- Coverage: Private sector, non-farm jobs

- Excludes: Government, farm, and non-profit employees

- Timing: Released two days before NFP, making it an early indicator for NFP

- Source: Data compiled by ADP, a leading payroll services provider

Understanding the ADP Non-Farm Employment Change: Strategic Insights for Traders

Did you know the monthly ADP Non-Farm Employment Change often sets the tone for global currency markets days before the official NFP release? Understanding this early indicator can give traders a crucial edge.

Article navigation

- ADP Non-Farm Employment Change: How Traders Use Employment Data for Market Strategies

- What is the ADP Non-Farm Employment Change?

- Why the ADP Report Matters for Traders

- ADP vs NFP: Key Differences for Traders

- How ADP Employment Data Impacts Markets

- Trading Strategies with the ADP Report

- Pocket Option Tools for Trading ADP Employment Data

ADP Non-Farm Employment Change: How Traders Use Employment Data for Market Strategies

The ADP Non-Farm Employment Change is a monthly economic report that tracks changes in private sector employment in the United States, excluding agricultural jobs. For traders, this report is more than just a headline–it’s a leading economic indicator that can move markets, shape trading strategies, and offer early clues about the health of the US job market. In this article, we’ll explore what the ADP report is, why it matters, how it compares to the official Non-Farm Payrolls (NFP) report, and how traders–using platforms like Pocket Option–capitalize on employment data releases.

What is the ADP Non-Farm Employment Change?

The ADP Non-Farm Employment Change, often called the monthly ADP employment report, is published on the first Wednesday of each month. It estimates the net change in private sector jobs, providing an early snapshot of the US labor market before the Bureau of Labor Statistics (BLS) releases its official Non-Farm Payrolls (NFP) data.

“The ADP report is a vital early signal for traders, often foreshadowing the direction of the official NFP numbers.”– Market Analyst, 2025

Why the ADP Report Matters for Traders

The ADP report is closely watched by forex, stock, and index traders because employment data is a key driver of economic growth and central bank policy. A strong ADP reading can boost the US dollar and equities, while a weak report may trigger risk-off sentiment.

- Provides early insight into US job market trends

- Influences market reaction in currency, equity, and bond markets

- Helps traders anticipate the tone of the upcoming NFP release

- Supports risk management and trade diversification strategies

“Employment data trading is all about timing–ADP gives you a head start before the main event.”– Senior FX Strategist, 2025

