order slippage, and time spent researching and learning market mechanics.

What are the risks of buying meme stocks like AMC?

Extreme volatility, potential for losing money, and rapid sentiment shifts make meme stocks high-risk investments.

What does CTB mean in stock trading?

CTB stands for "Cost to Borrow," a metric indicating how expensive it is to borrow a stock for short selling.

Can beginners succeed with learn AMC stock trading?

Yes, with education, disciplined risk management, and ongoing analysis, beginners can learn to trade AMC stock profitably.