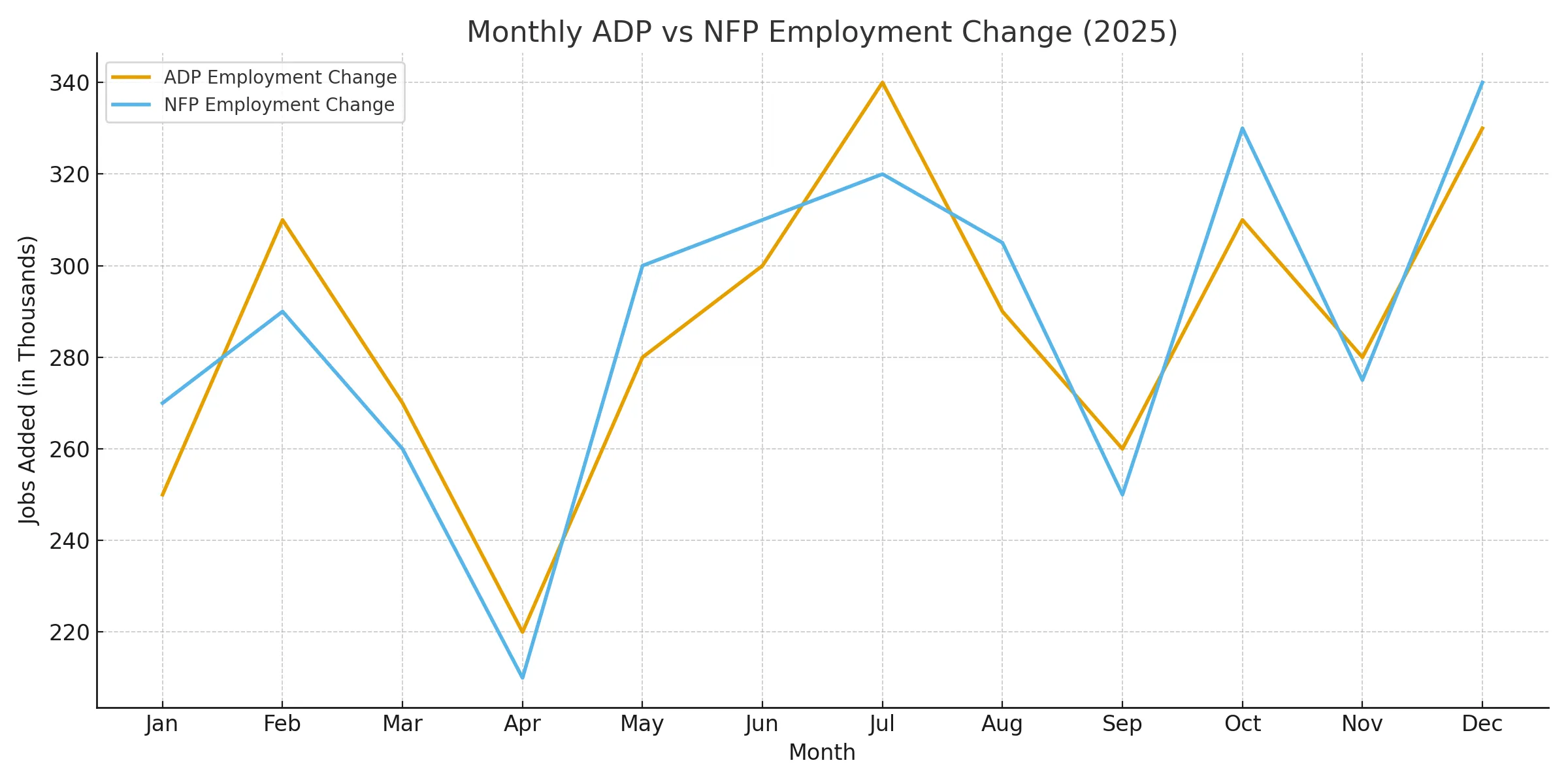

ADP vs NFP: Key Differences for Traders

| Feature | ADP Non-Farm Employment Change | Non-Farm Payrolls (NFP) |

|---|---|---|

| Publisher | ADP Research Institute | Bureau of Labor Statistics (BLS) |

| Coverage | Private sector, non-farm jobs | Private + government, non-farm jobs |

| Release Timing | First Wednesday of each month | First Friday of each month |

| Data Source | ADP payroll data | Government surveys |

| Market Impact | Early indicator, moderate to high | Major, high volatility |

“Comparing ADP and NFP helps traders gauge the reliability of early signals and adjust their strategies accordingly.”– Economic Data Specialist, 2025

How ADP Employment Data Impacts Markets

The impact of employment data on currency markets is immediate. For example, a higher-than-expected ADP number often strengthens the US dollar and lifts stock indices, while disappointing data can trigger sell-offs. Traders on platforms like Pocket Option use these moves to execute quick trades on major forex pairs, indices, and even commodities.

| Asset Class | Typical Reaction to Strong ADP | Typical Reaction to Weak ADP |

|---|---|---|

| USD Forex Pairs | USD strengthens (e.g., EUR/USD falls) | USD weakens (e.g., EUR/USD rises) |

| US Stock Indices | Indices rise (S&P 500, Dow up) | Indices fall |

| Gold | Gold falls (risk-on) | Gold rises (risk-off) |

“The ADP jobs data impact on forex is often sharpest in the first 30 minutes after release.”– Currency Market Commentator, 2025

Trading Strategies with the ADP Report

Traders often apply economic data trading strategies around the ADP release. These can include:

- Breakout Trading: Entering trades on major pairs like EUR/USD or USD/JPY immediately after the data release, targeting volatility spikes.

- Fade the Move: Waiting for an initial overreaction, then trading in the opposite direction as the market stabilizes.

- Correlation Play: Using ADP as an early indicator for NFP, positioning trades ahead of the official report.

“How to trade ADP report? Focus on the surprise factor–markets move most when the data beats or misses forecasts.”– Trading Educator, 2025

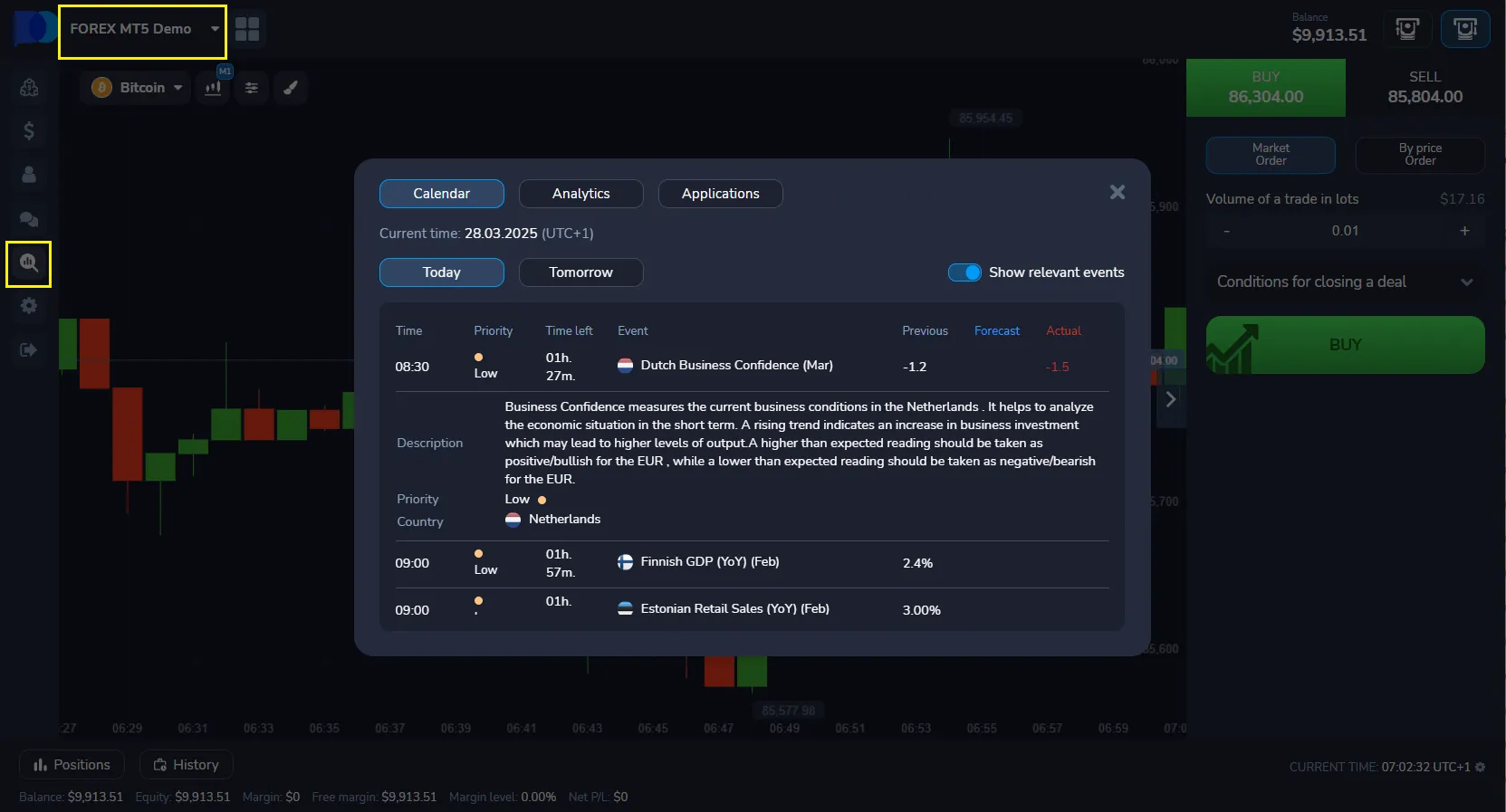

On the Pocket Option platform, traders can access real-time economic calendars, set alerts for employment data releases, and use demo accounts to test their strategies before trading live.

Pocket Option Tools for Trading ADP Employment Data

In practice, traders leverage Pocket Option’s suite of features to respond quickly to employment data releases:

- Integrated economic calendar

- Customizable price alerts for key assets

- One-click quick trading on forex, indices, and commodities

- Educational resources on economic indicators and trading strategies

“Platforms that offer real-time data and instant execution, like Pocket Option, are essential for news-based trading.”– Financial Technology Expert, 2025

FAQ

What is the difference between ADP and NFP reports?

The ADP report covers only private sector jobs and is released two days before the NFP, which includes both private and government jobs. NFP is considered the official employment report and typically has a larger market impact.

When is the ADP report released?

The ADP Non-Farm Employment Change is published on the first Wednesday of each month, usually at 8:15 AM Eastern Time.

How can I trade the ADP report on Pocket Option?

You can use Pocket Option’s economic calendar to track the ADP release, set alerts, and execute quick trades on affected assets like forex pairs and indices as the data is published.

Is the ADP report a reliable predictor of NFP?

While the ADP report often points in the same direction as NFP, differences in methodology mean the two can diverge. Traders use ADP as a guide but always monitor the official NFP for confirmation.

What assets are most affected by the ADP report?

Major USD forex pairs (like EUR/USD, USD/JPY), US stock indices, and gold are typically most sensitive to ADP employment data releases.

How does the ADP report impact trading?

The ADP report can trigger significant volatility in forex, stock, and index markets, especially if the data surprises relative to forecasts. Traders use it to anticipate market direction and adjust their positions.

What is the ADP Non-Farm Employment Change?

The ADP Non-Farm Employment Change is a monthly report estimating the net change in private sector jobs in the US, excluding farm, government, and non-profit employment. It serves as an early indicator of labor market health.

CONCLUSION

The ADP Non-Farm Employment Change is a powerful tool for traders seeking to anticipate market moves and refine their strategies. By understanding the nuances of employment data, comparing ADP with NFP, and leveraging advanced trading platforms like Pocket Option, traders can turn economic data releases into actionable opportunities. As the job market continues to evolve, staying informed and adaptable will remain key to trading success. “In 2025, employment data remains the heartbeat of market sentiment—smart traders never ignore the ADP report.” — Senior Market Economist, 2025 Start Trading on Economic Data

Start trading